Noticias del mercado

-

20:20

American focus: the Canadian dollar fell

The Canadian dollar weakened against the US dollar after the release of data on inflation in Canada. Report submitted by Statistics Canada showed that the annual growth of consumer prices stabilized in August as lower gasoline prices offset the rise in the cost of other goods, such as food.

According to the data, annual inflation in the country amounted to 1.3 per cent in August, as in the previous month. It is worth emphasizing latest update in line with expectations of experts. Core inflation, which excludes volatile items, rose by 2.1 percent compared with growth of 2.4 percent at the end of July, which is also in line with expectations.

Recall, the Bank of Canada twice this year lowered interest rates to support the economy, which was in a mild recession in the first half of 2015. The Central Bank noted that the depreciation of the national currency and some industry factors will temporarily pressure

core inflation.

The report also stated that on an annual basis, prices rose in seven of the eight major categories of the general consumer price index. The cost of food rose by 3.6 percent compared to the previous year, showing a maximum increase among all groups. Meat prices soared by 6.3 percent, while gasoline prices fell by 12.6 per cent per annum.

Basic consumer price index rose by the Bank of Canada rose by 2.1 per cent per annum, after rising 2.4 percent in July. On a monthly basis index rose by 0.1 percent compared to 0.2 percent last month.

The euro lost ground against the previously-earned dollar today due to the ongoing dynamics of the market reaction to yesterday's Fed decision on rates. Also had little impact on the euro zone data. The European Central Bank said that the positive balance of payments euro zone fell in July, which was caused by the growth of the deficit of secondary income. According to the data, the current account surplus narrowed to 22.6 billion. Euros in July from 24.9 billion. Euros in June. The surplus in trade in goods rose to 26.9 billion. Euros from 26.6 billion. Euro in the previous month. However, the surplus in the trade in services fell to 3.6 bln. Euro 5.6 billion. Euros. In addition, it became known that the main income account surplus more than doubled - to 2.8 bln. Euro 1.2 billion. Euros and secondary income account deficit increased to 10.7 billion. Euro 8.4 billion. Euro in the previous month. In unadjusted basis, the current account surplus rose 33.8 billion. Euros in July from 30.6 billion. Euros in June. In the financial account, combined direct and portfolio investments, an increase was recorded at 22 billion. Euros in assets and a decrease of 66 billion. Euros in liabilities.

-

16:39

U.S. leading economic index increases 0.1% in August

The Conference Board released its leading economic index for the U.S. on Friday. The leading economic index increased by 0.1% in August, missing expectations a 0.2% gain, after a flat reading in July. July's figure was revised up from a 0.2% decrease.

Five of the ten indicators rose.

"Average working hours and new orders in manufacturing have been weak, pointing to more slow growth in the industrial sector. However, employment, personal income and manufacturing and trade sales have all been rising, helping to offset the weakness in industrial production in recent months," director of business cycles and growth research at The Conference Board, Ataman Ozyildirim, said.

-

16:00

U.S.: Leading Indicators , August 0.1% (forecast 0.2%)

-

15:50

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1200(E1.0bn), $1.1300(E1.2bn), $1.1400(E1.3bn),$1.1500(E1.7bn)

USD/JPY: Y120.00($500mn), Y120.50($500mn), Y121.00(829mn), Y122.00($865mn), Y122.25($751mn)

USD/CAD: Cad1.3000($1.0bn), Cad1.3200($1.35bn), Cad1.3300($467mn), Cad1.3400($700mn)

AUD/USD: $0.7000(A$722mn), $0.7200(A$830mn), $0.7300(A$693mn)

EUR/GBP: stg0.7200(E1.32bn)

NZD/USD: $0.6325(NZ1.0bn)

AUD/NZD: $1.1295(A$400mn)

-

15:47

Construction production in Italy rises 0.3% in July

The Italian statistical office Istat released its construction output data on Friday. Construction production in Italy was up at on a seasonally adjusted rate of 0.3% in July, after a 1.2% drop in June.

On a yearly basis, construction output declined at a calendar-adjusted rate of 0.6% in July, after a 0.8% rise in June.

-

15:29

European Central Bank Executive Board member Benoit Coeure: monetary policies of the Eurozone and the U.S. have different directions

The European Central Bank (ECB) Executive Board member Benoit Coeure said on Friday that monetary policies of the Eurozone and the U.S. have different directions.

