Noticias del mercado

-

21:00

Dow +0.32% 16,381.98 +51.58 Nasdaq +0.21% 4,806.37 +10.12 S&P +0.08% 1,953.89 +1.60

-

18:30

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes are little changed on Friday as jittery investors took to the sidelines ahead of a crucial U.S. Federal Reserve meeting next week, when the central bank decides on an interest rate hike. However, the S&P 500 was poised for its biggest weekly gain in six weeks despite the recent volatility that has rocked the global financial market.

Most of Dow stocks in positive area (22 of 30). Top looser - Merck & Co. Inc. (MRK, -1.01%). Top gainer - McDonald's Corp. (MCD, +1.43).

S&P index sectors mixed. Top looser - Basic Materials (-1.3%). Top gainer - Healthcare (+0,4%).

At the moment:

Dow 16275.00 +70.00 +0.43%

S&P 500 1942.75 +3.00 +0.15%

Nasdaq 100 4288.50 +3.50 +0.08%

10 Year yield 2,19% -0,3

Oil 44.86 -1.06 -2.31%

Gold 1103.00 -6.30 -0.57%

-

18:10

WSE: Session Results

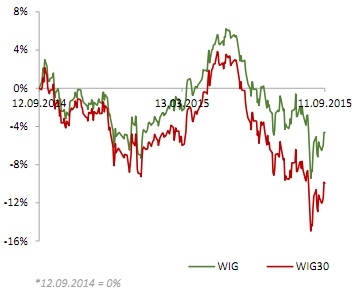

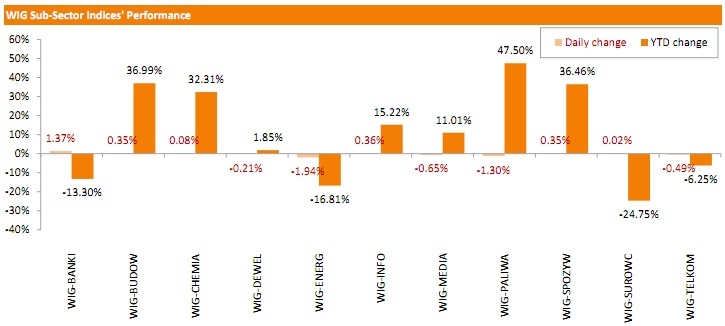

Polish equity market closed flat on Friday. The broad market measure, the WIG Index, inched down 0.01%. Within the index, banking sector (+1.37%) fared the best, while utilities names (-1.94%) declined the most.

The large-cap WIG30 Index edged down 0.14%. PGING (WSE: PGN) was the weakest name among the index components, plunging 2.84%. It was followed by utilities stocks TAURON PE (WSE: TPE) and ENEA (WSE: ENA), declining 2.72% and 2.63% respectively. CCC (WSE: CCC), GTC (WSE: GTC) and HANDLOWY (WSE: BHW) were also among top fallers, dropping more than 2% each. On the other side of the ledger, BOGDANKA (WSE: LWB) and KERNEL (WSE: KER) topped the list of advancers, climbing by 5.08% and 2% respectively. Banking names PKO BP (WSE: PKO), MBANK (WSE: MBK), PEKAO (WSE: PEO), ALIOR (WSE: ALR) and BZ WBK (WSE: BZW) were also good performers, jumping by 0.81-1.76% and extending their gains from the previous session.

-

18:00

European stocks close: stocks closed lower as market participants are awaiting the Fed's interest rate decision next week

Stock indices closed lower as market participants are awaiting the Fed's interest rate decision next week. It remains unclear if the Fed starts raising its interest rates in September or not.

Markets participants are also cautious as China will release the economic data on Sunday. These data could add to concerns over the slowdown in the Chinese economy.

Meanwhile, the economic data from the Eurozone was mostly negative. Destatis released its final consumer price data for Germany on Friday. German final consumer price index was flat in August, in line with the preliminary estimate, after a 0.2% rise in July.

On a yearly basis, German final consumer price index remained unchanged at 0.2% in August, in line with the preliminary estimate.

The decline was driven by falling energy prices, which dropped 7.6% year-on-year in August.

German wholesale prices fell 0.8% in August, after a 0.1% increase in July.

