Noticias del mercado

-

18:00

European stocks closed: FTSE 100 6,108.71 +4.60 +0.08% CAC 40 4,585.5 +49.65 +1.09% DAX 9,948.51 +32.35 +0.33%

-

17:23

Greece’s current account surplus climbs to €4.25 billion in July

The Bank of Greece released its current account data on Monday. Greece's current account surplus rose to €4.25 billion in July from €1.27 billion in July last year.

The Greek deficit on trade in goods and services widened to €2.47 billion in July.

The deficit on primary income totalled €54 million in July, while the surplus on secondary income climbed to €1.83 billion.

The capital account surplus was €2.4 million in July.

-

16:21

U.S. existing homes sales decline 4.8% in August

The National Association of Realtors released existing homes sales figures in the U.S. on Monday. Sales of existing homes declined 4.8% to a seasonally adjusted annual rate of 5.31 million in August from 5.58 million in July. July's figure was revised down from 5.59 million units.

Analysts had expected an increase to 5.53 million units.

"Sales activity was down in many parts of the country last month - especially in the South and West - as the persistent summer theme of tight inventory levels likely deterred some buyers. The good news for the housing market is that price appreciation the last two months has started to moderate from the unhealthier rate of growth seen earlier this year," the NAR chief economist Lawrence Yun said.

Sales to first-time buyers rose to 32% in August from 28% in July.

Yun noted that "the impact on mortgage rates and overall housing demand will likely not be pronounced" when the Fed will start raising its interest rates.

-

16:12

European Central Bank purchases €12.25 billion of government and agency bonds last week

The European Central Bank (ECB) purchased €12.25 billion of government and agency bonds under its quantitative-easing program last week.

ECB'S asset buying programme is intended to run to September 2016.

The ECB bought €2.16 billion of covered bonds, and €146 million of asset-backed securities.

-

16:00

U.S.: Existing Home Sales , August 5.31 (forecast 5.53)

-

15:48

Spain’s trade deficit narrows to €1.4 billion in July

Spain's Economy Ministry released its trade data on Monday. The trade deficit narrowed to €1.4 billion in July from €1.83 billion in July a year ago.

Exports rose at an annual rate of 8.9% in July, while imports jumped 6.4%.

In the January to July period, the trade deficit totalled €12.9 billion, down 6.1% from the same period of 2014.

Exports increased 5.5% in the January to July period, while imports gained 4.5%.

-

15:45

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1250(E222mn), $1.1300(E322mn), $1.1425(E331mn)

USD/JPY: Y120.00($250mn)

USD/CAD: Cad1.3000($260mn), Cad1.3120($300mn), Cad1.3150($510mn), Cad1.3185($600mn)

AUD/USD: $0.7120(A$335mn)

-

14:52

St. Louis Fed President James Bullard: the interest rate hike in October is possible

St. Louis Fed President James Bullard said in an interview with CNBC on Monday that the Fed should raise its interest rates and that the interest rate hike in October is possible.

"There's a chance. But the problem with going from one meeting to the next is how much information has really changed," he said.

Bullard is not a voting member of the Federal Open Market Committee this year.

-

14:43

Canada’s wholesale sales are flat in July

Statistics Canada released wholesale sales figures on Monday. Wholesale sales were flat in July, after a 1.3% rise in June.

Sales of automobiles and parts were up 0.2% in July.

Sales in the machinery, equipment and supplies subsector rose 1.0% in July, while sales in the food, beverage and tobacco subsector declined 0.5%.

Inventories climbed by 0.6% in July.

-

14:34

European Central Bank Governing Council member the head of the Bank of Spain Luis Maria Linde: the central bank’s asset-buying programme is working well and there is no need to extend it

The European Central Bank (ECB) Governing Council member the head of the Bank of Spain Luis Maria Linde said on Monday the central bank's asset-buying programme is working well and there is no need to extend it.

"The stimulus programme is working very well and, right now, there is no reason to change it. As long as the inflation target of near 2 percent is not reached, the programme will continue," he said.

Linde pointed out that the slowdown in the global economy weighs on the timing of the interest rate hike in the U.K. and the U.S.

