Noticias del mercado

-

22:18

U.S. stocks closed

U.S. stocks ended slightly higher as an increase in consumer stocks offset losses among materials producers including Freeport-McMoRan Inc. The dollar climbed to a six-month high against the euro, while Treasuries rose for the first time in seven days. Developing-country shares extended their losses since Friday's U.S. jobs report, which fueled speculation the Federal Reserve is preparing to raise interest rates next month. Base metals slipped as weak Chinese prices data reignited concern over the slowdown there.

Chinese consumer inflation waned in October, signaling policy makers may need to boost stimulus to ease deflationary pressures amid slackening growth. With China the world's biggest commodities consumer and Asia's largest economy, a surprise devaluation of the yuan in August spurred a rout in global financial markets and contributed to the Fed's decision to keep rates near zero in September. Renewed evidence of weakness abroad may limit the Fed's scope to tighten policy as the global economy remains fragile.

The S&P 500 rose 0.2 percent to 2,081.72 by 4 p.m. in New York after a four-day slide erased 1.5 percent. The index fell within 10 points of its average price for the past 200 days before erasing that decline. It hasn't fallen below that key technical level in two weeks.

Apple Inc. lost 3.2 percent with iPhone component orders recently down by as much as 10 percent, according to Credit Suisse Group AG. The firm attributed the drop to weak demand for the current model, the iPhone 6s.

Mining stocks were the biggest decliners on the S&P 500 amid mounting evidence of the slowdown in China. Natural resources company Freeport-McMoRan lost 6.3 percent for the second-biggest drop in the S&P 500. Anadarko Petroleum Corp. slid the most, falling 6.6 percent after it was said to have approached Apache Corp. with a takeover offer.

