Noticias del mercado

-

23:59

Schedule for today, Tuesday, Sep 15’2015:

(time / country / index / period / previous value / forecast)

01:30 Australia New Motor Vehicle Sales (MoM) August -1.3%

01:30 Australia New Motor Vehicle Sales (YoY) August 3.7%

01:30 Australia RBA Meeting's Minutes

03:00 Japan BoJ Interest Rate Decision 0%

03:00 Japan Bank of Japan Monetary Base Target 275

03:00 Japan BoJ Monetary Policy Statement

06:30 Japan BOJ Press Conference

06:45 France CPI, m/m August -0.4%

06:45 France CPI, y/y August 0.2%

08:30 United Kingdom Producer Price Index - Input (MoM) August -0.9% -2.4%

08:30 United Kingdom Producer Price Index - Input (YoY) August -12.4% -13.7%

08:30 United Kingdom Producer Price Index - Output (MoM) August -0.1% -0.2%

08:30 United Kingdom Producer Price Index - Output (YoY) August -1.6% -1.7%

08:30 United Kingdom Retail Price Index, m/m August -0.1% 0.3%

08:30 United Kingdom Retail prices, Y/Y August 1% 0.9%

08:30 United Kingdom HICP, m/m August -0.2% 0.2%

08:30 United Kingdom HICP, Y/Y August 0.1% 0.0%

08:30 United Kingdom HICP ex EFAT, Y/Y August 1.2%

09:00 Eurozone Employment Change Quarter II 0.1%

09:00 Eurozone Trade balance unadjusted July 26.4

09:00 Eurozone ZEW Economic Sentiment September 47.6

09:00 Germany ZEW Survey - Economic Sentiment September 25 18.5

12:30 U.S. NY Fed Empire State manufacturing index September -14.92 -2

12:30 U.S. Retail sales August 0.6% 0.4%

12:30 U.S. Retail sales excluding auto September 0.4% 0.2%

13:15 U.S. Capacity Utilization August 78% 77.8%

13:15 U.S. Industrial Production (MoM) August 0.6% -0.1%

13:15 U.S. Industrial Production YoY August 1.3%

14:00 U.S. Business inventories July 0.8% 0.1%

20:30 U.S. API Crude Oil Inventories September 2.1

22:45 New Zealand Current Account Quarter II 660 -1500

23:30 Australia RBA Assist Gov Debelle Speaks

-

20:16

American focus: the US dollar rose

The US dollar showed gains against major currencies in thin trade as investors have focused on the upcoming Thursday statement, the Federal Reserve's monetary policy. Sentiment on the dollar remained fragile amid fears that the US mixed economic reports and instability in global financial markets will force the US central bank to revise the terms of rise in interest rates this Thursday.

On Friday, data showed that the consumer confidence index from the University of Michigan fell to 85.7 from 91.9 in July, compared with forecasts of a decline to 91.2. Also, the US Labor Department reported that producer price index was unchanged last month after rising in July by 0.2%.

The Fed chief Yellen stated that increasing interest rates depends on the economic indicators, however, it also pointed out that the bank plans to raise interest rates before the end of this year.

Little support for the euro earlier had data on industrial production in the eurozone. Statistical Office Eurostat said that the seasonally adjusted volume of industrial production in the eurozone rose in July by 0.6%, offsetting a decline of 0.3% in June (revised from -0.4%). Experts expect that figure to grow by 0.3%. Meanwhile, industrial production in the EU rose by 0.3% after falling 0.1% the previous month. In annual terms, industrial production increased by 1.9% in euro area and by 1.8% among the 28 EU countries. The Eurostat also reported that the monthly change in the euro area was due to the increase in electricity production (3.0%), capital goods (1.4%) and consumer durables (1.3%). Meanwhile, production of intermediate goods and consumer non-durable goods fell by 0.6%.

The Swiss franc depreciated slightly against the US dollar, breaking the mark of CHF0.9700, which was caused by the publication of weak data on Switzerland. Report submitted by the Federal Statistical Office showed that producer prices and import prices declined substantially at the end of August, when fixing the maximum rate of more than six decades. According to the data, the index of producer prices and imports fell in August by 6.8 percent per annum, after falling 6.4 percent in July. It was the largest drop since April 1950, when this figure fell to 7.1 per cent. It should also be noted, the index shows a continuous drop since October 2013. In monthly terms, the producer price index and import recorded its fifth consecutive monthly decline. At the end of August the index dropped by 0.7 percent (the maximum rate for the three months). Recall that in July, a decline of 0.3 percent.

