Noticias del mercado

-

21:00

New Zealand: RBNZ Interest Rate Decision, 2.5% (forecast 2.5%)

-

20:21

American focus: the US dollar fell

The US dollar continues to decline, dropping to the lowest values of this month against the euro and Japanese yen, as investors were awaiting the Federal Reserve's meeting next week.

Investors have long been open position, relying on the growth of the US dollar in anticipation of higher key interest rate the Fed for the first time in nearly 10 years. Many expect that rates will be raised at a meeting of the Operations Committee on the open market, which will take place on December 15-16. The rising cost of borrowing in the United States will make the dollar more attractive to investors seeking higher returns.

Recently, however, some asset managers have come to the conclusion that immediately after the Fed's meeting will weaken the dollar, as it has historically, and only then begin to rise again.

In addition, investors are going to close the position at the completion of the year, and many expect that market liquidity will decline after the Fed meeting.

Pressure on the dollar has also today published statistics. A report published by the US Census Bureau showed that the seasonally adjusted inventories in the warehouses of wholesale trade declined in October by 0.1%, reaching $ 585.9 billion. Experts expect that stocks will rise by 0.1% after increasing by 0 2% in September (revised from 0.5%). Compared with October 2014 reserves increased by 3.6%. It also became known that the stocks of durable goods fell by 0.1% in monthly terms, but rose by 2.5% per annum. Stocks of metals and minerals, excluding oil, fell by 1.1%, while stocks of electrical and electronic products rose 0.6%. Stocks of non-durable goods decreased by 0.1% from September, but rose by 5.4% per annum.

In addition, the report showed that wholesale sales totaled $ 448.0 in October bln., Almost unchanged compared with September. However, in annual terms, sales declined by 3.7%. Sales of durable goods fell 0.8% in the month and decreased by 2.2% per annum. Sales of vehicles and spare parts to them declined by 2.6% in October. Sales of nondurable goods rose 0.7% for the month, but fell by 5.1% per annum. Sales of crude oil and petroleum products increased by 2.9%, while sales of paper and paper products increased by 1.5%.

Also, the Census Bureau reported that the ratio of inventories to sales was 1.31 months in October. Recall that in October 2014 the ratio was at 1.22 months.

Previously, little impact on the rise in the euro had data on the statement by the representative of Germany and the ECB Nowotny. Federal Statistical Office of Germany reported that the country's trade balance, without seasonal adjustment, reached 22.5 billion, lower than the previous value revised to 22.8 billion from 22.9 billion. Exports and imports of Germany in October decreased, and the economy is likely no longer It will rely heavily on the export sector. Exports adjusted for seasonal variation and calendar factors decreased by 1.2% compared to September, while imports decreased by 3.4%.

Also today, the IFO Institute has revised downwards its forecast for German growth in 2015 to 1.7% from 1.9%. Estimates for 2016 have been improved to 1.9% from 1.85%. Also added to the IFO that the fall in oil prices, the increase in earnings, as well as easing the tax burden on households will help to ensure that private consumption will continue to provide the greatest support to the economy. While investment in construction is expected to grow dramatically over the forecast period, investment in equipment will show only a modest increase, in spite of the favorable financing conditions. As imports grow more than exports due to strong domestic demand forecasts, there will be almost no stimulus from foreign trade.

Meanwhile, a representative of the European Central Bank Ewald Nowotny said that the recent decision to expand the bank's actions to support the economy was "correct" in view of the still slow economic growth. "Economic growth in the euro area remains slow," - said Nowotny, adding that inflation is still significantly lower than the ECB's target of "below 2%". Comments representative of the Central Bank were made a few days after the magnitude of easing monetary policy the ECB has not met the expectations of many market participants.

The pound has appreciated significantly against the dollar, having played with all the lost positions yesterday. The reason for such dynamics was a general weakening of the US dollar and expectations of tomorrow's meeting of the Bank of England. It is expected that the Bank of England will announce the maintaining interest rates at a record low of 0.5%. Probably eight out of nine members of the Bank Board voted for to leave rates unchanged. Experts also point out that the Central Bank may signal that rates will stay low for an extended period of time.

