Noticias del mercado

-

23:30

Australia: AIG Services Index, October 48.9

-

22:45

New Zealand: Employment Change, q/q, Quarter III -0.4% (forecast 0.4%)

-

22:45

New Zealand: Unemployment Rate, Quarter III 6% (forecast 6.0%)

-

18:00

European stocks closed: FTSE 100 6,383.61 +21.81 +0.34% CAC 40 4,936.18 +19.97 +0.41% DAX 10,951.15 +0.48 0.00%

-

17:06

OECD: consumer price inflation in the OECD area falls to 0.4% year-on-year in September

OECD released its consumer price inflation (CPI) data on Tuesday. Consumer price inflation in the OECD area declined to 0.4% year-on-year in September from 0.6% in August.

Energy prices dropped at an annual rate of 12.4% in September, while food prices remained unchanged at 1.4% year-on-year.

CPI excluding food and energy in the OECD area rose to an annual rate of 1.8% in September from 1.7% in August.

September's CPI was 0.0% year-on-year in Germany, Japan and the U.S., 0.2% in Italy, 1.0% in Canada, and -0.1% in the U.K.

The consumer price inflation in Eurozone was -0.1% in September, while the inflation in China was 1.6%.

-

16:27

U.S. factory orders drop 1.0% in September

The U.S. Commerce Department released factory orders data on Tuesday. Factory orders in the U.S. slid 1.0% in September, missing expectations for a 0.9% decline, after a 2.1% drop in August. August's figure was revised down from a 1.7% fall.

The decline was driven by a drop in durable goods and non-durable orders. Durable goods orders decreased by 1.2% in September, while orders for nondurable goods declined 0.8%.

Factory orders excluding transportation fell 0.6% in September, after a 1.1% decline in August. August's figure was revised down from a 0.8% decrease.

Orders for transportation equipment plunged 3.1% in September.

-

16:00

U.S.: Factory Orders , September -1.0% (forecast -0.9%)

-

14:50

Option expiries for today's 10:00 ET NY cut

USD/JPY 120.00 (USD 922m) 120.50 (750m) 121.00-20 (485m)

EUR/USD 1.1000 (EUR 1.6bln

GBP/USD 1.5450 (GBP 159m) 1.5600 (217m)

AUD/USD 0.7100 (AUD 311m) 0.7125 (240m) 0.7250 (458m)

NZD/USD 0.6700 (NZD 259m)

EUR/JPY 132.20 (EUR 230m)

EUR/GBP 0.7250 (EUR 202m)

-

14:39

European Central Bank’s bulletin: the stimulus measures contributed to the recovery in lending and economic activity

The European Central Bank (ECB) said in its bulletin on Tuesday that its stimulus measures contributed to the recovery in lending and economic activity, "which is expected to produce a sustained adjustment of inflation rates towards levels below, but close to, 2% over the medium term".

-

14:12

Foreign exchange market. European session: the British pound traded lower against the U.S. dollar after the release of the construction PMI data from the U.K.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

03:30 Australia Announcement of the RBA decision on the discount rate 2.0% 2% 2.0%

03:30 Australia RBA Rate Statement

09:30 United Kingdom PMI Construction October 59.9 58.8 58.8

The U.S. dollar traded higher against the most major currencies ahead of the release of the U.S. factory orders data. The U.S. factory orders are expected to drop 0.9% in September, after a 1.7 decline in August.

The euro traded mixed against the U.S. dollar in the absence of any major economic reports from the Eurozone.

The European Central Bank (ECB) President Mario Draghi will speak at 19:00 GMT.

The British pound traded lower against the U.S. dollar after the release of the construction PMI data from the U.K. Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. fell to 58.8 in October from 59.9 in September, in line with expectations.

A reading above 50 indicates expansion in the construction sector.

The index was mainly driven by a strong rise in commercial building work.

"Rather than acting as a drag on the economy, as suggested by recent GDP estimates, the sector is continuing to act as an important driving force behind the ongoing UK economic upturn," Senior Economist at Markit, Tim Moore, said.

