Noticias del mercado

-

23:59

Schedule for today, Friday, Nov 13’2015:

(time / country / index / period / previous value / forecast)

04:30 Japan Industrial Production (MoM) September -1.2% 1.0%

04:30 Japan Industrial Production (YoY) September -0.4% -0.9%

06:30 France GDP, Y/Y Quarter III 1.1%

06:30 France GDP, q/q Quarter III 0.0% 0.3%

07:00 Germany GDP (QoQ) Quarter III 0.4% 0.3%

07:00 Germany GDP (YoY) Quarter III 1.6% 1.8%

10:00 Eurozone Trade balance unadjusted September 11.2 18.2

10:00 Eurozone GDP (QoQ) (Preliminary) Quarter III 0.4% 0.4%

10:00 Eurozone GDP (YoY) (Preliminary) Quarter III 1.5% 1.7%

13:30 Canada Manufacturing Shipments (MoM) September -0.2%

13:30 U.S. Retail sales October 0.1% 0.3%

13:30 U.S. Retail Sales YoY October 2.4%

13:30 U.S. Retail sales excluding auto October -0.3% 0.4%

13:30 U.S. PPI, m/m October -0.5% 0.2%

13:30 U.S. PPI, y/y October -1.1% -1.2%

13:30 U.S. PPI excluding food and energy, m/m October -0.3% 0.1%

13:30 U.S. PPI excluding food and energy, Y/Y October 0.8% 0.5%

15:00 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) November 90 91.5

15:00 U.S. Business inventories September 0.0% 0%

-

20:20

American focus: the US dollar stopped growing

The US dollar fell against the euro and the yen after only one senior representative of the Federal Reserve expressed support for raising interest rates during the December meeting, while the market had expected stronger signals.

The dollar fell after the Fed President of New York, William Dudley, in his speech at the Economic Club of New York said he can not predict with precision timing of rising interest rates. Dudley also said that inflation still remains below the Fed's target level and added that the strengthening of the dollar has a negative impact on the export sector, the United States and leads to slower economic growth.

The US dollar has stopped its growth against the major currencies, but still stayed at a seven-month peak after the Federal Reserve Yellen declined to comment on the future of monetary policy.

The dollar weakened after in his speech on Thursday, Fed Chairman Janet Yellen gave no immediate comment on the outlook for the economy or monetary policy.

Today, investors evaluated the comments of a number of Fed officials. Chicago Fed President Evans said that the central bank should speak clearly about the prospects of its monetary policy. Therefore, it was not easy to say, 'Do not raise interest rates in December. " However, his performance in Chicago on Thursday morning suggests that perhaps it is his opinion.

According to the records of speeches by the Fed, most bankers expect a rate hike this year, before the end of which there are only one meeting of the Committee on Monetary Policy.

According to Evans, it is desirable "delayed start and a gradual normalization of the economy." Under blurred wording hides Council to postpone raising rates until next year.

Evans wants to see visual evidence of increasing inflation before raising rates. The December meeting of the Committee will be difficult to see them.

Earlier, the US Labor Department said the number of individuals filing for initial jobless benefits in the week ending November 7 has not changed compared to 276,000 the previous week. Analysts had expected jobless claims to fall to 270,000 by 6000.

The dollar was supported as positive data on employment in the US last week increased the likelihood of raising interest rates at the December meeting of the Federal Reserve.

The euro earlier fell sharply against the dollar, dropping briefly below $ 1.0700, which was triggered by ECB President Draghi's statements that the current QE program will be reviewed at the December meeting. He also pointed to the existence of obvious downside risks to the euro-zone economy and easing inflationary dynamics. "We will closely monitor the risks to price stability and to assess the sustainability of the factors slowing the growth of inflation to the target level. At the December meeting, we overestimate the degree of stimulation achieved by the monetary policy," - said Draghi. Recall, the ECB aims to maintain inflation at about 2 percent a year. According to the latest data, in October, the rate of inflation remained unchanged. Draghi also confirmed that the program of asset purchases (QE) may be extended for the period after September 2016, when the need arises. In addition, the ECB said that the euro zone economy is recovering slower than the American. He also noted the progress of Greek banks in the matter of raising funds and said that Greek bonds might be part of the QE program, subject to the necessary requirements.

Little impact on the euro had reports on Germany and the euro zone. Final data presented by the Statistics Office Destatis, showed that consumer prices rose last month by 0.3 percent year on year after a zero change in September. On a monthly basis, consumer prices remained unchanged after falling 0.2 percent fall in the previous month. The report also stated that energy prices fell by 8.6 per cent compared with October last year. Excluding energy prices, inflation was at 1.4 percent.

Meanwhile, data from the Statistical Office Eurostat have shown that the seasonally adjusted volume of industrial production in the euro zone fell in September by 0.3% after falling 0.4% in the previous month (revised from -0.5%). Experts forecast a decline in production by 0.1%. In annual terms, production increased by 1.7%. It was expected that production will increase by 1.3% after rising 2.2% in August.

-

20:00

U.S.: Federal budget , October -136 (forecast -130)

-

17:07

International Monetary Fund: the Fed should not start raising its interest rates before inflation in the U.S. will not begin to pick up toward the Fed’s 2% target

The International Monetary Fund (IMF) said in a report on Thursday that the Fed should not start raising its interest rates before inflation in the U.S. will not begin to pick up toward the Fed's 2% target.

