Noticias del mercado

-

22:18

U.S. stocks closed

U.S. stocks closed at their highest level in almost four weeks, with equities spurred on by a rally in energy shares and deal activity among beer brewers while Federal Reserve policy makers debated whether to raise interest rates.

The Standard & Poor's 500 Index rose 0.9 percent to 1,995.12 at 4 p.m. in New York, its highest since Aug. 20, after the gauge rallied 1.3 percent yesterday.

Data today showed prices paid by American households declined in August as cheaper gasoline helped keep inflation below the objective of Fed policy makers. The consumer-price index dropped 0.1 percent, the first decline since January. The so-called core measure, which strips out often-volatile fuel and food costs, rose 0.1 percent for a second month.

A 15 percent plunge in energy costs over the past 12 months and a rising dollar are acting as a brake on inflation that the Fed views as temporary. Central bankers will have to weigh restrained prices, uneasy financial markets and a resilient U.S. labor market as they consider raising rates.

Speculation has increased that the Fed will delay a rate increase as China ignited concern that its slowdown could weigh on global growth. While investors remain confident the central bank will raise borrowing costs this year, traders are pricing in a 28 percent chance of action on Thursday, down from 48 percent before China's currency devaluation last month. Odds of a move at the December meeting are about 63 percent.

The Organization for Economic Cooperation and Development said the Fed would be right to begin raising rates this week but it needs to signal its intentions to the rest of the world.

"Do it now to remove uncertainty facing emerging markets, but communicate more clearly the nature of the more gradual path, that's the message," OECD Chief Economist Catherine Mann said in an interview in Paris.

Equities have been particularly volatile recently amid concerns about China and the Fed's rate intentions. While the Chicago Board Options Exchange Volatility Index through Tuesday had slipped 45 percent from its high last month, it was still 41 percent above its annual average.

With the S&P 500 trading at 16.7 times its members' projected earnings, history shows that a Fed rate increase could be bad news for investors banking on a rebound in U.S. corporate earnings. Since World War II, profit growth has fallen by roughly half in the year after a Fed hike, data from Ned Davis Research Group show. Analysts predict S&P 500 earnings will be flat this year, before rising 9.7 percent in 2016.

-

21:00

DJIA 16718.62 118.77 0.72%, NASDAQ 4881.04 20.51 0.42%, S&P 500 1993.13 15.04 0.76%

-

19:27

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes rose. Energy stocks lifted Wall Street on Wednesday after a 5% jump in oil prices, even as investors braced for the Federal Reserve's decision on an interest rate hike. The Fed will decide on Thursday after a two-day meeting. Speculation about when the Fed will end seven years of near-zero interest rates has dogged Wall Street for months, with the picture complicated by recent market turbulence that some see as justification for the central bank to stand pat.

Almost all of Dow stocks in positive area (27 of 30). Top looser Verizon Communications Inc. (VZ, -0.17%). Top gainer - General Electric Company (GE, +2.77).

All S&P index sectors in positive area. Top gainer - Basic Materials (+2,6%).

At the moment:

Dow 16604.00 +84.00 +0.51%

S&P 500 1981.50 +11.50 +0.58%

Nasdaq 100 4363.75 +12.75 +0.29%

10 Year yield 2,28% -0,00

Oil 47.01 +2.42 +5.43%

Gold 1120.90 +18.30 +1.66%

-

18:10

WSE: Session Results

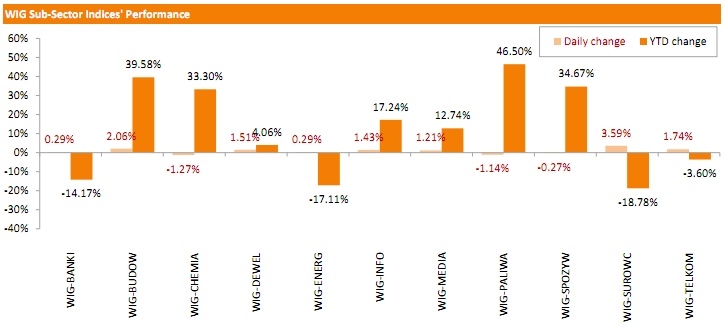

Polish equity market closed slightly higher on Wednesday. The broad market measure, the WIG index, added 0.09%. Sector-wise, materials (+3.59%) posted the best daily result, while chemicals (-1.27%) fared the worst.

