Noticias del mercado

-

22:43

U.S. stocks little changed

U.S. stocks were little changed, after the Standard & Poor's 500 Index neared a record, as semiconductors declined on SanDisk Corp. results to offset a rally in Netflix Inc.

The S&P 500 slipped 0.1 percent to 2,105.07 at 4 p.m. in New York, after earlier rising within 0.3 percent of its record.

"We're right up near the all-time highs in the S&P, and sometimes you take a breather before you break through those levels," said Matt Maley, an equity strategist at Miller Tabak & Co. in Newton, Massachusetts.

Energy shares in the S&P 500 erased a drop of 1.1 percent to rise as much as 0.5 percent before slipping again. The group's 6.5 percent rally in April -- its best month since January 2013 -- has underpinned the S&P 500's latest run at its first record since March 2.

The S&P 500 has been stuck in a range of 52 points since March 20 when it last neared its record, as weaker-than-forecast data from hiring to manufacturing elevated concern about earnings while at the same time bolstered the case for keeping interest rates lower for longer.

The benchmark has advanced 2.2 percent this year, trailing benchmark gauges in all developed markets tracked by Bloomberg except Greece, with the Federal Reserve set to raise rates this year.

Fourteen companies report quarterly results today. Analysts predict earnings for S&P 500 companies fell 5.6 percent in the first quarter, cutting projections amid concern over a surging dollar and worse-than-forecast economic reports.

Investors are also weighing economic reports for clues on the timing of the Fed's first rate increase since 2006. Fed Chair Janet Yellen has said that while rates will probably rise this year, any decision depends on economic data. Housing starts rose less than forecast in March, while jobless claims increased in the latest week.

-

21:00

S&P 500 2,110.1 +3.47 +0.16 %, NASDAQ 5,015.35 +4.33 +0.09 %, Dow 18,154.51 +41.90 +0.23 %

-

18:51

Wall Street. Major U.S. stock-indexes are little changed

U.S. stocks showed neutral dynamic on Thursday as corporate results showed little growth even as they largely beat profit expectations.

