Noticias del mercado

-

20:20

American focus: the US dollar moderately lower against major currencies

The US dollar was moderately lower against other major currencies in subdued trade as investors take profits after a rally on Friday to seven-month high on positive US statistics on employment in October.

Dollar fully appreciated after the US Labor Department reported on Friday that the US economy added 271,000 jobs last month against the expected 182,000, the highest since December. The unemployment rate fell to 7.5-year low of 5.0%.

Reliable figures increased the chances that the Fed will raise interest rates at the December meeting, with the result that the dollar will become more attractive for investors looking for profit.

Data on jobs came after the Fed chief Janet Yellen said that the economy is showing good momentum and that the rise of interest rates in December, is a "real possibility" if it will save the vector of development.

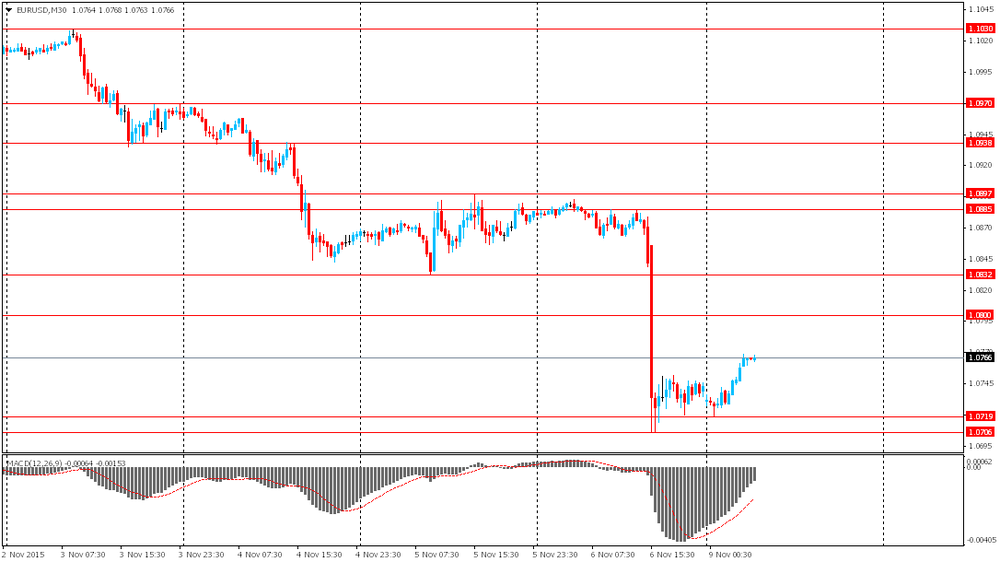

Euro moved away from session highs after Livesquawk, quoting informed sources, reported that the ECB is now considering the option of reducing the interest rates on deposits in December, contrary to most forecasts suggesting an increase in QE.

According to the source, currently an emerging consensus on the issue of lowering rates, and the debate is around the size of this reduction. Markets expect the ECB to increase the size of the program QE (now it is 60 billion euros per month).

Reduced rates on deposits would make it more accessible to a greater number of bond purchases under the program of QE.

Markets were assessed comments by the Fed Rosengren, who commented on the latest data and prospects for December's increase.

The president of the Federal Reserve Bank of Boston Eric Rosengren said on Monday that the improvement in the US economy may increase the likelihood of raising key interest rates at the next meeting of the Federal Reserve in December.

"December may be appropriate time to raise rates if the economic situation will correspond to forecasts", - stated in the materials prepared for the speech Rosengren on Monday before the Chamber of Commerce in Portsmouth.

Rosengren pointed to the wording of the Fed statement after a meeting in October, which made it clear that interest rates in December may be increased if Fed officials see the progress in achieving the objectives of the central bank to achieve price stability and employment. Rosengren added that he generally supports the decision.

