Noticias del mercado

-

21:00

Dow -0.16% 17,889.06 -29.09 Nasdaq -0.04% 5,143.02 -2.11 S&P -0.30% 2,103.50 -6.29

-

18:00

European stocks close: stocks closed mixed on company news

Stock indices closed mixed on company news. Volkswagen's shares dropped as the company said that the carbon dioxide emission levels of 800 000 cars were incorrectly specified.

Shares of the commodity company Glencore rose as the company said that it was on track to reduce its debt and boost liquidity.

Meanwhile, the economic data from the Eurozone was mixed. Eurostat released its producer price index for the Eurozone on Wednesday. Eurozone's producer price index declined 0.3% in September, beating expectations for a 0.4% drop, after a 0.8% decrease in August.

On a yearly basis, Eurozone's producer price index dropped 3.1% in September, beating expectations for a 3.3% decrease, after a 2.6% fall in August.

Eurozone's producer prices excluding energy fell 0.6% year-on-year in September.

Markit Economics released final services purchasing managers' index (PMI) for the Eurozone on Wednesday. Eurozone's final services purchasing managers' index (PMI) increased to 54.1 in October from 53.7 in September, down from the preliminary reading of 54.2.

The index was driven by rises in new business, backlogs of work and employment.

Eurozone's final composite output index rose to 53.9 in October from 53.6 in September, down from the preliminary reading of 54.0.

"The final PMI data confirm the steady but still somewhat lacklustre economic growth recorded in the euro area at the start of the fourth quarter. The survey suggests that the region's quarterly growth rate remains constrained at around 0.4%," Chief Economist at Markit Chris Williamson said.

Germany's final services purchasing managers' index (PMI) rose to 54.5 in October from 54.1 in September, down from the preliminary reading of 55.2.

France's final services purchasing managers' index (PMI) increased to 52.7 in October from 51.9 in September, up from the preliminary reading of 52.3.

Markit's and the Chartered Institute of Purchasing & Supply's services purchasing managers' index (PMI) for the U.K. rose to 54.9 in October from 53.3 in September, exceeding expectations for a rise to 54.5.

A reading above 50 indicates expansion in the sector.

The increase was driven by a faster growth in business activity and stronger job creation.

"The survey data point to GDP rising at a quarterly rate of 0.6% at the start of the fourth quarter, up from 0.5% in the third quarter. Such an improvement, together with the revival in hiring signalled by the three surveys, with job creation hitting an eight-month high in October, may coax more policymakers into raising interest rates before the end of the year," the Chief Economist at Markit Chris Williamson said.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,412.88 +29.27 +0.46 %

