Noticias del mercado

-

21:00

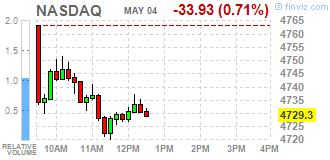

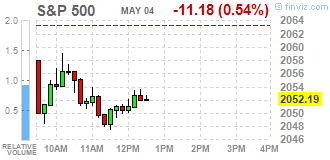

Dow -0.61% 17,643.25 -107.66 Nasdaq -0.82% 4,724.25 -38.97 S&P -0.65% 2,049.94 -13.43

-

18:40

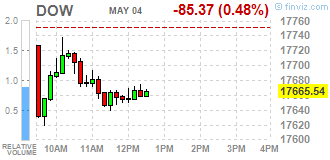

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes fell as ADP private jobs data misses expectations badly. The ADP National Employment Report showed U.S. companies hired just 156,000 people last month, the smallest gain since April 2013. Economists surveyed by Reuters had forecast a gain of 196,000 jobs, with estimates ranging from 116,000 to 225,000.

Most of Dow stocks in negative area (20 of 30) The Goldman Sachs Group, Inc. (GS, -2,27%). Top gainer - McDonald's Corp. (MCD, +1,24%).

Most of S&P sectors in negative area. Top looser - Basic Materials (-1,3%). Top gainer - Conglomerates (+1,7%).

At the moment:

Dow 17589.00 -84.00 -0.48%

S&P 500 2047.00 -10.00 -0.49%

Nasdaq 100 4311.75 -22.75 -0.52%

Oil 43.91 +0.26 +0.60%

Gold 1280.80 -11.00 -0.85%

U.S. 10yr 1.80 -0.01

-

18:00

European stocks closed: FTSE 100 6,112.02 -73.57 -1.19% CAC 40 4,324.23 -47.75 -1.09% DAX 9,828.25 -98.52 -0.99%

-

18:00

European stocks close: stocks traded lower as market participants eyed the economic data from the Eurozone

Stock indices traded lower on the economic data from the Eurozone. Markit Economics released final services purchasing managers' index (PMI) for the Eurozone on Wednesday. Eurozone's final services PMI remained unchanged at 53.1 in April, down from the preliminary reading of 53.2.

Eurozone's final composite output index fell to 53.0 in April from 53.1 in March, in line with the preliminary reading.

The decline was mainly driven by a fall in output prices.

"The final PMI data confirm the earlier flash estimate that the Eurozone economy grew at a steady but unspectacular annual rate of 1.5% at the start of the second quarter," Chief Economist at Markit Chris Williamson said.

"However, while still tepid, the sustained Eurozone growth contrasts with slowdowns in the US and UK, suggesting the ECB's more aggressive stimulus is helping to drive a steady recover," he added.

Germany's final services PMI fell to 54.5 in April from 55.1 in March, down from the preliminary reading of 54.6. The index was mainly driven by a slower growth in employment, while backlogs of work declined.

France's final services PMI increased to 50.6 in April from 49.9 in March, down from the preliminary reading of 50.8. The index was mainly driven by rises in new business, backlogs of work and input prices.

Eurostat released its retail sales data for the Eurozone on Wednesday. Retail sales in the Eurozone decreased 0.5% in March, missing expectations for a 0.1% fall, after a 0.3% gain in February. February's figure was revised up from a 0.2% increase.

Non-food sales decreased 0.5% in March, food, drinks and tobacco sales slid 1.3%, while automotive fuel sales were down 0.4%.

On a yearly basis, retail sales in the Eurozone climbed 2.1% in March, missing forecasts of a 2.5% gain, after a 2.7% increase in February. February's figure was revised up from a 2.4% rise.

Non-food sales gained 2.1% year-on-year in March, gasoline sales jumped 2.5%, while food, drinks and tobacco sales rose 1.5%.

Markit's and the Chartered Institute of Purchasing & Supply's construction PMI for the U.K. dropped to 52.0 in April from 54.2 in March, missing expectations for a decrease to 54.0. It was the lowest level since June 2013. The decline was mainly driven by a drop in new work.