The large-cap stocks' measure, the WIG30 Index, inched down 0.06%. In the index basket, PKN ORLEN (WSE: PKN) led the decliners with a 2.34% drop, followed by PZU (WSE: PZU) and GRUPA AZOTY (WSE: ATT), dropping by 2.07% and 1.83% respectively. On the other side of the ledger, coking coal producer JSW (WSE: JSW) generated the biggest gain, soaring by 27.81% on news the company agreed deal with its trade unions to curb some bonuses, which would allow the company to save PLN 2bln in 2016-2018 and stave off possible collapse. Other major outperformers were GTC (WSE: GTC), BOGDANKA (WSE: LWB), KGHM (WSE: KGH) and ASSECO POLAND (WSE: ACP), surging by 5.93%, 2.89%, 2.5% and 2.1% respectively.

-

18:00

European stocks close: stocks closed higher ahead of the Fed's interest rate decision tomorrow

Stock indices closed higher ahead of the Fed's interest rate decision tomorrow. The Fed's monetary policy meeting will start today. The results are scheduled to be released tomorrow at 18:00 GMT. According to analysts' forecasts, the Fed will not raise its interest rate in September due to concerns over a slowdown in the global economy and low inflationary expectations in the U.S.

Meanwhile, the economic data from the Eurozone was weak. Eurostat released its final consumer price inflation data for the Eurozone on Friday. Eurozone's final harmonized consumer price index was flat in August, in line with the preliminary reading, after a 0.6% drop in July.

On a yearly basis, Eurozone's final consumer price inflation fell to 0.1% in August from 0.2% in July, missing the previous estimate of a 0.2% increase.

Eurozone's consumer price inflation excluding food, energy, alcohol and tobacco declined to an annual rate of 0.9% in August from 1.0% in July, missing the previous estimate of 1.0% rise.

The Office for National Statistics (ONS) released its labour market data on Wednesday. The U.K. unemployment rate fell to 5.5% in the May to July quarter from 5.6% in the April to June quarter. It was the lowest reading since 2008.

Analysts had expected the unemployment rate to remain unchanged at 5.6%.

The claimant count rose by 1,200 people in August, missing expectations for a decline by 5,000, after a decrease of 6,800 people in July. July's figure was revised up from a fall of 4,900.

U.K. unemployment in the May to July period rose by 10,000 to 1.82 million from the previous quarter.

Average weekly earnings, excluding bonuses, climbed by 2.9% in the May to July quarter, in line with expectations, after a 2.8% gain in the February to April quarter. It was the highest gain since early 2009.

Average weekly earnings, including bonuses, rose by 2.9% in the May to July quarter, exceeding expectations for a gain of 2.5%, after a 2.6% increase in the February to April quarter. The previous three months' figure was revised up from a 2.4% increase.

The Bank of England monitors closely the wages growth it considers when to start hiking its interest rate.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,229.21 +91.61 +1.49 %

DAX 10,227.21 +39.08 +0.38 %

CAC 40 4,645.84 +76.47 +1.67 %

-

18:00

European stocks closed: FTSE 6229.21 91.61 1.49%, DAX 10227.21 39.08 0.38%, CAC 40 4645.84 76.47 1.67%

-

16:34

European Central Bank Governing Council member Ewald Nowotny: the low inflation is "a big problem for the ECB”

The European Central Bank (ECB) Governing Council member Ewald Nowotny said in an interview published online Tuesday that the low inflation is "a big problem for the ECB".

He pointed out that the central bank's had "a number of positive effects".

-

16:17

NAHB housing market index climbs to 62 in September, the highest level since November 2005

The National Association of Home Builders (NAHB) released its housing market index for the U.S. on Wednesday. The NAHB housing market index rose to 62 in September from 61 in August. Analysts had expected the index to remain unchanged at 61. It was the highest level since November 2005.

