Noticias del mercado

-

21:00

Dow +0.80% 17,804.51 +140.97 Nasdaq +1.42% 5,125.49 +71.74 S&P +6.67% 2,102.87 +131.47

-

18:31

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes rose on Monday as PMI data in key countries pointed to slowing but stabilizing manufacturing activity globally, and as healthcare stocks rose to their highest in a week. U.S. factory activity slowed in October. But, while the Institute for Supply Management's national manufacturing index slipped to 50.1, it was ahead of the expected reading of 50.0.

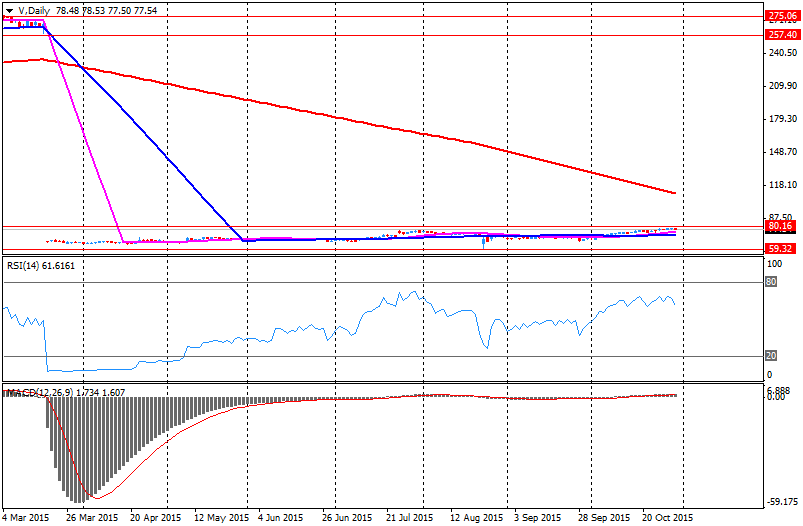

Most of Dow stocks in positive area (21 of 30). Top looser - Visa Inc. (V, -3.27%). Top gainer - Pfizer Inc. (PFE, +3.59%).

Most of S&P index sectors in positive area. Top gainer - Healthcare (+1,7%). Top looser - Utilities (-0.5%).

At the moment:

Dow 17670.00 +76.00 +0.43%

S&P 500 2086.50 +12.75 +0.61%

Nasdaq 100 4677.00 +33.75 +0.73%

Oil 46.23 -0.36 -0.77%

Gold 1135.30 -6.10 -0.53%

U.S. 10yr 2.18 +0.03

-

18:00

European stocks close: stocks closed higher on manufacturing PMIs from the Eurozone

Stock indices closed higher on the better-than-expected manufacturing purchasing managers' index (PMI) from the Eurozone. Markit Economics released its final manufacturing PMI for the Eurozone on Monday. Eurozone's final manufacturing purchasing managers' index (PMI) rose to 52.3 in October from 52.0 in September, up from the preliminary reading of 52.0.

"The eurozone manufacturing recovery remains disappointingly insipid. The October survey is signalling factory output growth of only 2% per annum, a lacklustre performance given the amount of central bank stimulus in place," Chris Williamson, Chief Economist at Markit said.

Germany's final manufacturing purchasing managers' index (PMI) declined to 52.1 in September from 52.3 in September, up from the preliminary reading of 51.6.

The decline was driven by a slower production and employment growth.

Markit Economics released its final manufacturing purchasing managers' index (PMI) for France on Monday. France's final manufacturing purchasing managers' index (PMI) remains at 50.6 in October, down from the preliminary reading of 50.7.

Output and new orders increased, while employment declined at the fastest pace since December 2014.

European Central Bank (ECB) Governing Council member Ewald Nowotny said in an interview with the Austrian newspaper Kleine Zeitung newspaper on Monday that the central bank should add further stimulus measures to boost the inflation in the Eurozone. But he added that there has been made no decision by the ECB.

