Noticias del mercado

-

21:00

U.S.: Consumer Credit , October 15.98 (forecast 20.7)

-

20:20

American focus: the US dollar rose moderately

The US dollar showed gains against major currencies, as strong US data, released on Friday, boosted hopes for a Fed rate increase in December, supporting demand for the dollar.

The dollar strengthened position after Friday the Labor Department reported last month that the US had created 211,000 jobs, after a gain of 298,000 in October.

The unemployment rate in November remained at the previous level of 5%. Economists had forecast job growth of 200,000 and only zero growth in unemployment.

Reports reinforced expectations that the upcoming meeting of December 15-16, the Fed will raise interest rates for the first time since 2006. During the growth rates of the US dollar will become more attractive for investors looking for profit.

The president of the Federal Reserve Bank of Atlanta Dennis Lockhart said on Monday that supports raising short-term interest rates to levels close to zero. This statement Lockhart made in anticipation of the next meeting of the Federal Reserve System, which will be held next week.

"I'm ready to take the decision to raise interest rates" to levels close to zero, at which they were in December 2008. Criteria for the tightening of monetary policy, the Fed indicated, "largely achieved," said Lockhart.

This interview with the Atlanta Fed President made on the eve of the next meeting of the Operations Committee on the open market, scheduled for December 15-16, during which he will participate in the vote. Many expect that the Fed will decide to raise rates from the levels where they were after the deepest financial crisis and significant deterioration of the economic situation since the Great Depression.

Some representatives of the central bank is uniquely made for the tightening of monetary policy, while others only indicated their readiness to act at the meeting. Most market participants expect a rate hike.

Sentiment on the euro remained lower after Friday European Central Bank President Mario Draghi said that, if necessary, to achieve the inflation target of the ECB is going to increase the volume of stimulation.

The comments came a day after the euro has shown the biggest one-day gain against the dollar in more than six years, jumped 3% after the recent measures announced by the ECB did not meet market expectations.

The focus of today were also the data for Germany and the euro zone. Ministry of Economy of Germany said that the volume of industrial production rose in October by 0.2%, against a decline of 1.1% in September. However, the value of the index was less than expected, as growth in manufacturing and construction partly offset by lower production in the energy sector. Most analysts forecast growth of industrial production by 0.7%. Compared with September, the volume of production in the manufacturing industry and in construction increased by 0.7%, and in the energy sector, they declined by 5.9%. "Strong winds and a large number of sunny days during the summer provide a noticeable increase in energy production from renewable sources", - the report said the ministry.

In addition, the results of the survey research group Sentix showed that the index of sentiment among investors in the euro zone improved in December, but was worse than forecasts of experts. According to the index of investor confidence rose in December to a level of 15.7 points compared to 15.1 points in November. The latter value was the highest in the last four months. Economists had expected the index to improve to 17.2 points. It also became known that the index of current conditions fell to 13.5 in December from 16.0 in the previous month. Meanwhile, the expectations index rose to 18.0 points from 14.3 points in November.

-

17:31

Fitch Ratings’ Global Economic Outlook: there will be no global recession

Fitch Ratings released its Global Economic Outlook on Monday. The agency expects the global economy to expand 2.3% in 2015, 2.6% in 2016 and 2.7% in 2017. The growth in 2015 would be the weakest growth since the global financial crisis in 2009.

Fitch said that the slowdown in emerging economies weighed on the global economy "but look unlikely to spark a global recession".

"While the global growth concerns of the late summer have not gone away, emerging-market problems do not appear to be causing extreme damage to activity in the major advanced economies. China looks most likely to muddle through rather than land hard and world trade indicators have improved marginally. Policy stimulus has been stepped up in the Eurozone and China and global consumer spending growth is holding up," the agency noted.

Fitch also said that the Fed is likely to hike its interest rate this month and to raise it four times before the end of 2016.

The Bank of Japan could add further stimulus measures, according to Fitch.