A level above 50.0 is considered positive, below indicates a negative outlook.

The increase was driven by a rise in two of three components of the index. The buyer traffic subindex rose two points to 47 in September, the current sales conditions subindex climbed one point to 67, while the subindex measuring sales expectations in the next six months declined to 68 from 70.

"Single-family housing is making solid progress. However, our members continue to tell us that they are concerned about the availability of lots and labour," the NAHB Chairman Tom Woods said.

"We expect housing to keep moving forward at a steady, modest rate through the end of the year," the NAHB Chief Economist David Crowe said.

-

16:03

U.S. weekly earnings rise 0.7% in August

The U.S. Labor Department released its real earnings data on Wednesday. Weekly earnings rose 0.7% in August, after a 0.1% increase in July.

The increase was driven by rises in workers' hourly pay and hours.

Average hourly earnings climbed 0.5%.

On a yearly basis, real average weekly earnings increased 2.3% in August, while hourly earnings rose 2%.

-

15:38

Standard & Poor's downgrades Japan's credit rating to A+

Ratings agency Standard & Poor's (S&P) downgraded Japan's credit rating to A+ from AA- to A+ on Wednesday. The outlook was upgraded to stable from negative.

It was the first downgrade by S&P since January 2011.

"Despite showing initial promise, we believe that the government's economic revival strategy - dubbed 'Abenomics'- will not be able to reverse this deterioration in the next two to three years. Economic support for Japan's sovereign creditworthiness has continued to weaken," the agency said.

-

15:32

U.S. Stocks open: Dow +0.07%, Nasdaq +0.01%, S&P +0.02%

-

15:25

Before the bell: S&P futures -0.15%, NASDAQ futures -0.10%

U.S. stock-index futures were little changed as the Federal Reserve policy makers head into a two-day meeting to decide whether to lift interest rates for the first time since 2006.

Global Stocks:

Nikkei 18,171.6 +145.12 +0.81%

Hang Seng 21,966.66 +511.43 +2.38%

Shanghai Composite 3,152.66 +147.49 +4.91%

FTSE 6,208.9 +71.30 +1.16%

CAC 4,630.91 +61.54 +1.35%

DAX 10,235.18 +47.05 +0.46%

Crude oil $45.62 (+2.40%)

Gold $1111.30 (+0.79%)

-

15:11

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

ALTRIA GROUP INC.

MO

55.67

2.88%

113.4K

Barrick Gold Corporation, NYSE

ABX

6.39

2.24%

34.7K

Hewlett-Packard Co.

HPQ

27.63

1.92%

35.7K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.50

1.86%

45.2K

Yandex N.V., NASDAQ

YNDX

12.44

1.63%

11.3K

Chevron Corp

CVX

77.82

0.84%

6.2K

ALCOA INC.

AA

9.71

0.83%

2.8K

Exxon Mobil Corp

XOM

73.46

0.82%

6.4K

General Electric Co

GE

25.48

0.71%

38.5K

JPMorgan Chase and Co

JPM

63.84

0.41%

5.8K

Microsoft Corp

MSFT

44.15

0.39%

14.1K

Ford Motor Co.

F

14.36

0.35%

11.0K

International Business Machines Co...

IBM

147.99

0.31%

0.3K

Citigroup Inc., NYSE

C

52.15

0.29%

7.3K

Pfizer Inc

PFE

33.24

0.21%

10.7K

Intel Corp

INTC

29.78

0.17%

0.2K

Caterpillar Inc

CAT

74.70

0.16%

0.5K

Nike

NKE

114.00

0.14%

0.1K

United Technologies Corp

UTX

92.79

0.12%

2.3K

Johnson & Johnson

JNJ

94.50

0.11%

0.1K

Google Inc.

