Noticias del mercado

-

21:00

Dow -1.47% 16,267.87 -242.32 Nasdaq -1.97% 4,734.03 -94.93 S&P -1.65% 1,934.43 -32.54

-

17:02

Asian Development Bank cut its growth forecasts for China and India

The Asian Development Bank (ADB) lowered growth forecasts for China and India. According to the ADB, China is expected to expand by 6.8% in 2015, down from July estimate of a 7.0% rise, and 6.7% in 2016, down from July estimate of a 6.8% increase.

India is expected to rise by 7.4% in the financial year 2015 ending March 2016, down from July estimate of a 7.8% rise, and 7.8% in the fiscal year 2016 ending March 2017, down from July estimate of a 8.2% increase.

The downgrade of the Indian growth was driven by a weak external demand and a slower-than-expected pace of reform implementation.

The economic growth of developing Asia is expected to be 5.8% this year, down from July estimate of a 6.1% increase, and 6% in 2016, down from July estimate of a 6.2% rise.

Inflation in developing Asia is expected to decline to 2.3% in 2015 from 3% in 2014 due to low global commodity prices.

Southeast Asia is expected to grow 4.4% in 2015 and 4.9% in 2016.

"The combination of a moderating prospect in China and India, together with delayed recovery of advanced countries, weighed on our forecast for the region as a whole," ADB Chief Economist Shang-Jin Wei said.

-

16:37

Eurozone’s preliminary consumer confidence index declines to -7.1 in September

The European Commission released its preliminary consumer confidence figures for the Eurozone on Tuesday. Eurozone's preliminary consumer confidence index fell to -7.1 in September from -6.9 in August, missing expectations for a decline to -7.0.

European Union's consumer confidence index declined by 0.8 points to -5.5 in September.

-

16:29

Richmond Fed Manufacturing Index drops to -5 in September

The Federal Reserve Bank of Richmond released its survey of manufacturing activity on Tuesday. The composite index for manufacturing dropped to -5 in September from 0 in August.

The decline was driven by decreases in new orders. New orders subindex was down to -12 from 1.

Shipments subindex rose to -3 in September from -4 in August.

"Order backlogs and new orders decreased, while shipments declined. Average wages continued to increase at a moderate pace this month, however manufacturing employment grew mildly. Prices of raw materials and prices of finished goods rose, although at a slightly slower pace compared to last month," the survey said.

-

16:01

Eurozone: Consumer Confidence, September -7 (forecast -7)

-

15:59

U.S.: Richmond Fed Manufacturing Index, September -5

-

15:49

U.S. house price index rise 0.6% in July

The Federal Housing Finance Agency (FHFA) released its monthly house price index for the U.S. on Tuesday. The U.S. house price index rose 0.6% on a seasonally adjusted basis in July, after a 0.2% gain in June.

On a yearly basis, U.S. house prices climbed 5.8% in July.

-

15:40

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1200(E498mn), $1.1250

USD/JPY: Y119.60, Y120.50, Y121.00

USD/CAD: Cad1.3150, Cad1.3210($565mn), Cad1.3300($540mn)

AUD/USD: $0.7200(A$813mn)

NZD/USD: $0.6325(NZ$403mn)

-

15:00

U.S.: Housing Price Index, m/m, July 0.6%

-

14:47

Australian house price index rises 4.7% in the second quarter

The Australian Bureau of Statistics released its house price index on Tuesday. The Australian house price index rose 4.7% in the second quarter, after a 1.6% gain in the first quarter.

On a yearly basis, house prices jumped 9.8% in the second quarter, after a 6.9% rise in the first quarter.

The total value of residential dwellings in Australia totalled A$5.761 trillion in the second quarter, up A$271.939 billion in the first quarter.

-

14:23

CBI industrial order books balance decreases to -7% in September

The Confederation of British Industry (CBI) released its industrial order books balance on Tuesday. The CBI industrial order books balance dropped to -7% in September from -1% in August, missing expectations for a rise to 0%.

