Noticias del mercado

-

20:20

American focus: the US dollar declined moderately

The US dollar fell moderately against other major currencies, but held near seven-month peak against the backdrop of growing expectations of US interest rates by year's end. Trading volumes are expected to remain reduced because today was not any major US publications. Demand for the dollar persists after Friday positive US employment data that increased the chance of the Fed raising interest rates in December. The US Labor Department reported that the US economy added 271,000 jobs last month against the expected 182,000, the highest since December. The unemployment rate fell to 7.5-year low of 5.0%.

The euro came under pressure after Reuters reported on Monday that the ECB may cut rates on deposits at its December meeting. Previously, the focus turned comments ECB Governing Council member Ignazio Visco. He noted that the ECB will consider the possibility of further lowering the deposit rate and changes to the settings of the program of asset purchases (QE) in order to achieve its inflation target. This was stated "It is advisable to maintain the current level of monetary authorities to fulfill our mandate," - said in a speech to his temple. - It may mean changing the volume, composition and duration of the asset purchase program. The ability to lower interest rates on deposits will also be negotiated. He added that the introduction of negative interest rates in the region was "smooth" and others do not seem to have difficulty in further reducing it.

The pound fell slightly against the dollar came under pressure data on the labor market in Britain, but then continued to increase and reached a level of $ 1.5200. The Office for National Statistics reported that the unemployment rate fell to 5.3 percent in the third quarter, which is the lowest level since February-April 2008. Economists had expected the unemployment rate will remain at around 5.4 percent. The report also stated that the overall average earnings of workers - including bonuses - increased by 3.0 percent in the three months to September, as in the previous three months. Experts predicted an acceleration of earnings growth of 3.2 percent .. In September, earnings increased by 2.0 per cent against 3.2 per cent in August. Meanwhile, excluding bonuses, average weekly earnings rose by 1.9 percent in September and 2.5 percent in the third quarter, recording the weakest growth since the first quarter. It was expected that the quarterly rise of 2.7 percent. In addition, the data showed that the number of employed increased by 177,000 in the 3rd quarter, which led to an increase in employment to 73.7 percent (up from 1971). The number of unemployed fell by 103,000, recording the biggest decline since July-September 2014.

Also had little impact statements by the chief economist of the Bank of England's Andrew Haldane. He noted that the current level of rates "corresponds to the situation." He added that the rate increase will be gradual and it will be increased to levels lower than in previous tightening cycles. He added that the growth of salaries remain low, while the economy is steadily recovering despite weak price pressures.

-

17:08

Bank of England (BoE) Governor Mark Carney: the BoE can manage the Brexit

The Bank of England (BoE) Governor Mark Carney said on Wednesday that the BoE can manage the Brexit if Britons decides to leave the European Union.

"Our job is to make whatever the British people decide work," he said.

"Our job is to keep inflation on target and it's to make sure that there's financial stability - that the financial system functions as it should - regardless of the relationship between the UK and Europe, and we'll continue to do that," the BoE governor added.

-

16:58

Bank of Spain expects the Spanish economy to expand 0.8% in the third quarter

The Bank of Spain its GDP growth forecasts on Wednesday. The Spanish economy is expected to expand 0.8% in the third quarter, 3.1% in 2015 and 2.7% in 2016.

The inflation in Spain is expected to be 0.5% in 2015 and 0.8% in 2015, but there are the downside risks to the inflation outlook.

-

16:15

European Central Bank Governing Council member Ardo Hansson: there is no need in the deposit rate cut

European Central Bank (ECB) Governing Council member Ardo Hansson said in an interview on Wednesday that there is no need in the deposit rate cut.

"Knowing what I know now, I don't think we should take that step. But if the trend in the next few weeks turns much negative, then every option is technically possible to analyse, but in the end it has to be a pretty thorough analysis," he said.

Hansson pointed out that the central bank's monetary policy decision will depend on the incoming economic data.

