Noticias del mercado

-

20:21

American focus: the US dollar rose despite disappointing reports

The US dollar rose against most currencies despite the exit of a number of weak reports on the US economy, while investors took a wait and see attitude on the eve of the forthcoming meeting of the Federal Reserve on Thursday. The volume of industrial production in the US decreased by the end of August, while exceeding the forecasts of experts that may have been due to the deteriorating economic situation abroad, and volatility in the financial markets. This was reported in the statement of the Federal Reserve System (FRS).

According to the data, the seasonally adjusted industrial production fell by 0.4%, partially offset by a July increase of 0.9%, which was revised from 0.6%. It is worth emphasizing this was the sixth decline in production over the past eight months. It also became known that the capacity utilization decreased in August to 77.6% compared to 78.0% in July. Economists had expected a decline in production by 0.2%, and reduce the capacity utilization to 77.8%.

Production in the manufacturing sector, which accounts for almost three quarters of the total industrial production decreased by 0.5%, which was due to a decrease in production of automobiles and auto parts. Meanwhile, the production of consumer goods increased by 0.4%. In annual terms, production in the manufacturing sector increased by 1.4%.

Meanwhile, the report showed that the ore extraction dropped 0.6%, reflecting a potentially lower energy prices and slowing demand for commodities from China. The relatively strong dollar, which makes exports more expensive for foreign buyers also put pressure on the performance in the manufacturing sector.

At the same time, American consumers increased their spending in August, but at a slower pace than in the previous month and less than the forecasts of experts. This was reported in the Ministry of Commerce.

According to data seasonally adjusted sales in retail stores and restaurants rose in August by 0.2% compared with an increase of 0.7% in June (revised from 0.6%). Meanwhile, retail sales excluding autos rose 0.3% against 0.6% in the previous month (revised from 0.4%). Experts expect that sales will increase by 0.3% and 0.2%, respectively.

We also learned that in annual terms, retail sales rose in August by 2.2%. Excluding gasoline purchases, sales in August increased by 0.4%. Compared with the same period of 2014, sales excluding gasoline prices increased by 4.4%.

Recall Consumer spending accounts for about 70% of economic activity in the United States and are a key indicator of the health of the economy. Retail sales represent a large share of total consumer spending. In general, the data show that consumers increased their spending in the spring and summer of this year as steel feel more confident about their economic situation. In addition to the low fuel prices, consumers have benefited from the stronger dollar, which makes imported goods cheaper. A strong labor market also helped increase costs.

The Department of Commerce also reported that sales of cars and auto parts increased by 0.7%, as sales in bars, restaurants and stores of food and beverages. Sales in the medical stores and stores personal care increased by 0.8%, while in clothing stores had recorded growth of 0.4%. On the other hand, sales at gas stations have fallen by 1.8% in August, noted the largest decline since January. Gasoline prices on average fell to $ 2.636 per gallon, compared to $ 2.794 per gallon in July.

Contrary to the expectations of economists, business activity producers in New York and did not show a significant improvement in September after an unexpected drop in August. This is evidenced by a report released Tuesday by the Federal Reserve Bank of New York. Reported Fed manufacturing index in New York rose to -14.7 this month from -14.9 in August. The August index was the lowest since 2009. By September, the index has declined for four months in a row. Economists expected the index to -0.75. Readings above zero indicate expanding activity.

Most of the sub-indices also continued to remain in negative territory. The fall in business activity and the deterioration in the labor market led to a reduction of manufacturers optimistic about future prospects. Expectations index of business activity fell by ten points, to 23.2.

Previously, the pressure on the euro was a report on the ZEW index according to which the German economic confidence weakened sharply in September, while reaching 10-month low. According to the data, the index of sentiment in the business environment fell in September to 12.1 points compared to 25.0 points in August. The last reading was the lowest since November 2014, when the figure was 11.5 points. Economists had expected the index to fall to 18.4 points. Also, the data showed that the index assess the current situation rose slightly in September - to 67.5 points versus 65.7 points last month. In addition, the ZEW said economic sentiment indicator for the euro zone fell in September by 14.3 points to 33.3 points. At the same time, the indicator of the current situation improved by 0.6 points to -9.7 points.

