Noticias del mercado

-

23:30

Australia: AIG Services Index, October 48.9

-

22:45

New Zealand: Employment Change, q/q, Quarter III -0.4% (forecast 0.4%)

-

22:45

New Zealand: Unemployment Rate, Quarter III 6% (forecast 6.0%)

-

21:00

Dow +0.74% 17,960.64 +131.88 Nasdaq +0.59% 5,157.16 +30.01 S&P +7.25% 2,114.34 +142.94

-

19:34

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes rose, continuing yesterday's rally. New orders for U.S. factory goods fell for a second straight month in September as the manufacturing sector continued to struggle under the weight of a strong dollar and deep spending cuts by energy companies. The decline of 1.0% was bigger than economist forecasts for a 0.9% drop.

Most of Dow stocks in positive area (18 of 30). Top looser - Verizon Communications Inc. (VZ, -0.99%). Top gainer - Visa Inc. (V, +3.75%).

S&P index sectors mixed. Top gainer - Basic Materials (+2,4%). Top looser - Conglomerates (-0.7%).

At the moment:

Dow 17840.00 +105.00 +0.59%

S&P 500 2103.25 +7.75 +0.37%

Nasdaq 100 4712.50 +18.50 +0.39%

Oil 48.06 +1.92 +4.16%

Gold 1115.50 -20.40 -1.80%

U.S. 10yr 2.22 +0.03

-

18:00

European stocks close: stocks closed higher due to a rise in oil prices

Stock indices closed higher as oil prices rose on concerns over oil supply from Libya and Brazil. Oil workers on Sunday began a strike at state-owned oil producer Petroleo Brasileiro. According to the International Energy Agency (IEA), Brazil produced 2.55 million barrels a day of crude oil and condensate in August.

Libya's oil company National Oil Corp. declared force majeure and suspended deliveries from the port of Zueitina.

Volkswagen's shares dropped as the U.S. Environmental Protection Agency said on Monday that 3.0-liter V6 diesel engines also had installed software aimed at manipulating U.S. pollution tests. Volkswagen answered that no software has been installed in such engines.

Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. fell to 58.8 in October from 59.9 in September, in line with expectations.

A reading above 50 indicates expansion in the construction sector.

The index was mainly driven by a strong rise in commercial building work.

"Rather than acting as a drag on the economy, as suggested by recent GDP estimates, the sector is continuing to act as an important driving force behind the ongoing UK economic upturn," Senior Economist at Markit, Tim Moore, said.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,383.61 +21.81 +0.34 %

DAX 10,951.15 +0.48 0.00%

CAC 40 4,936.18 +19.97 +0.41 %

-

18:00

European stocks closed: FTSE 100 6,383.61 +21.81 +0.34% CAC 40 4,936.18 +19.97 +0.41% DAX 10,951.15 +0.48 0.00%

-

17:51

WSE: Session Results

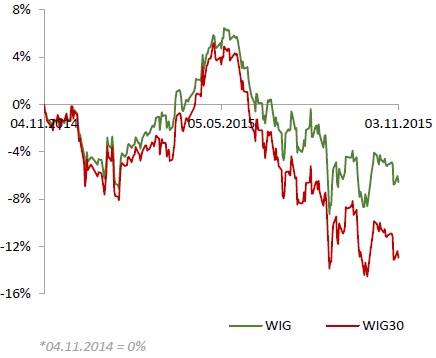

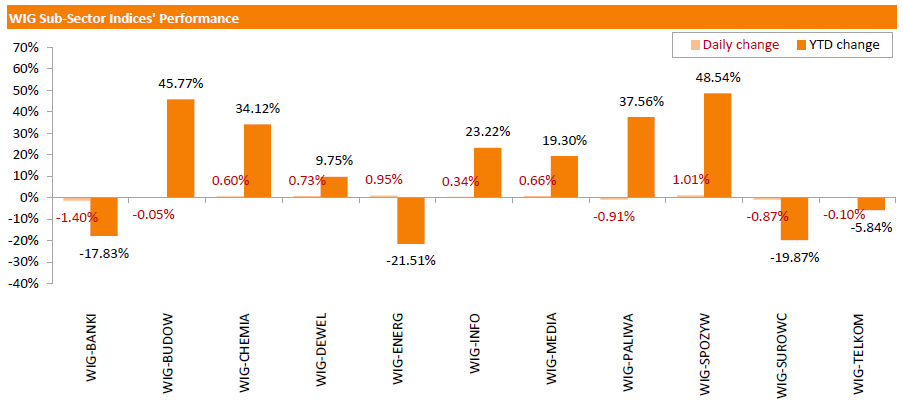

Polish equity market declined on Tuesday. The broad market benchmark, the WIG index, lost 0.54%. Sector-wise, food sector (+1.01%) and utilities (+0.95%) recorded the best daily returns, while banking sector (-1.4%) fared the worst.

