Noticias del mercado

-

21:01

DJIA 17261.50 -186.57 -1.07%, S&P 500 2024.53 -21.44 -1.05%, NASDAQ 4937.27 -67.81 -1.35%

-

18:03

European stocks closed: FTSE 6118.28 -60.40 -0.98%, DAX 10708.40 -74.23 -0.69%, CAC 40 4807.95 -48.70 -1.00%

-

17:41

WSE: Session Results

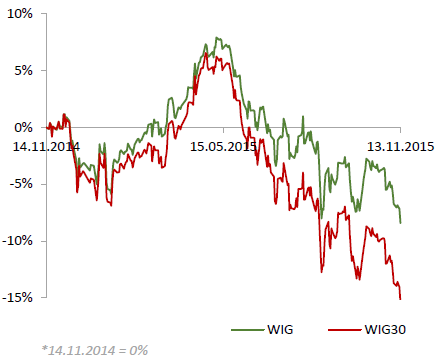

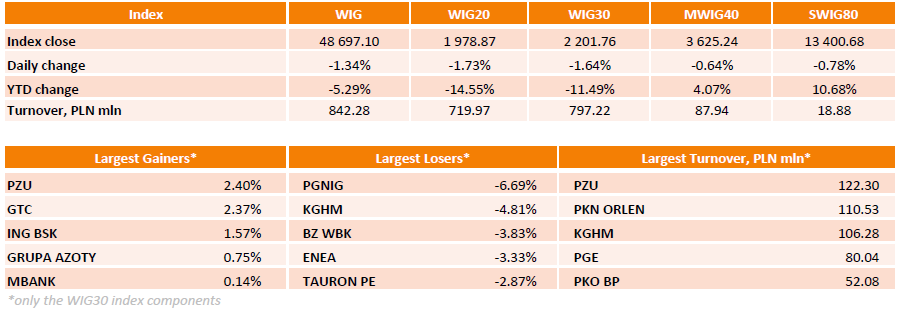

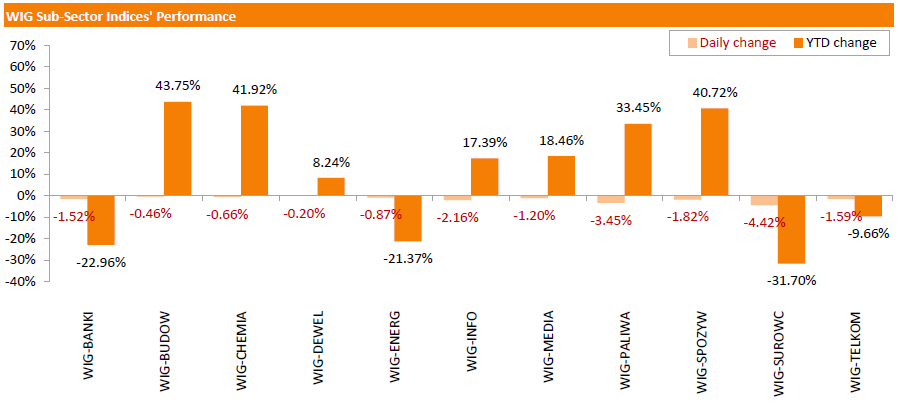

Polish equity market closed lower on Friday. The broad market measure, the WIG Index, plunged by 1.34%. All sectors in the WIG Index were down. Materials (-4.42%) fared the worst, followed by oil and gas sector (-3.45%) and IT sector (-2.16%).

The large-cap WIG30 Index fell by 1.64%. PGING (WSE: PGN) was the weakest name among the index components, tumbling 6.69%. It was followed by utilities stocks by KGHM (WSE: KGH), declining 4.81% after the company's CFO announced they would cut CAPEX in 2016 due to continued pressure on copper prices. BZ WBK (WSE: BZW), ENEA (WSE: ENA) and TAURON PE (WSE: TPE) were also among top fallers, dropping by 2.87%-3.83%. On the other side of the ledger, PZU (WSE: PZU) and GTC (WSE: GTC) became the best performers, gaining 2.40% and 2.37% respectively.