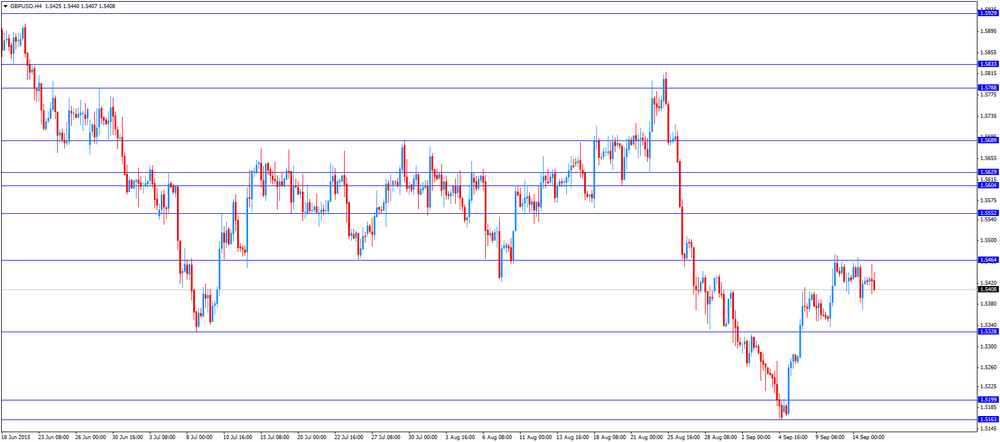

The pound fell against the dollar, the focus was on the UK inflation report, which showed that consumer prices rose in August by 0.2 percent in monthly terms, but were unchanged compared with the previous year. Last change coincided with forecasts of experts. Recall of the end of July was recorded decrease of 0.2 percent and an increase of 0.1 per cent, respectively. The ONS said that the fall in gasoline prices and lower seasonal increase in prices of clothing than in 2014, were the main factors slowing down the growth of prices. In addition, it was reported that producer prices fell in August by 1.8 percent per annum, recording a record decline since January. Also add that the cost of the British producers associated with crude oil, decreased by 47.7 percent compared to the same period in 2014. Also, today's report showed that core inflation, which excludes prices of energy, food, alcoholic beverages and tobacco increased by 1.0 per cent per annum, what was slower than the growth of 1.2 percent in July.