The large-cap stocks' measure, the WIG30 Index, fell by 0.65%. Within the WIG30 Index components, BOGDANKA (WSE: LWB) fared the worst, slumping 4.75%. It was followed by ENERGA (WSE: ENG), PKP CARGO (WSE: PKP) and EUROCASH (WSE: EUR), plunging by 3.82%, 3.77% and 3% respectively. On the other side of the ledger, utilities names TAURON PE (WSE: TPE) and PGE (WSE: PGE) became the session's best performers, as their stocks climbed by 3.61% and 1.89% respectively. Other major outperformers were GRUPA AZOTY (WSE: ATT) and KERNEL (WSE: KER), gaining 1.37% and 1.16% respectively.

-

17:50

Oil prices rise on concerns over oil supply from Libya and Brazil

Oil prices rose on concerns over oil supply from Libya and Brazil. Oil workers on Sunday began a strike at state-owned oil producer Petroleo Brasileiro. According to the International Energy Agency (IEA), Brazil produced 2.55 million barrels a day of crude oil and condensate in August.

Libya's oil company National Oil Corp. declared force majeure and suspended deliveries from the port of Zueitina.

Market participants are awaiting the release of U.S. crude oil inventories data. The American Petroleum Institute (API) is scheduled to release its U.S. oil inventories data later in the day, and U.S. oil inventories data from the U.S. Energy Information Administration is expected on Wednesday.

WTI crude oil for December delivery rose to $47.16 a barrel on the New York Mercantile Exchange.

Brent crude oil for December climbed to $49.82 a barrel on ICE Futures Europe.

-

17:24

Gold price continues to fall on speculation that the Fed will start raising its interest rate this year

Gold price continued to decline on speculation that the Fed will start raising its interest rate this year. The Fed released its interest rate decision last Wednesday. The Fed pointed out that an interest rate hike in December is still on the table.

Market participants eyed the U.S. economic data. The U.S. Commerce Department released factory orders data on Tuesday. Factory orders in the U.S. slid 1.0% in September, missing expectations for a 0.9% decline, after a 2.1% drop in August.

Market participants are awaiting the release of the U.S. labour market data on Friday. The U.S. unemployment rate is expected to remain unchanged at 5.1% in October. The U.S. economy is expected to add 180,000 jobs in October, after adding 142,000 jobs in September.

December futures for gold on the COMEX today declined to 1122.70 dollars per ounce.

-

17:06

OECD: consumer price inflation in the OECD area falls to 0.4% year-on-year in September

OECD released its consumer price inflation (CPI) data on Tuesday. Consumer price inflation in the OECD area declined to 0.4% year-on-year in September from 0.6% in August.

Energy prices dropped at an annual rate of 12.4% in September, while food prices remained unchanged at 1.4% year-on-year.

CPI excluding food and energy in the OECD area rose to an annual rate of 1.8% in September from 1.7% in August.

September's CPI was 0.0% year-on-year in Germany, Japan and the U.S., 0.2% in Italy, 1.0% in Canada, and -0.1% in the U.K.

The consumer price inflation in Eurozone was -0.1% in September, while the inflation in China was 1.6%.

-

16:27

U.S. factory orders drop 1.0% in September

The U.S. Commerce Department released factory orders data on Tuesday. Factory orders in the U.S. slid 1.0% in September, missing expectations for a 0.9% decline, after a 2.1% drop in August. August's figure was revised down from a 1.7% fall.

The decline was driven by a drop in durable goods and non-durable orders. Durable goods orders decreased by 1.2% in September, while orders for nondurable goods declined 0.8%.

Factory orders excluding transportation fell 0.6% in September, after a 1.1% decline in August. August's figure was revised down from a 0.8% decrease.

Orders for transportation equipment plunged 3.1% in September.

-

16:00

U.S.: Factory Orders , September -1.0% (forecast -0.9%)

-

15:33

U.S. Stocks open: Dow -0.14%, Nasdaq -0.33%, S&P -0.27%

-

15:12

Before the bell: S&P futures -0.23%, NASDAQ futures -0.27%

U.S. stock-index futures slipped as investors assess whether the economy and corporate earnings are strong enough to support further gains.