"The main near-term policy question is the appropriate timing and pace of monetary policy normalization. The Federal Open Market Committee's (FOMC) decision should remain data-dependent, with the first increase in the federal funds rate waiting until continued strength in the labour market is accompanied by firm signs of inflation rising steadily toward the Federal Reserve's 2 percent medium-term inflation objective," the IMF said.

-

17:00

U.S.: Crude Oil Inventories, November 4.224 (forecast 1.7)

-

16:41

Chicago Fed President Charles Evans wants to be confident that inflation begins to pick up toward the Fed’s target before to start raising interest rates

Chicago Fed President Charles Evans said in a speech on Thursday that he wants to be confident that inflation begins to pick up toward the Fed's target before to start raising interest rates.

"Before raising rates, I would like to have more confidence than I do today that inflation is indeed beginning to head higher. Given the current low level of core inflation, some evidence of true upward momentum in actual inflation is critical to this assessment," he said.

"I believe that it could well be the middle of next year before the headwinds from lower energy prices and the stronger dollar dissipate enough so that we begin to see some sustained upward movement in core inflation," Evans added.

Chicago Fed president pointed out that the Fed should hike its interest rate gradually.

Evans is a voting member of the Federal Open Market Committee this year.

-

16:29

St. Louis Fed President James Bullard: the Fed should start raising its interest rate as the Fed’s targets are reached

St. Louis Fed President James Bullard said in a speech on Thursday that the Fed should start raising its interest rate as the Fed's targets are reached.

"During 2015, I have been an advocate of beginning to normalize the policy rate in the U.S. My arguments have focused on the idea that the U.S. economy is quite close to normal today based on an unemployment rate of 5 percent, which is essentially at the Committee's estimate of the long‐run rate, and inflation net of the 2014 oil price shock only slightly below the Committee's target," he said.

"My current policy views have not changed," Bullard added.

He pointed out that the Fed's monetary policy should be changed if interest rate and inflation will remain low.

"Should we find ourselves in a persistent state of low nominal interest rates and low inflation, some of our fundamental assumptions about how U.S. monetary policy works may have to be altered," St. Louis Fed president noted.

-

16:13

Job openings climb to 5.526 million in September

The U.S. Bureau of Labor Statistics released its Job Openings and Labor Turnover Survey (JOLTS) report on Thursday. Job openings climbed to 5.526 million in September from 5.377 million in August. August's figure was revised up from 5.370 million.

The number of job openings rose for total private (5.020 million) and for government (506,000) in September.

The hires rate was 3.5% in September.

Total separations declined to 4.839 million in September from 4.886 million in August.

The JOLTS report is one of the Federal Reserve Chair Janet Yellen's favourite labour market indicators.

-

16:04

Fitch Ratings warned it could downgrade Portugal’s credit rating if the opposition will form new government

Fitch Ratings said on Wednesday that it could downgrade Portugal's credit rating if the opposition will form new government.

"Fiscal relaxation resulting in a less favourable trajectory in government debt/GDP levels could lead to negative rating action, as could weaker growth that had a negative effect on public finances," the agency said.

Portugal's credit rating is 'BB+'. The outlook is Positive.

Prime Minister Pedro Passos Coelho's minority government lost a confidence vote on Tuesday.

"The defeat of Portugal's minority government highlights the political instability created by October's elections and the resulting risks to fiscal consolidation and reform implementation. The extent of these risks will depend on any new government's cohesiveness, its policy programme, and whether political uncertainty damages economic and financial market confidence," Fitch said.

-

16:01

U.S.: JOLTs Job Openings, September 5.526 (forecast 5.370)

-

15:14

-

15:07

Canada’s new housing price index climbs 0.1% in September

Statistics Canada released its new housing price index on Thursday. New housing price index in Canada rose 0.1% in September, missing expectations of a 0.2% gain, after a 0.3% rise in August.

The increase was driven by gains in Toronto region and Vancouver. New home prices in Toronto and Oshawa region rose 0.2% in September, while new home prices in Vancouver climbed 0.4%.

On a yearly basis, new housing price index in Canada climbed 5.6% in September, after a 1.3% gain in August.

-

14:56

Option expiries for today's 10:00 ET NY cut

USD/JPY 123.00 (USD 433m) 123.20 (580m) 123.35 (1bln) 123.50 (400m)

EUR/USD 1.0690-1.0705 (EUR 2bln) 1.0750 (556m) 1.0800 (1.4bln)

AUD/USD 0.7000 (AUD 352m) 0.7200 (1.1bln)

NZD/USD 0.6600 (NZD 300m) 0.6610 (523m)

AUD/JPY 87.70 (AUD 684m) 88.00 (448m)

-

14:39

Initial jobless claims remain unchanged at 276,000 in the week ending November 01

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending November 01 in the U.S. remained unchanged at 276,000.

Analysts had expected the initial jobless claims to decrease to 270,000.

Jobless claims remained below 300,000 the 36th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims increased by 5,000 to 2,174,000 in the week ended October 31.

