Noticias del mercado

-

23:58

Schedule for today, Wednesday, Dec 9’2015:

(time / country / index / period / previous value / forecast)

00:30 Australia Home Loans October 2.0% -1%

01:30 China PPI y/y November -5.9% -5.9%

01:30 China CPI y/y November 1.3% 1.4%

06:00 Japan Prelim Machine Tool Orders, y/y November -23.1%

06:45 Switzerland Unemployment Rate (non s.a.) November 3.3% 3.3%

07:00 Germany Current Account October 25.1

07:00 Germany Trade Balance (non s.a.), bln October 22.9

12:00 U.S. MBA Mortgage Applications December -0.2%

15:00 U.S. Wholesale Inventories October 0.5% 0.1%

15:30 U.S. Crude Oil Inventories December 1.177

20:00 New Zealand RBNZ Interest Rate Decision 2.75% 2.5%

20:00 New Zealand RBNZ Rate Statement

20:05 New Zealand RBNZ Press Conference

23:50 Japan BSI Manufacturing Index Quarter IV 11 12.1

-

17:08

Japan’s Economics Minister Akira Amari: the latest final GDP data was a positive surprise for markets

Japan's Economics Minister Akira Amari said on Tuesday that the latest final GDP data was a positive surprise for markets.

"The data was a positive surprise for markets. It's a welcome one for us too. Companies are starting to implement their capital expenditure plans," he said.

Japan's Cabinet Office released its final gross domestic product (GDP) data for Japan late Monday evening. Japan's GDP increased by 0.3% in the third quarter, beating expectations for a flat reading and up from the preliminary reading of a 0.2% decline, after a 0.3% fall in the second quarter.

On a yearly basis, Japan's economy climbed by 1.0% in the third quarter, exceeding expectations for a 0.1% gain and up from the preliminary reading of a 0.8% drop, after a 0.5% decrease in the second quarter. The second quarter's figure was revised up from a 0.7% fall.

-

17:04

National Australia Bank’s business confidence index climbs to 5 points in November

The National Australia Bank (NAB) released its business confidence index for Australia on Tuesday. The index climbed to 5 points in November from 3 points in October. October's reading was revised up from 2 points.

"This is basically another strong result for the NAB Survey, which in conjunction with signs of improvement in the labour market, means we can put more faith in the building non-mining sector recovery," NAB Group Chief Economist Alan Oster said.

The main business conditions index increased 10 points in November from 9 points in October, while employment rose to 4 points in from -1 points.

-

16:44

NIESR’s gross domestic product rises by 0.6% in three months to November

The National Institute of Economic and Social Research (NIESR) released its estimate of gross domestic product (GDP) for the U.K. on Tuesday. The GDP estimate rose by 0.6% in three months to November, after a 0.5% growth in three months to October. The previous figure was revised down from a 0.6% growth.

"This rate of growth is consistent with the continued absorption of spare capacity in the UK economy and our own view that the Bank of England is most likely to begin to increase rates in February 2016," the NIESR said.

-

16:37

Japan’s Eco Watchers' current conditions index is down to 46.1 in November

Japan's Cabinet Office released Eco Watchers' Index figures on Tuesday. Japan's economy watchers' current conditions index decreased to 46.1 in November from 48.2 in October, missing expectations for a rise to 48.6.

Japan's economy watchers' future conditions index declined to 48.2 in November from 49.1 in October.

A reading above 50 indicates optimism, while a reading below 50 indicates pessimism.

-

16:25

Job openings fall to 5.383 million in October

The U.S. Bureau of Labor Statistics released its Job Openings and Labor Turnover Survey (JOLTS) report on Tuesday. Job openings fell to 5.383 million in October from 5.534 million in September. September's figure was revised up from 5.526 million.

The number of job openings declined for total private (4.887 million) in October from September, while the number of job openings rose for government (496,000).

The hires rate was 3.6% in October.

Total separations declined to 4.863 million in October from 4.886 million in September.

The JOLTS report is one of the Federal Reserve Chair Janet Yellen's favourite labour market indicators.

-

16:09

Japan’s current account surplus declines to ¥1,458.4 billion in October

Japan's Ministry of Finance released its current account data for Japan late Monday evening. Japan's current account surplus fell to ¥1,458.4 billion in October from ¥1,468 billion in September, missing expectations for a surplus of ¥1,659.4 billion.

Japan benefits from a weaker yen, which supports income from overseas investments.

The goods trade surplus climbed to ¥200.2 billion in October from ¥82.3 billion in September.

Exports dropped at an annual rate of 3.7% in October, while imports plunged 16.4%.

-

16:02

U.S.: JOLTs Job Openings, October 5.383 (forecast 5.550)

-

15:59

United Kingdom: NIESR GDP Estimate, November 0.6%

-

15:41

National Federation of Independent Business’s small-business optimism index for the U.S. declines to 94.8 in November

The National Federation of Independent Business (NFIB) released its small-business optimism index for the U.S. on Tuesday. The index decreased to 94.8 in November from 96.1 in October.