Global Stocks:

Hang Seng 22,568.43 +198.39 +0.89%

Shanghai Composite 3,318.3 -6.79 -0.20%

FTSE 6,353.28 -8.52 -0.13%

CAC 4,909.99 -6.22 -0.13%

DAX 10,918.35 -32.32 -0.30%

Crude oil $46.66 (+1.13%)

Gold $1128.20 (-0.68%)

-

15:00

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

ALCOA INC.

AA

9.22

0.55%

22.9K

Ford Motor Co.

F

14.82

0.47%

6.3K

Pfizer Inc

PFE

35.14

0.23%

2.3K

American Express Co

AXP

74.03

0.12%

3.4K

Exxon Mobil Corp

XOM

85.35

0.08%

16.6K

Merck & Co Inc

MRK

55.12

0.02%

0.2K

The Coca-Cola Co

KO

42.25

0.02%

14.1K

Nike

NKE

131.19

0.00%

0.7K

Verizon Communications Inc

VZ

46.78

0.00%

0.3K

Yandex N.V., NASDAQ

YNDX

16.39

0.00%

1.1K

Johnson & Johnson

JNJ

102.14

-0.03%

2.0K

Twitter, Inc., NYSE

TWTR

29.17

-0.10%

23.1K

Walt Disney Co

DIS

114.91

-0.11%

7.9K

Facebook, Inc.

FB

103.20

-0.11%

46.0K

Amazon.com Inc., NASDAQ

AMZN

627.37

-0.16%

1.8K

Chevron Corp

CVX

94.80

-0.17%

1.7K

Wal-Mart Stores Inc

WMT

57.50

-0.19%

1.3K

Goldman Sachs

GS

189.30

-0.20%

0.8K

General Motors Company, NYSE

GM

35.50

-0.20%

0.3K

Visa

V

75.04

-0.24%

0.1K

Microsoft Corp

MSFT

53.10

-0.26%

10.3K

Google Inc.

GOOG

719.25

-0.26%

0.8K

Boeing Co

BA

148.00

-0.27%

0.2K

ALTRIA GROUP INC.

MO

60.33

-0.28%

0.3K

AT&T Inc

T

33.51

-0.30%

1.2K

Citigroup Inc., NYSE

C

53.65

-0.33%

0.4K

JPMorgan Chase and Co

JPM

65.30

-0.37%

6.0K

McDonald's Corp

MCD

111.69

-0.37%

0.2K

International Business Machines Co...

IBM

139.84

-0.38%

0.3K

Starbucks Corporation, NASDAQ

SBUX

62.00

-0.39%

9.9K

Apple Inc.

AAPL

120.70

-0.40%

174.2K

Hewlett-Packard Co.

HPQ

13.77

-0.43%

33.0K

Caterpillar Inc

CAT

74.00

-0.46%

0.4K

General Electric Co

GE

29.26

-0.48%

5.4K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.76

-0.51%

0.1K

Tesla Motors, Inc., NASDAQ

TSLA

212.60

-0.56%

3.4K

UnitedHealth Group Inc

UNH

117.50

-1.00%

1.5K

Barrick Gold Corporation, NYSE

ABX

7.65

-1.42%

1.5K

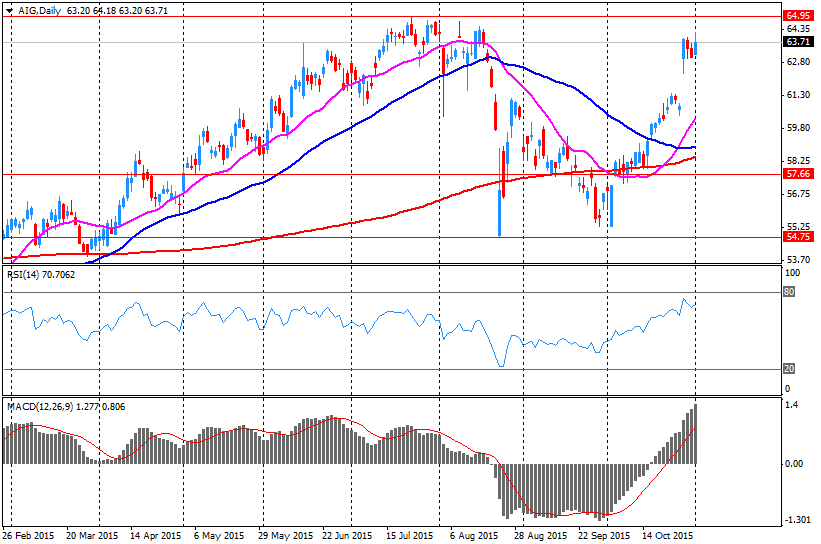

AMERICAN INTERNATIONAL GROUP

AIG

61.76

-3.11%

139.5K

HONEYWELL INTERNATIONAL INC.