On a yearly basis, wholesale prices in Germany dropped 1.1% in August, after a 0.5% decline in July. Wholesale prices have been declining since July 2013.

The fall was mainly driven by a 14.7% decline in the wholesale prices of solid fuels and related products.

The Bank of France released its current account data on Friday. France's current account surplus turned to a deficit of €0.4 billion in July from a surplus of €0.8 billion in June. June's figure was revised down from a surplus of €1.0 billion.

The deficit in the trade of goods was down to €0.9 billion in July from €1.0 billion in the previous month, while the surplus on services dropped to €0.3 billion from €1.7 billion.

The Office for National Statistics (ONS) released its construction output data for the U.K. on Friday. Construction output in the U.K. declined 1.0% in July, after a 0.9% rise in June.

The decline was driven by a drop in new work, which plunged 1.5% in July.

On a yearly basis, construction output decreased 0.7% in July. It was the first decline since May 2013.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,117.76 -38.05 -0.62 %

DAX 10,123.56 -86.88 -0.85 %

CAC 40 4,548.72 -47.81 -1.04 %

-

18:00

European stocks closed: FTSE 100 6,117.76 -38.05 -0.62% CAC 40 4,548.72 -47.81 -1.04% DAX 10,123.56 -86.88 -0.85%

-

16:50

Bank of England’s Monetary Policy Committee Member Kristin Forbes: the central bank may have to raise its interest rate sooner than expected

The Bank of England's (BoE) Monetary Policy Committee (MPC) Member Kristin Forbes said in Cardiff on Friday that the central bank may have to raise its interest rate sooner than expected if the strong pound has less of an impact on inflation than thought.

"Perhaps most important for monetary policy today, this approach also suggests that sterling's recent appreciation could create less drag on import prices and inflation than we might have expected if the levels of pass-through seen after the crisis persisted. If this plays out, monetary policy would need to be tightened sooner than based on older models," she said.

-

16:30

Thomson Reuters/University of Michigan preliminary consumer sentiment index drops to 85.7 in September, the lowest level since September 2014

The Thomson Reuters/University of Michigan preliminary consumer sentiment index slid to 85.7 in September from a final reading of 91.9 in August, missing expectations for a decrease to 91.2. It was the lowest level since September 2014.

"Consumers still anticipate a weaker domestic economy due to the global slowdown and are less optimistic about future growth in jobs and wages than they were a few months ago," the Surveys of Consumers chief economist at the University of Michigan Richard Curtin said.

The decline in the index was mainly driven by falls in the index of current economic conditions and the index of consumer expectations.

The index of current economic conditions declined to 100.3 in September from 105.1 in August, while the index of consumer expectations decreased to 76.4 from 83.4.

The one-year inflation expectations rose to 2.9% in September from 2.8% in August.

-

15:39

U.S. Stocks open: Dow -0.29%, Nasdaq -0.34%, S&P -0.33%

-

15:23

Before the bell: S&P futures -0.43%, NASDAQ futures -0.61%

U.S. stock-index futures declined as market volatility continues to prevail before the Federal Reserve's policy meeting next week.

Global Stocks:

Nikkei 18,264.22 -35.40 -0.19%

Hang Seng 21,504.37 -58.13 -0.27%

Shanghai Composite 3,200.45 +2.56 +0.08%

FTSE 6,122.4 -33.41 -0.54%

CAC 4,561.25 -35.28 -0.77%

DAX 10,138.34 -72.10 -0.71%

Crude oil $44.74 (-2.57%)

Gold $1106.00 (-0.29%)

-

15:04

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

ABX

Barrick Gold Corporation, NYSE

6.22

0.16%

55.9K

CVX

Chevron Corp

75.70

0.05%

4.0K

KO

The Coca-Cola Co

38.09

0.00%

2.4K

SBUX

Starbucks Corporation, NASDAQ

55.37

0.00%

0.2K

TWTR

Twitter, Inc., NYSE

27.71

0.00%

2.9K

AMZN

Amazon.com Inc., NASDAQ

521.95

-0.06%

24.5K

MO

ALTRIA GROUP INC.

52.62

-0.16%

175.9K

IBM

International Business Machines Co...

