Noticias del mercado

-

16:24

U.S. business inventories climb 0.3% in September

The U.S. Commerce Department released the business inventories data on Friday. The U.S. business inventories rose 0.3% in September, beating expectations for a flat reading, after a 0.1% gain in August. August's figure was revised up from a flat reading.

Retail inventories climbed 0.8% in September, wholesale inventories were up 0.5%, while manufacturing inventories fell 0.4%.

Both business and retail sales were flat in September.

The business inventories/sales ratio climbed to 1.38 months in September from 1.37 months in August. It was the highest ratio since May 2009. The business inventories /sales ratio is a measure of how long it would take to clear shelves.

-

16:12

Thomson Reuters/University of Michigan preliminary consumer sentiment index climbs to 93.1 in November

The Thomson Reuters/University of Michigan preliminary consumer sentiment index climbed to 93.1 in November from a final reading of 90.0 in October, exceeding expectations for an increase to 91.5.

"Confidence rose in early November mainly due to a stronger outlook for the domestic economy," the Surveys of Consumers chief economist at the University of Michigan Richard Curtin said.

"Two trends dominated the early November data: consumers anticipated somewhat larger income increases during the year ahead as well as expected a somewhat lower inflation rate. This meant that consumers held the most favourable inflation-adjusted income expectations since 2007," he added.

The index of current economic conditions increased to 104.8 in November from 102.3 in October, while the index of consumer expectations rose to 85.6 from 82.1.

The one-year inflation expectations fell to 2.5% in November from 2.7% in October.

-

16:05

U.K. leading economic index falls 0.3% in September

The Conference Board (CB) released its leading economic index for the U.K. on Friday. The leading economic index (LEI) decreased 0.3% in September, after a 0.1% rise in August.

The coincident index was up 0.3% in September, after a 0.3% gain in August.

"Taken together, the recent growth of the LEI suggests that there is an increasing risk that the current economic expansion may moderate in early 2016," the CB said.

-

16:00

U.S.: Business inventories , September 0.3% (forecast 0%)

-

16:00

U.S.: Reuters/Michigan Consumer Sentiment Index, November 93.1 (forecast 91.5)

-

15:46

Federal Reserve Bank of Cleveland Loretta Mester: the Fed could start raising its interest rate if the incoming economic data will be positive

The Federal Reserve Bank of Cleveland Loretta Mester said in a speech on Friday that the Fed could start raising its interest rate if the incoming economic data will be positive.

"If incoming economic information continues to support this forecast, then in my view it will be time to take the first step in the policy normalization process," she said.

Mester also said that U.S. labour market continues to improve and inflation is gradually returning to the Fed's 2% target over the medium period.

-

14:59

U.S. producer price falls 0.4% in October

The U.S. Commerce Department released the producer price index figures on Friday. The U.S. producer price index declined 0.4% in October, missing expectations for a 0.2% rise, after a 0.5% drop in September.

On a yearly basis, the producer price index decreased 1.6% in October, missing forecasts of a 1.2% decline, after a 1.1% fall in September. It was the largest decline since 2009.

A stronger U.S. dollar and weak global demand weigh on inflation.

Services prices were down 0.3% in October, while prices for goods declined 0.4%.

Food prices decreased by 0.8% in October, while energy prices were flat.

The producer price index excluding food and energy fell 0.3% in October, missing expectations for a 0.1% gain, after a 0.3% decrease in September.

On a yearly basis, the producer price index excluding food and energy climbed 0.1% in October, missing forecasts of a 0.5% increase, after a 0.8% rise in September.

These figures could mean that the Fed will not start raising its interest rate in December.

-

14:57

Option expiries for today's 10:00 ET NY cut

USD/JPY 123.00 (USD 930m) 123.50 (505m)

EUR/USD 1.0600 (EUR 822m) 1.0700 (1.25bln) 1.0745-50 (520m) 1.0775 (448m)

USD/CAD 1.3245-50 (USD 710m) 1.3300 (1.45bln)

AUD/USD 0.7000 (AUD 348m) 0.7200 (205m)

EUR/GBP 0.7035 (EUR 200m) 0.7100 (400m)

-

14:46

U.S. retail sales increase 0.1% in October

The U.S. Commerce Department released the retail sales data on Friday. The U.S. retail sales climbed 0.1% in October, missing expectations for a 0.3% increase, after a flat reading in September. September's figure was revised down from a 0.1% rise.

