Noticias del mercado

-

21:01

Dow +0.30% 16,841.20 +51.01 Nasdaq +0.40% 4,767.40 +19.04 S&P +0.35% 1,986.92 +7.00

-

18:10

Moody’s affirms the U.S. credit rating at "Aaa"

The ratings agency Moody's affirmed the U.S. credit rating at "Aaa" on Wednesday. The outlook is "stable".

Moody's warned that there could be uncertainty "from the contentiousness of the political process".

"On a positive note, the process has introduced an element of spending restraint which has contributed to deficit reduction ahead of our expectations in recent years," Moody's Senior Vice President Steven Hess said.

"The Aaa rating is buttressed by a large and diverse economy, a strong record of GDP and productivity growth, and the status of the dollar and the US Treasury bond as global reserve currency and benchmark, respectively," Moody's concluded.

-

18:00

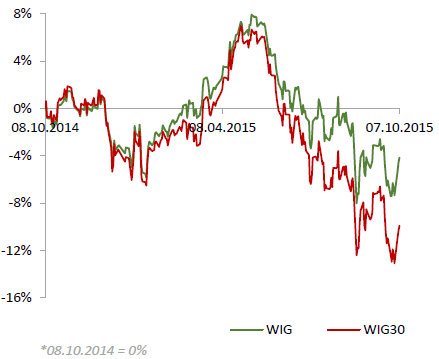

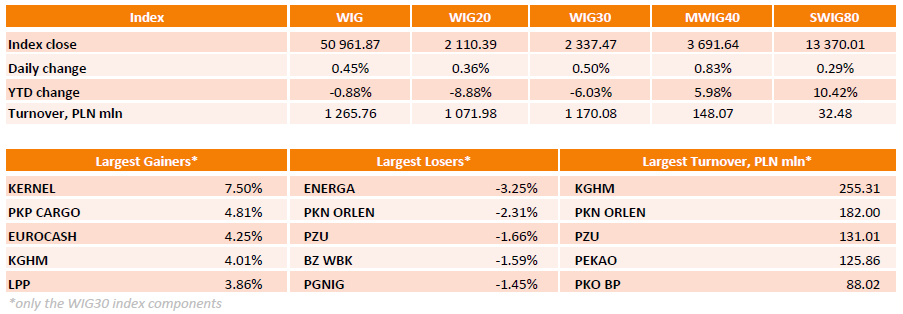

WSE: Session Results

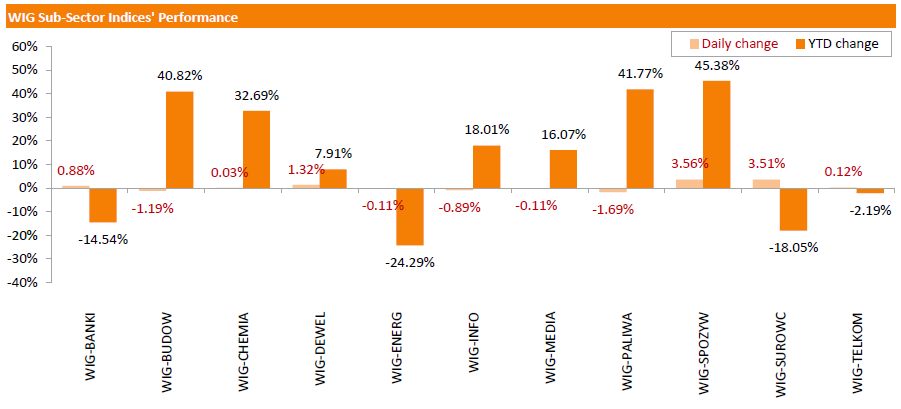

Polish equity market demonstrated growth on Wednesday. The broad market benchmark, the WIG Index, gained 0.45%. Sector-wise, oil and gas sector (-1.69%) posted the biggest decline, while food sector (+3.56%) and materials (+3.51%) recorded the largest rises.

The large-cap stocks' measure, the WIG30 Index, rose by 0.5%. Within the index's components, KERNEL (WSE: KER) jumped by 7.5% and became the session best performer, followed by PKP CARGO (WSE: PKP), EUROCASH (WSE: EUR) and KGHM (WSE: KGH), which advanced between 4.01% and 4.81%. At the same time, ENERGA (WSE: ENG) was the sharpest decliner, posting a 3.25% drop. The other two big losers were PKN ORLEN (WSE: PKN) and PZU (WSE: PZU), falling by 2.31% and 1.66% respectively.

