Noticias del mercado

-

17:40

Oil prices decline on concerns over the global oil oversupply

Oil prices declined on concerns over the global oil oversupply. The Organization of the Petroleum Exporting Countries (OPEC) released its monthly report on Monday. OPEC said that its oil production was 31.54 million barrels a day of crude in August, higher than in July. The target is 30 million barrels a day.

OPEC expects the oil demand for its crude to be average 30.31 million barrels per day (bpd) next year, up 190,000 bpd from last month.

OPEC expects that non-OPEC members will rise their output by 160,000 bpd next year, down 110,000 bpd from last month, while U.S. shale oil production was downgraded by 100,000 bpd.

Global oil demand growth is expected to be 1.29 million bpd in 2016, down 50,000 bpd from last month.

The oil driller Baker Hughes reported on Friday that the number of active U.S. rigs declined by 10 rigs to 652 last week. It was the second consecutive decrease.

Combined oil and gas rigs fell by 16 to 848.

Earlier last week, Baker Hughes said that the average total rig count declined by 17 to 883 in August from July.

WTI crude oil for October delivery fell to $43.81 a barrel on the New York Mercantile Exchange.

Brent crude oil for October declined to $47.13 a barrel on ICE Futures Europe.

-

17:22

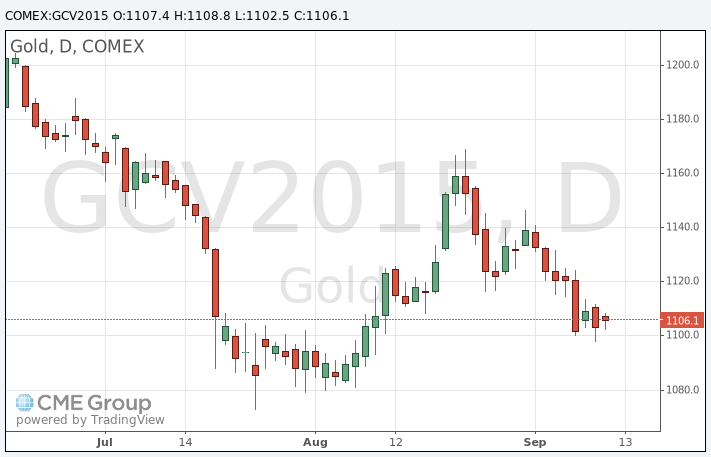

Gold price declines slightly

Gold price fell on the uncertainty over the Fed's interest rate hike continue to weigh on gold. It remains unclear if the Fed will start raising its interest rate in September or not.

The U.S. economic data was mixed in the recent weeks. The labour market continued to strengthen, while the inflation and wage growth remained low.

Gold is traded in U.S. dollars. It suffers when the U.S. dollar strengthens, becoming more expensive for holders of other currencies.

October futures for gold on the COMEX today fell to 1102.50 dollars per ounce.

-

16:15

OPEC expects higher demand for its oil in 2016

The Organization of the Petroleum Exporting Countries (OPEC) released its monthly report on Monday. OPEC expects the oil demand for its crude to be average 30.31 million barrels per day (bpd) next year, up 190,000 bpd from last month.

"Despite moderate economic growth, recent data shows better-than-expected oil-demand in the main consuming countries. At the same time, U.S. oil production has shown signs of slowing. This could contribute to a reduction in the imbalance of oil market fundamentals, however, it remains to be seen to what extent this can be achieved in the months to come," OPEC said.

OPEC expects that non-OPEC members will rise their output by 160,000 bpd next year, down 110,000 bpd from last month, while U.S. shale oil production was downgraded by 100,000 bpd.

Global oil demand growth is expected to be 1.29 million bpd in 2016, down 50,000 bpd from last month.

-

10:34

The number of active U.S. rigs declined by 10 rigs to 652 last week

The oil driller Baker Hughes reported on Friday that the number of active U.S. rigs declined by 10 rigs to 652 last week. It was the second consecutive decrease.

Combined oil and gas rigs fell by 16 to 848.

Earlier last week, Baker Hughes said that the average total rig count declined by 17 to 883 in August from July.

-

10:12

The Wall Street Journal survey: about 46% of economists expect the Fed to start raising its interest rate in September

According to The Wall Street Journal survey, about 46% of economists expect the Fed to start raising its interest rate in September. About 9.5% expect that the Fed would raise its interest in October, 35% said the Fed would wait until December, while 9.5% expect that the Fed will start raising its interest rate in 2016.

82% of economists expected last month that the Fed to start raising its interest rate in September, while 13% expected the first interest rate hike in December.

-

08:53

Oil prices declined

West Texas Intermediate futures for October delivery slid to $44.51 (-0.27%), while Brent crude fell to $47.74 (-0.83%) amid weak demand.

The International Energy Agency said on Friday that the number of drilling rigs in the U.S. fell by 10 to 652 last week. The agency noted that persistent production cuts could rebalance the market in 2016. Nevertheless now oil oversupply and declines in global car sales (-1.0% y/y in August) continue to weigh on prices.

Kuwait set its October Official Selling Price for crude to Asia 60 cents below its September level. OPEC's monthly market report will be published later today.

Traders are also waiting for a Federal Reserve's policymaking meeting this week.

-

08:38

Gold steady ahead of Federal Reserve meeting

Gold is currently at $1,107.40 (+0.37%) near a one-month low as investors await a Federal Reserve meeting later this week. The central bank will announce its interest rate decision on Thursday. Uncertainty regarding forecasts for the result of the meeting persists and may weigh on prices, although bullion is unlikely to choose a direction before the decision is known.

Concerns over China's economy, mixed economic data and turmoil in stock markets have intensified doubts about the probability of a rate hike in the U.S. this month. Preliminary Reuters/Michigan Consumer Sentiment Index, which reflects consumer confidence in the U.S., fell to 85.7 in September from 91.9 reported previously, while economists had expected a moderate decline to 91.2.

-

00:31

Commodities. Daily history for Sep 11’2015:

(raw materials / closing price /% change)

Oil 44.7 8+0.34%

Gold 1,107.90 +0.42%

-