Investors also drew attention to the report of the British Chamber of Commerce (BCC). It was reported that the UK economy will continue to show moderate growth, which will be mainly due to higher activity in the services sector and increased consumer spending. However, weakness in the sphere of trade and industrial activity will exert pressure on the economy. The BCC said that gross domestic product will grow by 2.4 percent this year, instead of 2.6 percent as reported in the latest economic forecast. The forecast for next year was lowered to 2.5 percent from 2.7 percent. For 2017, growth has been revised up to 2.5 percent from 2.7 percent. Weaker-than-expected trade data and manufacturing activity were the main reasons for lowering the forecast for GDP growth, said the BCC. Analysts said that the quarterly growth in the 4th quarter will average a little more than 0.6 percent. The services sector expanded by 2.7 percent in 2015, and production is expected to decline by 0.2 percent. In 2016, the growth in these sectors is likely to be 2.9 percent and 0.7 percent respectively. The unemployment rate is projected to decline from 5.3 percent in the third quarter of 2015 to 5.2 percent in the second quarter of 2016, and then to 5.1 percent in the second quarter of 2017.

-

16:37

British Chambers of Commerce downgrades its U.K. GDP growth forecasts

The British Chambers of Commerce (BCC) released its U.K. GDP growth forecast on Wednesday. The U.K. economy is expected to grow at 2.4% in 2015, down from the previous forecast of a 2.6% rise, 2.5% in 2016, down from the previous forecast of a 2.7% gain, and 2.5% in 2017, down from the previous forecast of a 2.7% increase.

The downgrade was driven by weaker-than-expected trade and manufacturing activity data.

The BCC noted that the U.K. economy will be supported by the strong activity in the service sector and consumer spending.

"Official data is starting to reflect what our Quarterly Economic Survey has been showing all year - that our persistently weak trade performance and current account balance are impacting our overall growth. Similarly, the manufacturing sector has been hit badly by falling global prospects, tipping an earlier prediction of growth in 2015 to an expected contraction," John Longworth, Director General of the British Chambers of Commerce, said.

"We cannot rely so heavily on consumer spending to fuel our economy, especially when driven by increased borrowing. We have been down this path before, and know that it leaves individuals and businesses exposed when interest rates do eventually rise," he added.

-

16:30

U.S.: Crude Oil Inventories, December -3.568 (forecast 0.0)

-

16:24

Wholesale inventories in the U.S. falls 0.1% in October

The U.S. Commerce Department released wholesale inventories on Wednesday. Wholesale inventories in the U.S. fell 0.1% in October, missing expectations for a 0.1 gain, after a 0.w% increase in September. September's figure was revised down from a 0.5% rise.

The decline was driven by a fall in inventories of non-durable and durable goods. Inventories of non-durable goods decreased 0.1% in October, while inventories of durable goods fell 0.1%.

Wholesale sales were flat in October, after a 0.5% gain in September.

-

16:02

Ifo institute upgrades its German economic growth for 2016

The Ifo institute upgraded its German economic growth for 2016 on Wednesday. Germany's economy is expected to expand 1.7% this year, 1.9% in 2016, up from the previous estimate of 1.8%, and 1.7% in 2017.

The Ifo institute expects private consumption to remain the main driver.

"The upturn in the German economy is continuing. Private consumption continues to drive the upturn, since the income outlook of private households remains good due to further improvements in the labour market. This effect is compounded by higher, credit-financed government spending on refugees, which is creating a temporary uptick in demand at the expense of future demand," Ifo President Hans-Werner Sinn said.

Inflation is expected to be 0.3% this year, 1.0% in 2016 and 1.5% in 2017.

-

16:00

U.S.: Wholesale Inventories, October -0.1% (forecast 0.1%)

-

15:21

Home loans in Australia fall 0.5% in October

The Australian Bureau of Statistics released its home loans data on Wednesday. Home loans in Australia decreased 0.5% in October, beating expectations for a 1.0% drop, after 2.0% rise in September.

The value of owner occupied loans rose at a seasonally adjusted 0.1% in October, investment lending dropped 6.1%, while the number of loans for the construction of dwellings fell 0.4%.