The lower increase was mainly driven by a fall in automobiles purchases. Sales at auto dealerships declined 0.5% in October.

Retail sales excluding automobiles increased 0.2% in October, missing forecasts of a 0.4% gain, after a 0.3% fall in September. September's figure was revised up from a 0.4% decrease.

Sales at building material and garden equipment stores climbed 0.9% in October, while sales at furniture stores increased 0.4%.

Sales at clothing retailers were flat in October, while sales at service stations dropped 0.9%.

These figures could mean that the Fed will not start raising its interest rate in December.

-

14:31

U.S.: Retail sales excluding auto, October 0.2% (forecast 0.4%)

-

14:31

U.S.: Retail Sales YoY, October 1.7%

-

14:31

U.S.: PPI excluding food and energy, Y/Y, October 0.1% (forecast 0.5%)

-

14:30

U.S.: PPI, m/m, October -0.4% (forecast 0.2%)

-

14:30

U.S.: PPI excluding food and energy, m/m, October -0.3% (forecast 0.1%)

-

14:30

U.S.: PPI, y/y, October -1.6% (forecast -1.2%)

-

14:30

U.S.: Retail sales, October 0.1% (forecast 0.3%)

-

14:02

Foreign exchange market. European session: the euro traded mixed against the U.S. dollar after the release of the weaker-than-expected GDP data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

04:30 Japan Industrial Production (MoM) (Finally) September -1.2% 1.0% 1.1%

04:30 Japan Industrial Production (YoY) (Finally) September -0.4% -0.9% -0.8%

06:30 France GDP, Y/Y (Preliminary) Quarter III 1.1% 1.2%

06:30 France GDP, q/q (Preliminary) Quarter III 0.0% 0.3% 0.3%

07:00 Germany GDP (QoQ) (Preliminary) Quarter III 0.4% 0.3% 0.3%

07:00 Germany GDP (YoY) (Preliminary) Quarter III 1.6% 1.8% 1.8%

10:00 Eurozone Trade balance unadjusted September 11.2 18.2 20.5

10:00 Eurozone GDP (QoQ) (Preliminary) Quarter III 0.4% 0.4% 0.3%

10:00 Eurozone GDP (YoY) (Preliminary) Quarter III 1.5% 1.7% 1.6%

The U.S. dollar traded mixed to lower against the most major currencies ahead the release of the U.S. economic data. The U.S. retail sales are expected to rise 0.3% in October, after a 0.1% gain in September.

Retail sales excluding automobiles are expected to increase 0.4% in October, after a 0.3% decrease in September.

The U.S. PPI is expected to climb 0.2% in October, after a 0.5% drop in September.

The U.S. producer price inflation excluding food and energy is expected to rise 0.1% in October, after a 0.3 fall in September.

The preliminary Thomson Reuters/University of Michigan preliminary consumer sentiment index is expected to rise to 91.5 in November from a final reading of 90.0 in October.

The euro traded mixed against the U.S. dollar after the release of the weaker-than-expected GDP data from the Eurozone. Eurostat released its GDP growth figures for the Eurozone on Friday. Eurozone's preliminary gross domestic product (GDP) increased by 0.3% in the third quarter, missing expectations for a 0.4% rise, after a 0.4% gain in the second quarter.

On a yearly basis, Eurozone's preliminary GDP rose by 1.6% in the third quarter, missing expectations for a 1.7% increase, after a 1.5% gain in the second quarter.

Eurostat released no details of the component breakdown of GDP.

The U.S. economy grew 0.4% in the third quarter, after a 1.0% growth in second quarter. On a yearly basis, the U.S. economy expanded at 2.0% in third quarter, after a 2.7% increase in the second quarter.

Eurozone's unadjusted trade surplus jumped to €20.5 billion in September from €11.2 billion in August, exceeding expectations for a rise €18.2 billion.

Exports rose at an annual rate of 1.0% in September, while imports decreased by 1.0%.