"Whatever happens, and whatever the Fed's decision, the monetary trajectories in the euro zone and the United States are very different," he said.

Coeure also said that there is the downside risk to the global outlook.

He noted that the inflation and growth in the Eurozone are expected to be lower than previously expected.

Coeure pointed out that the central bank could extend its asset-buying programme if needed.

-

15:18

Bank of England Chief Economist Andrew Haldane: the central bank should lower its interest rate to boost inflation

The Bank of England Chief Economist Andrew Haldane said in a speech on Friday that the central bank should lower its interest rate to boost inflation.

"Were the downside risks I have discussed to materialise, there could be a need to loosen rather than tighten the monetary reins as a next step to support UK growth and return inflation to target," he said.

-

14:42

Canadian consumer price inflation is flat in August

Statistics Canada released consumer price inflation data on Friday. Canadian consumer price inflation was flat in August, in line with expectations, after a 0.1% gain in July.

On a yearly basis, the consumer price index remained unchanged at 1.3% in August, in line with expectations.

The consumer price index was partly driven by higher food prices. Food prices climbed 3.6% year-on-year in August, while household operations, furnishings and equipment prices increased 2.5%.

Alcoholic beverages and tobacco prices climbed by 2.8% in August from the same month a year earlier, while gasoline prices dropped 12.6%.

The Canadian core consumer price index, which excludes some volatile goods, rose 0.2% in August, after a flat reading in July.

On a yearly basis, core consumer price index in Canada was down to 2.1% in August from 2.4% in July, in line with expectations.

The Bank of Canada's inflation target is 2.0%.

-

14:30

Canada: Consumer Price Index m / m, August 0.0% (forecast 0%)

-

14:30

Canada: Bank of Canada Consumer Price Index Core, y/y, August 2.1% (forecast 2.1%)

-

14:30

Canada: Consumer price index, y/y, August 1.3% (forecast 1.3%)

-

14:29

Greek industrial turnover slides 15.4% in July

The Hellenic Statistical Authority released its preliminary industrial turnover data for Greece on Friday. Greek overall turnover index slid 15.4% year-on-year in July, after a 12.9% drop in June.

Domestic market turnover fell at an annual rate of 17.8% in July, while foreign market turnover plunged by 11.7%.

Turnover in the manufacturing sector declined at an annual rate of 15.2% in July, while mining and quarrying turnover dropped by 22.8%.

-

14:19

Italy’s current account surplus falls to €6.65 billion in July

The Bank of Italy released its current account data on Friday. Italy's current account surplus declined to €6.65 billion in July from €7.63 billion in July last year.

The goods trade surplus decreased to €6.43 billion in July from €7.42 billion in July last year. The services trade balance fell to a surplus of €1.22 billion from €1.27 billion.

The capital account surplus turned to a deficit of €95 million in July from a surplus of €195 million last year, while the financial account surplus rose to €11.6 billion from €4.27 billion.

-

14:13

Foreign exchange market. European session: the U.S. dollar traded lower against the most major currencies as the Fed’s interest rate decision weighed on the greenback

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

08:00 Eurozone Current account, unadjusted, bln July 30.6 33.8

11:05 United Kingdom MPC Member Andy Haldane Speaks

The U.S. dollar traded lower against the most major currencies ahead of the release of the U.S. leading indicators. The U.S. leading economic index is expected to climb by 0.2% in August, after a 0.2% decrease in July.

Yesterday's interest rate decision weighed on the greenback. The Fed kept its interest rate unchanged at 0.00%-0.25%.

The Fed took into account the slowdown in the global economy and low inflation expectations. That was the main reason to keep the monetary policy unchanged.

"Recent global economic and financial developments may restrain economic activity somewhat and are likely to put further downward pressure on inflation in the near term," the Fed said.

