Noticias del mercado

-

21:02

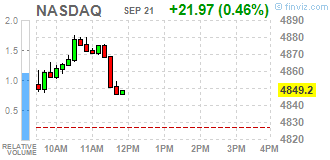

Dow +0.87% 16,527.19 +142.61 Nasdaq +0.24% 4,838.90 +11.67 S&P +0.65% 1,970.70 +12.67

-

18:13

WSE: Session Results

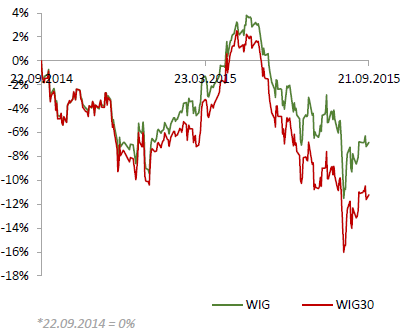

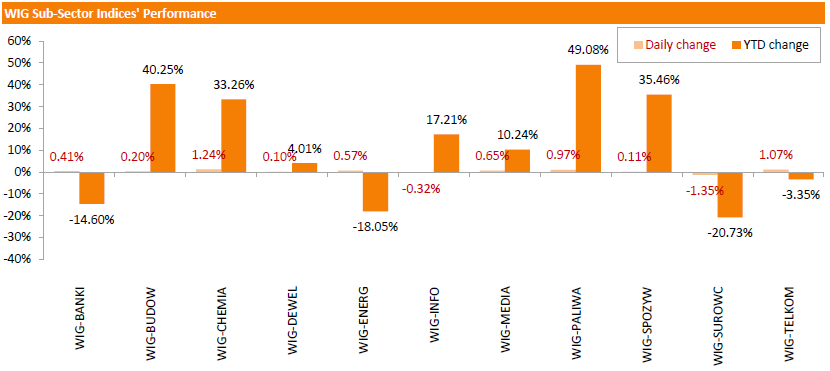

Polish equity market closed higher on Monday. The broad market measure, the WIG Index added 0.38%. Materials (-1.35%) and technologies (-0.32%) were the only sectors, which posted negative results. At the same time, chemicals sector (+1.24%) was the best-performing group.

The large-cap stocks' measure, the WIG30 Index, rose by 0.46%. Within the indicator's components, TAURON PE (WSE: TPE) and GRUPA AZOTY (WSE: ATT) were the biggest advancers, gaining 2.33% and 2.11% respectively. ALIOR (WSE: ALR) and BZ WBK (WSE: BZW) also produced solid gains, up 1.96% and 1.92% respectively. On the other side of the ledger, JSW (WSE: JSW) was the worst-performing name, losing 3.19%. The stock was dragged down by the news, the company couldn't persuade ING BSK (WSE: ING; +0.66%) to withhold with its request for early redemption of the company's bonds worth PLN 26.3 mln. It was followed by ASSECO POLAND (WSE: ACP) and EUROCASH (WSE: EUR), slumping 1.57% and 1.46% respectively.

-

17:59

European stocks close: stocks closed higher, rebounding from Friday's drop

Stock indices closed higher, rebounding from Friday's drop. Markets declined on Friday on the Fed's outlook of the global economy. The Fed kept its interest rate unchanged at 0.00%-0.25% on Thursday. The Fed took into account the slowdown in the global economy and low inflation expectations. That was the main reason to keep the monetary policy unchanged.

Alexis Tsipras' Syriza party has won the parliament election on Sunday. Syriza has won 35.47%. It was the fifth snap election in the country over the last six years.

The time is needed to form the new government. Syriza has no majority and it will form a coalition with the nationalist Independent Greeks.

Only 55% of Greeks voted on Sunday, down from 63% in January.

Meanwhile, the economic data from the Eurozone was negative. German producer price index (PPI) producer prices declined 0.5% in August, missing expectations for a 0.3% fall, after a flat reading in July.

On a yearly basis, German PPI dropped 1.7% in August, missing expectations for a 1.5% decrease, after a 1.3% fall in July.

PPI excluding energy sector fell by 0.5% year-on-year in August.