Markit Economics released its manufacturing purchasing managers' index (PMI) for the U.K. on Monday. The Markit/Chartered Institute of Procurement & Supply manufacturing PMI for the U.K. climbed to 55.5 in October from 51.8 in September, beating expectations for a fall to 51.3. September's figure was revised up from 51.5.

A reading above 50 indicates expansion.

The increase was driven by rises in output and new orders.

"The start of the final quarter saw UK manufacturing spring back into life and record its best month of factory output growth since June 2014. The revival provides a tentative suggestion that the manufacturers are pulling out of their recent funk, having been dogged by recession since the start of the year, and may help boost economic growth in the fourth quarter," Markit's Senior Economist Rob Dobson said.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,361.8 +0.71 +0.01 %

DAX 10,950.67 +100.53 +0.93 %

CAC 40 4,916.21 +18.55 +0.38 %

-

17:59

WSE: Session Results

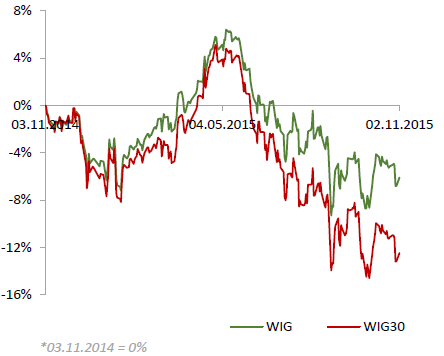

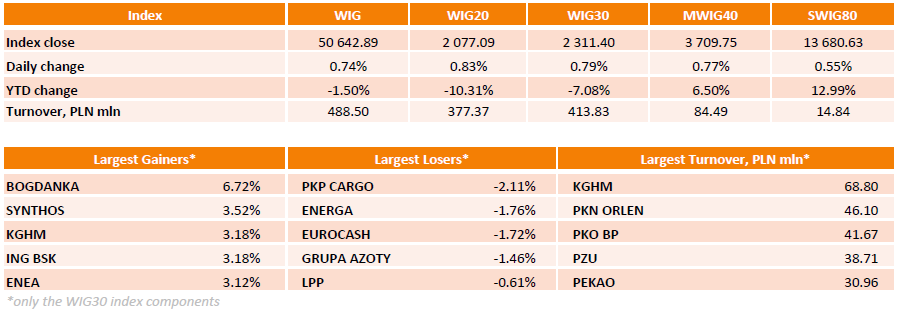

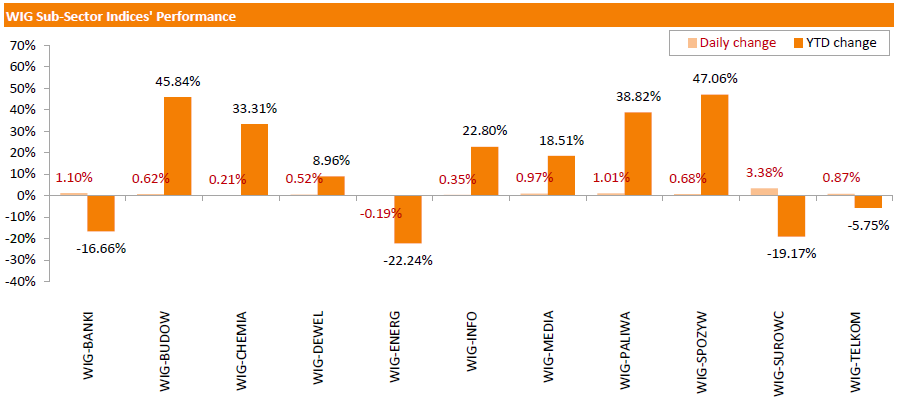

Polish equity market closed higher on Monday. The broad market measure, the WIG Index, rose by 0.74%. All sectors, but for utilities (-0.19%), did well with materials names (+3.38%) outperforming.

