Noticias del mercado

-

17:46

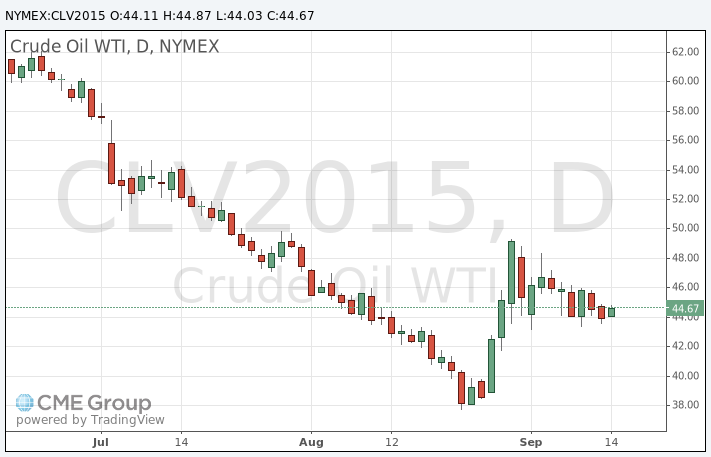

Oil prices increase slightly on signs that the oil output in the U.S. will decline

Oil prices rose slightly on signs that the oil output in the U.S. will decline. The U.S. Energy Information Administration (EIA) said on Monday that shale oil output is likely to decrease by 80,000 barrels a day by next month.

Market participants are awaiting the release of U.S. crude oil inventories data. The American Petroleum Institute (API) is scheduled to release its U.S. oil inventories data later in the day, and U.S. oil inventories data from the U.S. Energy Information Administration is expected on Wednesday.

WTI crude oil for October delivery rose to $44.87 a barrel on the New York Mercantile Exchange.

Brent crude oil for October rose to $46.70 a barrel on ICE Futures Europe.

-

17:22

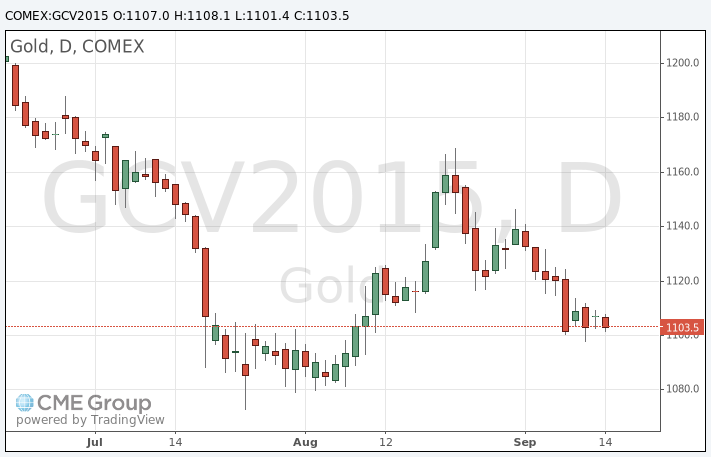

Gold price falls due to a stronger U.S. dollar

Gold price declined due to a stronger U.S. dollar and as the uncertainty over the Fed's interest rate hike continue to weigh on gold. It remains unclear if the Fed will start raising its interest rate in September or not.

The U.S. economic data was mixed in the recent weeks. The labour market continued to strengthen, while the inflation and wage growth remained low.

Gold is traded in U.S. dollars. It suffers when the U.S. dollar strengthens, becoming more expensive for holders of other currencies.

Gold price could be supported by concerns over the slowdown in the Chinese economy.

October futures for gold on the COMEX today fell to 1101.40 dollars per ounce.

-

10:21

Fitch Ratings: the interest rate hike by the Fed could have a negative impact on emerging economies

Fitch Ratings said in its report "Fed Lift-off Matters for Emerging Markets" that the interest rate hike by the Fed could have a negative impact on emerging economies, despite the fact that the Fed's interest rate hike is widely expected.

"Part of the rationale for ultra-loose monetary policies from global central banks has been to depress risk and term premiums via a portfolio-rebalancing effect. This is consistent with the emergence of pressure on emerging markets as Fed lift-off approaches," Fitch said.

The agency noted that the future path of interest rate hikes remains unclear and that "an outcome closer to the Fed's guidance could be a significant shock".

-

10:11

Chinese government seizes up to 1 trillion yuan from local governments who did not spend their budget

Sources that are close to the government said that the Chinese government seized up to 1 trillion yuan ($157 billion) from local governments who did not spend their budget to stimulate the country's growth. The money should be used for other investments.

"Investments were not realised, and the money will be reallocated," the source said.

-

09:01

Oil prices advanced slightly

West Texas Intermediate futures for October delivery climbed to $44.16 (+0.36%), while Brent crude is currently at $47.37 (+0.04%). Analysts said that these modest gains matched today's mixed Asian session, although generally demand remained weak and supply continued to be excessive.

Venezuela's president Nicolas Maduro repeated his request for a meeting with representatives of other members of the Organization of the Petroleum Exporting Countries saying he would present proposals to boost oil prices to the group. However OPEC members from the Middle East have so far pledged to keep output high trying to defend market share against rising competition.

-

08:44

Gold steady ahead of Federal Reserve meeting

Gold is flat. It is currently at $1,107.40 (-0.03%) near a one-month low as investors await a Federal Reserve meeting, which starts on Wednesday. The central bank will announce its interest rate decision on Thursday. Uncertainty regarding forecasts for the result of the meeting persists and may weigh on prices, although bullion is unlikely to choose a direction before the decision is known.

At the same time some analysts say that even if the Fed does not lift rates this week, this does not mean that the situation changed significantly as the Fed may take this step at the next meeting. That's why investors are likely to remain generally cautious.

-

00:32

Commodities. Daily history for Sep 14’2015:

(raw materials / closing price /% change)

Oil 44.12 +0.27%

Gold 1,107.60 -0.01%

-