-

14:30

Canada: New Housing Price Index, MoM, September 0.1% (forecast 0.2%)

-

14:30

U.S.: Initial Jobless Claims, November 276 (forecast 270)

-

14:30

U.S.: Continuing Jobless Claims, October 2174 (forecast 2160)

-

14:03

Foreign exchange market. European session: the euro traded lower against the U.S. dollar after a speech by the European Central Bank President Mario Draghi

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Australia Consumer Inflation Expectation October 3.5% 3.5%

00:30 Australia Changing the number of employed October -0.8 Revised From -5.1 15 58.6

00:30 Australia Unemployment rate October 6.2% 6.2% 5.9%

07:00 Germany CPI, m/m (Finally) October -0.2% 0.0% 0.0%

07:00 Germany CPI, y/y (Finally) October 0% 0.3% 0.3%

07:45 France CPI, m/m October -0.4% 0.1%

07:45 France CPI, y/y October 0.0% 0.1%

08:30 Eurozone ECB President Mario Draghi Speaks

10:00 Eurozone Industrial production, (MoM) September -0.4% Revised From -0.5% -0.1% -0.3%

10:00 Eurozone Industrial Production (YoY) September 2.2% Revised From 0.9% 1.3% 1.7%

10:30 Eurozone ECB President Mario Draghi Speaks

The U.S. dollar traded higher against the most major currencies ahead the release of the U.S. economic data and a speech by the Fed Chairwoman Janet Yellen.

The number of initial jobless claims in the U.S. is expected to decrease by 6,000 to 270,000 last week.

Job openings in the U.S. are expected to remain unchanged at 5.370 million in September.

The greenback remains supported by speculation that the Fed will start raising its interest rate next month.

The euro traded lower against the U.S. dollar after a speech by the European Central Bank (ECB) President Mario Draghi. He testified before the European parliament's Economic and Monetary Affairs Committee on Thursday. Draghi said that the central bank will review its monetary policy at its next meeting in December.

Regarding current economic outlook, he said that the Eurozone's economy recovered moderately, while the central bank's monetary policy and low energy prices supported consumption.

But there are downside risks to the growth and inflation outlook from the slowdown in the global economy and from a drop in oil prices, the ECB president added.

Meanwhile, the economic data from the Eurozone was positive. Eurostat released its industrial production data for the Eurozone on Thursday. Industrial production in the Eurozone declined 0.3% in September, missing expectations for a 0.1% decrease, after a 0.4% fall in August. August's figure was revised up from a 0.5% drop.

The decrease was driven by declines in durable consumer goods, non-durable consumer goods and capital output. Durable consumer goods output dropped 3.9% in September, non-durable consumer goods were down 1.0%, while capital goods output fell by 0.3%.

Intermediate goods output was flat in September, while energy output climbed 1.2%.

On a yearly basis, Eurozone's industrial production gained 1.7% in September, exceeding expectations for a 1.3% rise, after a 2.2% increase in August. August's figure was revised up from a 0.9% gain.

The increase was driven by rises in durable and non-durable consumer goods, intermediate goods output and capital goods. Durable consumer goods climbed by 2.6% in September from a year ago, capital goods rose by 2.2%, intermediate goods output increased by 1.8%, while non-durable consumer goods gained by 2.1%.

Energy output was down by 1.4% in September from a year ago.

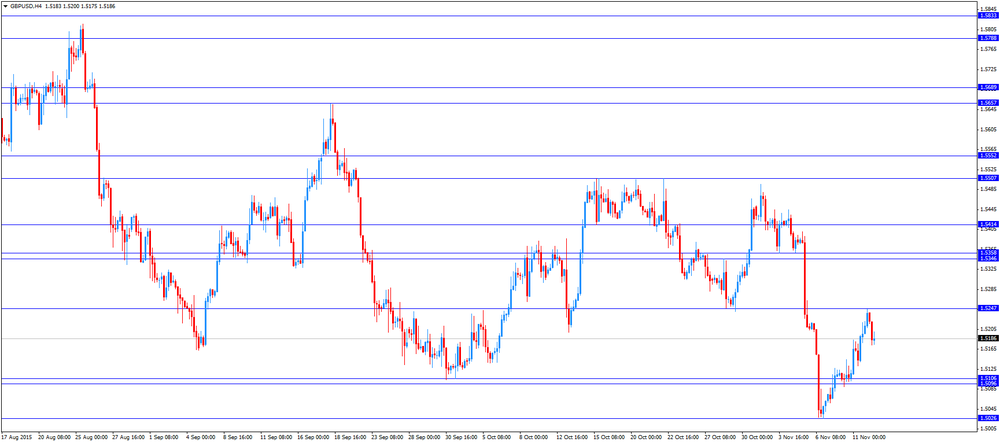

The British pound traded lower against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded lower against the U.S. dollar ahead of the release of the new housing price index from Canada. Canada's new housing price index is expected to rise 0.2% in September, after a 0.3% gain in August.