He noted that the ECB has enough time to make its decision.

"The clock is not ticking in the way that would force us to decide now. I think it would make more sense to think about it a bit later, when we get closer to the announced end of the program to see what comes next. Because then you have more information about how things are progressing," Hansson said.

-

15:13

German Economy Ministry’s monthly report: the German economy is expanding solidly

The German Economy Ministry said in its monthly report on Wednesday that the German economy is expanding solidly. The ministry noted that lower exports and industrial activity weighed on the economy in the third quarter.

According to the ministry, low oil prices, a weak euro and demand from refugees will help the German economy in the second half of the year.

-

14:49

Option expiries for today's 10:00 ET NY cut

USD/JPY 121.90-122.00 (USD 500m)

EUR/USD 1.0600 (EUR 278m) 1.0750 (305m)

USD/CAD 1.3250 (USD 550m) 1.3400 (530m)

AUD/USD 0.7000 (AUD 925m) 0.7100 (1.25bln) 0.7150 (1.2bln)

EUR/GBP 0.7000 (EUR 200m)

-

14:02

Foreign exchange market. European session: the British pound traded higher against the U.S. dollar on the labour market data from the U.K.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

05:30 China Retail Sales y/y October 10.9% 10.9% 11.0%

05:30 China Industrial Production y/y October 5.7% 5.8% 5.6%

05:30 China Fixed Asset Investment October 10.3% 10.2% 10.2%

06:00 Japan Prelim Machine Tool Orders, y/y October -19.1% -23.1%

09:30 United Kingdom Average Earnings, 3m/y September 3.0% 3.2% 3%

09:30 United Kingdom Average earnings ex bonuses, 3 m/y September 2.8% 2.7% 2.5%

09:30 United Kingdom Claimant count October 0.5 Revised From 4.6 1.5 3.3

09:30 United Kingdom ILO Unemployment Rate September 5.4% 5.4% 5.3%

12:00 U.S. MBA Mortgage Applications November -0.8% -1.3%

The U.S. dollar traded higher against the most major currencies in the absence of any major U.S. economic reports.

The greenback remains supported by speculation that the Fed will start raising its interest rate next month.

The euro traded lower against the U.S. dollar ahead a speech by the European Central Bank President Mario Draghi. Market participants will closely monitor his comments for signals what the central bank plans to decide on its December monetary policy meeting. The European Central Bank's (ECB) President Mario Draghi said at a press conference in October that the volume of the ECB's asset-buying programme will be discussed at the monetary policy meeting in December.

European Central Bank (ECB) Governing Council member Ignazio Visco said on Wednesday that the central bank will consider the deposit rate cut and the expansion of its asset-buying programme at its December monetary policy meeting to boost inflation in the Eurozone.

The German Council of Economic Experts (GCEE) released its Annual Economic Report on Wednesday. The experts said that the economy in Germany and the Eurozone continued to recover, but there are the downside risks from the slowdown in emerging economies.

The British pound traded higher against the U.S. dollar on the labour market data from the U.K. The Office for National Statistics (ONS) released its labour market data on Wednesday. The U.K. unemployment rate fell to 5.3% in the July to September quarter from 5.4% in the June to August quarter. It was the lowest reading since the second quarter of 2008.

Analysts had expected the unemployment rate to remain unchanged at 5.4%.

"These figures continue the recent strengthening trend in the labour market, with a new record high in the employment rate and the unemployment rate still at its lowest since spring 2008. Earnings continue to grow, albeit the rate for regular pay has fallen back a little from recent months," ONS labour market statistician, Nick Palmer said.

Average weekly earnings, excluding bonuses, climbed by 2.5% in the July to September quarter, missing expectations for a 2.7% rise, after a 2.8% gain in the June to August quarter.

Average weekly earnings, including bonuses, rose by 3.0% in the July to September quarter, missing expectations for a gain of 3.2%, after a 3.0% increase in the June to August quarter.

