Noticias del mercado

-

22:08

US stocks closed

The increased prospect that six years of near-zero borrowing costs in the U.S. may end next month rippled through global markets, as companies hurt most by the strengthening dollar led a selloff in American equities and bonds fell with emerging-market assets.

The Standard & Poor's 500 Index sank the most in a month, with large caps from Caterpillar Inc. to Nike Inc. pacing the drop. European stocks lost 1.1 percent. The dollar traded near the highest in a decade, as a gauge of emerging-market currencies slumped toward a five-week low. Treasury 10-year note rates climbed to 2.34 percent.

Global investors continue to adjust to the increased likelihood that America's benchmark rate will rise this year, a move that would end an unprecedented era of record-low borrowing costs. Concern that capital outflows from developing nations will worsen sent emerging assets lower, while dollar-denominated resources slumped with shares of American multinational companies. Treasuries pared losses with gold on haven demand.

Investors shrugged off the threat of higher rates on Friday, focusing instead on a blowout jobs report that signaled the U.S. economy may be ready to withstand tighter monetary policy. That sentiment reversed Monday in the absence of any additional data and after American equities ended last week near the highest level in three months.

"People sort-of stewed on it over the weekend that we're facing a rate hike in December," said Robert Pavlik, who helps oversee $9.1 billion as chief market strategist at Boston Private Wealth. "I don't think it's the 25 basis points that's necessarily leading the market down, but what comes after. How fast and furious do the rate hikes come now that this cheap money environment is coming to an end?"

The S&P 500 fell 1.2 percent at 2:54 p.m. in New York, the most since Oct. 2. The gauge is coming off its longest run of weekly gains this year, a streak that pushed it within 1.5 percent below its May record.

Consumer-discretionary stocks had the biggest declines among 10 groups in the S&P 500, falling 1.9 percent. Macy's Inc. and Kohl's Corp. declined more than 5.5 percent after Citigroup Inc. cut its earnings estimates for the companies, saying the industry is suffering from a sales slowdown and inventory glut.

There is an "absence of any real, compelling reason to step in and buy a lot right now," Peter Tuz, who helps manage $400 million as president of Chase Investment Counsel Corp. in Charlottesville, Virginia. "I don't think anyone came into work today figuring that they had to load up on stocks."

European stocks fell, after rising four times in the past five days, as investors weighed the outlook for global economic growth and stimulus. The Stoxx Europe 600 Index lost 1.1 percent. Shares of exporters fell after worse-than-forecast Chinese trade data.

-

21:00

DJIA 17705.76 -204.57 -1.14%, NASDAQ 5084.25 -62.87 -1.22%, S&P 500 2074.93 -24.27 -1.16%

-

18:55

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes fell 1% on Monday, their biggest fall in six weeks, as weak Chinese trade data and a cut in the OECD's global growth forecast sparked fears about a global economic slowdown. Data from China, one of the one of the U.S.'s biggest trade partners, showed a fall in exports and imports in October left it with a record high trade surplus. The Organisation for Economic Co-operation and Development cut its 2015 global growth forecast again.

All Dow stocks in negative area (30 of 30). Top looser - Caterpillar Inc. (CAT, -2.88%).

All S&P index sectors also in negative area. Top looser - Services (-1.9%).

At the moment:

Dow 17657.00 -186.00 -1.04%

S&P 500 2069.00 -24.75 -1.18%

Nasdaq 100 4638.50 -64.50 -1.37%

Oil 43.81 -0.48 -1.08%

Gold 1089.10 +1.40 +0.13%

U.S. 10yr 2.34 +0.01

-

18:18

WSE: Session Results

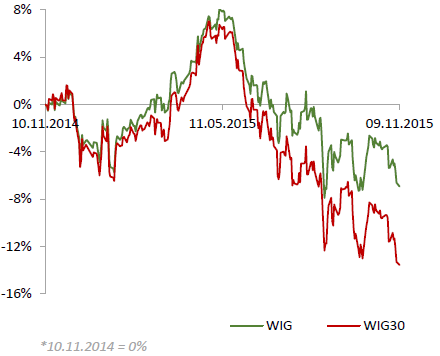

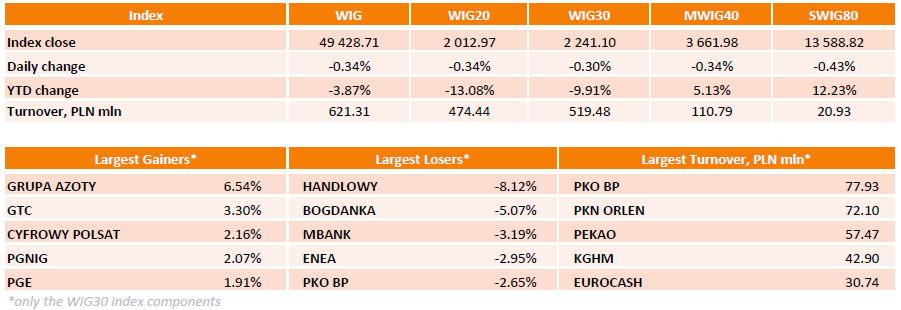

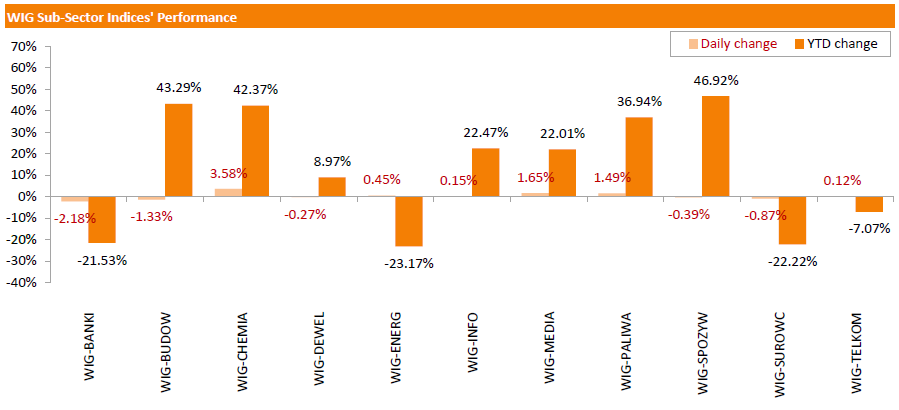

Polish equity market declined on Monday. The broad market measure, the WIG Index, slumped by 0.34%. Sector performance in the WIG Index was mixed. Banking sector (-2.18%) recorded the sharpest decline as the Polish president's office announced on Friday that President Andrzej Duda believes it would be equitable if banks bore between 50% and 90% of the cost of conversion of Swiss franc-denominated mortgages into zlotys at historical rates.

The large-cap stocks fell by 0.3%, as measured by the WIG30 Index. Within the index components, HANDLOWY (WSE: BHW) led the decliners, tumbling 8.12% on the back of worse-than-expected 3Q earnings (its Q3 profit was PLN140.9 mln versus consensus of PLN145.6 mln). It was followed by BOGDANKA (WSE: LWB), sliding down 5.07%. The other biggest losers were MBANK (WSE: MBK), ENEA (WSE: ENA), PKO BP (WSE: PKO), KERNEL (WSE: KER) and CCC (WSE: CCC), losing 2.24%-3.19%. On the other side of the ledger, GRUPA AZOTY (WSE: ATT) led the risers, climbing by 6.54% as the company's 3Q results beat analysts' expectations (its revenues accounted PLN 2401 mln versus consensus of PLN 2179 mln and its net income was PLN 73.6 mln versus consensus of PLN 39.8 mln). GTC (WSE: GTC), CYFROWY POLSAT (WSE: CPS) and PGNIG (WSE: PGN) were also noteworthy performers, gaining 3.3%, 2.16% and 2.07% respectively.