-

18:00

European stocks closed: FTSE 100 6,336.35 +10.19 +0.16% CAC 40 4,667.34 +6.70 +0.14% DAX 9,970.4 +67.57 +0.68%

-

18:00

European stocks close: stocks closed higher, supported by higher oil prices

Stock indices closed higher, supported by higher oil prices.

Meanwhile, the economic data from the Eurozone was negative. Destatis released its industrial production data for Germany on Wednesday. German industrial production slid 1.2% in August, missing expectations for a 0.2% gain, after a 1.2% rise in July. July's figure was revised up from a 0.7% increase.

The output of capital goods decreased 2.1% in August, energy output dropped 1.4%, and the production in the construction sector was down 1.3%, while the production of intermediate goods was flat.

The output of consumer goods decreased 0.4%.

German industrial production excluding energy and construction fell by 1.1% in August.

The Office for National Statistics (ONS) released its manufacturing industrial production figures for the U.K. on Wednesday. Manufacturing production in the U.K. rose 0.5% in August, exceeding expectations for a 0.3% gain, after a 0.7% decrease in July. July's figure was revised up from a 0.8% drop.

Manufacturing output was driven by a rise in the vehicle production.

On a yearly basis, manufacturing production in the U.K. decreased 0.8% in August, missing forecast of a 0.1% fall, after a 1.2% drop in July. July's figure was revised down from a 0.5% decrease.

Industrial production in the U.K. climbed 1.0% in August, beating forecasts of a 0.3% rise, after a 0.3% fall in July. July's figure was revised up from a 0.4% decline.

On a yearly basis, industrial production in the U.K. gained 1.9% in August, exceeding expectations for a 1.2% rise, after a 0.7% increase in July. July's figure was revised down from a 0.8% rise.

The increase was driven by adjustments in the ONS calculations. The extraction industry in the British North Sea was working at full capacity after shutdowns and maintenance work in July. A small increase in gas production also supported the industrial production.

The National Institute of Economic and Social Research (NIESR) released its estimate of gross domestic product (GDP) for the U.K. on Wednesday. The GDP estimate rose by 0.5% in three months to September, after a 0.6% growth in three months to August.

"This slight softening in the third quarter is expected to be temporary. It is consistent with our latest forecast for the year as a whole," the NIESR said.

The NIESR expects the U.K. economy to expand 2.5% in 2015 and 2.4% in 2016, according to its August forecasts.

The think tank expects the Bank of England to raise its interest rate in the first half of 2016.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,336.35 +10.19 +0.16 %

DAX 9,970.4 +67.57 +0.68 %

CAC 40 4,667.34 +6.70 +0.14 %

-

17:50

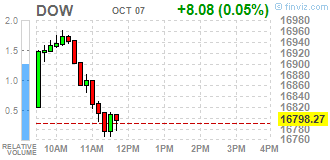

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes turned negative in trading on Wednesday as tech stocks, led by Apple, fell and a rally in crude oil prices was checked. A U.S. government report showed U.S. crude stocks rose more than expected last week, halting a rally earlier after a report showed demand would rise by its fastest rate in six years in 2016.

Dow stocks mixed (15 in negative area, 15 in positive). Top looser - Caterpillar Inc. (CAT, -2.10%). Top gainer - The Boeing Company (BA, +1.78%).

Most of S&P index sectors in positive area. Top looser - Technology (-0.5%). Top gainer - Basic Materials (+1,0%).

At the moment:

Dow 16712.00 +40.00 +0.24%

S&P 500 1973.50 +5.00 +0.25%

Nasdaq 100 4283.50 -6.75 -0.16%

10 Year yield 2,06% +0,02

Oil 48.37 -0.16 -0.33%

Gold 1145.80 -0.60 -0.05%

-

16:28

NIESR’s gross domestic product rises by 0.5% in three months to September

The National Institute of Economic and Social Research (NIESR) released its estimate of gross domestic product (GDP) for the U.K. on Wednesday. The GDP estimate rose by 0.5% in three months to September, after a 0.6% growth in three months to August.

"This slight softening in the third quarter is expected to be temporary. It is consistent with our latest forecast for the year as a whole," the NIESR said.

The NIESR expects the U.K. economy to expand 2.5% in 2015 and 2.4% in 2016, according to its August forecasts.