The Bank of England monitors closely the wages growth it considers when to start hiking its interest rate.

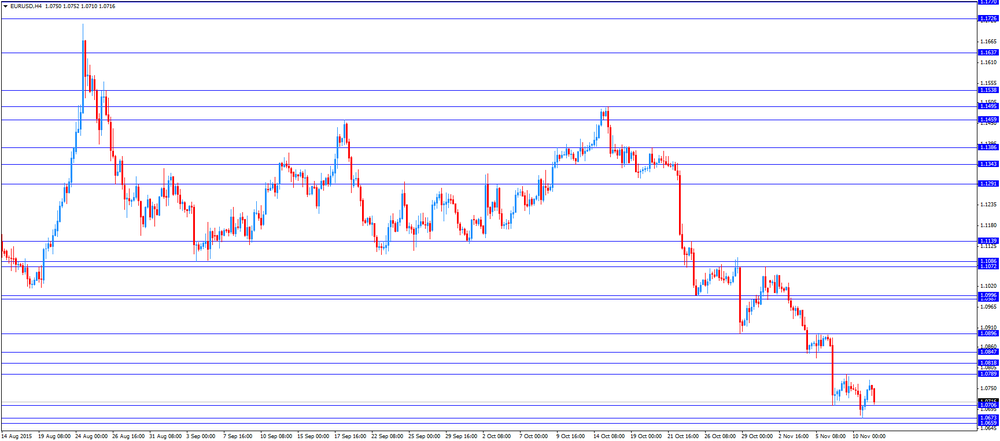

EUR/USD: the currency pair declined to $1.0710

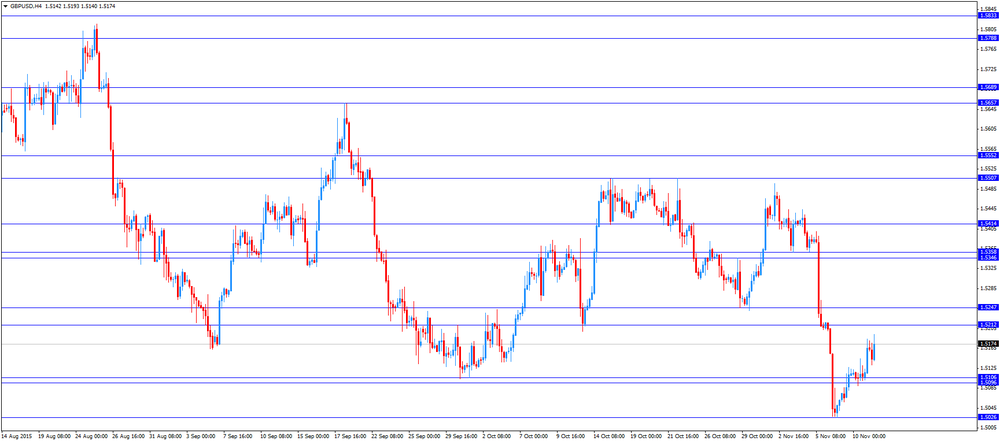

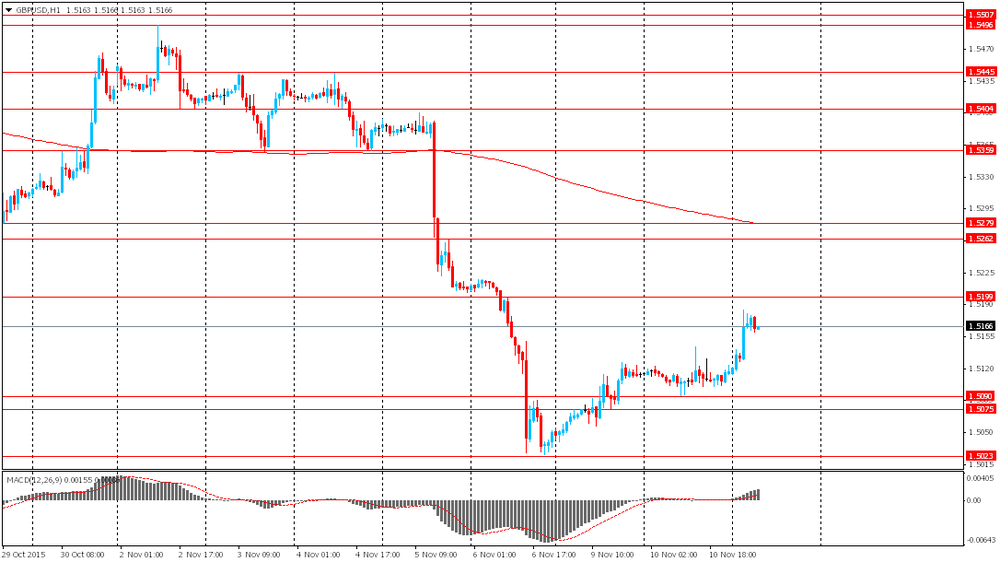

GBP/USD: the currency pair was up to $1.5193

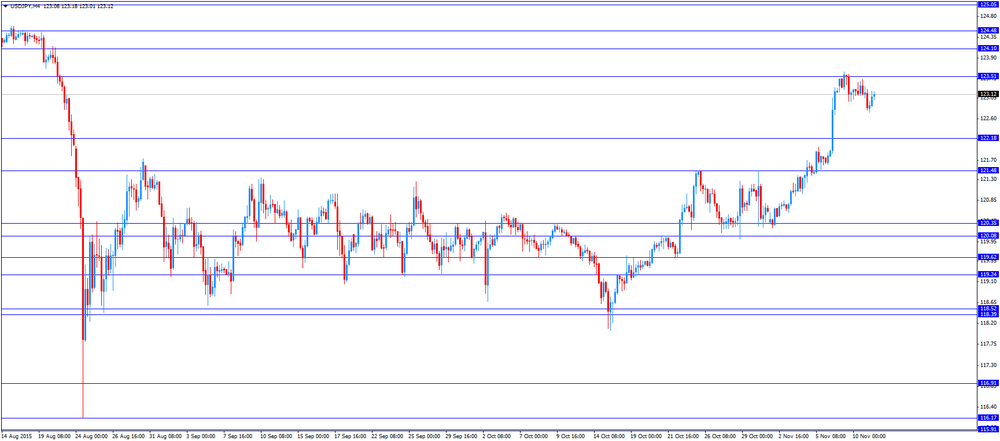

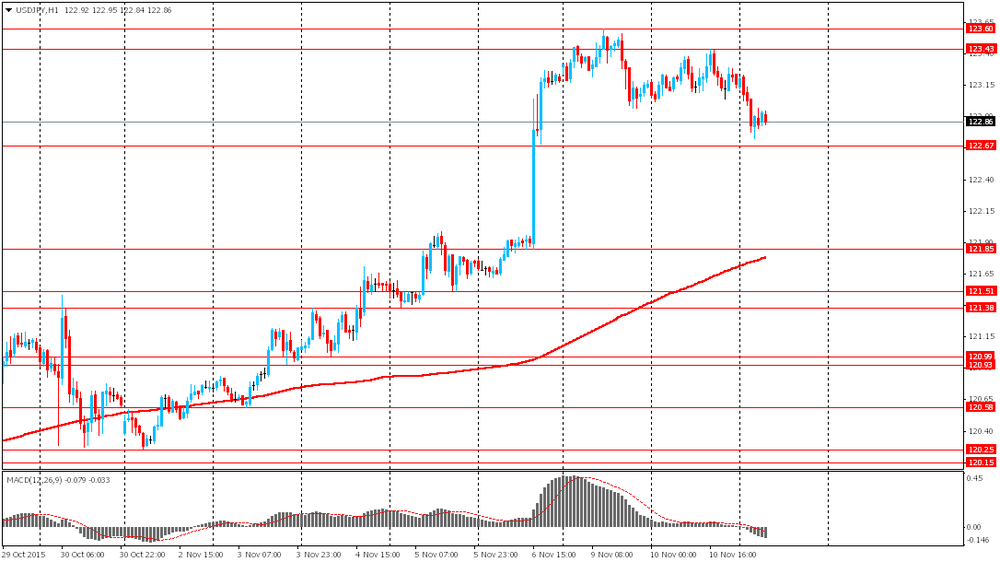

USD/JPY: the currency pair increased to Y123.20

The most important news that are expected (GMT0):

13:15 Eurozone ECB President Mario Draghi Speaks

21:30 New Zealand Business NZ PMI October 55.4

23:50 Japan Tertiary Industry Index September 0.1%

23:50 Japan Core Machinery Orders, y/y September -3.5% -4%

23:50 Japan Core Machinery Orders September -5.7% 3.3%

-

14:00

Orders

EUR/USD

Offers 1.0760-65 1.0780-85 1.0800 1.0820 1.0845-50 1.0885 1.0900 1.0925-30 1.0960 1.0980 1.1000

Bids 1.0730-35 1.0720 1.0700 1.0685 1.0665 1.0650 1.0630 1.0600

GBP/USD

Offers 1.5180-85 1.5200 1.5220 1.5245-50 1.5265 1.5280 1.5300

Bids 1.5125-30 1.5100 1.5080-85 1.5060 1.5045 1.5025-30 1.5000

EUR/GBP