-

14:30

Canada: Wholesale Sales, m/m, July 0.0%

-

14:24

Bundesbank’s monthly report: the German economy is likely to continue to expand in the second half of the year

The Bundesbank released its monthly report on Monday. The bank said that the German economy is likely to continue to expand in the second half of the year due to an increase in domestic consumption and exports.

Household spending benefited from low oil and energy prices, according to the Bundesbank.

The lender noted that the high number of refugees is expected to have an impact on Germany's labour market.

-

14:17

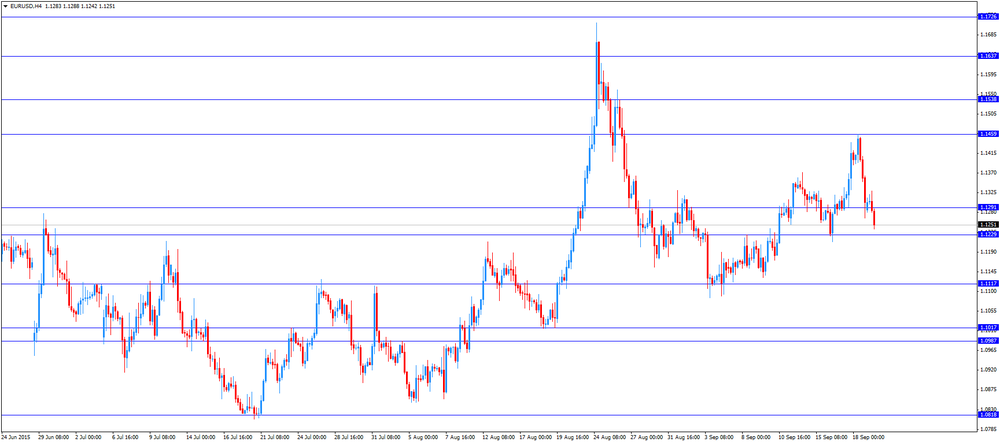

Foreign exchange market. European session: the euro traded lower against the U.S. dollar after the negative economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Japan Bank holiday

06:00 Germany Producer Price Index (MoM) August 0.0% -0.3% -0.5%

06:00 Germany Producer Price Index (YoY) August -1.3% -1.5% -1.7%

10:00 Germany Bundesbank Monthly Report

The U.S. dollar traded higher against the most major currencies ahead of the release of the U.S. existing home sales data. The existing home sales in the U.S. are expected to decrease to 5.53 million units in August from 5.59 million units in July.

The FOMC member Dennis Lockhart will speak at 17:00 GMT.

The euro traded lower against the U.S. dollar after the negative economic data from the Eurozone. German producer price index (PPI) producer prices declined 0.5% in August, missing expectations for a 0.3% fall, after a flat reading in July.

On a yearly basis, German PPI dropped 1.7% in August, missing expectations for a 1.5% decrease, after a 1.3% fall in July.

PPI excluding energy sector fell by 0.5% year-on-year in August.

The Bundesbank said in its monthly report on Monday that the German economy is likely to continue to expand in the second half of the year due to an increase in domestic consumption and exports. Household spending benefited from low oil and energy prices.

Alexis Tsipras' Syriza party has won the parliament election on Sunday. Syriza has won 35.47%. It was the fifth snap election in the country over the last six years.

The time is needed to form the new government. Syriza has no majority and it will form a coalition with the nationalist Independent Greeks.

Only 55% of Greeks voted on Sunday, down from 63% in January.

The British pound traded lower against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded loweragainst the U.S. dollar ahead of the release of the wholesale sales data from Canada.

EUR/USD: the currency pair decreased to $1.1242

GBP/USD: the currency pair fell to $1.5504

USD/JPY: the currency pair rose to Y120.38

The most important news that are expected (GMT0):