Meanwhile, another report showed that retail sales (seasonally adjusted) fell in July by 0.6 percent compared with 1.4 percent the previous month. In annual terms, sales decreased by 0.1 percent after falling 0.9 percent in June. Retail sales of food, beverages and tobacco increased by 0.7 percent, while sales in the non-food sector rose by 0.3 percent. Excluding fuel, sales (seasonally adjusted) fell by 0.4 percent compared to June.

The pound fell against the dollar and reached $ 1.5370. Investors turn their attention to tomorrow's report on inflation in Britain, which may affect the prospects for changes in interest rates of the Central Bank. Little influenced by the statement made by the Bank of England Martin Huila. He noted that interest rates in the UK should be raised "relatively soon" in order to achieve the inflation target over the medium term. "Solid growth in wages and improvement in the labor market is likely to help boost inflation to the target level in the next two or three years - said Wil. - Monetary policy should be adapted to such conditions. As a result, it seems likely that the banking the rate will need to raise in a relatively short time. " He will also noted that cheap oil has become one of the driving factors of reducing inflation in recent months, and added that such shocks could last for some time. However, he said that, in future, there is good reason to expect a return of inflation to the target value on the background of strong wage growth and the introduction of new national subsistence minimum.

-

17:03

European Central Bank Governing Council member Josef Bonnici: it will take time to see a full impact of the central bank’s asset buying programme

The European Central Bank Governing Council member Josef Bonnici said on Monday that it will take time to see a full impact of the central bank's asset buying programme. He added that it too early to decide on further stimulus measures.

-

16:58

Final industrial production in Japan declines 0.8% in July

Japan's Ministry of Economy, Trade and Industry released its final industrial production data on Monday. Industrial production in Japan declined at a seasonally adjusted rate of 0.8% in July, down from the preliminary reading of 0.6% fall, after 1.1% rise in June.

Shipments were down 0.4% in July, down from the preliminary reading of a 0.3, while inventories declined 0.8%, in line with the preliminary reading.

On a yearly basis, industrial production in Japan was flat in July, down from the preliminary reading of 0.2% increase, after a 2.3% rise in June.

-

16:36

European Central Bank purchases €13.02 billion of government and agency bonds last week

The European Central Bank (ECB) purchased €13.02 billion of government and agency bonds under its quantitative-easing program last week.

ECB'S asset buying programme is intended to run to September 2016.

The ECB bought €3.89 billion of covered bonds, and €366 million of asset-backed securities.

-

15:45

Option expiries for today's 10:00 ET NY cut

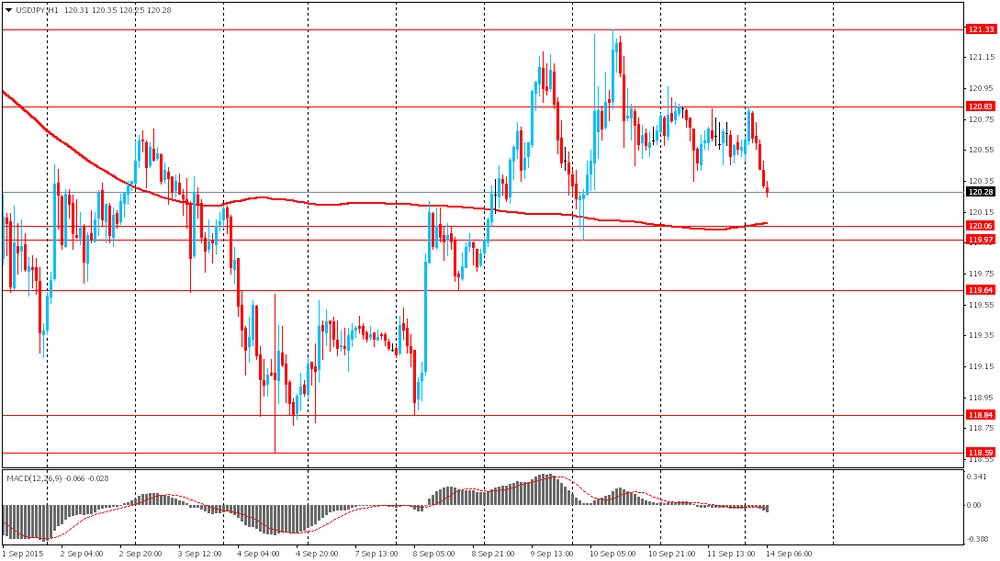

USDJPY 120.00 (USD 848m)

EURUSD 1.1150 (EUR 1bln) 1.1450 (1.1bln)

GBPUSD 1.5200 (GBP 268m) 1.5370 (255m)

EURJPY 136.00 (EUR 250m)

-

15:21

Preliminary real GDP in the OECD area climbs 0.7% in the second quarter

The Organization for Economic Cooperation and Development (OECD) released its preliminary real gross domestic product (GDP) growth figures on Monday. Real GDP of 34 OECD member countries rose 0.7% in the second quarter, after a 0.5% gain in the first quarter.