HON

100.86

-3.19%

0.9K

-

14:54

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

HP (HPQ) downgraded to Neutral from Buy at Citigroup

Other:

Pfizer (PFE) target raised to $46 from $41 at Argus

HP (HPQ) initiated with a Outperform at Bernstein

HP (HPQ) target lowered to $14 from $30 at Mizuho

-

14:50

Option expiries for today's 10:00 ET NY cut

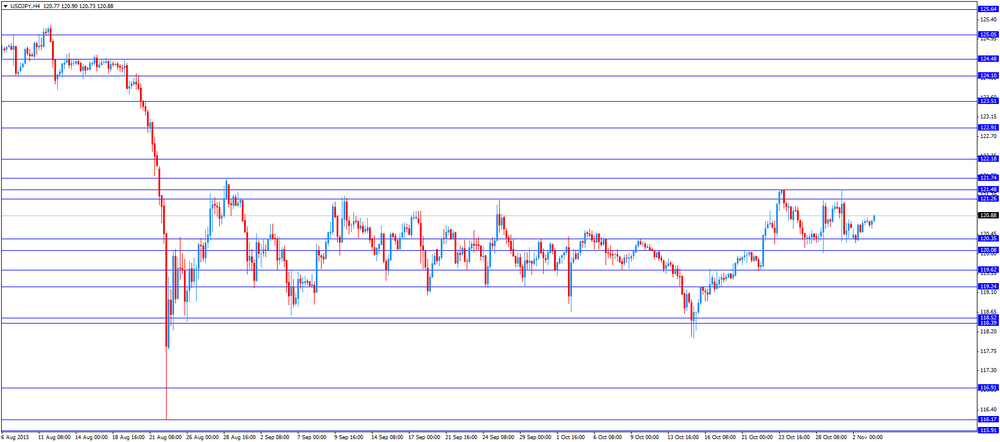

USD/JPY 120.00 (USD 922m) 120.50 (750m) 121.00-20 (485m)

EUR/USD 1.1000 (EUR 1.6bln

GBP/USD 1.5450 (GBP 159m) 1.5600 (217m)

AUD/USD 0.7100 (AUD 311m) 0.7125 (240m) 0.7250 (458m)

NZD/USD 0.6700 (NZD 259m)

EUR/JPY 132.20 (EUR 230m)

EUR/GBP 0.7250 (EUR 202m)

-

14:39

European Central Bank’s bulletin: the stimulus measures contributed to the recovery in lending and economic activity

The European Central Bank (ECB) said in its bulletin on Tuesday that its stimulus measures contributed to the recovery in lending and economic activity, "which is expected to produce a sustained adjustment of inflation rates towards levels below, but close to, 2% over the medium term".

