Noticias del mercado

-

20:20

American focus: the US dollar rose moderately

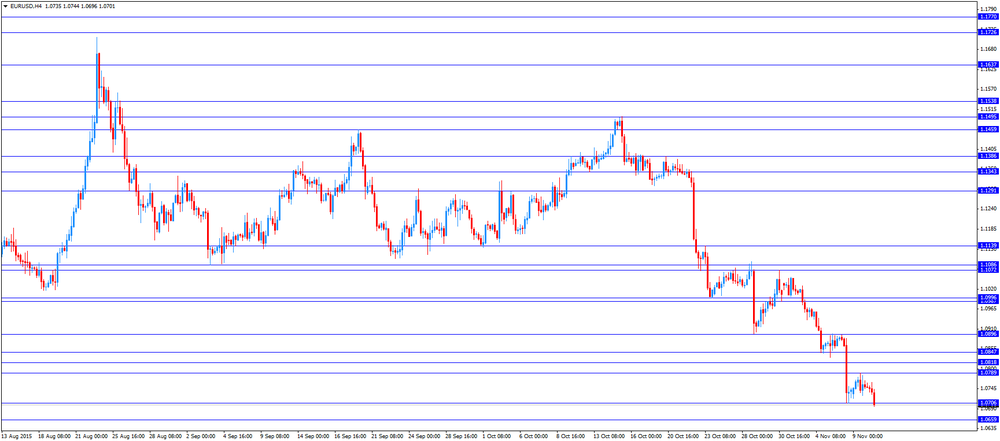

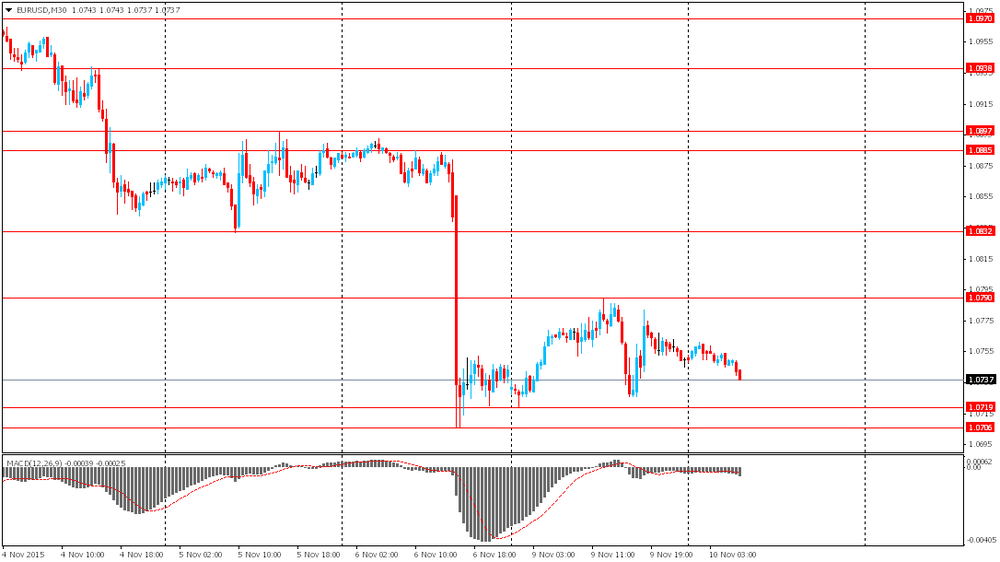

The US dollar continues to strengthen amid growing expectations of market participants regarding the first in nearly a decade of rising interest rates by the Federal Reserve System. The EUR / USD fell more than 0.5% to trade below $ 1.07, its lowest level since April. Further reduction of the pair will be observed in the case of rising interest rates in the US, and if the European Central Bank in December, decides to extend its program of quantitative easing.

Some impact on the dollar have data on import prices in the United States. Prices of imported goods in the United States continued to decline in October, pointing out that the cheap oil, a strong dollar and slower growth abroad continue to put pressure on inflation rates. This was reported in the report of the Department of Labor.