-

18:00

European stocks closed: FTSE 6295.16 -58.67 -0.92%, DAX 10815.45 -172.58 -1.57%, CAC 40 4911.17 -72.98 -1.46%

-

16:46

Bank of France’s new governor and European Central Bank (ECB) Governing Council member Francois Villeroy de Galhau: the inflation expectations in the Eurozone is still too low and uncertain

Bank of France's new governor and European Central Bank (ECB) Governing Council member Francois Villeroy de Galhau said in an interview with the German newspaper Handelsblatt that the inflation expectations in the Eurozone is still too low and uncertain since summer as concerns over the

"The (inflation) expectations are still too low, and uncertain since the summer," he noted.

Galhau pointed that the ECB will add further stimulus measures if needed.

"There are still margins to make monetary policy more effective -- the instruments are available," he said.

-

16:12

European Central Bank purchases €12.93 billion of government and agency bonds last week

The European Central Bank (ECB) purchased €12.93 billion of government and agency bonds under its quantitative-easing program last week.

The European Central Bank's (ECB) President Mario Draghi said at a press conference in October that the value of the ECB's asset-buying programme will be discussed at the monetary policy meeting in December.

ECB'S asset buying programme is intended to run to September 2016.

The ECB bought €1.38 billion of covered bonds, and €176 million of asset-backed securities.

-

15:35

U.S. Stocks open: Dow -0.46%, Nasdaq -0.46%, S&P -0.42%

-

15:29

Before the bell: S&P futures -0.01%, NASDAQ futures 0.00%

U.S. stock-index futures were flat.

Global Stocks:

Nikkei 19,642.74 +377.14 +1.96%

Hang Seng 22,726.77 -140.56 -0.61%

Shanghai Composite 3,647.14 +57.10 +1.59%

FTSE 6,354.29 +0.46 +0.01%

CAC 4,963.63 -20.52 -0.41%

DAX 10,970.49 -17.54 -0.16%

Crude oil $44.64 (+0.79%)

Gold $1091.60 (+0.36%)

-

15:10

OECD’s leading composite leading indicator declines to 99.8 in September

The Organization for Economic Cooperation and Development (OECD) released its leading indicators on Monday. The composite leading indicator decreased to 99.8 in September from 99.9 in August.

The leading indicators of Canada, France and Italy rose in September, while the indicators of China, the U.S., Japan, Germany and the U.K. declined.

Eurozone's leading indicator remained unchanged in September.

-

15:05

Labour cash earnings in Japan rise 0.6% in September

Japan's Ministry of Health, Labour and Welfare released its labour cash earnings data on Monday. Labour cash earnings in Japan rose at an annual rate of 0.6% in September, after a 0.4% rise in August.

August's figure was revised down from a 0.5% gain.

Summer bonuses in the June-August period slid 2.8% year-on-year. It was the biggest decline since 2009.

Total real wages climbed 0.5% in September, after a 0.1% gain in August.

-

14:57

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

General Motors Company, NYSE

GM

36.05

0.84%

8.8K

Yahoo! Inc., NASDAQ

YHOO

34.35

0.44%

3.3K

McDonald's Corp

MCD

113.7

0.34%

2.8K

Nike

NKE

132.2

0.32%

0.9K

JPMorgan Chase and Co

JPM

68.66

0.30%

0.2K

Hewlett-Packard Co.

HPQ

14.05

0.29%

2.0K

Barrick Gold Corporation, NYSE

ABX

7.07

0.28%

3.7K

Citigroup Inc., NYSE

C

56

0.23%

12.1K

Twitter, Inc., NYSE

TWTR

28.33

0.18%

32.0K

Goldman Sachs

GS

199.5

0.17%

5.5K

Apple Inc.

AAPL

121.25

0.16%

92.6K

Amazon.com Inc., NASDAQ

AMZN

660.25

0.13%

10.7K

Facebook, Inc.