6 of 10 sub-indexes fell last month, one sub-index rose, while 3 sub-index were flat.

"Overall, the outlook remains the same with a slow 2 percent-ish growth and there is still not much pressure on prices from Main Street. All we can do at this point is hope for a more business friendly New Year," NFIB Chief Economist Bill Dunkelberg said.

-

14:57

OECD’s composite leading indicator remains unchanged at 99.8 in October

The Organization for Economic Cooperation and Development (OECD) released its leading indicators on Tuesday. The composite leading indicator remained unchanged at 99.8 in October.

It signalled stable growth momentum in Canada, Italy, Japan, Germany and in the Eurozone as a whole.

The growth momentum firmed in France and India.

The index for the U.S., and the U.K. pointed to a loss in growth momentum.

The index for Russia showed signs of a weak growth momentum.

There were tentative signs of stabilisation in Brazil and China.

-

14:50

Option expiries for today's 10:00 ET NY cut

USDJPY 122.85 (USD 216m) 123.15 (220m) 123.45 (250m) 124.00 (325m)

EURUSD 1.0745-50 (EUR 1bln) 1.0800 (412m) 1.0850 (500m) 1.0925 (EUR 3.5bln)

GBPUSD 1.5000 (GBP 443m)

USDCAD 1.3350 (USD 845m)

AUDUSD 0.7425 (AUD 250m)

EURJPY 130.00 (EUR 1bln) 132.00 (700m)

-

14:40

Building permits in Canada soar 9.1% in October

Statistics Canada released housing market data on Tuesday. Building permits in Canada jumped 9.1% in October, exceeding expectations for a 3.2% rise, after a 6.6% drop in September. September's figure was revised up from a 6.7% decrease.

The rise was driven by an increase in construction intentions in the residential sector.

Building permits for non-residential construction declined 0.2% in October, while permits in the residential sector climbed 15.5%.

-

14:30

Canada: Building Permits (MoM) , October 9.1% (forecast 3.2%)

-

14:25

Housing starts in Canada climb to a seasonally adjusted annualized rate of 211,916 units in November

The Canada Mortgage and Housing Corporation (CMHC) released housing starts data on Tuesday. Housing starts in Canada rose to a seasonally adjusted annualized rate of 211,916 units in November from 197,712 units in October. October's figure was revised down from 198,065 untis.

Housing starts were driven by a rise in the multi-unit segment.

"Rising single home prices continue to support demand for multiples, which are poised to reach the largest proportion of total urban starts since 1971. However, inventory management is necessary to make sure that these units do not remain unsold upon completion," the CMHC's Chief Economist Bob Dugan said.

-

14:14

Canada: Housing Starts, November 211.9 (forecast 198.7)

-

14:09

Foreign exchange market. European session: the British pound traded lower against the U.S. dollar after the weaker-than-expected manufacturing data from the U.K.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia National Australia Bank's Business Confidence November 2 5

02:00 China Trade Balance, bln November 61.64 63.3 54.1

05:00 Japan Eco Watchers Survey: Outlook November 49.1 48.2

05:00 Japan Eco Watchers Survey: Current November 48.2 48.6 46.1

07:45 France Trade Balance, bln October -3.59 Revised From -3.38 -3.3 -4.58

08:00 United Kingdom Halifax house price index November 1.0% Revised From 1.1% 0.3% -0.2%

08:00 United Kingdom Halifax house price index 3m Y/Y November 9.7% 9%

09:30 United Kingdom Industrial Production (MoM) October 0.0% Revised From -0.2% 0.1% 0.1%

09:30 United Kingdom Industrial Production (YoY) October 1.5% Revised From 1.1% 1.2% 1.7%

09:30 United Kingdom Manufacturing Production (MoM) October 0.9% Revised From 0.8% 0% -0.4%

09:30 United Kingdom Manufacturing Production (YoY) October -0.4% Revised From -0.6% 0.1% -0.1%

10:00 Eurozone GDP (QoQ) (Revised) Quarter III 0.4% 0.3% 0.3%

10:00 Eurozone GDP (YoY) (Revised) Quarter III 1.5% 1.6% 1.6%

The U.S. dollar traded mixed against the most major currencies ahead the release of the U.S. job openings data. Job openings in the U.S. are expected to rise to 5.550 million in October from 5.526 million in September.

The euro mixed against the U.S. dollar on the GDP data from the Eurozone. Eurostat released its revised gross domestic product (GDP) data for the Eurozone on Tuesday. Eurozone's revised GDP rose 0.3% in third quarter, in line with the preliminary reading, after a 0.4% gain in the second quarter.

On a yearly basis, Eurozone's revised gross domestic product (GDP) increased 1.6% in third quarter, in line with the preliminary reading, after a 1.5% rise in the second quarter.