Real GDP of the United States was up to 0.9% from 0.2%, real GDP of Germany rose to 0.4% from 0.3%, while Britain's economy increased to 0.7% from 0.4%.

GDP of China rose 1.7% in the second quarter, up from 1.4% in the first quarter.

GDP of France dropped to 0.0% from 0.7%, Italy's economy decreased to 0.3% from 0.4%, while Japan's GDP plunged to -0.3% from 1.1%.

Eurozone's economy expanded at 0.4% in the second quarter, after a 0.5% rise in the first quarter.

On a yearly basis, GDP of 34 OECD member countries was up 3.2% in the second quarter, after a 3.2% gain in the previous quarter.

-

15:04

Greek import prices drop 2.4% in July

The Hellenic Statistical Authority released its import prices data for Greece on Monday. Greek import prices fell 2.4% in July, after a 1.0% decline in June.

On a yearly basis, import prices dropped 11.5% in July, after a 10.5% decrease in June.

Import prices for energy plunged by 36.3% in July, while price for non-durable consumer goods declined by 0.6%.

Prices of capital goods rose 0.2% in July, while intermediate goods prices increased 0.7%.

-

14:46

Final consumer prices in Italy increase 0.2% in August

The Italian statistical office Istat released its final consumer price inflation data for Italy on Monday. Final consumer prices in Italy increased 0.2% in August, in line with the preliminary reading, after a 0.1% decline in July.

The rise was mainly driven by a lower fall in energy (-1.3%) and higher services costs (+0.6%).

On a yearly basis, consumer prices climbed 0.2% in August, in line with the preliminary reading, after a 0.2% increase in July.

The annual inflation was driven by an increase in prices of some services.

-

14:16

Foreign exchange market. European session: the euro traded lower against the U.S. dollar despite the better-than-expected economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

04:30 Japan Tertiary Industry Index July 0.3% 0.2%

04:30 Japan Industrial Production (YoY) (Finally) July 2.3% 0.2% 0.0%

04:30 Japan Industrial Production (MoM) (Finally) July 1.1% -0.6% -0.8%

07:15 Switzerland Producer & Import Prices, m/m August -0.3% -0.7%

07:15 Switzerland Producer & Import Prices, y/y August -6.4% -6.8%

07:15 Switzerland Retail Sales (MoM) July 1.4% -0.6%

07:15 Switzerland Retail Sales Y/Y July -0.9% -0.1%

09:00 Eurozone Industrial production, (MoM) July -0.3% Revised From -0.4% 0.3% 0.6%

09:00 Eurozone Industrial Production (YoY) July 1.5% Revised From 1.2% 0.6% 1.9%

The U.S. dollar traded higher against the most major currencies in the absence of of any U.S. economic data today.

The euro traded lower against the U.S. dollar despite the better-than-expected economic data from the Eurozone. Eurostat released its industrial production data for the Eurozone on Monday. Industrial production in the Eurozone rose 0.6% in July, exceeding expectations for a 0.3% increase, after a 0.3% drop in June. June's figure was revised up from a 0.4%.

The increase was driven by a rise in energy, durable consumer goods and capital output. Energy output climbed 3.0% in July, durable consumer goods were up 1.3%, while capital goods output rose by 1.4%.

Intermediate goods declined by 0.6% in July, while non-durable consumer goods output fell 0.6%.

On a yearly basis, Eurozone's industrial production gained 1.9% in July, exceeding expectations for a 0.6% rise, after a 1.5% increase in June.

The increase was driven by a rise in durable consumer goods, capital goods and energy output. Durable consumer goods climbed by 2.6% in July from a year ago, capital goods rose by 2.2%, while energy output gained by 5.1%.

Non-durable consumer goods were up by 1.7%, while intermediate output was up by 0.5%.

The British pound traded lower against the U.S. dollar in the absence of any major economic reports from the U.K.