145.93

-0.18%

11.0K

WMT

Wal-Mart Stores Inc

64.00

-0.19%

238.4K

MRK

Merck & Co Inc

52.16

-0.21%

2.4K

C

Citigroup Inc., NYSE

50.95

-0.23%

134.7K

GE

General Electric Co

24.62

-0.24%

1.5K

JNJ

Johnson & Johnson

92.50

-0.24%

0.1K

VZ

Verizon Communications Inc

45.35

-0.24%

0.4K

DD

E. I. du Pont de Nemours and Co

48.50

-0.25%

0.3K

FB

Facebook, Inc.

91.75

-0.25%

23.7K

DIS

Walt Disney Co

102.32

-0.27%

0.4K

AA

ALCOA INC.

9.60

-0.31%

12.5K

V

Visa

70.00

-0.33%

0.2K

PFE

Pfizer Inc

32.50

-0.37%

12.4K

INTC

Intel Corp

29.15

-0.41%

1K

AAPL

Apple Inc.

112.11

-0.41%

69.4K

T

AT&T Inc

32.61

-0.43%

0.7K

TSLA

Tesla Motors, Inc., NASDAQ

247.40

-0.43%

4.9K

MSFT

Microsoft Corp

43.10

-0.44%

19.9K

YHOO

Yahoo! Inc., NASDAQ

31.00

-0.48%

1.4K

F

Ford Motor Co.

13.65

-0.58%

29.8K

CSCO

Cisco Systems Inc

26.10

-0.61%

8.5K

XOM

Exxon Mobil Corp

72.00

-0.72%

3.0K

FCX

Freeport-McMoRan Copper & Gold Inc., NYSE

11.15

-1.06%

9.8K

YNDX

Yandex N.V., NASDAQ

11.28

-1.48%

1.0K

-

14:59

U.S. producer price index is flat in August

The U.S. Commerce Department released the producer price index figures on Friday. The U.S. producer price index was flat in August, beating expectations for a 0.1% decline, after a 0.2% rise in July.

On a yearly basis, the producer price index decreased 0.8% in August, beating forecasts of a 0.9% decline, after a 0.8% fall in July.

A stronger U.S. dollar and low oil prices still weigh on inflation.

Services prices were up 0.4% in August, while prices for goods declined 0.6%.

Food prices increased by 0.3% in August, driven by a rise in wholesale egg prices, which jumped 23.2%.

Energy sales declined 3.3% in August.

The producer price index excluding food and energy climbed 0.3% in August, exceeding expectations for a 0.1% gain, after a 0.3% increase in July.

On a yearly basis, the producer price index excluding food and energy climbed 0.9% in August, beating forecasts of a 0.7% increase, after a 0.6% rise in July.

-

14:49

Upgrades and downgrades before the market open

Upgrades:

Chevron (CVX) upgraded to Overweight from Neutral at JP Morgan

Downgrades:

Other:

DuPont (DD) initiated with a Market Perform at Bernstein; target $56

NIKE (NKE) initiated with a Buy at B. Riley & Co; target $126

-

14:47

German Finance Minister Wolfgang Schaeuble: a high amount of liquidity can lead to price bubbles

German Finance Minister Wolfgang Schaeuble said on Friday that a high amount of liquidity can lead to price bubbles.

"If you look at what's going on [on] a global level, this increasing public and private liquidity on the financial markets, it's by sure that we are moving to the next bubble," he said.

Schaeuble added that structural reforms should be implemented.

"It should not serve as a way out of, or to neglect, what is necessary -- that is structural reforms," he said.

-

12:00

European stock markets mid session: stocks traded lower as market participants are awaiting the Fed’s interest rate decision next week

Stock indices traded lower as market participants are awaiting the Fed's interest rate decision next week. It remains unclear if the Fed starts raising its interest rates in September or not.

Markets participants are also cautious as China will release the economic data on Sunday. These data could add to concerns over the slowdown in the Chinese economy.

Meanwhile, the economic data from the Eurozone was mostly negative. Destatis released its final consumer price data for Germany on Friday. German final consumer price index was flat in August, in line with the preliminary estimate, after a 0.2% rise in July.

