Noticias del mercado

-

19:20

Major US stock indexes completed the session in different directions

Major US stock indices showed mixed dynamics, as sales of shares in the technology sector were sent to the minus the Nasdaq index, but had a limited impact on the broader market. At the same time, the rally in the banking sector pushed the Dow Jones Industrial Average to new records.

Today's session was shortened on the occasion of tomorrow's Independence Day holiday.

Investors also reacted positively to the report of the Institute for Supply Management (ISM), which showed that activity in the US manufacturing sector increased significantly in June, surpassing the average forecasts, and reaching the highest level since August 2014. According to the report, the PMI index for the manufacturing sector was 57.8 points in June against 54.9 points in May. Analysts had expected that this figure will grow only to 55.1 points. Recall, the value of the ISM index, exceeding 50, is usually considered as an indicator of growth in production activity, and less than 50, respectively, the fall.

Meanwhile, the final data presented by Markit Economics showed: with seasonal fluctuations, the manufacturing PMI index for the US fell to 52.0 points in June from 52.7 points in May. The latter value was lower than the preliminary estimate (52.1 points) and worse than the experts' forecasts (52.1 points).

In addition, the US Department of Commerce said that construction costs unexpectedly remained at the same level in May, but federal government spending on construction projects was the highest for more than four years. According to the data, construction costs remained unchanged in May, at $ 1.23 trillion. Meanwhile, expenses for April were revised towards improvement - to -0.7 percent from -1.4 percent. Economists forecast an increase of 0.3 percent. Compared with May 2016, construction spending increased by 4.5 percent.

Most components of the DOW index recorded a rise (20 out of 30). The leader of growth was the shares of The Goldman Sachs Group, Inc. (GS, + 2.42%). Most fell shares of Microsoft Corporation (MSFT, -1.10%).

Most sectors of S & P completed the auction in positive territory. The leader of growth was the base resources sector (+ 1.3%). Most fell the technological sector (-0.7%).

At closing:

DJIA + 0.61% 21.479.27 +129.64

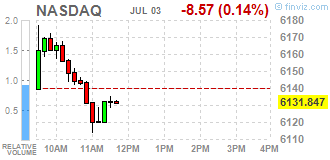

Nasdaq -0.49% 6,110.06 -30.36

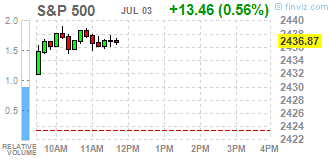

S & P + 0.23% 2.429.01 +5.60

-

18:04

Wall Street. Major U.S. stock-indexes mixed

Major U.S. stock-indexes were mixed, as a selloff in the technology sector pushed the tech-heavy Nasdaq into the negative territory but had a limited impact on the broader market. Moreover, a rally in banks took the Dow Jones Industrial Average to a record high. Investors' optimism was also bolstered by the ISM's report, which showed the U.S. factory activity rose to a three-year high in June.

Most of Dow stocks in positive area (22 of 30). Top gainer - The Goldman Sachs Group, Inc. (GS, +3.00%). Top loser - Wal-Mart Stores, Inc. (WMT, -0.61%).

A majority of S&P sectors in positive area. Top gainer - Financials (+1.50%). Top loser - Conglomerates (-0.45%).

At the moment:

Dow 21488.00 +188.00 +0.88%

S&P 500 2434.00 +13.00 +0.54%

Nasdaq 100 5623.75 -29.00 -0.51%

Crude Oil 46.84 +0.80 +1.74%

Gold 1222.20 -20.10 -1.62%

U.S. 10yr 2.35 +0.05

-

18:00

European stocks closed: FTSE 100 +64.37 7377.09 +0.88% DAX +150.19 12475.31 +1.22% CAC 40 +75.04 5195.72 +1.47%

-

15:31

U.S. Stocks open: Dow +0.36%, Nasdaq +0.55%, S&P +0.45%

-

15:05

Before the bell: S&P futures +0.35%, NASDAQ futures +0.38%

U.S. stock-index futures indicated the equity market would begin the third quarter on a higher note.

Global Stocks:

Nikkei 20,055.80 +22.37 +0.11%

Hang Seng 25,784.17 +19.59 +0.08%

Shanghai 3,194.79 +2.36 +0.07%

S&P/ASX 5,684.49 -37.01 -0.65%

FTSE 7,336.06 +23.34 +0.32%

CAC 5,173.01 +52.33 +1.02%

DAX 12,410.88 +85.76 +0.70%

Crude $46.31 (+0.59%)

Gold $1,231.90 (-0.84%)

-

14:56

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

210

1.81(0.87%)

200

Amazon.com Inc., NASDAQ

AMZN

971.8

3.80(0.39%)

15159

Apple Inc.

