Noticias del mercado

-

22:15

U.S. stocks declined

U.S. stocks declined, following equities' best week since July, before the Federal Reserve decides on Thursday whether the economy and turbulent financial markets can handle higher interest rates.

The Standard & Poor's 500 Index slipped 0.4 percent to 1,953.02 at 4 p.m. in New York, after the gauge rose 2.1 percent last week. Trading in S&P 500 companies was about 26 percent below the 30-day average for this time of day amid the Jewish new-year holiday.

"I think today we're seeing that tug-of-war in the market again, and nothing is going to matter until we know what the Fed's going to do," said Michael Gayed, the chief investment strategist who helps to manage $200 million at Pension Partners LLC in New York. "I think it's going to be a fun week."

Investors remain confident the Fed will raise borrowing costs this year, even as most bet the central bank will not increase rates at its Sept. 16-17 meeting. Traders are pricing in a 26 percent chance of action on Thursday, down from 48 percent before China's currency devaluation last month. Odds of a move at the December gathering are about 59 percent, according to data compiled by Bloomberg.

Words from Fed Vice Chairman Stanley Fischer in 2014 offer some support for those expecting a move on rates this week. Just months before taking over as the Fed's No.2 official last year, he said that delaying increases carried its own difficulties and the situation is always unclear and monetary policy takes time to affect the economy. "Don't overestimate the benefits of waiting for the situation to clarify," he said.

Chinese stocks slumped the most in three weeks after data added to concern that the country's economic slowdown is deepening. Industrial output missed economists' forecasts, while investment in the first eight months increased at the slowest pace since 2000.

Market swings and rapid shifts in investor sentiment have become more prevalent as uncertainty on the impact of China's slowdown coupled with the Fed's looming rate decision to whipsaw equities. For the ninth time in a row, the S&P 500 posted a weekly return that amounted to a reversal of the prior week's performance. Such a streak of alternating gains and losses has happened only three times in 20 years, according to data.

-

21:00

DJIA 16372.66 -60.43 -0.37%, NASDAQ 4807.06 -15.28 -0.32%, S&P 500 1953.10 -7.95 -0.41%

-

18:48

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes fell in morning trading on Monday as investors awaited Federal Reserve's interest rate meeting this week even as fears of slowing growth in China continue to rattle global markets. Stocks are expected to remain volatile in the run-up to the policy meeting on Wednesday and Thursday, when the Fed is expected to decide on its first interest rate increase since 2006. Data on Monday showed that growth in China's investment and factory output in August missed forecasts, raising the chances that China's third-quarter economic growth may dip below 7% for the first time since the global crisis.

Most of Dow stocks in negative area (26 of 30). Top looser - Visa Inc. (V, -1.45%). Top gainer - Apple Inc. (AAPL, +0.78).

Almost all S&P index sectors in negative area. Top looser - Conglomerates (-0.9%). Top gainer - Utilities (+0,1%).

At the moment:

Dow 16262.00 -75.00 -0.46%

S&P 500 1941.25 -9.00 -0.46%

Nasdaq 100 4293.50 -21.75 -0.50%

10 Year yield 2,18% -0,01

Oil 43.87 -0.76 -1.70%

Gold 1108.30 +5.00 +0.45%

-

18:38

WSE: Session Results

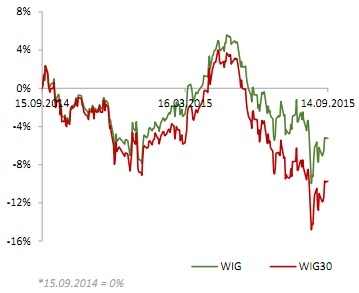

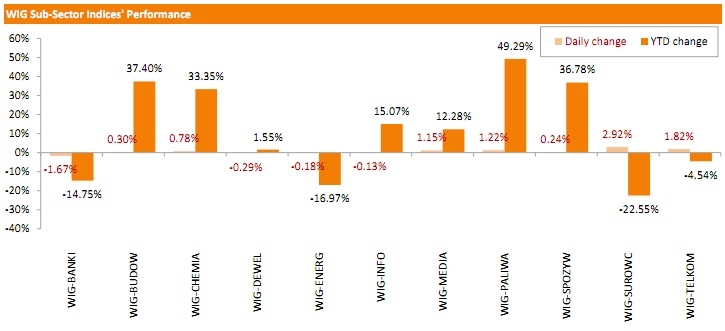

Polish equity market closed flat on Monday. The broad market measure, the WIG Index, slid down 0.07%. Sector-wise, materials (+2.92%) outperformed, while banking sector (-1.67%) lagged behind.

