Noticias del mercado

-

17:39

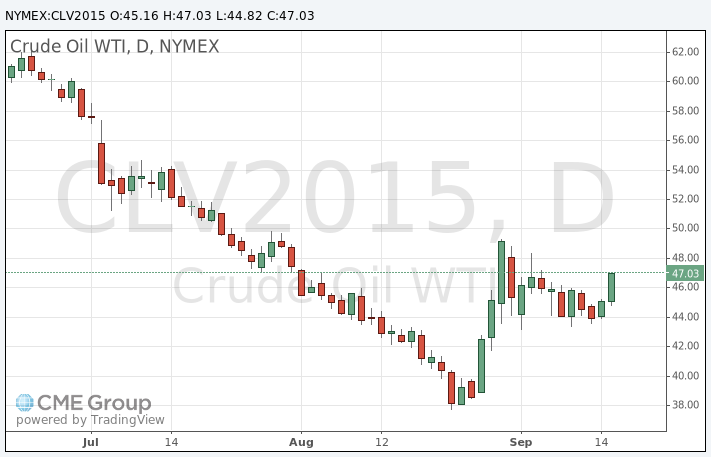

Oil prices increase on U.S. crude oil inventories data

Oil prices climbed as U.S. crude oil inventories declined last week. The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Wednesday. U.S. crude inventories fell by 2.1 million barrels to 455.9 million in the week to September 11.

Analysts had expected U.S. crude oil inventories to remain unchanged.

Gasoline inventories increased by 2.8 million barrels, according to the EIA.

Crude stocks at the Cushing, Oklahoma, declined by 1.906 million barrels. It was the biggest weekly decline since February 2014.

U.S. crude oil imports fell by 270,000 barrels per day.

Refineries in the U.S. were running at 93.1% of capacity, up from 90.9% the previous week.

WTI crude oil for October delivery rose to $47.25 a barrel on the New York Mercantile Exchange.

Brent crude oil for October increased to $49.39 a barrel on ICE Futures Europe.

-

17:20

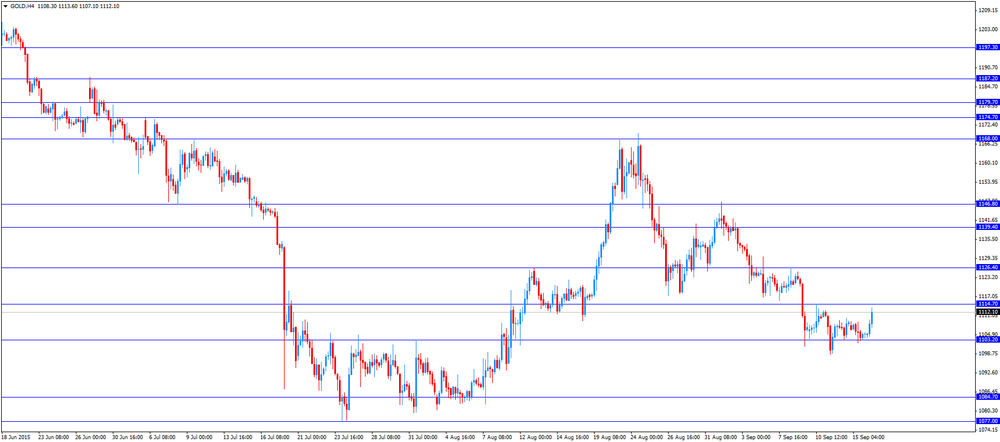

Gold price rises due to a weaker U.S. dollar

Gold price increased due to a weaker U.S. dollar. The greenback declined against other currencies after the release of the weak U.S. consumer price inflation data. The U.S. consumer price inflation fell 0.1% in August, missing expectations for a flat reading, after a 0.1% gain in July.

The decrease was partly driven by lower gasoline prices. Gasoline prices dropped 4.1% in August. It was the biggest decline since January.

Food prices increased 0.2% in August.

On a yearly basis, the U.S. consumer price index remained unchanged at 0.2% in August, in line with expectations.

The U.S. consumer price inflation excluding food and energy gained 0.1% in August, in line with expectations, after a 0.1% increase in July.

On a yearly basis, the U.S. consumer price index excluding food and energy remained unchanged at 1.8% in August, missing expectations for a rise to 1.9%.

The inflation remains low due to a weak wage growth and a stronger U.S. dollar.

Market participants are awaiting the release of the Fed's interest rate decision. The Fed's monetary policy meeting will start today. The results are scheduled to be released tomorrow at 18:00 GMT. According to analysts' forecasts, the Fed will not raise its interest rate in September due to concerns over a slowdown in the global economy and low inflationary expectations in the U.S.

October futures for gold on the COMEX today rise to 1119.70 dollars per ounce.

-

16:56

U.S. crude inventories decline by 2.1 million barrels to 455.9 million in the week to September 11

The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Wednesday. U.S. crude inventories fell by 2.1 million barrels to 455.9 million in the week to September 11.

Analysts had expected U.S. crude oil inventories to remain unchanged.

Gasoline inventories increased by 2.8 million barrels, according to the EIA.

Crude stocks at the Cushing, Oklahoma, declined by 1.906 million barrels. It was the biggest weekly decline since February 2014.

U.S. crude oil imports fell by 270,000 barrels per day.

Refineries in the U.S. were running at 93.1% of capacity, up from 90.9% the previous week.

-

14:43

-

10:21

House Republicans plan to vote on a bill that would lift the ban on crude oil exports

House Republicans plan to vote on a bill that would lift the ban on crude oil exports. The vote is being scheduled for the last week of September.

The White House does not want to back lifting the ban. White House press secretary Josh Earnest noted the Commerce Department should decide on the ban.

-

08:46

Oil prices advanced slightly

West Texas Intermediate futures for October delivery climbed to $44.89 (+0.67%), while Brent crude is currently at $47.85 (+0.21%). Both crudes advanced, but gains are likely to be limited as investors await the result of the Federal Reserve's meeting.

An increase in U.S. interest rates will boost the greenback but would likely weigh oil prices by making crude more expensive for foreign importers using other currencies.

Yesterday the American Petroleum Institute reported a 3.1-million-barrel decline in U.S. commercial oil inventories last week, a positive factor for oil prices. The U.S. Energy Information Administration will release its closely-watched data later today. Pricing agency Platts expects U.S. crude oil stocks to fall by 200,000 barrels.

-

08:32

Gold steady ahead of Federal Reserve meeting

Gold is flat. It is currently at $1,104.70 (+0.19%) near a one-month low as investors await a Federal Reserve meeting, which starts on Wednesday. The central bank will announce its interest rate decision on Thursday. Higher rates would harm the non-interest bearing precious metal.

A survey by the Wall Street Journal showed that approximately 46% of the economists surveyed last week expect the Fed to raise rates in September. 35% of economists said the Fed would raise rates in December and 9.5% said they expect a liftoff in 2016. At the same time Barclays surveyed 700 investors last week and only 36% of the respondents believe that the Central bank of the U.S. will raise rates in September.

-

00:36

Commodities. Daily history for Sep 15’2015:

(raw materials / closing price /% change)

Oil 45.15 +1.26%

Gold 1,104.30 +0.15%

-