"UK construction firms reported their worst month for almost three years in April, meaning that the first quarter slowdown is unlikely to prove temporary," Senior Economist at Markit, Tim Moore, said.

"Softer growth forecasts for the UK economy alongside uncertainty ahead of the EU referendum appear to have provided reasons for clients to delay major spending decisions until the fog has lifted," he added.

According to the British Retail Consortium (BRC), the U.K. shop prices declined by 1.7% year-on-year in April, after a 1.7% decline in March.

The decline was mainly driven by a drop in non-food prices, which plunged 2.9% year-on-year in April. Food prices rose at an annual rate of 0.1% in April.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,112.02 -73.57 -1.19 %

DAX 9,828.25 -98.52 -0.99 %

CAC 40 4,324.23 -47.75 -1.09 %

-

17:42

WSE: Session Results

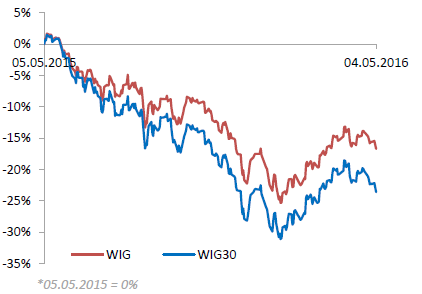

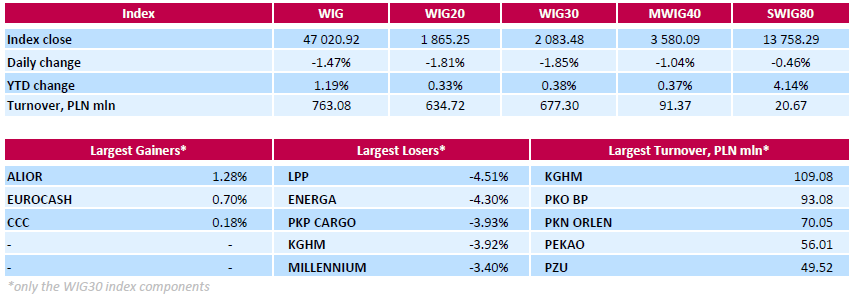

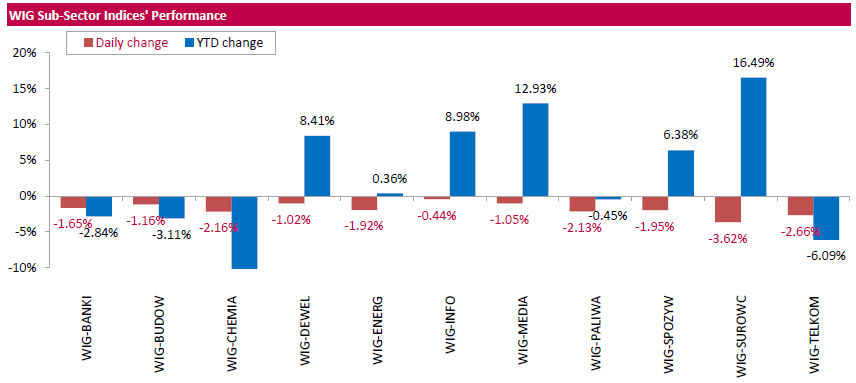

Polish equity market plunged on Wednesday. The broad market measure, the WIG Index, declined by 1.47%. All sectors in the WIG retreated, with materials (-3.62%) lagging behind.

The large-cap stocks' measure, the WIG30 Index, fell by 1.85%. A majority of the index components recorded losses. Clothing retailer LPP (WSE: LPP) and genco ENERGA (WSE: ENG) topped the decliners' list, dropping by 4.51% and 4.3% respectively. They were followed by railway freight transport operator PKP CARGO (WSE: PKP), copper producer KGHM (WSE: KGH), bank MILLENNIUM (WSE: MIL) and telecommunication services provider ORANGE POLSKA (WSE: OPL), slumping between 3.38% and 3.93%. At the same time, the handful advancers included bank ALIOR (WSE: ALR), FMCG-wholesaler EUROCASH (WSE: EUR) and footwear retailer CCC (WSE: CCC), gaining 1.28%, 0.7% and 0.18% respectively.