DAX 10,845.24 -105.91 -0.97 %

CAC 40 4,948.29 +12.11 +0.25 %

-

17:58

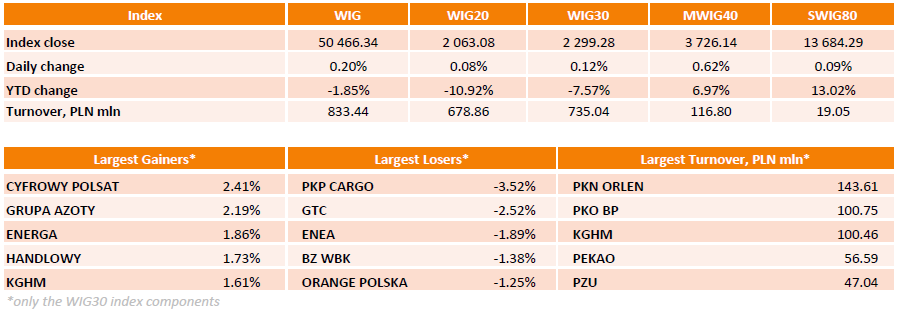

WSE: Session Results

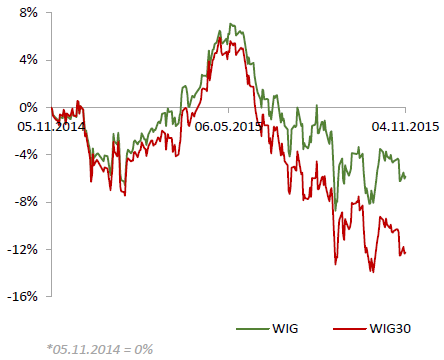

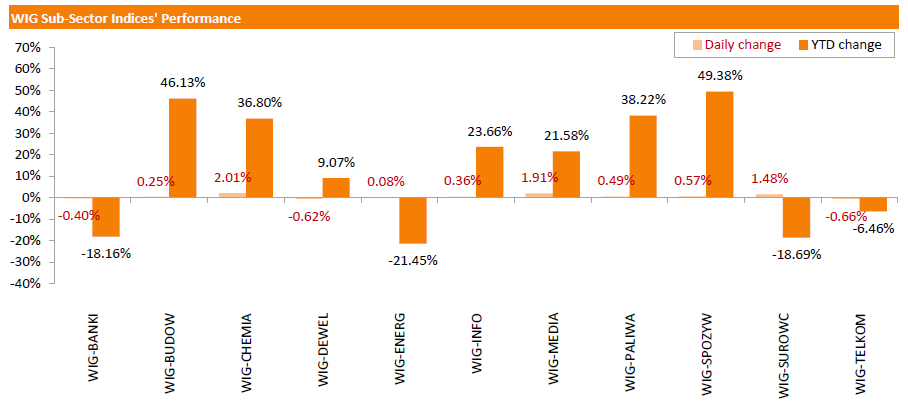

Polish equity market closed higher on Wednesday. The market broad measure, the WIG Index, added 0.20%. Sector-wise, chemical sector stocks (+2.01%) were the growth leaders in the WIG, while telecommunication sector names (-0.66%) were the poorest performers.

The large-cap stocks' benchmark, the WIG30 Index, rose 0.12%. Within the index components, CYFROWY POLSAT (WSE: CPS) and GRUPA AZOTY (WSE: ATT) generated the biggest advances, up 2.41% and 2.19% respectively. Other noticeable gainers included ENERGA (WSE: ENG), HANDLOWY (WSE: BHW) and KGHM (WSE: KGH), climbing 1.61%-1.86%. On the other side of the ledger, PKP CARGO (WSE: PKP) led the decliners with a 3.52% drop, followed by GTC (WSE: GTC) and ENEA (WSE: ENA), sliding 2.52% and 1.89% respectively.

-

17:52

European Central Bank President Mario Draghi: similar protection scheme of deposits across the Eurozone is needed

The European Central Bank (ECB) President Mario Draghi said on Wednesday that similar protection scheme of deposits across the Eurozone is needed.

"Deposits, which are the most widespread form of money, have to inspire the same level of confidence wherever they are located. To ensure that deposits are truly as safe everywhere across the euro area, the likelihood that a bank fails has to be independent of the jurisdiction where it is established. Resolution has to follow the same process in the event that a bank fails," he said.

-

17:24

Fed Chairwoman Janet Yelllen: the interest rate hike this year is still possible

The Fed Chairwoman Janet Yelllen testified before the House Financial Services Committee on Wednesday. She said that the interest rate hike this year is still possible, adding that the decision has not been made yet. Yellen pointed out that the Fed's decision will be depend on the incoming economic data.

The Fed chairwoman noted that the U.S. economy is performing well.

"Domestic spending has been growing at a solid pace," she said.

Yellen said the U.S. inflation is still well below the Fed's 2% target due to the low energy prices.

-

17:18

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indezes slightly lower on Wednesday, after two days of gains, fueled by a rally in energy stocks, pushed the three main indexes to within touching distance of their record highs. A report showing the private sector added more jobs than expected last month gave investors some optimism about the health of the labor market ahead of Friday's nonfarm payrolls data.

Dow stocks mixed (16 in negative area, 14 in positive area). Top looser - UnitedHealth Group Incorporated (UNH, -2.35%). Top gainer - Caterpillar Inc. (CAT, +0.83%).

S&P index sectors also mixed. Top gainer Industrial goods (+0,3%). Top looser - Conglomerates (-1.0%).