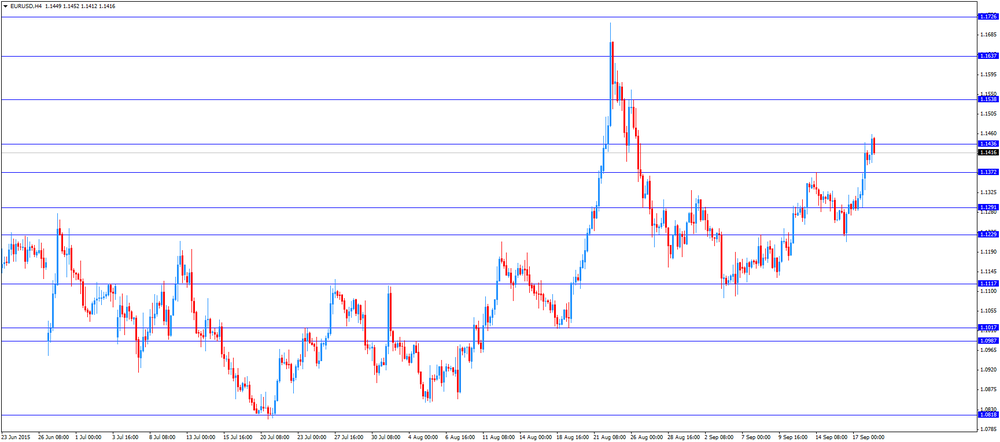

The euro traded higher against the U.S. dollar despite the slight decline in the Eurozone's current account surplus. Eurozone's current account surplus fell to a seasonally adjusted €22.6 billion in July from €24.9 billion in June. June's figure was revised down from a surplus of €25.4 billion.

The trade surplus rose to €26.9 billion in July from €26.6 billion in July, while primary income increased to €2.8 billion from €1.2 billion.

The surplus on services declined to €3.6 billion in July from €5.6 billion in June, while the secondary income increased to €10.7 billion from €8.4 billion.

Eurozone's unadjusted current account surplus soared to €33.3 billion in July from EUR 30.6 billion in June. June's figure was revised down from a surplus of €31.1 billion.

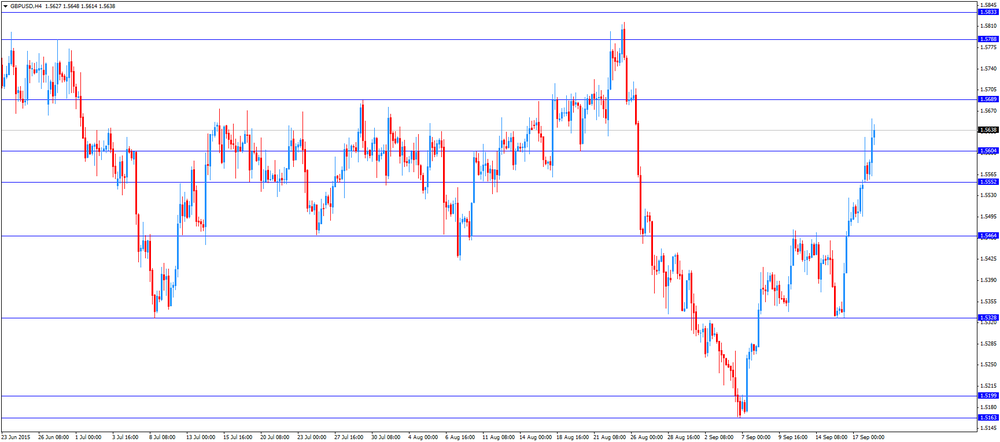

The British pound traded higher against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded higher against the U.S. dollar ahead of the release of the consumer price inflation data from Canada. The consumer price index in Canada is expected to remain unchanged at 1.3% year-on-year in August.

The core consumer price index in Canada is expected to decline to 2.1% year-on-year in August from 2.4% in July.