The large-cap stocks' measure, the WIG30 Index, edged up 0.08%. BOGDANKA (WSE: LWB) was the standout performer in the WIG30 Index basket, skyrocketing by 24.12% on media report that ENEA (WSE: ENA; +1.21%) offered PLN 1.48 bln (USD 398mln) for a 64.6-stake in the company. This implied a share price of PLN 67.39, or nearly 29% above LWB's Friday close. Other notable gainers were JSW (WSE: JSW), KERNEL (WSE: KER) and HANDLOWY (WSE: BHW), returning 6.45%, 2.03% and 2.02% respectively. On the other side of the ledger, banking names PEKAO (WSE: PEO), PKO BP (WSE: PKO), ING BSK (WSE: ING) and BZ WBK (WSE: BZW) were hit the hardest, tumbling 1.28-3.28% on speculations regarding the conversion of CHF-denominated loans. They were followed by PGE (WSE: PGE) and GTC (WSE: GTC), losing 1.17% and 1.04% respectively.

-

18:00

European stocks close: stocks closed mixed as market participants were cautious ahead of the Fed’s interest rate decision this week

Stock indices closed mixed as market participants were cautious ahead of the Fed's interest rate decision this week.

Meanwhile, the economic data from the Eurozone was better than expected. Eurostat released its industrial production data for the Eurozone on Monday. Industrial production in the Eurozone rose 0.6% in July, exceeding expectations for a 0.3% increase, after a 0.3% drop in June. June's figure was revised up from a 0.4%.

The increase was driven by a rise in energy, durable consumer goods and capital output. Energy output climbed 3.0% in July, durable consumer goods were up 1.3%, while capital goods output rose by 1.4%.

Intermediate goods declined by 0.6% in July, while non-durable consumer goods output fell 0.6%.

On a yearly basis, Eurozone's industrial production gained 1.9% in July, exceeding expectations for a 0.6% rise, after a 1.5% increase in June.

The increase was driven by a rise in durable consumer goods, capital goods and energy output. Durable consumer goods climbed by 2.6% in July from a year ago, capital goods rose by 2.2%, while energy output gained by 5.1%.

Non-durable consumer goods were up by 1.7%, while intermediate output was up by 0.5%.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,084.59 -33.17 -0.54 %

DAX 10,131.74 +8.18 +0.08 %

CAC 40 4,518.15 -30.57 -0.67 %

-

18:00

European stocks closed: FTSE 6084.59 -33.17 -0.54%, DAX 10131.74 8.18 0.08%, CAC 40 4518.15 -30.57 -0.67%

-

17:03

European Central Bank Governing Council member Josef Bonnici: it will take time to see a full impact of the central bank’s asset buying programme

The European Central Bank Governing Council member Josef Bonnici said on Monday that it will take time to see a full impact of the central bank's asset buying programme. He added that it too early to decide on further stimulus measures.

-

16:58

Final industrial production in Japan declines 0.8% in July

Japan's Ministry of Economy, Trade and Industry released its final industrial production data on Monday. Industrial production in Japan declined at a seasonally adjusted rate of 0.8% in July, down from the preliminary reading of 0.6% fall, after 1.1% rise in June.

Shipments were down 0.4% in July, down from the preliminary reading of a 0.3, while inventories declined 0.8%, in line with the preliminary reading.

On a yearly basis, industrial production in Japan was flat in July, down from the preliminary reading of 0.2% increase, after a 2.3% rise in June.

-

16:36

European Central Bank purchases €13.02 billion of government and agency bonds last week

The European Central Bank (ECB) purchased €13.02 billion of government and agency bonds under its quantitative-easing program last week.

ECB'S asset buying programme is intended to run to September 2016.

The ECB bought €3.89 billion of covered bonds, and €366 million of asset-backed securities.

-

15:35

U.S. Stocks open: Dow -0.03%, Nasdaq +0.13%, S&P -0.03%

-

15:22

Before the bell: S&P futures +0.05%, NASDAQ futures +0.21%

U.S. stock-index futures were little changed as investors speculated on whether the Federal Reserve will raise interest rates at Thursday's meeting.