-

17:38

Wall Street. Major U.S. stock-indexes fell

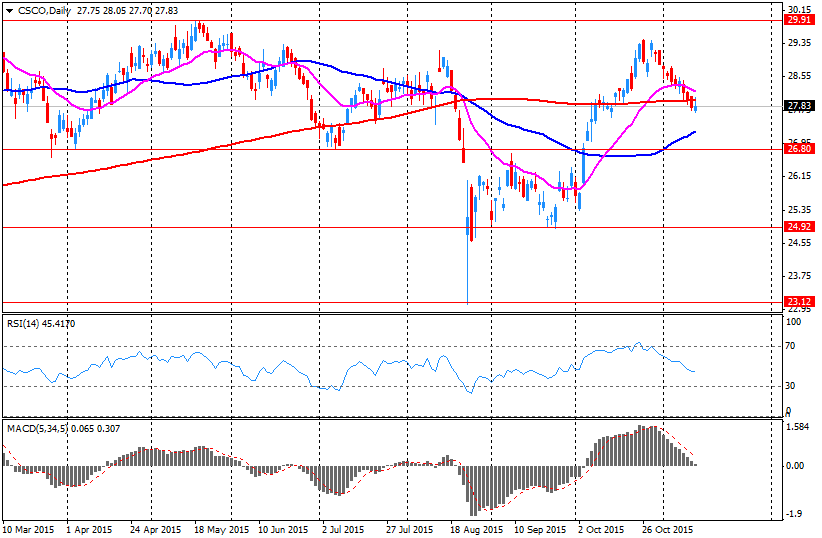

Major U.S. stock-indexes lower on Friday after Cisco's disappointing forecast and as weaker-than-expected October retail sales data and forecast cuts by department store chains fueled fears of a slowdown in demand ahead of the key holiday shopping season.

Cisco (CSCO) fell 6.5% to $26.27 after it gave a weak forecast, citing a slowdown in order growth and weak spending outside the United States. The stock was the second-biggest drag on the S&P and the Nasdaq.

Data showed U.S. retail sales rose less than expected in October, suggesting a slowdown in consumer spending that could temper expectations of a strong pickup in fourth-quarter economic growth.

Most of Dow stocks in negative area (25 of 30). Top looser - Cisco Systems, Inc. (CSCO, -6.50%). Top gainer - Caterpillar Inc. (CAT +0.70%).

Almost all S&P index sectors also fell. Top looser - Services (-1.5%). Top gainer - Healthcare (+0,2%).

At the moment:

Dow 17261.00 -137.00 -0.79%

S&P 500 2027.25 -13.25 -0.65%

Nasdaq 100 4535.75 -49.50 -1.08%

Oil 40.74 -1.01 -2.42%

Gold 1081.60 +0.60 +0.06%

U.S. 10yr 2.28 -0.04

-

16:24

U.S. business inventories climb 0.3% in September

The U.S. Commerce Department released the business inventories data on Friday. The U.S. business inventories rose 0.3% in September, beating expectations for a flat reading, after a 0.1% gain in August. August's figure was revised up from a flat reading.

Retail inventories climbed 0.8% in September, wholesale inventories were up 0.5%, while manufacturing inventories fell 0.4%.

Both business and retail sales were flat in September.

The business inventories/sales ratio climbed to 1.38 months in September from 1.37 months in August. It was the highest ratio since May 2009. The business inventories /sales ratio is a measure of how long it would take to clear shelves.

-

16:12

Thomson Reuters/University of Michigan preliminary consumer sentiment index climbs to 93.1 in November

The Thomson Reuters/University of Michigan preliminary consumer sentiment index climbed to 93.1 in November from a final reading of 90.0 in October, exceeding expectations for an increase to 91.5.

"Confidence rose in early November mainly due to a stronger outlook for the domestic economy," the Surveys of Consumers chief economist at the University of Michigan Richard Curtin said.