EUR/USD: the currency pair increased to $1.1459

GBP/USD: the currency pair rose to $1.5657

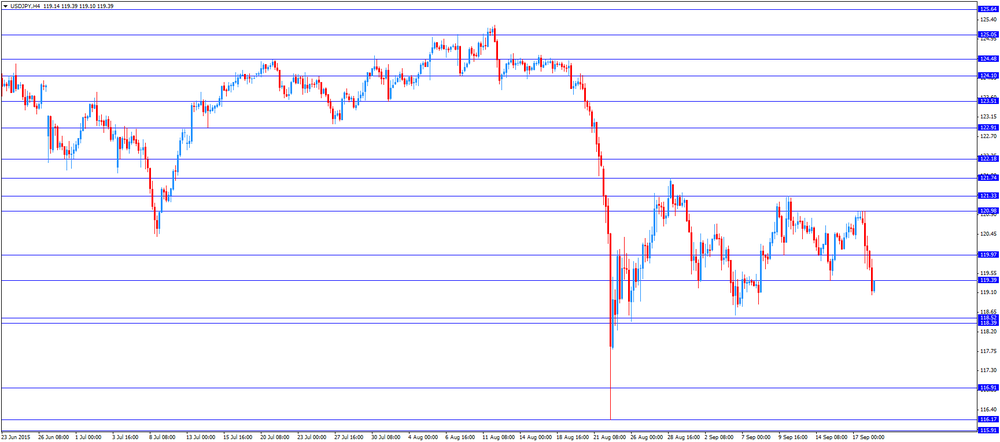

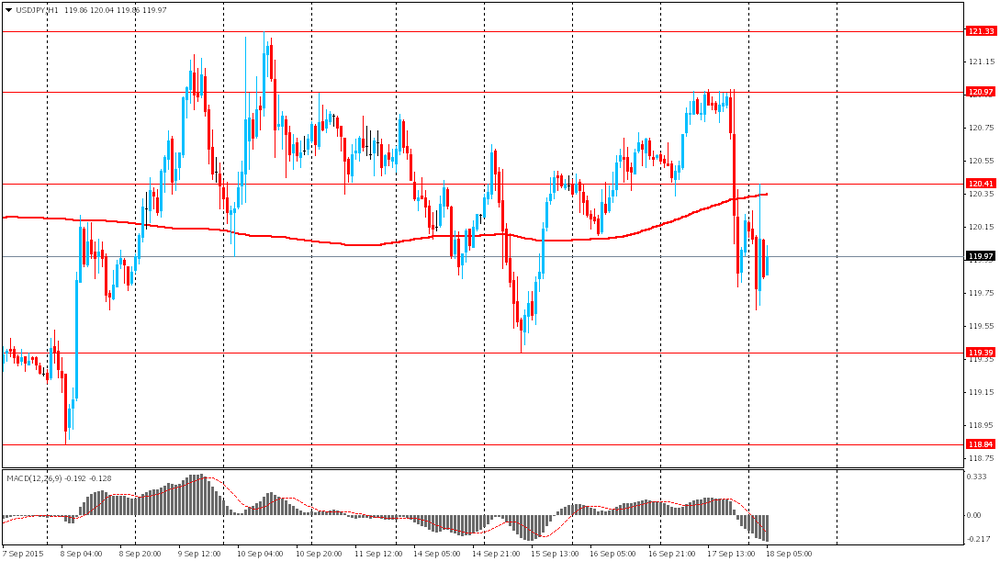

USD/JPY: the currency pair declined to Y119.05

The most important news that are expected (GMT0):

12:30 Canada Consumer Price Index m / m August 0.1% 0%

12:30 Canada Consumer price index, y/y August 1.3% 1.3%

12:30 Canada Bank of Canada Consumer Price Index Core, y/y August 2.4% 2.1%

14:00 U.S. Leading Indicators August -0.2% 0.2%

-

14:01

Orders

EUR/USD

Offers 1.1435 1.1450 1.1465 1.1480-85 1.1500 1.1520 1.1550

Bids 1.1395-1.1400 1.1380 1.1350 1.1330 1.1300 1.1285 1.1260 1.1245

GBP/USD

Offers 1.5600-05 1.5620 1.5650 1.5665-70 1.5685 1.5700-10 1.5725 1.5750

Bids 1.5550 1.5525-30 1.5500 1.5485 1.5465 1.5450 1.5425-30 1.5400 1.5380 1.5350 1.5330 1.5300

EUR/GBP

Offers 0.7350-55 0.7380-85 0.7400 0.7425 0.7450

Bids 0.7300 0.7285 0.7260-65 0.7250 0.7230 0.7200

EUR/JPY

Offers 136.75 136.90-137.00 137.30 137.50 137.75 138.00

Bids 136.20-25 136.00 135.80 135.50 135.25 135.00

USD/JPY

Offers 119.55-60 119.80 120.00 120.20 120.40 120.65 120.85 121.00

Bids 119.30 119.10 119.00 118.85 118.50 118.25-30 118.00

AUD/USD

Offers 0.7250 0.7265 0.7280 0.7300 0.7330 0.7350

Bids 0.7220 0.7200 0.7180 0.7155-60 0.7125-30 0.7100

-

11:53

Reserve Bank of Australia Glenn Stevens: the labour market in Australia seems to improve

The Reserve Bank of Australia Glenn Stevens said before the House of Representatives Standing Committee on Economics on late Thursday evening that a weaker Australian dollar begins to have a positive impact on the activity of companies, but the Australian economy expanded slower than expected.