Household spending gained 0.4% in the third quarter, while gross fixed capital formation was flat.

Exports climbed by 0.2% in the third quarter, while imports rose by 0.9%.

The Bank of France cuts its growth forecast for the fourth quarter on Tuesday. The central bank expects the French economy to expand 0.3% in the fourth quarter, down from the previous estimate of a 0.4% growth.

According to the French Customs, France's trade deficit widened to €4.58 billion in October from €3.59 billion in September, missing expectations for a decline to a deficit of €3.3 billion.

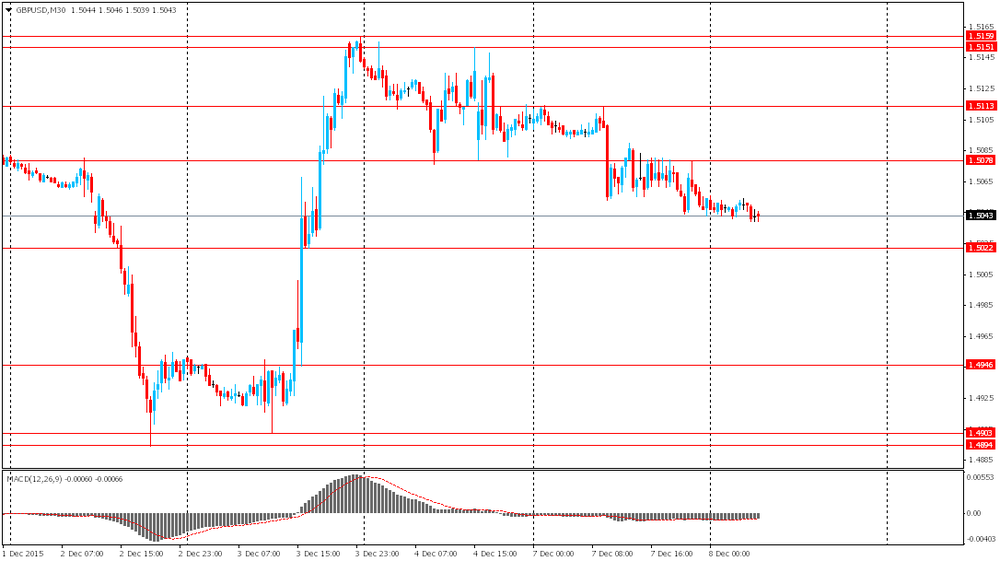

The British pound traded lower against the U.S. dollar after the weaker-than-expected manufacturing data from the U.K. The Office for National Statistics (ONS) released its manufacturing industrial production figures for the U.K. on Tuesday. Manufacturing production in the U.K. fell 0.4% in October, missing expectations for a flat reading, after a 0.9% increase in September. September's figure was revised up from a 0.8% rise.

Manufacturing output was driven by a drop in the repair and maintenance of aircraft and spacecraft, which plunged by 21.5% in October.

On a yearly basis, manufacturing production in the U.K. decreased 0.1% in October, missing forecast of a 0.1% gain, after a 0.4% drop in September. September's figure was revised up from a 0.6% decrease.

Industrial production in the U.K. climbed 0.1% in October, in line with forecasts, after a flat reading in September. September's figure was revised up from a 0.2% decline.

The increase was driven by a rise in the production of oil, water and power.

On a yearly basis, industrial production in the U.K. gained 1.7% in October, exceeding expectations for a 1.2% rise, after a 1.5% increase in September. September's figure was revised up from a 1.1% rise.

The Canadian dollar traded lower against the U.S. dollar ahead the release of the housing market data from Canada. The Canadian building permits are expected to rise 3.2% in October, after a 6.7% decline in September.

Housing starts in Canada are expected to rise to 198,700 in November from 198,100 in October.