According to the data, the import price index fell in October by 0.5% compared with a revised decline of 0.6% in September (originally reported -0.1%). Economists had expected a fall of the index by only 0.1%. In annual terms, import prices fell by 10.5% in October, registering the 15th consecutive monthly decline.

The Labor Department said that the decline in prices in October was broadly based. Prices for oil and natural gas, industrial supplies, paper and metal, food, automobiles and capital goods - all these categories recorded a decline. Meanwhile, petroleum import prices fell by 48% compared to last year.

But a stronger dollar and weak demand in overseas demand caused a decline in prices for other products: the import price index on non fuel products fell by 3.2% over the past year, showing the biggest decline in more than six years. Add the index continuously decreases from July 2014. Experts point out that the fall in prices for imported - one reason that inflation remains historically low.

Also, the data showed that export prices fell by 0.2% in October compared with the previous month. In annual terms, export prices decreased by 6.7%.

The pressure on the EUR / USD pair had recent reports on the formation of a consensus on further ECB rate cut on deposits in December. Meanwhile, speaking at the head of the Bundesbank and ECB Governing Council member Weidmann once again expressed concern the risks associated with the fact that monetary policy in the region may be too relaxed for too long. Meanwhile, a member of the Governing Council of the ECB Erkki Liikanen said that still can be traced risks for inflation prospects and economic growth, adding that the Central Bank "willing and able" to act in order to achieve its goal of price increases. "The Governing Council is willing and able to act using all available tools in the framework of its mandate, if it is necessary to maintain an appropriate degree of monetary control," - said Liikanen. "Inflation targeting ECB is symmetrical. This means that monetary policy reacts to too low and too high inflation with the same force," - said the politician.

The Swiss franc fell against the dollar. Experts note that although European shares and falling, it has not been able to support the safe haven franc. Demand for the dollar may remain strong amid growing expectations of Fed rate hike in December.

Little influenced by a report on the labor market of Switzerland. As it became known, the seasonally adjusted unemployment rate was 3.4 percent in October, unchanged compared with September. We also add the last value in line with expectations of experts. However, the unadjusted unemployment rate rose in October to 3.3 percent compared with 3.2 percent in the previous month. The growth rate confirmed expectations. The number of registered unemployed persons increased in October 3043 compared with the previous month, amounting to 141.269 people at the same time. In annual terms, the number of unemployed increased by 8.872 people. The unemployment rate among young people (age group 15-24) dropped to 3.5 percent from 3.7 percent in September.

-

17:13

National Federation of Independent Business’s small-business optimism index for the U.S. remains unchanged at 96.1 in October

The National Federation of Independent Business (NFIB) released its small-business optimism index for the U.S. on Tuesday. The index remained unchanged at 96.1 in October.

5 of 10 subindexes rose last month, three fell, while two were unchanged.

"The labour market components might have held at historically strong levels but this time owners reported no net growth in employment, which is a significant drop from reports in the previous four months," NFIB Chief Economist Bill Dunkelberg said.

-

16:11

Wholesale inventories in the U.S. rises 0.5% in September

The U.S. Commerce Department released wholesale inventories on Tuesday. Wholesale inventories in the U.S. rose 0.5% in September, beating expectations for a flat reading, after a 0.3% increase in August. August's figure was revised up from a 0.1% gain.

The increase was mainly driven by a rise in inventories of non-durable goods. Inventories of non-durable goods increased 1.9% in September as farm products jumped 6.7%, while inventories of durable goods fell 0.4%.

Wholesale sales climbed by 0.5% in September, after a 0.9% decrease in August.

-

16:00

U.S.: Wholesale Inventories, September 0.5% (forecast 0%)

-

15:44

U.S. import price index falls 0.5% in October

The U.S. Labor Department released its import and export prices data on Tuesday. The U.S. import price index fell by 0.5% in October, missing expectations for a 0.1% decrease, after a 0.6% decline in September. September's figure was revised down from a 0.1% drop.

The decline was mainly driven by lower prices for fuel imports.

A stronger U.S. currency lowers the price of imported goods.

U.S. export prices declined by 0.2% in October, after a 0.6% fall in September.