The Bundesbank said in its monthly report on Monday that the German economy is likely to continue to expand in the second half of the year due to an increase in domestic consumption and exports. Household spending benefited from low oil and energy prices.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,108.71 +4.60 +0.08 %

DAX 9,948.51 +32.35 +0.33 %

CAC 40 4,585.5 +49.65 +1.09 %

-

17:55

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes higher on Monday, recovering some of their big losses last week when the Federal Reserve's decision to keep interest rates near zero raised concerns about the health of the global economy. Investors will be looking for hints on when the Fed may finally raise rates when a number of central bank officials including Chair Janet Yellen, appear in public this week.

Almost all of Dow stocks in positive area (29 of 30). Top looser - Merck & Co. Inc. (MRK, -0.73%). Top gainer - Visa Inc. (V, +1.59).

Almost all of S&P index sectors also in positive area. Top looser - Conglomerates (-0.1%). Top gainer - Financial (+1,0%).

At the moment:

Dow 16405.00 +87.00 +0.53%

S&P 500 1959.25 +8.75 +0.45%

Nasdaq 100 4337.25 +10.50 +0.24%

10 Year yield 2,19% +0,06

Oil 46.32 +1.30 +2.89%

Gold 1131.90 -5.90 -0.52%

-

17:23

Greece’s current account surplus climbs to €4.25 billion in July

The Bank of Greece released its current account data on Monday. Greece's current account surplus rose to €4.25 billion in July from €1.27 billion in July last year.

The Greek deficit on trade in goods and services widened to €2.47 billion in July.

The deficit on primary income totalled €54 million in July, while the surplus on secondary income climbed to €1.83 billion.

The capital account surplus was €2.4 million in July.

-

16:21

U.S. existing homes sales decline 4.8% in August

The National Association of Realtors released existing homes sales figures in the U.S. on Monday. Sales of existing homes declined 4.8% to a seasonally adjusted annual rate of 5.31 million in August from 5.58 million in July. July's figure was revised down from 5.59 million units.

Analysts had expected an increase to 5.53 million units.

"Sales activity was down in many parts of the country last month - especially in the South and West - as the persistent summer theme of tight inventory levels likely deterred some buyers. The good news for the housing market is that price appreciation the last two months has started to moderate from the unhealthier rate of growth seen earlier this year," the NAR chief economist Lawrence Yun said.

Sales to first-time buyers rose to 32% in August from 28% in July.

Yun noted that "the impact on mortgage rates and overall housing demand will likely not be pronounced" when the Fed will start raising its interest rates.

-

16:12

European Central Bank purchases €12.25 billion of government and agency bonds last week

The European Central Bank (ECB) purchased €12.25 billion of government and agency bonds under its quantitative-easing program last week.

ECB'S asset buying programme is intended to run to September 2016.

The ECB bought €2.16 billion of covered bonds, and €146 million of asset-backed securities.

-

15:48

Spain’s trade deficit narrows to €1.4 billion in July

Spain's Economy Ministry released its trade data on Monday. The trade deficit narrowed to €1.4 billion in July from €1.83 billion in July a year ago.

Exports rose at an annual rate of 8.9% in July, while imports jumped 6.4%.

In the January to July period, the trade deficit totalled €12.9 billion, down 6.1% from the same period of 2014.

Exports increased 5.5% in the January to July period, while imports gained 4.5%.

-

15:34

U.S. Stocks open: Dow +0.07%, Nasdaq +0.01%, S&P +0.02%Dow +0.36%, Nasdaq +0.58%, S&P+0.40%

-

15:26

Before the bell: S&P futures +0.50%, NASDAQ futures +0.43%

U.S. stock-index futures advanced, with equities poised to rebound from Friday's selloff.

Hang Seng 21,756.93 -163.90 -0.75%

Shanghai Composite 3,157.15 +59.24 +1.91%

FTSE 6,147.41 +43.30 +0.71%

CAC 4,588.65 +52.80 +1.16%

DAX 9,935.03 +18.87 +0.19%

Japan Stock Market was closed.