-

17:13

China’s foreign-exchange reserves drop to the lowest level since February 2013

According to data released by the People's Bank of China (PBoC) on Monday, China's foreign-exchange reserves declined by $87.2 billion to $3.44 trillion in November, after a rise by $11.39 billion in October. It was the lowest level since February 2013.

It is likely that capital outflows from China continued.

The central bank also sold the U.S. dollar to support the yuan.

-

17:01

The European Central Bank will change the publication time of the euro foreign exchange reference rates

The European Central Bank (ECB) said in a statement on its website on Monday that it will change the publication time of the euro foreign exchange reference rates (ECB reference rates). ECB reference rates will be published at around 15:00 GMT.

New publication time would be effective from July 01, 2016.

The current publication time of ECB reference rates is around 13:30 GMT.

-

16:53

European Central Bank purchases €62.6 billion of public and private debt in November

The European Central Bank (ECB) purchased €62.6 billion of public and private debt under its quantitative-easing program in November, compared to €63.7 billion in October.

The ECB bought €55.1 billion of government and agency bonds in November, €6.9 billion of covered bonds, and €0.6 billion of asset-backed securities.

The ECB kept its interest rate unchanged at 0.05% on Thursday, but lowered its deposit rate to -0.3% from -0.2%. The asset-buying programme will be extended until the end of March 2017. The volume of the monthly purchases remained unchanged.

The ECB will pause its asset-buying programme between December 22 and January 1. The central bank will resume its purchases on January 04.

The central purchased €16.46 billion of government and agency bonds, €2.1 billion of covered bonds, and €0.15 billion of asset-backed securities last week.

-

16:34

U.K. manufacturers' association EEF lowers its manufacturing growth forecasts

The U.K. manufacturers' association EEF lowered its manufacturing growth forecasts on Monday. The manufacturing sector in the U.K. is expected to drop 0.1% in 2015 and to rise 0.8% in 2016.

The EEF expects the U.K. economy to expand 2.4% in 2015 and 2.1% in 2016.

The EEF said that output balance has reached the lowest level since the third quarter of 2009, while employment and investment balances were negative for the first time since the first quarter of 2010.

"The prospect of manufacturing contributing to growth in the UK economy this year has all but faded away with another disappointing set of indicators from our survey. The downbeat mood may not be universal across all industry sectors, but it certainly seems to be spreading as the challenges have mounted through this year - from the collapse in the oil price, slower world trade growth and weaker than expected construction activity," EEF Chief Economist, Lee Hopley, said.

-

16:15

Japan's leading index rises to 102.9 in October

Japan's Cabinet Office released its preliminary leading index data on Monday. The leading index increased to 102.9 in October from 101.6 in September.

Japan's coincident index was up to 114.3 in October from 112.3 in September. It was the highest level since January.

-

16:01

U.S.: Labor Market Conditions Index, November 0.5

-

15:49

Bank of Japan Governor Haruhiko Kuroda: there is no need for the implementation of negative deposit rates in Japan

The Bank of Japan (BoJ) Governor Haruhiko Kuroda said on Monday that there is no need for the implementation of negative deposit rates in Japan.

"Our QQE has had an intended impact on the economy and financial markets," he said.

"We don't think we should implement negative deposit interest rates," Kuroda said.

-

14:59

Atlanta Fed President Dennis Lockhart: financial markets are prepared for an interest rate hike by the Fed

Atlanta Fed President Dennis Lockhart said in an interview with CNBC on Monday that financial markets are prepared for an interest rate hike by the Fed.

He also said that he expects the gradual interest rate hikes once the Fed starts raising its interest rate.

Lockhart noted that diverging monetary policies of the European Central Bank and the Fed priced-in in the foreign exchange market.

Lockhart is a voting member of the Federal Open Market Committee (FOMC) this year.