At the moment:

Dow 17806.00 -35.00 -0.20%

S&P 500 2097.50 -5.50 -0.26%

Nasdaq 100 4699.75 -12.25 -0.26%

Oil 47.04 -0.86 -1.80%

Gold 1112.80 -1.30 -0.12%

U.S. 10yr 2.23 +0.01

-

17:12

European Central Bank’s economic bulletin: the direct impact of the slowdown in the Chinese economy on the economic growth in the Eurozone is modest

The European Central Bank (ECB) said in its economic bulletin that the direct impact of the slowdown in the Chinese economy on the economic growth in the Eurozone is modest.

"While trade spillovers from a continued slowdown of economic activity in China are likely to have only a modest impact on euro area GDP, other spillover channels can potentially be important," the central bank said.

The ECB noted that the global uncertainty due to the slowdown in the Chinese economy could have a negative impact on the economy in the Eurozone.

"A rise in global uncertainty could directly affect the confidence of euro area households and firms, hampering consumption and delaying investment decisions. Therefore, the impact on the euro area of a potential further slowdown in China ultimately hinges on the extent to which this slowdown spills over to other emerging markets more generally, and the degree to which the resulting loss of confidence affects global financial markets as well as global trade," the ECB noted.

-

17:01

European Central Bank Vice President Vitor Constancio: there is no overvaluation of asset prices in the Eurozone

European Central Bank Vice President Vitor Constancio said at a conference on Wednesday that there is no overvaluation of asset prices in the Eurozone. He added that the central bank's monetary policy should not combat bubles.

"There are pockets where assets are perhaps a little bit overvalued," Constancio said.

The ECB vice president noted that the ECB closely monitor these assets.

-

16:12

ISM non-manufacturing purchasing managers’ index climbs to 59.1 in October

The Institute for Supply Management released its non-manufacturing purchasing managers' index for the U.S. on Wednesday. The index climbed to 59.1 in October from 56.9 in September, beating expectations for a decrease to 56.5.

A reading above 50 indicates a growth in the service sector.

The increase was mainly driven by a rise in new orders sub-index. The ISM's new orders index increased to 62.0 in October from 56.7 in September.

The business activity/production index rose to 63.0 in October from 60.2 in September.

The ISM's employment index was up to 59.2 in October from 58.3 in September.

The prices index climbed to 49.1 in October from 48.4 in September.

-

16:04

Italy’s services PMI rises to 53.4 in October

Markit/ADACI's services purchasing managers' index (PMI) for Italy rose to 53.4 in October from 53.3 in September.

A reading above 50 indicates expansion in the sector.

The increase was driven by a stronger rise in new business.

"Italy's service sector continues to expand at a steady pace, with the headline PMI in October broadly in line with that seen in September and for the third quarter as a whole. Growth in new business strengthened to a six-month high, showing that demand continues to build," an economist at Markit Phil Smith said.

-

15:55

Final Markit/Nikkei services purchasing managers' index for Japan increases to 52.2 in October

The final Markit/Nikkei services Purchasing Managers' Index (PMI) for Japan increased to 52.2 in October from 51.4 in September.

A reading below 50 indicates contraction of activity.

The increase was driven by a stronger rise in new orders.

"Growth of the Japanese service sector improved at a faster rate in October, underpinned by a sharper rise in new orders. Despite this, employment levels declined at the fastest rate since December 2011, although this led consequently to an accumulation in volumes of unfinished work," economist at Markit, Amy Brownbill, said.

-

15:50

Final U.S. services PMI declines to 54.8 in October

Markit Economics released final services purchasing managers' index (PMI) for the U.S. on Wednesday. Final U.S. services purchasing managers' index (PMI) declined to 54.8 in October from 55.1 in September, up from the preliminary reading of 54.6.

The decline was partly driven by a weaker rise in business activity and new business.

"The surveys nevertheless signal ongoing moderate growth of business activity and employment in the manufacturing and service sectors, which will keep alive the possibility that policymakers could be persuaded into raising interest rates before the year is over. However, the survey data also reinforce strong arguments - notably a continued absence of inflationary pressures - that there is no rush to tighten policy," Chief Economist at Markit Chris Williamson said.