The think tank expects the Bank of England to raise its interest rate in the first half of 2016.

-

15:59

According to a Greek draft budget, the Greek economy will contract this and next year

According to a Greek draft budget submitted to the Greek parliament on Monday, the Greek economy will contract this and next year. The Greek economy is expected to contract 2.3% in 2015 and 1.3% in 2016.

The primary budget target is expected to be a deficit of 0.25% of gross domestic product in 2015 and a surplus of 0.5% in 2016, according to a draft budget.

The Greek unemployment rate is seen to rise to 25.8% in 2016 from 25.4% this year.

-

15:51

World Bank: developing East Asia will expand 6.5% in 2015

The World Bank released its forecast for economic growth in developing countries in East Asia and Pacific on Monday. Developing East Asia will expand 6.5% in 2015, down from its April estimate of a 6.7% growth.

The downgrade was driven by a slowdown in the Chinese economy and the expected interest rate hike by the Fed.

China is expected to grow 6.9% in 2015, 6.7% in 2016 and 6.5% in 2017.

"Growth in developing East Asia Pacific continues to be solid, but the moderating trend suggests policy makers in the region must remain focused on structural reforms that lay the foundation for sustainable, long-term and inclusive growth," the World Bank East Asia and Pacific Regional Vice President, Axel van Trotsenburg, said.

-

15:37

Swiss National Bank's foreign exchange reserves increase to 541.540 billion Swiss francs in September

The Swiss National Bank's foreign exchange reserves increased to 541.540 billion Swiss francs in September from 540.031 billion francs in August.

August's figure was revised down from 540.416 billion francs.

-

15:34

U.S. Stocks open: Dow +0.63%, Nasdaq +0.50%, S&P +0.56%

-

15:27

Before the bell: S&P futures +0.64%, NASDAQ futures +0.86%

U.S. stock-index futures climbed.

Nikkei 18,322.98 +136.88 +0.75%

Hang Seng 22,515.76 +684.14 +3.13%

FTSE 6,366.39 +40.23 +0.64%

CAC 4,699.79 +39.15 +0.84%

DAX 10,015.34 +112.51 +1.14%

Crude oil $49.22 (+1.42%)

Gold $1151.70 (+0.46%)

-

15:02

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12.24

3.47%

68.2K

International Paper Company

IP

40.65

2.01%

1.4K

Yandex N.V., NASDAQ

YNDX

12.22

2.00%

3.7K

ALCOA INC.

AA

11.18

1.82%

141.9K

Barrick Gold Corporation, NYSE

ABX

7.43

1.78%

43.8K

Twitter, Inc., NYSE

TWTR

28.06

1.59%

106.6K

Exxon Mobil Corp

XOM

78.88

1.27%

26.5K

Pfizer Inc

PFE

33.18

1.19%

14.1K

Yahoo! Inc., NASDAQ

YHOO

31.30

1.11%

2.3K

Chevron Corp

CVX

87.92

1.07%

6.6K

Caterpillar Inc

CAT

71.50

0.96%

1.7K

Intel Corp

INTC

32.04

0.95%

59.3K

Cisco Systems Inc

CSCO

27.47

0.88%

4.9K

Home Depot Inc

HD

119.69

0.85%

0.6K

Citigroup Inc., NYSE

C

51.48

0.82%

1.6K

Amazon.com Inc., NASDAQ

AMZN

541.75

0.79%

15.0K

Microsoft Corp

MSFT

47.09

0.73%

8.2K

Apple Inc.

AAPL

112.10

0.71%

332.1K

JPMorgan Chase and Co

JPM

62.48

0.69%

1.3K

Verizon Communications Inc

VZ

43.78

0.66%

2.8K

Goldman Sachs

GS

181.50

0.65%

21.8K

Boeing Co

BA

135.50

0.65%

0.2K

Facebook, Inc.

FB

93.40

0.65%

49.6K

ALTRIA GROUP INC.

MO

55.77

0.65%

2.3K

Hewlett-Packard Co.

HPQ

28.16

0.57%

10.3K

International Business Machines Co...

IBM

149.62

0.56%

0.2K

Ford Motor Co.