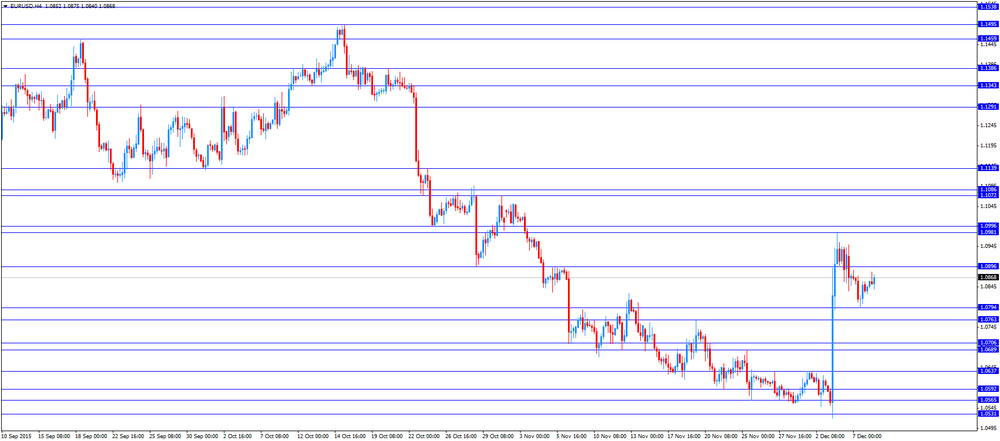

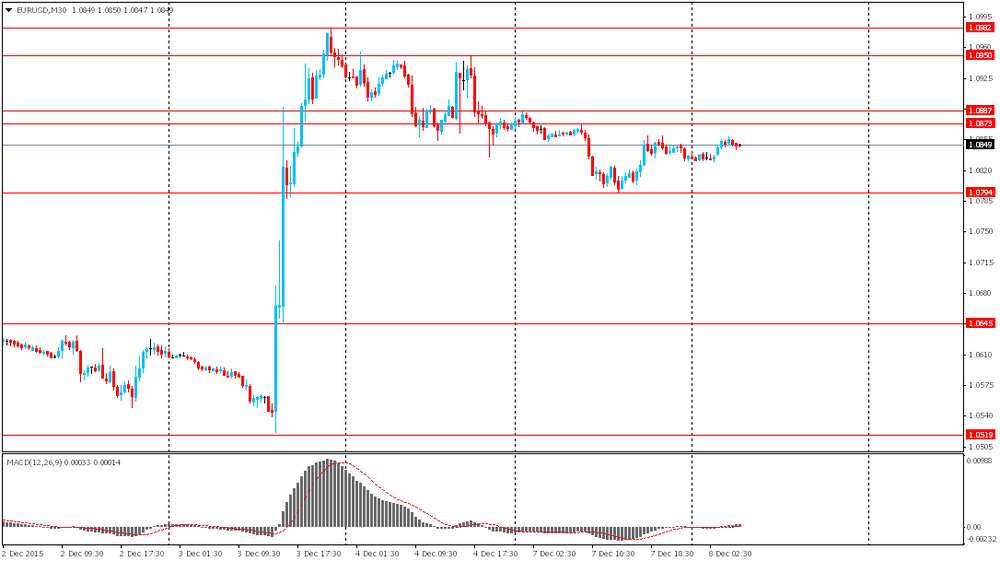

EUR/USD: the currency pair traded mixed

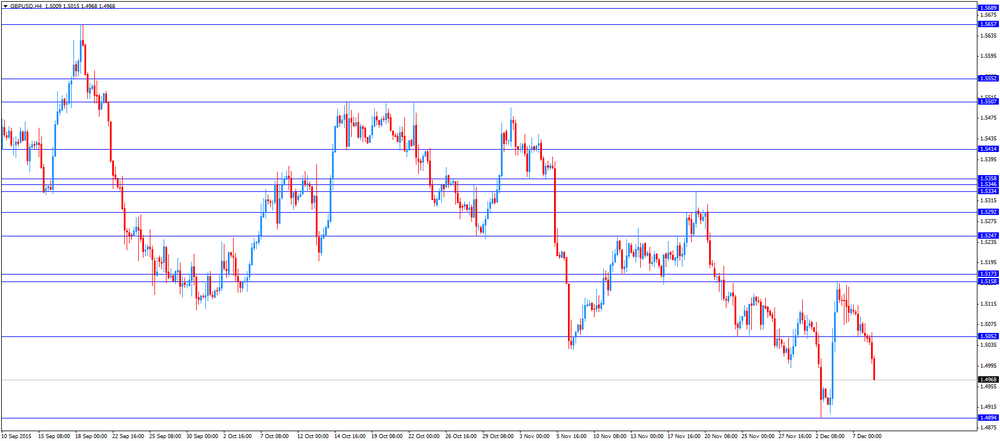

GBP/USD: the currency pair declines to $1.4968

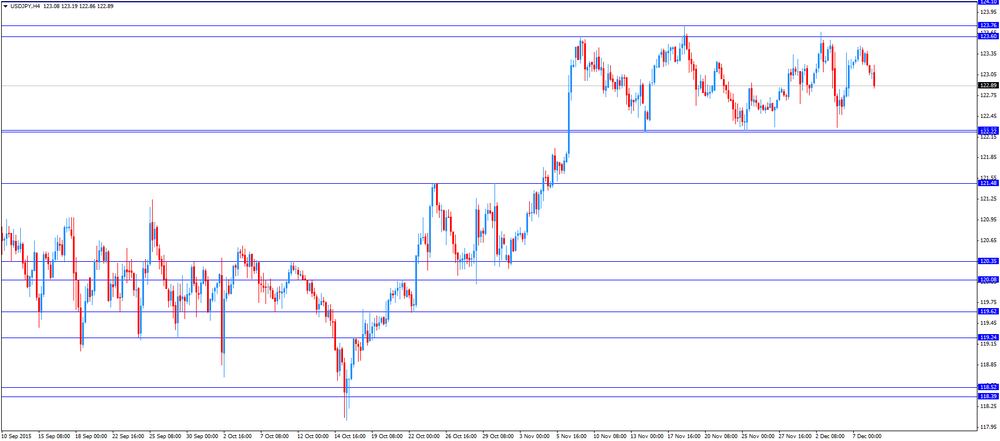

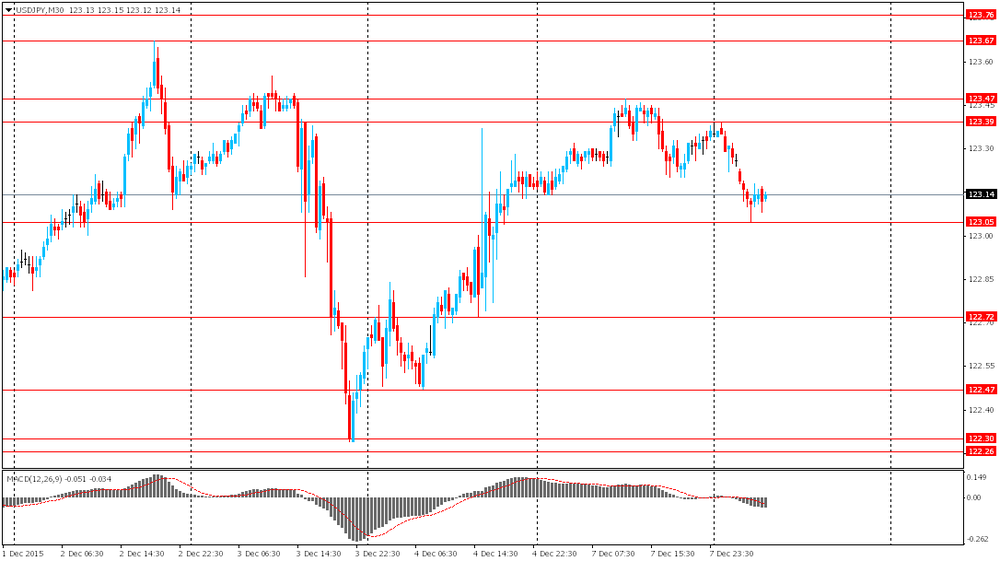

USD/JPY: the currency pair decreased to Y122.86

The most important news that are expected (GMT0):

13:15 Canada Housing Starts November 198.1 198.7

13:30 Canada Building Permits (MoM) October -6.7% 3.2%

15:00 United Kingdom NIESR GDP Estimate November 0.6%

15:00 U.S. JOLTs Job Openings October 5.526 5.550

17:50 Canada BOC Gov Stephen Poloz Speaks

23:30 Australia Westpac Consumer Confidence December 3.9%

23:50 Japan Core Machinery Orders October 7.5% -1.5%

23:50 Japan Core Machinery Orders, y/y October -1.7% 1.4%

-

13:45

Orders

EUR/USD

Offers 1.0885 1.0900 1.0920 1.0950-60 1.0980 1.1000 1.1030 1.1050 1.1080 1.1100 1.1130 1.1150

Bids 1.0850 1.0825-30 1.0800 1.0785 1.0750 1.0725-30 1.0700 1.0685 1.0665 1.0650 1.0630 1.0600

GBP/USD