-

17:20

Australian Industry Group’s services purchasing managers’ index for Australia rises to 49.7 in April

The Australian Industry Group (AiG) released its services purchasing managers' index (PMI) for Australia on the late Tuesday evening. The index rose to 49.7 in April from 49.5 in March.

A reading above 50 indicates expansion in the sector, while a reading below 50 indicates contraction in the sector.

Four of the five activity sub-indexes were below 50 points in March.

Main contributor to the rise were finance & insurance and health & community services.

-

16:21

U.S. factory orders climb 1.1% in March

The U.S. Commerce Department released factory orders data on Wednesday. Factory orders in the U.S. climbed 1.1% in March, exceeding expectations for a 0.6% gain, after a 1.9% decline in February. February's figure was revised down from a 1.7% decrease.

Durable goods orders were up 0.8% in March, while non-durable goods orders rose 1.5%.

Orders for transportation equipment jumped 2.8% in March, while orders for automobiles and parts declined 0.9%.

Factory orders excluding transportation increased 0.8% in March, after a 0.9% drop in February. February's figure was revised down from a 0.8% fall.

-

16:12

ISM non-manufacturing purchasing managers’ index rises to 55.7 in April

The Institute for Supply Management released its non-manufacturing purchasing managers' index for the U.S. on Wednesday. The index rose to 55.7 in April from 54.5 in March, beating expectations for an increase to 54.7.

A reading above 50 indicates a growth in the service sector.

The ISM's new orders index increased to 59.9 in April from 56.7 in March.

The business activity/production index decreased to 58.8 in April from 59.8 in March.

The ISM's employment index was up to 53.0 in April from 50.3 in March.

The prices index jumped to 53.4 in April from 49.1 in March.

-

15:54

Final U.S. services PMI rises to 52.8 in April

Markit Economics released final services purchasing managers' index (PMI) for the U.S. on Wednesday. Final U.S. services purchasing managers' index (PMI) rose to 52.8 in April from 51.3 in March, up from the preliminary reading of 52.1.

A reading above 50 indicates expansion in the sector, a reading below 50 indicates contraction of activity.

The index was driven by a rise in new work and input prices, while job creation declined.

"The PMI surveys show the economy continuing to pick itself up after the stagnation seen in February, with growth accelerating for a second successive month in April," Chief Economist at Markit Chris Williamson said.

"However, the rate of expansion remains tepid, reliant on sluggish growth in services as manufacturers report a stalling of production," he added.

-

15:49

WSE: After start on Wall Street

U.S. Stocks open: Dow -0.38%, Nasdaq -0.55%, S&P -0.46%

Wall Street after considerable negative deviation of future contracts began in red. Declines, however, are so far less than those presented by futures market. Smaller than expected is also a decline in the DJIA index.

Before the market still reading ISM index for the US services sector and data on fuel inventories in the United States, but short-term sentiment remains corrective, so the data should not determine the balance of power on Wall Street. It is worth to noting that the sharp drop in the first half of the session on the WIG20 index caught a short breath and turned to consolidation in the area of 1865 points.

-

15:32

U.S. Stocks open: Dow -0.38%, Nasdaq -0.55%, S&P -0.46%

-

15:18

Before the bell: S&P futures -0.64%, NASDAQ futures -0.73%

U.S. stock-index futures declined.

Global Stocks:

Nikkei Closed

Hang Seng 20,525.83 -151.11 -0.73%

Shanghai Composite 2,991.1 -1.54 -0.05%

FTSE 6,113.16 -72.43 -1.17%

CAC 4,339.91 -32.07 -0.73%

DAX 9,862.11 -64.66 -0.65%

Crude $44.00 (+0.80%)

Gold $1288.00 (-0.22%)

-

15:15

Productivity in the U.S. non-farm businesses slides at a 1.0% annual rate in the first quarter

The U.S. Labor Department released non-farm productivity figures on Wednesday. Preliminary productivity in the U.S. non-farm businesses slid at a 1.0% annual rate in the first quarter, beating expectations for a 1.4% decrease, after a 1.7% drop in the fourth quarter. The fourth quarter's figure was revised up from a 2.2% fall.

The drop was driven by a rise in labour-related production costs.

Hours worked jumped by 1.5% in the first quarter, while output rose by 0.4%.