GOOG

635.69

0.09%

0.3K

Cisco Systems Inc

CSCO

26.00

0.08%

0.2K

Procter & Gamble Co

PG

69.50

0.07%

3.2K

Starbucks Corporation, NASDAQ

SBUX

56.95

0.07%

0.6K

Goldman Sachs

GS

187.56

0.06%

0.3K

Home Depot Inc

HD

116.25

0.06%

2.1K

Amazon.com Inc., NASDAQ

AMZN

522.49

0.02%

4.5K

3M Co

MMM

143.62

0.01%

0.1K

Visa

V

70.51

0.00%

2.7K

The Coca-Cola Co

KO

38.50

0.00%

1.2K

Wal-Mart Stores Inc

WMT

64.32

0.00%

0.3K

Twitter, Inc., NYSE

TWTR

27.17

0.00%

11.7K

Facebook, Inc.

FB

92.88

-0.02%

47.9K

AT&T Inc

T

32.84

-0.06%

2.0K

Apple Inc.

AAPL

116.20

-0.07%

127.6K

Tesla Motors, Inc., NASDAQ

TSLA

253.40

-0.07%

3.4K

Yahoo! Inc., NASDAQ

YHOO

31.00

-0.13%

3.1K

Walt Disney Co

DIS

103.06

-0.36%

1.3K

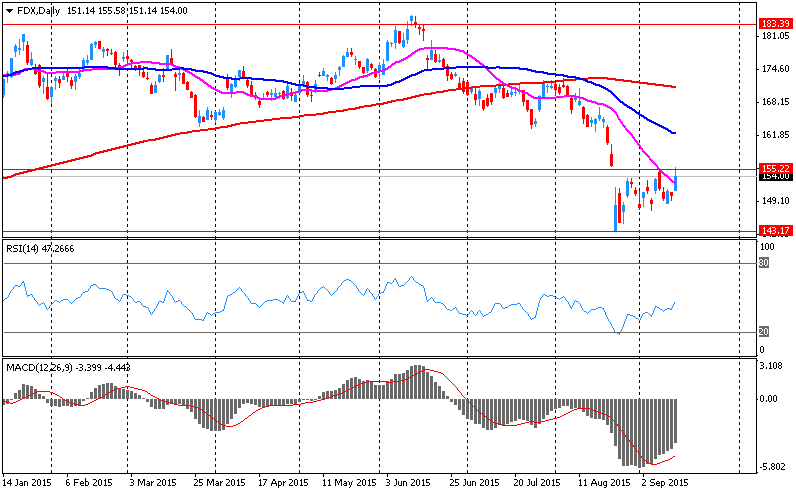

FedEx Corporation, NYSE

FDX

150.08

-2.55%

49.9K

-

15:04

Upgrades and downgrades before the market open

Upgrades:

JPMorgan Chase (JPM) upgraded to Outperform from Market Perform at BMO Capital

Yandex (YNDX) upgraded from Sell to Neutral at Goldman

Downgrades:

Other:

Apple (AAPL) target raised to $160 from $150 at JMP Securities

UnitedHealth (UNH) initiated with an Overweight at JP Morgan

Hewlett-Packard (HPQ) maintained at Neutral at Mizuho; $30 PT

General Electric (GE) added to U.S. and Global Focus Lists at Credit Suisse

-

14:59

U.S. consumer price inflation falls 0.1% in August

The U.S. Labor Department released consumer price inflation data on Wednesday. The U.S. consumer price inflation fell 0.1% in August, missing expectations for a flat reading, after a 0.1% gain in July.

The decrease was partly driven by lower gasoline prices. Gasoline prices dropped 4.1% in August. It was the biggest decline since January.

Food prices increased 0.2% in August.

On a yearly basis, the U.S. consumer price index remained unchanged at 0.2% in August, in line with expectations.

The U.S. consumer price inflation excluding food and energy gained 0.1% in August, in line with expectations, after a 0.1% increase in July.

On a yearly basis, the U.S. consumer price index excluding food and energy remained unchanged at 1.8% in August, missing expectations for a rise to 1.9%.

The inflation remains low due to a weak wage growth and a stronger U.S. dollar.

These inflation data is no help to understand if the Fed starts raising its interest rates this month.

-

14:39

Canadian manufacturing shipments are up 1.7% in July

Statistics Canada released manufacturing shipments on Wednesday. Canadian manufacturing shipments rose 1.7% in July, beating forecasts of a 1.0% increase, after a 1.5% gain in June. June's figure was revised up from a 1.2% rise.