Offers 1.5065 1.5085 1.5100 1.5120-25 1.5135 1.5150-55 1.5175 1.5200-10

Bids 1.5030 1.5000 1.4980-85 1.4965 1.4950 1.4930 1.4900 1.4885-90 1.4865 1.4850 1.4835 1.4800

EUR/GBP

Offers 0.7235-40 0.7250 0.7275-80 0.7300 0.7320 0.7350

Bids 0.7215-20 0.7200 0.7180 0.7165 0.7150 0.7130 0.7100 0.7075-80 0.7060

EUR/JPY

Offers 134.00 134.25 134.50 134.75 135.00 135.50 136.00

Bids 133.50 133.25-30 133.00 132.75 132.50 132.00 131.50 131.00

USD/JPY

Offers 123.20-25 123.50 123.75 124.00 124.30 124.50 124.75 125.00

Bids 123.00 122.85 122.65-70 122.50 122.20-25 122.00 121.75-80 121.50

AUD/USD

Offers 0.7250 0.7280 0.7300 0.7325 0.7340-50 0.7375 0.7400

Bids 0.7200 0.7185 0.7165 0.7150 0.7130 0.7100

-

12:07

China's trade surplus declines to $54.1 billion in November

The Chinese Customs Office released its trade data on Tuesday. China's trade surplus fell to $54.1 billion in November from $61.64 billion in October, missing expectations for a rise to a surplus of $63.3 billion.

Exports fell at an annual rate of 6.8% in November, while imports slid at an annual rate of 8.7%, the thirteenth consecutive decline.