Offers 0.7100 0.7125-30 0.7150 0.7170 0.7185 0.7200 0.7225-30 0.7250 0.7275 0.7300

Bids 0.7075-80 0.7050 0.7030-35 0.7020 0.7000 0.6985 0.6965 0.6950

EUR/JPY

Offers 132.40 132.60 132.75-80 133.00 133.20 133.50-60

Bids 132.00 131.80-85 131.50 131.30 131.00 130.80 130.50

USD/JPY

Offers 123.20-25 123.50 123.75-80 124.00 124.30 124.50 124.75 125.00

Bids 123.00 122.85 122.65 122.50 122.25 122.00 121.80 121.50-60

AUD/USD

Offers 0.7075-80 0.7100 0.7125-30 0.71500.7180-85 0.7200

Bids 0.7035-40 0.7020 0.7000 0.6985 0.6965 0.6950 0.6930 0.6900

-

13:38

Japan’s preliminary machine tool orders slides 6.3% in October

Japan Machine Tool Builders' Association released its preliminary machine tool orders data on Wednesday. Machine tool orders slid 6.3% in October.

The drop was driven by lower demand from China.

On a yearly basis, preliminary machine tool orders plunged 21.3% in October, after a 19.1% in September.

-

13:00

U.S.: MBA Mortgage Applications, November -1.3%

-

12:29

German Council of Economic Experts’ (GCEE) Annual Economic Report: that the economy in Germany and the Eurozone continued to recover

The German Council of Economic Experts (GCEE) released its Annual Economic Report on Wednesday. The experts said that the economy in Germany and the Eurozone continued to recover, but there are the downside risks from the slowdown in emerging economies.

"Positive economic developments are likely to continue this year and next. But the arrival of refugees has made it even more important to ensure the future viability of Germany's economy by fostering the right economic conditions," chairman of the GCEE, Christoph M. Schmidt, said.

The German economy is expected to expand 1.7% in 2015 and 1.6% in 2016.

Eurozone's economy is expected to grow by 1.6 % in 2015 and by 1.5 % in 2016.

-

11:46

European Central Bank Governing Council member Ignazio Visco: the central bank will consider the deposit rate cut and the expansion of its asset-buying programme at its December monetary policy meeting

European Central Bank (ECB) Governing Council member Ignazio Visco said on Wednesday that the central bank will consider the deposit rate cut and the expansion of its asset-buying programme at its December monetary policy meeting to boost inflation in the Eurozone.