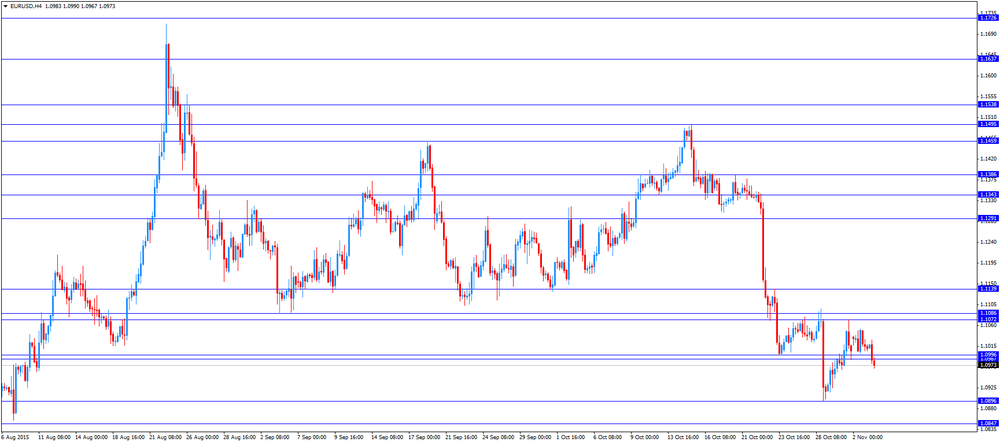

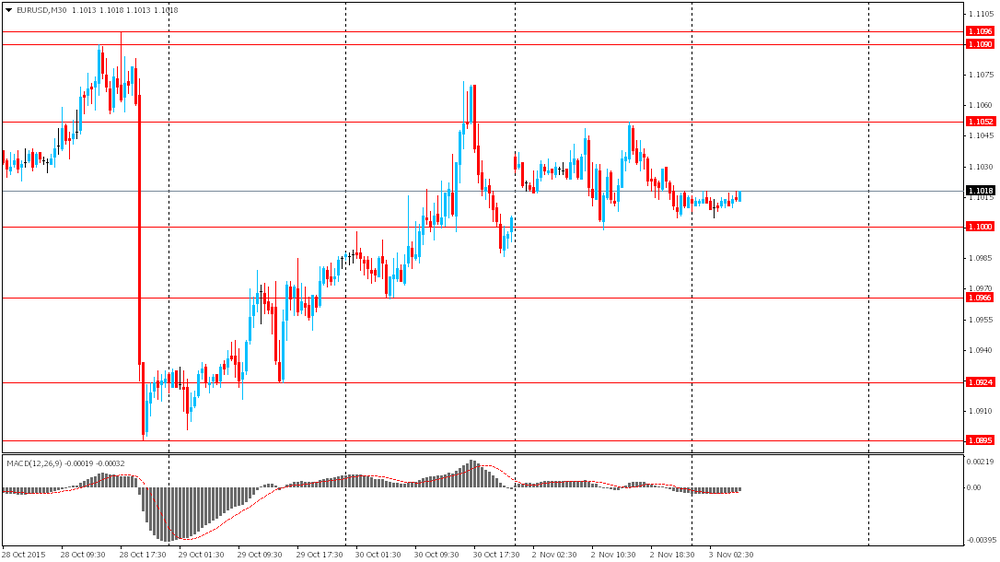

EUR/USD: the currency pair fell to $1.0967

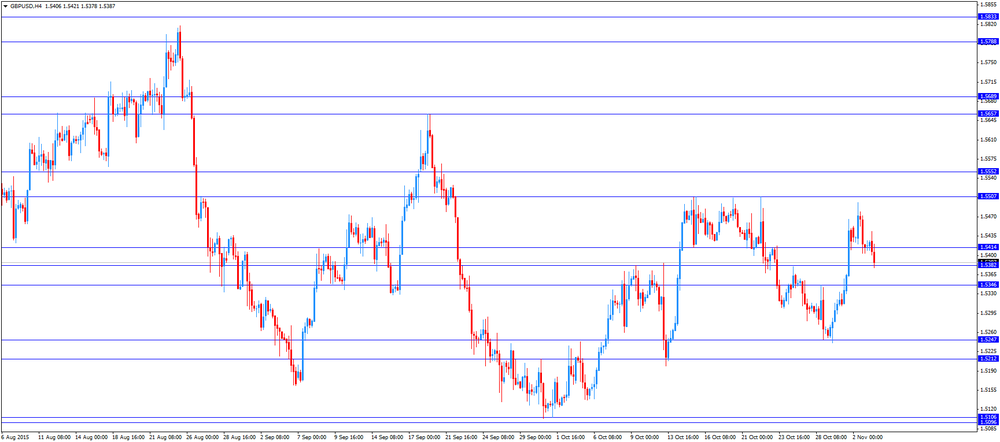

GBP/USD: the currency pair was down to $1.5378

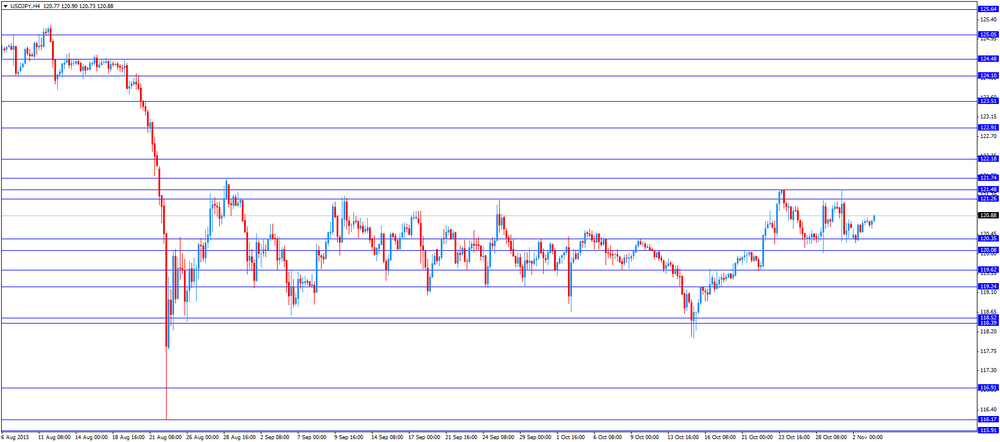

USD/JPY: the currency pair increased to Y120.90

The most important news that are expected (GMT0):

15:00 U.S. Factory Orders September -1.7% -0.9%

19:00 Eurozone ECB President Mario Draghi Speaks

21:45 New Zealand Employment Change, q/q Quarter III 0.3% 0.4%

21:45 New Zealand Unemployment Rate Quarter III 5.9% 6.0%

-

13:50

Orders

EUR/USD

Offers 1.1050 1.1075-80 1.1100 1.1130 1.1150 1.1165 1.1180 1.1200

Bids 1.1000-10 1.0980 1.0950 1.09201.0900 1.0885 1.0850 1.0830 1.0800

GBP/USD

Offers 1.5450 .5465 1.5480-85 1.5500-10 1.5530 1.5550

Bids 1.5420 1.5400 1.5380 1.5350 1.5325-30 1.5300 1.52 85 1.5250

EUR/GBP

Offers 0.7150-55 0.7170 0.7185 0.7200 0.7220-25 0.7250

Bids 0.7125-30 0.7120 0.7100 0.7085 0.7050 0.7030 0.7000

EUR/JPY

Offers 133.20 133.50-60 133.75-80 134.00 134.25 134.50 134.80 135.00

Bids 132.75-80 132.60 132.00 131.80 131.50 131.30 131.00

USD/JPY

Offers 120.75-80 121.00 121.20 121.35 121.50 121.80 122.00

Bids 120.50 120.20-25 120.00 119.80-85 119.50 119.25-30 119.00

AUD/USD

Offers 0.7220 0.7250 0.7265 0.7280-85 0.7300 0.7320 0.7335 0.7350

Bids 0.7175-80 0.7150 0.7125-30 0.7100-05 0.7080 0.7065 0.70500

-

11:51

China's President Xi Jinping: the economy should expand no less than 6.5% over the next five years

China's state-owned Xinhua News Agency reported on Tuesday that China's President Xi Jinping said the country's economy should expand no less than 6.5% over the next five years to reach all government's goals by 2020.

-

11:45

European Central Bank Governing Council members meet regularly with representatives from financial institutions

European Central Bank (ECB) Governing Council members met regularly with representatives from financial institutions, according to documents released Monday by the central bank. One meeting was on the same day as the ECB's monetary policy meeting.

