Noticias del mercado

-

17:44

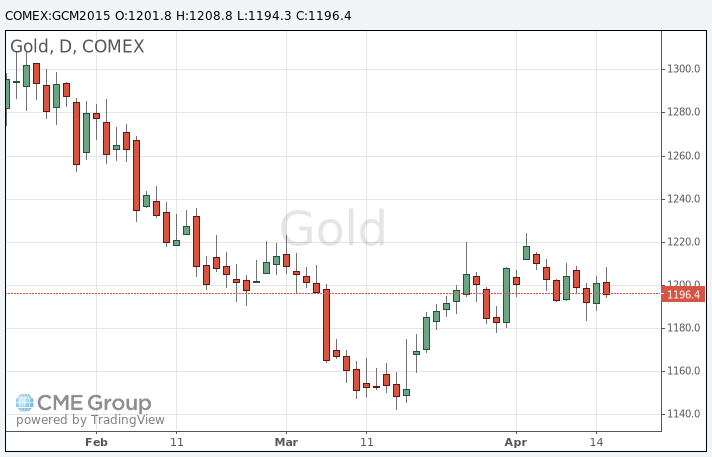

Gold price traded lower due to a stronger greenback

Gold price traded lower as the U.S. dollar strengthened. The greenback rose as The Philadelphia Federal Reserve Bank's manufacturing index increased better than expected in April. The index increased to 7.5 in April from 5.0 in March, exceeding expectations for a rise to 5.5.

The increase was driven by an improvement in labour market.

Soft demand for physical gold also weighed on gold price.

June futures for gold on the COMEX today rose to 1194.30 dollars per ounce.

-

17:25

Oil prices traded lower as OPEC confirmed its production increased in March

Oil prices traded lower as the Organisation of the Petroleum Exporting Countries (OPEC) confirmed that its production increased in March. OPEC said that it produced 30.79 million barrels a day of oil in March, a rise of 810,000 from February, according to secondary sources.

The production rise was led by Saudi Arabia, Iraq and Libya.

OPEC forecasts that demand for its oil would be average 28.25 million barrels a day in the second quarter of 2015, up 80,000 barrels a day from the previous estimate.

WTI crude oil for May delivery fell to $55.07 a barrel on the New York Mercantile Exchange. Brent crude oil increased to $62.54 a barrel on ICE Futures Europe.

-

01:02

Commodities. Daily history for Apr 15’2015:

(raw materials / closing price /% change)

Oil 56.39 +5.82%

Gold 1,201.50 +0.02%

-