-

14:56

Option expiries for today's 10:00 ET NY cut

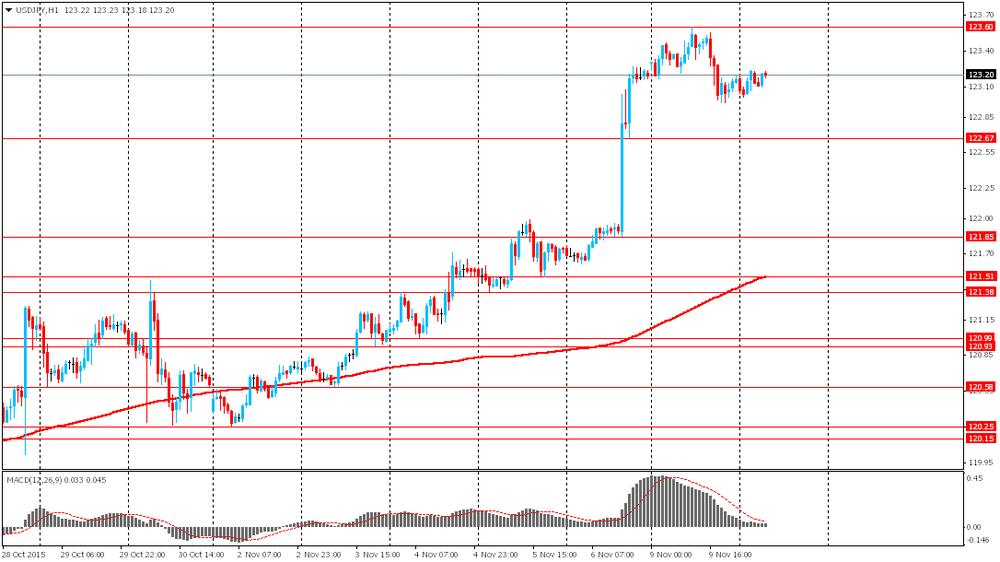

USD/JPY 123.00 (USD 2.1bln)

EUR/USD 1.0800 (EUR 644m)

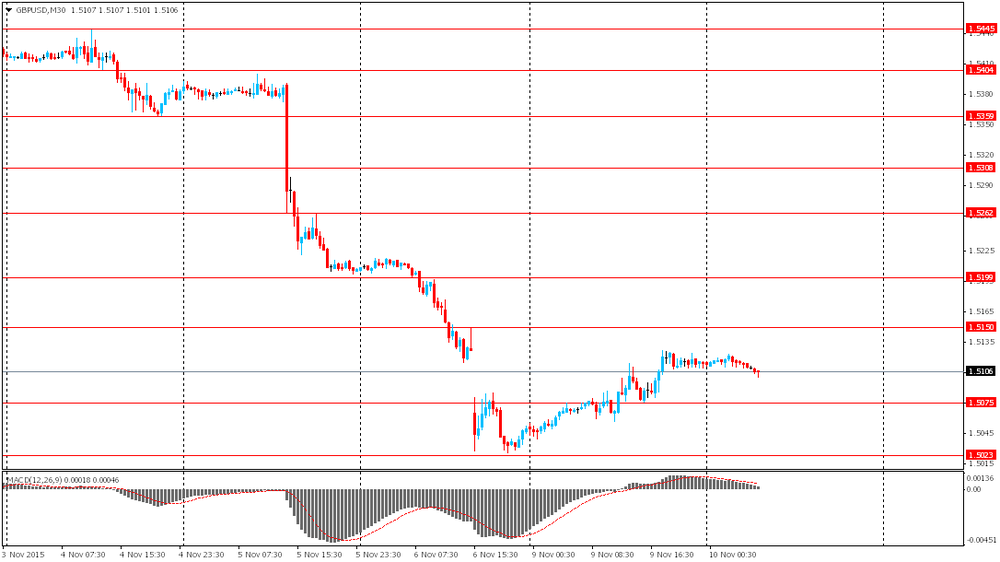

GBP/USD 1.0500 (203m)

USD/CHF 1.00 (USD 325m)

USD/CAD 1.3200 (USD 1.1bln) 1.3300 (500m)

NZD/USD 0.6510 (NZD 1.26bln)

-

14:30

U.S.: Import Price Index, October -0.5% (forecast -0.1%)