Preliminary unit labour costs increased 4.1% in the first quarter, exceeding expectations for a 3.3% rise, after a 2.7% gain in the fourth quarter. It was the largest rise since the fourth quarter of 2014.

The fourth quarter's figure was revised down from a 3.3% increase.

-

15:08

U.S. trade deficit narrows to $40.44 billion in March

The U.S. Commerce Department released the trade data on Wednesday. The U.S. trade deficit narrowed to $40.44 billion in March from a deficit of $46.96 billion in February. It was the smallest gap since February 2015.

February's figure was revised up from a deficit of $47.06 billion.

Analysts had expected a trade deficit of $41.5 billion.

The decline of a deficit was driven by a drop in imports. Exports decreased by 0.9% in March, while imports slid by 3.6%, the largest fall since February 2009.

-

14:56

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

10.28

-0.04(-0.3876%)

54397

Amazon.com Inc., NASDAQ

AMZN

666.95

-4.37(-0.651%)

16457

AMERICAN INTERNATIONAL GROUP

AIG

55.47

-0.47(-0.8402%)

1000

Apple Inc.

AAPL

94.82

-0.36(-0.3782%)

161864

Barrick Gold Corporation, NYSE

ABX

18.19

-0.19(-1.0337%)

165227

Boeing Co

BA

131.5

-0.99(-0.7472%)

132

Caterpillar Inc

CAT

76.33

-0.03(-0.0393%)

1292

Chevron Corp

CVX

101.16

-0.16(-0.1579%)

9253

Cisco Systems Inc

CSCO

26.71

-0.15(-0.5585%)

1708

Citigroup Inc., NYSE

C

45.03

-0.54(-1.185%)

54111

Exxon Mobil Corp

XOM

87.8

-0.31(-0.3518%)

848

Facebook, Inc.

FB

116.72

-0.71(-0.6046%)

137491

FedEx Corporation, NYSE

FDX

164.84

0.05(0.0303%)

1965

Ford Motor Co.

F

13.32

-0.11(-0.8191%)

20550

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.97

-0.04(-0.3331%)

278928

General Electric Co

GE

30.5

-0.13(-0.4244%)

5865

General Motors Company, NYSE

GM

30.79

-0.46(-1.472%)

304

Goldman Sachs

GS

161.49

-1.65(-1.0114%)

3175

Google Inc.

GOOG

689.01

-3.35(-0.4839%)

4588

Home Depot Inc

HD

133.98

-0.56(-0.4162%)

1480

Intel Corp

INTC

30.01

-0.09(-0.299%)

24199

Johnson & Johnson

JNJ

112.15

-0.54(-0.4792%)

796

JPMorgan Chase and Co

JPM

61.94

-0.62(-0.9911%)

1822

McDonald's Corp

MCD

128

-0.40(-0.3115%)

653

Microsoft Corp

MSFT

49.6

-0.18(-0.3616%)

28223

Nike

NKE

58.76

-0.76(-1.2769%)

340

Pfizer Inc

PFE

33.6

-0.10(-0.2967%)

3487

Procter & Gamble Co

PG

80.94

-0.16(-0.1973%)

335

Starbucks Corporation, NASDAQ

SBUX

55.95

-0.30(-0.5333%)

4954

Tesla Motors, Inc., NASDAQ

TSLA

230.27

-2.05(-0.8824%)

15607

The Coca-Cola Co

KO

44.66

-0.18(-0.4014%)

424

Twitter, Inc., NYSE

TWTR

13.97

-0.04(-0.2855%)

74222

Visa

V

76.54

-0.65(-0.8421%)

1503

Yahoo! Inc., NASDAQ

YHOO

35.83

-0.18(-0.4999%)

2855

Yandex N.V., NASDAQ

YNDX

19.73

-0.45(-2.2299%)

2500

-

14:51

Canada's trade deficit widens to C$3.41 billion in March

Statistics Canada released the trade data on Wednesday. Canada's trade deficit widened to C$3.41 billion in March from a deficit of C$2.47 billion in February. February's figure was revised down from a deficit of C$1.91 billion.

Analysts had expected a trade deficit of C$1.4 billion.

The rise in deficit was driven by a drop in exports. Exports slid 4.8% in March.