The British pound traded slightly higher against the U.S. dollar after the release of the U.K. construction data. The Office for National Statistics (ONS) released its construction output data for the U.K. on Friday. Construction output in the U.K. declined 0.2% in September, after a 3.4% drop in August. It was the third consecutive decline.

On a quarterly basis, construction output slid 2.2% in third quarter.

The decline was driven by a drop in in construction by smaller firms in August.

On a yearly basis, construction output fell 1.6% in September, after a 0.6% decrease in August.

Construction makes up 6% of UK's economy.

The Swiss franc traded mixed against the U.S. dollar. The Federal Statistical Office released its producer and import prices data on Friday. Switzerland's producer and import prices rose 0.2% in October, after a 0.1% drop in September.

The increase was mainly driven by higher prices for machinery and watches.

The Import Price Index decreased by 0.1% in October, while producer prices climbed 0.3%.

On a yearly basis, producer and import prices plunged 6.6% in October, after a 6.8% drop in September.

The Import Price Index fell by 11.0% year-on year in October, while producer prices dropped 4.5%.

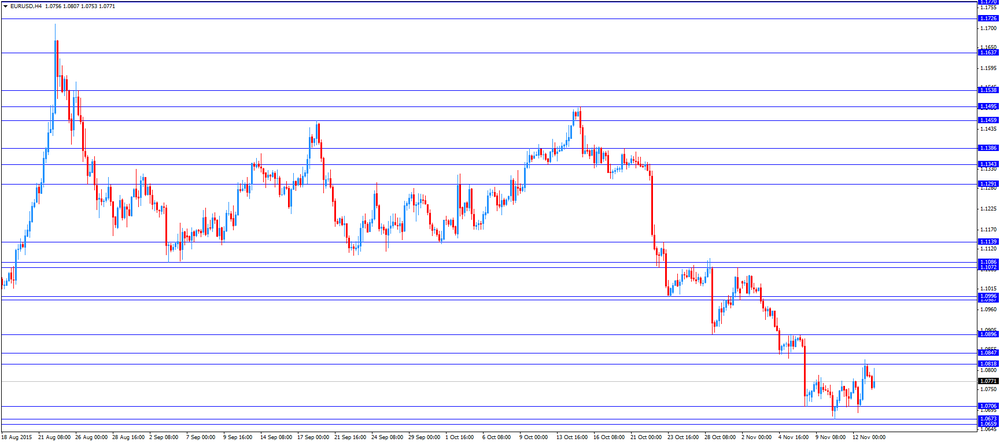

EUR/USD: the currency pair traded mixed

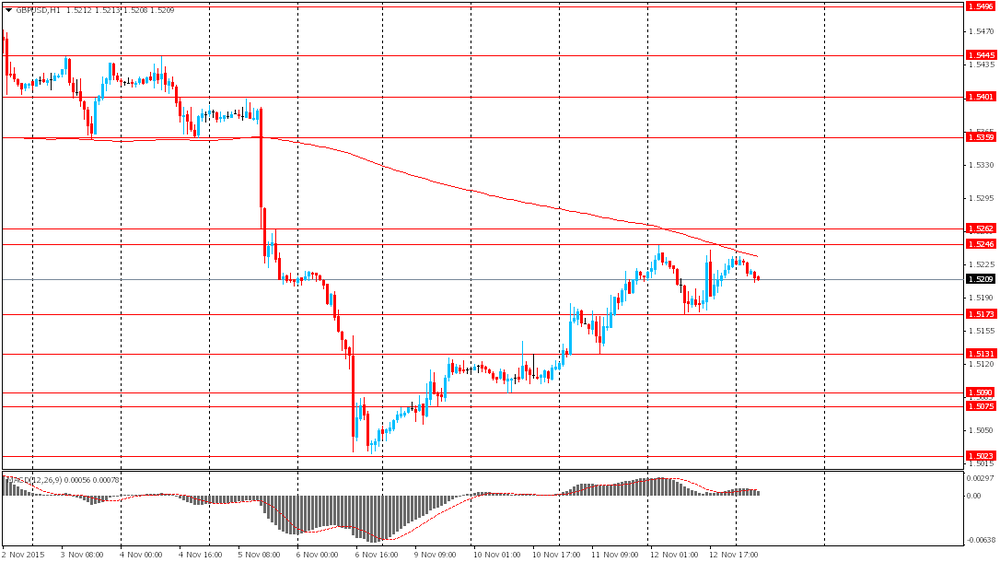

GBP/USD: the currency pair was up to $1.5231

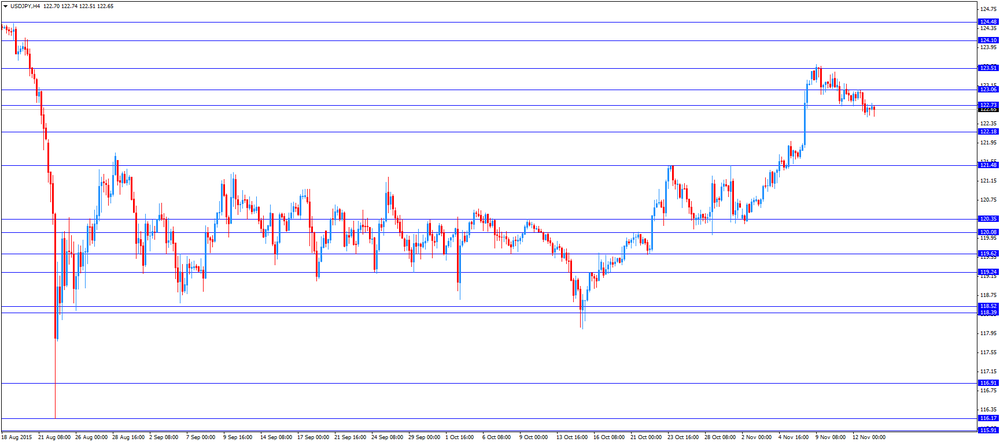

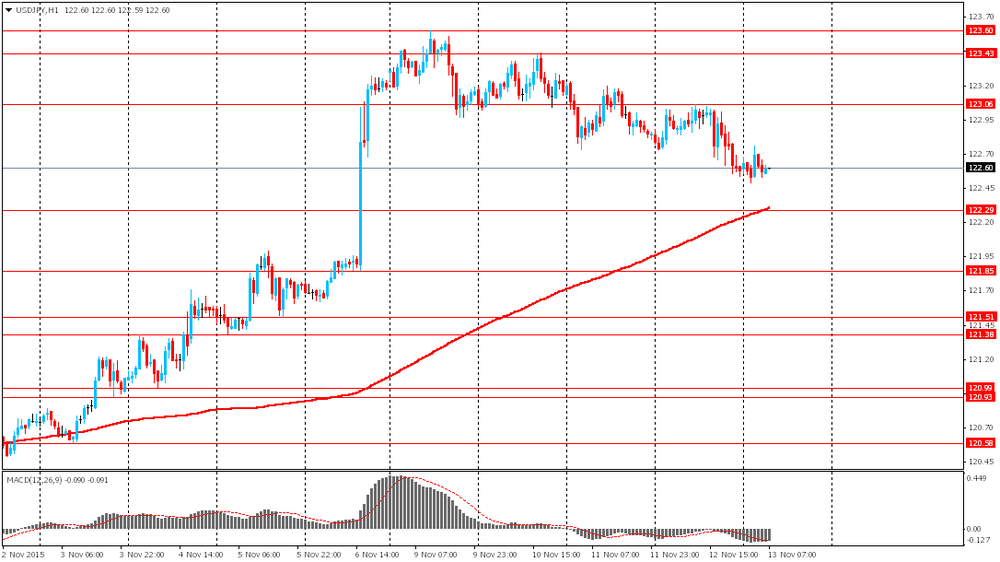

USD/JPY: the currency pair decreased to Y122.51

The most important news that are expected (GMT0):