-

15:45

Spain’s services PMI increases to 55.9 in October

Markit Economics released final services purchasing managers' index (PMI) for Spain on Wednesday. Spain's final services purchasing managers' index (PMI) increased to 55.9 in October from 55.1 in September.

The index was driven by an increase in activity and new business.

"The slight pick-up in growth rates of activity and new business was a positive from the latest services PMI survey as it broke the recent momentum of slowing rates of expansion, and provides optimism that solid increases can be recorded during the remainder of the year," Senior Economist at Markit Andrew Harker said.

-

15:36

U.S. Stocks open: Dow +0.14%, Nasdaq +0.27%, S&P +0.16%

-

15:28

Before the bell: S&P futures+0.24%, NASDAQ futures +0.33%

U.S. stock-index futures rose.

Global Stocks:

Nikkei 18,926.91 +243.67 +1.30%

Hang Seng 23,053.57 +485.14 +2.15%

Shanghai Composite 3,458.86 +142.17 +4.29%

FTSE 6,450.22 +66.61 +1.04%

CAC 4,984.27 +48.09 +0.97%

DAX 10,928.65 -22.50 -0.21 %

Crude oil $47.86 (-0.17%)

Gold $1117.80 (+0.33%)

-

15:09

Australian Industry Group’s services purchasing managers’ index for Australia slides to 48.9 in October

The Australian Industry Group (AiG) released its services purchasing managers' index (PMI) for Australia on the late Tuesday evening. The index slid to 48.9 in October from 52.3 in September.

A reading above 50 indicates expansion in the sector, while a reading below 50 indicates contraction in the sector.

Only two of the five activity sub-indexes were above 50 points in October.

Main contributor to the drop was the sales sub-index, which slid by 7.8 points.

-

15:09

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

AMERICAN INTERNATIONAL GROUP

AIG

60.97

+0.02%

9.3K

E. I. du Pont de Nemours and Co

DD

64.03

+0.03%

0.1K

Home Depot Inc

HD

125.70

+0.03%

0.2K

International Business Machines Co...

IBM

141.98

+0.07%

0.1K

McDonald's Corp

MCD

112.18

+0.09%

1.3K

Microsoft Corp

MSFT

54.20

+0.09%

26.1K

General Electric Co

GE

29.63

+0.14%

22.1K

Exxon Mobil Corp

XOM

87.00

+0.17%

5.4K

Ford Motor Co.

F

14.84

+0.20%

7.4K

Nike

NKE

131.70

+0.23%

2.0K

Chevron Corp

CVX

98.40

+0.26%

1K

UnitedHealth Group Inc

UNH

118.00

+0.29%

2.8K

Cisco Systems Inc

CSCO

28.70

+0.31%

1K

JPMorgan Chase and Co

JPM

65.99

+0.32%

1.8K

Citigroup Inc., NYSE

C

54.35

+0.35%

0.2K

Barrick Gold Corporation, NYSE

ABX

7.87

+0.38%

18.3K

AT&T Inc

T

33.76

+0.39%

5.6K

Google Inc.

GOOG

725.00

+0.39%

1.4K

Goldman Sachs

GS

191.48

+0.41%

0.2K

Amazon.com Inc., NASDAQ

AMZN

627.98

+0.43%

3.6K

Starbucks Corporation, NASDAQ

SBUX

63.09

+0.46%

7.2K

Pfizer Inc

PFE

34.86

+0.49%

9.2K

Procter & Gamble Co

PG

77.48

+0.56%

0.6K

Wal-Mart Stores Inc

WMT

58.45

+0.59%

3.6K

Facebook, Inc.

FB

103.19

+0.59%

172.7K

Apple Inc.

AAPL

123.30

+0.60%

273.1K

Caterpillar Inc

CAT

75.25

+0.67%

4.0K

Visa

V

78.45

+0.71%

3.1K

Twitter, Inc., NYSE

TWTR

29.35

+0.76%

46.6K

Yahoo! Inc., NASDAQ

YHOO

34.99

+0.78%

1.8K

Walt Disney Co

DIS

116.45

+0.79%

16.3K

Intel Corp

INTC

34.45

+1.12%

48.4K

ALCOA INC.