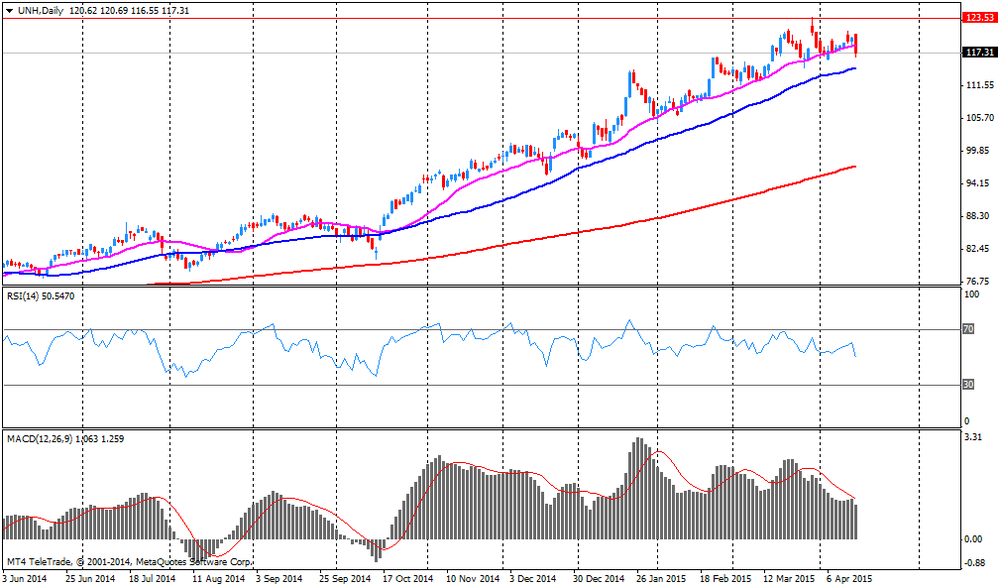

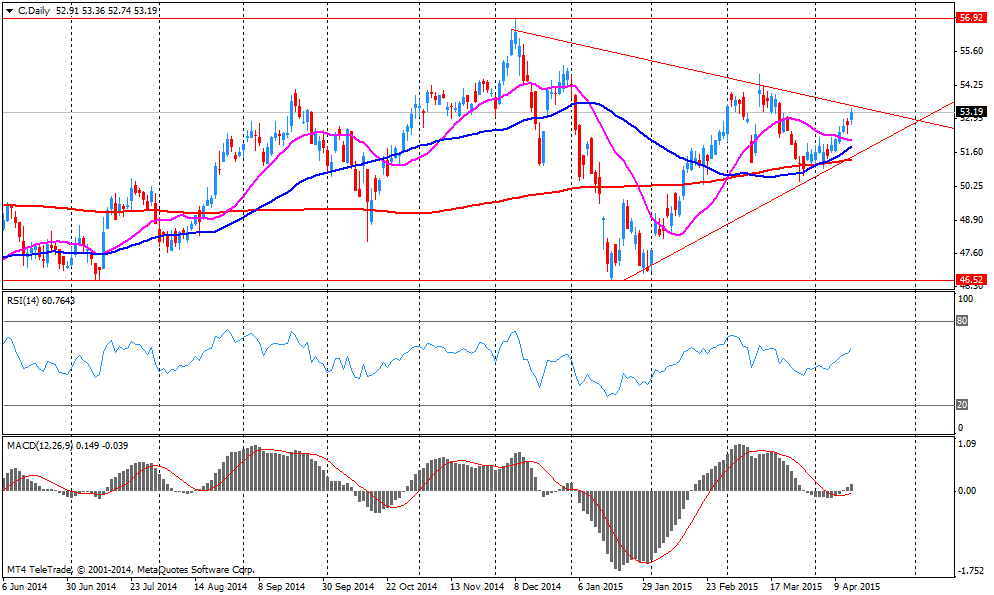

The most of the Dow stocks are trading in positive area (20 of 30).Top looser - Caterpillar Inc. (CAT, -2.45%). Top gainer - UnitedHealth Group Incorporated (UNH, +3.52%).

S&P index sectors are moving in different directions. Top gainer - Consumer Goods (+0,3%). Top looser - Utilities (-0.6%).

At the moment:

Dow 18038.00 +16.00 +0.09%

S&P 500 2099.25 -0.50 -0.02%

Nasdaq 100 4413.00 -8.75 -0.20%

10-year yield 1.92% +0.02

Oil 56.08 -0.31 -0.55%

Gold 1196.80 -4.50 -0.37%

-

18:20

Japan dethroned China as the largest holder of U.S. bonds

Japan was the largest foreign holder of U.S. Treasurys in February. Japan dethroned China as the largest holder of US bonds.

It was the first time since August 2008.

Both countries reduced their holdings of U.S. Treasurys in February. Japan held $1,224.4 billion in U.S. government debt, while China, excluding Hong Kong, held $1,223.7 billion.

-

18:12

Federal Reserve Vice Chairman Stanley Fischer: the Fed is likely to raise its interest rate this year

The Federal Reserve Vice Chairman Stanley Fischer said in an interview on Thursday that he expects the U.S. economy to grow despite the "poor" first quarter.

Fischer noted that the Fed will try to hike its interest rate "at the best possible time". He added that the central bank is likely to raise its interest rate this year but the timing would depend on economic data.

The Fed vice chairman also said that the Eurozone's economy improved as the European Central Bank launched its asset-buying programme.

-

18:00

European stocks closed: FTSE 100 7,068.93 -27.85 -0.4 %, CAC 40 5,221.18 -33.17 -0.6 %, DAX 11,999.43 -231.91 -1.9 %

-

18:00

European stocks close: stocks closed Greece's debt weighed on markets

Stock indices closed lower as Greece's debt weighed on markets. Greece will run out of cash if the Greek government will not sign an agreement with its creditors to receive new tranche of loans. Greece is due to repay the IMF loan of 760 million euro on May 12.