The decrease was partly driven by a fall in export order book balance. The export order book balance plunged to -24% in September from -8% in August.

The balance for output volumes for the next three months was 0% in September, down from +14% in August. It was the lowest level since October 2013.

"Exports are the missing link in the UK recovery at the moment, with the strong pound squeezing manufacturers' margins, even though lower commodity prices are helping to ease cost pressures. Meanwhile manufacturers will have an eye on China's slowdown and its effect on neighbouring markets. Boosting our export performance, alongside innovation, are vital to improving productivity," the CBI director of economics Rain Newton-Smith said.

-

14:11

Foreign exchange market. European session: the British pound traded lower against the U.S. dollar after the release of the negative economic data from the U.K.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Japan Bank holiday

01:30 Australia House Price Index (QoQ) Quarter II 1.6% 4.7%

06:00 Switzerland Trade Balance August 3.58 Revised From 3.74 2.87

08:30 United Kingdom PSNB, bln August -0.07 Revised From -2.07 8.65 11.31

10:00 United Kingdom CBI industrial order books balance September -1 0 -7

The U.S. dollar traded higher against the most major currencies in the absence of any major economic reports from the U.S.

The FOMC member Dennis Lockhart will speak at 22:30 GMT.

The euro traded lower against the U.S. dollar as comments by the European Central Bank (ECB) Chief Economist Peter Praet still weighed on the euro. He said on Monday that the central bank will expand its asset-buying programme to defend its inflation objective if needed.

Destatis released its real wages growth data for Germany on Tuesday. Real wages in Germany rose by 2.7% year-on-year in the second quarter, after a 2.5% growth in the first quarter. It was the biggest increase since the series began in 2008.

Nominal earnings climbed 3.2% year-on-year in the second quarter. In the same period, German consumer price index increased 0.5%.

The British pound traded lower against the U.S. dollar after the release of the negative economic data from the U.K. The Confederation of British Industry (CBI) released its industrial order books balance on Tuesday. The CBI industrial order books balance dropped to -7% in September from -1% in August, missing expectations for a rise to 0%.

The decrease was partly driven by a fall in export order book balance. The export order book balance plunged to -24% in September from -8% in August.

The balance for output volumes for the next three months was 0% in September, down from +14% in August.

The Office for National Statistics released public sector net borrowing for the U.K. on Tuesday. The public sector net borrowing in the U.K. rose to £11.31 billion in August from £0.07 billion in July. July's figure was revised up from -£2.07 billion. Analysts had expected an increase to £8.65 billion.

Public sector net borrowing excluding public sector banks totalled £12.1 billion in August, up by £1.4 billion from last year. It was the highest level for August since 2012.

Total debt was £1,506 billion in August, up £68.9 billion from last year. It was equal to 80.6% of GDP.

The increase in debt was driven by a decline in income tax paid.

The Swiss franc traded lower against the U.S. dollar after the release of the Swiss trade data. The Swiss trade surplus fell to CHF2.87 billion in August from CHF3.58 billion in the previous month. July's figure was revised down from a surplus of CHF3.74 billion.

Exports dropped 2.4% in August, while imports were down 4.0%.