-

14:18

-

14:12

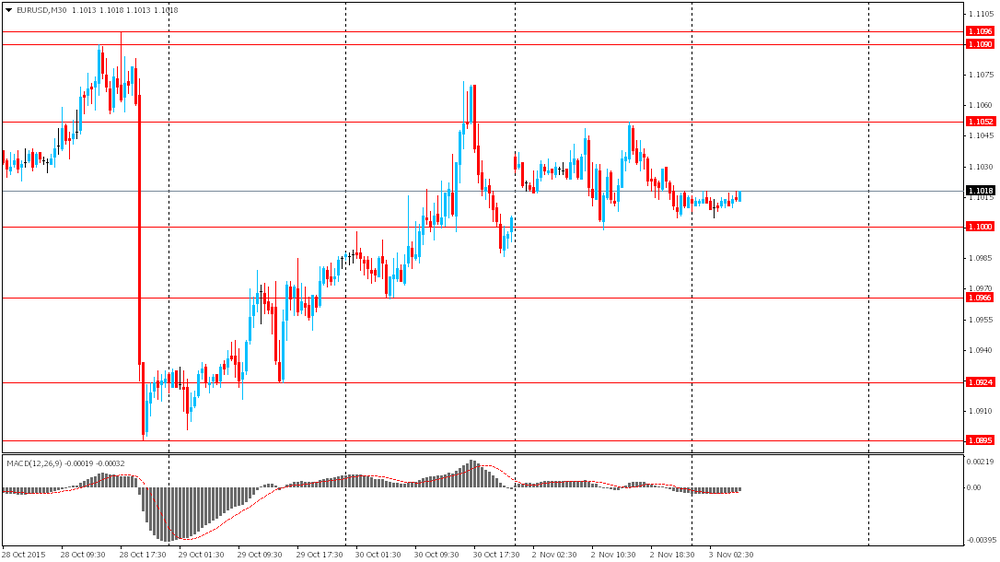

Foreign exchange market. European session: the British pound traded lower against the U.S. dollar after the release of the construction PMI data from the U.K.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

03:30 Australia Announcement of the RBA decision on the discount rate 2.0% 2% 2.0%

03:30 Australia RBA Rate Statement

09:30 United Kingdom PMI Construction October 59.9 58.8 58.8

The U.S. dollar traded higher against the most major currencies ahead of the release of the U.S. factory orders data. The U.S. factory orders are expected to drop 0.9% in September, after a 1.7 decline in August.

The euro traded mixed against the U.S. dollar in the absence of any major economic reports from the Eurozone.

The European Central Bank (ECB) President Mario Draghi will speak at 19:00 GMT.

The British pound traded lower against the U.S. dollar after the release of the construction PMI data from the U.K. Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. fell to 58.8 in October from 59.9 in September, in line with expectations.

A reading above 50 indicates expansion in the construction sector.

The index was mainly driven by a strong rise in commercial building work.

"Rather than acting as a drag on the economy, as suggested by recent GDP estimates, the sector is continuing to act as an important driving force behind the ongoing UK economic upturn," Senior Economist at Markit, Tim Moore, said.

EUR/USD: the currency pair fell to $1.0967

GBP/USD: the currency pair was down to $1.5378

USD/JPY: the currency pair increased to Y120.90

The most important news that are expected (GMT0):

15:00 U.S. Factory Orders September -1.7% -0.9%

19:00 Eurozone ECB President Mario Draghi Speaks

21:45 New Zealand Employment Change, q/q Quarter III 0.3% 0.4%

21:45 New Zealand Unemployment Rate Quarter III 5.9% 6.0%

-

13:50

Orders

EUR/USD

Offers 1.1050 1.1075-80 1.1100 1.1130 1.1150 1.1165 1.1180 1.1200

Bids 1.1000-10 1.0980 1.0950 1.09201.0900 1.0885 1.0850 1.0830 1.0800

GBP/USD

Offers 1.5450 .5465 1.5480-85 1.5500-10 1.5530 1.5550

Bids 1.5420 1.5400 1.5380 1.5350 1.5325-30 1.5300 1.52 85 1.5250

EUR/GBP

Offers 0.7150-55 0.7170 0.7185 0.7200 0.7220-25 0.7250

Bids 0.7125-30 0.7120 0.7100 0.7085 0.7050 0.7030 0.7000

EUR/JPY

Offers 133.20 133.50-60 133.75-80 134.00 134.25 134.50 134.80 135.00

Bids 132.75-80 132.60 132.00 131.80 131.50 131.30 131.00

USD/JPY

Offers 120.75-80 121.00 121.20 121.35 121.50 121.80 122.00

Bids 120.50 120.20-25 120.00 119.80-85 119.50 119.25-30 119.00

AUD/USD

Offers 0.7220 0.7250 0.7265 0.7280-85 0.7300 0.7320 0.7335 0.7350

Bids 0.7175-80 0.7150 0.7125-30 0.7100-05 0.7080 0.7065 0.70500

-

12:04

European stock markets mid session: stocks traded lower on company news

Stock indices traded lower on company news. Volkswagen's shares dropped as the U.S. Environmental Protection Agency said on Monday that 3.0-liter V6 diesel engines also had installed software aimed at manipulating U.S. pollution tests. Volkswagen answered that no software has been installed in such engines.

Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. fell to 58.8 in October from 59.9 in September, in line with expectations.

A reading above 50 indicates expansion in the construction sector.

The index was mainly driven by a strong rise in commercial building work.

"Rather than acting as a drag on the economy, as suggested by recent GDP estimates, the sector is continuing to act as an important driving force behind the ongoing UK economic upturn," Senior Economist at Markit, Tim Moore, said.

