Noticias del mercado

-

21:00

Dow +0.49% 16,995.33 +83.04 Nasdaq -0.00% 4,791.14 -0.01 S&P +0.52% 2,006.26 +10.43

-

18:00

European stocks closed: FTSE 100 6,374.82 +38.47 +0.61% CAC 40 4,675.91 +8.57 +0.18% DAX 9,993.07 +22.67 +0.23%

-

18:00

European stocks close: stocks closed higher on a rise in oil prices

Stock indices closed higher on a rise in oil prices. Oil prices rose as the Chinese market participants returned from public holidays.

The European Central Bank's (ECB) its minutes of September meeting on Thursday. According to the minutes, uncertainty in emerging economies could lead to a slowdown in the Eurozone's economy.

The central bank pointed out that it will raise the pace of its asset purchases from September to November 2015 "to prepare for the expected decline in market liquidity in December".

Meanwhile, the economic data from the Eurozone was weak. Destatis released its trade data for Germany on Thursday. Germany's seasonally adjusted trade surplus declined to €19.6 billion in August from 22.4 in July. July's figure was revised down from €22.8 billion.

Exports dropped at a seasonally and calendar-adjusted 5.2% in August, while imports fell 3.1%. It was the biggest drop in exports since January 2009.

On a yearly basis, German exports climbed by 5.0% in August, while imports rose by 4.0%.

Germany's current account surplus was at €12.3 billion in August, down from €24.7 billion in July. July's figure was revised up from €23.4 billion.

According to Destatis, manufacturing turnover declined on seasonally adjusted and on adjusted for working days basis by 1.3% in August, after a 1.4% rise in July. July's figure was revised down from a 1.9% increase.

Meanwhile, domestic turnover decreased by 0.9% in August, while the business with foreign customers dropped 1.8%.

Sales to euro area countries declined 2.8% in August, while sales to other countries were down 1.0%.

On a yearly basis, manufacturing turnover in Germany was up on seasonally adjusted and on adjusted for working days basis by 2.8% in August.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,374.82 +38.47 +0.61 %