-

14:47

Option expiries for today's 10:00 ET NY cut

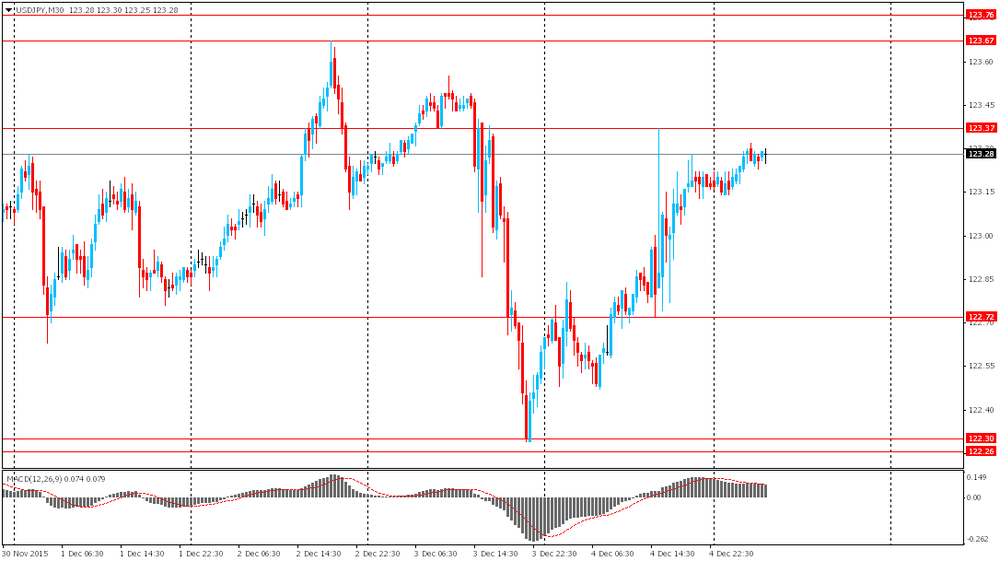

USDJPY 122.00 (USD 2.2bln) 123.00-20 (580m) 123.35 (222m) 124.00 (1.2bln)

EURUSD 1.0800 (EUR 1.9bln) 1.0850 (1.5bln) 1.0900 (1.5bln) 1.1000 (2.1bln)

GBPUSD 1.5000 (682m)

USDCAD 1.3250 (USD 473m) 1.3300 (550m)

AUDUSD 0.7200 (AUD 1bln) 0.7300 (705m)

EURGBP 0.7125 (EUR 318m) 0.7225 (279m) 0.7275 (201m)

-

14:04

Foreign exchange market. European session: the euro lower against the U.S. dollar on comments by the European Central Bank President Mario Draghi

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia ANZ Job Advertisements (MoM) November 0.3% Revised From 0.4% 1.3%

03:45 Japan BOJ Governor Haruhiko Kuroda Speaks

05:00 Japan Leading Economic Index (Preliminary) October 101.6 102.9

05:00 Japan Coincident Index (Preliminary) October 112.3 114.3

07:00 Germany Industrial Production s.a. (MoM) October -1.1% 0.7% 0.2%

07:00 Germany Industrial Production (YoY) October 0.4% Revised From 0.2% 0.0%

09:30 Eurozone Sentix Investor Confidence December 15.1 15.7

The U.S. dollar traded higher to higher against the most major currencies in the absence of any major economic reports today.

The greenback was supported by Friday's labour market data from the U.S. According to the U.S. Labor Department, the U.S. economy added 211,000 jobs in November, exceeding expectations for a rise of 200,000 jobs, after a gain of 298,000 jobs in October. October's figure was revised up from a rise of 271,000 jobs. The U.S. unemployment rate remained unchanged at 5.0% in November, in line with expectations.

Market participants speculate that the normalisation process by the Fed will be slow as the slowdown in the global economy will likely weigh on the U.S. economy.