Exports of consumer goods plunged 4.6% in March, exports of metal and non-metallic mineral products dropped by 5.4%, while exports of motor vehicles and parts were down 6.0%.

Imports fell 2.4% in March.

Imports of energy products jumped by 13.5% in March, imports of consumer goods decreased by 4.6%, while imports of aircraft and other transportation equipment and parts fell 20.4%.

-

14:47

Upgrades and downgrades before the market open

Upgrades:

FedEx (FDX) upgraded to Overweight from Equal Weight at Barclays

Downgrades:

Other:

-

14:25

U.S. ADP Employment Report: private sector adds 156,000 jobs in April

Private sector in the U.S. added 156,000 jobs in April, according the ADP report on Wednesday. March's figure was revised down to 194,000 jobs from a previous reading of 200,000 jobs.

Analysts expected the private sector to add 196,000 jobs.

Services sector added 166,000 jobs in April, while goods-producing sector shed 11,000.

"The job market appears to have stumbled in April. Job growth noticeably slowed, with some weakness across most sectors," the Chief Economist of Moody's Analytics Mark Zandi said.

"One month does not make a trend, but this bears close watching as the financial market turmoil earlier in the year may have done some damage to business hiring," he added.

Official labour market data will be released on Friday. Analysts expect that U.S. unemployment rate is expected to remain unchanged at 5.0% in April. The U.S. economy is expected to add 200,000 jobs in April, after adding 215,000 jobs in March.

-

13:20

WSE: Mid session comment

In the first half of the session, the Warsaw market show a weak trade. The WIG20 index descended to new lows session and fell below the Thursday's session minimum. Consequently, we are the lowest since almost two months, which of course increases the implementation of the favored medium-term negative scenario for the market.

At the halfway point of the session the WIG20 index was at 1866 points (-1.74%) traded at slightly more than PLN 290 mln turnover.

-

12:10

European stock markets mid session: stocks traded lower as market participants eyed the economic data from the Eurozone

Stock indices traded lower on the economic data from the Eurozone. Markit Economics released final services purchasing managers' index (PMI) for the Eurozone on Wednesday. Eurozone's final services PMI remained unchanged at 53.1 in April, down from the preliminary reading of 53.2.

Eurozone's final composite output index fell to 53.0 in April from 53.1 in March, in line with the preliminary reading.

The decline was mainly driven by a fall in output prices.

"The final PMI data confirm the earlier flash estimate that the Eurozone economy grew at a steady but unspectacular annual rate of 1.5% at the start of the second quarter," Chief Economist at Markit Chris Williamson said.

"However, while still tepid, the sustained Eurozone growth contrasts with slowdowns in the US and UK, suggesting the ECB's more aggressive stimulus is helping to drive a steady recover," he added.

Germany's final services PMI fell to 54.5 in April from 55.1 in March, down from the preliminary reading of 54.6. The index was mainly driven by a slower growth in employment, while backlogs of work declined.

France's final services PMI increased to 50.6 in April from 49.9 in March, down from the preliminary reading of 50.8. The index was mainly driven by rises in new business, backlogs of work and input prices.

Eurostat released its retail sales data for the Eurozone on Wednesday. Retail sales in the Eurozone decreased 0.5% in March, missing expectations for a 0.1% fall, after a 0.3% gain in February. February's figure was revised up from a 0.2% increase.

Non-food sales decreased 0.5% in March, food, drinks and tobacco sales slid 1.3%, while automotive fuel sales were down 0.4%.

On a yearly basis, retail sales in the Eurozone climbed 2.1% in March, missing forecasts of a 2.5% gain, after a 2.7% increase in February. February's figure was revised up from a 2.4% rise.

Non-food sales gained 2.1% year-on-year in March, gasoline sales jumped 2.5%, while food, drinks and tobacco sales rose 1.5%.

Markit's and the Chartered Institute of Purchasing & Supply's construction PMI for the U.K. dropped to 52.0 in April from 54.2 in March, missing expectations for a decrease to 54.0. It was the lowest level since June 2013. The decline was mainly driven by a drop in new work.

"UK construction firms reported their worst month for almost three years in April, meaning that the first quarter slowdown is unlikely to prove temporary," Senior Economist at Markit, Tim Moore, said.