Current figures:

Name Price Change Change %

FTSE 100 6,354.57 -7.23 -0.11 %

DAX 10,915.98 -34.69 -0.32 %

CAC 40 4,915.59 -0.62 -0.01 %

-

11:51

China's President Xi Jinping: the economy should expand no less than 6.5% over the next five years

China's state-owned Xinhua News Agency reported on Tuesday that China's President Xi Jinping said the country's economy should expand no less than 6.5% over the next five years to reach all government's goals by 2020.

-

11:45

European Central Bank Governing Council members meet regularly with representatives from financial institutions

European Central Bank (ECB) Governing Council members met regularly with representatives from financial institutions, according to documents released Monday by the central bank. One meeting was on the same day as the ECB's monetary policy meeting.

"The ECB does not operate in a vacuum. Regular contacts with different groups, including representatives from the financial sector help us understand the dynamics of the economy and financial markets. We make sure that at such meetings no financial market-sensitive information is disclosed," an ECB spokeswoman said.

-

11:27

Number of registered unemployed people in Spain increases by 82,327 in October

Spain's labour ministry release its labour market figures on Monday. The number of registered unemployed people rose by 82,327 in October, after a 22,087 increase in September.

The ministry said the increase was driven by a drop-off in a seasonal summer work.

-

11:08

UK construction PMI falls to 58.8 in October

Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. fell to 58.8 in October from 59.9 in September, in line with expectations.

A reading above 50 indicates expansion in the construction sector.

The index was mainly driven by a strong rise in commercial building work.

"Rather than acting as a drag on the economy, as suggested by recent GDP estimates, the sector is continuing to act as an important driving force behind the ongoing UK economic upturn," Senior Economist at Markit, Tim Moore, said.

-

10:55

Reserve Bank of Australia keeps its interest rate unchanged at 2.00% in November

The Reserve Bank of Australia (RBA) kept its interest rate unchanged at 2.00% on Tuesday. This decision was expected by analysts.

The RBA Governor Glenn Stevens said that the board' decision was appropriate at this meeting.

He pointed out that further interest rate cut is possible.

"Members also observed that the outlook for inflation may afford scope for further easing of policy, should that be appropriate to lend support to demand," the RBA governor said.

Stevens also said that the Australian economy continued to recover moderately, and that the employment grew strongly.

He noted that the Australian dollar was adjusting to the significant drop in key commodity prices.

-

10:46

The RBC manufacturing Purchasing Managers' Index (PMI) for Canada decreases to 48.0 in October

The RBC manufacturing Purchasing Managers' Index (PMI) for Canada decreased to 48.0 in October from 48.6 in September. A reading below 50 indicates contraction of activity.

The index was driven by declines in output, new orders and employment.

"As we move toward the end of the year, we expect that a strengthening U.S. economy and weaker Canadian dollar will fuel demand for Canada's exports, resulting in a shift to positive growth territory," senior vice president and chief economist at RBC, Craig Wright, said.

-

10:40

Morgan Stanley cuts its EUR/USD forecasts

Morgan Stanley cut its EUR/USD forecasts on Monday as it expects the European Central Bank (ECB) to add further stimulus measures. It expects the currency to be at $1.03 by the end of the first quarter 2016, down from the previous estimate of $1.11.

"We lower our forecast profile for euro/dollar, frontloading our anticipated euro/dollar decline into year-end and the first quarter of next year. We now project euro/dollar at $1.06 by end-2015 and $1.02 by mid-2016, but still ending 2016 at $1.00," Morgan Stanley currency strategist Ian Stannard said.

The lender expect the ECB to lower its deposit rate by 0.1% and to purchase additional €15 billion from January 16. According to Morgan Stanley, the asset-buying programme should be expected to run until March 2017, longer than the current period until September 2016.

-

10:30

United Kingdom: PMI Construction, October 58.8 (forecast 58.8)

-

10:22

The well-known analyst of the oil sector, Gary Ross, expects the OPEC to keep its oil production unchanged at its next meeting on December 04

The well-known analyst of the oil sector, Gary Ross, said in an interview on Monday that he expects the OPEC to keep its oil production unchanged at its next meeting on December 04.

He noted that the global oil consumption will rise, while oil output from non-OPEC countries will fall next year.

Ross also said that he expects Brent crude to rise to $70 a barrel by the end of 2016.

He correctly predicted last year's drop in oil prices.