Large-cap stocks benchmark, the WIG30 Index, added 0.79%. In the index basket, BOGDANKA (WSE: LWB) led the way up with a 6.72% gain, rebounding from the previous week's sharp decline. It was followed by SYNTHOS (WSE: SNS), ING BSK (WSE: ING), KGHM (WSE: KGH) and ENEA (WSE: ENA), advancing 3.12%-3.52%. On the other side of the ledger, PKP CARGO (WSE: PKP) was the weakest name, plunging by 2.11%. Other major underperformers were ENERGA (WSE: ENG), EUROCASH (WSE: EUR) and GRUPA AZOTY (WSE: ATT), declining by 1.46%-1.76%.

-

17:53

Building permits in Australia rise 2.2% in September

The Australian Bureau of Statistics released its building permits data on Monday. Building permits in Australia rose 2.2% in September, exceeding expectations for a 2.0% gain, after a 9.5% drop in August. August's figure was revised down from a 6.9% decrease.

Building permits for private sector houses declined 1.9% in September, while building permits for private sector dwellings excluding houses jumped 6.1%.

The seasonally adjusted estimate of the value of total building approved was down 2.1% in September.

On a yearly basis, building permits climbed 21.4% in September, after a 5.1% increase in August.

-

17:06

European Central Bank President Mario Draghi; the central bank is ready to expand its stimulus measures if there will be a risk to its medium-term inflation target

European Central Bank (ECB) President Mario Draghi said in an interview with the Italian newspaper the Italian daily Il Sole 24 Ore published on Saturday that the central bank is ready to expand its stimulus measures if there will be a risk to its medium-term inflation target.

"If we are convinced that our medium-term inflation target is at risk, we will take the necessary actions," he said.

Draghi noted that the inflation in the Eurozone is likely to remain close to zero until the beginning of next year.

The ECB president pointed out that there are risks to the Eurozone's growth from the slowdown in emerging economies.

"Global growth forecasts have been revised downwards. This slowdown is probably not temporary," Draghi said.

-

16:52

European Central Bank purchases €10.57 billion of government and agency bonds last week

The European Central Bank (ECB) purchased €10.57 billion of government and agency bonds under its quantitative-easing program last week.

The European Central Bank's (ECB) President Mario Draghi said at a press conference in October that the value of the ECB's asset-buying programme will be discussed at the monetary policy meeting in December.

ECB'S asset buying programme is intended to run to September 2016.

The ECB bought €3.01 billion of covered bonds, while holdings of asset-backed securities fell by €88 million.

-

16:39

Construction spending in the U.S. is up 0.6% in September

The U.S. Commerce Department released construction spending data on Monday. Construction spending in the U.S. rose 0.6% in September, exceeding expectations for a 0.5% gain, after a 0.7% increase in August.

The increase was mainly driven by a rise in private residential construction. Spending on private residential construction climbed 1.9% in September.

Spending on private non-residential construction projects decreased 0.1% in September, while public construction spending increased 0.7%.

-

16:30

ISM manufacturing purchasing managers’ index falls to 50.1 in October, the lowest level since May of 2013

The Institute for Supply Management released its manufacturing purchasing managers' index for the U.S. on Monday. The index declined to 50.1 in October from 50.2 in September, beating expectations for a fall to 50.0. It was the lowest level since May of 2013.

A reading above 50 indicates expansion, below indicates contraction.

The decline was partly driven by a fall in production. The employment index was down to 47.6 in October from 50.5 in September.

The production index increased to 52.9 in October from 51.8 in September.

The new orders index rose to 52.9 in October from 50.1 in September.

The price index was up to 39.0 in October from 38.0 in September.

-

15:50

U.S. final manufacturing purchasing managers' index (PMI) increases to 54.1 in October

Markit Economics released its final manufacturing purchasing managers' index (PMI) for the U.S. on Monday. The U.S. final manufacturing purchasing managers' index (PMI) increased to 54.1 in October from 53.1 in September, up from the previous estimate of 54.0.

A reading above 50 indicates expansion in economic activity.

The index was driven by rises in output, new orders and employment levels.

"With inflationary pressures remaining very subdued and signs of the slowdown persisting into the fourth quarter in the larger service sector, the policy outlook is by no means certain and debate about whether the economy yet needs higher interest rates will no doubt remain intense," Markit's Chief Economist Chris Williamson said.