-

11:52

Bank of France cuts its growth forecast for the fourth quarter

The Bank of France cuts its growth forecast for the fourth quarter on Tuesday. The central bank expects the French economy to expand 0.3% in the fourth quarter, down from the previous estimate of a 0.4% growth.

The manufacturing business confidence index fell to 98 in November from 99 in October.

The services business sentiment index declined to 96 in November from 97 in October.

The construction business sentiment index remained unchanged at 96 in November.

The Bank of France noted that the terror attacks in Paris continued to weigh on the economy.

-

11:43

House prices in the U.K. decline 0.2% in November

Halifax released its house prices data for the U.K. on Tuesday. House prices in the U.K. decreased 0.2% in November, missing expectations for a 0.3% gain, after a 1.0% rise in October. October's figure was revised down from a 1.1% increase.

On a yearly basis, house prices climbed 9.0% in the three months to November, after a 9.7% increase in the three months to October.

"Solid economic growth, rising real earnings and falls in already very low mortgage rates have combined to stimulate housing demand this year. The increasingly acute imbalance between supply and demand is causing prices to rise at a robust pace. A situation that is unlikely to reverse significantly in the short-term," Halifax's housing economist Martin Ellis said.

-

11:37

France's trade deficit widens to €4.58 billion in October

According to the French Customs, France's trade deficit widened to €4.58 billion in October from €3.59 billion in September, missing expectations for a decline to a deficit of €3.3 billion. September's figure was revised down from a deficit of €3.38 billion.

Exports fell 0.1% in October, while imports climbed 2.3%.

On a yearly basis, exports rose 1.8% in October, while imports declined 1.0%.

-

11:32

Eurozone's revised GDP climbs 0.3% in third quarter

Eurostat released its revised gross domestic product (GDP) data for the Eurozone on Tuesday. Eurozone's revised GDP rose 0.3% in third quarter, in line with the preliminary reading, after a 0.4% gain in the second quarter.

On a yearly basis, Eurozone's revised gross domestic product (GDP) increased 1.6% in third quarter, in line with the preliminary reading, after a 1.5% rise in the second quarter.

Household spending gained 0.4% in the third quarter, while gross fixed capital formation was flat.

Exports climbed by 0.2% in the third quarter, while imports rose by 0.9%.

-

11:26

U.K. manufacturing production falls 0.4% in October, while industrial production climbs 0.1%

The Office for National Statistics (ONS) released its manufacturing industrial production figures for the U.K. on Tuesday. Manufacturing production in the U.K. fell 0.4% in October, missing expectations for a flat reading, after a 0.9% increase in September. September's figure was revised up from a 0.8% rise.

Manufacturing output was driven by a drop in the repair and maintenance of aircraft and spacecraft, which plunged by 21.5% in October.

On a yearly basis, manufacturing production in the U.K. decreased 0.1% in October, missing forecast of a 0.1% gain, after a 0.4% drop in September. September's figure was revised up from a 0.6% decrease.

Industrial production in the U.K. climbed 0.1% in October, in line with forecasts, after a flat reading in September. September's figure was revised up from a 0.2% decline.

The increase was driven by a rise in the production of oil, water and power.

On a yearly basis, industrial production in the U.K. gained 1.7% in October, exceeding expectations for a 1.2% rise, after a 1.5% increase in September. September's figure was revised up from a 1.1% rise.

-

11:00

Eurozone: GDP (QoQ), Quarter III 0.3% (forecast 0.3%)

-

11:00

Eurozone: GDP (YoY), Quarter III 1.6% (forecast 1.6%)

-

10:59

St. Louis Fed President James Bullard: the Fed will focus on inflation once it starts raising its interest rate

St. Louis Fed President James Bullard said on Monday that the Fed will focus on inflation once it starts raising its interest rate.

He noted that inaccurate Fed forecasts of growth, employment and inflation led to the delay of an interest rate hike by the Fed.

"Negative surprises with respect to real GDP growth and inflation carried more weight during this period than the positive surprises on labour market performance," Bullard said.

-

10:49

Bank lending in Japan increases 2.3% year-on-year in November

The Bank of Japan released its bank lending data on Tuesday. Bank lending in Japan increased 2.3% year-on-year in November.

Lending excluding trusts climbed 2.3%, lending from trusts rose 2.2%, while lending from foreign banks was up 0.1%.

-

10:36

Japan’s final GDP rises 0.3% in the third quarter

Japan's Cabinet Office released its final gross domestic product (GDP) data for Japan late Monday evening. Japan's GDP increased by 0.3% in the third quarter, beating expectations for a flat reading and up from the preliminary reading of a 0.2% decline, after a 0.3% fall in the second quarter.

Business investment rose 0.6% in the third quarter, up from a preliminary reading of a 1.3% drop, while household spending increase 0.4%, down from a preliminary reading of a 0.5% gain.