The RBA governor noted that the labour market in Australia seems to improve.

"The labour force participation rate and the ratio of employment to population have both started to increase. The rate of unemployment, though variable from month to month, seems to have stopped rising," he said.

Stevens also said that resources sector exports rose strongly.

But he pointed out that the outlook depends on the global developments.

"Global factors will be important and the international setting continues to be a rather complex one. Since the last hearing, growth in the Chinese economy has continued to moderate. Growth in other parts of Asia was also weaker around the middle of the year. Reflecting these outcomes, forecasts for global growth over the period ahead are a little lower than they were six months ago," he said.

Stevens also said that the uncertainty over the Fed's is likely to weigh on the markets. But the RBA governor expects that the Fed will probably raise its interest rate before Christmas.

-

11:36

Bank of Japan’s August monetary policy meeting minutes: the country’s economy is expected to continue to recover moderately, but there are downside risks to the recovery

The Bank of Japan (BoJ) released its August monetary policy meeting minutes on late Thursday. According to minutes, the country's economy continued to recover.

Board members noted that there is the slowdown in emerging economies but the economies were likely to improve from a longer-term perspective.

Many board members wanted to monitor closely how Japan's exports could be effected by further slowdown in emerging economies, including China.

The central bank expects the country's economy to recover moderately.

"With regard to the outlook, Japan's economy is expected to continue recovering moderately. The year-on-year rate of increase in the CPI is likely to be about 0 percent for the time being, due to the effects of the decline in energy prices," the minutes said.

There are downside risks to the recovery in Japan from developments in emerging and commodity-driven economies as well as the debt problem and the momentum of economic activity and prices in Europe and the pace of recovery in the US. Economy, the minutes said.

Private consumption was resilient, while housing investment picked up, the central bank noted.

Minutes showed that the central bank wants to continue its monetary policy until the 2% inflation target will be reached, and it will adjust its monetary policy if needed.

The BoJ decided to keep unchanged its monetary policy at its August meeting.

-

11:06

Eurozone’s current account surplus falls to a seasonally adjusted €22.3 billion in July

The European Central Bank (ECB) released its current account on Friday. Eurozone's current account surplus fell to a seasonally adjusted €22.6 billion in July from €24.9 billion in June. June's figure was revised down from a surplus of €25.4 billion.

The trade surplus rose to €26.9 billion in July from €26.6 billion in July, while primary income increased to €2.8 billion from €1.2 billion.

The surplus on services declined to €3.6 billion in July from €5.6 billion in June, while the secondary income increased to €10.7 billion from €8.4 billion.

Eurozone's unadjusted current account surplus soared to €33.3 billion in July from EUR 30.6 billion in June. June's figure was revised down from a surplus of €31.1 billion.

-

10:54

The Fed keeps its monetary unchanged in September

The Fed released its interest rate decision on Thursday. The Fed kept its interest rate unchanged at 0.00%-0.25%. This decision was not unexpected.

The Fed took into account the slowdown in the global economy and low inflation expectations. That was the main reason to keep the monetary policy unchanged.

"Recent global economic and financial developments may restrain economic activity somewhat and are likely to put further downward pressure on inflation in the near term," the Fed said.

The accompanying statement and comments by the Fed Chairwoman Janet Yellen were more dovish than expected. The Fed did not announce any new guidelines on the terms of the first interest rate hike.

"When the Committee decides to begin to remove policy accommodation, it will take a balanced approach consistent with its longer-run goals of maximum employment and inflation of 2 percent," the Fed said.

The Fed pointed out that the pace of the interest rate hike will be slower than expected earlier once that the Fed starts raising its interest rates. GDP for 2016 and 2017 were downgraded.

The number of members awaiting the interest rates this year declined. 13 of 17 FOMC members are awaiting that the Fed starts raising its interest rates this year, down from 15 earlier.