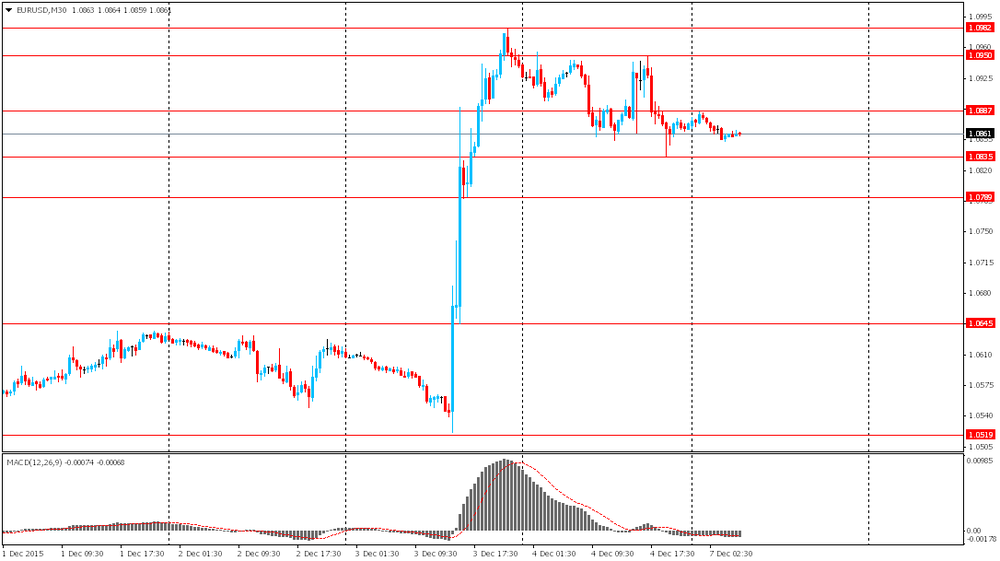

The euro lower against the U.S. dollar on comments by the European Central Bank (ECB) President Mario Draghi. He said in a speech in New York on Friday that the ECB is ready to add further stimulus measures to reach 2% inflation target if needed.

Meanwhile, the economic data from Eurozone was positive. Market research group Sentix released its investor confidence index for the Eurozone on Monday. The index climbed to 15.7 in December from 15.1 in November.

A reading above 0.0 indicates optimism, below indicates pessimism.

"The Eurozone outperforms other world regions as the effects of ECB's policy measures kick in. The remaining world regions depict signs of a slowdown. Japan slides back into recession. In contrast to Fed's interpretations of the state of the economy, the sentix indicator for the US economy highlights a contrary view amid the preparations for the first rate rise," Sentix said in its statement.

German investor confidence index increased to 22.7 in December from 20.1 in November.

Destatis released its industrial production data for Germany on Wednesday. German industrial production increased 0.2% in October, missing expectations for a 0.7% gain, after a 1.1% fall in September.

The output of capital goods increased 2.7% in October, energy output slid 5.9%, and the production in the construction sector was up 0.7%, while the production of intermediate goods dropped 1.1%.

The output of consumer goods decreased 0.1%.

German industrial production excluding energy and construction rose by 0.7% in October.

The British pound traded mixed against the U.S. dollar in the absence of any major economic reports from the U.K.

The Bank of England Governor Mark Carney will speak at 15:00 GMT.