13:30 Canada Manufacturing Shipments (MoM) September -0.2%

13:30 U.S. Retail sales October 0.1% 0.3%

13:30 U.S. Retail Sales YoY October 2.4%

13:30 U.S. Retail sales excluding auto October -0.3% 0.4%

13:30 U.S. PPI, m/m October -0.5% 0.2%

13:30 U.S. PPI, y/y October -1.1% -1.2%

13:30 U.S. PPI excluding food and energy, m/m October -0.3% 0.1%

13:30 U.S. PPI excluding food and energy, Y/Y October 0.8% 0.5%

15:00 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) November 90 91.5

15:00 U.S. Business inventories September 0.0% 0%

-

14:00

Orders

EUR/USD

Offers 1.0780-85 1.0800 1.0820 1.0845-50 1.0885 1.0900 1.0930 1.0950

Bids 1.0750 1.0730-35 1.0720 1.0700 1.0685 1.0665 1.0650 1.0630 1.0600

GBP/USD

Offers 1.5220-25 1.5235 1.5250 1.5265 1.5280 1.5300 1.5325 1.5350

Bids 1.5200 1.5185 1.5165-70 1.5150 1.5125-30 1.5100 1.5080-85 1.5060

EUR/GBP

Offers 0.7085 0.7100 0.7125-30 0.7150 0.7170 0.7185 0.7200

Bids 0.7050-60 0.7030-35 0.7020 0.7000 0.6985 0.6965 0.6950

EUR/JPY

Offers 132.40 132.60 132.75-80 133.00 133.20 133.50-60 133.80 134.00

Bids 131.90-132.00 131.50 131.30 131.00 130.80 130.50 130.25-30 130.00

USD/JPY

Offers 122.85 123.00 123.20-25 123.50 123.75-80 124.00 124.30 124.50

Bids 122.50 122.25 122.00 121.80 121.50-60 121.30 121.00

AUD/USD

Offers 0.7150-55 0.7180-85 0.7200 0.7220 0.7250

Bids 0.7120-25 0.7100 0.7085 0.7065 0.7050 0.7035 0.7020 0.7000

-

13:32

Greek GDP declines 0.5% in the third quarter

The Hellenic Statistical Authority released its preliminary gross domestic product (GDP) data for Greece on Friday. The Greek preliminary GDP declined 0.5% in the third quarter, after a revised 0.4% growth in the second quarter.

On a yearly basis, Greek final GDP fell 0.4% in the third quarter, after a revised 1.1% increase in the second quarter.

-

13:15

Final consumer price inflation in Spain rises 0.6% in October

The Spanish statistical office INE released its final consumer price inflation data on Friday. Consumer price inflation in Spain was up 0.6% in October, down from the preliminary reading of a 0.7% rise, after a 0.3% fall in September.

On a yearly basis, consumer prices fell by 0.7% in October from a year ago, in line with preliminary reading, after a 0.9% decline in September.

The annual decline was mainly driven by a drop in the prices of transport.

-

13:04

Switzerland's producer and import prices are 0.2% in October

The Federal Statistical Office released its producer and import prices data on Friday. Switzerland's producer and import prices rose 0.2% in October, after a 0.1% drop in September.

The increase was mainly driven by higher prices for machinery and watches.

The Import Price Index decreased by 0.1% in October, while producer prices climbed 0.3%.

On a yearly basis, producer and import prices plunged 6.6% in October, after a 6.8% drop in September.

The Import Price Index fell by 11.0% year-on year in October, while producer prices dropped 4.5%.

-

12:51

UK’s construction output declines 0.2% in September

The Office for National Statistics (ONS) released its construction output data for the U.K. on Friday. Construction output in the U.K. declined 0.2% in September, after a 3.4% drop in August. It was the third consecutive decline.

On a quarterly basis, construction output slid 2.2% in third quarter.

The decline was driven by a drop in in construction by smaller firms in August.

On a yearly basis, construction output fell 1.6% in September, after a 0.6% decrease in August.

Construction makes up 6% of UK's economy.

-

12:37

Final industrial production in Japan rises 1.1% in September

Japan's Ministry of Economy, Trade and Industry released its final industrial production data on Friday. Final industrial production in Japan rose 1.1% in September, up from the preliminary estimate of a 1.1% gain, after a 1.2% drop in August.

On a yearly basis, Japan's industrial production was down 0.8% in September, up from the preliminary estimate of a 0.9% fall, after a 0.4% decline in August.