-

14:50

Option expiries for today's 10:00 ET NY cut

USD/JPY 122.15 (USD 220m) 124.40 (444m)

EUR/USD 1.0800 (EUR 1.3bln) 1.0825 (EUR 629m) 1.0840 (1.6bln) 1.0970 (518m) 1.1000 (541m)

GBP/USD Nothing of note

USD/CAD Nothing of note

AUD/USD 0.7225 (AUD 249m) 0.7350 (341m)

EUR/JPY 132.10 (227m)

AUD/JPY 88.30 (AUD 283m)

-

14:38

European Central Bank Governing Council member Ewald Nowotny: it was the right decision to add further stimulus measures

The European Central Bank (ECB) Governing Council member Ewald Nowotny said in Vienna on Wednesday that it was the right decision to add further stimulus measures, saying that the economic development was still weak and inflation remains well below 2% target.

Nowotny pointed out that it is analysts fault for market disappointment after the release of the ECB's monetary policy decision.

"I think it was really a massive failure of market analysts. I do not think that the communication policy of the ECB sent the wrong signal," he said.

-

14:21

Core machinery orders in Japan jump 10.7% in October

Japan's Cabinet Office released its core machinery orders data on late Tuesday evening. Core machinery orders in Japan jumped 10.7% in October, beating expectations for a 1.5% fall, after a 7.5% rise in September.

On a yearly basis, core machinery orders climbed 10.3% in October, beating expectations for a 1.4% increase, after a 1.7% drop in September.

This data indicates that capital spending in Japan improved, and it could mean that the Bank of Japan may not expand its quantitative easing.

The total number of machinery orders soared 20.9% in October from a month earlier.

Orders from non-manufacturers jumped 10.7% in October, while orders from manufacturers were up 14.5%.

-

14:08

Foreign exchange market. European session: the euro higher against the U.S. dollar in the absence of any major economic reports from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Home Loans October 2.0% -1% -0.5%

01:30 China PPI y/y November -5.9% -5.9% -5.9%

01:30 China CPI y/y November 1.3% 1.4% 1.5%

06:00 Japan Prelim Machine Tool Orders, y/y November -22.9% Revised From -23.1% -17.9%

06:45 Switzerland Unemployment Rate (non s.a.) November 3.3% 3.3% 3.4%

07:00 Germany Current Account October 25.0 Revised From 25.1 23.0

07:00 Germany Trade Balance (non s.a.), bln October 22.8 Revised From 22.9 22.5

12:00 U.S. MBA Mortgage Applications December -0.2% 1.2%

The U.S. dollar traded lower against the most major currencies ahead the release of the U.S. wholesale inventories data. Wholesale inventories in the U.S. are expected to rise 0.1% in October, after a 0.5% increase in September.

The euro higher against the U.S. dollar in the absence of any major economic reports from the Eurozone.

Meanwhile, the economic data from Germany was weaker than in the previous period. Destatis released its trade data for Germany on Wednesday. Germany's seasonally adjusted trade surplus increased to €20.8 billion in October from 19.2 in September.

Exports fell at a seasonally and calendar-adjusted 1.2% in October, while imports dropped 3.4%.

On a yearly basis, German exports increased 3.3% in October, while imports rose by 3.0%.

Germany's current account surplus was at €23.0 billion in October, down from €25.0 billion in September. September's figure was revised down from a surplus of €25.1 billion.

The British pound traded higher against the U.S. dollar in the absence of any major economic reports from the U.K.

The Swiss franc traded higher against the U.S. dollar. The Swiss State Secretariat for Economic Affairs released its unemployment data for Switzerland on Wednesday. The Swiss unemployment rate remained at a seasonally adjusted 3.4% in November.

On a seasonally unadjusted basis, the unemployment rate in Switzerland increased to 3.4 in November from 3.3% in October. Analysts had expected the unemployment rate to remain unchanged at 3.3%.

The number of unemployed people in Switzerland rose by 6,874 to 148,143 in November from a month earlier.

The youth unemployment rate was down to 3.3% in November from 3.5% in October.