"Two trends dominated the early November data: consumers anticipated somewhat larger income increases during the year ahead as well as expected a somewhat lower inflation rate. This meant that consumers held the most favourable inflation-adjusted income expectations since 2007," he added.

The index of current economic conditions increased to 104.8 in November from 102.3 in October, while the index of consumer expectations rose to 85.6 from 82.1.

The one-year inflation expectations fell to 2.5% in November from 2.7% in October.

-

16:05

U.K. leading economic index falls 0.3% in September

The Conference Board (CB) released its leading economic index for the U.K. on Friday. The leading economic index (LEI) decreased 0.3% in September, after a 0.1% rise in August.

The coincident index was up 0.3% in September, after a 0.3% gain in August.

"Taken together, the recent growth of the LEI suggests that there is an increasing risk that the current economic expansion may moderate in early 2016," the CB said.

-

15:46

Federal Reserve Bank of Cleveland Loretta Mester: the Fed could start raising its interest rate if the incoming economic data will be positive

The Federal Reserve Bank of Cleveland Loretta Mester said in a speech on Friday that the Fed could start raising its interest rate if the incoming economic data will be positive.

"If incoming economic information continues to support this forecast, then in my view it will be time to take the first step in the policy normalization process," she said.

Mester also said that U.S. labour market continues to improve and inflation is gradually returning to the Fed's 2% target over the medium period.

-

15:32

U.S. Stocks open: Dow -0.27%, Nasdaq -0.45%, S&P -0.25%

-

15:23

Before the bell: S&P futures -0.13%, NASDAQ futures -0.30%

U.S. stock-index futures slipped.

Global Stocks:

Nikkei 19,596.91 -100.86 -0.51%

Hang Seng 22,396.14 -492.78 -2.15%

Shanghai Composite 3,581.7 -51.20 -1.41%

FTSE 6,121.21 -57.47 -0.93%

CAC 4,803.45 -53.20 -1.10%

DAX 10,710.45 -72.18 -0.67%

Crude oil $41.70 (-0.17%)

Gold $1086.10 (+0.47%)

-

14:59

U.S. producer price falls 0.4% in October

The U.S. Commerce Department released the producer price index figures on Friday. The U.S. producer price index declined 0.4% in October, missing expectations for a 0.2% rise, after a 0.5% drop in September.

On a yearly basis, the producer price index decreased 1.6% in October, missing forecasts of a 1.2% decline, after a 1.1% fall in September. It was the largest decline since 2009.

A stronger U.S. dollar and weak global demand weigh on inflation.

Services prices were down 0.3% in October, while prices for goods declined 0.4%.

Food prices decreased by 0.8% in October, while energy prices were flat.

The producer price index excluding food and energy fell 0.3% in October, missing expectations for a 0.1% gain, after a 0.3% decrease in September.

On a yearly basis, the producer price index excluding food and energy climbed 0.1% in October, missing forecasts of a 0.5% increase, after a 0.8% rise in September.

These figures could mean that the Fed will not start raising its interest rate in December.

-

14:58

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

8.89

1.37%

20.9K

ALCOA INC.

AA

7.86

0.51%

6.3K

Pfizer Inc

PFE

33.40

0.03%

0.8K

AT&T Inc

T

32.69

0.00%

4.8K

Hewlett-Packard Co.

HPQ

13.31

0.00%

40.1K

Starbucks Corporation, NASDAQ

SBUX

61.06

-0.02%

0.6K

Google Inc.

GOOG

730.98

-0.03%

0.2K

Merck & Co Inc

MRK

53.00

-0.06%

1.6K

Home Depot Inc

HD

123.69

-0.10%

1.1K

Chevron Corp

CVX

89.75

-0.12%

21.2K

International Paper Company

IP

40.19

-0.12%

0.7K

Procter & Gamble Co

PG

74.56

-0.13%

0.8K

Ford Motor Co.

F

14.02

-0.14%

1.7K

Caterpillar Inc

CAT

68.56

-0.15%

0.1K

HONEYWELL INTERNATIONAL INC.