FB

107.16

0.06%

60.5K

Exxon Mobil Corp

XOM

83.77

0.04%

1.8K

ALTRIA GROUP INC.

MO

57.09

0.00%

15.5K

AMERICAN INTERNATIONAL GROUP

AIG

61.9

-0.05%

37.4K

International Business Machines Co...

IBM

138.15

-0.07%

1.1K

Home Depot Inc

HD

125.88

-0.08%

9.7K

Starbucks Corporation, NASDAQ

SBUX

61.7

-0.11%

0.2K

Intel Corp

INTC

33.8

-0.12%

0.6K

Visa

V

78.65

-0.13%

1.3K

Ford Motor Co.

F

14.5

-0.14%

0.5K

E. I. du Pont de Nemours and Co

DD

66

-0.17%

1.9K

Verizon Communications Inc

VZ

45.7

-0.17%

0.4K

AT&T Inc

T

33.09

-0.21%

8.3K

Procter & Gamble Co

PG

75.4

-0.22%

5.1K

Wal-Mart Stores Inc

WMT

58.65

-0.22%

1.8K

Walt Disney Co

DIS

115.35

-0.27%

5.8K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.72

-0.28%

23.1K

Chevron Corp

CVX

93.72

-0.33%

0.3K

Microsoft Corp

MSFT

54.73

-0.35%

14.0K

Cisco Systems Inc

CSCO

28.34

-0.39%

8.9K

General Electric Co

GE

29.8

-0.40%

43.2K

Caterpillar Inc

CAT

73.52

-0.43%

12.6K

Johnson & Johnson

JNJ

101.44

-0.47%

0.2K

Pfizer Inc

PFE

33.76

-0.49%

29.2K

Tesla Motors, Inc., NASDAQ

TSLA

231.1

-0.54%

1.8K

ALCOA INC.

AA

9.04

-0.55%

62.0K

American Express Co

AXP

73.73

-0.77%

0.5K

UnitedHealth Group Inc

UNH

113.9

-0.79%

3.9K

Yandex N.V., NASDAQ

YNDX

15.67

-1.01%

1.0K

HONEYWELL INTERNATIONAL INC.

HON

102

-1.92%

0.1K

-

14:51

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Alcoa (AA) downgraded to Neutral from Buy at Nomura

Other:

Walt Disney (DIS) target raised to $129 from $123 at Argus

Wal-Mart (WMT) initiated with a Neutral at Citigroup

-

14:34

OECD downgrades its global growth outlook

The Organization for Economic Cooperation and Development (OECD) released its growth forecast on Monday. The OECD downgraded its global growth outlook.

"The slowdown in global trade and the continuing weakness in investment are deeply concerning. Robust trade and investment and stronger global growth should go hand in hand," the OECD Secretary-General Angel Gurria.

The OECD expect the global economy to grow at 2.9% in 2015, down from the previous estimate of 3.0%, and at 3.3% in 2016, down from the previous estimate of 3.6%.

The global economy is expected to expand 3.6% in 2017.

The U.S. economy is expected to grow at 2.4% in 2015, 2.5% in 2016, down from the previous estimate of 2.6%, and 2.4% in 2017.

Japan's economy is expected to grow at 0.6% in 2015 and at 1.0% in 2016, down from its previous estimate of 1.2%, and 0.5% for 2017.

Eurozone's forecasts were downgraded to 1.5% in 2015 from the previous estimate of 1.6% and to 1.8% in 2016 from the previous estimate of 1.9%. Eurozone's economy is expected to expand 1.9%.

China is expected to expand at 6.8% in 2015, up from the previous estimate of 6.7%. Growth forecast for 2016 remained unchanged at 6.5%, while 2017 forecast was 6.2%.