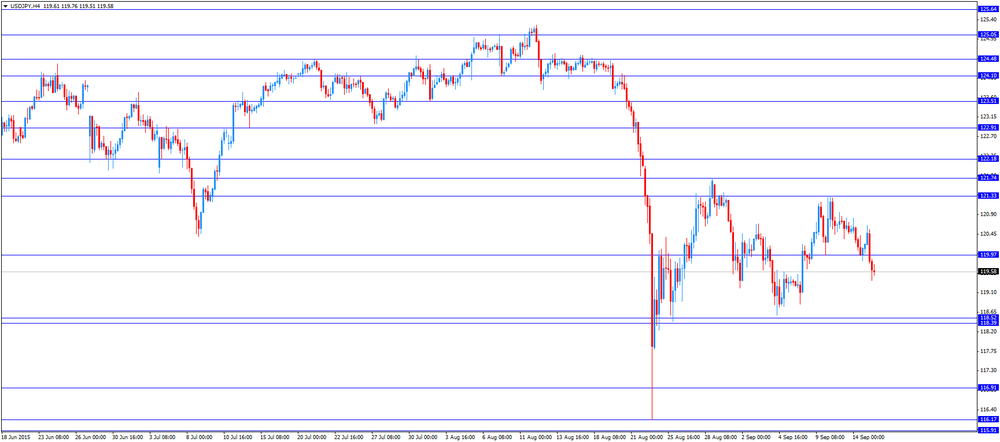

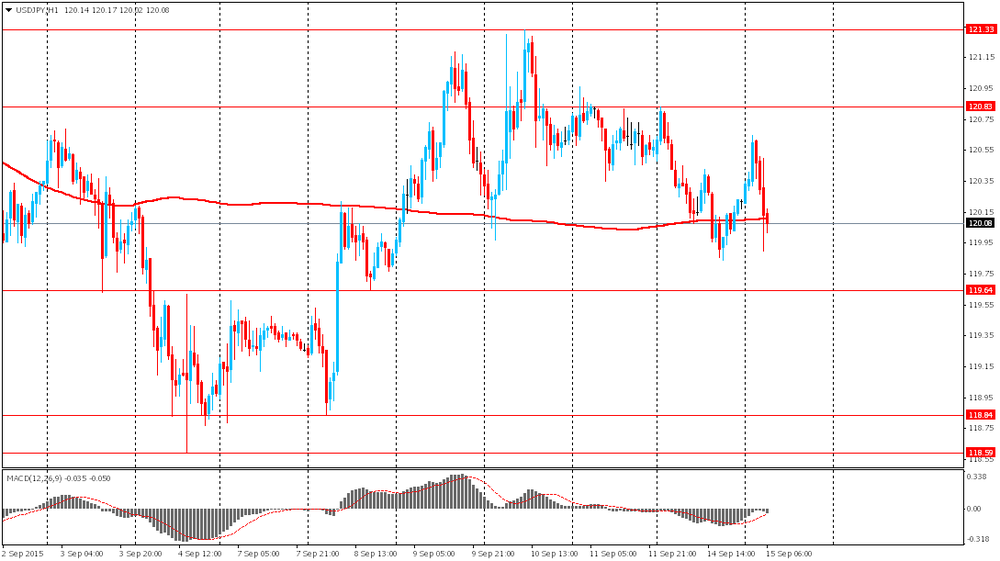

The yen strengthened against the dollar earlier, and set a new session high at Y119.39. Earlier today, the Bank of Japan kept its previous course of monetary policy. The decision was adopted 8 votes to 1. Board member Kiuchi has traditionally been against the decision of the Monetary Policy. In addition, the Bank of Japan decided to maintain the monetary policy parameters unchanged, the Central Bank has lowered its assessment of the economy. In a statement submitted after the two-day meeting, the Bank of Japan said that exports and industrial production "in recent years remained more or less unchanged", while last month it was noted that they are animated. In addition, the bank has changed the assessment of the economy in general, stating that "the economy continued to recover moderately, although the slowdown in emerging economies impact on exports and production." Meanwhile, the head of the Central Bank of Kuroda said he expects growth of consumer prices to the target level of 2% in the 1st half of 2016.

-

16:40

U.K. leading economic index falls 0.3% in July

The Conference Board (CB) released its leading economic index for the U.K. on Tuesday. The leading economic index decreased 0.3% in July, after a 0.3% decline in June.

The coincident index was up 0.1% in July, after a flat reading in July.

"The current behaviour of the composite indexes suggests that the economy is likely to continue to grow in the short-term, but the pace is unlikely to pick up," the CB said.

-

16:23

U.S. business inventories rise 0.1% in July

The U.S. Commerce Department released the business inventories data on Tuesday. The U.S. business inventories rose 0.1% in July, in line with expectations, after a 0.7% gain in June. It was the smallest rise since March.

June's figure was revised down from a 0.8% increase.

The increase was partly driven by a rise in retail inventories. Retail inventories climbed 0.6% in July, wholesale inventories were down 0.1%, while manufacturing inventories fell 0.1%.

Business sales climbed 0.1% in July, while retail sales increased 0.8%.

The business inventories/sales ratio remained unchanged at 1.36 months in July. The business inventories /sales ratio is a measure of how long it would take to clear shelves.

-

16:00

U.S.: Business inventories , July 0.1% (forecast 0.1%)

-

15:50

U.S. industrial production declines 0.4% in August

The Federal Reserve released its industrial production report on Tuesday. The U.S. industrial production fell 0.4% in August, missing expectations for a 0.2% decrease, after a 0.9% gain in July. July's figure was revised up from a 0.6% rise.

The drop was driven by a fall in the manufacturing output, which plunged by 0.5% in August. It was the biggest drop since January 2014.

Mining output was down 0.6% in August, while utilities production increased 0.6%.

Capacity utilisation rate decreased to 77.6% in August from 78.0% in July, missing expectations for a decline to 77.8%.

-

15:45

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1100/25(E1.5bn), $1.1425/30(E800mn)

USD/JPY: Y119.70($730mn), Y120.05($200mn), Y120.65($200mn), Y122.50($360mn)

USD/CAD: Cad1.3058($450mn), Cad1.3100($300mn), Cad1.3200($800mn)

AUD/USD: $0.7000(A$3.0bn), $0.7100(A$363mn), $0.7125(A$329mn), $0.7140(A$480mn), $0.7200(A$583mn)

EUR/JPY: Y134.00(E261mn), Y136.50(E326mn)

AUD/NZD: NZ$1.1350(A$325mn)

-

15:16

U.S.: Capacity Utilization, August 77.6% (forecast 77.8%)

-

15:15

U.S.: Industrial Production YoY , August 0.9%

-

15:15

U.S.: Industrial Production (MoM), August -0.4% (forecast -0.2%)

-

15:01

U.S. retail sales increase 0.2% in August

The U.S. Commerce Department released the retail sales data on Tuesday. The U.S. retail sales climbed 0.2% in August, missing expectations for a 0.3% increase, after a 0.7% gain in July. July's figure was revised up from a 0.6% rise.

The increase was partly driven by higher automobiles purchases. Automobiles and car parts sales rose 0.7% in August.

Retail sales excluding automobiles increased 0.3% in August, beating forecasts of a 0.2% rise, after a 0.7% gain in July. July's figure was revised up from a 0.4% increase.

Sales at building material and garden equipment stores dropped 1.8% in August and sales at furniture stores decreased 0.9%.

Sales at clothing retailers were up 0.4% in August.

These figures could add to speculation on that the Fed starts raising its interest rate this month.

-

14:48

NY Fed Empire State manufacturing index rises to -14.67 in September

The New York Federal Reserve released its survey on Tuesday. The NY Fed Empire State manufacturing index rose slightly to -14.67 in September from -14.92 in August, missing expectations for an increase to -0.75. August's reading was the lowest level since April 2009.

