Noticias del mercado

-

17:34

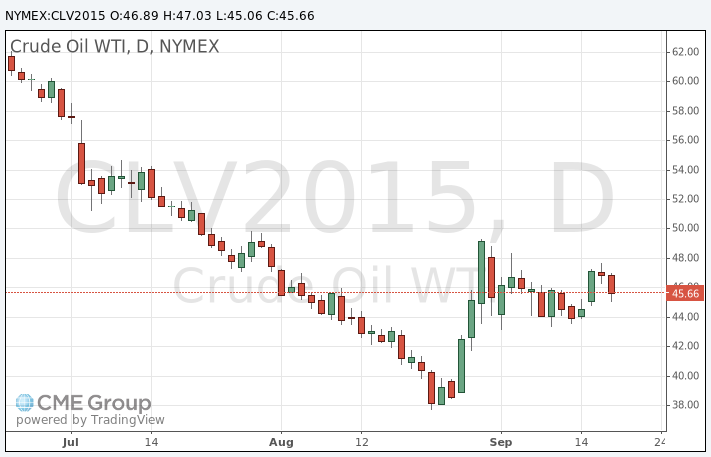

Oil prices fall on the Fed’s interest rate decision

Oil prices declined on the Fed's interest rate decision. The Fed kept its interest rate unchanged at 0.00%-0.25%.

The Fed took into account the slowdown in the global economy and low inflation expectations. That was the main reason to keep the monetary policy unchanged.

"Recent global economic and financial developments may restrain economic activity somewhat and are likely to put further downward pressure on inflation in the near term," the Fed said.

The Fed's decision led to a weaker U.S. dollar. Oil prices are traded in U.S. dollars. A weaker U.S. dollar leads to higher demand in oil and to higher oil prices. But oil prices today declined despite this fact.

Russian Deputy Energy Minister Alexei Teksler said on Friday that Russia will cut its oil output if the oil price declines below $40 a barrel.

"If the price falls below $40 per barrel, then we, most likely, would be faced with a production decline," he said.

Teksler noted that oil companies have to adjust their models if oil is persistently below $45 a barrel.

"With a price of $40-$45 per barrel, the companies will revise their models, if the low price persists long term. Previously approved models would stop working efficiently," he said.

Market participants are awaiting the release of the number of active U.S. rigs later in the day. The oil driller Baker Hughes reported that the number of active U.S. rigs declined by 10 rigs to 652 last week.

WTI crude oil for October delivery declined to $45.06 a barrel on the New York Mercantile Exchange.

Brent crude oil for October decreased to $48.00 a barrel on ICE Futures Europe.

-

17:22

Gold price rises as the Fed kept its monetary policy unchanged

Gold price rose as the Fed kept its monetary policy unchanged. The Fed kept its interest rate unchanged at 0.00%-0.25%.

The Fed took into account the slowdown in the global economy and low inflation expectations. That was the main reason to keep the monetary policy unchanged.

"Recent global economic and financial developments may restrain economic activity somewhat and are likely to put further downward pressure on inflation in the near term," the Fed said.

Gold is traded in U.S. dollars. It suffers when the U.S. dollar strengthens, becoming more expensive for holders of other currencies.

October futures for gold on the COMEX today climbed to 1141.60 dollars per ounce.

-

16:50

Russian Deputy Energy Minister Alexei Teksler: Russia will cut its oil output if the oil price declines below $40 a barrel

Russian Deputy Energy Minister Alexei Teksler said on Friday that Russia will cut its oil output if the oil price declines below $40 a barrel.

"If the price falls below $40 per barrel, then we, most likely, would be faced with a production decline," he said.

Teksler noted that oil companies have to adjust their models if oil is persistently below $45 a barrel.

"With a price of $40-$45 per barrel, the companies will revise their models, if the low price persists long term. Previously approved models would stop working efficiently," he said.

-

10:54

The Fed keeps its monetary unchanged in September

The Fed released its interest rate decision on Thursday. The Fed kept its interest rate unchanged at 0.00%-0.25%. This decision was not unexpected.

The Fed took into account the slowdown in the global economy and low inflation expectations. That was the main reason to keep the monetary policy unchanged.

"Recent global economic and financial developments may restrain economic activity somewhat and are likely to put further downward pressure on inflation in the near term," the Fed said.

The accompanying statement and comments by the Fed Chairwoman Janet Yellen were more dovish than expected. The Fed did not announce any new guidelines on the terms of the first interest rate hike.

"When the Committee decides to begin to remove policy accommodation, it will take a balanced approach consistent with its longer-run goals of maximum employment and inflation of 2 percent," the Fed said.

The Fed pointed out that the pace of the interest rate hike will be slower than expected earlier once that the Fed starts raising its interest rates. GDP for 2016 and 2017 were downgraded.

The number of members awaiting the interest rates this year declined. 13 of 17 FOMC members are awaiting that the Fed starts raising its interest rates this year, down from 15 earlier.

FOMC members voted 9-1 to keep interest rates unchanged. Only Richmond Fed President Jeffrey Lacker voted to raise interest rate by 0.25%.

Yellen noted that the developments abroad had impact on the Fed's decision.

"The outlook abroad appears to have become less certain," she said, adding that the Fed "judged it appropriate to wait".

The Fed chairwoman pointed out that the interest rate hike in October is possible.

-

10:24

China plans to launch a crude oil futures contract this year

China plans to launch a crude oil futures contract this year. The new contract should be traded at the Shanghai International Energy Exchange (INE) and will be available to foreign investors. The contract will be priced and settled in yuan.

-

09:11

Oil prices declined

West Texas Intermediate futures for October delivery fell to $46.79 (-0.76%), while Brent crude slid to $48.86 (-0.45%) retreating from levels reached after the announcement of Fed's decision yesterday. Federal Reserve's policy makers voted to wait for more evidence of strength of the U.S. economy and kept interest rates unchanged. Normally low interest rates weigh on greenback and support this dollar-denominated commodity; however Fed's decision was based on economic concerns. That's why many analysts and investors remained concerned about global oil demand.

Kuwait said on Thursday that the oil market would balance itself as the time goes, signaling that OPEC intends to continue defending its market share.

Other sources said that oil prices are likely to rise by up to $5 a barrel a year and reach $80 by 2020.

-

00:31

Commodities. Daily history for Sep 17’2015:

(raw materials / closing price /% change)

Oil 46.900.00%

Gold 1,130.20 +1.18%

-