-

14:22

Housing starts in Canada declines to a seasonally adjusted annualized rate of 198,065 units in October

The Canada Mortgage and Housing Corporation (CMHC) released housing starts data on Monday. Housing starts in Canada fell to a seasonally adjusted annualized rate of 198,065 units in October from a revised reading of 231,304 units in September.

Housing starts were driven by a rise in new condominium and rental starts.

"Rental starts across urban centres are poised to reach their highest level since 1992 due to low vacancy rates in recent years," the CMHC's Chief Economist Bob Dugan said.

-

13:09

Greek industrial production declines 1.8% in September

The Hellenic Statistical Authority released its preliminary industrial production data for Greece on Monday. Greek industrial production fell 1.8% in September.

On a yearly basis, industrial production in Greece increased at an adjusted rate of 2.8% in September, after a 4.1% rise in August. August's figure was revised down from a 4.5% gain.

Production in the manufacturing sector rose at an annual rate of 2.6% in September, output in the mining and quarrying sector slid 4.4%, while electricity production jumped by 6.3%.

-

12:55

Building permits in Canada drops 6.7% in September

Statistics Canada released housing market data on Friday. Building permits in Canada fell 6.7% in September, missing expectations for a 1.3% rise, after a 3.6% drop in August. August's figure was revised up from a 3.7% decrease.

The decline was mainly driven by lower construction intentions for residential buildings and commercial structures in Ontario.

Building permits for non-residential construction gained 1.6% in September, while permits in the residential sector slid 11.6%.

-

12:44

Canada’s unemployment rate falls to 7.0%in October

Statistics Canada released the labour market data on Friday. Canada's unemployment rate fell to 7.0% in October from 7.1% in September. Analysts had expected the unemployment rate to remain unchanged at 7.1%.

The increase was driven by higher labour participation. The labour participation rate increased slightly to 66.0% in October from 65.9% in September.

The number of employed people climbed by 44,400 jobs in October, beating expectations for a rise of 10,000 jobs, after a 12,100 increase in September.

The increase was driven by a rise in full-time work. Full-time employment was up by 14,587 in October, while part-time employment increased by 3,436 jobs.

The Bank of Canada monitors closely the labour participation rate.

-

12:23

Bank of France expects the country’s economy to expand at 0.4% in the fourth quarter

The Bank of France released its gross domestic product (GDP) forecasts for France on Monday. French economy is expected to expand at 0.4% in the fourth quarter.

The economy is expected to grow 0.2% in the third quarter.

The manufacturing business confidence index increased to 99 in October 98 in September, driven by rises in the automobile and chemical sectors. Services companies expect an increase in activity in November.

The services business sentiment index rose to 98 in October from 97 in September. Services companies expect a rise in activity in November.

The construction business sentiment index was up to 96 in October from 95 in September.

-

12:10

NIESR’s gross domestic product rises by 0.6% in three months to October

The National Institute of Economic and Social Research (NIESR) released its estimate of gross domestic product (GDP) for the U.K. on Friday. The GDP estimate rose by 0.6% in three months to October, in line with forecasts, after a 0.5% growth in three months to September.

"This implies that reasonable economic growth has continued into the fourth quarter of 2015," the NIESR said.

-

12:05

China's trade surplus climbs to $61.64 billion in October

The Chinese Customs Office released its trade data on Sunday. China's trade surplus rose to $61.64 billion in October from $60.34 billion in September.

Exports fell at an annual rate of 6.9% in October, while imports slid at an annual rate of 18.8%, the twelfth consecutive decline.

-

12:00

European stock markets mid session: stocks traded mixed on the weak Chinese trade data

Stock indices traded mixed on the weak Chinese trade data. The Chinese Customs Office released its trade data on Sunday. Exports fell at an annual rate of 6.9% in October, while imports slid at an annual rate of 18.8%, the twelfth consecutive decline.

Meanwhile, the economic data from the Eurozone was positive. Market research group Sentix released its investor confidence index for the Eurozone on Monday. The index climbed to 15.1 in November from 11.7 in October. It was the lowest level since February.