-

21:00

DJIA 17751.09 20.61 0.12%, NASDAQ 5083.40 -11.90 -0.23%, S&P 500 2081.55 2.97 0.14%

-

18:21

WSE: Session Results

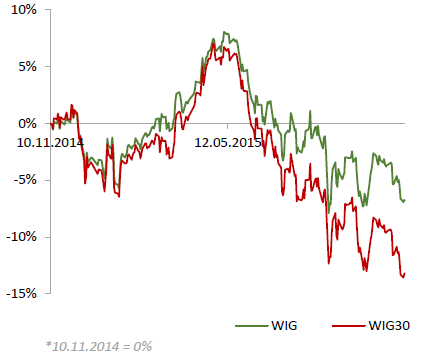

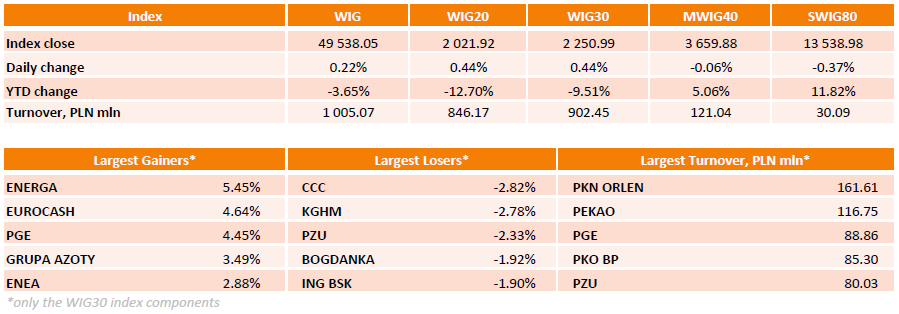

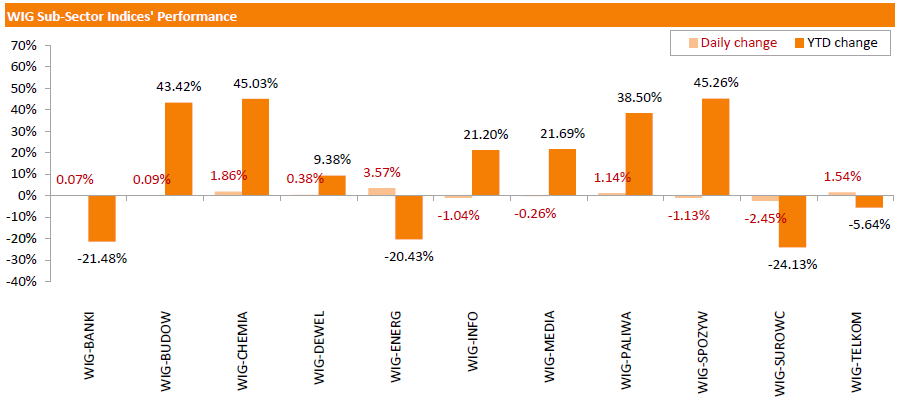

Polish equity market closed higher on Tuesday. The broad market measure, the WIG Index, rose by 0.22%. Sector-wise, utilities (+3.57%) performed best, while materials (-2.45%) lagged behind.

The large-cap stocks' measure, the WIG30 Index, added 0.44%. Within the indicator's components, ENERGA (WSE: ENG) was the biggest advancer, jumping by 5.45%. EUROCASH (WSE: EUR) and PGE (WSE; PGE) also produced noticeable gains, up 4.64% and 4.45% respectively, supported by better-than-expected Q3 profits. The former reported Q3 net income of PLN 70.1 mln versus consensus of PLN 67.6 mln, while the latter posted Q3 profit of PLN 1029 mln versus consensus of PLN 1008 mln. Other major gainers were GRUPA AZOTY (WSE: ATT), ENEA (WSE: ENA) and LOTOS (WSE: LTS), surging by 3.49%, 2.88% and 2.87% respectively. On the other side of the ledger, CCC (WSE: CCC) and KGHM (WSE: KGH) were the worst-performing names, tumbling by 2.82% and 2.78% respectively. They were followed by PZU (WSE: PZU), slumping 2.33% as the company reported Q3 profit of PLN 510.9 mln (-39% y/y), whereas the analysts expected PLN 525.9 mln.

On 11 November Poland celebrates the National Independence Day. The Warsaw Stock Exchange will be closed for trading.

-

18:00

European stocks closed: FTSE 6275.28 -19.88 -0.32%, DAX 10832.52 17.07 0.16%, CAC 40 4912.16 0.99 0.02%

-

17:56

European stocks close: stocks closed mixed on the weak Chinese consumer inflation data

Stock indices closed mixed on the weak Chinese consumer inflation data. The Chinese National Bureau of Statistics released its consumer and producer price inflation data for China on Tuesday. The Chinese consumer price index (CPI) rose at annual rate of 1.3% in October, missing expectations for a 1.5% increase, after a 1.6% gain in September. The Chinese producer price index (PPI) dropped 5.9% in October, missing expectations for a 5.8% fall, after a 5.9% decline in September.

European Central Bank (ECB) Governing Council member Erkki Liikanen said on Tuesday that there are downside risks to the Eurozone's inflation and growth outlook, adding that the central bank is ready to act.

"The growth and inflation outlook is still subject to downside risks," he said.

"The Governing Council is willing and able to act by using all the instruments available within its mandate if warranted in order to maintain an appropriate degree of monetary accommodation," Liikanen noted.

Meanwhile, the economic data from the Eurozone was positive. The French statistical office Insee its industrial production figures on Tuesday. Industrial production in France rose 0.1% in September, exceeding expectations for a flat reading, after a 1.7% gain in August. August's figure was revised up from a 1.6% increase.

Manufacturing output was flat in September, while construction output slid 1.7%.

Output in mining and quarrying, energy, water supply and waste management increased 0.7% in September.

On a yearly basis, the French industrial production dropped 1.0% in September, after a 0.6% gain in August.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,275.28 -19.88 -0.32 %

DAX 10,832.52 +17.07 +0.16 %

CAC 40 4,912.16 +0.99 +0.02 %

-

17:13

National Federation of Independent Business’s small-business optimism index for the U.S. remains unchanged at 96.1 in October

The National Federation of Independent Business (NFIB) released its small-business optimism index for the U.S. on Tuesday. The index remained unchanged at 96.1 in October.

5 of 10 subindexes rose last month, three fell, while two were unchanged.