AA

9.47

+1.28%

9.0K

United Technologies Corp

UTX

101.85

+1.85%

0.3K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12.68

+2.18%

38.9K

Tesla Motors, Inc., NASDAQ

TSLA

225.00

+7.99%

167.1K

Verizon Communications Inc

VZ

46.45

0.00%

5.5K

General Motors Company, NYSE

GM

35.78

0.00%

0.1K

Hewlett-Packard Co.

HPQ

14.19

-0.70%

3.1K

-

14:56

U.S. trade deficit narrows to $40.81 billion in September

The U.S. Commerce Department released the trade data on Wednesday. The U.S. trade deficit narrowed to $40.81 billion in September from a deficit of $48.02 billion in August. August's figure was revised up from a deficit of $43.30 billion.

Analysts had expected a trade deficit of $41.1 billion.

The decline of a deficit was driven by a rise in exports. Exports climbed by 1.6% in September, while imports decreased by 1.8%.

Exports to Canada, China and the European Union increased in September, while exports to Japan declined by 13.8%, the lowest level since April 2010.

Imports from China climbed 3.8% in September.

-

14:52

Upgrades and downgrades before the market open

Upgrades:

HP Inc.(HPQ) upgraded to Equal Weight from Underweight at Barclays

Downgrades:

HP Inc.(HPQ) downgraded to Neutral from Overweight at JP Morgan

Other:

HP Inc.(HPQ) initiated with a Neutral at UBS

-

14:44

Canada's trade deficit narrows to C$1.73 billion in September

Statistics Canada released the trade data on Wednesday. Canada's trade deficit narrowed to C$1.73 billion in September from a deficit of C$2.66 billion in August. August's figure was revised down from a deficit of C$2.53 billion.

Analysts had expected a trade deficit of C$1.9 billion.

The decrease in deficit was driven by a drop in imports. Imports fell 1.2% in September.

Imports of basic and industrial chemical, plastic and rubber products declined by 5.2% in September, and imports of metal and non-metallic mineral products dropped 14.3%, while imports of energy products slid 12.3%.

Exports increased 0.7% in September.

Exports of energy products rose by 3.7% in September, exports of consumer goods jumped by 4.3%, exports of motor vehicles and parts dropped by 3.7%, while exports of metal and non-metallic mineral product were up 3.2%.

-

14:33

ADP Employment Report: private sector adds 182,000 jobs in October

Private sector in the U.S. added 182,000 jobs in October, according the ADP report on Wednesday. September's figure was revised down to 190,000 jobs from a previous reading of 200,000 jobs.

Analysts expected the private sector to add 180,000 jobs.

Services sector added 158,000 jobs in October, while goods-producing sector added 24,000 jobs.

The manufacturing sector lost 2,000 jobs in October. It was second consecutive monthly loss.

"Job growth as measured by the ADP Research Institute is not slowing meaningfully in contrast with the recent slowdown in the government's data. The economy is creating close to 200,000 jobs per month," the Chief Economist of Moody's Analytics Mark Zandi said.

Official labour market data will be released on Friday. Analysts expect that U.S. unemployment rate is expected to remain unchanged at 5.1% in October. The U.S. economy is expected to add 180,000 jobs in October, after adding 142,000 jobs in September.

-

14:24

Japan’s consumer confidence index rises to 41.5 in October

Japan's Cabinet Office released its consumer confidence index on Wednesday. The consumer confidence index rose to 41.5 in October from 40.6 in September, exceeding expectations for a gain to 41.4.

The increase was driven by rises in all sub-indexes. The overall livelihood sub-index increased to39.6 in October from 38.8 in September, the income growth sub-index was up to 40.0 from 39.4, the employment sub-index climbed to 45.9 from 44.9, while the willingness to buy durable goods sub-index rose to 40.3 from 39.1.

-

12:00

European stock markets mid session: stocks traded mixed on company news

Stock indices traded mixed on company news. Volkswagen's shares dropped as the company said that the carbon dioxide emission levels of 800 000 cars were incorrectly specified.