-

15:38

U.S. Stocks open: Dow +0.27%, Nasdaq +0.20%, S&P +0.26%

-

15:28

Before the bell: S&P futures +0.05%, NASDAQ futures +0.16%

U.S. stock-index futures were little changed.

Global Stocks:

Nikkei 18,683.24 -399.86 -2.10%

Hang Seng 22,370.04 -270.00 -1.19%

Shanghai Composite 3,326.49 -56.08 -1.66%

FTSE 6,343.15 -17.94 -0.28%

CAC 4,912.58 +14.92 +0.30%

DAX 10,930.43 +80.29 +0.74%

Crude oil $45.87 (-1.55%)

Gold $1137.80 (-0.32%)

-

15:13

Swiss manufacturing PMI climbs to 50.7 in October

Credit Suisse and procure.ch released their manufacturing purchasing managers' index (PMI) for Switzerland on Monday. The manufacturing purchasing managers' index in Switzerland climbed to 50.7 in October from 49.5 in September, exceeding expectations for an increase to 50.2.

A reading above 50 indicates contraction.

The increase was largely driven by a rise in production. The production increased to 53.7 in October from 49.1 in September.

Purchase prices increased to 36.1 in October from 35.1 in September, while the backlog of orders sub-index fell to 51.2 from 51.5.

Employment rose to 44.0 in October from 43.6 in September.

-

14:58

Greece’s final manufacturing PMI climbs to 47.3 in October

Markit Economics released its final manufacturing purchasing managers' index (PMI) for Greece on Monday. Greece's manufacturing purchasing managers' index (PMI) climbed to 47.3 in October from 43.3 in September.

The contraction of production eased in October, while job shedding also eased.

"Overall, the lack of capital circulating through the economy continued to take its toll on operating conditions at Greek manufacturers. However, the economic decline appears to be slowing to a more stable pace," Markit economist Samuel Agass said.

-

14:58

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Pfizer Inc

PFE

34.15

0.98%

30.6K

Twitter, Inc., NYSE

TWTR

28.69

0.81%

42.0K

Walt Disney Co

DIS

114.25

0.45%

0.6K

Starbucks Corporation, NASDAQ

SBUX

62.80

0.37%

5.2K

International Paper Company

IP

42.80

0.26%

1.0K

Apple Inc.

AAPL

119.80

0.25%

114.7K

ALCOA INC.

AA

8.95

0.22%

11.0K

Microsoft Corp

MSFT

52.75

0.21%

3.5K

Facebook, Inc.

FB

102.15

0.18%

34.1K

Merck & Co Inc

MRK

54.75

0.16%

0.3K

Johnson & Johnson

JNJ

101.14

0.11%

1.1K

General Electric Co

GE

28.95

0.10%

5.7K

Google Inc.

GOOG

711.18

0.05%

0.2K

Amazon.com Inc., NASDAQ

AMZN

626.18

0.04%

8.0K

Verizon Communications Inc

VZ

46.88

0.00%

2.2K

Deere & Company, NYSE

DE

78.00

0.00%

2.5K

Tesla Motors, Inc., NASDAQ

TSLA

206.90

-0.01%

3.2K

Citigroup Inc., NYSE

C

53.16

-0.02%

1.0K

Wal-Mart Stores Inc

WMT

57.21

-0.05%

2.7K

Caterpillar Inc

CAT

72.90

-0.12%

1.4K

Barrick Gold Corporation, NYSE

ABX

7.68

-0.13%

10.6K

Yahoo! Inc., NASDAQ

YHOO

35.52

-0.28%

1.4K

Exxon Mobil Corp

XOM

82.30

-0.53%

9.0K

Intel Corp

INTC

33.62

-0.71%

17.8K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.68

-0.76%

2.6K

Visa

V

76.25

-1.71%

154.9K

Yandex N.V., NASDAQ

YNDX

15.80

-1.86%

1.2K

Hewlett-Packard Co.