"The appropriate degree of monetary accommodation has to be maintained to fulfil our mandate. This may imply, as it has been stated, a change in the size, composition and duration of the APP (Asset Purchase Programme). The possibility to once again lower the interest rate on the deposit facility will also be assessed," he said.

-

11:22

German wholesale prices fall 0.4% in October

The German statistical office Destatis released its wholesale prices for Germany on Wednesday. German wholesale prices fell 0.4% in October, after a 0.6% decrease in September.

On a yearly basis, wholesale prices in Germany dropped 1.6% in October, after a 1.8% decline in September. Wholesale prices have been declining since July 2013.

The fall was mainly driven by a 17.8% drop in prices of ores, metals and metal ores.

-

11:09

U.K. unemployment rate declines to 5.3% in the July to September quarter

The Office for National Statistics (ONS) released its labour market data on Wednesday. The U.K. unemployment rate fell to 5.3% in the July to September quarter from 5.4% in the June to August quarter. It was the lowest reading since the second quarter of 2008.

Analysts had expected the unemployment rate to remain unchanged at 5.4%.

"These figures continue the recent strengthening trend in the labour market, with a new record high in the employment rate and the unemployment rate still at its lowest since spring 2008. Earnings continue to grow, albeit the rate for regular pay has fallen back a little from recent months," ONS labour market statistician, Nick Palmer said.

The claimant count rose by 3,300 people in October, beating expectations for a rise by 1,500, after an increase of 500 people in September. September's figure was revised down from 4,600.

U.K. unemployment in the July to September period dropped by 13,000 to 1.5 million from the previous quarter.

Average weekly earnings, excluding bonuses, climbed by 2.5% in the July to September quarter, missing expectations for a 2.7% rise, after a 2.8% gain in the June to August quarter.

Average weekly earnings, including bonuses, rose by 3.0% in the July to September quarter, missing expectations for a gain of 3.2%, after a 3.0% increase in the June to August quarter.

The Bank of England monitors closely the wages growth it considers when to start hiking its interest rate.

-

10:58

China’s industrial production increases 5.6% year-on-year in October

The National Bureau of Statistics said on Wednesday that China's industrial production increased 5.6% year-on-year in October, missing expectations for a 5.8% rise, down from a 5.7% gain in September.

Fixed-asset investment in China climbed 10.2% year-on-year in the January-October period, in line with expectations, after a 10.3% rise in the January-September period.

Retail sales in China increased 11.0% year-on-year in October, exceeding expectations for a 10.9% gain, after a 10.9% rise in September.

-

10:49

Chinese Premier Li Keqiang: the government plans to innovate monetary policy tools

Chinese Premier Li Keqiang said on Tuesday that the government plans to innovate monetary policy tools that should help Chinese companies to lower their financing costs. Li added that the government will try to create a fair environment for market competition.

-

10:44

Reserve Bank of New Zealand Graeme Wheeler: risks to the global financial stability and to the dairy and housing sectors in New Zealand have increased

The Reserve Bank of New Zealand (RBNZ) released its Financial Stability Report on Tuesday. The RBNZ Graeme Wheeler said that risks to the global financial stability and to the dairy and housing sectors in New Zealand have increased.

"Global economic growth has softened over the past six months, and uncertainty over the path of economic and financial adjustment in China has helped to depress commodity prices and added to financial market uncertainty. Interest rates at historic lows are encouraging higher leverage, leading to a build-up in risk in international asset markets," Wheeler said.

"The dairy sector faces a second consecutive season of weak cash flow due to low international dairy commodity prices," he noted.

-

10:37

Moody's: global growth will be weak over the next two years

Moody's Investors Service said on Tuesday that global growth will be weak over the next two years as the slowdown in China and other emerging economies continues to weigh on the global economy. The agency expects G20 GDP to grow at average 2.8% in 2015-17. G20 GDP is forecast to increase to 2.8% in 2016 and 3% in 2017 from 2.6% in 2015.