12:30 Canada Wholesale Sales, m/m July 1.3%

14:00 U.S. Existing Home Sales August 5.59 5.53

17:00 U.S. FOMC Member Dennis Lockhart Speaks

18:45 Canada BOC Gov Stephen Poloz Speaks

-

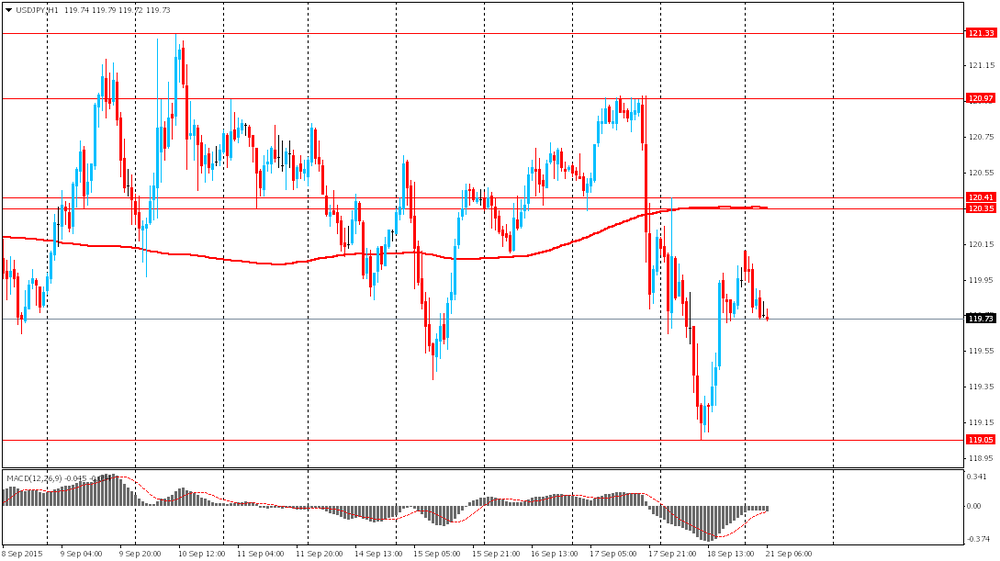

13:50

Orders

EUR/USD

Offers 1.1325-30 1.1350 1.1380 1.1400 1.1435 1.1450 1.1465 1.1480-85 1.1500 1.1520 1.1550

Bids 1.1285 1.1260 1.1245 1.1225 1.1200 1.1185 1.1165 1.1150

GBP/USD

Offers 1.5575-80 1.5600-05 1.5620 1.5650 1.5665-70 1.5685 1.5700-10 1.5725 1.5750

Bids 1.5525-30 1.5500 1.5485 1.5465 1.5450 1.5425-30 1.5400 1.5380 1.5350 1.5330 1.5300

EUR/GBP

Offers 0.7285 0.7300 0.7325-30 0.7350-55 0.7380-85 0.7400

Bids 0.7260-65 0.7250 0.7230 0.7200 0.7185 0.7150

EUR/JPY

Offers 136.25 136.50 136.75 136.90-137.00 137.30 137.50

Bids 135.65 135.50 135.25-30 135.00 134.80 134.50

USD/JPY

Offers 120.20-25 120.40 120.65 120.85 121.00 121.30 121.50

Bids 119.75-80 119.50 119.30 119.10 119.00 118.85 118.50 118.25-30 118.00

AUD/USD

Offers 0.7185 0.7200 0.7220 0.7250 0.7265 0.7280 0.7300

Bids 0.7155-60 0.7125-30 0.7100 0.7085 0.7065 0.7050

-

11:44

Switzerland’s current account surplus rises to CHF18 billion in the second quarter

The Swiss National Bank (SNB) released its current account data for the second quarter on Monday. Switzerland's current account surplus rose to CHF18 billion in the second quarter from CHF15 billion in the first quarter. The increase was largely driven by the drop in the expenses surplus on secondary income.

The trade in goods surplus climbed to CHF14 billion in the second quarter, while the trade in services surplus fell to CHF4 billion.

-

11:33

German producer prices drop 0.5% in August

Destatis released its producer price index (PPI) for Germany on Monday. German PPI producer prices declined 0.5% in August, missing expectations for a 0.3% fall, after a flat reading in July.

On a yearly basis, German PPI dropped 1.7% in August, missing expectations for a 1.5% decrease, after a 1.3% fall in July.

PPI excluding energy sector fell by 0.5% year-on-year in August.

Energy prices were down 5.0% year-on-year in August.

Consumer non-durable goods prices fell 1.5% year-on-year in August, intermediate goods sector prices decreased by 1.0%, and capital goods prices increased 0.8%, while durable consumer goods sector prices rose 1.4%.