HON

101.79

-0.18%

0.1K

Verizon Communications Inc

VZ

44.73

-0.22%

0.1K

American Express Co

AXP

71.79

-0.26%

2.2K

International Business Machines Co...

IBM

132.70

-0.26%

0.3K

General Motors Company, NYSE

GM

35.00

-0.26%

0.3K

Visa

V

78.10

-0.27%

2.9K

Apple Inc.

AAPL

115.40

-0.28%

59.4K

Exxon Mobil Corp

XOM

79.18

-0.29%

5.6K

McDonald's Corp

MCD

111.78

-0.29%

3.6K

AMERICAN INTERNATIONAL GROUP

AIG

59.20

-0.30%

1.0K

The Coca-Cola Co

KO

41.45

-0.31%

0.1K

Intel Corp

INTC

32.28

-0.37%

1.6K

Walt Disney Co

DIS

115.77

-0.38%

4.8K

Barrick Gold Corporation, NYSE

ABX

7.52

-0.40%

24.5K

Facebook, Inc.

FB

107.59

-0.40%

62.3K

Tesla Motors, Inc., NASDAQ

TSLA

212.00

-0.44%

2.0K

Yandex N.V., NASDAQ

YNDX

15.16

-0.46%

1.0K

Goldman Sachs

GS

191.75

-0.53%

0.5K

JPMorgan Chase and Co

JPM

65.62

-0.58%

0.4K

Amazon.com Inc., NASDAQ

AMZN

661.57

-0.61%

12.9K

Citigroup Inc., NYSE

C

53.10

-0.67%

1.4K

General Electric Co

GE

29.95

-0.70%

29.1K

Wal-Mart Stores Inc

WMT

56.55

-0.70%

0.1K

Microsoft Corp

MSFT

52.89

-0.81%

46.1K

Nike

NKE

124.95

-0.82%

0.5K

Twitter, Inc., NYSE

TWTR

25.87

-1.00%

5.7K

Yahoo! Inc., NASDAQ

YHOO

32.62

-1.84%

9.4K

Cisco Systems Inc

CSCO

26.56

-4.56%

236.7K

-

14:46

U.S. retail sales increase 0.1% in October

The U.S. Commerce Department released the retail sales data on Friday. The U.S. retail sales climbed 0.1% in October, missing expectations for a 0.3% increase, after a flat reading in September. September's figure was revised down from a 0.1% rise.

The lower increase was mainly driven by a fall in automobiles purchases. Sales at auto dealerships declined 0.5% in October.

Retail sales excluding automobiles increased 0.2% in October, missing forecasts of a 0.4% gain, after a 0.3% fall in September. September's figure was revised up from a 0.4% decrease.

Sales at building material and garden equipment stores climbed 0.9% in October, while sales at furniture stores increased 0.4%.

Sales at clothing retailers were flat in October, while sales at service stations dropped 0.9%.

These figures could mean that the Fed will not start raising its interest rate in December.

-

14:43

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Cisco Systems (CSCO) reiterated with an Outperform at RBC Capital Mkts; target lowered to $30 from $33

-

14:21

Company News: Cisco Systems’ (CSCO) quarterly profit beats expectations

Cisco reported Q1 (Oct) earnings of $0.59 per share, beating analysts' consensus of $0.56.

The company's revenues amounted to $12.682 bln (+3.6% y/y), generally inline with consensus estimate of $12.648 bln.

Cisco expects Q2 EPS of $0.53-0.55 (versus consensus of $0.56) and $11.94-12.17 bln (versus consensus of $12.54 bln).

CSCO fell to $26.30 (-5.50%) in pre-market trading.

-

13:32

Greek GDP declines 0.5% in the third quarter

The Hellenic Statistical Authority released its preliminary gross domestic product (GDP) data for Greece on Friday. The Greek preliminary GDP declined 0.5% in the third quarter, after a revised 0.4% growth in the second quarter.

On a yearly basis, Greek final GDP fell 0.4% in the third quarter, after a revised 1.1% increase in the second quarter.