Industrial shipments were upgraded to a 1.4% rise from the preliminary 1.3% gain, while inventories remained unchanged at a 0.4% decrease.

-

12:27

Final consumer prices in Italy increase 0.2% in October

The Italian statistical office Istat released its final consumer price inflation data for Italy on Friday. Preliminary consumer prices in Italy rose 0.2% in October, in line with preliminary reading, after a 0.4% fall in September.

The increase was mainly driven by a rise in prices of electricity, of gas and of unprocessed food. Prices of electricity jumped 2.9% in October, prices of gas rose 1.9%, while prices of unprocessed food were up 0.7%.

On a yearly basis, consumer prices climbed 0.3% in October, in line with preliminary reading, after a 0.2% increase in September.

The increase was driven by a rise in unprocessed food and higher prices for services related to recreation including repair and personal care. Prices for unprocessed food climbed 4.1% year-on-year in October, while prices for services related to recreation including repair and personal care rose 1.4% year-on-year.

Consumer price inflation excluding unprocessed food and energy prices remained unchanged at 0.8% year-on-year in October.

-

12:12

Italian economy increases 0.2% in the third quarter

The Italian statistical office Istat released its gross domestic product (GDP) growth for Italy on Friday. Italy's preliminary GDP increased 0.2% in the third quarter, after a 0.3% rise in the second quarter.

The growth was driven by an increase in domestic demand.

On a yearly basis, Italy's GDP rose to 0.9% in the third quarter from 0.6% in the second quarter.

-

11:57

Eurozone's unadjusted trade surplus jumps to €20.5 billion in September

Eurostat released its trade data for the Eurozone on Friday. Eurozone's unadjusted trade surplus jumped to €20.5 billion in September from €11.2 billion in August, exceeding expectations for a rise €18.2 billion.

Exports rose at an annual rate of 1.0% in September, while imports decreased by 1.0%.

-

11:50

Eurozone’s economy expands at 0.3% in the third quarter

Eurostat released its GDP growth figures for the Eurozone on Friday. Eurozone's preliminary gross domestic product (GDP) increased by 0.3% in the third quarter, missing expectations for a 0.4% rise, after a 0.4% gain in the second quarter.

On a yearly basis, Eurozone's preliminary GDP rose by 1.6% in the third quarter, missing expectations for a 1.7% increase, after a 1.5% gain in the second quarter.

Eurostat released no details of the component breakdown of GDP.

The U.S. economy grew 0.4% in the third quarter, after a 1.0% growth in second quarter. On a yearly basis, the U.S. economy expanded at 2.0% in third quarter, after a 2.7% increase in the second quarter.

-

11:46

French economy expands 0.3% in the third quarter

The French statistical office Insee released its gross domestic product (GDP) growth for France on Friday. France's preliminary GDP climbed 0.3% in the third quarter, in line with expectations, after a flat reading in the second quarter.

Total production in goods and services was up 0.4% in the third quarter.

Households' spending rose 0.3% in the third quarter.

Export fell 0.6% in the third quarter, while imports rose 1.7%.

On a yearly basis, France's GDP rose to 1.2% in the third quarter from 1.0% in the second quarter.

-

11:39

German economy grows 0.3% in the third quarter

Destatis released its gross domestic product (GDP) growth for Germany on Friday. Germany's preliminary GDP gained by 0.3% in the third quarter, in line with expectations, after a 0.4% increase in the second quarter.

The increase was driven by domestic final consumption expenditure. Household and government consumption expenditure increased.

On a yearly basis, Germany's GDP rose to 1.8% in the third quarter from 1.6% in the second quarter, in line with expectations.

-

11:34

Fed Vice Chairman Stanley Fischer: inflation in the U.S. should rebound next year

The Fed Vice Chairman Stanley Fischer said on Thursday that inflation in the U.S. should rebound next year as the effect of a stronger U.S. dollar and low energy prices will fade.

"Some of the forces holding down inflation in 2015--particularly those due to a stronger dollar and lower energy prices--will begin to fade next year. Consequently, overall PCE inflation is likely on this account alone to rebound next year to around 1-1/2 percent," he said.

Fischer pointed out that the interest rate hike in December is possible, but it will depend on the incoming inflation and employment data.