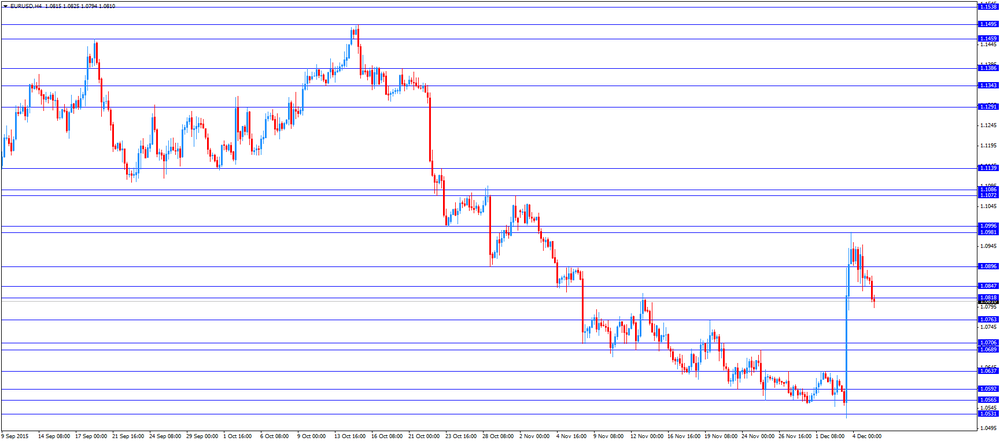

EUR/USD: the currency pair fell to $1.0794

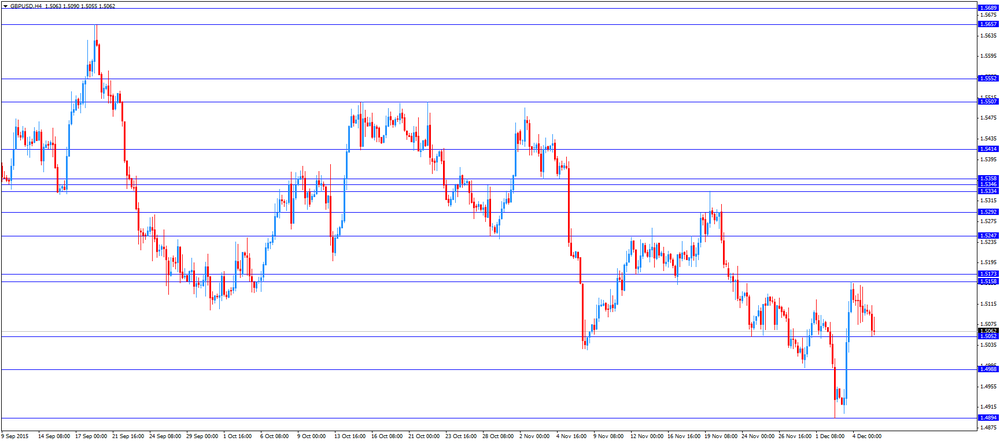

GBP/USD: the currency pair declines to $1.5053

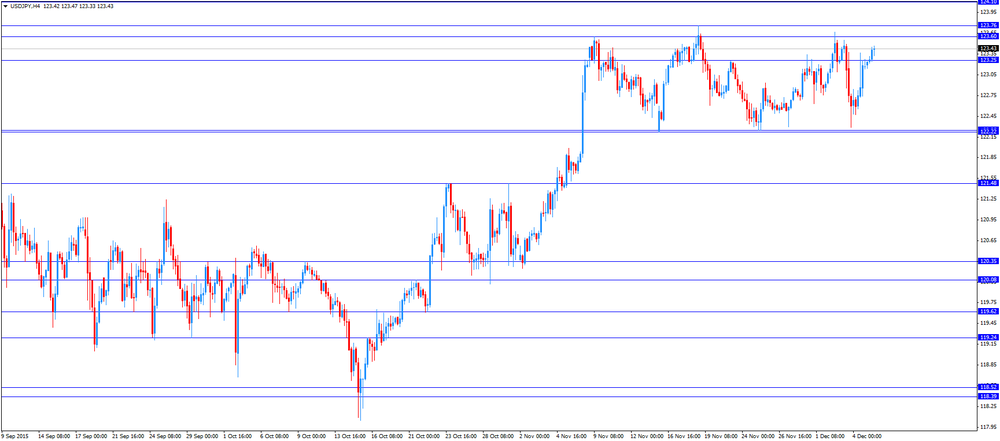

USD/JPY: the currency pair increased to Y123.47

The most important news that are expected (GMT0):