"The ECB does not operate in a vacuum. Regular contacts with different groups, including representatives from the financial sector help us understand the dynamics of the economy and financial markets. We make sure that at such meetings no financial market-sensitive information is disclosed," an ECB spokeswoman said.

-

11:27

Number of registered unemployed people in Spain increases by 82,327 in October

Spain's labour ministry release its labour market figures on Monday. The number of registered unemployed people rose by 82,327 in October, after a 22,087 increase in September.

The ministry said the increase was driven by a drop-off in a seasonal summer work.

-

11:08

UK construction PMI falls to 58.8 in October

Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. fell to 58.8 in October from 59.9 in September, in line with expectations.

A reading above 50 indicates expansion in the construction sector.

The index was mainly driven by a strong rise in commercial building work.

"Rather than acting as a drag on the economy, as suggested by recent GDP estimates, the sector is continuing to act as an important driving force behind the ongoing UK economic upturn," Senior Economist at Markit, Tim Moore, said.

-

10:55

Reserve Bank of Australia keeps its interest rate unchanged at 2.00% in November

The Reserve Bank of Australia (RBA) kept its interest rate unchanged at 2.00% on Tuesday. This decision was expected by analysts.

The RBA Governor Glenn Stevens said that the board' decision was appropriate at this meeting.

He pointed out that further interest rate cut is possible.

"Members also observed that the outlook for inflation may afford scope for further easing of policy, should that be appropriate to lend support to demand," the RBA governor said.

Stevens also said that the Australian economy continued to recover moderately, and that the employment grew strongly.

He noted that the Australian dollar was adjusting to the significant drop in key commodity prices.

-

10:46

The RBC manufacturing Purchasing Managers' Index (PMI) for Canada decreases to 48.0 in October

The RBC manufacturing Purchasing Managers' Index (PMI) for Canada decreased to 48.0 in October from 48.6 in September. A reading below 50 indicates contraction of activity.

The index was driven by declines in output, new orders and employment.

"As we move toward the end of the year, we expect that a strengthening U.S. economy and weaker Canadian dollar will fuel demand for Canada's exports, resulting in a shift to positive growth territory," senior vice president and chief economist at RBC, Craig Wright, said.

-

10:40

Morgan Stanley cuts its EUR/USD forecasts

Morgan Stanley cut its EUR/USD forecasts on Monday as it expects the European Central Bank (ECB) to add further stimulus measures. It expects the currency to be at $1.03 by the end of the first quarter 2016, down from the previous estimate of $1.11.

"We lower our forecast profile for euro/dollar, frontloading our anticipated euro/dollar decline into year-end and the first quarter of next year. We now project euro/dollar at $1.06 by end-2015 and $1.02 by mid-2016, but still ending 2016 at $1.00," Morgan Stanley currency strategist Ian Stannard said.

The lender expect the ECB to lower its deposit rate by 0.1% and to purchase additional €15 billion from January 16. According to Morgan Stanley, the asset-buying programme should be expected to run until March 2017, longer than the current period until September 2016.

-

10:30

United Kingdom: PMI Construction, October 58.8 (forecast 58.8)

-

10:11

U.S. President Barack Obama signs a budget deal

U.S. President Barack Obama on Monday signed a budget deal. The deal helps to avoid a U.S. default, and means that debt limit was raised through March 2017.

Federal spending on defence and domestic programmes will rise over $80 billion for the next two years.

"Last week, Democrats and Republicans came together to set up a responsible long-term budget process. What we now see is a budget that reflects our values, grows our economy, creates jobs and keeps America safe. It should finally free us from the cycle of shutdown threats and last-minute fixes," Obama said.

-

10:02

Option expiries for today's 10:00 ET NY cut

USD/JPY 120.00 (USD 922m) 120.50 (750m) 121.00-20 (485m)

EUR/USD 1.1000 (EUR 1.6bln

GBP/USD 1.5450 (GBP 159m) 1.5600 (217m)

AUD/USD 0.7100 (AUD 311m) 0.7125 (240m) 0.7250 (458m)

NZD/USD 0.6700 (NZD 259m)

EUR/JPY 132.20 (EUR 230m)

EUR/GBP 0.7250 (EUR 202m)

-

08:25

Options levels on tuesday, November 3, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1210 (5020)

$1.1168 (2112)

$1.1100 (2444)

