Noticias del mercado

-

21:00

Dow +0.74% 17,960.64 +131.88 Nasdaq +0.59% 5,157.16 +30.01 S&P +7.25% 2,114.34 +142.94

-

19:34

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes rose, continuing yesterday's rally. New orders for U.S. factory goods fell for a second straight month in September as the manufacturing sector continued to struggle under the weight of a strong dollar and deep spending cuts by energy companies. The decline of 1.0% was bigger than economist forecasts for a 0.9% drop.

Most of Dow stocks in positive area (18 of 30). Top looser - Verizon Communications Inc. (VZ, -0.99%). Top gainer - Visa Inc. (V, +3.75%).

S&P index sectors mixed. Top gainer - Basic Materials (+2,4%). Top looser - Conglomerates (-0.7%).

At the moment:

Dow 17840.00 +105.00 +0.59%

S&P 500 2103.25 +7.75 +0.37%

Nasdaq 100 4712.50 +18.50 +0.39%

Oil 48.06 +1.92 +4.16%

Gold 1115.50 -20.40 -1.80%

U.S. 10yr 2.22 +0.03

-

18:00

European stocks close: stocks closed higher due to a rise in oil prices

Stock indices closed higher as oil prices rose on concerns over oil supply from Libya and Brazil. Oil workers on Sunday began a strike at state-owned oil producer Petroleo Brasileiro. According to the International Energy Agency (IEA), Brazil produced 2.55 million barrels a day of crude oil and condensate in August.

Libya's oil company National Oil Corp. declared force majeure and suspended deliveries from the port of Zueitina.

Volkswagen's shares dropped as the U.S. Environmental Protection Agency said on Monday that 3.0-liter V6 diesel engines also had installed software aimed at manipulating U.S. pollution tests. Volkswagen answered that no software has been installed in such engines.

Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. fell to 58.8 in October from 59.9 in September, in line with expectations.

A reading above 50 indicates expansion in the construction sector.

The index was mainly driven by a strong rise in commercial building work.

"Rather than acting as a drag on the economy, as suggested by recent GDP estimates, the sector is continuing to act as an important driving force behind the ongoing UK economic upturn," Senior Economist at Markit, Tim Moore, said.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,383.61 +21.81 +0.34 %