HPQ

12.30

-54.38%

1.7K

-

14:54

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Hewlett-Packard (HPQ) target lowered to $13 from $35 at RBC Capital Mkts

Hewlett-Packard (HPQ) initiated with a Outperform at Credit Suisse; target $19

Hewlett-Packard (HPQ) initiated with a Buy at Needham; target $14.50

-

14:46

Spain’s final manufacturing PMI falls to 51.3 in October

Markit Economics released its final manufacturing purchasing managers' index (PMI) for Spain on Monday. Spain's manufacturing purchasing managers' index (PMI) declined to 51.3 in October from 51.7 in September. It was the lowest level since December 2013.

The decline was driven by a slower pace of production growth and a decline in input prices.

"It's looking like a low key end to the year for the Spanish manufacturing sector as growth rates for output, new orders and employment have all slowed to a crawl in recent months. The forthcoming election is likely resulting in some caution among firms and clients alike as they wait to see the outcome of the December vote," a senior economist at Markit Andrew Harker said.

-

14:34

Italy’s final manufacturing PMI rises to 54.1 in October

Markit Economics released its final manufacturing purchasing managers' index (PMI) for Italy on Monday. Italy's manufacturing purchasing managers' index (PMI) climbed to 54.1 in October from 52.7 in September.

The increase was driven by rises in output and new orders.

"Latest PMI data showed the upturn in the manufacturing sector regain some momentum at the start of the fourth quarter, with October seeing stronger rises in output, new orders and employment. Encouragingly, according to panel member reports sources of growth were both domestic and international, boding well for the sustainability of the recovery," Markit economist Phil Smith said.

-

14:17

Earnings Season in U.S.: Major Reports of the Week

November 2

Before the Open:

Visa (V). Consensus EPS $0.63, Consensus Revenue $3562.94

After the Close:

American Intl (AIG). Consensus EPS $1.01, Consensus Revenue $14314.00

November 3

After the Close:

Tesla Motors (TSLA). Consensus EPS $-0.60, Consensus Revenue $1253.10

November 4

After the Close:

Facebook (FB). Consensus EPS $0.52, Consensus Revenue $4369.16

November 5

After the Close:

Walt Disney (DIS). Consensus EPS $1.14, Consensus Revenue $13526.76

-

14:16

-

12:00

European stock markets mid session: stocks traded mixed on the better-than-expected manufacturing purchasing managers' index from the Eurozone

Stock indices traded mixed on the better-than-expected manufacturing purchasing managers' index (PMI) from the Eurozone. Markit Economics released its final manufacturing PMI for the Eurozone on Monday. Eurozone's final manufacturing purchasing managers' index (PMI) rose to 52.3 in October from 52.0 in September, up from the preliminary reading of 52.0.

"The eurozone manufacturing recovery remains disappointingly insipid. The October survey is signalling factory output growth of only 2% per annum, a lacklustre performance given the amount of central bank stimulus in place," Chris Williamson, Chief Economist at Markit said.

Germany's final manufacturing purchasing managers' index (PMI) declined to 52.1 in September from 52.3 in September, up from the preliminary reading of 51.6.

The decline was driven by a slower production and employment growth.

Markit Economics released its final manufacturing purchasing managers' index (PMI) for France on Monday. France's final manufacturing purchasing managers' index (PMI) remains at 50.6 in October, down from the preliminary reading of 50.7.

Output and new orders increased, while employment declined at the fastest pace since December 2014.

European Central Bank (ECB) Governing Council member Ewald Nowotny said in an interview with the Austrian newspaper Kleine Zeitung newspaper on Monday that the central bank should add further stimulus measures to boost the inflation in the Eurozone. But he added that there has been made no decision by the ECB.

Earlier, stock markets fell on the Chinese economic data. The Chinese preliminary Markit/Caixin manufacturing Purchasing Managers' Index (PMI) rose to 48.3 in October from 47.2 in September, exceeding expectations for a rise to 47.5.