Athens and its creditors will continue negations on April 24.

The Greek Finance Minister Yanis Varoufakis is to meet U.S. President Barack Obama in Washington later in the day.

The ratings agency Standard & Poor's (S&P) lower Greece's credit rating to 'CCC+' from 'B-'.

Indexes on the close:

Name Price Change Change %

FTSE 100 7,060.45 -36.33 -0.51 %

DAX 11,998.86 -232.48 -1.90 %

CAC 40 5,224.49 -29.86 -0.57 %

-

17:02

Australia's unemployment rate declines to 6.1% in March

The Australian Bureau of Statistics released its labour market figures on Thursday. Australia's unemployment rate fell to 6.1% in March from 6.2% in February.

February's figure was revised up from 6.3%.

Analysts had expected the unemployment rate to rise 6.3%. The number of employed people in Australia rose by 37,700 in March, exceeding expectations for an increase by 15,100, after a gain by 41,900 in February.

February's figure was revised up from a rise by 15,600.

The gain was driven by increases in full-time employment. Full-time jobs increased by 31,500 in March, while part-time jobs climbed by 6,100.

The participation rate climbed to 64.8% in March from 64.7% in February. February's figure was revised up from 64.6%.

-

16:31

Philadelphia Federal Reserve Bank’s manufacturing index increases to 7.5 in April

The Philadelphia Federal Reserve Bank released its manufacturing index on Thursday. The index increased to 7.5 in April from 5.0 in March, exceeding expectations for a rise to 5.5.

A reading above zero indicates expansion.

The increase was driven by an improvement in labour market. The number of employees index was up to 11.5 in April from 3.5 last month.

Shipments index rose to -1.8 in April from -7.8 in March.

The new orders index decreased to 0.7 in April from 3.9 in March.

The prices paid index fell to -7.5 in April from -3.0 in March, while the prices received index were up to -4.1 from -6.4.

The diffusion index for future activity rose to 35.5 in April from 32.0 in March.

According to the report, the indicators of future activity continue to show that the manufacturing sector is expected to continue growing over the next six months.

-

15:47

RICS house price balance increased to +21 in March

The Royal Institution of Chartered Surveyors' (RICS) released its house price data on late Wednesday. The monthly house price balance increased to +21 in March from +15 in February, exceeding expectations for a gain to +15.

February's figure was revised up from +14.

The increase was driven by a shortage of properties.

-

15:33

U.S. Stocks open: Dow -0.20%, Nasdaq -0.17%, S&P -0.15%

-

15:26

Before the bell: S&P futures -0.40%, NASDAQ futures -0.41%

U.S. stock-index futures fell as semiconductors slumped and oil declined for the first time in six days.

The earnings reporting is goog this morning. Goldman Sachs (GS), Citigroup (C) and United Health (UNH) had some good results.

Global markets:

Nikkei 19,885.77 +16.01 +0.08%

Hang Seng 27,739.71 +120.89 +0.44%

Shanghai Composite 4,194.65 +110.49 +2.71%

FTSE 7,070.27 -26.51 -0.37%

CAC 5,221.78 -32.57 -0.62%

DAX 12,022.97 -208.37 -1.70%

Crude oil $55.18 (-2.15%)

Gold $1205.80 (+0.73%)

-

15:18

U.S. housing market data missed forecasts in March

The U.S. Commerce Department released the housing market data on Thursday. Housing starts in the U.S. climbed 2.0% to 926,000 annualized rate in March from a 908,000 pace in February, missing expectations for a rise to 1.040 million.

February's figure was revised up from 897,000 units.

The increase was driven by a gain in starts of single-family homes.

Building permits in the U.S. dropped 5.7% to 1.039 million annualized rate in March from a 1.102 million pace in February. Analysts had expected building permits to fall to 1.080 million units.