"The labour market components might have held at historically strong levels but this time owners reported no net growth in employment, which is a significant drop from reports in the previous four months," NFIB Chief Economist Bill Dunkelberg said.

-

16:59

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes lower on Tuesday, dragged down by Apple, as investors worried about China's economic health and braced for an interest rate hike by the Federal Reserve next month. Apple's shares (AAPL) fell 2.5 percent after Credit Suisse said the iPhone maker had lowered component orders by as much as 10%. The stock was the biggest drag on the three major indexes. The report on Apple added to fears of a slowdown in global growth, especially in China, a key market for many U.S. companies including Apple, ahead of the crucial holiday shopping season.

Most of Dow stocks in negative area (18 of 30). Top looser - Apple Inc. (AAPL, -2.53%). Top gainer - Visa Inc. (V, +0.94%).

Most of S&P index sectors also in negative area. Top looser Basic Materials (-1.0%). Top gainer - Utilities (+0,5%).

At the moment:

Dow 17626.00 -49.00 -0.28%

S&P 500 2067.50 -5.50 -0.27%

Nasdaq 100 4621.25 -31.50 -0.68%

Oil 44.32 +0.45 +1.03%

Gold 1087.30 -0.80 -0.07%

U.S. 10yr 2.33 -0.01

-

16:11

Wholesale inventories in the U.S. rises 0.5% in September

The U.S. Commerce Department released wholesale inventories on Tuesday. Wholesale inventories in the U.S. rose 0.5% in September, beating expectations for a flat reading, after a 0.3% increase in August. August's figure was revised up from a 0.1% gain.

The increase was mainly driven by a rise in inventories of non-durable goods. Inventories of non-durable goods increased 1.9% in September as farm products jumped 6.7%, while inventories of durable goods fell 0.4%.

Wholesale sales climbed by 0.5% in September, after a 0.9% decrease in August.

-

15:44

U.S. import price index falls 0.5% in October

The U.S. Labor Department released its import and export prices data on Tuesday. The U.S. import price index fell by 0.5% in October, missing expectations for a 0.1% decrease, after a 0.6% decline in September. September's figure was revised down from a 0.1% drop.

The decline was mainly driven by lower prices for fuel imports.

A stronger U.S. currency lowers the price of imported goods.

U.S. export prices declined by 0.2% in October, after a 0.6% fall in September.

-

15:29

Before the bell: S&P futures -0.16%, NASDAQ futures -0.46%

U.S. stock-index futures were little changed.

Global Stocks:

Nikkei 19,671.26 +28.52 +0.15%

Hang Seng 22,401.7 -325.07 -1.43%

Shanghai Composite 3,642.46 -4.42 -0.12%

FTSE 6,282.19 -12.97 -0.21%

CAC 4,906.48 -4.69 -0.10%

DAX 10,828.38 +12.93 +0.12%

Crude oil $44.18 (+0.71%)

Gold $1088.00 (-0.01%)

-

15:00

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Merck & Co Inc

MRK

54.49

0.46%

2.6K

Caterpillar Inc

CAT

72.08

0.26%

3.0K

Visa

V

78.05

0.19%

9.1K

FedEx Corporation, NYSE

FDX

160.85

0.19%

0.2K

Pfizer Inc

PFE

33.7

0.15%

4.5K

International Business Machines Co...

IBM

135.5

0.14%

0.9K

ALCOA INC.

AA

8.62

0.12%

4.2K

Chevron Corp

CVX

92.4

0.09%

13.6K

Exxon Mobil Corp

XOM

81.99

0.05%

1.2K

Johnson & Johnson

JNJ

100.86

0.02%

1.4K

Verizon Communications Inc

VZ

45.3

0.00%

4.0K

United Technologies Corp

UTX

99.01

-0.01%

0.2K

E. I. du Pont de Nemours and Co

DD

66.38

-0.02%

0.8K

AT&T Inc

T

32.83

-0.03%

3.6K

Walt Disney Co

DIS

116.38

-0.03%

10.0K

General Motors Company, NYSE

GM

35.66

-0.03%

39.7K

Procter & Gamble Co

PG

75.35

-0.07%

8.0K

Goldman Sachs

GS

196.6

-0.08%

11.0K

JPMorgan Chase and Co

JPM

67.33

-0.09%

6.0K

Microsoft Corp

MSFT

54.1

-0.11%

13.4K

Hewlett-Packard Co.