Shares of the commodity company Glencore rose as the company said that it was on track to reduce its debt and boost liquidity.

Meanwhile, the economic data from the Eurozone was mixed. Eurostat released its producer price index for the Eurozone on Wednesday. Eurozone's producer price index declined 0.3% in September, beating expectations for a 0.4% drop, after a 0.8% decrease in August.

On a yearly basis, Eurozone's producer price index dropped 3.1% in September, beating expectations for a 3.3% decrease, after a 2.6% fall in August.

Eurozone's producer prices excluding energy fell 0.6% year-on-year in September.

Markit Economics released final services purchasing managers' index (PMI) for the Eurozone on Wednesday. Eurozone's final services purchasing managers' index (PMI) increased to 54.1 in October from 53.7 in September, down from the preliminary reading of 54.2.

The index was driven by rises in new business, backlogs of work and employment.

Eurozone's final composite output index rose to 53.9 in October from 53.6 in September, down from the preliminary reading of 54.0.

"The final PMI data confirm the steady but still somewhat lacklustre economic growth recorded in the euro area at the start of the fourth quarter. The survey suggests that the region's quarterly growth rate remains constrained at around 0.4%," Chief Economist at Markit Chris Williamson said.

Germany's final services purchasing managers' index (PMI) rose to 54.5 in October from 54.1 in September, down from the preliminary reading of 55.2.

France's final services purchasing managers' index (PMI) increased to 52.7 in October from 51.9 in September, up from the preliminary reading of 52.3.

Markit's and the Chartered Institute of Purchasing & Supply's services purchasing managers' index (PMI) for the U.K. rose to 54.9 in October from 53.3 in September, exceeding expectations for a rise to 54.5.

A reading above 50 indicates expansion in the sector.

The increase was driven by a faster growth in business activity and stronger job creation.

"The survey data point to GDP rising at a quarterly rate of 0.6% at the start of the fourth quarter, up from 0.5% in the third quarter. Such an improvement, together with the revival in hiring signalled by the three surveys, with job creation hitting an eight-month high in October, may coax more policymakers into raising interest rates before the end of the year," the Chief Economist at Markit Chris Williamson said.

Current figures:

Name Price Change Change %

FTSE 100 6,446.65 +63.04 +0.99 %

DAX 10,936.49 -14.66 -0.13 %

CAC 40 4,982.98 +46.80 +0.95 %

-

11:45

Retail sales in Australia climb 0.4% in September

The Australian Bureau of Statistics released its retail sales data on Wednesday. Retail sales in Australia rose 0.4% in September, in line with expectations, after a 0.4% gain in August.

The increase was mainly driven by higher household goods sales and cafes, restaurants and takeaway food services sales. Household goods sales were up 1.0% in September, while cafes, restaurants and takeaway food services sales increased 0.9%.

On a quarterly basis, retail sales rose 0.6% in the third quarter, after a 0.8% increase in the second quarter.

On a yearly basis, retail sales climbed 5.8% in September.

-

11:29

France's final services PMI climbs to 52.7 in October

Markit Economics released final services purchasing managers' index (PMI) for France on Wednesday. France's final services purchasing managers' index (PMI) increased to 52.7 in October from 51.9 in September, up from the preliminary reading of 52.3.

The increase was driven by a stronger rise in new business and backlogs of work.

"The French service sector started the fourth quarter on a firmer footing, posting its strongest performance in four months. However, growth remains below-par compared with the survey's long-run trend and, although expansion has been sustained for nine successive months, the sector has thus far failed to generate more than a stuttering recovery," Senior Economist at Markit Jack Kennedy said.

-

11:22

Germany's final services PMI rises to 54.5 in October

Markit Economics released final services purchasing managers' index (PMI) for Germany on Wednesday. Germany's final services purchasing managers' index (PMI) rose to 54.5 in October from 54.1 in September, down from the preliminary reading of 55.2.

"Germany's service sector remained in good shape at the start of the fourth quarter, with growth of activity accelerating slightly since September. Moreover, the strongest rise in business outstanding since June 2011 and sharply increasing employment levels are supportive of hopes that growth can be sustained as we move towards the end of the year," an economist at Markit, Oliver Kolodseike, said.