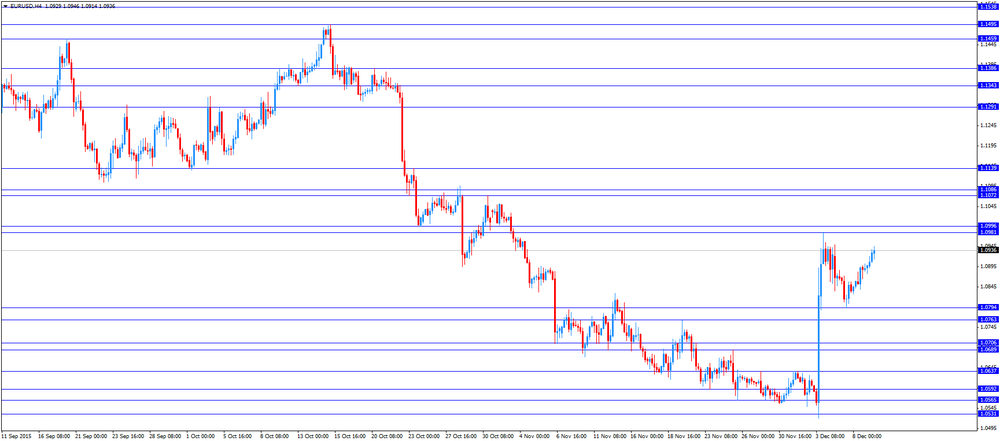

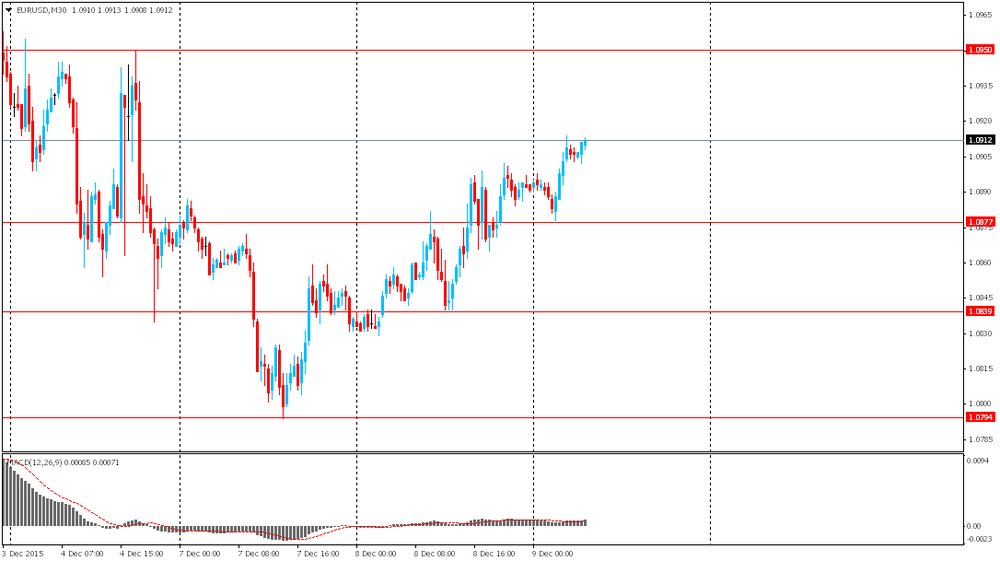

EUR/USD: the currency pair rose to $1.0946

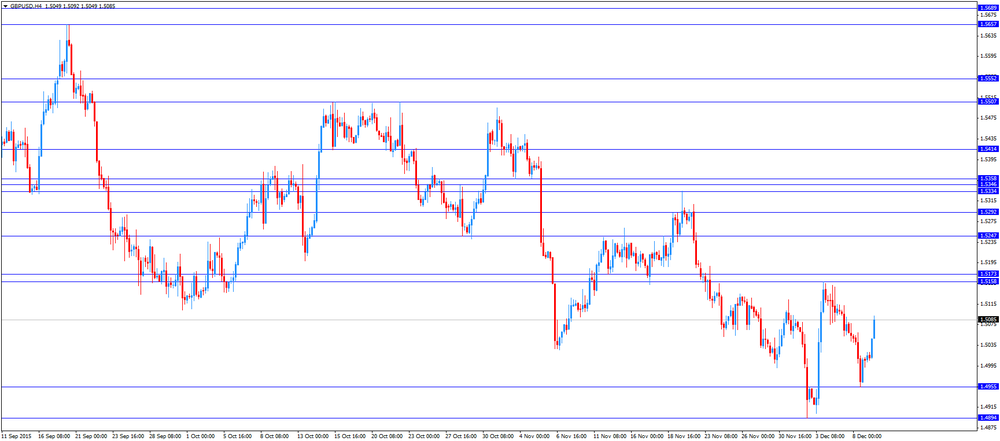

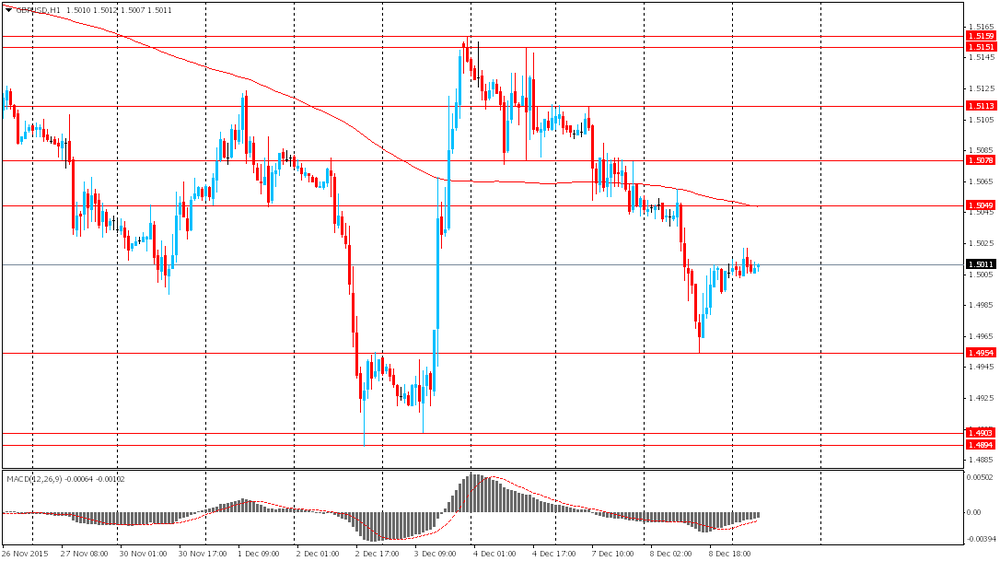

GBP/USD: the currency pair increased to $1.5092

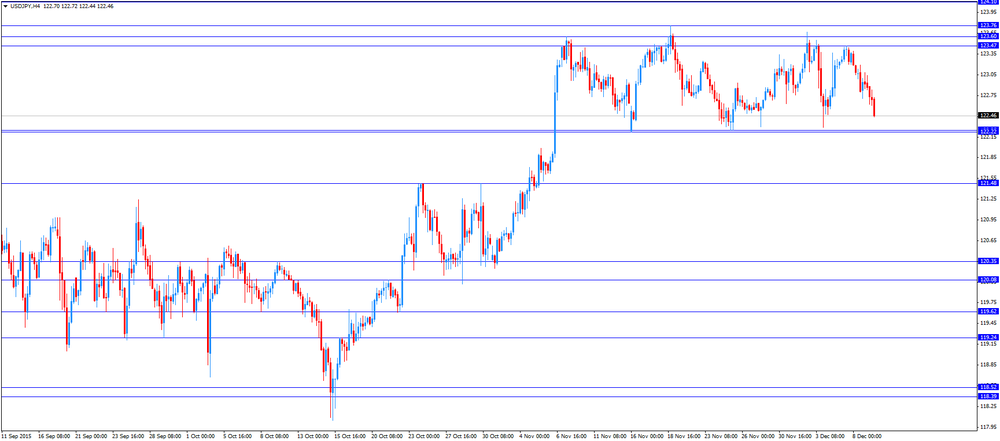

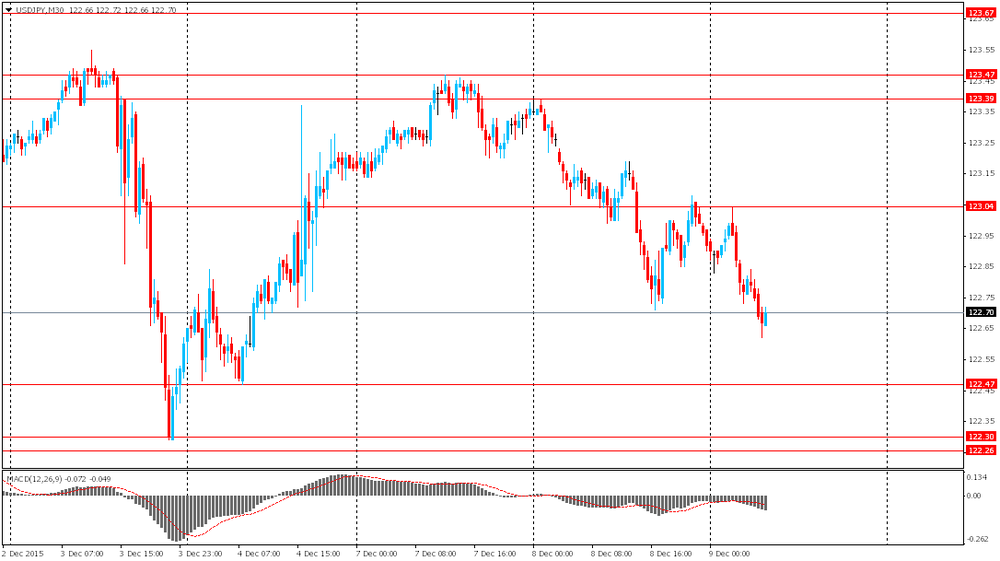

USD/JPY: the currency pair decreased to Y122.44

The most important news that are expected (GMT0):

15:00 U.S. Wholesale Inventories October 0.5% 0.1%

15:30 U.S. Crude Oil Inventories December 1.177 0.0

20:00 New Zealand RBNZ Interest Rate Decision 2.75% 2.5%

20:00 New Zealand RBNZ Rate Statement

20:05 New Zealand RBNZ Press Conference

23:50 Japan BSI Manufacturing Index Quarter IV 11 12.1

-

13:50

Orders

EUR/USD

Offers 1.0930-35 1.0950-60 1.0980 1.1000 1.1030 1.1050 1.1080 1.1100

Bids 1.0900 1.0880 1.0865 1.0850 1.0825-30 1.0800 1.0785 1.0750 1.0725-30 1.0700