Crude oil $45.80 (+2.51%)

Gold $1133.10 (-0.41%)

-

15:05

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Starbucks Corporation, NASDAQ

SBUX

57.75

1.60%

1.6K

Goldman Sachs

GS

183.40

1.36%

9.9K

ALCOA INC.

AA

10.10

1.30%

7.5K

Deere & Company, NYSE

DE

80.57

1.29%

0.1K

General Motors Company, NYSE

GM

30.89

1.25%

15.6K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.01

1.19%

29.7K

Yahoo! Inc., NASDAQ

YHOO

31.10

1.17%

15.8K

Chevron Corp

CVX

78.56

1.05%

1.5K

Google Inc.

GOOG

635.69

1.02%

55.4K

Tesla Motors, Inc., NASDAQ

TSLA

263.25

1.01%

16.3K

Visa

V

70.46

0.96%

19.8K

Exxon Mobil Corp

XOM

73.35

0.92%

9.5K

Caterpillar Inc

CAT

72.50

0.89%

1.0K

Yandex N.V., NASDAQ

YNDX

12.60

0.88%

3.0K

Procter & Gamble Co

PG

70.55

0.87%

1.4K

E. I. du Pont de Nemours and Co

DD

47.93

0.84%

2.4K

AMERICAN INTERNATIONAL GROUP

AIG

58.26

0.83%

1.0K

Citigroup Inc., NYSE

C

50.70

0.82%

20.2K

Verizon Communications Inc

VZ

44.92

0.79%

0.8K

Cisco Systems Inc

CSCO

25.74

0.78%

3.5K

Home Depot Inc

HD

116.00

0.76%

0.7K

Pfizer Inc

PFE

33.10

0.76%

1.7K

JPMorgan Chase and Co

JPM

61.40

0.75%

5.1K

Microsoft Corp

MSFT

43.80

0.74%

2.7K

Walt Disney Co

DIS

103.59

0.73%

67.0K

Nike

NKE

115.88

0.72%

6.2K

Ford Motor Co.

F

14.38

0.70%

0.4K

General Electric Co

GE

24.97

0.69%

14.5K

McDonald's Corp

MCD

97.72

0.69%

0.2K

Amazon.com Inc., NASDAQ

AMZN

543.76

0.65%

22.0K

Apple Inc.

AAPL

114.17

0.63%

152.2K

International Business Machines Co...

IBM

145.41

0.62%

6.8K

Merck & Co Inc

MRK

52.45

0.61%

2.5K

Boeing Co

BA

136.90

0.60%

1.2K

Wal-Mart Stores Inc

WMT

63.69

0.55%

0.8K

The Coca-Cola Co

KO

39.15

0.44%

1.5K

AT&T Inc

T

32.69

0.43%

8.1K

Intel Corp

INTC

29.12

0.34%

7.7K

Facebook, Inc.

FB

94.70

0.32%

144.6K

Twitter, Inc., NYSE

TWTR

28.00

0.14%

38.4K

ALTRIA GROUP INC.

MO

54.10

0.09%

0.4K

Barrick Gold Corporation, NYSE

ABX

6.68

-1.04%

7.8K

Hewlett-Packard Co.

HPQ

26.17

-1.39%

115.1K

-

14:57

Upgrades and downgrades before the market open

Upgrades:

Goldman Sachs (GS) upgraded to Outperform at Oppenheimer

Downgrades:

Other:

Google (GOOG) target raised to $847 from $720 at JMP Securities

Intel (INTC) target lowered to $31 from $32 at Mizuho

-

14:52

St. Louis Fed President James Bullard: the interest rate hike in October is possible

St. Louis Fed President James Bullard said in an interview with CNBC on Monday that the Fed should raise its interest rates and that the interest rate hike in October is possible.

"There's a chance. But the problem with going from one meeting to the next is how much information has really changed," he said.

Bullard is not a voting member of the Federal Open Market Committee this year.

-

14:43

Canada’s wholesale sales are flat in July

Statistics Canada released wholesale sales figures on Monday. Wholesale sales were flat in July, after a 1.3% rise in June.