-

11:18

Eurozone's final services PMI increases to 54.1 in October

Markit Economics released final services purchasing managers' index (PMI) for the Eurozone on Wednesday. Eurozone's final services purchasing managers' index (PMI) increased to 54.1 in October from 53.7 in September, down from the preliminary reading of 54.2.

The index was driven by rises in new business, backlogs of work and employment.

Eurozone's final composite output index rose to 53.9 in October from 53.6 in September, down from the preliminary reading of 54.0.

"The final PMI data confirm the steady but still somewhat lacklustre economic growth recorded in the euro area at the start of the fourth quarter. The survey suggests that the region's quarterly growth rate remains constrained at around 0.4%," Chief Economist at Markit Chris Williamson said.

-

11:12

Eurozone's producer price index declines 0.3% in September

Eurostat released its producer price index for the Eurozone on Wednesday. Eurozone's producer price index declined 0.3% in September, beating expectations for a 0.4% drop, after a 0.8% decrease in August.

Intermediate goods prices fell 0.5% in September, capital goods prices were flat, non-durable consumer goods prices climbed 0.1%, and durable consumer goods prices declined 0.1%, while energy prices decreased 0.8%.

On a yearly basis, Eurozone's producer price index dropped 3.1% in September, beating expectations for a 3.3% decrease, after a 2.6% fall in August.

Eurozone's producer prices excluding energy fell 0.6% year-on-year in September. Energy prices dropped at an annual rate of 9.8%.

-

11:05

UK’s services PMI rises to 54.9 in October

Markit's and the Chartered Institute of Purchasing & Supply's services purchasing managers' index (PMI) for the U.K. rose to 54.9 in October from 53.3 in September, exceeding expectations for a rise to 54.5.

A reading above 50 indicates expansion in the sector.

The increase was driven by a faster growth in business activity and stronger job creation.

"The survey data point to GDP rising at a quarterly rate of 0.6% at the start of the fourth quarter, up from 0.5% in the third quarter. Such an improvement, together with the revival in hiring signalled by the three surveys, with job creation hitting an eight-month high in October, may coax more policymakers into raising interest rates before the end of the year," the Chief Economist at Markit Chris Williamson said.

-

10:57

Australia's trade deficit narrows to A$2.32 billion in September

The Australian Bureau of Statistics released its trade data on Wednesday. Australia's trade deficit narrowed to A$2.32 billion in September from A$2.71 billion in August, beating expectations for a rise to a deficit of A$3.0 billion. August's figure was revised up from a deficit of A$3.1 billion.

Exports rose by 3.0% in September, while imports climbed by 2.0%.

-

10:53

Chinese Markit/Caixin services PMI climbs to 52.0 in October

The Caixin/Markit Services Purchasing Managers' Index (PMI) for China climbed to 52.0 in October from 50.5 in September, exceeding expectations for an increase to 50.8.

The index was driven by a further increase in total new business.

"The Caixin China Services PMI is 52.0 for October, up significantly from 50.5 the previous month. The Caixin Composite Output Index reached 49.9, also much higher than 48.0 in September, close to the neutral 50-point level. This shows that previous stimulus policies have begun to take effect, while the economic structure steadily improved," Dr. He Fan, Chief Economist at Caixin Insight Group, said.

"The economy has started to show signs of stabilizing, reducing the need for a further stimulus. The government must be resolute and push forward the reform agenda in a well-rounded manner to release the long-term potential for sustainable economic growth," he added.

-

10:45

New Zealand’s unemployment rate climbs to 6.0% in the third quarter

Statistics New Zealand released its labour market data on late Tuesday evening. The unemployment rate rose to 6.0% in the third quarter from 5.9% in the second quarter, in line with expectations.

Employment decreased 0.4% in the third quarter, after a 0.3% gain in the second quarter, missing expectations for a 0.4% rise.

The participation rate declined to 68.6% in the third quarter from 69.3% in the second quarter.

