Noticias del mercado

-

17:46

Oil prices fall on concerns over the slowdown in the Chinese economy and concerns over the global oil slowdown

Oil prices declined on concerns over the slowdown in the Chinese economy and concerns over the global oil slowdown. Market participants expect the oil supply to rise when sanctions against Iran will be lifted off.

Market participants are awaiting the release of the Chinese preliminary manufacturing purchasing managers' index (PMI) tomorrow. The index is expected to rise to 47.5 in September from 47.3 in August.

Meanwhile, the Asian Development Bank (ADB) lowered growth forecasts for China. According to the ADB, China is expected to expand by 6.8% in 2015, down from July estimate of a 7.0% rise, and 6.7% in 2016, down from July estimate of a 6.8% increase.

Market participants are awaiting the release of U.S. crude oil inventories data. The American Petroleum Institute (API) is scheduled to release its U.S. oil inventories data later in the day, and U.S. oil inventories data from the U.S. Energy Information Administration is expected on Wednesday.

WTI crude oil for October delivery fell to $45.46 a barrel on the New York Mercantile Exchange.

Brent crude oil for October declined to $47.96 a barrel on ICE Futures Europe.

-

17:28

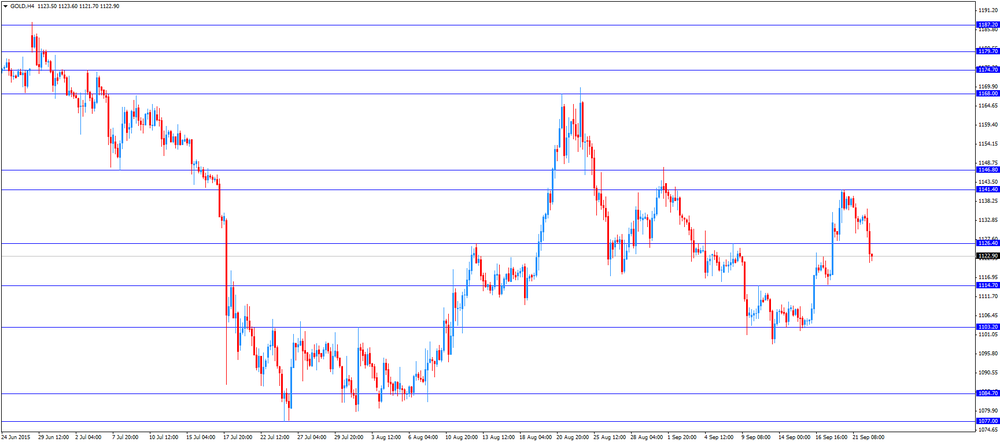

Gold price declines around 1% on speculation on that the Fed will start raising its interest rates this year

Gold price drops on speculation on that the Fed will start raising its interest rates this year, while a decline in prices of other commodities also weighed on gold price.

A stronger U.S. dollar also weighed on gold price. The greenback was supported by comments by St. Louis Fed President James Bullard and Atlanta Fed President Dennis Lockhart. Both officials said that the Fed could start raising its interest rates this year.

Market participants are awaiting the release of the Chinese preliminary manufacturing purchasing managers' index (PMI) tomorrow. The index is expected to rise to 47.5 in September from 47.3 in August.

Meanwhile, the Asian Development Bank (ADB) lowered growth forecasts for China. According to the ADB, China is expected to expand by 6.8% in 2015, down from July estimate of a 7.0% rise, and 6.7% in 2016, down from July estimate of a 6.8% increase.

October futures for gold on the COMEX today declined to 1123.00 dollars per ounce.

-

17:02

Asian Development Bank cut its growth forecasts for China and India

The Asian Development Bank (ADB) lowered growth forecasts for China and India. According to the ADB, China is expected to expand by 6.8% in 2015, down from July estimate of a 7.0% rise, and 6.7% in 2016, down from July estimate of a 6.8% increase.

India is expected to rise by 7.4% in the financial year 2015 ending March 2016, down from July estimate of a 7.8% rise, and 7.8% in the fiscal year 2016 ending March 2017, down from July estimate of a 8.2% increase.

The downgrade of the Indian growth was driven by a weak external demand and a slower-than-expected pace of reform implementation.

The economic growth of developing Asia is expected to be 5.8% this year, down from July estimate of a 6.1% increase, and 6% in 2016, down from July estimate of a 6.2% rise.

Inflation in developing Asia is expected to decline to 2.3% in 2015 from 3% in 2014 due to low global commodity prices.

Southeast Asia is expected to grow 4.4% in 2015 and 4.9% in 2016.

"The combination of a moderating prospect in China and India, together with delayed recovery of advanced countries, weighed on our forecast for the region as a whole," ADB Chief Economist Shang-Jin Wei said.

-

16:40

-

08:51

Oil prices fell

West Texas Intermediate futures for October delivery, which expires today, fell to $46.30 (-1.41%), while Brent crude declined to $48.41 (-1.04%) as traders took profits after yesterday's gains.

Reuters reported on Tuesday based on official data that China's implied oil demand rose by 1.2% in August compared to July.

Some analysts say that prices have reached their bottom. However several banks including Goldman Sachs and ANZ cut their price forecasts this month, arguing it will take until next year or 2017 to reduce supply glut.

-

08:25

Gold under pressure

Gold is currently at $1,133.20 (+0.04%). The precious metal slipped from earlier highs as a stronger dollar and gains in stocks lowered demand for safe-haven assets.

Several Federal Reserve's officials said yesterday that they still expect a rate hike by the end of the current year. Higher rates would harm non-interest-bearing bullion. Investors are also waiting for Fed Chair Yellen's speech scheduled for Thursday.

-

00:34

Commodities. Daily history for Sep 21’2015:

(raw materials / closing price /% change)

Oil 46.48 -0.43%

Gold 1,132.60 -0.02%

-