"Softer growth forecasts for the UK economy alongside uncertainty ahead of the EU referendum appear to have provided reasons for clients to delay major spending decisions until the fog has lifted," he added.

According to the British Retail Consortium (BRC), the U.K. shop prices declined by 1.7% year-on-year in April, after a 1.7% decline in March.

The decline was mainly driven by a drop in non-food prices, which plunged 2.9% year-on-year in April. Food prices rose at an annual rate of 0.1% in April.

Current figures:

Name Price Change Change %

FTSE 100 6,106.4 -79.19 -1.28 %

DAX 9,848.37 -78.40 -0.79 %

CAC 40 4,337.34 -34.64 -0.79 %

-

12:04

BRC: U.K. shop prices are down 1.7% year-on-year in April

According to the British Retail Consortium (BRC), the U.K. shop prices declined by 1.7% year-on-year in April, after a 1.7% decline in March.

The decline was mainly driven by a drop in non-food prices, which plunged 2.9% year-on-year in April.

Food prices rose at an annual rate of 0.1% in April.

"The thirty-six consecutive months of price falls is being driven by intense competition across the industry. It has knock on implications for margins and profitability given the combination of continued investment in digital and rising cost pressures, compounded by recent policy announcements," BRC Chief Executive, Helen Dickinson, said.

-

12:00

Greece’s manufacturing PMI rises to 49.7 in April

Markit Economics released its manufacturing purchasing managers' index (PMI) for Greece on Wednesday. Greece's manufacturing purchasing managers' index (PMI) rose to 49.7 in April from 49.0 in March.

Output levels stabilised during April despite a decline in incoming new orders, while buying activity rose.

"Production stabilised for the first time during 2016 and job creation was still evident, highlighting firms' intentions to invigorate future output with increased manpower," Markit economist Samuel Agass said.

-

11:51

Italy’s services PMI climbs to 52.1 in April

Markit/ADACI's services purchasing managers' index (PMI) for Italy climbed to 52.1 in April from 51.2 in March.

A reading above 50 indicates expansion in the sector.

The index was mainly driven by rises in new business and job creation.

"All indices from the services PMI survey nudged higher in April, pointing to slightly faster rates of growth in business activity, new work and employment, as well as a strengthening of business confidence towards the outlook," an economist at Markit Phil Smith said.

-

11:47

Number of registered unemployed people in Spain decrease by 83,599 in April

Spain's labour ministry release its labour market figures on Wednesday. The number of registered unemployed people decreased by 83,599 in April, after a 58,216 rise in March.

The decline was driven by a rise in employment in the services sector.

The number of registered youth unemployed people fell by 40,955 in April from the last year.

The total number of jobless in Spain was 4.01 million in April.

-

11:41

Spain’s services PMI falls to 55.1 in April

Markit Economics released services purchasing managers' index (PMI) for Spain on Wednesday. Spain's services purchasing managers' index (PMI) fell to 55.1 in April from 55.3 in March.

The decline was driven by a softer growth in in new orders and employment, while output prices decreased.

"While the headline activity figure from the latest Spain services PMI suggests that growth remained marked during April, other indices from the survey paint a less positive picture," Senior Economist at Markit Andrew Harker said.

"Political uncertainty contributed to the weakest rise in new business for close to a year-and-a-half," he added.

-

11:37

France’s current account deficit falls to €1.8 billion in March

The Bank of France released its current account data on Wednesday. France's current account deficit was €1.8 billion in March, down from a deficit of €4.1 billion in February. January's figure was revised down from a deficit of €3.9 billion.

The trade goods deficit narrowed to €2.7 billion in March from €3.7 billion in February, while the deficit on services turned into a surplus of €1.2 billion from a deficit of €0.1 billion.

-

11:31

France's trade deficit narrows to €4.37 billion in March

According to the French Customs, France's trade deficit narrowed to €4.37 billion in March from €5.12 billion in February, beating expectations for a decline to a deficit of €4.4 billion. February's figure was revised up from a deficit of €5.18 billion.

The decrease in deficit was driven by lower imports. Exports declined to €36.38 billion in March from €37.87 billion in February, while imports dropped to €40.75 billion from €42.98 billion.