"Until recently, the labour market has been keeping pace with New Zealand's population growth, but in the past three months this has changed. This quarter also had the largest increase in the number of people outside the labour force since the March 2009 quarter," labour market and household statistics manager Diane Ramsay said.

-

10:36

IBD/TIPP Poll: the U.S. IBD/TIPP Economic Optimism Index declines to 45.5 in November

According to the IBD/TIPP Poll, the U.S. IBD/TIPP Economic Optimism Index fell to 45.5 in November from 47.3 in October. A reading above 50 indicates optimism, a reading below 50 indicates pessimism.

The index consists of three main subindices. All subindices declined in November.

-

10:25

European Central Bank's President Mario Draghi: the central bank will review the volume of its asset-buying programme at the monetary policy meeting in December

The European Central Bank's (ECB) President Mario Draghi said on Tuesday that the central bank will review the volume of its asset-buying programme at the monetary policy meeting in December.

He pointed out that the ECB will add further stimulus measures if needed.

"The Governing Council is willing and able to act by using all the instruments available within its mandate if warranted in order to maintain an appropriate degree of monetary accommodation," Draghi said.

The ECB president noted that there are "downside risks to the outlook for growth and inflation" from the slowdown in emerging economies.

-

10:13

Swiss National Bank President Thomas Jordan: the Swiss franc remains overvalued

The Swiss National Bank (SNB) President Thomas Jordan said on Tuesday that the Swiss franc remains overvalued, adding that the central bank intervened in the foreign exchange market.

Jordan also explained the central bank's monetary policy.

"Our current monetary policy is based on two pillars. The first pillar is the negative interest rate on sight deposits at the SNB. The second pillar is our willingness to intervene on the foreign exchange market as required," he said.

-

07:48

Global Stocks: energy stocks pushed U.S. stock indices higher

U.S. stock indices rose on Tuesday. Energy stocks were the biggest positive contributors.

The Dow Jones Industrial Average rose 89.39 points, or 0.5%, to 17,918.15. The S&P 500 added 5.74 points, or 0.3%, to 2,109.79 (its energy sector rose 2.5%). The Nasdaq Composite Index gained 17.98 points, or 0.4%, to 5,145.13.

The Commerce Department reported that U.S. factory orders fell for the second straight month in September, while the manufacturing sector continued struggling with a strong dollar and energy companies' expenditure cuts. Factory orders fell by 1.0% after the 2.1% decline in August.

Meanwhile the index of U.S. economic optimism calculated by Investor's Business Daily and TechnoMetrica Institute of Policy and Politics declined to 45.5 in November from 47.3 in October. The latest reading is 2.5 points below the index's 12-month average (48.0 points) and 3.6 points below the average throughout the history of the index (49.1).

Investors are waiting for U.S. jobs data. A strong report could intensify expectations for a rate hike in December.

This morning in Asia Hong Kong Hang Seng rose 2.48%, or 559.70, to 23,128.13. China Shanghai Composite Index gained 2.70%, or 89.66, to 3.406.36. The Nikkei 225 rose 1.84%, or 344.09, to 19,027.33.

Asian indices advanced. Japanese stocks climbed on the biggest initial public offering in the country since 1998. Market participants are closely watching IPO of Japan Post ignoring other factors. Stocks of Japan Post Holdings Co. and its financial units jumped 14%.

-

03:05

Nikkei 225 19,038.63 +355.39 +1.90 %, Hang Seng 22,853.27 +284.84 +1.26 %, Shanghai Composite 3,331.59 +14.89 +0.45 %

-

00:30

Stocks. Daily history for Sep Nov 3’2015:

(index / closing price / change items /% change)

Hang Seng 22,568.43 +198.39 +0.89 %

Shanghai Composite 3,318.3 -6.79 -0.20 %

FTSE 100 6,383.61 +21.81 +0.34 %

CAC 40 4,936.18 +19.97 +0.41 %

Xetra DAX 10,951.15 +0.48 0.00%

S&P 500 2,109.79 +5.74 +0.27 %

NASDAQ Composite 5,145.13 +17.98 +0.35 %

Dow Jones 17,918.15 +89.39 +0.50 %

-