GBP/USD

Offers 1.5055-60 1.5080-85 1.5100 1.5120-25 1.5135 1.5150-55 1.5175 1.5200-10

Bids 1.5020-25 1.5000 1.4985 1.4965 1.4950 1.4930 1.4900 1.4885-90 1.4865 1.4850 1.4835 1.4800

EUR/GBP

Offers 0.7275-80 0.7300 0.7320 0.7350 0.7375 0.7400

Bids 0.7245-50 0.7215-20 0.7200 0.7180 0.7165 0.7150 0.7130 0.7100

EUR/JPY

Offers 134.20-25 134.50 134.75 135.00 135.50 136.00

Bids 133.80 133.50 133.25-30 133.00 132.75 132.50 132.00 131.50 131.00

USD/JPY

Offers 122.85 123.00 123.20-25 123.50 123.75 124.00 124.30 124.50

Bids 122.65 122.50 122.20-25 122.00 121.75-80 121.50 121.30 121.00

AUD/USD

Offers 0.7235 0.7250 0.7280 0.7300 0.7325 0.7340-50 0.7375 0.7400

Bids 0.7200 0.7185 0.7165 0.7150 0.7130 0.7100 0.7085 0.7065 0.7050

-

13:00

U.S.: MBA Mortgage Applications, December 1.2%

-

11:45

Westpac’ consumer confidence index for Australia declines 0.8% in November

Westpac Bank released its consumer confidence index for Australia on late Tuesday evening. The index fell 0.8% in December, after a 3.9% gain in November.

The index was mainly driven by a drop in a future economic conditions (next 5 years) sub-index.

"The Index has held on to most of the gains from last month's surprise 4% lift and is 10.7% above its levels this time last year. There have only been two months since January 2014 with higher index readings," Westpac Chief Economist Bill Evans said.

"The Reserve Bank Board next meets on February 2. We expect the Board will decide to hold rates steady pending further evidence on the labour market; commodity prices; the Australian dollar; and inflation. Westpac has long held the view that the RBA will be on hold throughout 2016 with the risk to any move being clearly to the downside," he noted.