15:00 United Kingdom BOE Gov Mark Carney Speaks

20:00 U.S. Consumer Credit October 28.92 20.7

23:50 Japan Current Account, bln October 1468 1659.4

23:50 Japan GDP, q/q (Finally) Quarter III -0.3% 0%

23:50 Japan GDP, y/y (Finally) Quarter III -0.7% 0.1%

-

13:59

Orders

EUR/USD

Offers 1.0865 1.0885 1.0900 1.0920 1.0950-60 1.0980 1.1000 1.1030 1.1050 1.1080 1.1100 1.1130 1.1150

Bids 1.0825-30 1.0800 1.0785 1.0750 1.0725-30 1.0700 1.0685 1.0665 1.0650 1.0630 1.0600

GBP/USD

Offers 1.5085 1.5100 1.5120-25 1.5135 1.5150-55 1.5175 1.5200-10 1.5225 1.5250 1.5280 1.5300

Bids 1.5050 1.5030 1.5000 1.4980-85 1.4965 1.4950 1.4930 1.4900 1.4885-90 1.4865 1.4850 1.4835 1.4800

EUR/GBP

Offers 0.7200 0.7220 0.7235 0.7250 0.7275-80 0.7300 0.7320 0.7350

Bids 0.7180 0.7165 0.7150 0.7130 0.7100 0.7075-80 0.7060 0.7035-40

EUR/JPY

Offers 133.85 134.00 134.25 134.50 134.75 135.00 135.50 136.00

Bids 133.25-30 133.00 132.75 132.50 132.00 131.50 131.00 130.80 130.50

USD/JPY

Offers 123.50 123.75 124.00 124.30 124.50 124.75 125.00

Bids 123.20 123.00 122.85 122.65-70 122.50 122.20-25 122.00 121.75-80 121.50

AUD/USD

Offers 0.7340-50 0.7375 0.7400 0.7425-30 0.7450

Bids 0.7300 0.7285 0.7265-70 0.7250 0.7235 0.7200 0.7185 0.7165 0.7150

-

11:47

Ai Group/HIA Australian Performance of Construction Index is down to 50.7 in November

The Australian Industry Group (AiG) released its construction data for Australia on late Sunday evening. The Ai Group/HIA Australian Performance of Construction Index fell to 50.7 in November from 52.1 in October.

A reading above 50 indicates expansion in the sector.

The decline was mainly driven by a drop in house building and commercial and engineering construction.

"The continuing boom in apartment building saw a slight lift in the overall construction sector in November despite falls in house building and commercial and engineering construction," Ai Group Head of Policy, Peter Burn, said.

-

11:38

German industrial production rises 0.2% in October

Destatis released its industrial production data for Germany on Wednesday. German industrial production increased 0.2% in October, missing expectations for a 0.7% gain, after a 1.1% fall in September.

The output of capital goods increased 2.7% in October, energy output slid 5.9%, and the production in the construction sector was up 0.7%, while the production of intermediate goods dropped 1.1%.

The output of consumer goods decreased 0.1%.

German industrial production excluding energy and construction rose by 0.7% in October.

-

11:20

Sentix investor confidence index for the Eurozone is up to 15.7 in December

Market research group Sentix released its investor confidence index for the Eurozone on Monday. The index climbed to 15.7 in December from 15.1 in November.

A reading above 0.0 indicates optimism, below indicates pessimism.

"The Eurozone outperforms other world regions as the effects of ECB's policy measures kick in. The remaining world regions depict signs of a slowdown. Japan slides back into recession. In contrast to Fed's interpretations of the state of the economy, the sentix indicator for the US economy highlights a contrary view amid the preparations for the first rate rise," Sentix said in its statement.

The current conditions index dropped to 13.5 in December from 16.0 in November.

The expectations index jumped to 18.0 in December from 14.3 in November.

German investor confidence index increased to 22.7 in December from 20.1 in November.