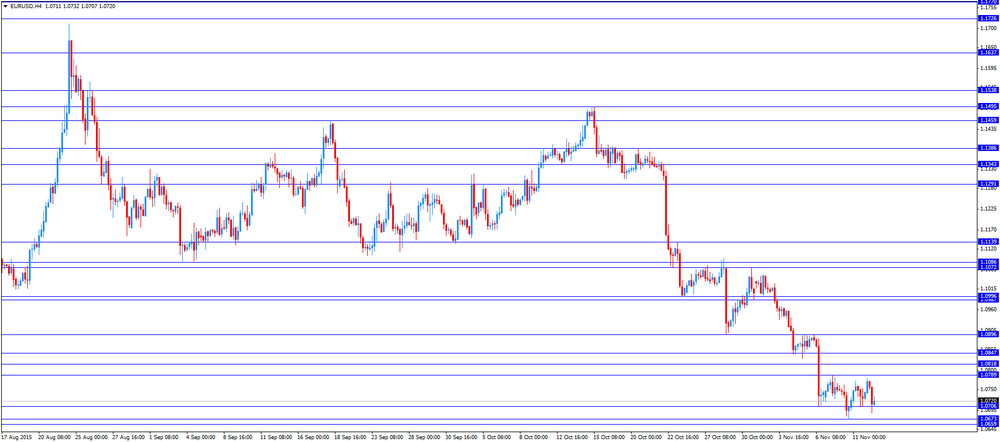

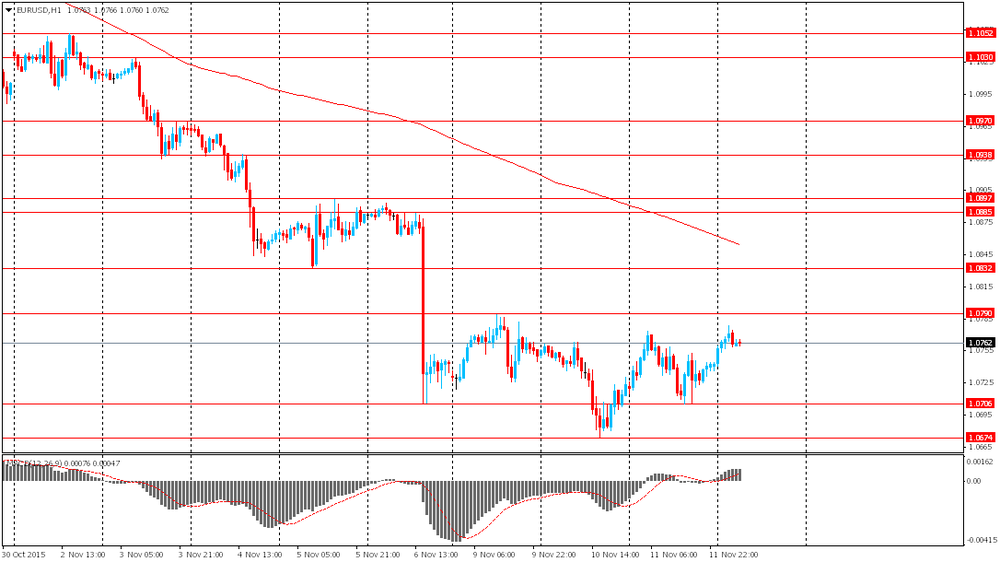

EUR/USD: the currency pair declined to $1.0690

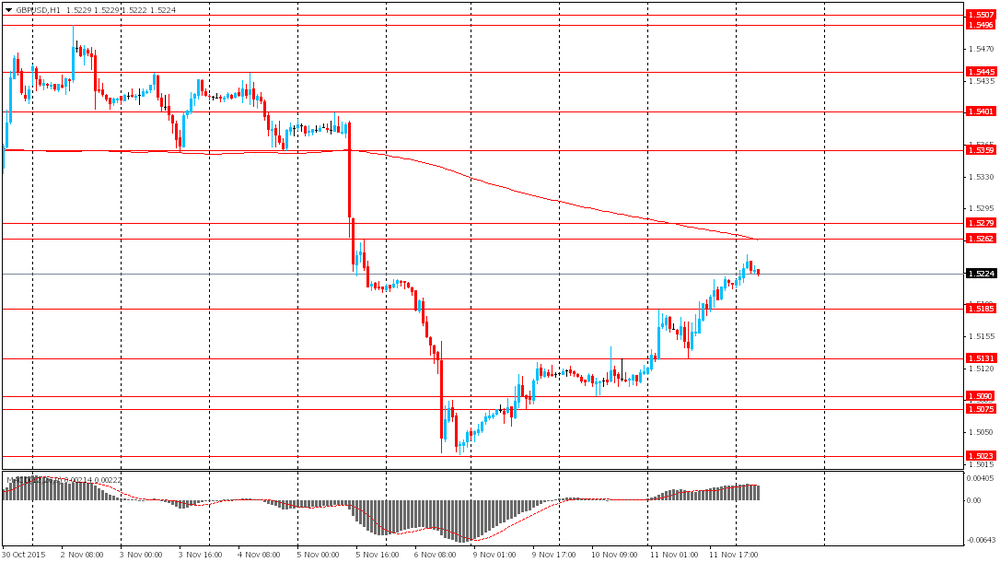

GBP/USD: the currency pair was down to $1.5173

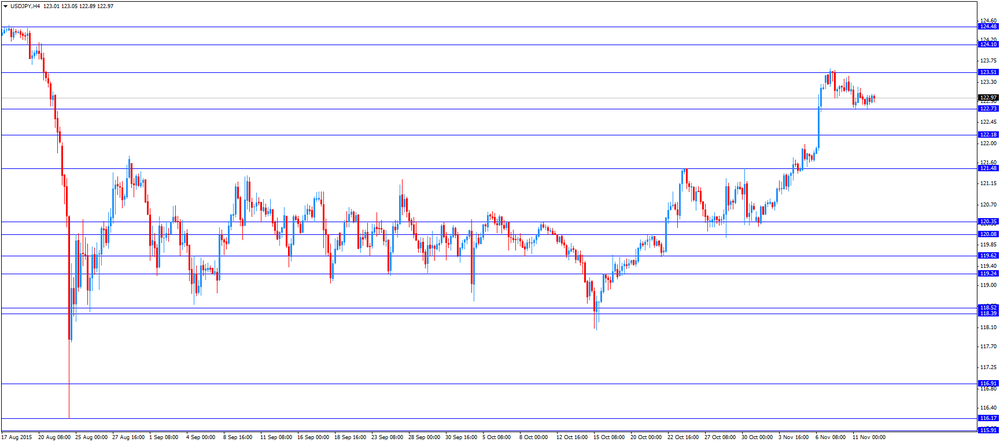

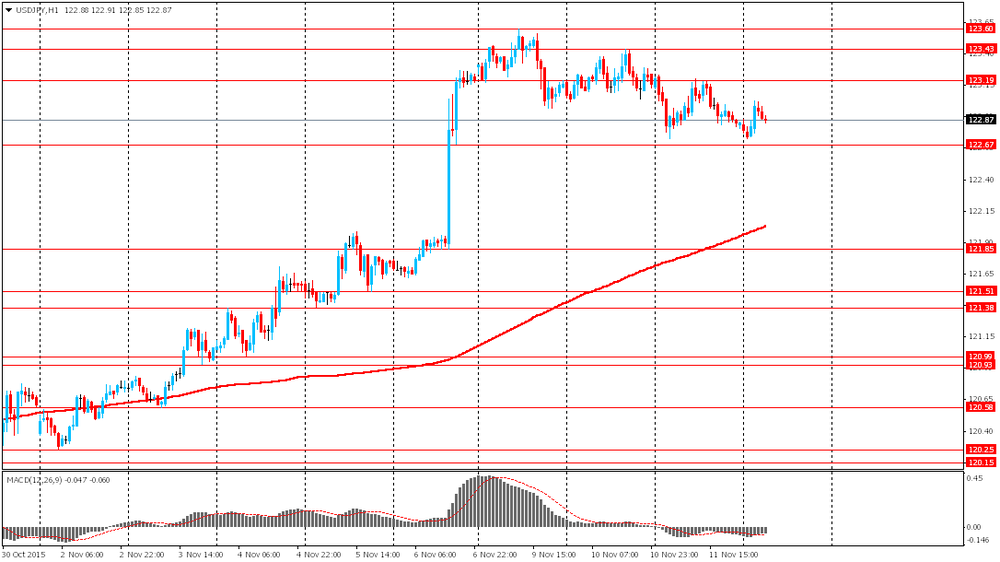

USD/JPY: the currency pair increased to Y123.06

The most important news that are expected (GMT0):

13:30 Canada New Housing Price Index, MoM September 0.3% 0.2%

13:30 U.S. Initial Jobless Claims November 276 270

14:30 U.S. Fed Chairman Janet Yellen Speaks

15:00 U.S. JOLTs Job Openings September 5.370 5.370

15:15 U.S. FOMC Member Charles Evans Speaks

17:15 U.S. FOMC Member Dudley Speak

23:00 U.S. FED Vice Chairman Stanley Fischer Speaks

-

14:00

Orders

EUR/USD

Offers 1.0760-65 1.0780-85 1.0800 1.0820 1.0845-50 1.0885 1.0900 1.0925-30 1.0960 1.0980 1.1000

Bids 1.0730-35 1.0720 1.0700 1.0685 1.0665 1.0650 1.0630 1.0600

GBP/USD