-

11:25

Eurozone’s retail sales decrease 0.5% in March

Eurostat released its retail sales data for the Eurozone on Wednesday. Retail sales in the Eurozone decreased 0.5% in March, missing expectations for a 0.1% fall, after a 0.3% gain in February. February's figure was revised up from a 0.2% increase.

Non-food sales decreased 0.5% in March, food, drinks and tobacco sales slid 1.3%, while automotive fuel sales were down 0.4%.

On a yearly basis, retail sales in the Eurozone climbed 2.1% in March, missing forecasts of a 2.5% gain, after a 2.7% increase in February. February's figure was revised up from a 2.4% rise.

Non-food sales gained 2.1% year-on-year in March, gasoline sales jumped 2.5%, while food, drinks and tobacco sales rose 1.5%.

-

11:19

France's final services PMI increases to 50.6 in April

Markit Economics released final services purchasing managers' index (PMI) for France on Wednesday. France's final services purchasing managers' index (PMI) increased to 50.6 in April from 49.9 in March, down from the preliminary reading of 50.8.

The index was mainly driven by rises in new business, backlogs of work and input prices.

"France's service sector expanded at the start of the second quarter, although the pace of growth signalled was marginal. PMI data continue to paint a weaker picture than the latest GDP figures," Senior Economist at Markit Jack Kennedy said.

-

11:11

Germany's final services PMI falls to 54.5 in April

Markit Economics released final services purchasing managers' index (PMI) for Germany on Wednesday. Germany's final services purchasing managers' index (PMI) fell to 54.5 in April from 55.1 in March, down from the preliminary reading of 54.6.

The index was mainly driven by a slower growth in employment, while backlogs of work declined.

"It is slightly disappointing, although not surprising that activity growth at German service providers slowed during April, as last months' new business and employment indicators had already pointed to a potential slowdown. Nonetheless, Germany's service sector continued to grow at a steady pace at the start of the second quarter," an economist at Markit, Oliver Kolodseike, said.

-

11:03

Eurozone's final services PMI remains unchanged at 53.1 in April

Markit Economics released final services purchasing managers' index (PMI) for the Eurozone on Wednesday. Eurozone's final services purchasing managers' index (PMI) remained unchanged at 53.1 in April, down from the preliminary reading of 53.2.

The downward revision was mainly driven by Germany.

Eurozone's final composite output index fell to 53.0 in April from 53.1 in March, in line with the preliminary reading.

The decline was mainly driven by a fall in output prices.

"The final PMI data confirm the earlier flash estimate that the Eurozone economy grew at a steady but unspectacular annual rate of 1.5% at the start of the second quarter," Chief Economist at Markit Chris Williamson said.

"However, while still tepid, the sustained Eurozone growth contrasts with slowdowns in the US and UK, suggesting the ECB's more aggressive stimulus is helping to drive a steady recover," he added.

-

10:53

UK construction PMI slides to 52.0 in April

Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. dropped to 52.0 in April from 54.2 in March, missing expectations for a decrease to 54.0. It was the lowest level since June 2013.

A reading above 50 indicates expansion in the construction sector.

The decline was mainly driven by a drop in new work.

"UK construction firms reported their worst month for almost three years in April, meaning that the first quarter slowdown is unlikely to prove temporary," Senior Economist at Markit, Tim Moore, said.

"Softer growth forecasts for the UK economy alongside uncertainty ahead of the EU referendum appear to have provided reasons for clients to delay major spending decisions until the fog has lifted," he added.

-

10:24

Goldman Sachs Group Inc.’s co-head of investment banking David Solomon: interest rates could lead to volatility

Goldman Sachs Group Inc.'s co-head of investment banking David Solomon said in a speech on Monday that negative interest rates could lead to volatility as market participants were seeking for higher yields. He noted that there were no asset bubbles, adding that the financial system was in good shape.

-

10:11

New Zealand’s unemployment rate climbs to 5.7% in the first quarter

Statistics New Zealand released its labour market data on late Tuesday evening. The unemployment rate rose to 5.7% in the first quarter from 5.4% in the fourth quarter, missing expectations for a rise to 5.5%. The fourth quarter's figure was revised up from 5.3%.