The Swiss franc traded lower against the U.S. dollar after the weak economic data from Switzerland. Retail sales in Switzerland declined at an annual rate of 0.1% in July, after a 0.9% drop in June.

Sales of food, beverages and tobacco fell at an annual rate of 0.6% in July, while non-food sales dropped 2.7%.

On a monthly basis, retail sales fell by 0.6% in July, after a 1.4% increase in June.

Sales of food, beverages and tobacco were down 0.4% in July, while non-food sales decreased 1.0%.

Switzerland's producer and import prices fell 0.7% in August, after a 0.3% drop in July.

The decline was mainly driven by lower prices for chemical and pharmaceutical products.

On a yearly basis, producer and import prices plunged 6.8% in August, after a 6.4% drop in July. It was the biggest drop since April 1950.

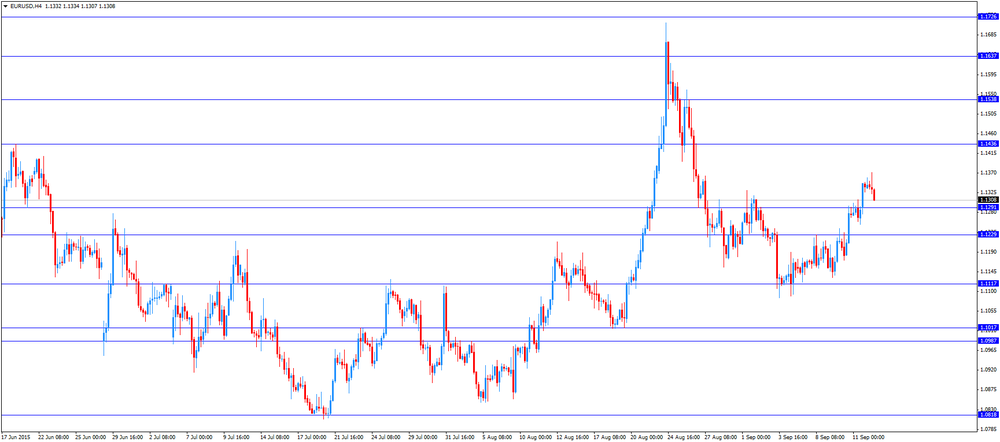

EUR/USD: the currency pair fell to $1.1307

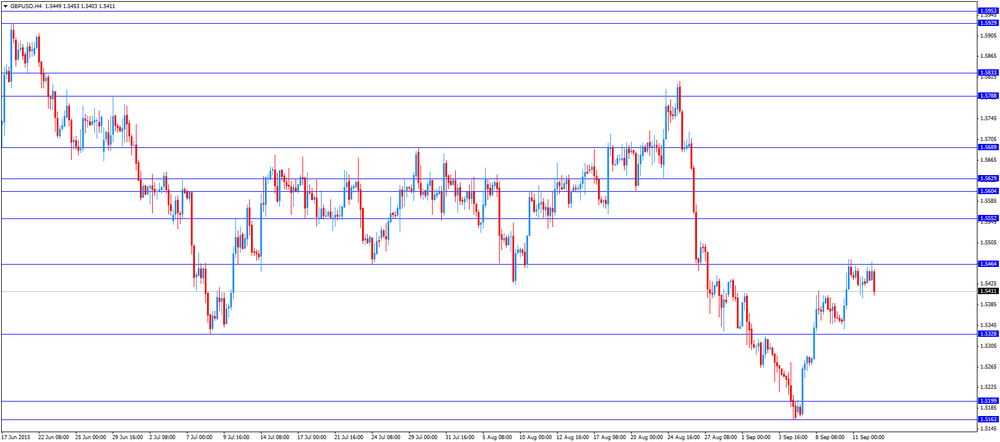

GBP/USD: the currency pair declined to $1.5403

USD/JPY: the currency pair rose to Y120.43

-

14:00

Orders

EUR/USD

Offers 1.1355-60 1.1370-75 1.1390-1.1400 1.1420 1.1450

Bids 1.1320 1.1300 1.1285 1.1265-70 1.1250 1.1225 1.1200

GBP/USD

Offers 1.5480 1.5500-10 1.5530 1.5550 1.5585 1.5600 1.5630 1.5650

Bids 1.5450 1.5425-30 1.5400 1.5380 1.5350 1.5330 1.5320 1.5300

EUR/GBP

Offers 0.7355-60 0.7380-85 0.7400 0.7425 0.7450

Bids 0.7320-25 0.7300 0.7295-0.7300 0.7280 0.7260-65 0.7250

EUR/JPY

Offers 136.60 136.80 137.00 137.50 137.80 138.00

Bids 136.20 136.00 135.80 135.50 135.00 134.80-85 134.65 134.50

USD/JPY

Offers 120.50 120.80 121.00 121.20 121.35 121.50 121.80 122.00

Bids 120.00 119.80-85 119.50 119.30 119.00 118.85 118.50

Offers 0.7120-25 0.7150 0.7180 0.7200

Bids 0.7045-50 0.7020 0.7000 0.6980-85 0.6965 0.6950

-

11:43

Swiss retail sales fall 0.6% in July

The Federal Statistical Office released its retail sales data for Switzerland on Monday. Retail sales in Switzerland declined at an annual rate of 0.1% in July, after a 0.9% drop in June.

Sales of food, beverages and tobacco fell at an annual rate of 0.6% in July, while non-food sales dropped 2.7%.

On a monthly basis, retail sales fell by 0.6% in July, after a 1.4% increase in June.

Sales of food, beverages and tobacco were down 0.4% in July, while non-food sales decreased 1.0%.

-

11:34

Switzerland's producer and import prices fall 0.7% in August

The Federal Statistical Office released its producer and import prices data on Monday. Switzerland's producer and import prices fell 0.7% in August, after a 0.3% drop in July.

The decline was mainly driven by lower prices for chemical and pharmaceutical products.

The Import Price Index decreased by 1.0% in August, while producer prices fell 0.6%.

On a yearly basis, producer and import prices plunged 6.8% in August, after a 6.4% drop in July. It was the biggest drop since April 1950.

The Import Price Index fell by 11.2% year-on year in August, while producer prices dropped 4.8%.