The rise was partly driven by higher sales of motor vehicle parts and motor vehicles. Sales of motor vehicle parts jumped 12.1% in July, while sales in the motor vehicle assembly industry increased 5.6%.

Inventories rose 1.1% in July.

Sales increased in 12 of 21 categories.

-

14:29

European Central Bank (ECB) Vice President Vitor Constancio: there is a scope to extend the asset-buying programme

The European Central Bank (ECB) Vice President Vitor Constancio said in an interview with Reuters on Wednesday that there is a scope to extend the asset-buying programme as the volume of the ECB's quantitative easing is smaller than other asset-buying programmes.

"The total amount that we have purchased represents 5.3 percent of the GDP (gross domestic product) of the euro area, whereas what the Fed has done represents almost 25 percent of the U.S. GDP, what the Bank of Japan has done represents 64 percent of the Japanese GDP and what the U.K. has done 21 percent of the UK's GDP," he said.

Constancio pointed out that the Eurozone needs strong growth in the U.S. and China.

"We need a strong recovery in the U.S. China can still stabilise its situation and to keep growth above 6 percent is achievable in the short term," he said.

-

14:24

Company News: FedEx (FDX) missed earnings estimates and lowered EPS outlook

Company reported Q1 profit of $2.42 per share versus $2.46 consensus. Revenues rose 5.0% y/y to $12.3 bln versus $12.3 bln consensus.

Company issued downside guidance for FY16, lowered EPS to $10.40-10.90 from $10.60-11.10 versus $10.82 consensus.

During the quarter, the company acquired 1.1 million shares of FedEx common stock.

FDX fell to $148.90 (-3.31%) on the premarket.

-

12:02

European stock markets mid session: stocks traded higher ahead of the Fed’s interest rate decision tomorrow

Stock indices traded higher ahead of the Fed's interest rate decision tomorrow. The Fed's monetary policy meeting will start today. The results are scheduled to be released tomorrow at 18:00 GMT. According to analysts' forecasts, the Fed will not raise its interest rate in September due to concerns over a slowdown in the global economy and low inflationary expectations in the U.S.

Meanwhile, the economic data from the Eurozone was weak. Eurostat released its final consumer price inflation data for the Eurozone on Friday. Eurozone's final harmonized consumer price index was flat in August, in line with the preliminary reading, after a 0.6% drop in July.

On a yearly basis, Eurozone's final consumer price inflation fell to 0.1% in August from 0.2% in July, missing the previous estimate of a 0.2% increase.

Eurozone's consumer price inflation excluding food, energy, alcohol and tobacco declined to an annual rate of 0.9% in August from 1.0% in July, missing the previous estimate of 1.0% rise.

The Office for National Statistics (ONS) released its labour market data on Wednesday. The U.K. unemployment rate fell to 5.5% in the May to July quarter from 5.6% in the April to June quarter. It was the lowest reading since 2008.

Analysts had expected the unemployment rate to remain unchanged at 5.6%.

The claimant count rose by 1,200 people in August, missing expectations for a decline by 5,000, after a decrease of 6,800 people in July. July's figure was revised up from a fall of 4,900.

U.K. unemployment in the May to July period rose by 10,000 to 1.82 million from the previous quarter.

Average weekly earnings, excluding bonuses, climbed by 2.9% in the May to July quarter, in line with expectations, after a 2.8% gain in the February to April quarter. It was the highest gain since early 2009.

Average weekly earnings, including bonuses, rose by 2.9% in the May to July quarter, exceeding expectations for a gain of 2.5%, after a 2.6% increase in the February to April quarter. The previous three months' figure was revised up from a 2.4% increase.

The Bank of England monitors closely the wages growth it considers when to start hiking its interest rate.

Current figures:

Name Price Change Change %

FTSE 100 6,193.21 +55.61 +0.91 %

DAX 10,248.09 +59.96 +0.59 %

CAC 40 4,624.68 +55.31 +1.21 %

-

11:57

OECD downgrades its global growth outlook

The Organization for Economic Cooperation and Development (OECD) released its growth forecast on Wednesday. The OECD downgraded its global growth outlook. The downgrade was largely driven by a slowdown in emerging market economies.