DAX 10,951.15 +0.48 0.00%

CAC 40 4,936.18 +19.97 +0.41 %

-

17:51

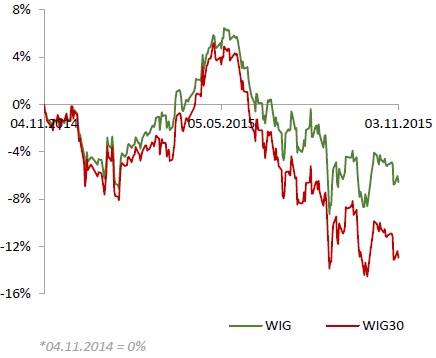

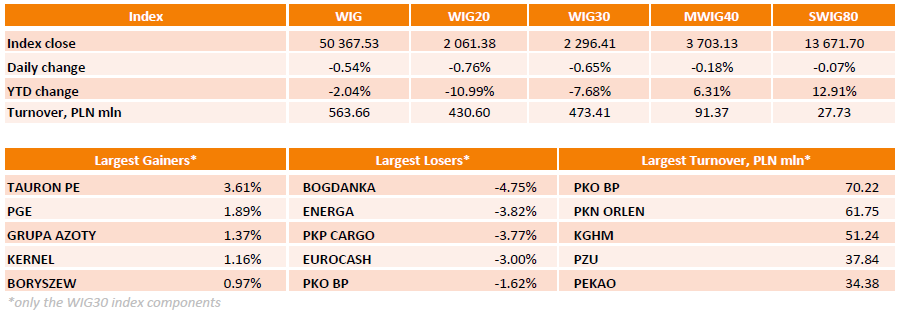

WSE: Session Results

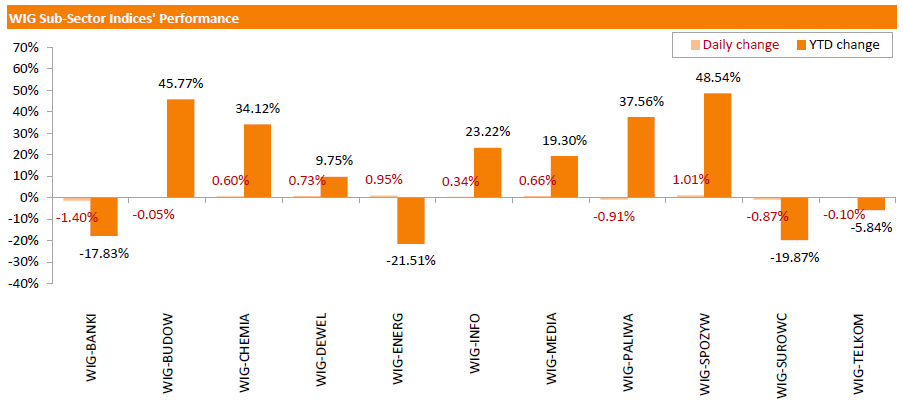

Polish equity market declined on Tuesday. The broad market benchmark, the WIG index, lost 0.54%. Sector-wise, food sector (+1.01%) and utilities (+0.95%) recorded the best daily returns, while banking sector (-1.4%) fared the worst.

The large-cap stocks' measure, the WIG30 Index, fell by 0.65%. Within the WIG30 Index components, BOGDANKA (WSE: LWB) fared the worst, slumping 4.75%. It was followed by ENERGA (WSE: ENG), PKP CARGO (WSE: PKP) and EUROCASH (WSE: EUR), plunging by 3.82%, 3.77% and 3% respectively. On the other side of the ledger, utilities names TAURON PE (WSE: TPE) and PGE (WSE: PGE) became the session's best performers, as their stocks climbed by 3.61% and 1.89% respectively. Other major outperformers were GRUPA AZOTY (WSE: ATT) and KERNEL (WSE: KER), gaining 1.37% and 1.16% respectively.

-

17:06

OECD: consumer price inflation in the OECD area falls to 0.4% year-on-year in September

OECD released its consumer price inflation (CPI) data on Tuesday. Consumer price inflation in the OECD area declined to 0.4% year-on-year in September from 0.6% in August.

Energy prices dropped at an annual rate of 12.4% in September, while food prices remained unchanged at 1.4% year-on-year.

CPI excluding food and energy in the OECD area rose to an annual rate of 1.8% in September from 1.7% in August.

September's CPI was 0.0% year-on-year in Germany, Japan and the U.S., 0.2% in Italy, 1.0% in Canada, and -0.1% in the U.K.

The consumer price inflation in Eurozone was -0.1% in September, while the inflation in China was 1.6%.

-

16:27

U.S. factory orders drop 1.0% in September

The U.S. Commerce Department released factory orders data on Tuesday. Factory orders in the U.S. slid 1.0% in September, missing expectations for a 0.9% decline, after a 2.1% drop in August. August's figure was revised down from a 1.7% fall.

The decline was driven by a drop in durable goods and non-durable orders. Durable goods orders decreased by 1.2% in September, while orders for nondurable goods declined 0.8%.

Factory orders excluding transportation fell 0.6% in September, after a 1.1% decline in August. August's figure was revised down from a 0.8% decrease.

Orders for transportation equipment plunged 3.1% in September.

-

15:33

U.S. Stocks open: Dow -0.14%, Nasdaq -0.33%, S&P -0.27%

-

15:12

Before the bell: S&P futures -0.23%, NASDAQ futures -0.27%

U.S. stock-index futures slipped as investors assess whether the economy and corporate earnings are strong enough to support further gains.