-

11:09

Italy’s government upgrades its growth forecasts for this and next year

The government of Italy's Prime Minister Matteo Renzi upgraded its growth forecasts for this and next year on Friday. Italy's gross domestic product (GDP) is expected to grow 0.9% in 2015, up from April's estimate of a 0.7% increase, and to climb 1.6% in 2016, up from April's forecast of a 1.4% rise.

The Italian economy is showing signs of a recovery. The economy has been in a recession for three years in a row.

-

10:54

Alexis Tsipras’ Syriza party wins the parliament election

Alexis Tsipras' Syriza party has won the parliament election on Sunday. Syriza has won 35.47%. It was the fifth snap election in the country over the last six years.

The time is needed to form the new government. Syriza has no majority and it will form a coalition with the nationalist Independent Greeks.

Only 55% of Greeks voted on Sunday, down from 63% in January.

"We have difficulties ahead of us but we also have a solid ground, we know where we can step, we have a prospect. Recovery from the crisis can't come magically, but it can come through tough work," Tsipras said after his victory.

-

10:43

Standard & Poor's raises Portugal's credit rating to “BB+”

The ratings agency Standard & Poor's (S&P) upgraded Portugal's credit rating to "BB+" from "BB" on Friday. The outlook is "stable".

"Portugal's economic recovery and budgetary consolidation continue in line with our expectations, putting net government debt to gross domestic product on a declining path after 15 consecutive years of increases," S&P said.

-

10:34

OECD: five sets of French Economy Minister Emmanuel Macron’s measures could boost the country’s GDP

The Organisation for Economic Co-operation and Development (OECD) said on Friday that five sets of French Economy Minister Emmanuel Macron's measures could boost the country's GDP by 0.3% over 5 years and by 0.4% over 10 years.

The measures are including the reform of regulated professions, the extension of Sunday and evening trading, the opening-up of passenger coach transport, the simplification of redundancy rules, and easier procedures for obtaining a driving licence.

-

10:26

Moody’s cuts France’s credit rating to "Aa2"

The ratings agency Moody's lowered France's credit rating to "Aa2" from "Aa1" on Friday. The outlook was upgraded to "stable" from "negative".

Moody's noted that the economic recovery in France is too slow.

"The current economic recovery in France has already proven to be significantly slower -- and Moody's believes that it will remain so -- compared with the recoveries observed over the past few decades, "the agency said.

"France faces material economic challenges, such as a high rate of structural unemployment, relatively weak corporate profit margins, and a loss of global export market share that have their roots in long-standing rigidities in its labour and product markets," Moody's added.

The French government said on Sunday that it has taken note of the Moody's decision and it was "firmly committed to continue and strengthen its policy of reforms to back French economy's potential growth and employment".

-

08:22

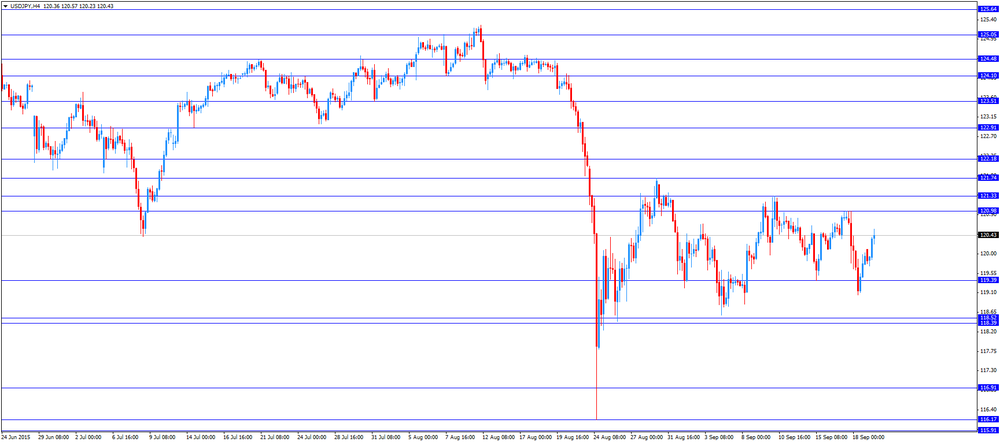

Foreign exchange market. Asian session: the pound is under pressure

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

06:00 Germany Producer Price Index (MoM) August 0.0% -0.3% -0.5%

06:00 Germany Producer Price Index (YoY) August -1.3% -1.5% -1.7%

The U.S. dollar stabilized after recent loss, which was triggered by the Federal Reserve's decision to keep interest rates unchanged. Investors' attitude towards the greenback also improved after FOMC Member Williams said that rates are likely to be raised this year.