-

11:32

Swiss unemployment rate remains unchanged at a seasonally adjusted 3.4% in November

The Swiss State Secretariat for Economic Affairs released its unemployment data for Switzerland on Wednesday. The Swiss unemployment rate remained at a seasonally adjusted 3.4% in November.

On a seasonally unadjusted basis, the unemployment rate in Switzerland increased to 3.4 in November from 3.3% in October. Analysts had expected the unemployment rate to remain unchanged at 3.3%.

The number of unemployed people in Switzerland rose by 6,874 to 148,143 in November from a month earlier.

The youth unemployment rate was down to 3.3% in November from 3.5% in October.

-

11:22

Germany’s labour costs per hour worked are flat in the third quarter

The German statistical office Destatis relased its labour costs data for the third quarter on Wednesday. Labour costs per hour worked were flat in the third quarter on a seasonally and calendar adjusted basis, after a 0.6% increase in the second quarter.

On a yearly basis, labour costs per hour worked increased 2.4% in the third quarter on a calendar adjusted basis, after a 3.0% gain in the second quarter.

The costs of gross earnings climbed a calendar adjusted 2.3% year-on-year in the third quarter, while non-wage costs were up 2.5%.

-

10:58

Germany's seasonally adjusted trade surplus increases to €20.8 billion in October

Destatis released its trade data for Germany on Wednesday. Germany's seasonally adjusted trade surplus increased to €20.8 billion in October from 19.2 in September.

Exports fell at a seasonally and calendar-adjusted 1.2% in October, while imports dropped 3.4%.

On a yearly basis, German exports increased 3.3% in October, while imports rose by 3.0%.

Germany's current account surplus was at €23.0 billion in October, down from €25.0 billion in September. September's figure was revised down from a surplus of €25.1 billion.

-

10:43

Chinese consumer price index rises at annual rate of 1.5% in November

The Chinese National Bureau of Statistics released its consumer and producer price inflation data for China on Wednesday. The Chinese consumer price index (CPI) rose at annual rate of 1.5% in November, exceeding expectations for a 1.4% increase, after a 1.3% gain in October.

Food prices rose at an annual rate of 2.3% in November, while non-food prices increased 1.1%.

On a monthly basis, consumer price inflation was flat in November, after a 0.3% fall in October.

The Chinese producer price index (PPI) dropped 5.9% in November, in line with expectations, after a 5.9% decline in October.

-

10:21

Bank of Canada Governor Stephen Poloz: the Canadian economy will continue to recover in 2016

The Bank of Canada (BoC) Governor Stephen Poloz said in a speech on Tuesday that the Canadian economy will continue to recover in 2016.

""I think we've got all the ingredients of a recovery in place. It's being masked right now, to some degree, by the declines especially in the energy sector, but also in other resource areas," he said.

Poloz pointed out that the BoC could use negative interest rates in the event of a crisis.

"We don't need unconventional policies now, and we don't expect to use them. However, it's prudent to be prepared for every eventuality," the BoC governor noted.

"Regardless of the situation, the Bank will keep its primary focus on achieving the inflation target," he added.

-

09:21

Option expiries for today's 10:00 ET NY cut

USD/JPY 122.15 (USD 220m) 124.40 (444m)

EUR/USD 1.0800 (EUR 1.3bln) 1.0825 (EUR 629m) 1.0840 (1.6bln) 1.0970 (518m) 1.1000 (541m)

GBP/USD Nothing of note

USD/CAD Nothing of note

AUD/USD 0.7225 (AUD 249m) 0.7350 (341m)

EUR/JPY 132.10 (227m)

AUD/JPY 88.30 (AUD 283m)

-

08:32

Options levels on wednesday, December 9, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1035 (5032)

$1.0994 (2796)

$1.0965 (1802)

Price at time of writing this review: $1.0918

Support levels (open interest**, contracts):

$1.0826 (1029)

$1.0779 (1306)

$1.0720 (3580)

Comments:

- Overall open interest on the CALL options with the expiration date January, 8 is 48799 contracts, with the maximum number of contracts with strike price $1,0900 (5032);

- Overall open interest on the PUT options with the expiration date January, 8 is 60545 contracts, with the maximum number of contracts with strike price $1,0450 (7713);