Markit Economics released its manufacturing purchasing managers' index (PMI) for the U.K. on Monday. The Markit/Chartered Institute of Procurement & Supply manufacturing PMI for the U.K. climbed to 55.5 in October from 51.8 in September, beating expectations for a fall to 51.3. September's figure was revised up from 51.5.

A reading above 50 indicates expansion.

The increase was driven by rises in output and new orders.

"The start of the final quarter saw UK manufacturing spring back into life and record its best month of factory output growth since June 2014. The revival provides a tentative suggestion that the manufacturers are pulling out of their recent funk, having been dogged by recession since the start of the year, and may help boost economic growth in the fourth quarter," Markit's Senior Economist Rob Dobson said.

Current figures:

Name Price Change Change %

FTSE 100 6,343.03 -18.06 -0.28 %

DAX 10,923.62 +73.48 +0.68 %

CAC 40 4,914.86 +17.20 +0.35 %

-

11:52

European Central Bank Governing Council member Ewald Nowotny: the central bank should add further stimulus measures to boost the inflation in the Eurozone

European Central Bank (ECB) Governing Council member Ewald Nowotny said in an interview with the Austrian newspaper Kleine Zeitung newspaper on Monday that the central bank should add further stimulus measures to boost the inflation in the Eurozone. But he added that there has been made no decision by the ECB.

-

11:43

Swiss retail sales rise 0.2% year-on-year in September

The Federal Statistical Office released its retail sales data for Switzerland on Monday. Retail sales in Switzerland were up at an annual rate of 0.2% in September, after a 0.6% drop in August. August's figure was revised down from a 0.3% fall.

Sales of food, beverages and tobacco climbed at an annual rate of 2.0% in September, while non-food sales rose 0.4%.

On a monthly basis, retail sales increased by 0.1% in September.

Sales of food, beverages and tobacco rose 1.0% in September, while non-food sales declined 0.4%.

-

11:23

France’s final manufacturing PMI remains unchanged at 50.6 in October

Markit Economics released its final manufacturing purchasing managers' index (PMI) for France on Monday. France's final manufacturing purchasing managers' index (PMI) remains at 50.6 in October, down from the preliminary reading of 50.7.

Output and new orders increased, while employment declined at the fastest pace since December 2014.

"Although remaining inside expansion territory, growth continues to be fragile. The fact that employment fell at the sharpest rate in ten months suggests that firms are hardly gearing up for a sustained upturn," Markit Senior Economist Jack Kennedy said.

-

11:14

Germany’s final manufacturing PMI falls to 52.1 in October

Markit Economics released its final manufacturing purchasing managers' index (PMI) for Germany on Monday. Germany's final manufacturing purchasing managers' index (PMI) declined to 52.1 in September from 52.3 in September, up from the preliminary reading of 51.6.

The decline was driven by a slower production and employment growth.

"There are some warning signs in the data set. In particular, stocks of finished goods rose for the first time in a year, suggesting that a future rise in demand could be satisfied by using existing stock, rather than scaling up production levels," Markit economist Oliver Kolodseike said.

-

11:04

Eurozone’s final manufacturing PMI rises to 52.3 in October

Markit Economics released its final manufacturing purchasing managers' index (PMI) for the Eurozone on Monday. Eurozone's final manufacturing purchasing managers' index (PMI) rose to 52.3 in October from 52.0 in September, up from the preliminary reading of 52.0.

"The eurozone manufacturing recovery remains disappointingly insipid. The October survey is signalling factory output growth of only 2% per annum, a lacklustre performance given the amount of central bank stimulus in place," Chris Williamson, Chief Economist at Markit said.

-

10:55

Markit/Chartered Institute of Procurement & Supply manufacturing PMI for the U.K. jumps to 55.5 in October

Markit Economics released its manufacturing purchasing managers' index (PMI) for the U.K. on Monday. The Markit/Chartered Institute of Procurement & Supply manufacturing PMI for the U.K. climbed to 55.5 in October from 51.8 in September, beating expectations for a fall to 51.3. September's figure was revised up from 51.5.

A reading above 50 indicates expansion.

The increase was driven by rises in output and new orders.