DAX 9,993.07 +22.67 +0.23 %

CAC 40 4,675.91 +8.57 +0.18 %

-

18:00

WSE: Session Results

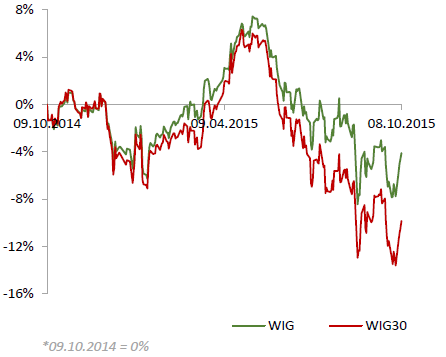

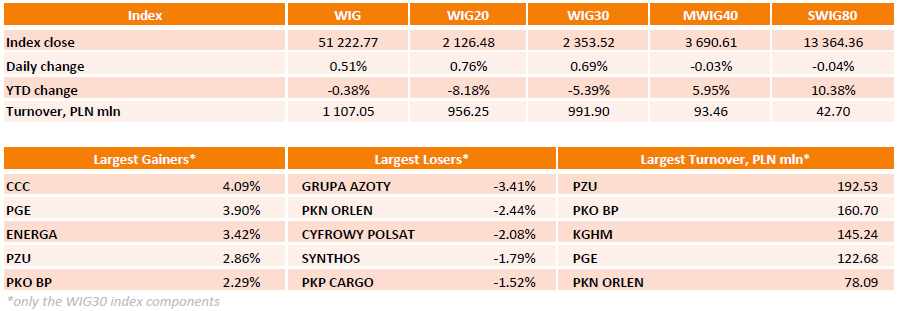

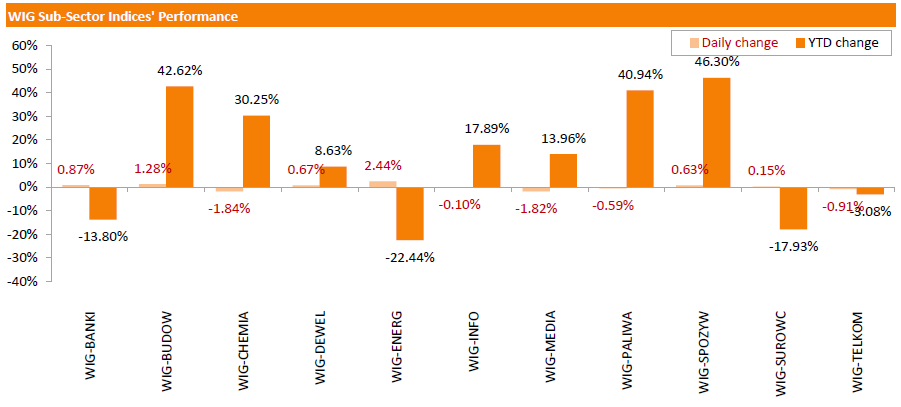

Polish equity market continued its upward movement on Thursday. The broad market measure, the WIG index, added 0.51%. Sector-wise, utilities (+2.44%) fared the best, while chemicals (-1.84%) produced the biggest losses.

The large-cap stocks' measure, the WIG30 Index, rose by 0.69%. Within the index components, CCC (WSE: CCC) led the gainers pack, advancing by 4.09% and erasing losses from the previous two sessions. Other major outperformers included PGE (WSE: PGE), ENERGA (WSE: ENG) and PZU (WSE: PZU), surging by 2.86%-3.90%. On the other side of the ledger, GRUPA AZOTY (WSE: ATT) was the weakest performer, retreating by 3.41%. It was followed by PKN ORLEN (WSE: PKN) and CYFROWY POLSAT (WSE: CPS), which lost 2.44% and 2.08% respectively.

-

16:57

The government of Greek Prime Minister Alexis Tsipras wins a confidence vote

The government of Greek Prime Minister Alexis Tsipras won a confidence vote on Thursday. 155 of 299 parliament members voted in favour of the government.

-

16:46

European Central Bank chief economist Peter Praet: seeping pessimism weighs on the recovery of the Eurozone’s economy

European Central Bank chief economist Peter Praet said on Thursday that seeping pessimism weighs on the recovery of the Eurozone's economy.

"The economic environment is characterised by seeping pessimism about the prospects for long-term growth. It holds back a stronger recovery, as uncertainty about the future can feed back into weaker investment today through expectations and confidence channels," he said.

Praet noted that further reforms needed to be implemented

-

16:24

Bank of Japan’ monthly report: the central bank cuts its industrial output forecast for the third quarter

The Bank of Japan (BoJ) released its monthly report on Thursday. The central bank lowered its industrial output forecast for the third quarter, saying that "industrial production have recently been more or less flat", driven mainly by the effects of the slowdown in emerging economies.

The central bank also said that Japan's economy continued to recover moderately.

The inflation is expected to be around zero "for the time being", due to lower energy prices.

-

16:05

ECB Monetary Policy Meeting Account: the central bank will raise the pace of its asset purchases from September to November 2015

The European Central Bank's (ECB) its minutes of September meeting on Thursday. According to the minutes, uncertainty in emerging economies could lead to a slowdown in the Eurozone's economy.

"Uncertainty arising from developments in economic and financial conditions in emerging market economies, particularly China, had clearly increased," the minutes said.

"The slowdown in demand in China could contribute to greater global uncertainty and a possible loss of confidence, which could have a more substantial impact on global growth," the central bank said in its minutes.

The central bank pointed out that it will raise the pace of its asset purchases from September to November 2015 "to prepare for the expected decline in market liquidity in December".

"There was also wide agreement for stressing that the monthly asset purchases of €60 billion would be fully implemented until the end of September 2016, and beyond, if necessary, and, in any case, until a sustained adjustment in the path of inflation, consistent with the Governing Council's aim of achieving inflation rates below, but close to, 2% over the medium term, was visible," the ECB concluded.