- The ratio of PUT/CALL was 1.24 versus 1.23 from the previous trading day according to data from December, 8

GBP/USD

Resistance levels (open interest**, contracts)

$1.5303 (1005)

$1.5205 (716)

$1.5108 (2503)

Price at time of writing this review: $1.5037

Support levels (open interest**, contracts):

$1.4987 (1204)

$1.4891 (1346)

$1.4794 (1316)

Comments:

- Overall open interest on the CALL options with the expiration date January, 8 is 14555 contracts, with the maximum number of contracts with strike price $1,5100 (2503);

- Overall open interest on the PUT options with the expiration date January, 8 is 14744 contracts, with the maximum number of contracts with strike price $1,5100 (2733);

- The ratio of PUT/CALL was 1.01 versus 1.04 from the previous trading day according to data from December, 8

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:01

Germany: Trade Balance (non s.a.), bln, October 22.5

-

08:00

Germany: Current Account , October 23.0

-

07:54

Foreign exchange market. Asian session: the New Zealand dollar declined

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia Home Loans October 2.0% -1% -0.5%

01:30 China PPI y/y November -5.9% -5.9% -5.9%

01:30 China CPI y/y November 1.3% 1.4% 1.5%

06:00 Japan Prelim Machine Tool Orders, y/y November -23.1% -17.9%

06:45 Switzerland Unemployment Rate (non s.a.) November 3.3% 3.3% 3.4%

The New Zealand dollar declined slightly ahead of The Reserve Bank of New Zealand meeting scheduled for tomorrow. Most economists expect the central bank to cut its benchmark interest rate by 25 basis points to 2.5%. Nevertheless some analysts say that the RBNZ will not change its policy now ahead of the FOMC meeting.

The Australian dollar remained under pressure amid weak trade data from China. Meanwhile today the National Bureau of Statistics of China reported that the consumer price index rose by 1.5% y/y in November compared to +1.3% in October. Analysts had expected prices to grow by 1.4% y/y. The index gained mostly due to higher food prices. Faster price growth in China suggests that the government's actions start to influence the economy.

The yen advanced against the U.S. dollar amid machinery orders data. The corresponding index rose to 10.7% in October from 7.5% reported previously. Economists had expected a reading of -1.5%.

EUR/USD: the pair rose to $1.0920 in Asian trade

USD/JPY: the pair fell to Y122.60

GBP/USD: the traded within $1.5000-20

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:00 Germany Current Account October 25.1

07:00 Germany Trade Balance (non s.a.), bln October 22.9

12:00 U.S. MBA Mortgage Applications December -0.2%

15:00 U.S. Wholesale Inventories October 0.5% 0.1%

15:30 U.S. Crude Oil Inventories December 1.177 0.0

20:00 New Zealand RBNZ Interest Rate Decision 2.75% 2.5%

20:00 New Zealand RBNZ Rate Statement

20:05 New Zealand RBNZ Press Conference

23:50 Japan BSI Manufacturing Index Quarter IV 11 12.1

-

07:45

Switzerland: Unemployment Rate (non s.a.), November 3.4% (forecast 3.3%)

-

07:16

Japan: Prelim Machine Tool Orders, y/y , November -17.9%

-

02:30

China: CPI y/y, November 1.5% (forecast 1.4%)

-

02:30

China: PPI y/y, November -5.9% (forecast -5.9%)

-

01:30

Australia: Home Loans , October -0.5% (forecast -1%)

-

01:03

Currencies. Daily history for Dec 8’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0891 +0,51%

GBP/USD $1,5006 -0,32%

USD/CHF Chf0,9922 -0,78%

USD/JPY Y122,92 -0,36%

EUR/JPY Y133,88 +0,15%

GBP/JPY Y184,46 -0,67%

AUD/USD $0,7214 -0,72%

NZD/USD $0,6642 +0,02%

USD/CAD C$1,3584 +0,65%

-

00:51

Japan: Core Machinery Orders, October 10.7% (forecast -1.5%)

-

00:50

Japan: Core Machinery Orders, y/y, October 10.3% (forecast 1.4%)

-

00:30

Australia: Westpac Consumer Confidence, December -0.8%

-