-

11:07

European Central Bank President Mario Draghi: the ECB is ready to add further stimulus measures to reach 2% inflation target if needed

The European Central Bank (ECB) President Mario Draghi said in a speech in New York on Friday that the ECB is ready to add further stimulus measures to reach 2% inflation target if needed.

"There is no doubt that if we had to intensify the use of our instruments to ensure that we achieve our price stability mandate, we would. There cannot be any limit to how far we are willing to deploy our instruments, within our mandate, and to achieve our mandate," he said.

"I can say therefore with confidence - and without any complacency - that we will secure the return of inflation to 2% without undue delay, because we are currently deploying tools that we believe will achieve this, and because we can, in any case, deploy our tools further if that proves necessary," Draghi added.

-

10:59

European Central Bank Governing Council member Jan Smets believes new stimulus measure by the ECB will help to reach 2% inflation target

The European Central Bank (ECB) Governing Council member Jan Smets said on Friday that he believes new stimulus measure by the ECB will help to reach 2% inflation target.

"I'm really confident that with these measures taken, we drastically increase the probability of a complete return to what we consider to be price stability," he said.

Smets noted that there were signs of the economic recovery in the Eurozone.

-

10:35

Bank of Japan board member Takehiro Sato: the effect of the central bank’s stimulus measures declined

The Bank of Japan (BoJ) board member Takehiro Sato said on Monday that the effect of the central bank's stimulus measures declined.

"Monetary easing effects appear cumulatively in theory, but in terms of positive effects and side effects, it is likely that the easing effects have been diminishing," he said.

Sato noted that the central bank cannot purchase government debt indefinitely at its current pace.

-

10:23

Greek parliament approves 2016 budget

The Greek parliament approved 2016 budget on Sunday. The vote for the budget was 153-145.

The Greek government will cut public spending by €5.7 billion.

The government forecasts a budget deficit of 2.1% of GDP next year.

-

09:21

Option expiries for today's 10:00 ET NY cut

USD/JPY 122.00 (USD 2.2bln) 123.00-20 (580m) 123.35 (222m) 124.00 (1.2bln)

EUR/USD 1.0800 (EUR 1.9bln) 1.0850 (1.5bln) 1.0900 (1.5bln) 1.1000 (2.1bln)

GBP/USD 1.5000 (682m)

USD/CAD 1.3250 (USD 473m) 1.3300 (550m)

AUD/USD 0.7200 (AUD 1bln) 0.7300 (705m)

EUR/GBP 0.7125 (EUR 318m) 0.7225 (279m) 0.7275 (201m)

-

08:16

Germany: Industrial Production (YoY), October 0.2%

-

08:02

Germany: Industrial Production s.a. (MoM), October 0.2% (forecast 0.7%)

-

07:43

Foreign exchange market. Asian session: the U.S. dollar gained

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia ANZ Job Advertisements (MoM) November 0.4% 1.3%

03:45 Japan BOJ Governor Haruhiko Kuroda Speaks

05:00 Japan Leading Economic Index (Preliminary) October 101.6 102.9

05:00 Japan Coincident Index (Preliminary) October 112.3 114.3

The U.S. dollar advanced against the yen on strong employment data. The U.S. Department of Labor reported on Friday that the U.S. economy created 211,000 jobs in November compared to expectations for a 200,000 gain. The unemployment rate remained at 5% in line with expectations. The Federal Reserve is now widely expected to raise interest rates later this month.

The Australian dollar was traded range-bound amid mixed data. The Australian Industry Group reported that the Performance of Construction Index declined to 50.7 in November from 52.1 reported previously. The index remained above the 50 point threshold due to apartment building activity with a reading of 69. Meanwhile house building contracted to a reading of 48. New orders slipped to a reading of 49.8. The employment sub-index came in at 54.5.

ANZ Job Advertisements index came in at 1.3% in November compared to 0.4% in October signaling that Australia's labor market is getting healthier.