-

15:36

U.S. Stocks open: Dow -0.20%, Nasdaq -0.40%, S&P -0.24%

-

15:28

Before the bell: S&P futures -0.39%, NASDAQ futures -0.40%

U.S. stock-index futures slipped.

Nikkei 18,141.17 -181.81 -0.99%

Hang Seng 22,354.91 -160.85 -0.71%

Shanghai Composite 3,144.23 +91.45 +3.00%

FTSE 6,357.44 +21.09 +0.33%

CAC 4,662.02 -5.32 -0.11%

DAX 9,988.8 +18.40 +0.18%

Crude oil $48.11 (+0.65%)

Gold $1137.70 (-0.98%)

-

15:23

Bank of England's Monetary Policy Committee October minutes: 8-1 split to keep monetary policy unchanged

The Bank of England's Monetary Policy Committee (MPC) released its October meeting minutes on Thursday. 8 members voted to keep the central bank's monetary policy unchanged. Ian McCafferty voted to hike interest rate by 0.25%.

The consumer price inflation in the U.K. was zero in August, below the central bank's 2% target. The BoE noted that the low inflation was mainly driven by lower prices for energy, food and other imported goods prices.

"With inflation below the target, and the likelihood that at least some spare capacity remains in the economy, the MPC intends to set monetary policy so as to ensure that growth is sufficient to absorb any remaining underutilised resources. That will support domestic cost growth and is necessary to ensure that inflation is on track to return sustainably to the 2% target rate within two years," the minutes said.

The central bank said that a deterioration in the global economy would have a negative effect on the U.K. economy.

"That could occur, for example, were the slowdown currently underway in a range of emerging economies, including China, to intensify," the minutes said.

MPC members pointed out that the interest rate hike will be gradual when the Bank of England starts to raise its interest rate, adding that the decision will depend on the incoming economic data.

-

15:06

Bank of England keeps its interest rate on hold at 0.5% in October

The Bank of England (BoE) released its interest rate decision on Thursday. The BoE kept its interest rates unchanged at 0.5% and its asset purchase program unchanged at £375 billion. This decision was widely expected.

Bank of England (BoE) Governor Mark Carney said in September that it will become clearer "around the turn of this year" whether to start raising interest rates or not.

Financial markets suggest that the BoE will start to raise its interest rate by the end of next year or even early 2017.

The central bank expect the U.K. economy to expand 0.6% in the third quarter.

-

15:02

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

13.15

1.08%

299.1K

Yandex N.V., NASDAQ

YNDX

11.90

0.59%

6.7K

Nike

NKE

122.21

0.09%

2.4K

Procter & Gamble Co

PG

73.74

0.03%

0.3K

McDonald's Corp

MCD

101.74

-0.03%

0.1K

Walt Disney Co

DIS

103.25

-0.14%

4.5K

Visa

V

73.10

-0.16%

0.2K

International Business Machines Co...

IBM

149.74

-0.23%

0.5K

ALTRIA GROUP INC.

MO

55.75

-0.27%

4.8K

Merck & Co Inc

MRK

50.80

-0.29%

18.5K

AT&T Inc

T

33.01

-0.33%

3.0K

Cisco Systems Inc

CSCO

27.45

-0.33%

15.4K

Home Depot Inc

HD

119.25

-0.33%

0.6K

Apple Inc.

AAPL

110.41

-0.33%

74.3K

Google Inc.

GOOG

640.17

-0.34%

1.4K

Chevron Corp

CVX

87.81

-0.35%

0.5K

Intel Corp

INTC

32.20

-0.36%

8.5K

Microsoft Corp

MSFT

46.63

-0.36%

20.9K

Amazon.com Inc., NASDAQ

AMZN

540.00

-0.36%

5.2K

Exxon Mobil Corp

XOM

78.90

-0.38%

5.0K

Caterpillar Inc

CAT

70.09

-0.41%

0.6K

Citigroup Inc., NYSE

C

51.10

-0.43%

2.9K

General Motors Company, NYSE

GM

32.90

-0.45%

0.6K

Facebook, Inc.