HPQ

13.85

-0.14%

1.5K

Citigroup Inc., NYSE

C

55.6

-0.20%

8.2K

Intel Corp

INTC

33.28

-0.21%

0.1K

Yahoo! Inc., NASDAQ

YHOO

33.61

-0.21%

0.2K

McDonald's Corp

MCD

112.65

-0.25%

0.5K

Cisco Systems Inc

CSCO

28.1

-0.27%

0.6K

Ford Motor Co.

F

14.29

-0.28%

1.8K

American Express Co

AXP

73.2

-0.30%

60.7K

Wal-Mart Stores Inc

WMT

58.31

-0.31%

0.4K

Boeing Co

BA

145.5

-0.33%

0.1K

Facebook, Inc.

FB

106.14

-0.33%

34.6K

Amazon.com Inc., NASDAQ

AMZN

653.29

-0.34%

3.7K

Google Inc.

GOOG

722.27

-0.36%

1.2K

3M Co

MMM

156.8

-0.43%

0.1K

Starbucks Corporation, NASDAQ

SBUX

61.06

-0.46%

1.7K

General Electric Co

GE

29.61

-0.47%

43.1K

Yandex N.V., NASDAQ

YNDX

15.98

-0.56%

4.9K

Twitter, Inc., NYSE

TWTR

26.88

-0.78%

26.0K

Tesla Motors, Inc., NASDAQ

TSLA

223.55

-0.79%

3.2K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.4

-0.86%

6.1K

Barrick Gold Corporation, NYSE

ABX

7.28

-1.09%

6.0K

Apple Inc.

AAPL

117.78

-2.31%

682.2K

-

14:53

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Microsoft (MSFT) target raised to $64 from $53 at Piper Jaffray

-

12:51

National Australia Bank’s business confidence index falls to 2 points in October

The National Australia Bank (NAB) released its business confidence index for Australia on Tuesday. The index fell to 2 points in October from 5 points in September.

"Business confidence remains somewhat fickle, despite persistent strength in business conditions," the NAB said.

The main business conditions index remained unchanged at 9 points in October, while employment remained unchanged at 3 points.

-

12:33

Home loans in Australia are up 2.0% in September

The Australian Bureau of Statistics released its home loans data on Tuesday. Home loans in Australia increased 2.0% in September, exceeding expectations for a flat reading, after 1.5% rise in August. August's figure was revised down from 2.9% gain.

The value of home loans slid at a seasonally adjusted 1.6% in September, investment lending dropped 8.5%, while the number of loans for the construction of dwellings rose 1.9%.

-

12:00

European stock markets mid session: stocks traded lower on the weak Chinese consumer inflation data

Stock indices traded lower on the weak Chinese consumer inflation data. The Chinese National Bureau of Statistics released its consumer and producer price inflation data for China on Tuesday. The Chinese consumer price index (CPI) rose at annual rate of 1.3% in October, missing expectations for a 1.5% increase, after a 1.6% gain in September. The Chinese producer price index (PPI) dropped 5.9% in October, missing expectations for a 5.8% fall, after a 5.9% decline in September.

Meanwhile, the economic data from the Eurozone was positive. The French statistical office Insee its industrial production figures on Tuesday. Industrial production in France rose 0.1% in September, exceeding expectations for a flat reading, after a 1.7% gain in August. August's figure was revised up from a 1.6% increase.

Manufacturing output was flat in September, while construction output slid 1.7%.

Output in mining and quarrying, energy, water supply and waste management increased 0.7% in September.

On a yearly basis, the French industrial production dropped 1.0% in September, after a 0.6% gain in August.

Current figures:

Name Price Change Change %

FTSE 100 6,271.34 -23.82 -0.38 %

DAX 10,764.39 -51.06 -0.47 %

CAC 40 4,891.36 -19.81 -0.40 %

-

11:50

Greek consumer prices decrease 0.1% in October

The Hellenic Statistical Authority released its consumer price inflation data for Greece on Monday. Greek consumer prices decreased 0.1% in October, after the 0.8% drop in September.