F

14.39

0.56%

0.3K

Procter & Gamble Co

PG

73.80

0.54%

0.4K

E. I. du Pont de Nemours and Co

DD

55.50

0.53%

2.7K

UnitedHealth Group Inc

UNH

116.66

0.53%

1.5K

General Motors Company, NYSE

GM

32.39

0.53%

5.8K

AT&T Inc

T

33.00

0.49%

25.0K

General Electric Co

GE

27.41

0.44%

18.9K

Google Inc.

GOOG

648.29

0.44%

4.2K

Walt Disney Co

DIS

104.22

0.43%

6.5K

Merck & Co Inc

MRK

50.00

0.40%

15.1K

United Technologies Corp

UTX

92.78

0.25%

0.5K

The Coca-Cola Co

KO

41.00

0.10%

39.7K

Starbucks Corporation, NASDAQ

SBUX

58.67

-0.03%

5.3K

Wal-Mart Stores Inc

WMT

65.40

-0.43%

0.9K

McDonald's Corp

MCD

100.96

-0.92%

2.8K

Tesla Motors, Inc., NASDAQ

TSLA

236.80

-1.93%

12.2K

-

14:57

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Tesla Motors (TSLA) downgraded to Neutral from Outperform at Robert W. Baird; target lowered to $282 from $335

Other:

Tesla Motors (TSLA) initiated with a Sector Perform at RBC Capital Mkts; target $280

-

14:44

French Finance Minister Michel Sapin: the government will not revise its growth targets

French Finance Minister Michel Sapin said on Wednesday that the government will not revise its growth targets despite the downgrade of the global growth forecasts by the International Monetary Fund (IMF).

"I don't think this will jeopardise the European economic growth or jeopardise our growth targets," he said.

Sapin noted that the government expects the French economy to expand 1% this year and 1.5% in 2016.

The IMF lowered its global economic growth forecasts on Tuesday due to a weaker growth in advanced economies and the slowdown in emerging economies. The global economy will expand 3.1% in 2015, down from the previous forecast of 3.3%, and 3.6% in 2016, down from the previous forecast of 3.8%, according to the IMF.

-

14:38

Building permits in Canada fall 3.7% in August

Statistics Canada released housing market data on Wednesday. Building permits in Canada fell 3.7% in August, missing expectations for a 0.8% rise, after a 0.7% gain in July. July's figure was revised up from a 0.6% decrease.

The decline was driven by lower construction intentions in the non-residential and residential sector.

Building permits for non-residential construction declined 1.3% in August, while permits in the residential sector slid 5.1%.

-

14:25

European Central Bank lowers the amount of emergency funding (ELA) to Greek banks by €1 billion

The Bank of Greece said on Wednesday that the European Central Bank (ECB) lowered the amount of emergency funding (ELA) to Greek banks to €87.9 billion from €88.9 billion as the liquidity of Greek banks improved.

"The reduction by 1.0 billion euros of the ceiling reflects an improvement in the liquidity of Greek banks," the Bank of Greece said.

-

12:00

European stock markets mid session: stocks traded higher on a rise in oil prices

Stock indices traded higher on a rise in oil prices. Oil prices increased on speculation that oil production will decline and on a weaker U.S. dollar. The U.S. Energy Information Administration said on Tuesday that oil production was 120,000 barrels a day lower in September than in August.

Comments by OPEC Secretary-General Abdalla Salem el-Badri also supported oil prices. He said on Tuesday that oil prices will rebound due to lower oil investments. el-Badri expects global oil investments to drop by 22.4% this year.

Meanwhile, the economic data from the Eurozone was negative. Destatis released its industrial production data for Germany on Wednesday. German industrial production slid 1.2% in August, missing expectations for a 0.2% gain, after a 1.2% rise in July. July's figure was revised up from a 0.7% increase.

The output of capital goods decreased 2.1% in August, energy output dropped 1.4%, and the production in the construction sector was down 1.3%, while the production of intermediate goods was flat.

The output of consumer goods decreased 0.4%.

German industrial production excluding energy and construction fell by 1.1% in August.

The Office for National Statistics (ONS) released its manufacturing industrial production figures for the U.K. on Wednesday. Manufacturing production in the U.K. rose 0.5% in August, exceeding expectations for a 0.3% gain, after a 0.7% decrease in July. July's figure was revised up from a 0.8% drop.

Manufacturing output was driven by a rise in the vehicle production.

On a yearly basis, manufacturing production in the U.K. decreased 0.8% in August, missing forecast of a 0.1% fall, after a 1.2% drop in July. July's figure was revised down from a 0.5% decrease.

