Noticias del mercado

-

17:43

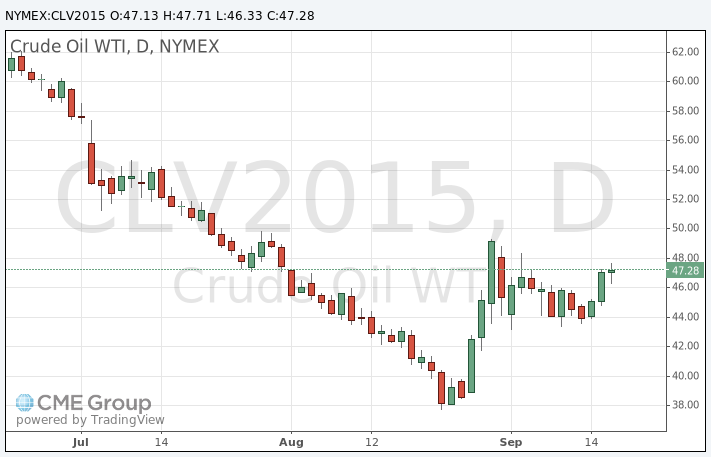

WTI crude rises ahead the Fed’s interest rate decision, while Brent crude oil declines

WTI crude oil rose ahead the Fed's interest rate decision, while Brent crude oil declined. The U.S. oil was supported by the initial jobless claims data. The number of initial jobless claims in the week ending September 12 in the U.S. declined by 11,000 to 264,000 from 275,000 in the previous week. Analysts had expected the initial jobless claims to remain unchanged at 275,000.

Yesterday's U.S. oil inventories data also supported WTI crude oil. U.S. crude inventories fell by 2.1 million barrels to 455.9 million in the week to September 11.

Concerns over the slowdown in the economy in Asia weighed on Brent crude. The Ministry of Finance released its trade data for Japan on the late Wednesday evening. Japan's trade deficit widened to ¥569.7 billion in August from a deficit of ¥268.1 billion in July. Analysts had expected a deficit of ¥541.3 billion.

Exports rose 3.1% year-on-year, while imports dropped 3.1%

WTI crude oil for October delivery rose to $47.71 a barrel on the New York Mercantile Exchange.

Brent crude oil for October decreased to $49.65 a barrel on ICE Futures Europe.

-

17:24

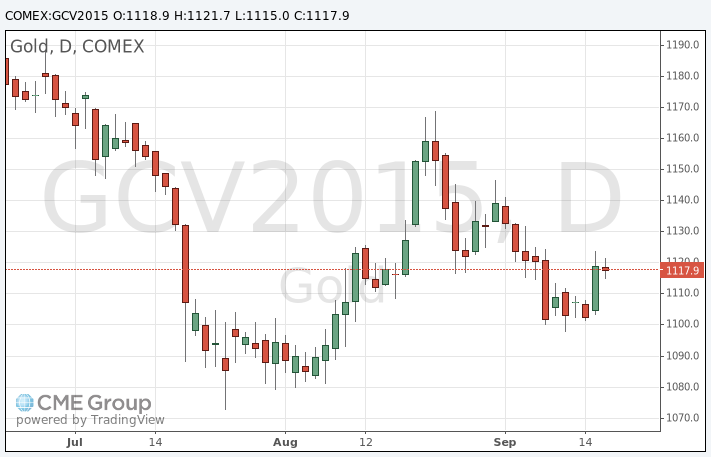

Gold price declines slightly ahead of the release of the Fed's interest rate decision

Gold price decreased slightly ahead of the release of the Fed's interest rate decision. The results are scheduled to be released tomorrow at 18:00 GMT. Market participants were cautious.

According to analysts' forecasts, the Fed will not raise its interest rate in September due to concerns over a slowdown in the global economy and low inflationary expectations in the U.S.

The interest rate hike by the Fed could weigh on gold price. Gold is traded in U.S. dollars. It suffers when the U.S. dollar strengthens, becoming more expensive for holders of other currencies.

October futures for gold on the COMEX today declined to 1114.90 dollars per ounce.

-

08:50

Oil prices advanced

West Texas Intermediate futures for October delivery climbed to $47.27 (+0.25%), while Brent crude rose to $50.09 (+0.68%) still supported by Energy Information Administration's data released yesterday. However gains are slowing as the focus returns to the Federal Reserve's two day meeting, which ends today.

Yesterday's report showed a 2.1 million barrel drop in U.S. crude inventories in the week to September 11 including a 1.9 million barrel decline at the Cushing trading hub.

Some analysts note that non-OPEC and non-U.S. supply started to decline as low prices weigh on producers. Output cuts would lead to a combined reduction of 400 million barrels per day by the end of the year, but the global glut would persist through 2016.

-

08:33

Gold climbed ahead of Federal Reserve meeting

Gold climbed to $1,119.50 (+0.04%) as weak inflation data from the U.S. eased concerns about a possible rate hike by the Federal Reserve today. Expectations that the central bank would raise rates this month had already declined due to recent concerns over China's economic slowdown and volatility in financial markets. However uncertainty persists. Higher rates could harm demand for non-interest-paying precious metal.

-

00:43

Commodities. Daily history for Sep 16’2015:

(raw materials / closing price /% change)

Oil 47.13 -0.04%

Gold 1,118.40 -0.05%

-