Global Stocks:

Nikkei 17,965.7 -298.52 -1.63%

Hang Seng 21,561.9 +57.53 +0.27%

Shanghai Composite 3,114.87 -85.37 -2.67%

FTSE 6,093.78 -23.98 -0.39%

CAC 4,530.19 -18.53 -0.41%

DAX 10,119.02 -4.54 -0.04%

Crude oil $44.30 (-0.74%)

Gold $1104.50 (+0.11%)

-

15:21

Preliminary real GDP in the OECD area climbs 0.7% in the second quarter

The Organization for Economic Cooperation and Development (OECD) released its preliminary real gross domestic product (GDP) growth figures on Monday. Real GDP of 34 OECD member countries rose 0.7% in the second quarter, after a 0.5% gain in the first quarter.

Real GDP of the United States was up to 0.9% from 0.2%, real GDP of Germany rose to 0.4% from 0.3%, while Britain's economy increased to 0.7% from 0.4%.

GDP of China rose 1.7% in the second quarter, up from 1.4% in the first quarter.

GDP of France dropped to 0.0% from 0.7%, Italy's economy decreased to 0.3% from 0.4%, while Japan's GDP plunged to -0.3% from 1.1%.

Eurozone's economy expanded at 0.4% in the second quarter, after a 0.5% rise in the first quarter.

On a yearly basis, GDP of 34 OECD member countries was up 3.2% in the second quarter, after a 3.2% gain in the previous quarter.

-

15:06

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)(company / ticker / price / change, % / volume)

Apple Inc.

AAPL

116.75

2.22%

1.2M

Yandex N.V., NASDAQ

YNDX

11.34

0.62%

1.3K

General Motors Company, NYSE

GM

30.30

0.50%

2.0K

Cisco Systems Inc

CSCO

26.10

0.31%

21.6K

Procter & Gamble Co

PG

68.60

0.26%

1K

Boeing Co

BA

135.00

0.25%

0.1K

JPMorgan Chase and Co

JPM

62.71

0.24%

0.1K

Facebook, Inc.

FB

92.25

0.22%

21.3M

Hewlett-Packard Co.

HPQ

27.20

0.18%

3.0K

Walt Disney Co

DIS

104.62

0.13%

4.3K

Citigroup Inc., NYSE

C

51.15

0.10%

0.7K

Ford Motor Co.

F

13.72

0.07%

12.0K

Microsoft Corp

MSFT

43.50

0.05%

7.6K

The Coca-Cola Co

KO

38.15

0.05%

9.6K

Twitter, Inc., NYSE

TWTR

27.40

0.04%

9.8K

E. I. du Pont de Nemours and Co

DD

48.45

0.02%

2.6K

Johnson & Johnson

JNJ

92.93

0.00%

0.3K

Starbucks Corporation, NASDAQ

SBUX

56.53

0.00%

8.4M

AT&T Inc

T

32.70

-0.06%

10.7K

McDonald's Corp

MCD

97.35

-0.06%

3.6K

Intel Corp

INTC

29.45

-0.07%

2.2K

Amazon.com Inc., NASDAQ

AMZN

529.00

-0.08%

6.5K

Google Inc.

GOOG

625.00

-0.12%

0.8K

Tesla Motors, Inc., NASDAQ

TSLA

249.90

-0.14%

2.4M

Goldman Sachs

GS

185.00

-0.15%

0.2K

General Electric Co

GE

24.91

-0.16%

0.5K

Travelers Companies Inc

TRV

99.30

-0.19%

1.4K

Chevron Corp

CVX

75.64

-0.20%

0.1K

Pfizer Inc

PFE

32.90

-0.21%

0.4K

Home Depot Inc

HD

115.17

-0.23%

0.7K

International Business Machines Co...

IBM

147.00

-0.25%

1.7K

Wal-Mart Stores Inc

WMT

64.49

-0.25%

6.8K

Visa

V

70.52

-0.34%

2.5K

Caterpillar Inc

CAT

72.38

-0.34%

0.4K

ALCOA INC.

AA

9.60

-0.52%

3.1K

Exxon Mobil Corp

XOM

72.30

-0.54%

1.7K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.32

-0.70%

9.5K

ALTRIA GROUP INC.

MO

52.20

-0.74%

0.3K

Barrick Gold Corporation, NYSE

ABX

6.30

-0.79%

63.3K

Yahoo! Inc., NASDAQ

YHOO

30.90

-1.69%

20.2K

-

15:04

Greek import prices drop 2.4% in July

The Hellenic Statistical Authority released its import prices data for Greece on Monday. Greek import prices fell 2.4% in July, after a 1.0% decline in June.