Global Stocks:

Hang Seng 22,568.43 +198.39 +0.89%

Shanghai Composite 3,318.3 -6.79 -0.20%

FTSE 6,353.28 -8.52 -0.13%

CAC 4,909.99 -6.22 -0.13%

DAX 10,918.35 -32.32 -0.30%

Crude oil $46.66 (+1.13%)

Gold $1128.20 (-0.68%)

-

15:00

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

ALCOA INC.

AA

9.22

0.55%

22.9K

Ford Motor Co.

F

14.82

0.47%

6.3K

Pfizer Inc

PFE

35.14

0.23%

2.3K

American Express Co

AXP

74.03

0.12%

3.4K

Exxon Mobil Corp

XOM

85.35

0.08%

16.6K

Merck & Co Inc

MRK

55.12

0.02%

0.2K

The Coca-Cola Co

KO

42.25

0.02%

14.1K

Nike

NKE

131.19

0.00%

0.7K

Verizon Communications Inc

VZ

46.78

0.00%

0.3K

Yandex N.V., NASDAQ

YNDX

16.39

0.00%

1.1K

Johnson & Johnson

JNJ

102.14

-0.03%

2.0K

Twitter, Inc., NYSE

TWTR

29.17

-0.10%

23.1K

Walt Disney Co

DIS

114.91

-0.11%

7.9K

Facebook, Inc.

FB

103.20

-0.11%

46.0K

Amazon.com Inc., NASDAQ

AMZN

627.37

-0.16%

1.8K

Chevron Corp

CVX

94.80

-0.17%

1.7K

Wal-Mart Stores Inc

WMT

57.50

-0.19%

1.3K

Goldman Sachs

GS

189.30

-0.20%

0.8K

General Motors Company, NYSE

GM

35.50

-0.20%

0.3K

Visa

V

75.04

-0.24%

0.1K

Microsoft Corp

MSFT

53.10

-0.26%

10.3K

Google Inc.

GOOG

719.25

-0.26%

0.8K

Boeing Co

BA

148.00

-0.27%

0.2K

ALTRIA GROUP INC.

MO

60.33

-0.28%

0.3K

AT&T Inc

T

33.51

-0.30%

1.2K

Citigroup Inc., NYSE

C

53.65

-0.33%

0.4K

JPMorgan Chase and Co

JPM

65.30

-0.37%

6.0K

McDonald's Corp

MCD

111.69

-0.37%

0.2K

International Business Machines Co...

IBM

139.84

-0.38%

0.3K

Starbucks Corporation, NASDAQ

SBUX

62.00

-0.39%

9.9K

Apple Inc.

AAPL

120.70

-0.40%

174.2K

Hewlett-Packard Co.