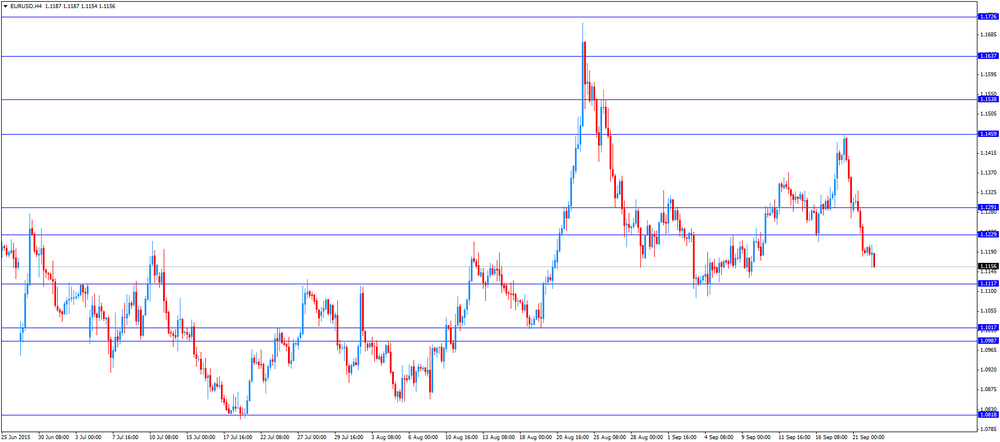

EUR/USD: the currency pair decreased to $1.1154

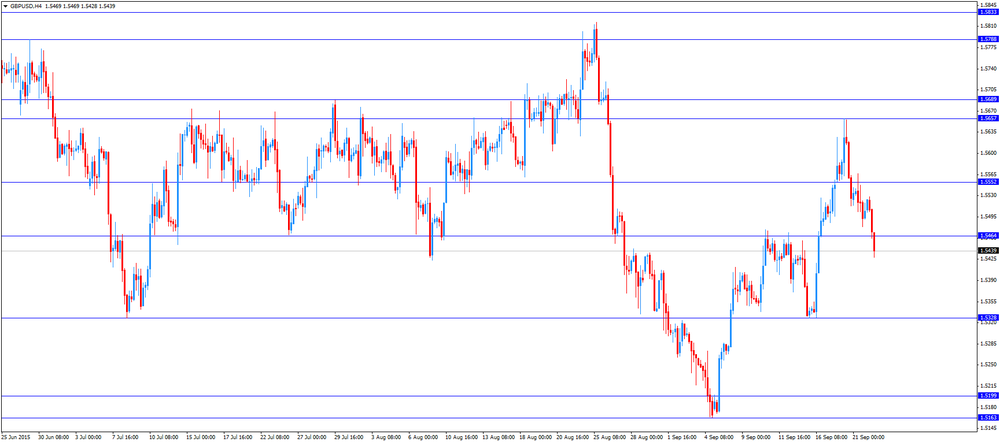

GBP/USD: the currency pair fell to $1.5428

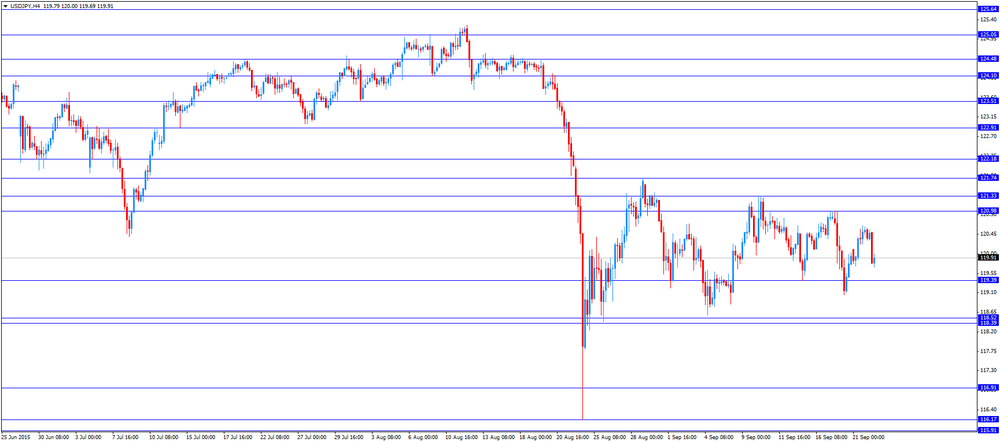

USD/JPY: the currency pair declined to Y119.69

The most important news that are expected (GMT0):