Sales of automobiles and parts were up 0.2% in July.

Sales in the machinery, equipment and supplies subsector rose 1.0% in July, while sales in the food, beverage and tobacco subsector declined 0.5%.

Inventories climbed by 0.6% in July.

-

14:34

European Central Bank Governing Council member the head of the Bank of Spain Luis Maria Linde: the central bank’s asset-buying programme is working well and there is no need to extend it

The European Central Bank (ECB) Governing Council member the head of the Bank of Spain Luis Maria Linde said on Monday the central bank's asset-buying programme is working well and there is no need to extend it.

"The stimulus programme is working very well and, right now, there is no reason to change it. As long as the inflation target of near 2 percent is not reached, the programme will continue," he said.

Linde pointed out that the slowdown in the global economy weighs on the timing of the interest rate hike in the U.K. and the U.S.

-

14:24

Bundesbank’s monthly report: the German economy is likely to continue to expand in the second half of the year

The Bundesbank released its monthly report on Monday. The bank said that the German economy is likely to continue to expand in the second half of the year due to an increase in domestic consumption and exports.

Household spending benefited from low oil and energy prices, according to the Bundesbank.

The lender noted that the high number of refugees is expected to have an impact on Germany's labour market.

-

12:00

European stock markets mid session: stocks traded mixed after Friday’s drop

Stock indices traded mixed after Friday's drop. Markets were supported by rises in health-care and oil shares.

Alexis Tsipras' Syriza party has won the parliament election on Sunday. Syriza has won 35.47%. It was the fifth snap election in the country over the last six years.

The time is needed to form the new government. Syriza has no majority and it will form a coalition with the nationalist Independent Greeks.

Only 55% of Greeks voted on Sunday, down from 63% in January.

Meanwhile, the economic data from the Eurozone was negative. German producer price index (PPI) producer prices declined 0.5% in August, missing expectations for a 0.3% fall, after a flat reading in July.

On a yearly basis, German PPI dropped 1.7% in August, missing expectations for a 1.5% decrease, after a 1.3% fall in July.

PPI excluding energy sector fell by 0.5% year-on-year in August.

Current figures:

Name Price Change Change %

FTSE 100 6,133.62 +29.51 +0.48 %

DAX 9,853.24 -62.92 -0.63 %

CAC 40 4,574.72 +38.87 +0.86 %

-

11:44

Switzerland’s current account surplus rises to CHF18 billion in the second quarter

The Swiss National Bank (SNB) released its current account data for the second quarter on Monday. Switzerland's current account surplus rose to CHF18 billion in the second quarter from CHF15 billion in the first quarter. The increase was largely driven by the drop in the expenses surplus on secondary income.

The trade in goods surplus climbed to CHF14 billion in the second quarter, while the trade in services surplus fell to CHF4 billion.

-

11:33

German producer prices drop 0.5% in August

Destatis released its producer price index (PPI) for Germany on Monday. German PPI producer prices declined 0.5% in August, missing expectations for a 0.3% fall, after a flat reading in July.

On a yearly basis, German PPI dropped 1.7% in August, missing expectations for a 1.5% decrease, after a 1.3% fall in July.

PPI excluding energy sector fell by 0.5% year-on-year in August.

Energy prices were down 5.0% year-on-year in August.

Consumer non-durable goods prices fell 1.5% year-on-year in August, intermediate goods sector prices decreased by 1.0%, and capital goods prices increased 0.8%, while durable consumer goods sector prices rose 1.4%.

-

11:09

Italy’s government upgrades its growth forecasts for this and next year

The government of Italy's Prime Minister Matteo Renzi upgraded its growth forecasts for this and next year on Friday. Italy's gross domestic product (GDP) is expected to grow 0.9% in 2015, up from April's estimate of a 0.7% increase, and to climb 1.6% in 2016, up from April's forecast of a 1.4% rise.

The Italian economy is showing signs of a recovery. The economy has been in a recession for three years in a row.

-

10:54

Alexis Tsipras’ Syriza party wins the parliament election

Alexis Tsipras' Syriza party has won the parliament election on Sunday. Syriza has won 35.47%. It was the fifth snap election in the country over the last six years.