Industrial production in the U.K. climbed 1.0% in August, beating forecasts of a 0.3% rise, after a 0.3% fall in July. July's figure was revised up from a 0.4% decline.

On a yearly basis, industrial production in the U.K. gained 1.9% in August, exceeding expectations for a 1.2% rise, after a 0.7% increase in July. July's figure was revised down from a 0.8% rise.

The increase was driven by adjustments in the ONS calculations. The extraction industry in the British North Sea was working at full capacity after shutdowns and maintenance work in July. A small increase in gas production also supported the industrial production.

Current figures:

Name Price Change Change %

FTSE 100 6,369.69 +43.53 +0.69 %

DAX 10,021.23 +118.40 +1.20 %

CAC 40 4,701.02 +40.38 +0.87 %

-

11:40

San Francisco Fed President John Williams expects the Fed to start raising its interest rates this year

San Francisco Fed President John Williams said on Tuesday that he expects the Fed to start raising its interest rates this year despite the weak U.S. labour market in September.

"Things are looking up, and if they stay on track, I see this as the year we start the process of monetary policy normalization," he said.

-

11:36

Industrial production in Spain declines 1.4% in August

Spanish statistical office INE released its industrial production figures for Spain on Wednesday. Industrial production in Spain was down 1.4% in August, after a 0.7% gain in July.

On a yearly basis, industrial production in Spain climbed at adjusted 2.7% in August, after a 5.2% increase in July.

Output of capital goods jumped at seasonally adjusted 8.6% year-on-year in August, output of intermediate goods climbed 2.5%, energy production was up 1.1%, while consumer goods output rose 0.3%.

-

11:18

Bank of Japan Governor Haruhiko Kuroda: the central bank will not cut its deposit rate in the "near future".

The Bank of Japan (BoJ) Governor Haruhiko Kuroda said at a press conference on Wednesday that the central bank will not cut its deposit rate in the "near future".

"I am not considering lowering the excess-reserve rate, and there will be no change in my views in the near future," he said.

Kuroda pointed out that the inflation is on track to reach the central bank's 2% target.

"Consumer prices are expected to stay around zero percent from a year earlier because of falling energy prices, but I think prices will gain upward momentum toward a 2 percent target once the impact of falling energy prices disappear," he said.

-

11:10

Bank of Japan keeps its monetary policy unchanged in October

The Bank of Japan (BoJ) released its interest rate decision on Wednesday. The BoJ kept its monetary policy unchanged (interest rate: 0.00-0.10%, monetary base target: 275 trillion yen). The central bank will expand its monetary base at an annual pace of 80 trillion yen. This decision was expected by analysts.

The BoJ board members voted 8-1 to keep monetary policy unchanged.

The BoJ noted that the country's economy continued to recover moderately, "although exports and production are affected by the slowdown in emerging economies".

The central bank said that the annual inflation in Japan was flat, but inflation expectations seems to be rising.

The BoJ expect the inflation to be about 0% "for the time being", due to low energy prices.

-

11:04

France's trade deficit narrows to €2.98 billion in August

According to the French Customs, France's trade deficit narrowed to €2.98 billion in August from €3.2 billion in July. July's figure was revised up from a deficit of €3.3 billion.

The decline in deficit was driven by a drop in imports.

-

10:55

German industrial production slides 1.2% in August

Destatis released its industrial production data for Germany on Wednesday. German industrial production slid 1.2% in August, missing expectations for a 0.2% gain, after a 1.2% rise in July. July's figure was revised up from a 0.7% increase.

The output of capital goods decreased 2.1% in August, energy output dropped 1.4%, and the production in the construction sector was down 1.3%, while the production of intermediate goods was flat.

The output of consumer goods decreased 0.4%.

German industrial production excluding energy and construction fell by 1.1% in August.

-

10:49

U.K. manufacturing production rises 0.5% in August, while industrial production climbs 1.0%

The Office for National Statistics (ONS) released its manufacturing industrial production figures for the U.K. on Wednesday. Manufacturing production in the U.K. rose 0.5% in August, exceeding expectations for a 0.3% gain, after a 0.7% decrease in July. July's figure was revised up from a 0.8% drop.

Manufacturing output was driven by a rise in the vehicle production.

On a yearly basis, manufacturing production in the U.K. decreased 0.8% in August, missing forecast of a 0.1% fall, after a 1.2% drop in July. July's figure was revised down from a 0.5% decrease.