Price at time of writing this review: $1.1028

Support levels (open interest**, contracts):

$1.0942 (4608)

$1.0912 (2298)

$1.0876 (5990)

Comments:

- Overall open interest on the CALL options with the expiration date November, 6 is 55002 contracts, with the maximum number of contracts with strike price $1,1200 (5020);

- Overall open interest on the PUT options with the expiration date November, 6 is 56776 contracts, with the maximum number of contracts with strike price $1,0900 (5990);

- The ratio of PUT/CALL was 1.03 versus 1.05 from the previous trading day according to data from November, 2

GBP/USD

Resistance levels (open interest**, contracts)

$1.5700 (823)

$1.5601 (1185)

$1.5502 (2756)

Price at time of writing this review: $1.5437

Support levels (open interest**, contracts):

$1.5394 (627)

$1.5298 (2695)

$1.5199 (2893)

Comments:

- Overall open interest on the CALL options with the expiration date November, 6 is 21469 contracts, with the maximum number of contracts with strike price $1,5500 (2756);

- Overall open interest on the PUT options with the expiration date November, 6 is 21874 contracts, with the maximum number of contracts with strike price $1,5200 (2893);

- The ratio of PUT/CALL was 1.02 versus 1.00 from the previous trading day according to data from November, 2

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:15

Foreign exchange market. Asian session: the euro little changed

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

03:30 Australia Announcement of the RBA decision on the discount rate 2.0% 2% 2.0%

03:30 Australia RBA Rate Statement

The euro little changed before speeches of officials from the EU, the U.K. and the U.S. U.K. finance Minister George Osborne will tell European leaders about his country's demands regarding EU membership. He is expected to demand legally-binding safeguards for the single market and a commitment not to "discriminate" against countries not in the euro area. EU Finance commissioner Pierre Moscovici will visit Greece today and tomorrow and meet Prime Minister Alexis Tsipras. The visit will take place amid Greece's preparations for reforms required for financial aid from international lenders.

The Australian dollar rose against the greenback after the Reserve Bank of Australia decided to keep its benchmark interest rate at 2%. The bank said in its statement that the country's economy continued to expand at a moderate pace and prospects of improvements got clearer even though economic indices remained slightly below long-term targets. RBA Governor Glenn Stevens said that the AUD was adjusting to lower commodity prices.

EUR/USD: the pair fluctuated within $1.1005-20 in Asian trade

USD/JPY: the pair fell to Y120.60

GBP/USD: the pair traded within $1.5410-25

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

09:30 United Kingdom PMI Construction October 59.9 58.8

15:00 U.S. Factory Orders September -1.7% -0.9%

19:00 Eurozone ECB President Mario Draghi Speaks

20:30 U.S. Total Vehicle Sales, mln October 18.2 17.7

21:45 New Zealand Employment Change, q/q Quarter III 0.3% 0.4%

21:45 New Zealand Unemployment Rate Quarter III 5.9% 6.0%

22:30 Australia AIG Services Index October 52.3

-

04:30

Australia: Announcement of the RBA decision on the discount rate, 2.0% (forecast 2%)

-

00:32

Currencies. Daily history for Nov 2’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1015 +0,09%

GBP/USD $1,5415 -0,07%

USD/CHF Chf0,9862 -0,14%

USD/JPY Y120,75 +0,12%

EUR/JPY Y133,00 +0,20%

GBP/JPY Y186,12 +0,03%

AUD/USD $0,7144 +0,13%

NZD/USD $0,6743 -0,49%

USD/CAD C$1,3093 +0,14%

-

00:01

Schedule for today, Tuesday, Nov 3’2015:

(time / country / index / period / previous value / forecast)

03:30 Australia Announcement of the RBA decision on the discount rate 2.0% 2%

03:30 Australia RBA Rate Statement

09:30 United Kingdom PMI Construction October 59.9 58.8

15:00 U.S. Factory Orders September -1.7% -0.9%

19:00 Eurozone ECB President Mario Draghi Speaks

20:30 U.S. Total Vehicle Sales, mln October 18.2 17.7

21:45 New Zealand Employment Change, q/q Quarter III 0.3%

21:45 New Zealand Unemployment Rate Quarter III 5.9%

22:30 Australia AIG Services Index October 52.3

-