-

10:11

U.S. President Barack Obama signs a budget deal

U.S. President Barack Obama on Monday signed a budget deal. The deal helps to avoid a U.S. default, and means that debt limit was raised through March 2017.

Federal spending on defence and domestic programmes will rise over $80 billion for the next two years.

"Last week, Democrats and Republicans came together to set up a responsible long-term budget process. What we now see is a budget that reflects our values, grows our economy, creates jobs and keeps America safe. It should finally free us from the cycle of shutdown threats and last-minute fixes," Obama said.

-

10:02

Option expiries for today's 10:00 ET NY cut

USD/JPY 120.00 (USD 922m) 120.50 (750m) 121.00-20 (485m)

EUR/USD 1.1000 (EUR 1.6bln

GBP/USD 1.5450 (GBP 159m) 1.5600 (217m)

AUD/USD 0.7100 (AUD 311m) 0.7125 (240m) 0.7250 (458m)

NZD/USD 0.6700 (NZD 259m)

EUR/JPY 132.20 (EUR 230m)

EUR/GBP 0.7250 (EUR 202m)

-

08:25

Options levels on tuesday, November 3, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1210 (5020)

$1.1168 (2112)

$1.1100 (2444)

Price at time of writing this review: $1.1028

Support levels (open interest**, contracts):

$1.0942 (4608)

$1.0912 (2298)

$1.0876 (5990)

Comments:

- Overall open interest on the CALL options with the expiration date November, 6 is 55002 contracts, with the maximum number of contracts with strike price $1,1200 (5020);

- Overall open interest on the PUT options with the expiration date November, 6 is 56776 contracts, with the maximum number of contracts with strike price $1,0900 (5990);

- The ratio of PUT/CALL was 1.03 versus 1.05 from the previous trading day according to data from November, 2

GBP/USD

Resistance levels (open interest**, contracts)

$1.5700 (823)

$1.5601 (1185)

$1.5502 (2756)

Price at time of writing this review: $1.5437

Support levels (open interest**, contracts):

$1.5394 (627)

$1.5298 (2695)

$1.5199 (2893)

Comments:

- Overall open interest on the CALL options with the expiration date November, 6 is 21469 contracts, with the maximum number of contracts with strike price $1,5500 (2756);

- Overall open interest on the PUT options with the expiration date November, 6 is 21874 contracts, with the maximum number of contracts with strike price $1,5200 (2893);

- The ratio of PUT/CALL was 1.02 versus 1.00 from the previous trading day according to data from November, 2

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:15

Foreign exchange market. Asian session: the euro little changed

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

03:30 Australia Announcement of the RBA decision on the discount rate 2.0% 2% 2.0%

03:30 Australia RBA Rate Statement

The euro little changed before speeches of officials from the EU, the U.K. and the U.S. U.K. finance Minister George Osborne will tell European leaders about his country's demands regarding EU membership. He is expected to demand legally-binding safeguards for the single market and a commitment not to "discriminate" against countries not in the euro area. EU Finance commissioner Pierre Moscovici will visit Greece today and tomorrow and meet Prime Minister Alexis Tsipras. The visit will take place amid Greece's preparations for reforms required for financial aid from international lenders.

The Australian dollar rose against the greenback after the Reserve Bank of Australia decided to keep its benchmark interest rate at 2%. The bank said in its statement that the country's economy continued to expand at a moderate pace and prospects of improvements got clearer even though economic indices remained slightly below long-term targets. RBA Governor Glenn Stevens said that the AUD was adjusting to lower commodity prices.

EUR/USD: the pair fluctuated within $1.1005-20 in Asian trade

USD/JPY: the pair fell to Y120.60

GBP/USD: the pair traded within $1.5410-25

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

09:30 United Kingdom PMI Construction October 59.9 58.8

15:00 U.S. Factory Orders September -1.7% -0.9%

19:00 Eurozone ECB President Mario Draghi Speaks

20:30 U.S. Total Vehicle Sales, mln October 18.2 17.7

21:45 New Zealand Employment Change, q/q Quarter III 0.3% 0.4%

21:45 New Zealand Unemployment Rate Quarter III 5.9% 6.0%

22:30 Australia AIG Services Index October 52.3

-

07:46

Oil prices under pressure

West Texas Intermediate futures for December delivery edged up to $46.26 (+0.26%), while Brent crude is currently at $48.83 (+0.08%). Nevertheless weaker manufacturing activity in China, the world's second-biggest consumer of crude, suggests weaker demand. Thus fundamentals remain bearish. "Crude continues to remain under pressure due to emerging supply-side news and slowing Chinese demand. Russian oil output broke a post-Soviet record in October for the fourth time this year. News from Iran is also painting a negative picture," ANZ bank said.