Offers 1.5200 1.5220-25 1.5245-50 1.5265 1.5280 1.5300 1.5325 1.5350

Bids 1.5165-70 1.5150 1.5125-30 1.5100 1.5080-85 1.5060 1.5045 1.5025-30 1.5000

EUR/GBP

Offers 0.7065-70 0.7085 0.7100 0.7125-30 0.7150 0.7170 0.7185 0.7200

Bids 0.7030-35 0.7020 0.7000 0.6985 0.6965 0.6950 0.6930 0.6900

EUR/JPY

Offers 131.90-132.00 132.25 132.40 132.60 132.75-80 133.00 133.20 133.50-60

Bids 131.50 131.30 131.00 130.80 130.50 130.25-30 130.00

USD/JPY

Offers 123.20-25 123.50 123.75-80 124.00 124.30 124.50 124.75 125.00

Bids 122.85 122.65 122.50 122.25 122.00 121.80 121.50-60

AUD/USD

Offers 0.7150-55 0.7180-85 0.7200 0.7220 0.7250

Bids 0.7125 0.7100 0.7085 0.7065 0.7050 0.7035 0.7020 0.7000

-

13:46

Business NZ performance of manufacturing index for New Zealand falls to 53.3 in October

According to the Business NZ Survey published on late Wednesday evening, the Business NZ performance of manufacturing index (PMI) for New Zealand fell 53.3 in October to 55.4 in September.