A reading above 0.0 indicates optimism, below indicates pessimism.

"Reason for rising economic expectations is gaining confidence in Asian markets," Sentix said in its statement.

Destatis released its trade data for Germany on Monday. Germany's seasonally adjusted trade surplus declined to €19.4 billion in September from 19.4 in August.

Exports rose 4.4% year-on-year in September, while imports climbed 3.9% year-on-year.

On a yearly basis, German exports increased at a seasonally and calendar-adjusted 2.6% in September, while imports rose by 3.6%.

Germany's current account surplus was at €25.1 billion in September, up from €13.3 billion in August. August's figure was revised up from €12.3 billion.

Current figures:

Name Price Change Change %

FTSE 100 6,356.02 +2.19 +0.03 %

DAX 10,952.71 -35.32 -0.32 %

CAC 40 4,956.6 -27.55 -0.55 %

-

11:54

St. Louis Fed President James Bullard: the risk of the slowdown in China and other concerns over the global economy, which led to the delay of the Fed’s interest rate hike in September, almost dissipated

St. Louis Fed President James Bullard said on Friday that the risk of the slowdown in China and other concerns over the global economy, which led to the delay of the Fed's interest rate hike in September, almost dissipated.

"The probability of a hard landing in China is no higher today than it was earlier this year," he noted.

Regarding the U.S. economy, Bullard said that U.S. labour markets have largely normalized, and it is likely that the inflation will return to 2% target when oil prices will stabilise.

-

11:46

Sentix investor confidence index for the Eurozone is up to 15.1 in November

Market research group Sentix released its investor confidence index for the Eurozone on Monday. The index climbed to 15.1 in November from 11.7 in October. It was the lowest level since February.

A reading above 0.0 indicates optimism, below indicates pessimism.

"Reason for rising economic expectations is gaining confidence in Asian markets," Sentix said in its statement.

The current conditions index rose to 16.0 in November from 13.0 in October.

The expectations index jumped to 14.3 in November from 10.5 in October from 12.3 in September.

German investor confidence index increased to 20.1 from 17.8.

-

11:37

European Central Bank Governing Council member Ardo Hansson: there is no need for further stimulus measures

The European Central Bank (ECB) Governing Council member Ardo Hansson said in an interview with Bloomberg on Friday that there is no need for further stimulus measures.

"I would see even less reason to make changes now," he said.

-

11:35

European Central Bank Executive Board member Peter Praet: the central bank will run its asset-buying programme until the Eurozone reaches sustained adjustment in the path of inflation

The European Central Bank (ECB) Executive Board member Peter Praet said on Friday that the central bank will run its asset-buying programme until the Eurozone reaches sustained adjustment in the path of inflation.

The ECB President Mario Draghi said that the ECB will review the volume of its asset-buying programme at its December monetary policy meeting.

-

09:26

Germany’s manufacturing turnover declines by 1.1% in September

Destatis released its manufacturing turnover data for Germany on Monday. Manufacturing turnover declined on seasonally adjusted and on adjusted for working days basis by 1.1% in September, after a 1.0% fall in August. August's figure was revised down up a 1.3% decrease.

Meanwhile, domestic turnover decreased by 1.2% in September, while the business with foreign customers dropped 1.1%.

Sales to euro area countries rose 1.6% in September, while sales to other countries were down 2.9%.

On a yearly basis, manufacturing turnover in Germany was up on seasonally adjusted and on adjusted for working days basis by 0.7% in September.

-

09:15

Germany's seasonally adjusted trade surplus declines to €19.4 billion in September

Destatis released its trade data for Germany on Monday. Germany's seasonally adjusted trade surplus declined to €19.4 billion in September from 19.4 in August.

Exports rose 4.4% year-on-year in September, while imports climbed 3.9% year-on-year.

On a yearly basis, German exports increased at a seasonally and calendar-adjusted 2.6% in September, while imports rose by 3.6%.