The increase was driven by a rise in the new orders and shipments index. The new orders index increased to -12.90 in September from -15.70 in August, while the shipments index climbed to -7.9 from 13.79.

The general business conditions expectations index for the next six months decreased to 23.2 in August from 33.64 in August.

The price-paid index decreased to 4.1 in September from 7.27 in August.

The index for the number of employees fell to -6. 2 in September from 1.82 last month.

-

14:30

U.S.: NY Fed Empire State manufacturing index , September -14.67 (forecast -0.75)

-

14:30

U.S.: Retail sales excluding auto, August 0.3% (forecast 0.2%)

-

14:30

U.S.: Retail sales, August 0.2% (forecast 0.3%)

-

14:29

UK house price inflation rises 0.8% in July

The Office for National Statistics (ONS) released its house inflation data for the U.K. on Tuesday. The U.K. house price index rose at a seasonally adjusted rate of 0.8% in July, faster than a 0.6% in June.

The increase was mainly driven by a rise in prices in the east and south-east of England.

On a yearly basis, the U.K. house price index increased at a seasonally adjusted rate of 5.2% in July, down from a 5.7% gain in June. It was the lowest rise since September 2013.

The lower house price inflation was mainly driven by a decline in prices in Scotland and the north-east of England.

The average mix-adjusted house price was £282,000 in July, up from £277,000 in June.

-

14:16

Bank of Japan Governor Haruhiko Kuroda: that the country’s exports and production were "affected by the slowdown in emerging economies"

The Bank of Japan (BoJ) Governor Haruhiko Kuroda said at a press conference on Tuesday that the country's exports and production were "affected by the slowdown in emerging economies". But he pointed out that there is no need for further stimulus measures.

"It's true exports and output are being affected by the slowdown in emerging economies. But there's no change to our view that Japan's economy continues to recover moderately," the BoJ governor said.

Kuroda noted that the underlying trend of inflation was increasing.

The BoJ governor expects the Chinese economy to grow due to the support by the Chinese government.

-

14:05

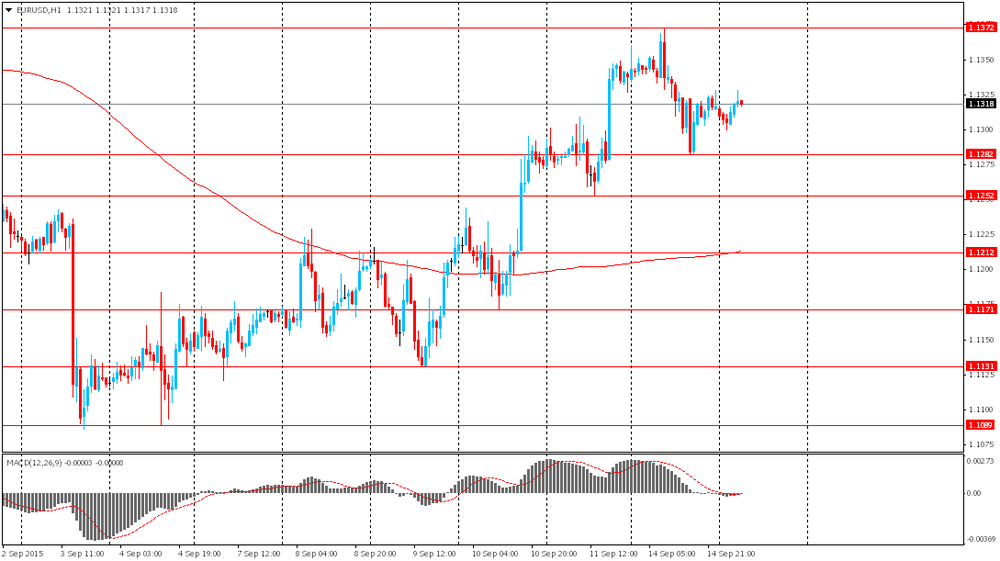

Foreign exchange market. European session: the euro traded mixed against the U.S. dollar after the mixed economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia New Motor Vehicle Sales (MoM) August -1.3% -1.6%

01:30 Australia New Motor Vehicle Sales (YoY) August 3.7% 2.1%

01:30 Australia RBA Meeting's Minutes

03:00 Japan BoJ Interest Rate Decision 0% 0% 0%

03:00 Japan Bank of Japan Monetary Base Target 275 275

03:00 Japan BoJ Monetary Policy Statement

06:30 Japan BOJ Press Conference

06:45 France CPI, m/m August -0.4% 0.3%

06:45 France CPI, y/y August 0.2% 0.0%

08:30 United Kingdom Producer Price Index - Input (MoM) August 1.2% Revised From -0.9% -2.4% -2.4%