On a yearly basis, import prices dropped 11.5% in July, after a 10.5% decrease in June.

Import prices for energy plunged by 36.3% in July, while price for non-durable consumer goods declined by 0.6%.

Prices of capital goods rose 0.2% in July, while intermediate goods prices increased 0.7%.

-

14:46

Final consumer prices in Italy increase 0.2% in August

The Italian statistical office Istat released its final consumer price inflation data for Italy on Monday. Final consumer prices in Italy increased 0.2% in August, in line with the preliminary reading, after a 0.1% decline in July.

The rise was mainly driven by a lower fall in energy (-1.3%) and higher services costs (+0.6%).

On a yearly basis, consumer prices climbed 0.2% in August, in line with the preliminary reading, after a 0.2% increase in July.

The annual inflation was driven by an increase in prices of some services.

-

12:00

European stock markets mid session: stocks traded higher on the better-than-expected economic data from the Eurozone

Stock indices traded higher on the better-than-expected economic data from the Eurozone. Eurostat released its industrial production data for the Eurozone on Monday. Industrial production in the Eurozone rose 0.6% in July, exceeding expectations for a 0.3% increase, after a 0.3% drop in June. June's figure was revised up from a 0.4%.

The increase was driven by a rise in energy, durable consumer goods and capital output. Energy output climbed 3.0% in July, durable consumer goods were up 1.3%, while capital goods output rose by 1.4%.

Intermediate goods declined by 0.6% in July, while non-durable consumer goods output fell 0.6%.

On a yearly basis, Eurozone's industrial production gained 1.9% in July, exceeding expectations for a 0.6% rise, after a 1.5% increase in June.

The increase was driven by a rise in durable consumer goods, capital goods and energy output. Durable consumer goods climbed by 2.6% in July from a year ago, capital goods rose by 2.2%, while energy output gained by 5.1%.

Non-durable consumer goods were up by 1.7%, while intermediate output was up by 0.5%.

Current figures:

Name Price Change Change %

FTSE 100 6,165.79 +48.03 +0.79 %

DAX 10,149.02 +25.46 +0.25 %

CAC 40 4,559.89 +11.17 +0.25 %

-

11:43

Swiss retail sales fall 0.6% in July

The Federal Statistical Office released its retail sales data for Switzerland on Monday. Retail sales in Switzerland declined at an annual rate of 0.1% in July, after a 0.9% drop in June.

Sales of food, beverages and tobacco fell at an annual rate of 0.6% in July, while non-food sales dropped 2.7%.

On a monthly basis, retail sales fell by 0.6% in July, after a 1.4% increase in June.

Sales of food, beverages and tobacco were down 0.4% in July, while non-food sales decreased 1.0%.

-

11:34

Switzerland's producer and import prices fall 0.7% in August

The Federal Statistical Office released its producer and import prices data on Monday. Switzerland's producer and import prices fell 0.7% in August, after a 0.3% drop in July.

The decline was mainly driven by lower prices for chemical and pharmaceutical products.

The Import Price Index decreased by 1.0% in August, while producer prices fell 0.6%.

On a yearly basis, producer and import prices plunged 6.8% in August, after a 6.4% drop in July. It was the biggest drop since April 1950.

The Import Price Index fell by 11.2% year-on year in August, while producer prices dropped 4.8%.

-

11:22

Eurozone’s industrial production rises in July

Eurostat released its industrial production data for the Eurozone on Monday. Industrial production in the Eurozone rose 0.6% in July, exceeding expectations for a 0.3% increase, after a 0.3% drop in June. June's figure was revised up from a 0.4%.

The increase was driven by a rise in energy, durable consumer goods and capital output. Energy output climbed 3.0% in July, durable consumer goods were up 1.3%, while capital goods output rose by 1.4%.

Intermediate goods declined by 0.6% in July, while non-durable consumer goods output fell 0.6%.

On a yearly basis, Eurozone's industrial production gained 1.9% in July, exceeding expectations for a 0.6% rise, after a 1.5% increase in June.

The increase was driven by a rise in durable consumer goods, capital goods and energy output. Durable consumer goods climbed by 2.6% in July from a year ago, capital goods rose by 2.2%, while energy output gained by 5.1%.