13:00 U.S. Housing Price Index, m/m July 0.2%

14:00 Eurozone Consumer Confidence (Preliminary) September -6.9 -7

14:00 U.S. Richmond Fed Manufacturing Index September 0

22:30 U.S. FOMC Member Dennis Lockhart Speaks

-

13:50

Orders

EUR/USD

Offers 1.1200 1.1225 1.1245 1.1275 1.1300 1.1325-30 1.1350

Bids 1.1150 1.1135 1.1120 1.1100 1.1085 1.1065 1.1050 1.1030 1.1000

GBP/USD

Offers 1.5520 1.5545-50 1.5575 1.5600-05 1.5620 1.5650

Bids 1.5475-80 1.5465 1.5450 1.5425-30 1.5400 1.5380 1.5350

EUR/GBP

Offers 0.7230-35 0.7250 0.7265 0.7285 0.7300 0.7325-30 0.7350-55

Bids 0.7200 0.7185 0.7150 0.7130 0.7100 0.7085

EUR/JPY

Offers 134.40 134.80 135.00 135.50 135.80 136.00 136.25 136.50

Bids 134.00 133.80 133.50 133.30 133.00 132.75 132.50

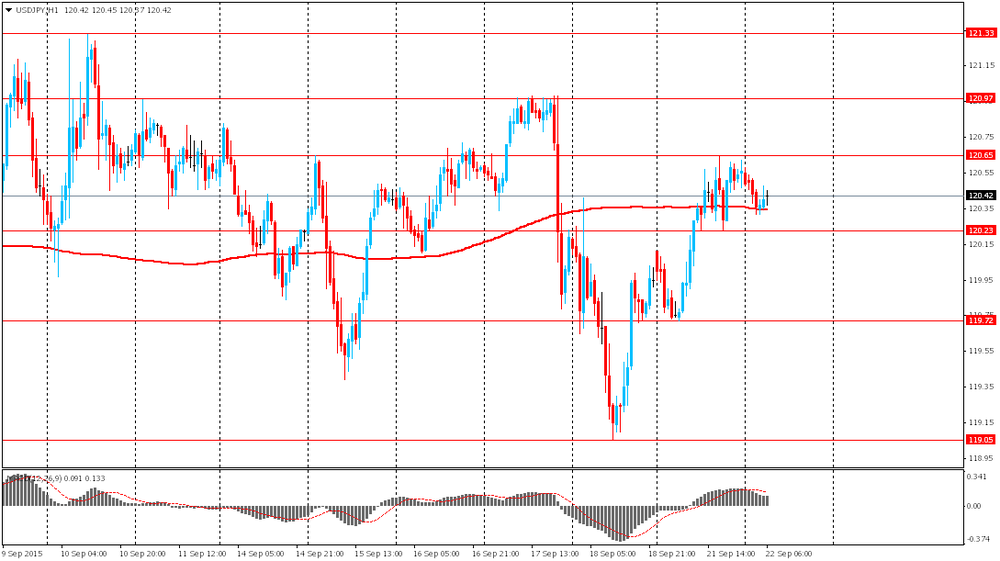

USD/JPY

Offers 120.20-25 120.40 120.60-65 120.85 121.00 121.30 121.50

Bids 120.00 119.75-80 119.50 119.30 119.10 119.00 118.85 118.50

AUD/USD

Offers 0.7165-70 0.7185 0.7200 0.72200.7250 0.7265 0.7280 0.7300

Bids 0.7120-25 0.7100 0.7085 0.7065 0.7050

-

12:00

United Kingdom: CBI industrial order books balance, September -7

-

11:54

European Central Bank Chief Economist Peter Praet: the central bank will expand its asset-buying programme to defend its inflation

The European Central Bank (ECB) Chief Economist Peter Praet said on Monday that the central bank will expand its asset-buying programme to defend its inflation objective if needed.

He noted that the ECB will "certainly do what's necessary".

-

11:44

Public sector net borrowing in the U.K. rises to £11.31 billion in August

The Office for National Statistics released public sector net borrowing for the U.K. on Tuesday. The public sector net borrowing in the U.K. rose to £11.31 billion in August from £0.07 billion in July. July's figure was revised up from -£2.07 billion. Analysts had expected an increase to £8.65 billion.