-

13:15

Final consumer price inflation in Spain rises 0.6% in October

The Spanish statistical office INE released its final consumer price inflation data on Friday. Consumer price inflation in Spain was up 0.6% in October, down from the preliminary reading of a 0.7% rise, after a 0.3% fall in September.

On a yearly basis, consumer prices fell by 0.7% in October from a year ago, in line with preliminary reading, after a 0.9% decline in September.

The annual decline was mainly driven by a drop in the prices of transport.

-

13:04

Switzerland's producer and import prices are 0.2% in October

The Federal Statistical Office released its producer and import prices data on Friday. Switzerland's producer and import prices rose 0.2% in October, after a 0.1% drop in September.

The increase was mainly driven by higher prices for machinery and watches.

The Import Price Index decreased by 0.1% in October, while producer prices climbed 0.3%.

On a yearly basis, producer and import prices plunged 6.6% in October, after a 6.8% drop in September.

The Import Price Index fell by 11.0% year-on year in October, while producer prices dropped 4.5%.

-

12:51

UK’s construction output declines 0.2% in September

The Office for National Statistics (ONS) released its construction output data for the U.K. on Friday. Construction output in the U.K. declined 0.2% in September, after a 3.4% drop in August. It was the third consecutive decline.

On a quarterly basis, construction output slid 2.2% in third quarter.

The decline was driven by a drop in in construction by smaller firms in August.

On a yearly basis, construction output fell 1.6% in September, after a 0.6% decrease in August.

Construction makes up 6% of UK's economy.

-

12:37

Final industrial production in Japan rises 1.1% in September

Japan's Ministry of Economy, Trade and Industry released its final industrial production data on Friday. Final industrial production in Japan rose 1.1% in September, up from the preliminary estimate of a 1.1% gain, after a 1.2% drop in August.

On a yearly basis, Japan's industrial production was down 0.8% in September, up from the preliminary estimate of a 0.9% fall, after a 0.4% decline in August.

Industrial shipments were upgraded to a 1.4% rise from the preliminary 1.3% gain, while inventories remained unchanged at a 0.4% decrease.

-

12:27

Final consumer prices in Italy increase 0.2% in October

The Italian statistical office Istat released its final consumer price inflation data for Italy on Friday. Preliminary consumer prices in Italy rose 0.2% in October, in line with preliminary reading, after a 0.4% fall in September.

The increase was mainly driven by a rise in prices of electricity, of gas and of unprocessed food. Prices of electricity jumped 2.9% in October, prices of gas rose 1.9%, while prices of unprocessed food were up 0.7%.

On a yearly basis, consumer prices climbed 0.3% in October, in line with preliminary reading, after a 0.2% increase in September.

The increase was driven by a rise in unprocessed food and higher prices for services related to recreation including repair and personal care. Prices for unprocessed food climbed 4.1% year-on-year in October, while prices for services related to recreation including repair and personal care rose 1.4% year-on-year.

Consumer price inflation excluding unprocessed food and energy prices remained unchanged at 0.8% year-on-year in October.

-

12:12

Italian economy increases 0.2% in the third quarter

The Italian statistical office Istat released its gross domestic product (GDP) growth for Italy on Friday. Italy's preliminary GDP increased 0.2% in the third quarter, after a 0.3% rise in the second quarter.

The growth was driven by an increase in domestic demand.

On a yearly basis, Italy's GDP rose to 0.9% in the third quarter from 0.6% in the second quarter.

-

12:01

European stock markets mid session: stocks traded lower on the weaker-than-expected GDP data from the Eurozone

Stock indices traded lower on the weaker-than-expected GDP data from the Eurozone. Eurostat released its GDP growth figures for the Eurozone on Friday. Eurozone's preliminary gross domestic product (GDP) increased by 0.3% in the third quarter, missing expectations for a 0.4% rise, after a 0.4% gain in the second quarter.

On a yearly basis, Eurozone's preliminary GDP rose by 1.6% in the third quarter, missing expectations for a 1.7% increase, after a 1.5% gain in the second quarter.

Eurostat released no details of the component breakdown of GDP.