-

14:07

Foreign exchange market. European session: the euro traded lower against the U.S. in the absence of any major economic reports from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Home Loans September 1.5% Revised From 2.9% 0% 2.0%

00:30 Australia National Australia Bank's Business Confidence October 5 2

01:30 China PPI y/y October -5.9% -5.8% -5.9%

01:30 China CPI y/y October 1.6% 1.5% 1.3%

05:00 Japan Eco Watchers Survey: Current October 47.5 48.2 48.2

05:00 Japan Eco Watchers Survey: Outlook October 49.1 49.1

06:45 Switzerland Unemployment Rate (non s.a.) October 3.2% 3.3% 3.3%

07:45 France Industrial Production, m/m September 1.7% Revised From 1.6% 0% 0.1%

07:45 France Industrial Production, y/y September 0.6% 0.7%

The U.S. dollar traded mixed against the most major currencies ahead the U.S. economic data. The U.S. import price index is expected to decline 0.1% in October, after a 0.1% fall in September.

Wholesale inventories in the U.S. are expected to be flat in September, after a 0.1% increase in August.

The euro traded lower against the U.S. in the absence of any major economic reports from the Eurozone.

The French statistical office Insee its industrial production figures on Tuesday. Industrial production in France rose 0.1% in September, exceeding expectations for a flat reading, after a 1.7% gain in August. August's figure was revised up from a 1.6% increase.

Manufacturing output was flat in September, while construction output slid 1.7%.

Output in mining and quarrying, energy, water supply and waste management increased 0.7% in September.

On a yearly basis, the French industrial production dropped 1.0% in September, after a 0.6% gain in August.

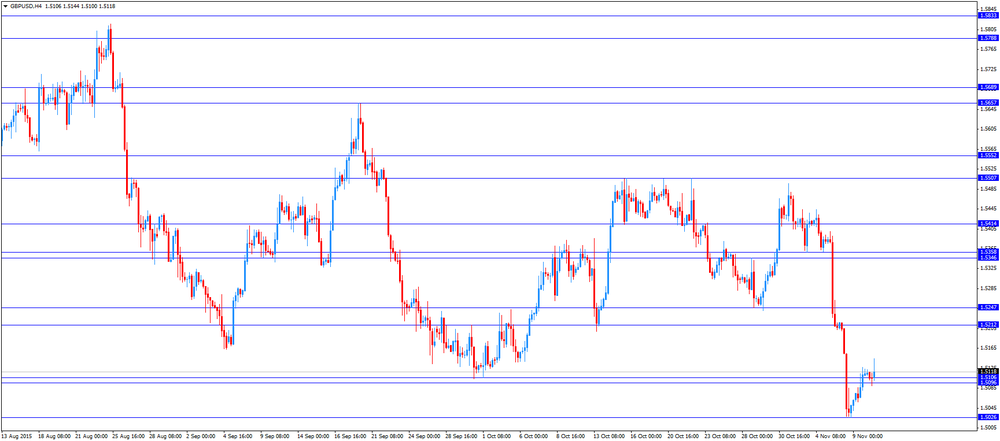

The British pound traded higher against the U.S. dollar in the absence of any major economic reports from the U.K.

The Swiss franc traded lower against the U.S. dollar. The Swiss State Secretariat for Economic Affairs released its unemployment data for Switzerland on Thursday. The Swiss unemployment rate remained at a seasonally adjusted 3.4% in October.

On a seasonally unadjusted basis, the unemployment rate in Switzerland increased to 3.3 in October from 3.2% in September, in line with expectations.

The number of unemployed people in Switzerland rose by 3,043 to 141,269 in October from a month earlier.