Starts of single-family homes jumped 4.4% in February. Building permits for single-family homes rose 2.1%.

Starts of multifamily buildings decreased 2.5% in February. Permits for multi-family housing dropped 15.9%.

-

15:08

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Procter & Gamble Co

PG

83.55

+0.05%

0.2K

Walt Disney Co

DIS

107.09

+0.10%

0.2K

E. I. du Pont de Nemours and Co

DD

72.20

+0.14%

1K

Amazon.com Inc., NASDAQ

AMZN

384.10

+0.17%

3.9K

Starbucks Corporation, NASDAQ

SBUX

48.34

+0.42%

1.9K

General Motors Company, NYSE

GM

37.10

+0.43%

23.2K

Barrick Gold Corporation, NYSE

ABX

12.95

+0.78%

8.0K

ALTRIA GROUP INC.

MO

52.10

+0.95%

5.9K

Citigroup Inc., NYSE

C

54.09

+1.65%

20.9K

ALCOA INC.

AA

13.57

+1.72%

162.3K

UnitedHealth Group Inc

UNH

120.80

+2.97%

34.2K

Twitter, Inc., NYSE

TWTR

51.25

-0.10%

25.8K

Ford Motor Co.

F

16.05

-0.12%

4.3K

Hewlett-Packard Co.

HPQ

33.00

-0.12%

0.3K

Wal-Mart Stores Inc

WMT

79.64

-0.13%

0.5K

Facebook, Inc.

FB

82.60

-0.13%

24.6K

Travelers Companies Inc

TRV

107.91

-0.16%

0.1K

JPMorgan Chase and Co

JPM

64.10

-0.17%

16.2K

The Coca-Cola Co

KO

40.33

-0.17%

5.6K

Home Depot Inc

HD

113.20

-0.22%

0.2K

Yahoo! Inc., NASDAQ

YHOO

45.63

-0.22%

1.0K

McDonald's Corp

MCD

96.21

-0.24%

0.4K

Boeing Co

BA

152.00

-0.28%

2.2K

Apple Inc.

AAPL

126.42

-0.28%

100.8K

Google Inc.

GOOG

530.99

-0.29%

8.7K

Exxon Mobil Corp

XOM

87.81

-0.31%

11.5K

Nike

NKE

99.52

-0.31%

2.3K

Cisco Systems Inc

CSCO

28.16

-0.32%

8.2K

AT&T Inc

T

32.78

-0.33%

3.8K

Verizon Communications Inc

VZ

49.22

-0.34%

2.4K

Johnson & Johnson

JNJ

100.25

-0.35%

1.3K

Chevron Corp

CVX

110.00

-0.37%

2.5K

Microsoft Corp

MSFT

42.10

-0.37%

9.7K

Visa

V

65.43

-0.38%

1.1K

General Electric Co

GE

27.35

-0.40%

30.5K

Tesla Motors, Inc., NASDAQ

TSLA

207.00

-0.40%

4.1K

Pfizer Inc

PFE

35.05

-0.45%

356.8K

International Business Machines Co...

IBM

163.37

-0.46%

0.2K

Merck & Co Inc

MRK

58.18

-0.46%

1.7K

United Technologies Corp

UTX

117.28

-0.50%

0.6K

Caterpillar Inc

CAT

84.00

-0.54%

3.1K

Intel Corp

INTC

32.63

-0.61%

47.7K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

20.54

-0.63%

6.3K

Yandex N.V., NASDAQ

YNDX

19.92

-2.35%

43.9K

-

15:02

Upgrades and downgrades before the market open

Upgrades:

Intel (INTC) upgraded from Underperform to Mkt Perform at Bernstein

Downgrades:

Other:

McDonald's (MCD) initiated at Buy at Guggenheim, target $108

-

14:51

Company News: UnitedHealth (UNH) beats estimates and raises guidance

Company reports Q1 earnings of $1.46 per share versus $1.35 consensus. Revenues rose 12.8% year/year to $35.76 bln versus $34.63 bln consensus.