FB

91.95

-0.49%

15.9K

Yahoo! Inc., NASDAQ

YHOO

31.70

-0.53%

25.4K

ALCOA INC.

AA

10.87

-0.64%

2.2K

E. I. du Pont de Nemours and Co

DD

55.02

-0.65%

0.5K

Starbucks Corporation, NASDAQ

SBUX

58.35

-0.73%

0.4K

Boeing Co

BA

136.00

-0.74%

1.4K

General Electric Co

GE

27.55

-0.79%

39.0K

Twitter, Inc., NYSE

TWTR

29.58

-0.84%

10.3K

Hewlett-Packard Co.

HPQ

27.77

-0.86%

0.1K

Ford Motor Co.

F

14.62

-0.88%

4.1K

Tesla Motors, Inc., NASDAQ

TSLA

229.67

-0.99%

15.4K

Barrick Gold Corporation, NYSE

ABX

7.10

-1.93%

8.5K

-

14:59

Canada’s new housing price index climbs 0.3% in August

Statistics Canada released its new housing price index on Thursday. New housing price index in Canada rose 0.3% in August, exceeding expectations of a 0.2% gain, after a 0.1% rise in July.

The increase was driven by gains in Toronto and Oshawa region, which rose 0.6% in August.

On a yearly basis, new housing price index in Canada climbed 1.3% in August, after a 1.3% gain in July.

-

14:56

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

McDonald's (MCD) initiated with a Buy at Sun Trust Rbsn Humphrey

-

14:39

Initial jobless claims decrease by 13,000 to 263,000 in the week ending October 03

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending October 03 in the U.S. declined by 13,000 to 263,000 from 276,000 in the previous week. The previous week's figure was revised down 277,000.

Analysts had expected the initial jobless claims to increase to 274,000.

Jobless claims remained below 300,000 the 31th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims increased by 9,000 to 2,204,000 in the week ended September 26.

-

14:29

OECD’s composite leading indicator falls to 99.9 in August

The Organization for Economic Cooperation and Development (OECD) released its leading indicators on Thursday. The composite leading indicator fell to 99.9 in August from 100.0 in July.

It signalled stable growth momentum in Germany and in the Eurozone as a whole.

The growth momentum firmed in France and Italy.

The index for the U.S., the U.K. and China pointed to a loss in growth momentum.

The index for Brazil and Russia showed signs of a weak growth momentum.

The index for Canada pointed to an easing in growth.

-

12:00

European stock markets mid session: stocks traded mixed on the weak German economic data

Stock indices traded mixed on the weak German economic data. Destatis released its trade data for Germany on Thursday. Germany's seasonally adjusted trade surplus declined to €19.6 billion in August from 22.4 in July. July's figure was revised down from €22.8 billion.

Exports dropped at a seasonally and calendar-adjusted 5.2% in August, while imports fell 3.1%. It was the biggest drop in exports since January 2009.

On a yearly basis, German exports climbed by 5.0% in August, while imports rose by 4.0%.

Germany's current account surplus was at €12.3 billion in August, down from €24.7 billion in July. July's figure was revised up from €23.4 billion.

According to Destatis, manufacturing turnover declined on seasonally adjusted and on adjusted for working days basis by 1.3% in August, after a 1.4% rise in July. July's figure was revised down from a 1.9% increase.

Meanwhile, domestic turnover decreased by 0.9% in August, while the business with foreign customers dropped 1.8%.

Sales to euro area countries declined 2.8% in August, while sales to other countries were down 1.0%.

On a yearly basis, manufacturing turnover in Germany was up on seasonally adjusted and on adjusted for working days basis by 2.8% in August.