The U.S. economy grew 0.4% in the third quarter, after a 1.0% growth in second quarter. On a yearly basis, the U.S. economy expanded at 2.0% in third quarter, after a 2.7% increase in the second quarter.

Eurozone's unadjusted trade surplus jumped to €20.5 billion in September from €11.2 billion in August, exceeding expectations for a rise €18.2 billion.

Exports rose at an annual rate of 1.0% in September, while imports decreased by 1.0%.

Current figures:

Name Price Change Change %

FTSE 100 6,137.17 -41.51 -0.67 %

DAX 10,757.64 -24.99 -0.23 %

CAC 40 4,834.92 -21.73 -0.45 %

-

11:57

Eurozone's unadjusted trade surplus jumps to €20.5 billion in September

Eurostat released its trade data for the Eurozone on Friday. Eurozone's unadjusted trade surplus jumped to €20.5 billion in September from €11.2 billion in August, exceeding expectations for a rise €18.2 billion.

Exports rose at an annual rate of 1.0% in September, while imports decreased by 1.0%.

-

11:50

Eurozone’s economy expands at 0.3% in the third quarter

Eurostat released its GDP growth figures for the Eurozone on Friday. Eurozone's preliminary gross domestic product (GDP) increased by 0.3% in the third quarter, missing expectations for a 0.4% rise, after a 0.4% gain in the second quarter.

On a yearly basis, Eurozone's preliminary GDP rose by 1.6% in the third quarter, missing expectations for a 1.7% increase, after a 1.5% gain in the second quarter.

Eurostat released no details of the component breakdown of GDP.

The U.S. economy grew 0.4% in the third quarter, after a 1.0% growth in second quarter. On a yearly basis, the U.S. economy expanded at 2.0% in third quarter, after a 2.7% increase in the second quarter.

-

11:46

French economy expands 0.3% in the third quarter

The French statistical office Insee released its gross domestic product (GDP) growth for France on Friday. France's preliminary GDP climbed 0.3% in the third quarter, in line with expectations, after a flat reading in the second quarter.

Total production in goods and services was up 0.4% in the third quarter.

Households' spending rose 0.3% in the third quarter.

Export fell 0.6% in the third quarter, while imports rose 1.7%.

On a yearly basis, France's GDP rose to 1.2% in the third quarter from 1.0% in the second quarter.

-

11:39

German economy grows 0.3% in the third quarter

Destatis released its gross domestic product (GDP) growth for Germany on Friday. Germany's preliminary GDP gained by 0.3% in the third quarter, in line with expectations, after a 0.4% increase in the second quarter.

The increase was driven by domestic final consumption expenditure. Household and government consumption expenditure increased.

On a yearly basis, Germany's GDP rose to 1.8% in the third quarter from 1.6% in the second quarter, in line with expectations.

-

11:34

Fed Vice Chairman Stanley Fischer: inflation in the U.S. should rebound next year

The Fed Vice Chairman Stanley Fischer said on Thursday that inflation in the U.S. should rebound next year as the effect of a stronger U.S. dollar and low energy prices will fade.

"Some of the forces holding down inflation in 2015--particularly those due to a stronger dollar and lower energy prices--will begin to fade next year. Consequently, overall PCE inflation is likely on this account alone to rebound next year to around 1-1/2 percent," he said.

Fischer pointed out that the interest rate hike in December is possible, but it will depend on the incoming inflation and employment data.

"The October 2015 FOMC statement indicated that it may be appropriate to raise the target range for the federal funds rate at the next meeting in December, though the outcome will depend on the Committee's assessment of the progress--realized and expected--that has been made toward meeting our goals of maximum employment and price stability," he noted.

-

11:24

New York Fed President William Dudley: the interest rate hike in December will depend on the incoming economic data

New York Fed President William Dudley said on Thursday that the interest rate hike in December will depend on the incoming economic data.

"I think it is quite possible that the conditions the Committee has established to begin to normalize monetary policy could soon be satisfied. In particular, I will be evaluating the incoming information to see if it confirms my expectation that growth will be sufficient to further tighten the U.S. labour market," he said.