-

11:22

Eurozone’s industrial production rises in July

Eurostat released its industrial production data for the Eurozone on Monday. Industrial production in the Eurozone rose 0.6% in July, exceeding expectations for a 0.3% increase, after a 0.3% drop in June. June's figure was revised up from a 0.4%.

The increase was driven by a rise in energy, durable consumer goods and capital output. Energy output climbed 3.0% in July, durable consumer goods were up 1.3%, while capital goods output rose by 1.4%.

Intermediate goods declined by 0.6% in July, while non-durable consumer goods output fell 0.6%.

On a yearly basis, Eurozone's industrial production gained 1.9% in July, exceeding expectations for a 0.6% rise, after a 1.5% increase in June.

The increase was driven by a rise in durable consumer goods, capital goods and energy output. Durable consumer goods climbed by 2.6% in July from a year ago, capital goods rose by 2.2%, while energy output gained by 5.1%.

Non-durable consumer goods were up by 1.7%, while intermediate output was up by 0.5%.

-

11:00

Eurozone: Industrial production, (MoM), July 0.6% (forecast 0.3%)

-

11:00

Eurozone: Industrial Production (YoY), July 1.9% (forecast 0.6%)

-

10:54

European Central Bank Executive Board member Benoit Coeure: the economy in the Eurozone is too weak to create enough jobs

The European Central Bank (ECB) Executive Board member Benoit Coeure said in an interview on Friday that the economy in the Eurozone is too weak to create enough jobs.

"Growth is still not strong enough to create a sufficient number of jobs. When inflation is weak, the best way to bring it up to the 2 percent objective is to support economic activity," he said.

Coeure pointed out that growth and employment are very important for price stability.

-

10:50

Standard & Poor's affirms Greece's sovereign debt rating at CCC+

The rating agency Standard & Poor's on Friday affirmed Greece's sovereign debt rating at CCC+. The outlook remained stable.

The agency warned that it will downgrades the country's rating if the government does not implement reforms.

"We could lower the ratings on Greece if the new government cannot implement the reforms it has agreed to in the Memorandum of Understanding signed with the European Commission," Standard & Poor's said.

Greece will elect the new parliament on September 20.

The agency expect the Greece's economy to contract 3% this year.

-

10:22

U.S. budget deficit falls to $64.4 billion in August

The U.S. Treasury Department released its federal budget data on Friday. The budget deficit decreased to $64.4 billion in August, down from a deficit of $149.2 billion in July.

The budget deficit declined due to shifts in the timing of certain benefit payments.

In the first 11 months of the fiscal year 2015, which ends at September this year, the budget deficit totalled $530 billion, 10% lower than a year ago.