On a yearly basis, the Greek consumer price index declined 0.9% in October, after a 1.7 fall in September. Consumer prices in Greece declined since March 2013.

Housing prices plunged at an annual rate of 5.4% in October, transport costs dropped by 0.5%, clothing and footwear prices declined 1.7%, while household equipment prices were down 1.5%.

Prices of food and non-alcoholic beverages decreased at an annual rate of 1.1% in October, while alcoholic beverages and tobacco prices climbed by 2.0%.

-

11:41

European Central Bank Governing Council member Erkki Liikanen: there are downside risks to the Eurozone's inflation and growth outlook

European Central Bank (ECB) Governing Council member Erkki Liikanen said on Tuesday that there are downside risks to the Eurozone's inflation and growth outlook, adding that the central bank is ready to act.

"The growth and inflation outlook is still subject to downside risks," he said.

"The Governing Council is willing and able to act by using all the instruments available within its mandate if warranted in order to maintain an appropriate degree of monetary accommodation," Liikanen noted.

-

11:35

Industrial production in Italy increases 0.2% in September

The Italian statistical office Istat released its industrial production data on Tuesday. Industrial production in Italy increased at a seasonally-adjusted rate of 0.2% in September, after a 0.5% fall in August.

On a yearly basis, industrial production in Italy jumped at a seasonally-adjusted rate of 1.7% in September, after a 1.0% increase in August.

-

11:29

French industrial production rises 0.1% in September

The French statistical office Insee its industrial production figures on Tuesday. Industrial production in France rose 0.1% in September, exceeding expectations for a flat reading, after a 1.7% gain in August. August's figure was revised up from a 1.6% increase.

Manufacturing output was flat in September, while construction output slid 1.7%.

Output in mining and quarrying, energy, water supply and waste management increased 0.7% in September.

On a yearly basis, the French industrial production dropped 1.0% in September, after a 0.6% gain in August.

-

11:17

Swiss unemployment rate remains unchanged at a seasonally adjusted 3.4% in October

The Swiss State Secretariat for Economic Affairs released its unemployment data for Switzerland on Thursday. The Swiss unemployment rate remained at a seasonally adjusted 3.4% in October.

On a seasonally unadjusted basis, the unemployment rate in Switzerland increased to 3.3 in October from 3.2% in September, in line with expectations.

The number of unemployed people in Switzerland rose by 3,043 to 141,269 in October from a month earlier.

The youth unemployment rate was down to 3.5% from 3.7% in September.

-

11:10

Japan’s Eco Watchers' current conditions index climbs to 48.2 in October

Japan's Cabinet Office released Eco Watchers' Index figures on Wednesday. Japan's economy watchers' current conditions index climbed to 48.2 in October from 47.5 in September, in line with expectations.

Japan's economy watchers' future conditions index remained unchanged at 49.1 in October.

A reading above 50 indicates optimism, while a reading below 50 indicates pessimism.

-

10:59

Japan’s current account surplus declines to ¥1,468.4 billion in September

Japan's Ministry of Finance released its current account data for Japan late Tuesday evening. Japan's current account surplus fell to ¥1,468.4 billion in September from ¥1,653.1 billion in August, missing expectations for a surplus of ¥2,235.2 billion.

Japan benefits from a weaker yen, which supports income from overseas investments.

The goods trade deficit turned into a surplus of ¥82.3 billion in September from a deficit of ¥326.1 billion in August.

Exports rose at an annual rate of 2.8% in September, while imports dropped 7.4%.

-

10:50

Chinese consumer price index rises at annual rate of 1.3% in October

The Chinese National Bureau of Statistics released its consumer and producer price inflation data for China on Tuesday. The Chinese consumer price index (CPI) rose at annual rate of 1.3% in October, missing expectations for a 1.5% increase, after a 1.6% gain in September.

Food prices rose at an annual rate of 1.9% in October, while non-food prices increased 0.9%.

On a monthly basis, consumer price inflation decreased 0.3% in October, after a 0.1% rise in September.