"Muted global economic growth will not support a significant reduction in government debt or allow central banks to raise interest rates markedly. Authorities lack the large fiscal and conventional monetary policy buffers to protect their economies from potential shocks," Senior Vice President, Credit Policy, Marie Diron, said.

The Chinese GDP is expected to rise under 7% in 2015, 6.3% in 2016 and 6.1% in 2017.

-

10:30

United Kingdom: Average Earnings, 3m/y , September 3% (forecast 3.2%)

-

10:30

United Kingdom: ILO Unemployment Rate, September 5.3% (forecast 5.4%)

-

10:30

United Kingdom: Average earnings ex bonuses, 3 m/y, September 2.5% (forecast 2.7%)

-

10:30

United Kingdom: Claimant count , October 3.3 (forecast 1.5)

-

10:29

San Francisco Federal Reserve President John Williams: that the Fed will start hiking its interest rate in December if the U.S. economy continues to improve

San Francisco Federal Reserve President John Williams said in an interview with USA TODAY that the Fed will start hiking its interest rate in December if the U.S. economy continues to improve and Fed officials are confident that inflation in the U.S. will rise toward the Fed's 2% target.

Regarding the slowdown in the Chinese economy and concerns about spillover to other countries, he said that "those risks have not materialized".

-

10:28

Option expiries for today's 10:00 ET NY cut

USD/JPY 121.90-122.00 (USD 500m)

EUR/USD 1.0600 (EUR 278m) 1.0750 (305m)

GBP/USD Nothing of note

USD/CAD 1.3250 (USD 550m) 1.3400 (530m)

AUD/USD 0.7000 (AUD 925m) 0.7100 (1.25bln) 0.7150 (1.2bln)

EUR/GBP 0.7000 (EUR 200m)

-

10:11

Westpac’ consumer confidence index for Australia rises 3.9% in November

Westpac Bank released its consumer confidence index for Australia on late Tuesday evening. The index climbed 3.9% in November, after a 4.2% gain in October. The index was driven by the change of prime minister from Tony Abbott to Malcolm Turnbull, according to the bank.

"The increase also comes despite the banks' decisions to raise mortgage rates for both owner occupiers and investors. It is surprising that such events did not have a negative impact on confidence. It appears that such is the boost to confidence from the recent political events that the impact of the interest rate increases was comfortably contained," Westpac Chief Economist Bill Evans said.

-

09:01

Japan: Prelim Machine Tool Orders, y/y , October -23.1%

-

08:27

Options levels on wednesday, November 11, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.0894 (2770)

$1.0841 (688)

$1.0799 (245)

Price at time of writing this review: $1.0737

Support levels (open interest**, contracts):

$1.0674 (5511)

$1.0651 (4700)

$1.0617 (5919)

Comments:

- Overall open interest on the CALL options with the expiration date December, 4 is 82296 contracts, with the maximum number of contracts with strike price $1,1200 (5441);

- Overall open interest on the PUT options with the expiration date December, 4 is 111927 contracts, with the maximum number of contracts with strike price $1,0700 (8048);

- The ratio of PUT/CALL was 1.36 versus 1.40 from the previous trading day according to data from November, 10

GBP/USD

Resistance levels (open interest**, contracts)

$1.5402 (1113)

$1.5304 (2057)

$1.5207 (1023)

Price at time of writing this review: $1.5156

Support levels (open interest**, contracts):

$1.5089 (1698)

$1.4993 (2702)

$1.4896 (1840)

Comments:

- Overall open interest on the CALL options with the expiration date December, 4 is 25609 contracts, with the maximum number of contracts with strike price $1,5600 (3623);

- Overall open interest on the PUT options with the expiration date December, 4 is 29585 contracts, with the maximum number of contracts with strike price $1,5050 (4085);

- The ratio of PUT/CALL was 1.16 versus 1.16 from the previous trading day according to data from November, 10