A reading above 50 indicates expansion in the manufacturing sector.

The decline was mainly driven by a slower expansion in the production and new orders.

"Although the key sub-indices of production (53.1) and new orders (55.9) both experienced lower levels of expansion, they continued to lead the way for October. In addition, the proportion of positive comments for October (61.8%) picked up from September (58.7%), with many of these in relation to increased offshore orders and new customers," Business NZ's executive director for manufacturing, Catherine Beard, said.

-

13:08

Core machinery orders in Japan surges 7.5% in September

Japan's Cabinet Office released its core machinery orders data on late Wednesday evening. Core machinery orders in Japan jumped 7.5% in September, exceeding expectations for a 3.3% rise, after a 3.5% fall in August.

On a yearly basis, core machinery orders slid 1.7% in September, beating expectations for a 4.0% drop, after a 3.5% fall in August.

This data indicates that capital spending in Japan improved, and it could mean that the Bank of Japan may not expand its quantitative easing.

The total number of machinery orders declined 0.5% in September from a month earlier.

Orders from non-manufacturers jumped 14.3% in September, while orders from manufacturers slid 5.5%.

-

11:34

Greek unemployment rate declines to 24.6% in August

The Hellenic Statistical Authority released its unemployment data on Thursday. The seasonally adjusted unemployment rate in Greece declined to 24.6% in August from 24.9% in July. July's figure was revised down from 25.0%.

The number of unemployed fell by 15,740 persons compared with July 2015.

The youth unemployment rate was 47.9% in August.

-

11:28

France’s current account surplus is €0.5 billion in September

The Bank of France released its current account data on Thursday. France's current account surplus was €0.5 billion in September, up from a deficit of €0.1 billion in August.

The trade goods deficit widened to €1.6 billion in September from €1.2 billion in August, while the surplus on services rose to €1.8 billion from €0.7 billion.

The surplus on financial account decreased to €10.3 billion in September from €10.4 billion in August.

-

11:21

European Central Bank President Mario Draghi repeats that the central bank will review its monetary policy at its next meeting in December

The European Central Bank (ECB) President Mario Draghi testified before the European parliament's Economic and Monetary Affairs Committee on Thursday. He said that the central bank will review its monetary policy at its next meeting in December.

"At our December monetary policy meeting, we will re-examine the degree of monetary policy accommodation," he said.

Regarding current economic outlook, he said that the Eurozone's economy recovered moderately, while the central bank's monetary policy and low energy prices supported consumption.

But there are downside risks to the growth and inflation outlook from the slowdown in the global economy and from a drop in oil prices, the ECB president added.

"However, downside risks stemming from global growth and trade are clearly visible. Moreover, inflation dynamics have somewhat weakened, mainly due to lower oil prices and the delayed effects of the stronger euro exchange rate seen earlier in the year," Draghi said.

He pointed out that the ECB will add further stimulus measures if needed to boost inflation in the Eurozone.

"If we were to conclude that our medium-term price stability objective is at risk, we would act by using all the instruments available within our mandate to ensure that an appropriate degree of monetary accommodation is maintained. Consistent with our forward guidance, the asset purchase programme is considered to be a particularly powerful and flexible instrument," Draghi said.

-

11:21

Option expiries for today's 10:00 ET NY cut

USD/JPY 123.00 (USD 433m) 123.20 (580m) 123.35 (1bln) 123.50 (400m)

EUR/USD 1.0690-1.0705 (EUR 2bln) 1.0750 (556m) 1.0800 (1.4bln)

AUD/USD 0.7000 (AUD 352m) 0.7200 (1.1bln)

NZD/USD 0.6600 (NZD 300m) 0.6610 (523m)

AUD/JPY 87.70 (AUD 684m) 88.00 (448m)

-

11:12

Eurozone’s industrial production declines 0.3% in September

Eurostat released its industrial production data for the Eurozone on Thursday. Industrial production in the Eurozone declined 0.3% in September, missing expectations for a 0.1% decrease, after a 0.4% fall in August. August's figure was revised up from a 0.5% drop.

The decrease was driven by declines in durable consumer goods, non-durable consumer goods and capital output. Durable consumer goods output dropped 3.9% in September, non-durable consumer goods were down 1.0%, while capital goods output fell by 0.3%.

Intermediate goods output was flat in September, while energy output climbed 1.2%.

On a yearly basis, Eurozone's industrial production gained 1.7% in September, exceeding expectations for a 1.3% rise, after a 2.2% increase in August. August's figure was revised up from a 0.9% gain.

The increase was driven by rises in durable and non-durable consumer goods, intermediate goods output and capital goods. Durable consumer goods climbed by 2.6% in September from a year ago, capital goods rose by 2.2%, intermediate goods output increased by 1.8%, while non-durable consumer goods gained by 2.1%.

Energy output was down by 1.4% in September from a year ago.

-

11:00

Eurozone: Industrial Production (YoY), September 1.7% (forecast 1.3%)

-

11:00

Eurozone: Industrial production, (MoM), September -0.3% (forecast -0.1%)

-

10:46

French consumer price inflation rises 0.1% in October

The French statistical office Insee released its consumer price inflation for France on Thursday. The French consumer price inflation increased 0.1% in October, after a 0.4% fall in September.