Germany's current account surplus was at €25.1 billion in September, up from €13.3 billion in August. August's figure was revised up from €12.3 billion.

-

09:05

Chicago Federal Reserve Bank President Charles Evans: the Fed should delay the interest rate hike despite the strong U.S. labour market data

Chicago Federal Reserve Bank President Charles Evans said in an interview with CNBC on Friday that the Fed should delay the interest rate hike despite the strong U.S. labour market data until the inflation in the U.S. will be on the track to achieve the Fed's 2% target.

He noted that the strong U.S. labour market data in October was "very good news".

"We've indicated that conditions look like they could be ripe of an increase," Evans said.

-

08:55

U.S. unemployment rate falls to 5.0% in October, 271,000 jobs are added

The U.S. Labor Department released the labour market data on Friday. The U.S. economy added 271,000 jobs in October, exceeding expectations for a rise of 180,000 jobs, after a gain of 137,000 jobs in September. It was the largest increase since December 2014.

September's figure was revised down from a rise of 142,000 jobs.

The increase was mainly driven by a rise in the services sector. The services sector added 241,000 jobs in October, while the manufacturing sector added no jobs.

The strong U.S. dollar weighed on the manufacturing sector.

Professional and business services sector added 78,000 jobs in October.

The U.S. unemployment rate declined to 5.0% in October from 5.1% in September. It was the lowest level since April 2008.

Analysts had expected the unemployment rate to remain unchanged at 5.1%.

Average hourly earnings climbed 0.4% in October, beating forecasts of a 0.2% gain, after a flat reading in September.

The labour-force participation rate remained unchanged at 62.4% in October. It was the lowest level since October 1977.

These figures indicate that the interest rate by the Fed in December is likely if November's labour market data will be strong enough and there will be no surprises.

-

07:06

Global Stocks: U.S. stock indices posted mixed results on Friday but rose over the week

U.S. stock indices mostly climbed on Friday amid a strong jobs report.

The Dow Jones Industrial Average rose 46.90 points, or 0.3%, to 17,910.33 (+1.4% over the week). The S&P 500 edged down 0.73 points, or 0.03%, to 2,099.20 (+0.95% over the week). The Nasdaq Composite climbed 19.38 points, or 0.4%, to 5,147.12 (+1.9% over the week).

The Labor Department reported the U.S. economy exceeded expectations for 180,000 jobs and generated 271,000 jobs in October, the biggest monthly gain this year, while the unemployment rate fell to 5% from 5.1%. Hourly wages rose 9 cents or 2.5% y/y at the fastest year-over-year pace since 2009.

This morning in Asia Hong Kong Hang Seng climbed 0.12%, or 27.58, to 22,894.91. China Shanghai Composite Index gained 1.63%, or 58.39, to 3.648.42. The Nikkei 225 rose 1.94%, or 372.90, to 19,638.5.

Asian indices rose amid optimistic employment data from the U.S. Japanese stocks rose amid a weaker yen, which is favorable for exporters.

-

03:35

Nikkei 225 19,603.29 +337.69 +1.75 %, Hang Seng 22,850.99 -16.34 -0.07 %, Shanghai Composite 3,625.72 +35.69 +0.99 %

-

00:43

Stocks. Daily history for Sep Nov 6’2015:

(index / closing price / change items /% change)

Nikkei 225 19,265.6 +149.19 +0.78 %

Hang Seng 22,867.33 -183.71 -0.80 %

Shanghai Composite 3,590.03 +67.21 +1.91 %

FTSE 100 6,353.83 -11.07 -0.17 %

CAC 40 4,984.15 +4.11 +0.08 %

Xetra DAX 10,988.03 +100.29 +0.92 %

S&P 500 2,099.2 -0.73 -0.03 %

NASDAQ Composite 5,147.12 +19.38 +0.38 %

Dow Jones 17,910.33 +46.90 +0.26 %

-