Company raises guidance for FY15: EPS to $6.15-6.30 from $6.00-6.25 versus $6.21 consensus, revenues to about $143 bln from $140.5-141.5 bln versus $141.73 bln consensus.

UNH gained to $120.95 (+3.09%) on the premarket.

-

14:48

Standard & Poor's (S&P) lowered Greece's credit rating to 'CCC+' from 'B-'

The ratings agency Standard & Poor's (S&P) lowered Greece's credit rating to 'CCC+' from 'B-' as Greece could not sign an agreement with its creditors to receive new tranche of loans. S&P believes that Greece will run out of cash if there is no agreement by May 12, when Greece is due to repay the IMF loan of 760 million euro.

The agency also gave Greece a negative outlook.

-

14:34

-

14:28

-

12:00

European stock markets mid session: stocks traded lower on concerns over Greece’s debt

Stock indices traded lower on concerns over Greece's debt. Greece will run out of cash if the Greek government will not sign an agreement with its creditors to receive new tranche of loans. Greece is due to repay the IMF loan of 760 million euro on May 12. The Greek Finance Minister Yanis Varoufakis is to meet U.S. President Barack Obama in Washington later in the day.

The ratings agency Standard & Poor's (S&P) lower Greece's credit rating to 'CCC+' from 'B-'.

The European Central Bank (ECB) kept its interest rate unchanged at 0.05% on Wednesday. The ECB President Mario Draghi said at a press conference that there are signs that quantitative easing by the central bank has been effective. He pointed out the need to complete the full asset-buying programme.

Current figures:

Name Price Change Change %

FTSE 100 7,089.09 -7.69 -0.11 %

DAX 12,148.67 -82.67 -0.68 %

CAC 40 5,246.11 -8.24 -0.16 %

-

11:37

Switzerland's producer and import prices rise 0.2% in March

The Federal Statistical Office released its producer and import prices data on Thursday. Switzerland's producer and import prices climbed 0.2% in March, exceeding expectations for a 0.1% increase, after a 1.4% drop in February. That was the first increase in ten months.

On a yearly basis, producer and import prices decreased 3.4% in March, after a 3.6% drop in February.

The increase was driven by higher prices for petroleum and petroleum products.

-

11:05

U.K. monthly house price balance rises to +21 in March

The Royal Institution of Chartered Surveyors' (RICS) released its house price data on late Wednesday. The monthly house price balance increased to +21 in March from +15 in February, exceeding expectations for a gain to +15.

February's figure was revised up from +14.

The increase was driven by a shortage of properties.

-

10:44

Fed’s Beige Book: falling oil prices have been cost jobs in the U.S.

The Federal Reserve released its Beige Book on Wednesday. The Fed said that falling oil prices have been cost jobs in the U.S. But the U.S. economy expanded moderately in the period February through March.

The U.S. manufacturing sector was hurt by the strong dollar and a cold winter.

Labour markets remained stable or continued to strengthen.

-

04:00

Nikkei 225 19,806.97 -62.79 -0.32 %, Hang Seng 27,525.64 -93.18 -0.34 %, Shanghai Composite 4,055.92 -28.25 -0.69 %

-

01:02

Stocks. Daily history for Apr 15’2015:

(index / closing price / change items /% change)

Nikkei 225 19,869.76 -38.92 -0.20 %

Hang Seng 27,618.82 +57.33 +0.21 %

S&P/ASX 200 5,908.42 -38.13 -0.64 %

Shanghai Composite 4,083.28 -52.28 -1.26 %

FTSE 100 7,096.78 +21.52 +0.30 %

CAC 40 5,254.35 +36.29 +0.70 %

Xetra DAX 12,231.34 +3.74 +0.03 %

S&P 500 2,106.63 +10.79 +0.51 %

NASDAQ Composite 5,011.02 +33.73 +0.68 %

Dow Jones 18,112.61 +75.91 +0.42 %

-