On a yearly basis, the consumer price index climbed 0.1% in October, after a flat reading in September.

Fresh food prices rose 7.1% year-on-year in October, while petroleum products prices dropped by 13.6%.

-

10:36

German final consumer price inflation is flat in October

Destatis released its final consumer price data for Germany on Thursday. German final consumer price index were flat in October, in line with the preliminary estimate, after a 0.2% fall in September.

On a yearly basis, German final consumer price index rose to 0.3% in October from 0.0% in September, in line with the preliminary estimate.

The increase was partly driven by a slower decline in energy prices, which dropped 8.6% year-on-year in October.

Food prices climbed 0.5% year-on-year in October.

-

10:24

Australia's unemployment rate falls to 5.9% in October

The Australian Bureau of Statistics released its labour market data on Thursday. Australia's unemployment rate dropped to 5.9% in October from 6.2% in September. Analysts had expected the unemployment rate to remain unchanged at 6.2%.

The number of employed people in Australia rose by 58,600 in October, beating forecast of a rise by 15,000, after a fall by 800 in September. September's figure was revised up from a drop by 5,100.

Full-time employment rose by 40,000 in October, while part-time employment climbed by 18,600.

The participation rate increased to 65.0% in October from to 64.9% in September.

-

10:15

RICS house price balance for the U.K. increased to +49% in October

The Royal Institution of Chartered Surveyors' (RICS) released its house price data for the U.K. on Thursday. The monthly house price balance increased to +49% in October from +44% in September. The increase was driven by higher demand and a shortage of properties.

"It is hard to get away from the issue of supply when it comes to the current state of the housing market. The legacy of the drop in new build following the onset of the global financial crisis is now really hitting home, with both the sales and letting markets continuing to show demand outstripping supply on a month by month basis," RICS Chief Economist, Simon Rubinsohn, said.

-

10:05

European Central Bank Vice President Vitor Constancio: an interest rate hike in the U.S. will have no direct impact on the Eurozone’s economy

The European Central Bank (ECB) Vice President Vitor Constancio said on Wednesday that an interest rate hike in the U.S. will have no direct impact on the Eurozone's economy.

"We think there will not be any significant direct impact, indirectly (it could have an impact) in economic, trade terms by the possible effect on emerging countries," he said.

Constancio pointed out that the central bank made no decision yet what it will do at its December monetary policy meeting.

-

08:47

France: CPI, m/m, October 0.1%

-

08:47

France: CPI, y/y, October 0.1%

-

08:27

Options levels on thursday, November 12, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.0903 (2763)

$1.0852 (673)

$1.0813 (245)

Price at time of writing this review: $1.0744

Support levels (open interest**, contracts):

$1.0692 (5498)

$1.0667 (4589)

$1.0631 (5912)

Comments:

- Overall open interest on the CALL options with the expiration date December, 4 is 83589 contracts, with the maximum number of contracts with strike price $1,1200 (5516);

- Overall open interest on the PUT options with the expiration date December, 4 is 113942 contracts, with the maximum number of contracts with strike price $1,0700 (8234);

- The ratio of PUT/CALL was 1.36 versus 1.36 from the previous trading day according to data from November, 11

GBP/USD

Resistance levels (open interest**, contracts)

$1.5502 (659)

$1.5404 (1484)

$1.5306 (2037)

Price at time of writing this review: $1.5207

Support levels (open interest**, contracts):

$1.5093 (1844)

$1.4996 (2961)

$1.4897 (1817)

Comments:

- Overall open interest on the CALL options with the expiration date December, 4 is 26196 contracts, with the maximum number of contracts with strike price $1,5600 (3626);

- Overall open interest on the PUT options with the expiration date December, 4 is 30056 contracts, with the maximum number of contracts with strike price $1,5050 (4103);

- The ratio of PUT/CALL was 1.15 versus 1.16 from the previous trading day according to data from November, 11

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:01

Germany: CPI, m/m, October 0.0% (forecast 0.0%)

-

08:01

Germany: CPI, y/y , October 0.3% (forecast 0.3%)

-

07:44

Foreign exchange market. Asian session: the Australian dollar rose

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:00 Australia Consumer Inflation Expectation October 3.5% 3.5%

00:30 Australia Changing the number of employed October -0.8 Revised From -5.1 15 58.6

00:30 Australia Unemployment rate October 6.2% 6.2% 5.9%

The U.S. dollar slightly advanced against the yen ahead of speeches from Federal Reserve's officials. Market participants expect to hear more clues on the probability of a rate hike in December. Fed Chairwoman Janet Yellen, Vice Chair Stanley Fischer and New York Fed President William Dudley are due to speck today. According to Bloomberg there is almost a 70% chance of a rate hike next month.

The Australian dollar rose against the greenback amid a better-than-expected jobs report. The Australian Bureau of Statistics said the number of employed rose by 58,600 in October and the unemployment rate fell to 5.9%. Most economists had expected the unemployment rate to remain at 6.2%. This year the Australian economy created 197,000 jobs, marking the biggest increase in four and a half years. This means the Reserve Bank of Australia was right when it decided not to cut its benchmark interest rate at the last meeting and monitor upcoming economic data.