"The start of the final quarter saw UK manufacturing spring back into life and record its best month of factory output growth since June 2014. The revival provides a tentative suggestion that the manufacturers are pulling out of their recent funk, having been dogged by recession since the start of the year, and may help boost economic growth in the fourth quarter," Markit's Senior Economist Rob Dobson said.

-

10:43

Chinese preliminary Markit/Caixin manufacturing Purchasing Managers' Index rises to 48.3 in October

The Chinese preliminary Markit/Caixin manufacturing Purchasing Managers' Index (PMI) rose to 48.3 in October from 47.2 in September, exceeding expectations for a rise to 47.5.

A reading below 50 indicates contraction of activity.

The index was driven by a slower contraction of new business.

"The slight upswing shows the manufacturing industry's overall weakening has slowed down, indicating that previous stimulating measures have begun to take effect. Weak aggregate demand remained the biggest obstacle to economic growth, and the risk of deflation resulting from the continued fall in the prices of bulk commodities needs attention," Dr. He Fan, Chief Economist at Caixin Insight Group, said.

-

10:35

Final Markit/Nikkei manufacturing purchasing managers' index for Japan increases to 52.4 in October

The final Markit/Nikkei manufacturing Purchasing Managers' Index (PMI) for Japan increased to 52.4 in October from 51.0 in September, down from the preliminary reading of 52.5.

A reading below 50 indicates contraction of activity.

The index was driven by a rise in new orders.

"Operating conditions at Japanese manufacturers improved substantially at the start of the final quarter of 2015. Growth in production accelerated to the fastest since February, underpinned by a sharp rise in total new orders," economist at Markit, Amy Brownbill, said.

-

08:03

Global Stocks: U.S. stock indices posted strong gains in October

U.S. stock indices edged down on Friday amid mixed earnings and some weaker-than-expected economic reports, but posted strong gains over the month.

The Dow Jones Industrial Average declined 92.26 points, or 0.5%, to 17663.54 (+0.1% over the week and +8.5% during October). The S&P 500 lost 10.05 points, or 0.5%, to 2079.36 (+0.2% over the week and +8.3% during October). The Nasdaq Composite fell 20.53 points, or 0.4%, to 5053.75 (+0.4% over the week and +9.4% during October).

Personal spending in the U.S. rose by 0.1% in September compared to a 0.4% increase in August and a 0.3% rise in July. Meanwhile personal income rose by 0.1%. Economists expected both indices to grow by 0.2%.

This morning in Asia Hong Kong Hang Seng fell 0.64%, or 144.39, to 22,495.65. China Shanghai Composite Index lost 0.13%, or 4.38, to 3.378.18. The Nikkei plunged 1.94%, or 370.43, to 18,712.67.

Asian indices declined after a report showed that economic activity in China's manufacturing sector contracted in October, although the pace of decline slowed down. Markit/Caixin Manufacturing Purchasing Managers' Index came in at 48.3 in October compared to expectations for a 47.5 reading and 47.2 reported previously. China's economy affects the global economy, that's why these data will influence currency markets as well.

Japanese stocks declined as many investors took profits after four consecutive sessions of gains.

-

03:03

Nikkei 225 18,759.94 -323.16 -1.69 %, Hang Seng 22,470.43 -169.61 -0.75 %, Shanghai Composite 3,332.82 -49.74 -1.47 %

-

00:32

Stocks. Daily history for Sep Oct 30’2015:

(index / closing price / change items /% change)

Nikkei 225 19,083.1 +147.39 +0.78 %

Hang Seng 22,640.04 -179.90 -0.79 %

Shanghai Composite 3,382.92 -4.39 -0.13 %

FTSE 100 6,361.09 -34.71 -0.54 %

CAC 40 4,897.66 +11.84 +0.24 %

Xetra DAX 10,850.14 +49.30 +0.46 %

S&P 500 2,079.36 -10.05 -0.48 %

NASDAQ Composite 5,053.75 -20.53 -0.40 %

Dow Jones 17,663.54 -92.26 -0.52 %

-