"The October 2015 FOMC statement indicated that it may be appropriate to raise the target range for the federal funds rate at the next meeting in December, though the outcome will depend on the Committee's assessment of the progress--realized and expected--that has been made toward meeting our goals of maximum employment and price stability," he noted.

-

11:24

New York Fed President William Dudley: the interest rate hike in December will depend on the incoming economic data

New York Fed President William Dudley said on Thursday that the interest rate hike in December will depend on the incoming economic data.

"I think it is quite possible that the conditions the Committee has established to begin to normalize monetary policy could soon be satisfied. In particular, I will be evaluating the incoming information to see if it confirms my expectation that growth will be sufficient to further tighten the U.S. labour market," he said.

Dudley added that the interest rate hikes will be gradual once the Fed starts raising its interest rate.

Dudley is a voting member of the Federal Open Market Committee this year.

-

11:21

Option expiries for today's 10:00 ET NY cut

USD/JPY 123.00 (USD 930m) 123.50 (505m)

EUR/USD 1.0600 (EUR 822m) 1.0700 (1.25bln) 1.0745-50 (520m) 1.0775 (448m)

USD/CAD 1.3245-50 (USD 710m) 1.3300 (1.45bln)

AUD/USD 0.7000 (AUD 348m) 0.7200 (205m)

EUR/GBP 0.7035 (EUR 200m) 0.7100 (400m)

-

11:00

Eurozone: GDP (QoQ), Quarter III 0.3% (forecast 0.4%)

-

11:00

Eurozone: GDP (YoY), Quarter III 1.6% (forecast 1.7%)

-

11:00

Eurozone: Trade balance unadjusted, September 20.5 (forecast 18.2)

-

10:23

Bloomberg Consumer Comfort Index: consumers’ expectations for U.S. economy rise to 45.2 in in the week ended October 11

According to data from the Bloomberg Consumer Comfort Index, consumers' expectations for U.S. economy increased to 41.6 in in the week ended November 08 from 41.1 the prior week. The increase was driven by a rise in the buying climate index, which climbed to 38.0 from 35.8.

The measure of views of the economy fell to 31.7 from 31.9.

The personal finances index was down to 55.1 from 55.8.

-

10:15

European Central Bank Governing Council member Jens Weidmann: the Eurozone faces no deflation

The European Central Bank (ECB) Governing Council member Jens Weidmann said in a speech in Paris on Thursday that the Eurozone faces no deflation.

"What we see now is not that we are going towards deflation," he said. Weidmann pointed out that the Eurozone's low inflation is mainly driven by low energy prices.

He also said that the ECB should not expand its asset-buying programme as it will blur the lines between fiscal and monetary policy.

Weidmann noted that Diverging monetary policies in the Eurozone and the U.S. could lead to fluctuations in the foreign exchange market.

-

10:09

U.S. budget deficit falls to $136.0 billion in October

The U.S. Treasury Department released its federal budget data on Thursday. The budget deficit increased to $136.0 billion in October, missing expectations for a deficit of $130.0 billion, down from a surplus of $91.0 billion in September.

The budget deficit rose due to shifts in the timing of some payments.

In the first month of the fiscal year 2016, which ends at September next year, the budget deficit totalled $348 billion, 4% higher than a year ago.

-

08:35

Options levels on friday, November 13, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.0960 (1291)

$1.0910 (1390)

$1.0872 (364)

Price at time of writing this review: $1.0777

Support levels (open interest**, contracts):

$1.0726 (4737)

$1.0688 (3248)

$1.0638 (5883)

Comments:

- Overall open interest on the CALL options with the expiration date December, 4 is 85029 contracts, with the maximum number of contracts with strike price $1,1000 (5692);

- Overall open interest on the PUT options with the expiration date December, 4 is 112963 contracts, with the maximum number of contracts with strike price $1,0700 (7807);

- The ratio of PUT/CALL was 1.33 versus 1.36 from the previous trading day according to data from November, 12

GBP/USD

Resistance levels (open interest**, contracts)

$1.5502 (668)

$1.5404 (1548)

$1.5307 (2138)

Price at time of writing this review: $1.5218

Support levels (open interest**, contracts):

$1.5190 (2258)