08:30 United Kingdom Producer Price Index - Input (YoY) August -12.6% Revised From -12.4% -13.7% -13.8%

08:30 United Kingdom Producer Price Index - Output (MoM) August -0.1% -0.2% -0.4%

08:30 United Kingdom Producer Price Index - Output (YoY) August -1.6% -1.7% -1.8%

08:30 United Kingdom Retail Price Index, m/m August -0.1% 0.3% 0.5%

08:30 United Kingdom Retail prices, Y/Y August 1% 0.9% 1.1%

08:30 United Kingdom HICP, m/m August -0.2% 0.2% 0.2%

08:30 United Kingdom HICP, Y/Y August 0.1% 0.0% 0.0%

08:30 United Kingdom HICP ex EFAT, Y/Y August 1.2% 1.0%

09:00 Eurozone Employment Change Quarter II 0.2% Revised From 0.1% 0.3%

09:00 Eurozone Trade balance unadjusted July 26.4 31.4

09:00 Eurozone ZEW Economic Sentiment September 47.6 33.3

09:00 Germany ZEW Survey - Economic Sentiment September 25 18.4 12.1

The U.S. dollar traded mixed against the most major currencies ahead of the release of the U.S. economic data. The U.S. retail sales are expected to rise 0.3% in August, after a 0.6% gain in July.

Retail sales excluding automobiles are expected to climb 0.2% in August, after a 0.4% increase in June.

The NY Fed Empire State manufacturing index is expected to rise to -0.75 in September from -14.92 in August.

The U.S. industrial production is expected to decline 0.2% in August, after a 0.6% rise in July.

The euro traded mixed against the U.S. dollar after the mixed economic data from the Eurozone. The ZEW Center for European Economic Research released its economic sentiment index for Germany and the Eurozone on Tuesday. Germany's ZEW economic sentiment index declined to 12.1 in September from 25.0 in August, missing expectations for a fall to 18.4.

"The weakening economic development in emerging markets dampens the economic outlook for Germany's export-oriented economy. While economic growth in the second quarter was largely driven by external demand, it is becoming less likely that exports will stimulate growth in the near future," the ZEW President Clemens Fuest.

Eurozone's ZEW economic sentiment index decreased to 33.3 in September from 47.6 in August.

Eurozone's unadjusted trade surplus jumped to €31.4 billion in July from €26.4 billion in June.

Exports rose at an annual rate of 7.0% in July, while imports increased at 1.0%.

Eurozone's employment increased by 0.3% in the second quarter, after a 0.2% rise in the first quarter. The first quarter's figure was revised up from a 0.1% gain.

The British pound traded mixed against the U.S. dollar after the release of the U.K. inflation data. The Office for National Statistics (ONS) released the consumer price inflation data for the U.K. on Tuesday. The U.K. consumer price index declined to 0.0% in August from 0.1% in July, in line with expectations.

The decline was driven by low petrol prices.

On a monthly basis, U.K. consumer prices rose 0.2% in August, in line with expectations, after a 0.2% decline in July.

Consumer price inflation excluding food, energy, alcohol and tobacco prices fell to 1.0% in August from 1.0% the month before.

The Retail Prices Index remained climbed to 1.1% in August from 1.0% in July, beating expectations for a decrease to 0.9%.

The consumer price inflation is below the Bank of England's 2% target.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 U.S. NY Fed Empire State manufacturing index September -14.92 -0.75