EUR/USD: the currency pair declined to $1.0696

GBP/USD: the currency pair was up to $1.5144

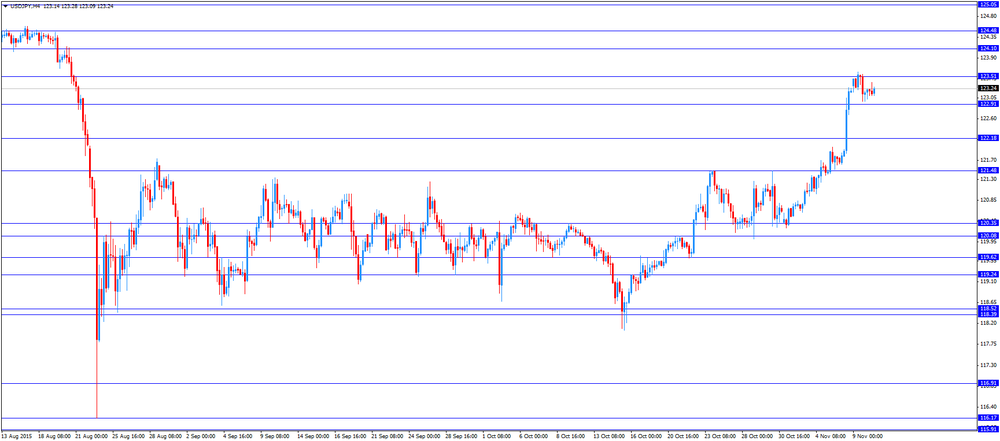

USD/JPY: the currency pair decreased to Y123.09

The most important news that are expected (GMT0):

13:30 U.S. Import Price Index October -0.1% -0.1%

15:00 U.S. Wholesale Inventories September 0.1% 0%

17:00 Canada Gov Council Member Wilkins Speaks

19:30 U.S. FOMC Member Charles Evans Speaks

20:00 New Zealand RBNZ Financial Stability Report

20:05 New Zealand RBNZ Governor Graeme Wheeler Speaks

23:30 Australia Westpac Consumer Confidence November 4.2%

-

14:00

Orders

EUR/USD

Offers 1.0760-65 1.0780-85 1.0800 1.0820 1.0845-50 1.0885 1.0900 1.0925-30 1.0960 1.0980 1.1000

Bids 1.0685 1.0665 1.0650 1.0630 1.0600

GBP/USD

Offers 1.5120 1.5140 1.5175-80 1.5200 1.5220 1.5245-50

Bids 1.5085-90 1.5060 1.5045 1.5025-30 1.5000 1.4985 1.4965 1.4950 1.4930 1.4900

EUR/GBP

Offers 0.7125-30 0.7150 0.7170 0.7185 0.7200 0.7225-30 0.7250 0.7275 0.7300

Bids 0.7100 0.7085 0.7050 0.7030-35 0.7020 0.7000

EUR/JPY

Offers 132.60 132.75-80 133.00 133.20 133.50-60 133.75-80 134.00 134.30 134.50

Bids 132.20 132.00 131.80 131.50 131.30 131.00

USD/JPY

Offers 123.50 123.75-80 124.00 124.30 124.50 124.75 125.00

Bids 123.20 123.00 122.80 122.50 122.25 122.00 121.80 121.50-60

AUD/USD

Offers 0.7075-80 0.7100 0.7125-30 0.7150 0.7180-85 0.7200 0.7220 0.7250

Bids 0.7035-40 0.7020 0.7000 0.6985 0.6965 0.6950 0.6930 0.6900

-

12:51

National Australia Bank’s business confidence index falls to 2 points in October

The National Australia Bank (NAB) released its business confidence index for Australia on Tuesday. The index fell to 2 points in October from 5 points in September.

"Business confidence remains somewhat fickle, despite persistent strength in business conditions," the NAB said.

The main business conditions index remained unchanged at 9 points in October, while employment remained unchanged at 3 points.

-

12:33

Home loans in Australia are up 2.0% in September

The Australian Bureau of Statistics released its home loans data on Tuesday. Home loans in Australia increased 2.0% in September, exceeding expectations for a flat reading, after 1.5% rise in August. August's figure was revised down from 2.9% gain.

The value of home loans slid at a seasonally adjusted 1.6% in September, investment lending dropped 8.5%, while the number of loans for the construction of dwellings rose 1.9%.

-

11:50

Greek consumer prices decrease 0.1% in October

The Hellenic Statistical Authority released its consumer price inflation data for Greece on Monday. Greek consumer prices decreased 0.1% in October, after the 0.8% drop in September.