The Chinese producer price index (PPI) dropped 5.9% in October, missing expectations for a 5.8% fall, after a 5.9% decline in September.

-

10:38

The Conference Board’s Employment Trends Index (ETI) for the U.S. rises to 129.48 in October

The Conference Board released its Employment Trends Index (ETI) for the U.S on Monday. The index rose to 129.48 in October from 128.65 in September.

Six of the eight components increased.

"The Employment Trends Index continues to show solid and broad-based gains, with no significant slowdown in job growth expected through the first quarter of 2016. Solid job growth and the lack of recovery in labour-force participation suggest that the unemployment rate may dip below 4.5 percent by this time next year," Managing Director of Macroeconomic and Labour Market Research at The Conference Board, said Gad Levanon.

-

10:21

Eurogroup will not transfer €2 billion to Greece as the Greek government has not fulfilled agreed obligations

The Eurogroup decided on Monday not to transfer €2 billion to Greece as the Greek government has not fulfilled agreed obligations. Eurogroup President Jeroen Dijsselbloem said that Greek Finance Minister Euclid Tsakalotos claimed that Greece and its lenders will reach an agreement within this week.

"The 2 billion will only be paid out once the institutions give the green light and say that all agreed actions have been carried out and have been implemented. That still has not happened," Dijsselbloem noted ahead of the meeting.

-

10:13

Boston Fed President Eric Rosengren: if there is a significant improvement in the U.S. economy, the Fed should start raising its interest rate

Boston Fed President Eric Rosengren said on Monday that if there is a significant improvement in the U.S. economy, the Fed should start raising its interest rate.

"If we see continued gradual improvement in the U.S. economy, it will be appropriate to gradually increase short-term rates," he said.

Rosengren hinted the possible interest rate hike in December.

"I would highlight that the data received recently have been positive, reflecting real improvement for the economy," Boston Fed president noted.

He added that December "could be an appropriate time for raising rates, as long as the economy continues to improve as expected".

-

07:07

Global Stocks: U.S. stock indices fell 1%

On Monday U.S. stock indices posted their biggest decline in six weeks amid Chinese trade data and a revised global growth forecast.

The Dow Jones Industrial Average fell 179.85 points, or 1%, to 17,730.48. The S&P 500 lost 20.60 points, or 1%, to 2,078.60 (9 out of its 10 sectors declined). The Nasdaq Composite fell 51.82 points, or 1%, to 5,095.30.

The Organization for Economic Co-operation and Development cut its global economic growth forecast citing weakness in China and other emerging markets. The 2015 forecast was lowered to 2.9% from 3% and the next year forecast was cut to 3.3% from 3.6%.

Sources reported that Chinese imports and exports fell in October leaving the country a record trade surplus.

This morning in Asia Hong Kong Hang Seng dropped 1.31%, or 297.07, to 22,429.70. China Shanghai Composite Index edged down 0.14%, or 4.94, to 3.641.94. The Nikkei 225 climbed 0.13%, or 24.87, to 19,667.61.

Asian indices mostly slid following declines in U.S. stocks.

Chinese consumer price index rose by 1.3% y/y in October after a 1.6% increase in September. Economists had expected a 1.5% reading. A decline in inflation growth pace suggests that domestic demand remains weak. Food prices are among major negative contributors.

-

03:05

Nikkei 225 19,525.87 -116.87 -0.59 %, Hang Seng 22,410.9 -315.87 -1.39 %, Shanghai Composite 3,632.46 -14.42 -0.40 %

-

00:35

Stocks. Daily history for Sep Nov 9’2015:

(index / closing price / change items /% change)

Nikkei 225 19,642.74 +377.14 +1.96 %

Hang Seng 22,726.77 -140.56 -0.61 %

Shanghai Composite 3,647.14 +57.10 +1.59 %

FTSE 100 6,295.16 -58.67 -0.92 %

CAC 40 4,911.17 -72.98 -1.46 %

Xetra DAX 10,815.45 -172.58 -1.57 %

S&P 500 2,078.58 -20.62 -0.98 %

NASDAQ Composite 5,095.3 -51.82 -1.01 %

Dow Jones Industrial Average 17,730.48 -179.85 -1.00 %

-