12:30 U.S. Retail sales August 0.6% 0.3%

12:30 U.S. Retail sales excluding auto August 0.4% 0.2%

13:15 U.S. Capacity Utilization August 78% 77.8%

13:15 U.S. Industrial Production (MoM) August 0.6% -0.2%

13:15 U.S. Industrial Production YoY August 1.3%

14:00 U.S. Business inventories July 0.8% 0.1%

23:30 Australia RBA Assist Gov Debelle Speaks

-

14:01

Orders

EUR/USD

Offers 1.1330-35 1.1355-60 1.1375 1.1390-1.1400 1.1420 1.1450

Bids 1.1285 1.1265-70 1.1250 1.1225 1.1200

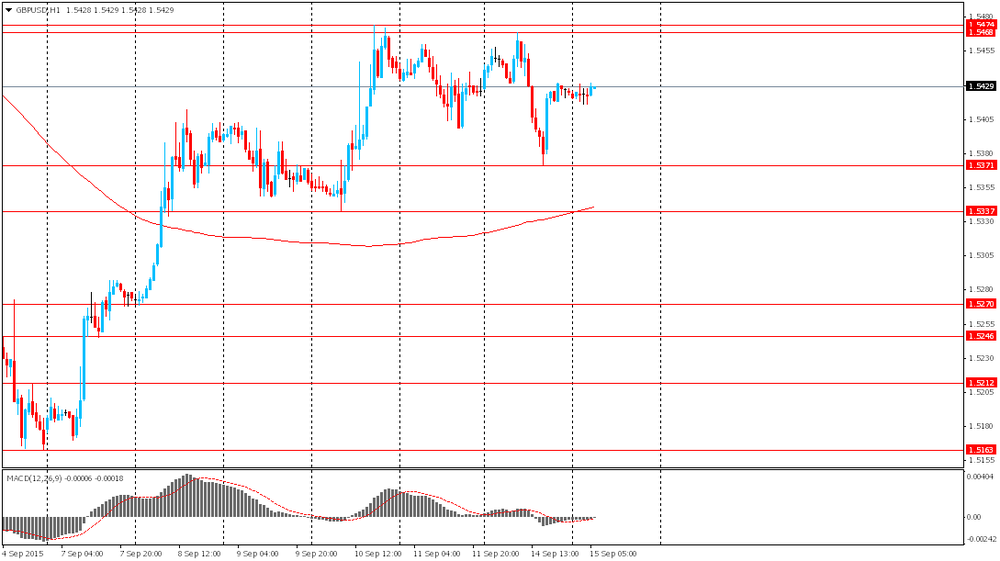

GBP/USD

Offers 1.5450 1.5480 1.5500-10 1.5530 1.5550 1.5585 1.5600 1.5630 1.5650

Bids 1.5400 1.5380 1.5350 1.5330 1.5320 1.5300 1.5285 1.5260

EUR/GBP

Offers 0.7350-55 0.7380-85 0.7400 0.7425 0.7450

Bids 0.7295-0.7300 0.7280-85 0.7260-65 0.7250 0.7230 0.7200

EUR/JPY

Offers 135.40 135.80 136.00 136.30136.60 136.80 137.00 137.50

Bids 135.00 134.80-85 134.65 134.50 134.30 134.00

USD/JPY

Offers 119.85 120.00 120.25-30 120.50 120.65 120.80 121.00

Bids 119.50 119.30 119.00 118.85 118.50

AUD/USD

Offers 0.7150 0.7165 0.7180 0.7200 0.7225 0.7250

Bids 0.7100 0.7085 0.7065 0.7045-50 0.7020 0.7000

-

11:58

Eurozone's employment increases by 0.3% in the second quarter

Eurostat released its employment growth data for the Eurozone on Tuesday. Eurozone's employment increased by 0.3% in the second quarter, after a 0.2% rise in the first quarter. The first quarter's figure was revised up from a 0.1% gain.

Main contributors were Portugal (+1.3%) and Greece (+1.2%).

On a yearly basis, employment in the Eurozone increased by 0.8% in the second quarter.

-

11:53

Eurozone's unadjusted trade surplus rises to €31.4 billion in July

Eurostat released its trade data for the Eurozone on Tuesday. Eurozone's unadjusted trade surplus jumped to €31.4 billion in July from €26.4 billion in June.

Exports rose at an annual rate of 7.0% in July, while imports increased at 1.0%.

-

11:45

Germany's ZEW economic sentiment index drops to 12.1 in September

The ZEW Center for European Economic Research released its economic sentiment index for Germany and the Eurozone on Tuesday. Germany's ZEW economic sentiment index declined to 12.1 in September from 25.0 in August, missing expectations for a fall to 18.4.

"The weakening economic development in emerging markets dampens the economic outlook for Germany's export-oriented economy. While economic growth in the second quarter was largely driven by external demand, it is becoming less likely that exports will stimulate growth in the near future," the ZEW President Clemens Fuest.

Eurozone's ZEW economic sentiment index decreased to 33.3 in September from 47.6 in August.

-

11:41

UK consumer price inflation is down to 0.0% in August

The Office for National Statistics (ONS) released the consumer price inflation data for the U.K. on Tuesday. The U.K. consumer price index declined to 0.0% in August from 0.1% in July, in line with expectations.

The decline was driven by low petrol prices.

On a monthly basis, U.K. consumer prices rose 0.2% in August, in line with expectations, after a 0.2% decline in July.

Consumer price inflation excluding food, energy, alcohol and tobacco prices fell to 1.0% in August from 1.0% the month before.

The Retail Prices Index remained climbed to 1.1% in August from 1.0% in July, beating expectations for a decrease to 0.9%.

The consumer price inflation is below the Bank of England's 2% target.

-

11:01

Eurozone: ZEW Economic Sentiment, September 33.3

-

11:00

Germany: ZEW Survey - Economic Sentiment, September 12.1 (forecast 18.4)

-

11:00

Eurozone: Trade balance unadjusted, July 31.4

-

11:00

Eurozone: Employment Change, Quarter II 0.3%

-

10:50

French consumer price inflation rises 0.3% in August

The French statistical office Insee released its consumer price inflation for France on Tuesday. The French consumer price inflation increased 0.3% in August, after a 0.4% decrease in July.