Employment increased 1.2% in the first quarter, exceeding expectations for a 0.7% gain, after a 0.9% rise in the fourth quarter.

The participation rate increased to 69.0% in the first quarter from 68.4% in the fourth quarter.

"The total labour force increased by 38,000 people in the March 2016 quarter. This resulted in more New Zealanders in unemployment and employment than three months ago," labour market and household senior manager Jason Attewell said.

-

09:17

WSE: After opening

The WIG20 futures (WSE: FW20M16) started the day 15 points below Monday's closing or 0.8 percent in the red. After the scale of yesterday's declines on stock exchanges in Europe and the US such descent of contracts was not surprising.

WIG20 index opened at 1890.87 points (-0.47%)*

WIG 47457.73 -0.55%

WIG30 2107.45 -0.72%

mWIG40 3610.17 -0.21%

*/ - change to previous close

After a festive day in which through the European and American stock markets swept a wave of sell-off, the Warsaw Stock Exchange resumed trading in red. The direction pre-determined by the contract is clear. In this context, today's session could be very interesting. Bulls will have the opportunity to fight for the denial of yesterday's trend in Europe.

European markets started the day with modest changes. There are no surprises, but we can see attempts of chasing yesterday's losses on the part of the companies that served yesterday as leaders of the supply. In conjunction with the displacement in Warsaw it raises the chance of bulls to keep the WIG20 in the area of support.

-

08:17

WSE: Before opening

Tuesday's session ended in solidarity declines of most of the markets. From the morning on stock exchanges there was the mood of risk aversion triggered by a weaker-than-expected reading of the index of economic situation in the Chinese industry. During the day joined to it the strengthening of the dollar and declines in commodity prices. In the final the DAX lost nearly 2 percent and the US indices decreased from 0.8 to 1.1 percent. Night did not bring any major improvement. Contracts on the S&P500 and the DAX record losses, so maintaining the current atmosphere to the opening of markets in Europe will not be the basis for a rebound yesterday's declines.

From the WSE point of view the mix of above mentioned variables arranged in a simple downward scenario. On Monday WIG20 recorded a modest increase, part of which was the shallowness of trade and calm of the zloty to the dollar. Tuesday brought the weakening of the Polish currency to the euro and the dollar. When we take into account the fact that in recent weeks the USD/PLN relationship had an impact on the condition of the WIG20, there is an additional element supporting the forces of supply today. We have to expect the down opening gap and confrontation with violated already the level of support in the region of 1,892 points.

Corrective sentiment on core markets, more and more are beginning to fit into the scheme: "sell in May and go away".

-

06:54

Global Stocks

European stocks closed sharply lower Tuesday, logging its worst three-day decline in nearly three months as the euro hit a roughly nine-month high against the U.S. dollar. Selling in bank shares following poor financial results in the sector also weighed.

U.S. stocks fell to their lowest level in three weeks on Tuesday, as weaker-than-expected manufacturing data in China revived worries about global growth and sent investors scurrying out of the perceived risk of equities.

Most shares in Asia were back in the red Wednesday with Australia slipping below breaking even for the year amid a renewed fall in oil prices and a nearly 10% plunge in shares of Anglo-Australian BHP Billiton Ltd.

Based on MarketWatch materials

-

04:04

Hang Seng 20,462.53 -214.41 -1.04 %,S&P/ASX 200 5,285.1 -68.74 -1.28 %, Shanghai Composite 2,988.06 -4.59 -0.15 %

-

00:59

Stocks. Daily history for Sep Apr May 3’2016:

(index / closing price / change items /% change)

Hang Seng 20,676.94 -390.11 -1.85 %

S&P/ASX 200 5,353.84 +110.87 +2.11 %

Shanghai Composite 2,993.2 +54.87 +1.87 %

FTSE 100 6,185.59 -56.30 -0.90 %

CAC 40 4,371.98 -70.77 -1.59 %

Xetra DAX 9,926.77 -196.50 -1.94 %

S&P 500 2,063.37 -18.06 -0.87 %

NASDAQ Composite 4,763.22 -54.37 -1.13 %

Dow Jones 17,750.91 -140.25 -0.78 %

-