HPQ

13.77

-0.43%

33.0K

Caterpillar Inc

CAT

74.00

-0.46%

0.4K

General Electric Co

GE

29.26

-0.48%

5.4K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.76

-0.51%

0.1K

Tesla Motors, Inc., NASDAQ

TSLA

212.60

-0.56%

3.4K

UnitedHealth Group Inc

UNH

117.50

-1.00%

1.5K

Barrick Gold Corporation, NYSE

ABX

7.65

-1.42%

1.5K

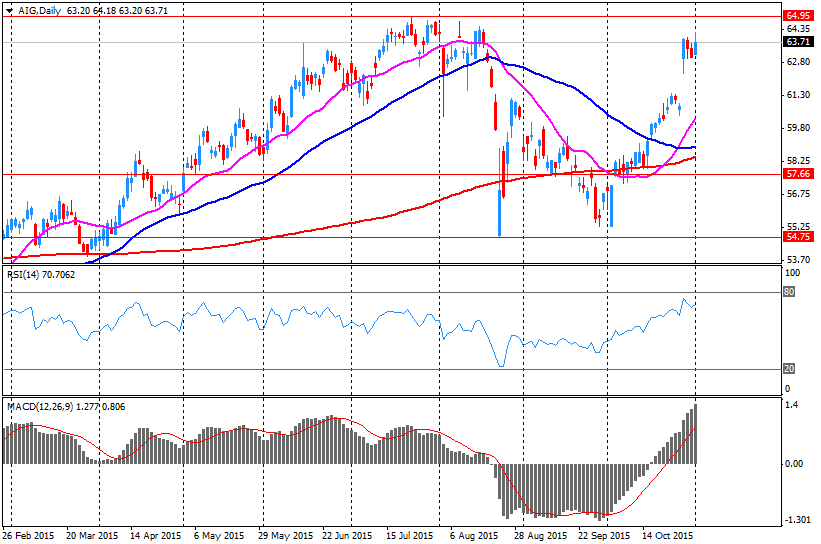

AMERICAN INTERNATIONAL GROUP

AIG

61.76

-3.11%

139.5K

HONEYWELL INTERNATIONAL INC.

HON

100.86

-3.19%

0.9K

-

14:54

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

HP (HPQ) downgraded to Neutral from Buy at Citigroup

Other:

Pfizer (PFE) target raised to $46 from $41 at Argus

HP (HPQ) initiated with a Outperform at Bernstein

HP (HPQ) target lowered to $14 from $30 at Mizuho

-

14:39

European Central Bank’s bulletin: the stimulus measures contributed to the recovery in lending and economic activity

The European Central Bank (ECB) said in its bulletin on Tuesday that its stimulus measures contributed to the recovery in lending and economic activity, "which is expected to produce a sustained adjustment of inflation rates towards levels below, but close to, 2% over the medium term".

-

14:18

-

12:04

European stock markets mid session: stocks traded lower on company news

Stock indices traded lower on company news. Volkswagen's shares dropped as the U.S. Environmental Protection Agency said on Monday that 3.0-liter V6 diesel engines also had installed software aimed at manipulating U.S. pollution tests. Volkswagen answered that no software has been installed in such engines.

Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. fell to 58.8 in October from 59.9 in September, in line with expectations.

A reading above 50 indicates expansion in the construction sector.

The index was mainly driven by a strong rise in commercial building work.

"Rather than acting as a drag on the economy, as suggested by recent GDP estimates, the sector is continuing to act as an important driving force behind the ongoing UK economic upturn," Senior Economist at Markit, Tim Moore, said.

Current figures:

Name Price Change Change %

FTSE 100 6,354.57 -7.23 -0.11 %

DAX 10,915.98 -34.69 -0.32 %

CAC 40 4,915.59 -0.62 -0.01 %

-

11:51

China's President Xi Jinping: the economy should expand no less than 6.5% over the next five years

China's state-owned Xinhua News Agency reported on Tuesday that China's President Xi Jinping said the country's economy should expand no less than 6.5% over the next five years to reach all government's goals by 2020.

-

11:45

European Central Bank Governing Council members meet regularly with representatives from financial institutions

European Central Bank (ECB) Governing Council members met regularly with representatives from financial institutions, according to documents released Monday by the central bank. One meeting was on the same day as the ECB's monetary policy meeting.

"The ECB does not operate in a vacuum. Regular contacts with different groups, including representatives from the financial sector help us understand the dynamics of the economy and financial markets. We make sure that at such meetings no financial market-sensitive information is disclosed," an ECB spokeswoman said.

-

11:27

Number of registered unemployed people in Spain increases by 82,327 in October

Spain's labour ministry release its labour market figures on Monday. The number of registered unemployed people rose by 82,327 in October, after a 22,087 increase in September.

The ministry said the increase was driven by a drop-off in a seasonal summer work.

-

11:08

UK construction PMI falls to 58.8 in October

Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. fell to 58.8 in October from 59.9 in September, in line with expectations.

A reading above 50 indicates expansion in the construction sector.

The index was mainly driven by a strong rise in commercial building work.