On a yearly basis, the consumer price index was flat in August, after a 0.2% rise in July.

Fresh food prices rose 8.0% year-on-year in August, while petroleum products prices dropped by 12.5%.

-

10:38

September’s Reserve Bank of Australia monetary policy meeting: there is a downside risk to the outlook for global growth

The Reserve Bank of Australia (RBA) released its minutes from September monetary policy meeting on Tuesday. The RBA said that the accommodative monetary policy was appropriate, adding that the monetary policy decision will depend on the incoming economic data.

The central bank noted that there is a downside risk to the outlook for global growth.

"But it was too early to assess the extent to which this would materially alter the forecast for GDP growth in Australia's trading partners," the RBA said.

Board members pointed out that mining investment will stabilise at lower level.

"Members discussed the implications of the recent emphasis on cost cutting in the mining sector, noting that it would probably lead to mining investment eventually stabilising at a lower level than had previously been expected," the minutes said.

The central bank also said that the Fed's interest rate hike "could have significant effects on financial markets despite the fact that it had been well telegraphed".

The RBA kept unchanged its interest rate at 2.00% in September.

-

10:30

United Kingdom: Producer Price Index - Output (MoM), August -0.4% (forecast -0.2%)

-

10:30

United Kingdom: Producer Price Index - Input (YoY) , August -13.8% (forecast -13.7%)

-

10:30

United Kingdom: HICP, Y/Y, August 0.0% (forecast 0.0%)

-

10:30

United Kingdom: Retail prices, Y/Y, August 1.1% (forecast 0.9%)

-

10:30

United Kingdom: Producer Price Index - Output (YoY) , August -1.8% (forecast -1.7%)

-

10:30

United Kingdom: HICP, m/m, August 0.2% (forecast 0.2%)

-

10:30

United Kingdom: Producer Price Index - Input (MoM), August -2.4% (forecast -2.4%)

-

10:30

United Kingdom: Retail Price Index, m/m, August 0.5% (forecast 0.3%)

-

10:30

United Kingdom: HICP ex EFAT, Y/Y, August 1.0%

-

10:29

Bank of Japan keeps its monetary policy unchanged in September

The Bank of Japan (BoJ) released its interest rate decision on Tuesday. The BoJ kept its monetary policy unchanged (interest rate: 0.00-0.10%, monetary base target: 275 trillion yen). The central bank will expand its monetary base at an annual pace of 80 trillion yen. This decision was expected by analysts.

The BoJ board members voted 8-1 to keep monetary policy unchanged.

The BoJ noted that the country's economy continued to recover moderately.

The central bank said that the annual inflation in Japan was flat, but inflation expectations seems to be rising.

The BoJ pointed out that exports and production were "affected by the slowdown in emerging economies".

-

10:21

Fitch Ratings: the interest rate hike by the Fed could have a negative impact on emerging economies

Fitch Ratings said in its report "Fed Lift-off Matters for Emerging Markets" that the interest rate hike by the Fed could have a negative impact on emerging economies, despite the fact that the Fed's interest rate hike is widely expected.

"Part of the rationale for ultra-loose monetary policies from global central banks has been to depress risk and term premiums via a portfolio-rebalancing effect. This is consistent with the emergence of pressure on emerging markets as Fed lift-off approaches," Fitch said.

The agency noted that the future path of interest rate hikes remains unclear and that "an outcome closer to the Fed's guidance could be a significant shock".

-

10:11

Chinese government seizes up to 1 trillion yuan from local governments who did not spend their budget

Sources that are close to the government said that the Chinese government seized up to 1 trillion yuan ($157 billion) from local governments who did not spend their budget to stimulate the country's growth. The money should be used for other investments.

"Investments were not realised, and the money will be reallocated," the source said.

-

08:47

France: CPI, y/y, August 0.2%

-

08:46

France: CPI, m/m, August 0.3%

-

08:18

Foreign exchange market. Asian session: the yen gained after BOJ meeting

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

01:30 Australia New Motor Vehicle Sales (MoM) August -1.3% -1.6%

01:30 Australia New Motor Vehicle Sales (YoY) August 3.7% 2.1%

01:30 Australia RBA Meeting's Minutes

03:00 Japan BoJ Interest Rate Decision 0% 0% 0%

03:00 Japan Bank of Japan Monetary Base Target 275 275

03:00 Japan BoJ Monetary Policy Statement

The yen advanced against the U.S. dollar after the Bank of Japan voted 8-1 to keep monetary base growth at annual pace of 80 trillion yen. Traditionally BOJ Board member Kiuchi was against the majority's decision. The central bank cut assessment of overseas economies saying that Japan economy continued to grow moderately. Investors are waiting for BOJ Governor Kuroda conference at 6:30 GMT. If the policymaker does not signal further easing of monetary policy, the yen might continue strengthening.