EUR/USD: the pair rose to $1.0780 in Asian trade

USD/JPY: the pair rose to Y123.05

GBP/USD: the pair rose to $1.5245

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:00 Germany CPI, m/m (Finally) October -0.2% 0.0%

07:00 Germany CPI, y/y (Finally) October 0% 0.3%

07:45 France CPI, m/m October -0.4%

07:45 France CPI, y/y October 0.0%

08:30 Eurozone ECB President Mario Draghi Speaks

10:00 Eurozone Industrial production, (MoM) September -0.5% -0.1%

10:00 Eurozone Industrial Production (YoY) September 0.9% 1.3%

10:30 Eurozone ECB President Mario Draghi Speaks

13:30 Canada New Housing Price Index, MoM September 0.3% 0.2%

13:30 U.S. Continuing Jobless Claims October 2163 2160

13:30 U.S. Initial Jobless Claims November 276 270

14:30 U.S. Fed Chairman Janet Yellen Speaks

15:00 U.S. JOLTs Job Openings September 5.370 5.370

15:15 U.S. FOMC Member Charles Evans Speaks

16:00 U.S. Crude Oil Inventories November 2.847 1.7

17:15 U.S. FOMC Member Dudley Speak

19:00 U.S. Federal budget October 91 -130

23:00 U.S. FED Vice Chairman Stanley Fischer Speaks

23:30 Australia Westpac Consumer Confidence November 4.2%

-

01:30

Australia: Unemployment rate, October 5.9% (forecast 6.2%)

-

01:30

Australia: Changing the number of employed, October 58.6 (forecast 15)

-

01:00

Australia: Consumer Inflation Expectation, October 3.5%

-

00:50

Japan: Core Machinery Orders, y/y, September -1.7% (forecast -4%)

-

00:50

Japan: Core Machinery Orders, September 7.5% (forecast 3.3%)

-

00:32

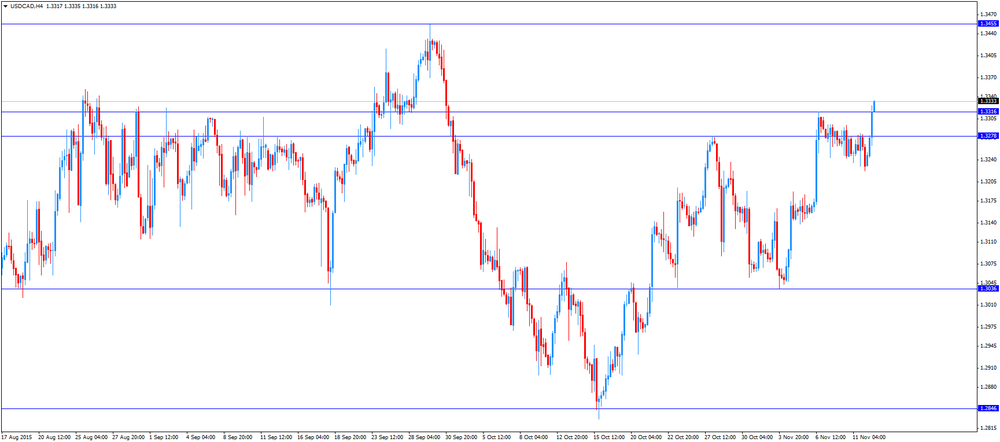

Currencies. Daily history for Nov 11’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0742 +0,18%

GBP/USD $1,5212 +0,62%

USD/CHF Chf1,0044 -0,20%

USD/JPY Y122,85 -0,25%

EUR/JPY Y131,44 -0,48%

GBP/JPY Y186,26 +0,04%

AUD/USD $0,7059 +0,41%

NZD/USD $0,6542 +0,21%

USD/CAD C$1,3260 -0,09%

-

00:17

Schedule for today, Thursday, Nov 12’2015:

(time / country / index / period / previous value / forecast)

00:00 Australia Consumer Inflation Expectation October 3.5%

00:30 Australia Changing the number of employed October -5.1 15

00:30 Australia Unemployment rate October 6.2% 6.2%

07:00 Germany CPI, m/m (Finally) October -0.2% 0.0%

07:00 Germany CPI, y/y (Finally) October 0% 0.3%

07:45 France CPI, m/m October -0.4%

07:45 France CPI, y/y October 0.0%

08:30 Eurozone ECB President Mario Draghi Speaks

10:00 Eurozone Industrial production, (MoM) September -0.5% -0.1%

10:00 Eurozone Industrial Production (YoY) September 0.9% 1.3%

10:30 Eurozone ECB President Mario Draghi Speaks

13:30 Canada New Housing Price Index, MoM September 0.3% 0.2%

13:30 U.S. Continuing Jobless Claims October 2163 2160

13:30 U.S. Initial Jobless Claims November 276 270

14:30 U.S. Fed Chairman Janet Yellen Speaks

15:00 U.S. JOLTs Job Openings September 5.370 5.370

15:15 U.S. FOMC Member Charles Evans Speaks

16:00 U.S. Crude Oil Inventories November 2.847 1.7

17:15 U.S. FOMC Member Dudley Speak

19:00 U.S. Federal budget October 91 -130

23:00 U.S. FED Vice Chairman Stanley Fischer Speaks

23:30 Australia Westpac Consumer Confidence November 4.2%

-