Industry group the American Petroleum Institute will publish its data on U.S. crude stockpiles later today, while more accurate data by the Energy Information Administration will be released on Wednesday.

-

07:44

Gold near a four-week low

Gold slightly climbed to $1,136.90 (+0.09%), but stayed near its four-week low. Expectations that the Federal Reserve can still raise interest rates till the end of the year continue weighing on this non-interest-paying asset. Higher rates would decrease demand for gold further.

On Monday the Institute for Supply Management reported that activity in U.S. manufacturing sector was almost unchanged in October, but slightly exceeded economists' expectations. The Manufacturing PMI posted 50.1 in October vs 50.2 in September and 50 expected. The new orders sub-index rose giving hope for better results in the future.

Assets in SPDR Gold Trust, world's largest gold-backed exchange-traded fund, fell 0.43% to 689.28 tonnes on Monday, the lowest level in three weeks.

-

07:42

Global Stocks: U.S. stock indices rose

U.S. stock indices rose on Monday amid strong earnings reports. Energy, health-care and financial stocks led the gains.

The Dow Jones Industrial Average rose 165.22 points, or 0.9%, to 17,828.76. The S&P 500 gained 24.69 points, or 1.2%, to 2,104.05 (all of its sectors climbed). The Nasdaq Composite rose 73.40 points, or 1.5%, to 5,127.15.

The Institute for Supply Management reported that activity in the U.S. manufacturing sector was almost unchanged in October, but slightly exceeded economists' expectations. The Manufacturing PMI posted 50.1 in October vs 50.2 in September and 50 expected.

Investors are waiting for U.S. jobs data. A strong report could intensify expectations for a rate hike in December.

This morning in Asia Hong Kong Hang Seng rose 1.24%, or 277.49, to 22,647.53. China Shanghai Composite Index climbed 0.11%, or 3.57, to 3.328.66. Japanese markets are on holiday.

Asian indices advanced following gains in U.S. equities. Stocks of technology companies rose most.

-

04:30

Australia: Announcement of the RBA decision on the discount rate, 2.0% (forecast 2%)

-

04:03

Hang Seng 22,645.46 +275.42 +1.2 %, Shanghai Composite 3,309.73 -15.35 -0.5 %

-

00:38

Commodities. Daily history for Nov 2’2015:

(raw materials / closing price /% change)

Oil 46.26 +0.26%

Gold 1,133.60 -0.20%

-

00:37

Stocks. Daily history for Sep Nov 2’2015:

(index / closing price / change items /% change)

Nikkei 225 18,683.24 -399.86 -2.10 %

Hang Seng 22,370.04 -270.00 -1.19 %

Shanghai Composite 3,325.08 -57.48 -1.70 %

FTSE 100 6,361.8 +0.71 +0.01 %

CAC 40 4,916.21 +18.55 +0.38 %

Xetra DAX 10,950.67 +100.53 +0.93 %

S&P 500 2,104.05 +24.69 +1.19 %

NASDAQ Composite 5,127.15 +73.40 +1.45 %

Dow Jones 17,828.76 +165.22 +0.94 %

-

00:32

Currencies. Daily history for Nov 2’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1015 +0,09%

GBP/USD $1,5415 -0,07%

USD/CHF Chf0,9862 -0,14%

USD/JPY Y120,75 +0,12%

EUR/JPY Y133,00 +0,20%

GBP/JPY Y186,12 +0,03%

AUD/USD $0,7144 +0,13%

NZD/USD $0,6743 -0,49%

USD/CAD C$1,3093 +0,14%

-

00:01

Schedule for today, Tuesday, Nov 3’2015:

(time / country / index / period / previous value / forecast)

03:30 Australia Announcement of the RBA decision on the discount rate 2.0% 2%

03:30 Australia RBA Rate Statement

09:30 United Kingdom PMI Construction October 59.9 58.8

15:00 U.S. Factory Orders September -1.7% -0.9%

19:00 Eurozone ECB President Mario Draghi Speaks

20:30 U.S. Total Vehicle Sales, mln October 18.2 17.7

21:45 New Zealand Employment Change, q/q Quarter III 0.3%

21:45 New Zealand Unemployment Rate Quarter III 5.9%

22:30 Australia AIG Services Index October 52.3

-