-

10:12

The Wall Street Journal survey: about 46% of economists expect the Fed to start raising its interest rate in September

According to The Wall Street Journal survey, about 46% of economists expect the Fed to start raising its interest rate in September. About 9.5% expect that the Fed would raise its interest in October, 35% said the Fed would wait until December, while 9.5% expect that the Fed will start raising its interest rate in 2016.

82% of economists expected last month that the Fed to start raising its interest rate in September, while 13% expected the first interest rate hike in December.

-

09:31

Switzerland: Retail Sales Y/Y, July -0.1%

-

09:17

Switzerland: Retail Sales (MoM), July -0.6%

-

09:15

Switzerland: Producer & Import Prices, y/y, August -6.8%

-

09:15

Switzerland: Producer & Import Prices, m/m, August -0.7%

-

08:31

Foreign exchange market. Asian session: the yen gained

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

04:30 Japan Tertiary Industry Index July 0.3% 0.2%

04:30 Japan Industrial Production (YoY) (Finally) July 2.3% 0.2% 0.0%

04:30 Japan Industrial Production (MoM) (Finally) July 1.1% -0.6% -0.8%

The yen advanced against the U.S. dollar after demand for this safe-haven currency had grown amid data on the Chinese economy. The National Bureau of Statistics of China reported on Sunday that the country's industrial production rose by 6.1% y/y in August vs 6.4% expected and 6.0% previous. Meanwhile retail sales exceeded expectations and rose by 10.5% y/y in the same month. Fixed asset investment rose by 10.9% y/y in the first eight months of the current year, which is below expectations for an 11.1% growth and the previous reading of 11.2%.

Federal Open Market Committee meeting will be this week's key event. A survey by the Wall Street Journal showed that approximately 46% of the economists surveyed last week expect the Fed to raise rates in September. 35% of economists said the Fed would raise rates in December and 9.5% said they expect a liftoff in 2016.

The New Zealand dollar managed to recover early losses amid Prime Minister John Key speech. He said that the government is always ready to respond to economic slowdown. Last week John Key sounded very optimistic about the country's economy.

EUR/USD: the pair fluctuated within $1.1335-60 in Asian trade

USD/JPY: the pair fell to Y120.25

GBP/USD: the pair traded within $1.5425-55

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:15 Switzerland Producer & Import Prices, m/m August -0.3%

07:15 Switzerland Producer & Import Prices, y/y August -6.4%

07:15 Switzerland Retail Sales (MoM) July 1.4%

07:15 Switzerland Retail Sales Y/Y July -0.9%

09:00 Eurozone Industrial production, (MoM) July -0.4% 0.3%

09:00 Eurozone Industrial Production (YoY) July 1.2% 0.6%

-

08:15

Options levels on monday, September 14, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1475 (1570)

$1.1436 (1266)

$1.1397 (530)

Price at time of writing this review: $1.1348

Support levels (open interest**, contracts):

$1.1249 (429)

$1.1204 (949)

$1.1148 (2253)

Comments:

- Overall open interest on the CALL options with the expiration date October, 9 is 48412 contracts, with the maximum number of contracts with strike price $1,1500 (4293);

- Overall open interest on the PUT options with the expiration date October, 9 is 63303 contracts, with the maximum number of contracts with strike price $1,1000 (5976);

- The ratio of PUT/CALL was 1.31 versus 1.30 from the previous trading day according to data from September, 11

GBP/USD

Resistance levels (open interest**, contracts)

$1.5704 (1257)

$1.5606 (1289)

$1.5510 (1694)

Price at time of writing this review: $1.5448

Support levels (open interest**, contracts):

$1.5387 (882)

$1.5292 (1153)

$1.5194 (2728)

Comments:

- Overall open interest on the CALL options with the expiration date October, 9 is 20188 contracts, with the maximum number of contracts with strike price $1,5500 (1694);

- Overall open interest on the PUT options with the expiration date October, 9 is 19826 contracts, with the maximum number of contracts with strike price $1,5200 (2728);

- The ratio of PUT/CALL was 0.98 versus 0.91 from the previous trading day according to data from September, 11

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

06:32

Japan: Tertiary Industry Index , July 0.2%

-

00:28

Currencies. Daily history for Sep 11’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1338 +0,56%

GBP/USD $1,5426 -0,11%

USD/CHF Chf0,969 -0,42%

USD/JPY Y120,57 -0,09%

EUR/JPY Y136,68 +0,44%

GBP/JPY Y186,02 -0,19%

AUD/USD $0,7089 +0,23%

NZD/USD $0,6314 +0,30%

USD/CAD C$1,3264 +0,20%

-