"Rather than acting as a drag on the economy, as suggested by recent GDP estimates, the sector is continuing to act as an important driving force behind the ongoing UK economic upturn," Senior Economist at Markit, Tim Moore, said.

-

10:55

Reserve Bank of Australia keeps its interest rate unchanged at 2.00% in November

The Reserve Bank of Australia (RBA) kept its interest rate unchanged at 2.00% on Tuesday. This decision was expected by analysts.

The RBA Governor Glenn Stevens said that the board' decision was appropriate at this meeting.

He pointed out that further interest rate cut is possible.

"Members also observed that the outlook for inflation may afford scope for further easing of policy, should that be appropriate to lend support to demand," the RBA governor said.

Stevens also said that the Australian economy continued to recover moderately, and that the employment grew strongly.

He noted that the Australian dollar was adjusting to the significant drop in key commodity prices.

-

10:46

The RBC manufacturing Purchasing Managers' Index (PMI) for Canada decreases to 48.0 in October

The RBC manufacturing Purchasing Managers' Index (PMI) for Canada decreased to 48.0 in October from 48.6 in September. A reading below 50 indicates contraction of activity.

The index was driven by declines in output, new orders and employment.

"As we move toward the end of the year, we expect that a strengthening U.S. economy and weaker Canadian dollar will fuel demand for Canada's exports, resulting in a shift to positive growth territory," senior vice president and chief economist at RBC, Craig Wright, said.

-

10:11

U.S. President Barack Obama signs a budget deal

U.S. President Barack Obama on Monday signed a budget deal. The deal helps to avoid a U.S. default, and means that debt limit was raised through March 2017.

Federal spending on defence and domestic programmes will rise over $80 billion for the next two years.

"Last week, Democrats and Republicans came together to set up a responsible long-term budget process. What we now see is a budget that reflects our values, grows our economy, creates jobs and keeps America safe. It should finally free us from the cycle of shutdown threats and last-minute fixes," Obama said.

-

07:42

Global Stocks: U.S. stock indices rose

U.S. stock indices rose on Monday amid strong earnings reports. Energy, health-care and financial stocks led the gains.

The Dow Jones Industrial Average rose 165.22 points, or 0.9%, to 17,828.76. The S&P 500 gained 24.69 points, or 1.2%, to 2,104.05 (all of its sectors climbed). The Nasdaq Composite rose 73.40 points, or 1.5%, to 5,127.15.

The Institute for Supply Management reported that activity in the U.S. manufacturing sector was almost unchanged in October, but slightly exceeded economists' expectations. The Manufacturing PMI posted 50.1 in October vs 50.2 in September and 50 expected.

Investors are waiting for U.S. jobs data. A strong report could intensify expectations for a rate hike in December.

This morning in Asia Hong Kong Hang Seng rose 1.24%, or 277.49, to 22,647.53. China Shanghai Composite Index climbed 0.11%, or 3.57, to 3.328.66. Japanese markets are on holiday.

Asian indices advanced following gains in U.S. equities. Stocks of technology companies rose most.

-

04:03

Hang Seng 22,645.46 +275.42 +1.2 %, Shanghai Composite 3,309.73 -15.35 -0.5 %

-

00:37

Stocks. Daily history for Sep Nov 2’2015:

(index / closing price / change items /% change)

Nikkei 225 18,683.24 -399.86 -2.10 %

Hang Seng 22,370.04 -270.00 -1.19 %

Shanghai Composite 3,325.08 -57.48 -1.70 %

FTSE 100 6,361.8 +0.71 +0.01 %

CAC 40 4,916.21 +18.55 +0.38 %

Xetra DAX 10,950.67 +100.53 +0.93 %

S&P 500 2,104.05 +24.69 +1.19 %

NASDAQ Composite 5,127.15 +73.40 +1.45 %

Dow Jones 17,828.76 +165.22 +0.94 %

-