EUR/USD: the pair fluctuated within $1.0850-85 in Asian trade

USD/JPY: the pair rose to Y123.30

GBP/USD: the traded within $1.5090-15

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:00 Germany Industrial Production s.a. (MoM) October -1.1% 0.7%

07:00 Germany Industrial Production (YoY) October 0.2%

09:30 Eurozone Sentix Investor Confidence December 15.1

15:00 United Kingdom BOE Gov Mark Carney Speaks

15:00 U.S. Labor Market Conditions Index November 1.6

20:00 U.S. Consumer Credit October 28.92 20.7

23:50 Japan Current Account, bln October 1468 1659.4

23:50 Japan GDP, q/q (Finally) Quarter III -0.3% 0%

23:50 Japan GDP, y/y (Finally) Quarter III -0.7% 0.1%

-

07:06

Options levels on monday, December 7, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1038 (5102)

$1.0995 (2723)

$1.0941 (1586)

Price at time of writing this review: $1.0860

Support levels (open interest**, contracts):

$1.0808 (1018)

$1.0763 (1142)

$1.0706 (3465)

Comments:

- Overall open interest on the CALL options with the expiration date January, 8 is 44503 contracts, with the maximum number of contracts with strike price $1,0900 (5102);

- Overall open interest on the PUT options with the expiration date January, 8 is 54700 contracts, with the maximum number of contracts with strike price $1,0450 (7725);

- The ratio of PUT/CALL was 1.23 versus 1.15 from the previous trading day according to data from December, 4

GBP/USD

Resistance levels (open interest**, contracts)

$1.5403 (621)

$1.5305 (978)

$1.5208 (678)

Price at time of writing this review: $1.5097

Support levels (open interest**, contracts):

$1.4991 (1193)

$1.4894 (1348)

$1.4796 (918)

Comments:

- Overall open interest on the CALL options with the expiration date January, 8 is 11198 contracts, with the maximum number of contracts with strike price $1,5250 (1525);

- Overall open interest on the PUT options with the expiration date January, 8 is 11621 contracts, with the maximum number of contracts with strike price $1,5100 (1782);

- The ratio of PUT/CALL was 1.04 versus 1.05 from the previous trading day according to data from December, 4

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

06:31

Japan: Leading Economic Index , October 102.9

-

06:31

Japan: Coincident Index, October 114.3

-

01:31

Australia: ANZ Job Advertisements (MoM), November 1.3%

-

00:31

Currencies. Daily history for Dec 4’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0873 -0,61%

GBP/USD $1,5106 -0,24%

USD/CHF Chf0,9968 +0,36%

USD/JPY Y123,17 +0,46%

EUR/JPY Y133,92 -0,14%

GBP/JPY Y186,05 +0,23%

AUD/USD $0,7336 -0,03%

NZD/USD $0,6738 +0,77%

USD/CAD C$1,3375 +0,17%

-

00:00

Schedule for today, Monday, Dec 7’2015:

(time / country / index / period / previous value / forecast)

00:30 Australia ANZ Job Advertisements (MoM) November 0.4%

03:45 Japan BOJ Governor Haruhiko Kuroda Speaks

05:00 Japan Leading Economic Index (Preliminary) October 101.6

05:00 Japan Coincident Index (Preliminary) October 112.3

07:00 Germany Industrial Production s.a. (MoM) October -1.1% 0.7%

07:00 Germany Industrial Production (YoY) October 0.2%

09:30 Eurozone Sentix Investor Confidence December 15.1

15:00 United Kingdom BOE Gov Mark Carney Speaks

15:00 U.S. Labor Market Conditions Index November 1.6

20:00 U.S. Consumer Credit October 28.92 20.7

23:50 Japan Current Account, bln October 1468 1659.4

23:50 Japan GDP, q/q (Finally) Quarter III -0.3% 0%

23:50 Japan GDP, y/y (Finally) Quarter III -0.7% 0.1%

-