Industrial production in the U.K. climbed 1.0% in August, beating forecasts of a 0.3% rise, after a 0.3% fall in July. July's figure was revised up from a 0.4% decline.

On a yearly basis, industrial production in the U.K. gained 1.9% in August, exceeding expectations for a 1.2% rise, after a 0.7% increase in July. July's figure was revised down from a 0.8% rise.

The increase was driven by adjustments in the ONS calculations. The extraction industry in the British North Sea was working at full capacity after shutdowns and maintenance work in July. A small increase in gas production also supported the industrial production.

-

10:36

China’s foreign-exchange reserves decline by $43.26 billion in September

The People's Bank of China (PBoC) said on Wednesday that the country's foreign-exchange reserves declined by $43.26 billion to $3.514 trillion in September from a month earlier.

China's foreign-exchange reserves dropped by $93.9 billion to $3.557 trillion in August after the yuan devaluation.

-

10:26

European Central Bank Governing Council member Erkki Liikanen: the central should not adjust its asset-buying programme

The European Central Bank (ECB) Governing Council member Erkki Liikanen said on Tuesday that the central should not adjust its asset-buying programme.

"Let's keep the tempo and let's stick to our plan. And if things change, we should not draw any hasty conclusions," he said.

Liikanen pointed out that a slowdown in the Chinese economy and low oil prices are the biggest risks to the Eurozone's economy.

-

10:10

Ai Group/HIA Australian Performance of Construction Index is down to 51.9 in September

The Australian Industry Group (AiG) released its construction data for Australia on late Tuesday evening. The Ai Group/HIA Australian Performance of Construction Index fell to 51.9 in September from 53.8 in August.

A reading above 50 indicates expansion in the sector.

The decline was driven by a drop in engineering, which slid by 9.3 point to 36.6 in September.

"Residential construction activity remains the cornerstone of the broader construction industry and will retain this role into at least the first half of 2016," HIA economist, Diwa Hopkins, said.

-

08:30

Global Stocks: U.S. indices posted mixed results

U.S. stock indices posted mixed results on Tuesday amid domestic economic data and revised global growth forecasts by the International Monetary Fund.

The Dow Jones Industrial Average climbed 13.76 points, or less than 0.1%, to 16,790.19. The S&P 500 declined 7.13, or 0.4%, to 1,979.92 (health-care sector led declines while shares of energy companies climbed). The Nasdaq Composite Index fell 32.90, or 0.7%, to 4,748.36.

U.S. trade deficit expanded in August amid a stronger dollar, low commodity prices. Slow growth overseas also affected demand for U.S. products. The deficit rose by seasonally adjusted 15.6% to $48.33 billion in August. Imports rose by 1.2%, while exports fell by 2% (the lowest level since October 2012).

The IMF cut global GDP growth forecast for 2015 and 2016 by 0.2% to 3.1% and 3.6% respectively. "Relative to last year, the recovery in advanced economies is expected to pick up slightly, while activity in emerging market and developing economies is projected to slow for the fifth year in a row, primarily reflecting weaker prospects for some large emerging market economies and oil-exporting countries," the IMF said.

This morning in Asia Hong Kong Hang Seng rose 1.25%, or 273.51, to 22,105.13. The Nikkei rose 0.92%, or 168.06, to 18,354.16. Markets in China are on holiday.

Asian indices advanced with energy companies leading gains after the Energy Information Administration raised its 2015 global oil demand forecast.

Japanese shares rose driven by energy stocks too. However Bank of Japan's decision to keep its monetary policy unchanged was a negative factor today.

-

01:01

Stocks. Daily history for Sep Oct 6’2015:

(index / closing price / change items /% change)

Nikkei 225 18,186.1 +180.61 +1.00 %

Hang Seng 21,831.62 -22.88 -0.10 %

S&P/ASX 200 5,167.4 +16.87 +0.33 %

Topix 1,475.84 +11.92 +0.81 %

FTSE 100 6,326.16 +27.24 +0.43 %

CAC 40 4,660.64 +43.74 +0.95 %

Xetra DAX 9,902.83 +88.04 +0.90 %

S&P 500 1,979.92 -7.13 -0.36 %

NASDAQ Composite 4,748.36 -32.90 -0.69 %

Dow Jones 16,790.19 +13.76 +0.08 %

-