Global GDP is estimated to grow 3.0% in 2015 and 3.6% in 2016, down from 3.1% and from 3.8%.

"Global growth prospects have weakened slightly and the outlook is clouded by important uncertainties. Emerging economies have vulnerabilities that could be exposed by rising US interest rates and/or a sharper-than-expected slowdown in China, giving rise to financial and economic turbulence that could also exert a significant drag on advanced economies," OECD Chief Economist Catherine Mann said.

The OECD expect the U.S. will grow at 2.4% in 2015, up from the previous estimate of 2.0%, and at 2.6% in 2016, down from the previous estimate of 2.8%. The OECD said that the Fed will soon start to hike its interest rates, adding that the pace of the interest rate hike is more important than the timing.

Japan's economy is expected to grow at 0.6% in 2015 and at 1.2% in 2016, down from June estimate of 0.7% for 2015 and down 1.4% for 2016.

Eurozone's forecasts were upgraded to 1.6% in 2015 from the previous estimate of 1.4% and downgraded to 1.9% in 2016 from the previous estimate of 2.1%. OECD chief economist noted that the pace of recovery in the Eurozone was disappointing.

China is expected to expand at 6.7% in 2015, down from 6.8% estimate in June. Growth forecast for 2016 remained unchanged at 6.5%.

Mann pointed out that advanced and emerging countries should implement structural reforms "to encourage investment and reverse the slowdown in the growth potential output".

-

11:32

Hourly labour costs in the Eurozone climb 1.6% in the second quarter

Eurostat released its labour costs data for the Eurozone on Wednesday. Hourly labour costs in the Eurozone rose at an annual rate of 1.6% in the second quarter, after a 1.9% gain in the previous quarter.

Wages and salaries per hour climbed 1.9% year-on-year in the second quarter, while non-wage costs gained 0.4%.

In the second quarter of 2015, hourly labour costs increased 2.0% year-on-year in industry, 1.1% in construction, 1.5% in services, while 1.4% in the mainly non-business economy.

-

11:25

ZEW Institute and Credit Suisse Group’s survey: Switzerland's economic sentiment index climbs to 9.7 points in September, the highest reading since March 2014

A survey by the ZEW Institute and Credit Suisse Group showed on Wednesday that Switzerland's economic sentiment index climbed to 9.7 points in September from 5.9 points in August. It was the highest reading since March 2014.

"Experts remain cautious, however, in regard to the economic trend in Switzerland. Slightly more than one third of respondents expect the situation to improve, one quarter forecast deterioration and the remaining respondents do not expect any change in the Swiss economic situation," the ZEW said.

The current conditions rose by 7.9 points to -9.7 points in September from -17.6 points in August.

-

11:18

Eurozone's final harmonized consumer price index is flat in August

Eurostat released its final consumer price inflation data for the Eurozone on Friday. Eurozone's final harmonized consumer price index was flat in August, in line with the preliminary reading, after a 0.6% drop in July.

On a yearly basis, Eurozone's final consumer price inflation fell to 0.1% in August from 0.2% in July, missing the previous estimate of a 0.2% increase.

Restaurants and cafés prices were up 0.10% year-on-year in August, vegetables prices rose by 0.09%, tobacco prices gained 0.08%, fuel prices for transport declined by 0.55%, heating oil prices decreased by 0.25%, while milk, cheese and eggs prices were down by 0.07%.

Eurozone's consumer price inflation excluding food, energy, alcohol and tobacco declined to an annual rate of 0.9% in August from 1.0% in July, missing the previous estimate of 1.0% rise.

-

10:48

U.K. unemployment rate declines to 5.5% in the May to July quarter

The Office for National Statistics (ONS) released its labour market data on Wednesday. The U.K. unemployment rate fell to 5.5% in the May to July quarter from 5.6% in the April to June quarter. It was the lowest reading since 2008.

Analysts had expected the unemployment rate to remain unchanged at 5.6%.