On a yearly basis, the Greek consumer price index declined 0.9% in October, after a 1.7 fall in September. Consumer prices in Greece declined since March 2013.

Housing prices plunged at an annual rate of 5.4% in October, transport costs dropped by 0.5%, clothing and footwear prices declined 1.7%, while household equipment prices were down 1.5%.

Prices of food and non-alcoholic beverages decreased at an annual rate of 1.1% in October, while alcoholic beverages and tobacco prices climbed by 2.0%.

-

11:41

European Central Bank Governing Council member Erkki Liikanen: there are downside risks to the Eurozone's inflation and growth outlook

European Central Bank (ECB) Governing Council member Erkki Liikanen said on Tuesday that there are downside risks to the Eurozone's inflation and growth outlook, adding that the central bank is ready to act.

"The growth and inflation outlook is still subject to downside risks," he said.

"The Governing Council is willing and able to act by using all the instruments available within its mandate if warranted in order to maintain an appropriate degree of monetary accommodation," Liikanen noted.

-

11:35

Industrial production in Italy increases 0.2% in September

The Italian statistical office Istat released its industrial production data on Tuesday. Industrial production in Italy increased at a seasonally-adjusted rate of 0.2% in September, after a 0.5% fall in August.

On a yearly basis, industrial production in Italy jumped at a seasonally-adjusted rate of 1.7% in September, after a 1.0% increase in August.

-

11:29

French industrial production rises 0.1% in September

The French statistical office Insee its industrial production figures on Tuesday. Industrial production in France rose 0.1% in September, exceeding expectations for a flat reading, after a 1.7% gain in August. August's figure was revised up from a 1.6% increase.

Manufacturing output was flat in September, while construction output slid 1.7%.

Output in mining and quarrying, energy, water supply and waste management increased 0.7% in September.

On a yearly basis, the French industrial production dropped 1.0% in September, after a 0.6% gain in August.

-

11:17

Swiss unemployment rate remains unchanged at a seasonally adjusted 3.4% in October

The Swiss State Secretariat for Economic Affairs released its unemployment data for Switzerland on Thursday. The Swiss unemployment rate remained at a seasonally adjusted 3.4% in October.

On a seasonally unadjusted basis, the unemployment rate in Switzerland increased to 3.3 in October from 3.2% in September, in line with expectations.

The number of unemployed people in Switzerland rose by 3,043 to 141,269 in October from a month earlier.

The youth unemployment rate was down to 3.5% from 3.7% in September.

-

11:10

Japan’s Eco Watchers' current conditions index climbs to 48.2 in October

Japan's Cabinet Office released Eco Watchers' Index figures on Wednesday. Japan's economy watchers' current conditions index climbed to 48.2 in October from 47.5 in September, in line with expectations.

Japan's economy watchers' future conditions index remained unchanged at 49.1 in October.

A reading above 50 indicates optimism, while a reading below 50 indicates pessimism.

-

10:59

Japan’s current account surplus declines to ¥1,468.4 billion in September

Japan's Ministry of Finance released its current account data for Japan late Tuesday evening. Japan's current account surplus fell to ¥1,468.4 billion in September from ¥1,653.1 billion in August, missing expectations for a surplus of ¥2,235.2 billion.

Japan benefits from a weaker yen, which supports income from overseas investments.

The goods trade deficit turned into a surplus of ¥82.3 billion in September from a deficit of ¥326.1 billion in August.

Exports rose at an annual rate of 2.8% in September, while imports dropped 7.4%.

-

10:50

Chinese consumer price index rises at annual rate of 1.3% in October

The Chinese National Bureau of Statistics released its consumer and producer price inflation data for China on Tuesday. The Chinese consumer price index (CPI) rose at annual rate of 1.3% in October, missing expectations for a 1.5% increase, after a 1.6% gain in September.

Food prices rose at an annual rate of 1.9% in October, while non-food prices increased 0.9%.

On a monthly basis, consumer price inflation decreased 0.3% in October, after a 0.1% rise in September.

The Chinese producer price index (PPI) dropped 5.9% in October, missing expectations for a 5.8% fall, after a 5.9% decline in September.