Public sector net borrowing excluding public sector banks totalled £12.1 billion in August, up by £1.4 billion from last year. It was the highest level for August since 2012.

Total debt was £1,506 billion in August, up £68.9 billion from last year. It was equal to 80.6% of GDP.

The increase in debt was driven by a decline in income tax paid.

-

11:14

Real wages in Germany climb by 2.7% year-on-year in the second quarter

Destatis released its real wages growth data for Germany on Tuesday. Real wages in Germany rose by 2.7% year-on-year in the second quarter, after a 2.5% growth in the first quarter. It was the biggest increase since the series began in 2008.

Nominal earnings climbed 3.2% year-on-year in the second quarter. In the same period, German consumer price index increased 0.5%.

-

11:03

Swiss trade surplus declines to CHF2.87 billion in August

The Swiss Federal Customs Administration released its trade data on Tuesday. The Swiss trade surplus fell to CHF2.87 billion in August from CHF3.58 billion in the previous month. July's figure was revised down from a surplus of CHF3.74 billion.

Exports dropped 2.4% in August, while imports were down 4.0%.

On a yearly basis, exports fell 2.1% in August, while imports decreased 7.4%.

-

10:49

European Central Bank (ECB) Governing Council member Ardo Hansson: low interest rates for a longer period “may lead into unbalances or risks”

European Central Bank (ECB) Governing Council member Ardo Hansson said on Monday that low interest rates for a longer period "may lead into unbalances or risks that-in case they become reality-may become very costly to the society".

He pointed out that "possible bubbles on financial markets or in real-estate prices are more likely when interest rates are low".

-

10:34

European Central Bank (ECB) Governing Council member Ewald Nowotny: interest rates in the Eurozone are likely to stay low as long as the economic growth stays low

European Central Bank (ECB) Governing Council member Ewald Nowotny said on Monday that interest rates in the Eurozone are likely to stay low as long as the economic growth stays low.

"One should not overestimate the possibilities that central banks have in relation to influencing the long-term interest rate. As long as we have an economy with relatively low growth rates, we will have to live with low interest rates," he said.

Nowotny pointed out that it is dangerous to hike interest rates too soon.

"That's a horror scenario," he noted.

Nowotny also said that the ECB pursues "no particular exchange rate policy".

-

10:30

United Kingdom: PSNB, bln, August -11.31 (forecast -8.65)

-

10:24

Atlanta Fed President Dennis Lockhart: the Fed could still start raising its interest rates in 2015

Atlanta Fed President Dennis Lockhart said on Monday that the Fed could still start raising its interest rates in 2015.

"As things settle down, I will be ready for the first policy move on the path to a more normal interest rate environment. I am confident the much-used phrase later this year is still operative," he said.

Lockhart noted that the U.S. economy was "performing solidly".

Atlanta Fed president said that he voted for keeping interest rates unchanged last week.

"I supported the decision last week to hold off. The altered risk picture relative to the economic outlook was decisive in my thinking. I thought it prudent to wait to evaluate whether recent developments change the outlook," he said.

Lockhart is a voting member of the Federal Open Market Committee this year.

-

10:12

Alexis Tsipras' Syriza won 35.46% on Sunday

Alexis Tsipras' Syriza party has won the parliament election on Sunday. Syriza has won 35.46%. That share gives the party 145 seats in the 300-seat parliament. The Conservative New Democracy won 28.1% - 75 seats. The fascist party Golden Dawn came in third place with 6.99% - 18 seats. The Independent Greeks, the coalition partner of Tsipras, won 3.69% - 10 seats.

Tsipras has to form the new government.