AAPL

144.71

0.69(0.48%)

30642

AT&T Inc

T

37.98

0.25(0.66%)

49468

Barrick Gold Corporation, NYSE

ABX

15.7

-0.21(-1.32%)

12210

Caterpillar Inc

CAT

106.9

-0.56(-0.52%)

9474

Cisco Systems Inc

CSCO

31.41

0.11(0.35%)

2133

Citigroup Inc., NYSE

C

67.13

0.25(0.37%)

20654

Deere & Company, NYSE

DE

124.42

0.83(0.67%)

1332

Exxon Mobil Corp

XOM

80.75

0.02(0.02%)

7783

Facebook, Inc.

FB

151.57

0.59(0.39%)

38913

Ford Motor Co.

F

11.24

0.05(0.45%)

2052

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12.05

0.04(0.33%)

2300

General Electric Co

GE

27.11

0.10(0.37%)

1368

Goldman Sachs

GS

223.3

1.40(0.63%)

7447

Google Inc.

GOOG

913.19

4.46(0.49%)

2199

Hewlett-Packard Co.

HPQ

17.5

0.02(0.11%)

2100

Intel Corp

INTC

33.79

0.05(0.15%)

229

International Business Machines Co...

IBM

153.57

-0.26(-0.17%)

3573

Johnson & Johnson

JNJ

133.25

0.96(0.73%)

4754

JPMorgan Chase and Co

JPM

91.4

0.50(0.55%)

6701

McDonald's Corp

MCD

153.15

-0.01(-0.01%)

318

Merck & Co Inc

MRK

64

-0.09(-0.14%)

472

Microsoft Corp

MSFT

69.24

0.31(0.45%)

8968

Nike

NKE

58.65

-0.35(-0.59%)

45762

Pfizer Inc

PFE

33.45

-0.14(-0.42%)

1422

Starbucks Corporation, NASDAQ

SBUX

58.5

0.19(0.33%)

1046

Tesla Motors, Inc., NASDAQ

TSLA

370

8.39(2.32%)

138191

The Coca-Cola Co

KO

45.17

0.32(0.71%)

1656

Twitter, Inc., NYSE

TWTR

18.03

0.16(0.90%)

25210

Verizon Communications Inc

VZ

44.65

-0.01(-0.02%)

36344

Visa

V

93.85

0.07(0.07%)

250

Wal-Mart Stores Inc

WMT

75.95

0.27(0.36%)

430

Walt Disney Co

DIS

106.97

0.72(0.68%)

6148

Yandex N.V., NASDAQ

YNDX

26.1

-0.14(-0.53%)

200

-

09:36

Major European stock exchanges trading in the green zone: FTSE 7341.96 +29.24 + 0.40%, DAX 12400.87 +75.75 + 0.61%, CAC 5161.46 +40.78 + 0.80%

-

07:29

Global Stocks

Germany's DAX 30 joined other European benchmarks in closing lower Friday, with Bayer AG ending a losing month for regional equities by cautioning investors that its profit was under pressure.

U.S. stocks closed modestly higher Friday after trimming gains in the last few minutes of the session. However, steep losses in technology and health-care stocks earlier in the week resulted in poor weekly and mixed monthly performances for all three benchmarks.

Equity markets struggled to find direction in Asia as the second half of the year kicked off, tracking mixed signals from U.S. markets. Market participants were expected to focus more closely on the Chinese bond and currency markets with the launch of a new program allowing global investors to invest in the world's third-largest market for fixed income via Hong Kong.

-

01:57

Stocks. Daily history for Jun 30’2017:

(index / closing price / change items /% change)

Nikkei -186.87 20033.43 -0.92%

TOPIX -12.17 1611.90 -0.75%

Hang Seng -200.84 25764.58 -0.77%

CSI 300 -2.03 3666.80 -0.06%

Euro Stoxx 50 -29.45 3441.88 -0.85%

FTSE 100 -37.60 7312.72 -0.51%

DAX -91.07 12325.12 -0.73%

CAC 40 -33.67 5120.68 -0.65%

DJIA +62.60 21349.63 +0.29%

S&P 500 +3.71 2423.41 +0.15%

NASDAQ -3.93 6140.42 -0.06%

S&P/TSX -31.23 15182.19 -0.21%

-