Non-durable consumer goods were up by 1.7%, while intermediate output was up by 0.5%.

-

10:54

European Central Bank Executive Board member Benoit Coeure: the economy in the Eurozone is too weak to create enough jobs

The European Central Bank (ECB) Executive Board member Benoit Coeure said in an interview on Friday that the economy in the Eurozone is too weak to create enough jobs.

"Growth is still not strong enough to create a sufficient number of jobs. When inflation is weak, the best way to bring it up to the 2 percent objective is to support economic activity," he said.

Coeure pointed out that growth and employment are very important for price stability.

-

10:50

Standard & Poor's affirms Greece's sovereign debt rating at CCC+

The rating agency Standard & Poor's on Friday affirmed Greece's sovereign debt rating at CCC+. The outlook remained stable.

The agency warned that it will downgrades the country's rating if the government does not implement reforms.

"We could lower the ratings on Greece if the new government cannot implement the reforms it has agreed to in the Memorandum of Understanding signed with the European Commission," Standard & Poor's said.

Greece will elect the new parliament on September 20.

The agency expect the Greece's economy to contract 3% this year.

-

10:22

U.S. budget deficit falls to $64.4 billion in August

The U.S. Treasury Department released its federal budget data on Friday. The budget deficit decreased to $64.4 billion in August, down from a deficit of $149.2 billion in July.

The budget deficit declined due to shifts in the timing of certain benefit payments.

In the first 11 months of the fiscal year 2015, which ends at September this year, the budget deficit totalled $530 billion, 10% lower than a year ago.

-

10:12

The Wall Street Journal survey: about 46% of economists expect the Fed to start raising its interest rate in September

According to The Wall Street Journal survey, about 46% of economists expect the Fed to start raising its interest rate in September. About 9.5% expect that the Fed would raise its interest in October, 35% said the Fed would wait until December, while 9.5% expect that the Fed will start raising its interest rate in 2016.

82% of economists expected last month that the Fed to start raising its interest rate in September, while 13% expected the first interest rate hike in December.

-

08:35

Global Stocks: U.S. indices advanced

U.S. stock indices advanced on Friday in a relatively calm session as investors prepared for a Fed policymaking meeting scheduled for September 16-17.

Technology and health-care stocks led the gains last week, while stocks of energy companies declined amid low oil prices.

The Dow Jones Industrial Average rose 102.49 points, or 0.6%, to 16,432.89 (+2% over the week). The S&P 500 gained 8.72 points, or 0.5%, to 1,961.01 (+2.1% over the week). The Nasdaq Composite Index climbed 26.09 points, or 0.5%, to 4,822.34 (+3% over the week).

This morning in Asia Hong Kong Hang Seng slid 0.10%, or 22.15 points, to 21,482.22. China Shanghai Composite Index fell 3.20%, or 102.53 point, to 3,097.71. The Nikkei lost 1.35%, or 246.99 points, to 18,017.23.

Asian stock indices declined as investors assessed the latest data from China. The National Bureau of Statistics of China reported on Sunday that the country's industrial production rose by 6.1% y/y in August vs 6.4% expected and 6.0% previous. Meanwhile retail sales exceeded expectations and rose by 10.5% y/y in the same month. Fixed asset investment rose by 10.9% y/y in the first eight months of the current year, which is below expectations for an 11.1% growth and the previous reading of 11.2%. Slower investment growth points to a weaker economic growth in China.

Japanese stocks were weighed by data from China and the looming Fed meeting.

-

04:16

Nikkei 22518,213.76 -50.46 -0.28 %, Hang Seng 21,749.9 +245.53 +1.14 %, Shanghai Composite 3,192.98 -7.26 -0.23 %

-

00:31

Stocks. Daily history for Sep 11’2015:

(index / closing price / change items /% change)

Nikkei 225 18,264.22 -35.40 -0.19 %

Hang Seng 21,504.37 -58.13 -0.27 %

S&P/ASX 200 5,071.08 -23.93 -0.47 %

Shanghai Composite 3,200.45 +2.56 +0.08 %

FTSE 100 6,117.76 -38.05 -0.62 %

CAC 40 4,548.72 -47.81 -1.04 %

Xetra DAX 10,123.56 -86.88 -0.85 %

S&P 500 1,961.05 +8.76 +0.45 %

NASDAQ Composite 4,822.34 +26.09 +0.54 %

Dow Jones 16,433.09 +102.69 +0.63 %

-