The pound is under pressure ahead of publication of UK budget deficit data, scheduled for this week. The deficit is expected to post an increase in August compared to the previous month. However higher revenues from taxes might have lowered the deficit compared to the same period last year.

The New Zealand dollar fell amid a stronger greenback. Data by Westpac showed that consumer sentiment came in at 106 in the third quarter compared to 113 reported previously. The index has been falling since its peak in the first quarter of 2014, although it is still above 100.

EUR/USD: the pair climbed to $1.1320 in Asian trade

USD/JPY: the pair fell to Y119.70

GBP/USD: the pair traded within $1.5515-45

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

10:00 Germany Bundesbank Monthly Report

12:30 Canada Wholesale Sales, m/m July 1.3%

14:00 U.S. Existing Home Sales August 5.59 5.53

17:00 U.S. FOMC Member Dennis Lockhart Speaks

18:45 Canada BOC Gov Stephen Poloz Speaks

-

08:14

Options levels on monday, September 21, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1447 (1658)

$1.1414 (1147)

$1.1378 (560)

Price at time of writing this review: $1.1314

Support levels (open interest**, contracts):

$1.1221 (1349)

$1.1189 (2440)

$1.1153 (4773)

Comments:

- Overall open interest on the CALL options with the expiration date October, 9 is 51323 contracts, with the maximum number of contracts with strike price $1,1600 (4669);

- Overall open interest on the PUT options with the expiration date October, 9 is 68834 contracts, with the maximum number of contracts with strike price $1,1000 (7560);

- The ratio of PUT/CALL was 1.34 versus 1.34 from the previous trading day according to data from September, 18

GBP/USD

Resistance levels (open interest**, contracts)

$1.5803 (1139)

$1.5705 (1308)

$1.5608 (1385)

Price at time of writing this review: $1.5538

Support levels (open interest**, contracts):

$1.5395 (873)

$1.5297 (1214)

$1.5198 (2758)

Comments:

- Overall open interest on the CALL options with the expiration date October, 9 is 22249 contracts, with the maximum number of contracts with strike price $1,5500 (1652);

- Overall open interest on the PUT options with the expiration date October, 9 is 21076 contracts, with the maximum number of contracts with strike price $1,5200 (2758);

- The ratio of PUT/CALL was 0.95 versus 0.94 from the previous trading day according to data from September, 18

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:00

Germany: Producer Price Index (MoM), August -0.5% (forecast -0.3%)

-

08:00

Germany: Producer Price Index (YoY), August -1.7% (forecast -1.5%)

-

01:04

Currencies. Daily history for Sep 18’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1303 -0,99%

GBP/USD $1,5526 -0,36%

USD/CHF Chf0,9683 +0,65%

USD/JPY Y119,95 -0,20%

EUR/JPY Y135,55 -1,22%

GBP/JPY Y186,26 -0,54%

AUD/USD $0,7187 +0,31%

NZD/USD $0,6399 +0,70%

USD/CAD C$1,3224 +0,34%

-

00:45

New Zealand: Visitor Arrivals, August 7.4%

-

00:00

New Zealand: Westpac Consumer Sentiment, Quarter III 106

-

00:00

Schedule for today, Monday, Sep 21’2015:

(time / country / index / period / previous value / forecast)

06:00 Germany Producer Price Index (MoM) August 0.0% -0.3%

06:00 Germany Producer Price Index (YoY) August -1.3% -1.5%

10:00 Germany Bundesbank Monthly Report

12:30 Canada Wholesale Sales, m/m July 1.3%

14:00 U.S. Existing Home Sales August 5.59 5.53

17:00 U.S. FOMC Member Dennis Lockhart Speaks

18:45 Canada BOC Gov Stephen Poloz Speaks

-