Dudley added that the interest rate hikes will be gradual once the Fed starts raising its interest rate.

Dudley is a voting member of the Federal Open Market Committee this year.

-

10:23

Bloomberg Consumer Comfort Index: consumers’ expectations for U.S. economy rise to 45.2 in in the week ended October 11

According to data from the Bloomberg Consumer Comfort Index, consumers' expectations for U.S. economy increased to 41.6 in in the week ended November 08 from 41.1 the prior week. The increase was driven by a rise in the buying climate index, which climbed to 38.0 from 35.8.

The measure of views of the economy fell to 31.7 from 31.9.

The personal finances index was down to 55.1 from 55.8.

-

10:15

European Central Bank Governing Council member Jens Weidmann: the Eurozone faces no deflation

The European Central Bank (ECB) Governing Council member Jens Weidmann said in a speech in Paris on Thursday that the Eurozone faces no deflation.

"What we see now is not that we are going towards deflation," he said. Weidmann pointed out that the Eurozone's low inflation is mainly driven by low energy prices.

He also said that the ECB should not expand its asset-buying programme as it will blur the lines between fiscal and monetary policy.

Weidmann noted that Diverging monetary policies in the Eurozone and the U.S. could lead to fluctuations in the foreign exchange market.

-

10:09

U.S. budget deficit falls to $136.0 billion in October

The U.S. Treasury Department released its federal budget data on Thursday. The budget deficit increased to $136.0 billion in October, missing expectations for a deficit of $130.0 billion, down from a surplus of $91.0 billion in September.

The budget deficit rose due to shifts in the timing of some payments.

In the first month of the fiscal year 2016, which ends at September next year, the budget deficit totalled $348 billion, 4% higher than a year ago.

-

07:56

Global Stocks: U.S. and Asian stock indices declined

U.S. stock indices fell on Thursday with energy stocks leading declines amid lower commodity prices. Investors also eyed comments from Federal Reserve's officials, however they failed to clarify the timing of the first interest rate hike in nearly a decade.

The Dow Jones Industrial Average fell 254.15 points, or 1.4%, to 17,448.07. The S&P 500 lost 29.03 points, or 1.4%, to 2,045.97. The Nasdaq Composite declined 61.94 points, or 1.2%, to 5,005.08.

The Congressional Budget Office reported on Thursday that the U.S. budget deficit rose last month. In twelve months through October the deficit rose to $454 billion or 2.4% of GDP compared to a deficit of $515 billion or 2.9% of GDP last year. The U.S. budged deficit has been at levels close to minimum since 2008.

This morning in Asia Hong Kong Hang Seng dropped 2.07%, or 473.05, to 22,415.87. China Shanghai Composite Index fell 1.16%, or 42.08, to 3.590.82. The Nikkei 225 lost 0.71%, or 140.79, to 19,556.98.

Asian indices fell. Stocks of Chinese energy companies led declines, while airlines stocks advanced.

Japanese stocks were influenced by comments from Fed officials, who said that they would be cautious when it comes to raising rates and they would analyze probable results of this step.

A stronger yen also weighed on stocks.

-

03:06

Nikkei 225 19,523.02 -174.75 -0.89%, Hang Seng 22,395.68 -493.24 -2.15%, S&P/ASX 200 5,049.7 -75.99 -1.48%

-

01:03

Stocks. Daily history for Sep Nov 12’2015:

(index / closing price / change items /% change)

Nikkei 22519,697.77 +6.38 +0.03%

Hang Seng 22,888.92 +536.75 +2.40%

Shanghai Composite 3,633.67 -16.58 -0.45%

FTSE 100 6,178.68 -118.52 -1.88%

CAC 40 4,856.65 -95.86 -1.94%

Xetra DAX 10,782.63 -125.24 -1.15%

S&P 500 2,045.97 -29.03 -1.40%

NASDAQ Composite 5,005.08 -61.94 -1.22%

Dow Jones 17,448.07 -254.15 -1.44%

-