On a yearly basis, German final consumer price index remained unchanged at 0.2% in August, in line with the preliminary estimate.

The decline was driven by falling energy prices, which dropped 7.6% year-on-year in August.

German wholesale prices fell 0.8% in August, after a 0.1% increase in July.

On a yearly basis, wholesale prices in Germany dropped 1.1% in August, after a 0.5% decline in July. Wholesale prices have been declining since July 2013.

The fall was mainly driven by a 14.7% decline in the wholesale prices of solid fuels and related products.

The Bank of France released its current account data on Friday. France's current account surplus turned to a deficit of €0.4 billion in July from a surplus of €0.8 billion in June. June's figure was revised down from a surplus of €1.0 billion.

The deficit in the trade of goods was down to €0.9 billion in July from €1.0 billion in the previous month, while the surplus on services dropped to €0.3 billion from €1.7 billion.

The Office for National Statistics (ONS) released its construction output data for the U.K. on Friday. Construction output in the U.K. declined 1.0% in July, after a 0.9% rise in June.

The decline was driven by a drop in new work, which plunged 1.5% in July.

On a yearly basis, construction output decreased 0.7% in July. It was the first decline since May 2013.

Current figures:

Name Price Change Change %

FTSE 100 6,136.28 -19.53 -0.32 %

DAX 10,107.19 -103.25 -1.01 %

CAC 40 4,556.12 -40.41 -0.88 %

-

11:43

UK’s construction output declines 1.0% in July

The Office for National Statistics (ONS) released its construction output data for the U.K. on Friday. Construction output in the U.K. declined 1.0% in July, after a 0.9% rise in June.

The decline was driven by a drop in new work, which plunged 1.5% in July.

On a yearly basis, construction output decreased 0.7% in July. It was the first decline since May 2013.

-

11:34

Industrial production in Italy rises 1.1% in July

The Italian statistical office Istat released its industrial production data on Friday. Industrial production in Italy climbed at a seasonally-adjusted rate of 1.1% in July, after a 1.0% fall in June. June's figure was revised down from a 1.1% drop.

Consumer goods output rose 1.0% in July, intermediate goods output increased 0.6%, energy output jumped 7.1%, while production in the capital goods sector was up 0.3%.

On a yearly basis, industrial production in Italy jumped at a seasonally-adjusted rate of 2.7% in July, after a 0.3% decrease in May.

-

11:23

France’s current account surplus turns to a deficit of €0.4 billion in July

The Bank of France released its current account data on Friday. France's current account surplus turned to a deficit of €0.4 billion in July from a surplus of €0.8 billion in June. June's figure was revised down from a surplus of €1.0 billion.

The deficit in the trade of goods was down to €0.9 billion in July from €1.0 billion in the previous month, while the surplus on services dropped to €0.3 billion from €1.7 billion.

-

11:11

Final consumer price inflation in Spain declines 0.3% in August

The Spanish statistical office INE released its final consumer price inflation data on Friday. Consumer price inflation in Spain was down 0.3% in August, in line with preliminary reading, after a 0.9% drop in July.

On a yearly basis, consumer prices fell by 0.4% in August from a year ago, in line with preliminary reading, after a 0.1% rise in July.

The decline was mainly driven by the decline in the prices of fuels (gas and diesel oil) and electricity.

-

11:03

German wholesale prices fall 0.8% in August

The German statistical office Destatis released its wholesale prices for Germany on Friday. German wholesale prices fell 0.8% in August, after a 0.1% increase in July.

On a yearly basis, wholesale prices in Germany dropped 1.1% in August, after a 0.5% decline in July. Wholesale prices have been declining since July 2013.

The fall was mainly driven by a 14.7% decline in the wholesale prices of solid fuels and related products.

-

10:50

German final consumer price inflation is flat in August

Destatis released its final consumer price data for Germany on Friday. German final consumer price index was flat in August, in line with the preliminary estimate, after a 0.2% rise in July.

On a yearly basis, German final consumer price index remained unchanged at 0.2% in August, in line with the preliminary estimate.

The decline was driven by falling energy prices, which dropped 7.6% year-on-year in August.

Food prices climbed 0.8% year-on-year in August.