FOMC members voted 9-1 to keep interest rates unchanged. Only Richmond Fed President Jeffrey Lacker voted to raise interest rate by 0.25%.

Yellen noted that the developments abroad had impact on the Fed's decision.

"The outlook abroad appears to have become less certain," she said, adding that the Fed "judged it appropriate to wait".

The Fed chairwoman pointed out that the interest rate hike in October is possible.

-

10:18

Bloomberg Consumer Comfort Index: consumers’ expectations for U.S. economy decline to 44.5 in the week ended September 13

According to data from the Bloomberg Consumer Comfort Index, consumers' expectations for U.S. economy declined to 44.5 in in the week ended September 13 from 46.0 the prior week. The slowdown in the global economy was one of the reasons for the decline.

The measure of views of the economy decreased to 30.9 from 33.3.

The buying climate index fell by 1 point to 34.9.

The personal finances index was down to 54.9 from 55.1.

-

10:08

Eurozone: Current account, unadjusted, bln , July 22.6

-

08:26

Foreign exchange market. Asian session: the euro slid

The U.S. dollar little changed after yesterday's fall against most currencies after the Federal Reserve decided to keep its interest rates unchanged. "In light of the heightened uncertainties abroad and the slightly softer than expected path for inflation, the committee judged it appropriate to wait for more evidence," Fed Chair Yellen said. Low rates for a longer period of time are a negative factor for the dollar, because they make this currency less attractive for investors.

The euro slightly declined against the greenback due to correction after yesterday's surge, which was triggered by the decision by the Federal Reserve.

The yen rose after release of Bank of Japan's meeting minutes. Some Board members said that oil prices should be watched closely, because they are a source of uncertainty. Policy makers also said that a slowdown in China's economy should be monitored.

EUR/USD: the pair declined $1.1385 in Asian trade

USD/JPY: the pair traded within Y119.65-40

GBP/USD: the pair traded within $1.5555-85

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:00 Eurozone Current account, unadjusted, bln July 31.1

11:05 United Kingdom MPC Member Andy Haldane Speaks

12:30 Canada Consumer Price Index m / m August 0.1% 0%

12:30 Canada Consumer price index, y/y August 1.3% 1.3%

12:30 Canada Bank of Canada Consumer Price Index Core, y/y August 2.4% 2.1%

14:00 U.S. Leading Indicators August -0.2% 0.2%

-

08:26

Options levels on friday, September 18, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1525 (3715)

$1.1484 (1626)

$1.1454 (1165)

Price at time of writing this review: $1.1401

Support levels (open interest**, contracts):

$1.1350 (146)

$1.1312 (449)

$1.1260 (1265)

Comments:

- Overall open interest on the CALL options with the expiration date October, 9 is 51273 contracts, with the maximum number of contracts with strike price $1,1600 (5112);

- Overall open interest on the PUT options with the expiration date October, 9 is 68922 contracts, with the maximum number of contracts with strike price $1,1000 (7204);

- The ratio of PUT/CALL was 1.34 versus 1.34 from the previous trading day according to data from September, 17

GBP/USD

Resistance levels (open interest**, contracts)

$1.5903 (1180)

$1.5804 (1175)

$1.5708 (1391)

Price at time of writing this review: $1.5580

Support levels (open interest**, contracts):

$1.5493 (585)

$1.5396 (855)

$1.5298 (1212)

Comments:

- Overall open interest on the CALL options with the expiration date October, 9 is 22465 contracts, with the maximum number of contracts with strike price $1,5500 (1637);

- Overall open interest on the PUT options with the expiration date October, 9 is 21106 contracts, with the maximum number of contracts with strike price $1,5200 (2752);

- The ratio of PUT/CALL was 0.94 versus 0.93 from the previous trading day according to data from September, 17

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

00:29

Currencies. Daily history for Sep 17’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1415 +1,11%

GBP/USD $1,5582 +0,58%

USD/CHF Chf0,962 -0,91%

USD/JPY Y120,19 -0,32%

EUR/JPY Y137,21 +0,79%

GBP/JPY Y187,26 +0,25%

AUD/USD $0,7165 -0,33%

NZD/USD $0,6354 -0,28%

USD/CAD C$1,3179 +0,05%

-