The time is needed to form the new government. Syriza has no majority and it will form a coalition with the nationalist Independent Greeks.

Only 55% of Greeks voted on Sunday, down from 63% in January.

"We have difficulties ahead of us but we also have a solid ground, we know where we can step, we have a prospect. Recovery from the crisis can't come magically, but it can come through tough work," Tsipras said after his victory.

-

10:43

Standard & Poor's raises Portugal's credit rating to “BB+”

The ratings agency Standard & Poor's (S&P) upgraded Portugal's credit rating to "BB+" from "BB" on Friday. The outlook is "stable".

"Portugal's economic recovery and budgetary consolidation continue in line with our expectations, putting net government debt to gross domestic product on a declining path after 15 consecutive years of increases," S&P said.

-

10:34

OECD: five sets of French Economy Minister Emmanuel Macron’s measures could boost the country’s GDP

The Organisation for Economic Co-operation and Development (OECD) said on Friday that five sets of French Economy Minister Emmanuel Macron's measures could boost the country's GDP by 0.3% over 5 years and by 0.4% over 10 years.

The measures are including the reform of regulated professions, the extension of Sunday and evening trading, the opening-up of passenger coach transport, the simplification of redundancy rules, and easier procedures for obtaining a driving licence.

-

10:26

Moody’s cuts France’s credit rating to "Aa2"

The ratings agency Moody's lowered France's credit rating to "Aa2" from "Aa1" on Friday. The outlook was upgraded to "stable" from "negative".

Moody's noted that the economic recovery in France is too slow.

"The current economic recovery in France has already proven to be significantly slower -- and Moody's believes that it will remain so -- compared with the recoveries observed over the past few decades, "the agency said.

"France faces material economic challenges, such as a high rate of structural unemployment, relatively weak corporate profit margins, and a loss of global export market share that have their roots in long-standing rigidities in its labour and product markets," Moody's added.

The French government said on Sunday that it has taken note of the Moody's decision and it was "firmly committed to continue and strengthen its policy of reforms to back French economy's potential growth and employment".

-

08:25

Global Stocks: U.S. indices fell amid concerns over global economic growth

U.S. stock indices declined on Friday as the Federal Reserve's decision not to raise rates intensified concerns over global economic growth.

The Dow Jones Industrial Average fell 289.95 points, or 1.7%, to 16,384.79 (-0.3% over the week). The S&P 500 lost 32.16 points, or 1.6%, to 1,958.08 (-0.2% over the week). The Nasdaq Composite Index fell 66.72 points, or 1.4% to 4,827.23 (+0.1% over the week).

All 30 components of the Dow Jones index fell.

Trading volume was high due to expiration of several stock-index futures and options.

This morning in Asia Hong Kong Hang Seng fell 1.30%, or 285.70 points, to 21,635.13. China Shanghai Composite Index gained 0.67%, or 20.89 point, to 3,118.81. Japanese markets are on holiday due to Respect for the Aged Day.

Asian stock indices outside China fell amid renewed concerns over health of the global economy. Chinese stocks climbed after the China Beige Book survey showed no signs of a forthcoming growth crisis despite the recent slowdown.

-

04:01

Hang Seng 21,664.5 -256.33 -1.17 %, Shanghai Composite 3,072.09 -25.82 -0.83 %

-

01:05

Stocks. Daily history for Sep 18’2015:

(index / closing price / change items /% change)

Nikkei 225 18,070.21 -362.06 -1.96 %

Hang Seng 21,920.83 +66.20 +0.30 %

S&P/ASX 200 5,170.5 +23.68 +0.46 %

Shanghai Composite 3,099.12 +13.05 +0.42 %

FTSE 100 6,104.11 -82.88 -1.34 %

CAC 40 4,535.85 -119.29 -2.56 %

Xetra DAX 9,916.16 -313.42 -3.06 %

S&P 500 1,958.03 -32.17 -1.62 %

NASDAQ Composite 4,827.23 -66.72 -1.36 %

Dow Jones 16,384.58 -290.16 -1.74 %

-