-

10:38

The Conference Board’s Employment Trends Index (ETI) for the U.S. rises to 129.48 in October

The Conference Board released its Employment Trends Index (ETI) for the U.S on Monday. The index rose to 129.48 in October from 128.65 in September.

Six of the eight components increased.

"The Employment Trends Index continues to show solid and broad-based gains, with no significant slowdown in job growth expected through the first quarter of 2016. Solid job growth and the lack of recovery in labour-force participation suggest that the unemployment rate may dip below 4.5 percent by this time next year," Managing Director of Macroeconomic and Labour Market Research at The Conference Board, said Gad Levanon.

-

10:21

Eurogroup will not transfer €2 billion to Greece as the Greek government has not fulfilled agreed obligations

The Eurogroup decided on Monday not to transfer €2 billion to Greece as the Greek government has not fulfilled agreed obligations. Eurogroup President Jeroen Dijsselbloem said that Greek Finance Minister Euclid Tsakalotos claimed that Greece and its lenders will reach an agreement within this week.

"The 2 billion will only be paid out once the institutions give the green light and say that all agreed actions have been carried out and have been implemented. That still has not happened," Dijsselbloem noted ahead of the meeting.

-

10:13

Boston Fed President Eric Rosengren: if there is a significant improvement in the U.S. economy, the Fed should start raising its interest rate

Boston Fed President Eric Rosengren said on Monday that if there is a significant improvement in the U.S. economy, the Fed should start raising its interest rate.

"If we see continued gradual improvement in the U.S. economy, it will be appropriate to gradually increase short-term rates," he said.

Rosengren hinted the possible interest rate hike in December.

"I would highlight that the data received recently have been positive, reflecting real improvement for the economy," Boston Fed president noted.

He added that December "could be an appropriate time for raising rates, as long as the economy continues to improve as expected".

-

10:01

Option expiries for today's 10:00 ET NY cut

USD/JPY 123.00 (USD 2.1bln)

EUR/USD 1.0800 (EUR 644m)

GBP/USD 1.0500 (203m)

USD/CHF 1.00 (USD 325m)

USD/CAD 1.3200 (USD 1.1bln) 1.3300 (500m)

NZD/USD 0.6510 (NZD 1.26bln)

-

08:46

France: Industrial Production, y/y, September -1.0%

-

08:45

France: Industrial Production, m/m, September 0.1% (forecast 0%)

-

08:32

Options levels on tuesday, November 10, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.0945 (961)

$1.0891 (1059)

$1.0850 (100)

Price at time of writing this review: $1.0749

Support levels (open interest**, contracts):

$1.0700 (4788)

$1.0667 (4851)

$1.0621 (5927)

Comments:

- Overall open interest on the CALL options with the expiration date December, 4 is 80887 contracts, with the maximum number of contracts with strike price $1,1200 (5475);

- Overall open interest on the PUT options with the expiration date December, 4 is 113677 contracts, with the maximum number of contracts with strike price $1,0700 (8164);

- The ratio of PUT/CALL was 1.40 versus 1.46 from the previous trading day according to data from November, 9

GBP/USD

Resistance levels (open interest**, contracts)

$1.5403 (1090)

$1.5305 (2116)

$1.5208 (1012)

Price at time of writing this review: $1.5106

Support levels (open interest**, contracts):

$1.4993 (2691)

$1.4896 (1832)

$1.4797 (1183)

Comments:

- Overall open interest on the CALL options with the expiration date December, 4 is 25114 contracts, with the maximum number of contracts with strike price $1,5600 (3632);

- Overall open interest on the PUT options with the expiration date December, 4 is 29223 contracts, with the maximum number of contracts with strike price $1,5050 (4101);

- The ratio of PUT/CALL was 1.16 versus 1.09 from the previous trading day according to data from November, 9

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:56

Foreign exchange market. Asian session: the U.S. dollar rebounded against the yen

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia Home Loans September 1.5% Revised From 2.9% 0% 2.0%

00:30 Australia National Australia Bank's Business Confidence October 5 2

01:30 China PPI y/y October -5.9% -5.8% -5.9%

01:30 China CPI y/y October 1.6% 1.5% 1.3%

05:00 Japan Eco Watchers Survey: Current October 47.5 48.2 48.2

05:00 Japan Eco Watchers Survey: Outlook October 49.1 49.1

06:45 Switzerland Unemployment Rate (non s.a.) October 3.2% 3.3% 3.3%

The U.S. dollar rebounded against the yen by the end of the Asian session. Investors are awaiting speeches from Fed officials. Federal Reserve Chairwoman Janet Yellen, Fed vice chair Stanley Fischer and New York Fed President William Dudley will speak on Thursday. Market participants expect to hear more clues on the imminent interest rate hike.