On a yearly basis, Japan's economy climbed by 1.0% in the third quarter, exceeding expectations for a 0.1% gain and up from the preliminary reading of a 0.8% drop, after a 0.5% decrease in the second quarter. The second quarter's figure was revised up from a 0.7% fall.

-

10:30

United Kingdom: Industrial Production (YoY), October 1.7% (forecast 1.2%)

-

10:30

United Kingdom: Manufacturing Production (YoY), October -0.1% (forecast 0.1%)

-

10:30

United Kingdom: Industrial Production (MoM), October 0.1% (forecast 0.1%)

-

10:30

United Kingdom: Manufacturing Production (MoM) , October -0.4% (forecast 0%)

-

10:24

Consumer credit in the U.S. increases by $15.98 billion in October

The Fed released its consumer credits figures on Monday. Consumer credit in the U.S. rose by $15.98 billion in October, missing expectations for a $20.7 billion increase, after a $28.57 billion gain September. September's figure was revised down from a $28.92 billion rise.

The increase was driven by gains in non-revolving credit. Revolving credit climbed by $0.18 billion in October, while non-revolving credit jumped by $15.8 billion.

-

10:12

The Conference Board’s Employment Trends Index (ETI) for the U.S. declines to 128.69 in November

The Conference Board released its Employment Trends Index (ETI) for the U.S on Monday. The index declined to 128.69 in November from 129.75 in October.

Five of the eight components decreased.

"Despite the strong numbers on job creation in the past few months, the Employment Trends Index posted the largest one month decline since the Great Recession, with five of the eight components contributing negatively to the index. While two of the components - initial claims for unemployment and our forecast of job openings - suggest modest adverse developments, their levels are still healthy. However, the past month's weakness in consumer confidence in job growth and the slowdown in temporary help needs careful watching. Overall, there is reason for caution to not linearly extrapolate the current strong growth into 2016," Managing Director of Macroeconomic and Labour Market Research at The Conference Board, Gad Levanon, said.

-

09:24

Option expiries for today's 10:00 ET NY cut

USD/JPY 122.85 (USD 216m) 123.15 (220m) 123.45 (250m) 124.00 (325m)

EUR/USD 1.0745-50 (EUR 1bln) 1.0800 (412m) 1.0850 (500m) 1.0925 (EUR 3.5bln)

GBP/USD 1.5000 (GBP 443m)

USD/CAD 1.3350 (USD 845m)

AUD/USD 0.7425 (AUD 250m)

EUR/JPY 130.00 (EUR 1bln) 132.00 (700m)

-

09:01

United Kingdom: Halifax house price index, November -0.2% (forecast 0.3%)

-

09:01

United Kingdom: Halifax house price index, November -0.2% (forecast 0.3%)

-

09:01

United Kingdom: Halifax house price index 3m Y/Y, November 9%

-

08:45

France: Trade Balance, bln, October -4.58 (forecast -3.3)

-

08:34

Options levels on tuesday, December 8, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1038 (5102)

$1.0995 (2723)

$1.0941 (1586)

Price at time of writing this review: $1.0861

Support levels (open interest**, contracts):

$1.0808 (1018)

$1.0763 (1142)

$1.0706 (3465)

Comments:

- Overall open interest on the CALL options with the expiration date January, 8 is 44503 contracts, with the maximum number of contracts with strike price $1,0900 (5102);

- Overall open interest on the PUT options with the expiration date January, 8 is 54700 contracts, with the maximum number of contracts with strike price $1,0450 (7725);

- The ratio of PUT/CALL was 1.23 versus 1.15 from the previous trading day according to data from December, 4

GBP/USD

Resistance levels (open interest**, contracts)

$1.5403 (621)

$1.5305 (978)

$1.5208 (678)

Price at time of writing this review: $1.5053

Support levels (open interest**, contracts):

$1.4991 (1193)

$1.4894 (1348)

$1.4796 (918)

Comments:

- Overall open interest on the CALL options with the expiration date January, 8 is 11198 contracts, with the maximum number of contracts with strike price $1,5250 (1525);

- Overall open interest on the PUT options with the expiration date January, 8 is 11621 contracts, with the maximum number of contracts with strike price $1,5100 (1782);

- The ratio of PUT/CALL was 1.04 versus 1.05 from the previous trading day according to data from December, 4

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:00

Foreign exchange market. Asian session: the Australian dollar plunged amid data from China

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia National Australia Bank's Business Confidence November 2 5

02:00 China Trade Balance, bln November 61.64 63.3 54.1

05:00 Japan Eco Watchers Survey: Outlook November 49.1 48.2

05:00 Japan Eco Watchers Survey: Current November 48.2 48.6 46.1

The Australian dollar fell against the U.S. dollar amid weak data from China, Australia's key trading partner. China's trading surplus contracted to $54.1 billion in November from $61.64 billion reported previously, while economists had expected the surplus to expand to $62.8 billion. Exports fell by 6.8% y/y, while imports declined by 8.7%. Economists had expected imports to fall by 12.6%. Weak imports suggest that exports from Australia were also weak and weigh on the AUD. Declines in commodity prices put additional pressure on the country's currency.