The claimant count rose by 1,200 people in August, missing expectations for a decline by 5,000, after a decrease of 6,800 people in July. July's figure was revised up from a fall of 4,900.

U.K. unemployment in the May to July period rose by 10,000 to 1.82 million from the previous quarter.

Average weekly earnings, excluding bonuses, climbed by 2.9% in the May to July quarter, in line with expectations, after a 2.8% gain in the February to April quarter. It was the highest gain since early 2009.

Average weekly earnings, including bonuses, rose by 2.9% in the May to July quarter, exceeding expectations for a gain of 2.5%, after a 2.6% increase in the February to April quarter. The previous three months' figure was revised up from a 2.4% increase.

The Bank of England monitors closely the wages growth it considers when to start hiking its interest rate.

-

10:34

European Central Bank (ECB) Governing Council member Jens Weidmann: a loose monetary policy cannot support sustained growth and could lead to risks over time

European Central Bank (ECB) Governing Council member Jens Weidmann said in an interview published Wednesday in German newspaper Sueddeutsche Zeitung that a loose monetary policy cannot support sustained growth and could lead to risks over time.

"All the cheap money cannot ignite sustained growth and builds bigger risks over time, for example for financial stability," he said.

-

10:12

European Central Bank Governing Council member Ewald Nowotny: the central bank might extend its asset-buying programme

The European Central Bank (ECB) Governing Council member Ewald Nowotny said in an interview on Tuesday that the central bank's asset-buying programme might be extended. He did not mentioned any details.

The ECB's asset-buying programme should run until September 2016. The central bank is buying €60 billion per month in assets.

-

08:11

Global Stocks: U.S. indices gained and helped Asian stocks climb

U.S. stock indices rose on Tuesday as investors prepared for the Federal Reserve's meeting. "There is a lot of uncertainty around the decision and for the large part the market is just willing the decision and that uncertainty to be over," an analyst at J.P. Morgan said.

The Dow Jones Industrial Average rose 228.89 points, or 1.4%, to 16599.85. The S&P 500 gained 25.06 points, or 1.3%, to 1978.09 (all of its 10 sectors gained). The Nasdaq Composite Index added 54.76 points, or 1.1%, to 4,860.52.

The Department of Commerce reported yesterday that U.S. consumers increased their spending in August, though at a slower pace than economists had expected. Sales at retail shops and restaurants rose by a seasonally adjusted 0.2% in August compared to a 0.7% rise reported previously (revised from +0.6%). Economists expected sales to grow by 0.3%.

Meanwhile the NY Fed Empire State manufacturing index slightly improved in September, but missed expectations. The index climbed to -14.67 from -14.92 in August. Economists expected the index to advance to -0.75.

This morning in Asia Hong Kong Hang Seng rose 1.01%, or 217.38 points, to 21,672.61. China Shanghai Composite Index climbed 0.15%, or 4.39 point, to 3,009.57. The Nikkei added 0.81%, or 145.89 points, to 18,172.37.

Asian stock indices rose following gains in U.S. equities. Investors are also waiting for news from the Federal Reserve.

Stocks of export-oriented Japanese companies were supported by a weaker yen.

-

04:18

Nikkei 225 18,203.31 +176.83 +1.0 %, Hang Seng 21,636.12 +180.89 +0.8 %, Shanghai Composite 2,996.45 -8.72 -0.3 %

-

00:35

Stocks. Daily history for Sep 15’2015:

(index / closing price / change items /% change)

Nikkei 225 18,026.48 +60.78 +0.34 %

Hang Seng 21,455.23 -106.67 -0.49 %

S&P/ASX 200 5,018.44 -78.03 -1.53 %

Shanghai Composite 3,004.36 -110.44 -3.55 %

FTSE 100 6,137.6 +53.01 +0.87 %

CAC 40 4,569.37 +51.22 +1.13 %

Xetra DAX 10,188.13 +56.39 +0.56 %

S&P 500 1,978.09 +25.06 +1.28 %

NASDAQ Composite 4,860.52 +54.76 +1.14 %

Dow Jones 16,599.85 +228.89 +1.40 %

-