The Australian dollar little changed amid mixed Chinese and domestic data. China is Australia's major trading partner and its consumer price index rose by 1.3% y/y in October after a 1.6% increase in September. Economists had expected a 1.5% reading. A decline in inflation growth pace suggests that domestic demand remains weak. Food prices are among major negative contributors.

Australia's home loans came in at 2.0% in September compared to 0.0% expected by economists and 1.5% (revised from 2.9%) reported previously. Meanwhile National Australia Bank's Business Confidence declined to 2 in October from 5 reported previously. The business conditions index remained at 9.

EUR/USD: the pair fluctuated within $1.0735-60 in Asian trade

USD/JPY: the pair traded within Y123.00-25

GBP/USD: the pair traded within $1.5100-25

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:45 France Industrial Production, m/m September 1.6% 0%

07:45 France Industrial Production, y/y September 0.6%

13:30 U.S. Import Price Index October -0.1% -0.1%

15:00 U.S. Wholesale Inventories September 0.1% 0%

17:00 Canada Gov Council Member Wilkins Speaks

19:30 U.S. FOMC Member Charles Evans Speaks

20:00 New Zealand RBNZ Financial Stability Report

20:05 New Zealand RBNZ Governor Graeme Wheeler Speaks

23:30 Australia Westpac Consumer Confidence November 4.2%

-

07:45

Switzerland: Unemployment Rate (non s.a.), October 3.3% (forecast 3.3%)

-

06:16

Japan: Eco Watchers Survey: Outlook, October 49.1

-

06:00

Japan: Eco Watchers Survey: Current , October 48.2 (forecast 48.2)

-

02:30

China: CPI y/y, October 1.3% (forecast 1.5%)

-

02:30

China: PPI y/y, October -5.9% (forecast -5.8%)

-

01:30

Australia: National Australia Bank's Business Confidence, October 2

-

01:30

Australia: Home Loans , September 2.0% (forecast 0%)

-

00:50

Japan: Current Account, bln, September 1468 (forecast 2235.2)

-

00:34

Currencies. Daily history for Nov 9’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0750 +0,07%

GBP/USD $1,5114 +0,42%

USD/CHF Chf1,0034 -0,23%

USD/JPY Y123,16 -0,02%

EUR/JPY Y132,41 +0,05%

GBP/JPY Y186,14 +0,40%

AUD/USD $0,7045 -0,01%

NZD/USD $0,6531 +0,14%

USD/CAD C$1,3285 -0,06%

-

00:01

Schedule for today, Tuesday, Nov 10’2015:

(time / country / index / period / previous value / forecast)

00:30 Australia Home Loans September 2.9% 0%

00:30 Australia National Australia Bank's Business Confidence October 5

01:30 China PPI y/y October -5.9% -5.8%

01:30 China CPI y/y October 1.6% 1.5%

05:00 Japan Eco Watchers Survey: Current October 47.5

05:00 Japan Eco Watchers Survey: Outlook October 49.1

06:45 Switzerland Unemployment Rate (non s.a.) October 3.2%

07:45 France Industrial Production, m/m September 1.6% 0.1%

07:45 France Industrial Production, y/y September 0.6%

13:30 U.S. Import Price Index October -0.1% -0.1%

15:00 U.S. Wholesale Inventories September 0.1% 0.1%

17:00 Canada Gov Council Member Wilkins Speaks

19:30 U.S. FOMC Member Charles Evans Speaks

20:00 New Zealand RBNZ Financial Stability Report

20:05 New Zealand RBNZ Governor Graeme Wheeler Speaks

23:30 Australia Westpac Consumer Confidence November 4.2%

-