Current figures:

Name Price Change Change %

FTSE 100 6,340.5 +4.15 +0.07 %

DAX 9,953.92 -16.48 -0.17 %

CAC 40 4,649.35 -17.99 -0.39 %

-

11:50

Germany’s manufacturing turnover declines by 1.3% in August

Destatis released its manufacturing turnover data for Germany on Thursday. Manufacturing turnover declined on seasonally adjusted and on adjusted for working days basis by 1.3% in August, after a 1.4% rise in July. July's figure was revised down from a 1.9% increase.

Meanwhile, domestic turnover decreased by 0.9% in August, while the business with foreign customers dropped 1.8%.

Sales to euro area countries declined 2.8% in August, while sales to other countries were down 1.0%.

On a yearly basis, manufacturing turnover in Germany was up on seasonally adjusted and on adjusted for working days basis by 2.8% in August.

-

11:45

Greek unemployment rate remains unchanged at 25.0% in July

The Hellenic Statistical Authority released its unemployment data on Thursday. The seasonally adjusted unemployment rate in Greece remained unchanged at 25.0% in July. June's figure was revised down from 25.2%.

The number of unemployed fell by 1,984 persons compared with June 2015.

The youth unemployment rate was 48.6% in July.

-

11:39

Japan’s Eco Watchers' current conditions index falls to 47.5 in September

Japan's Cabinet Office released Eco Watchers' Index figures on Thursday. Japan's economy watchers' current conditions index dropped to 47.5 in September from 49.3 in August. It was the lowest level since January.

Japan's economy watchers' future conditions index rose to 49.1 in September from 48.2 in August.

A reading above 50 indicates optimism, while a reading below 50 indicates pessimism.

-

11:32

Japan’s current account surplus declines to ¥1,653.1 billion in August

Japan's Ministry of Finance released its current account data for Japan late Wednesday evening. Japan's current account surplus fell to ¥1,653.1 billion in August from ¥1,808.6 billion in July, beating expectations for a surplus of ¥1,221.1 billion.

Japan benefits from a weaker yen, which supports income from overseas investments.

The goods trade deficit declined by 61.7% year-on-year to ¥326.1 billion in August.

Exports rose at an annual rate of 3.6% in August, while imports dropped 4.9%.

-

11:21

Bank of France lowers its growth forecast for the third quarter

The Bank of France lowered its growth forecast for the third quarter on Thursday. The French economy is expected to expand 0.2% in the third quarter, down from the previous estimate of a 0.3% growth.

The downward revision was driven by a weaker industrial output.

The Bank of France's business sentiment index for the industry sector declined to 97 in September from 98 in August.

"Production of transport equipment, and notably automobiles, declined after several months of growth. Most of the other sectors remained flat or saw modest growth," the central bank said.

The Bank of France's business sentiment index for the services sector was up to 97 in September from 96 in August.

-

10:58

Swiss unemployment rate climbs to a seasonally adjusted 3.4% in September

The Swiss State Secretariat for Economic Affairs released its unemployment data for Switzerland on Thursday. The Swiss unemployment rate rose to a seasonally adjusted 3.4% in September from 3.3% in August.

On a seasonally unadjusted basis, the unemployment rate in Switzerland remained unchanged at 3.2% in September. Analysts had expected the unemployment rate to rise to 3.3%.

The number of unemployed people in Switzerland rose by 1,243 to 138,226 in September from a month earlier.

The youth unemployment rate was up to 3.7% in September from 3.6% in August.

-

10:51

Germany's seasonally adjusted trade surplus declines to €19.6 billion in August

Destatis released its trade data for Germany on Thursday. Germany's seasonally adjusted trade surplus declined to €19.6 billion in August from 22.4 in July. July's figure was revised down from €22.8 billion.

Exports dropped at a seasonally and calendar-adjusted 5.2% in August, while imports fell 3.1%. It was the biggest drop in exports since January 2009.

On a yearly basis, German exports climbed by 5.0% in August, while imports rose by 4.0%.

Germany's current account surplus was at €12.3 billion in August, down from €24.7 billion in July. July's figure was revised up from €23.4 billion.