The euro climbed slightly ahead of today's trade balance data and a report on business confidence from the ZEW. The data are expected to be favorable.

Meanwhile the pound was flat ahead of inflation data. A median forecast suggests that the consumer price index rose by 0.2% in August compared to -0.2% in July.

Federal Open Market Committee meeting will be this week's key event. A survey by the Wall Street Journal showed that approximately 46% of the economists surveyed last week expect the Fed to raise rates in September. 35% of economists said the Fed would raise rates in December and 9.5% said they expect a liftoff in 2016.

EUR/USD: the pair fluctuated within $1.1300-25 in Asian trade

USD/JPY: the pair fell to Y119.90

GBP/USD: the pair traded within $1.5415-30

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

06:30 Japan BOJ Press Conference

06:45 France CPI, m/m August -0.4%

06:45 France CPI, y/y August 0.2%

08:30 United Kingdom Producer Price Index - Input (MoM) August -0.9% -2.4%

08:30 United Kingdom Producer Price Index - Input (YoY) August -12.4% -13.7%

08:30 United Kingdom Producer Price Index - Output (MoM) August -0.1% -0.2%

08:30 United Kingdom Producer Price Index - Output (YoY) August -1.6% -1.7%

08:30 United Kingdom Retail Price Index, m/m August -0.1% 0.3%

08:30 United Kingdom Retail prices, Y/Y August 1% 0.9%

08:30 United Kingdom HICP, m/m August -0.2% 0.2%

08:30 United Kingdom HICP, Y/Y August 0.1% 0.0%

08:30 United Kingdom HICP ex EFAT, Y/Y August 1.2%

09:00 Eurozone Employment Change Quarter II 0.1%

09:00 Eurozone Trade balance unadjusted July 26.4

09:00 Eurozone ZEW Economic Sentiment September 47.6

09:00 Germany ZEW Survey - Economic Sentiment September 25 18.4

12:30 U.S. NY Fed Empire State manufacturing index September -14.92 -0.75

12:30 U.S. Retail sales August 0.6% 0.3%

12:30 U.S. Retail sales excluding auto September 0.4% 0.2%

13:15 U.S. Capacity Utilization August 78% 77.8%

13:15 U.S. Industrial Production (MoM) August 0.6% -0.2%

13:15 U.S. Industrial Production YoY August 1.3%

14:00 U.S. Business inventories July 0.8% 0.1%

20:30 U.S. API Crude Oil Inventories September 2.1

22:45 New Zealand Current Account Quarter II 660 -1500

23:30 Australia RBA Assist Gov Debelle Speaks

-

08:08

Options levels on tuesday, September 15, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1475 (1570)

$1.1436 (1266)

$1.1397 (530)

Price at time of writing this review: $1.1314

Support levels (open interest**, contracts):

$1.1249 (429)

$1.1204 (949)

$1.1148 (2253)

Comments:

- Overall open interest on the CALL options with the expiration date October, 9 is 48412 contracts, with the maximum number of contracts with strike price $1,1500 (4293);

- Overall open interest on the PUT options with the expiration date October, 9 is 63303 contracts, with the maximum number of contracts with strike price $1,1000 (5976);

- The ratio of PUT/CALL was 1.31 versus 1.30 from the previous trading day according to data from September, 11

GBP/USD

Resistance levels (open interest**, contracts)

$1.5704 (1257)

$1.5606 (1289)

$1.5510 (1694)

Price at time of writing this review: $1.5432

Support levels (open interest**, contracts):

$1.5387 (882)

$1.5292 (1153)

$1.5194 (2728)

Comments:

- Overall open interest on the CALL options with the expiration date October, 9 is 20188 contracts, with the maximum number of contracts with strike price $1,5500 (1694);

- Overall open interest on the PUT options with the expiration date October, 9 is 19826 contracts, with the maximum number of contracts with strike price $1,5200 (2728);

- The ratio of PUT/CALL was 0.98 versus 0.91 from the previous trading day according to data from September, 11

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

04:59

Japan: BoJ Interest Rate Decision, 0% (forecast 0%)

-

03:32

Australia: New Motor Vehicle Sales (YoY) , August 2.1%

-

03:32

Australia: New Motor Vehicle Sales (MoM) , August -1.6%

-

00:30

Currencies. Daily history for Sep 14’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1316 -0,19%

GBP/USD $1,5425 -0,01%

USD/CHF Chf0,9679 -0,11%

USD/JPY Y120,22 -0,29%

EUR/JPY Y136,04 -0,47%

GBP/JPY Y185,43 -0,32%

AUD/USD $0,7143 +0,76%

NZD/USD $0,6325 +0,17%

USD/CAD C$1,3257 -0,05%

-