-

08:23

Options levels on tuesday, September 22, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1365 (1617)

$1.1309 (1382)

$1.1254 (530)

Price at time of writing this review: $1.1166

Support levels (open interest**, contracts):

$1.1121 (2473)

$1.1097 (5042)

$1.1069 (1649)

Comments:

- Overall open interest on the CALL options with the expiration date October, 9 is 50603 contracts, with the maximum number of contracts with strike price $1,1500 (4976);

- Overall open interest on the PUT options with the expiration date October, 9 is 67952 contracts, with the maximum number of contracts with strike price $1,1000 (7180);

- The ratio of PUT/CALL was 1.34 versus 1.34 from the previous trading day according to data from September, 21

GBP/USD

Resistance levels (open interest**, contracts)

$1.5802 (1133)

$1.5703 (1360)

$1.5606 (1284)

Price at time of writing this review: $1.5487

Support levels (open interest**, contracts):

$1.5394 (1453)

$1.5296 (1265)

$1.5198 (2772)

Comments:

- Overall open interest on the CALL options with the expiration date October, 9 is 22248 contracts, with the maximum number of contracts with strike price $1,5500 (1663);

- Overall open interest on the PUT options with the expiration date October, 9 is 22063 contracts, with the maximum number of contracts with strike price $1,5200 (2772);

- The ratio of PUT/CALL was 0.99 versus 0.95 from the previous trading day according to data from September, 21

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:12

Foreign exchange market. Asian session: the dollar strengthened

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

01:30 Australia House Price Index (QoQ) Quarter II 1.6% 4.7%

06:00 Switzerland Trade Balance August 3.74 2.87

The U.S. dollar climbed against the euro amid hawkish comments from Fed officials. Three policy makers said yesterday that they expect higher rates by the end of 2015. The dollar rose amid speculation that the U.S. economy was ready for a rate hike.

The pound is under pressure ahead of publication of UK budget deficit data, scheduled for this week. The deficit is expected to post an increase in August compared to the previous month. However higher revenues from taxes might have decreased the deficit compared to the same period last year.

The yen climbed after yesterday's decline. Dealers from Asia said that Japanese exporters placed sell orders above Y120.50, which weigh on the greenback and support the yen. These orders used to be at Y121.00 and higher. However exporters moved them lower. Japanese stock markets are closed due to the National Day holiday.

EUR/USD: the pair fluctuated within $1.1180-95 in Asian trade

USD/JPY: the pair fell to Y120.30

GBP/USD: the pair rose to $1.5530

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:30 United Kingdom PSNB, bln August 2.07 -8.65

10:00 United Kingdom CBI industrial order books balance September -1 0

13:00 U.S. Housing Price Index, m/m July 0.2%

14:00 Eurozone Consumer Confidence (Preliminary) September -6.9 -7

14:00 U.S. Richmond Fed Manufacturing Index September 0

20:30 U.S. API Crude Oil Inventories September -3.1

22:30 U.S. FOMC Member Dennis Lockhart Speaks

-

08:00

Switzerland: Trade Balance, August 2.87

-

03:30

Australia: House Price Index (QoQ), Quarter II 4.7%

-

00:32

Currencies. Daily history for Sep 21’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1188 -1,03%

GBP/USD $1,5505 -0,14%

USD/CHF Chf0,9719 +0,37%

USD/JPY Y120,56 +0,51%

EUR/JPY Y134,88 -0,50%

GBP/JPY Y186,92 +0,35%

AUD/USD $0,7131 -0,79%

NZD/USD $0,6317 -1,30%

USD/CAD C$1,3249 +0,19%

-

00:00

Schedule for today, Tuesday, Sep 22’2015:

(time / country / index / period / previous value / forecast)

00:00 Japan Bank holiday

01:30 Australia House Price Index (QoQ) Quarter II 1.6%

06:00 Switzerland Trade Balance August 3.74

08:30 United Kingdom PSNB, bln August 2.07 -8.65

10:00 United Kingdom CBI industrial order books balance September -1 0

13:00 U.S. Housing Price Index, m/m July 0.2%

14:00 Eurozone Consumer Confidence (Preliminary) September -6.9 -6.95

14:00 U.S. Richmond Fed Manufacturing Index September 0

20:30 U.S. API Crude Oil Inventories September -3.1

22:30 U.S. FOMC Member Dennis Lockhart Speaks

-