-

10:32

Core machinery orders in Japan drop 5.7% in August

Japan's Cabinet Office released its core machinery orders data on late Wednesday evening. Core machinery orders in Japan dropped 5.7% in August, missing expectations for a 3.2% rise, after a 3.6% fall in July.

On a yearly basis, core machinery orders slid 3.5% in August, missing expectations for a 4.2% increase, after a 2.8% gain in July.

This data indicates that capital spending in Japan is weaker than expected, and it could lead to the expansion of quantitative easing by the Bank of Japan.

Machinery orders declined 3.2% in August from a month earlier, driven by electronics, steel and car manufacturers.

Orders from non-manufacturers plunged 6.1% in August, driven by falls in orders from financial services and shipping.

-

10:19

Consumer credit in the U.S. increases by $16.02 billion in August

The Fed released its consumer credits figures on Wednesday. Consumer credit in the U.S. rose by $16.02 billion in August, missing expectations for a $19.0 billion increase, after a $18.94 billion gain July. July's figure was revised down from a $19.1 billion rise. The increase was driven by gains in both revolving and non-revolving credit. Revolving credit climbed by $4.0 billion in August, while non-revolving credit jumped by $12.0 billion.

-

10:10

Former Fed Chairman Ben Bernanke: the Fed’ decision not to raise its interest rates in September was reasonable

Former Fed Chairman Ben Bernanke said in an interview on Wednesday that the Fed' decision not to raise its interest rates in September was reasonable.

He also said that the U.S. economy is strong.

"We have a pretty good domestic expansion. The household sector, which is driving growth, has been solid for a while," Bernanke said.

-

08:19

Global Stocks: U.S. indices advanced

U.S. stock indices rose in a volatile session on Wednesday. Some analysts say that stocks have been following energy prices over the past few days.

The Dow Jones Industrial Average rose 122.10 points, or 0.7%, to 16,912.29. The S&P 500 advanced by 15.91, or 0.8%, to 1,995.83. The Nasdaq Composite Index rose 42.79, or 0.9%, to 4,791.15.

Moody's Investor Service affirmed credit rating of the U.S. at "AAA", outlook stable. Moody's explained that the high rating is supported by strong GDP growth, strong dollar and reliable bonds. Nevertheless the agency noted potential threats to the rating in the long-term period.

Meanwhile investors are preparing for third quarter earnings reports. Aluminum producer Alcoa will traditionally report first. Its data will be published on Thursday after trading stops.

This morning in Asia Hong Kong Hang Seng fell 0.69%, or 155.13, to 22,360.63. China Shanghai Composite Index added 3.80%, or 116.11, to 3.168.89. The Nikkei lost 0.78%, or 142.56, to 18,180.42.

Asian indices posted mixed results. Chinese stocks rose after markets reopened after National Day holidays.

Japanese stocks declined amid weak machinery orders data. The corresponding index fell by 5.7% in August, while economists had expected it to grow by 3.2%. On an annualized basis orders fell by 3.5% vs expectations for a 4.2% rise.

Yesterday the Bank of Japan lowered its assessment of business confidence noting some cautiousness. However on the whole assessment remained positive.

-

04:11

Nikkei 22518,301.93 -21.05 -0.11 %, Hang Seng 22,312.99 -202.77 -0.90 %, Shanghai Composite 3,134.27 +81.49 +2.67 %

-

00:32

Stocks. Daily history for Sep Oct 7’2015:

(index / closing price / change items /% change)

Nikkei 225 18,322.98 +136.88 +0.75 %

Hang Seng 22,515.76 +684.14 +3.13 %

S&P/ASX 200 5,197.87 +30.47 +0.59 %

FTSE 100 6,336.35 +10.19 +0.16 %

CAC 40 4,667.34 +6.70 +0.14 %

Xetra DAX 9,970.4 +67.57 +0.68 %

S&P 500 1,995.83 +15.91 +0.80 %

NASDAQ Composite 4,791.15 +42.79 +0.90 %

Dow Jones 16,912.29 +122.10 +0.73 %

-