$1.5094 (2510)

$1.4997 (2983)

Comments:

- Overall open interest on the CALL options with the expiration date December, 4 is 26329 contracts, with the maximum number of contracts with strike price $1,5600 (3624);

- Overall open interest on the PUT options with the expiration date December, 4 is 31674 contracts, with the maximum number of contracts with strike price $1,5050 (4292);

- The ratio of PUT/CALL was 1.20 versus 1.15 from the previous trading day according to data from November, 12

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:01

Germany: GDP (YoY), Quarter III 1.8% (forecast 1.8%)

-

08:00

Germany: GDP (QoQ), Quarter III 0.3% (forecast 0.3%)

-

07:52

Foreign exchange market. Asian session: the U.S. dollar climbed against the euro

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

04:30 Japan Industrial Production (MoM) (Finally) September -1.2% 1.0% 1.1%

04:30 Japan Industrial Production (YoY) (Finally) September -0.4% -0.9% -0.8%

06:30 France GDP, Y/Y (Preliminary) Quarter III 1.1% 1.2%

06:30 France GDP, q/q (Preliminary) Quarter III 0.0% 0.3% 0.3%

The U.S. dollar slightly advanced against the euro and the pound amid speculation that the Federal Reserve would raise its interest rates soon, while the European Central Bank on the contrary was considering loosening its monetary policy to support the economy. Yesterday Fed officials signaled that rates will continue rising gradually once the liftoff takes place.

The euro declined against the greenback ahead of release of euro zone GDP reports. It's worth reminding that the euro zone economy expanded by 0.4% in the second quarter brining annualized growth rate to 1.5% (the fastest growth since 2011). Consumer spending and exports were the biggest contributors to this increase. Investors are expected to pay much attention to third quarter data, because they might influence prospects of introduction of additional stimulus measures at a meeting in December. If GDP data come in line with forecasts, this would mean that European exporters can overcome difficult conditions.

Yesterday ECB President Mario Draghi signaled that the quantitative easing program will be revised in December, which gave investors hope for its expansion.

EUR/USD: the pair fell to $1.0780 in Asian trade

USD/JPY: the pair traded within Y122.50-75

GBP/USD: the pair fell to $1.5205

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:00 Germany GDP (QoQ) (Preliminary) Quarter III 0.4% 0.3%

07:00 Germany GDP (YoY) (Preliminary) Quarter III 1.6% 1.8%

10:00 Eurozone Trade balance unadjusted September 11.2 18.2

10:00 Eurozone GDP (QoQ) (Preliminary) Quarter III 0.4% 0.4%

10:00 Eurozone GDP (YoY) (Preliminary) Quarter III 1.5% 1.7%

13:30 Canada Manufacturing Shipments (MoM) September -0.2%

13:30 U.S. Retail sales October 0.1% 0.3%

13:30 U.S. Retail Sales YoY October 2.4%

13:30 U.S. Retail sales excluding auto October -0.3% 0.4%

13:30 U.S. PPI, m/m October -0.5% 0.2%

13:30 U.S. PPI, y/y October -1.1% -1.2%

13:30 U.S. PPI excluding food and energy, m/m October -0.3% 0.1%

13:30 U.S. PPI excluding food and energy, Y/Y October 0.8% 0.5%

15:00 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) November 90 91.5

15:00 U.S. Business inventories September 0.0% 0%

-

07:46

France: GDP, Y/Y, Quarter III 1.2%

-

07:46

France: GDP, q/q, Quarter III 0.3% (forecast 0.3%)

-

05:35

Japan: Industrial Production (YoY), September -0.8% (forecast -0.9%)

-

05:31

Japan: Industrial Production (MoM) , September 1.1% (forecast 1.0%)

-

01:02

Currencies. Daily history for Nov 12’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0813 +0,66%

GBP/USD $1,5231 +0,12%

USD/CHF Chf1 -0,44%

USD/JPY Y122,58 -0,22%

EUR/JPY Y132,55 +0,84%

GBP/JPY Y186,72 +0,25%

AUD/USD $0,7124 +0,91%

NZD/USD $0,6541 -0,02%

USD/CAD C$1,3289 +0,22%

-