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:48

Foreign exchange market. Asian session: the U.S. dollar declined against the euro and the pound

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

05:30 China Retail Sales y/y October 10.9% 10.9% 11.0%

05:30 China Industrial Production y/y October 5.7% 5.8% 5.6%

05:30 China Fixed Asset Investment September 10.3% 10.2% 10.2%

The U.S. dollar declined against the euro and the pound amid data from China. The National Bureau of Statistics of China reported that country's industrial production rose only by 5.6% in October, while economists had expected a 5.8% increase. The latest change was also below the previous month's reading of +5.7%. These weak data added to concerns over China's economic outlook and might influence the Fed's monetary policy decision.

The Australian dollar climbed on consumer confidence data from Westpac. The corresponding index rose by 3.9% to 101.7 in November, which was a little bit less than +4.2% in the previous month. Three out of the index's five sub-indices climbed over the month, led by a giant 24.2% increase towards economic expectations over the next five years. The sub-index for one-year expectations rose 5.8%, while the sub-index reflecting consumers' opinion on whether now was a good time to buy a major household item improved by 4.8%.

EUR/USD: the pair rose to $1.0775 in Asian trade

USD/JPY: the pair fell to Y122.70

GBP/USD: the pair rose to $1.5185

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

09:30 United Kingdom Average Earnings, 3m/y September 3.0% 3.2%

09:30 United Kingdom Average earnings ex bonuses, 3 m/y September 2.8% 2.7%

09:30 United Kingdom Claimant count October 4.6 1.5

09:30 United Kingdom ILO Unemployment Rate September 5.4% 5.4%

12:00 U.S. MBA Mortgage Applications November -0.8%

13:15 Eurozone ECB President Mario Draghi Speaks

21:30 New Zealand Business NZ PMI October 55.4

23:50 Japan Tertiary Industry Index September 0.1%

23:50 Japan Core Machinery Orders, y/y September -3.5% -4%

23:50 Japan Core Machinery Orders September -5.7% 3.3%

-

06:31

China: Fixed Asset Investment, September 10.2% (forecast 10.2%)

-

06:30

China: Industrial Production y/y, October 5.6% (forecast 5.8%)

-

06:30

China: Retail Sales y/y, October 11.0% (forecast 10.9%)

-

01:02

Currencies. Daily history for Nov 10’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0723 -0,25%

GBP/USD $1,5117 +0,02%

USD/CHF Chf1,0064 +0,30%

USD/JPY Y123,16 0,00%

EUR/JPY Y132,07 -0,26%

GBP/JPY Y186,18 +0,02%

AUD/USD $0,7030 -0,21%

NZD/USD $0,6528 -0,05%

USD/CAD C$1,3272 -0,10%

-

00:30

Australia: Westpac Consumer Confidence, November 3.9%

-

00:01

Schedule for today, Wednesday, Nov 11’2015:

(time / country / index / period / previous value / forecast)

05:30 China Retail Sales y/y October 10.9% 10.9%

05:30 China Industrial Production y/y October 5.7% 5.8%

05:30 China Fixed Asset Investment September 10.3% 10.2%

06:00 Japan Prelim Machine Tool Orders, y/y October -19.1%

09:30 United Kingdom Average Earnings, 3m/y September 3.0% 3.2%

09:30 United Kingdom Average earnings ex bonuses, 3 m/y September 2.8% 2.7%

09:30 United Kingdom Claimant count October 4.6 1.5

09:30 United Kingdom ILO Unemployment Rate September 5.4% 5.4%

12:00 U.S. MBA Mortgage Applications November -0.8%

13:15 Eurozone ECB President Mario Draghi Speaks

21:30 New Zealand Business NZ PMI October 55.4

23:50 Japan Tertiary Industry Index September 0.1%

23:50 Japan Core Machinery Orders, y/y September -3.5% -4%

23:50 Japan Core Machinery Orders September -5.7% 3.3%

-