The yen rose after revised GDP data lowered expectations of further monetary policy easing from the Bank of Japan. The Economic and Social Research Institute reported that the country's GDP rose by 0.3% q/q in the third quarter compared to -0.2% reported previously. The GDP rose by 1.0% on an annualized basis in line with expectations.

Today investors are waiting for data on GDP in the EU. A median forecast suggests that the euro zone GDP rose by 0.3% in the third quarter compared to a 0.4% rise reported previously.

EUR/USD: the pair rose to $1.0860 in Asian trade

USD/JPY: the pair fell to Y123.05

GBP/USD: the traded within $1.5040-55

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:45 France Trade Balance, bln October -3.38 -3.3

08:00 United Kingdom Halifax house price index November 1.1% 0.3%

08:00 United Kingdom Halifax house price index 3m Y/Y November 9.7%

09:30 United Kingdom Industrial Production (MoM) October -0.2% 0.1%

09:30 United Kingdom Industrial Production (YoY) October 1.1% 1.2%

09:30 United Kingdom Manufacturing Production (MoM) October 0.8% 0%

09:30 United Kingdom Manufacturing Production (YoY) October -0.6% 0.1%

10:00 Eurozone GDP (QoQ) (Revised) Quarter III 0.4% 0.3%

10:00 Eurozone GDP (YoY) (Revised) Quarter III 1.5% 1.6%

13:15 Canada Housing Starts November 198.1 198.7

13:30 Canada Building Permits (MoM) October -6.7% 3.2%

15:00 United Kingdom NIESR GDP Estimate November 0.6%

15:00 U.S. JOLTs Job Openings October 5.526 5.550

17:50 Canada BOC Gov Stephen Poloz Speaks

23:30 Australia Westpac Consumer Confidence December 3.9%

23:50 Japan Core Machinery Orders October 7.5% -1.5%

23:50 Japan Core Machinery Orders, y/y October -1.7% 1.4%

-

06:01

Japan: Eco Watchers Survey: Current , November 46.1 (forecast 48.6)

-

06:01

Japan: Eco Watchers Survey: Outlook, November 48.2

-

04:01

China: Trade Balance, bln, November 54.1 (forecast 63.3)

-

01:46

Australia: National Australia Bank's Business Confidence, November 5

-

00:51

Japan: Current Account, bln, October 1458.4 (forecast 1659.4)

-

00:50

Japan: GDP, y/y, Quarter III 1.0% (forecast 0.1%)

-

00:50

Japan: GDP, q/q, Quarter III 0.3% (forecast 0%)

-

00:29

Currencies. Daily history for Dec 7’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0836 -0,34%

GBP/USD $1,5054 -0,35%

USD/CHF Chf0,9999 +0,31%

USD/JPY Y123,36 +0,15%

EUR/JPY Y133,68 -0,18%

GBP/JPY Y185,69 -0,19%

AUD/USD $0,7266 -0,96%

NZD/USD $0,6641 -1,46%

USD/CAD C$1,3496 +0,90%

-

00:03

Schedule for today, Tuesday, Dec 8’2015:

(time / country / index / period / previous value / forecast)

00:30 Australia National Australia Bank's Business Confidence November 2

02:00 China Trade Balance, bln November 61.64 63.3

05:00 Japan Eco Watchers Survey: Outlook November 49.1

05:00 Japan Eco Watchers Survey: Current November 48.2

07:45 France Trade Balance, bln October -3.38

08:00 United Kingdom Halifax house price index November 1.1% 0.3%

08:00 United Kingdom Halifax house price index 3m Y/Y November 9.7%

09:30 United Kingdom Industrial Production (MoM) October -0.2% 0.1%

09:30 United Kingdom Industrial Production (YoY) October 1.1% 1.3%

09:30 United Kingdom Manufacturing Production (MoM) October 0.8% 0%

09:30 United Kingdom Manufacturing Production (YoY) October -0.6% 0.2%

10:00 Eurozone GDP (QoQ) (Revised) Quarter III 0.4% 0.3%

10:00 Eurozone GDP (YoY) (Revised) Quarter III 1.5% 1.6%

13:15 Canada Housing Starts November 198.1

13:30 Canada Building Permits (MoM) October -6.7%

15:00 United Kingdom NIESR GDP Estimate November 0.6%

15:00 U.S. JOLTs Job Openings October 5.526 5.550

17:50 Canada BOC Gov Stephen Poloz Speaks

23:30 Australia Westpac Consumer Confidence December 3.9%

23:50 Japan Core Machinery Orders October 7.5% -1.5%

23:50 Japan Core Machinery Orders, y/y October -1.7% 1.4%

-