-

10:43

White House warns the budget battle could lead to another US government shut down

The White House warned on Thursday that the budget battle could lead to another US government shut down. Rival lawmakers have time until October 1 to reach a deal.

"If Republican leaders maintain their insistence on trying to pass a budget along party lines, then we are going to be headed for a shut down," White House spokesman Josh Earnest said. Any shutdown could lead to an economic and financial turmoil on markets.

The last government shutdown happened in October 2013. The U.S. economy lost an estimated $24 billion during the last shutdown.

-

10:32

European Central Bank's Chief Economist Peter Praet: low interest rates were caused due to "economic malaise" in the Eurozone and across world

The European Central Bank's (ECB) Chief Economist Peter Praet said on Thursday that low interest rates were caused due to "economic malaise" in the Eurozone and across world.

"Low interest rates are ultimately a consequence of weak secular trends, coupled with the cyclical consequences of a complex debt crisis, exacerbated by a monetary union with institutional and structural flaw," he said.

Praet noted that the central bank will monitor closely risks to the risks to the inflation outlook, adding that it could adjust its asset buying programme.

-

10:22

RICS: house prices in the U.K. are expected to rise 6% this year

According to the Royal Institution of Chartered Surveyors' (RICS), house prices in the U.K. are expected to rise 6% this year. RICS upgraded its forecasts from the previous estimate of a 3% growth due to the shortage of homes on the market and higher house prices.

"Given current market conditions, the latest data unsurprisingly shows house prices continuing to rise, and at an accelerating pace. And there is good reason for this trend to be sustained into next year, however uncomfortable that may be for those looking to enter the market," RICS Chief Economist, Simon Rubinsohn, said.

-

10:12

Japan’s business survey index (BSI) of manufacturers' sentiment rises to 11.0 in third quarter

Japan's Ministry of Finance and the Cabinet Office released its quarterly survey on late Thursday evening. The business survey index (BSI) of manufacturers' sentiment rose to 11.0 in third quarter from -6.0 in the second quarter.

The sentiment is expected to decline to 10.5 in the three months to December, and to be 7.1 in the first quarter of 2016.

-

08:38

Global Stocks: U.S. indices advanced

U.S. stock indices advanced on Thursday ahead of next week's Fed policymaking meeting. Analysts say that there is a 28% probability of a rate hike next week and a 60% probability of a rate increase by the end of the current year.

Apple stocks and the healthcare sector led gains.

Investors remained concerned over China's economy.

The Dow Jones Industrial Average rose 76.83 points, or 0.5%, to 16330.40. The S&P 500 gained 10.25 points, or 0.5%, to 1952.29. The Nasdaq Composite Index climbed 39.72 points, or 0.8%, to 4796.25.

This morning in Asia Hong Kong Hang Seng climbed 0.89%, or 192.52 points, to 21,755.02. China Shanghai Composite Index slid 0.05%, or 1.75 point, to 3,196.14. The Nikkei gained 0.07%, or 12.98 points, to 18,312.60.

Asian stock indices posted mixed results. Stocks were supported by gains in U.S. markets; however uncertainty over Fed rates keeps investors concerned.

Japan Business Sentiment Index, which is based on a survey of large Japanese manufacturers, rose to +11 in the third quarter from -6 reported previously.

-

04:04

Nikkei 225 18,243.58 -56.04 -0.31%, Hang Seng 21,707.43 +144.93 +0.67%, Shanghai Composite 3,204.05 +6.15 +0.19%

-

00:45

Stocks. Daily history for Sep 10’2015:

(index / closing price / change items /% change)

Nikkei 225 18,299.62 -470.89 -2.51 %

Hang Seng 21,562.5 -568.81 -2.57 %

S&P/ASX 200 5,095.02 -126.11 -2.42 %

Shanghai Composite 3,196.22 -46.87 -1.45 %

FTSE 100 6,155.81 -73.20 -1.18 %

CAC 40 4,596.53 -68.06 -1.46 %

Xetra DAX 10,210.44 -92.68 -0.90 %

S&P 500 1,952.29 +10.25 +0.53 %

NASDAQ Composite 4,796.25 +39.72 +0.84 %

Dow Jones 16,330.4 +76.83 +0.47 %

-