"I want to emphasize that recent economic data were positive and reflect real improvement in the economy", - said in the text of the speech.

Previously, support for the euro have data for the euro area and Germany. As it became known today, foreign trade surplus in Germany in September rose to 22.9 billion euros. Thus the index jumped in August against 1.5. Exports from Germany amounted to 105.9 billion euros, 4.4% more than in September 2014. With the exception of seasonal and calendar factors exports compared with the previous month increased by 2.6%. Imports increased by 3.9% compared to the same period in 2014 - up to 83 billion euros. With the exception of seasonal and calendar factors imports in September compared to August increased by 3.6%. Economists had expected a surplus of 20 billion euros.

Meanwhile, the Sentix survey results showed that the mood among investors in the euro zone improved considerably in November, exceeding in this case, despite a migration crisis in Europe. According to the index of investor confidence rose in November to a level of 15.1 points compared to 11.7 points in October. The latter value was the highest for the last three months. Economists had expected the index to improve to only 12.7 points. It also became known that the index of current conditions rose in November 16 from 13 in the previous month. Likewise, the expectations index rose to 14.3 points from 10.5 points in October.

-

16:46

Bank of France’s new governor and European Central Bank (ECB) Governing Council member Francois Villeroy de Galhau: the inflation expectations in the Eurozone is still too low and uncertain

Bank of France's new governor and European Central Bank (ECB) Governing Council member Francois Villeroy de Galhau said in an interview with the German newspaper Handelsblatt that the inflation expectations in the Eurozone is still too low and uncertain since summer as concerns over the

"The (inflation) expectations are still too low, and uncertain since the summer," he noted.

Galhau pointed that the ECB will add further stimulus measures if needed.

"There are still margins to make monetary policy more effective -- the instruments are available," he said.

-

16:27

Chairman of the state-owned Saudi Arabian Oil Company Khalid al-Falih: the country will not cut its oil production

Chairman of the state-owned Saudi Arabian Oil Company (Saudi Aramco), Khalid al-Falih, said in an interview with the Financial Times that the country will not cut its oil production.

"The only thing to do now is to let the market do its job. There have been no conversations here that say we should cut production now that we've seen the pain," he said.

-

16:12

European Central Bank purchases €12.93 billion of government and agency bonds last week

The European Central Bank (ECB) purchased €12.93 billion of government and agency bonds under its quantitative-easing program last week.

The European Central Bank's (ECB) President Mario Draghi said at a press conference in October that the value of the ECB's asset-buying programme will be discussed at the monetary policy meeting in December.

ECB'S asset buying programme is intended to run to September 2016.

The ECB bought €1.38 billion of covered bonds, and €176 million of asset-backed securities.

-

16:01

U.S.: Labor Market Conditions Index, October 1.6

-

15:10

OECD’s leading composite leading indicator declines to 99.8 in September

The Organization for Economic Cooperation and Development (OECD) released its leading indicators on Monday. The composite leading indicator decreased to 99.8 in September from 99.9 in August.

The leading indicators of Canada, France and Italy rose in September, while the indicators of China, the U.S., Japan, Germany and the U.K. declined.

Eurozone's leading indicator remained unchanged in September.

-

15:05

Labour cash earnings in Japan rise 0.6% in September

Japan's Ministry of Health, Labour and Welfare released its labour cash earnings data on Monday. Labour cash earnings in Japan rose at an annual rate of 0.6% in September, after a 0.4% rise in August.

August's figure was revised down from a 0.5% gain.

Summer bonuses in the June-August period slid 2.8% year-on-year. It was the biggest decline since 2009.

Total real wages climbed 0.5% in September, after a 0.1% gain in August.

-

14:50

Option expiries for today's 10:00 ET NY cut

USD/JPY 122.00 (USD 305m)

EUR/USD 1.0800 (EUR 909m)

GBP/USD 1.5400 (GBP 478m)

USD/CHF 0.9925 (USD 525m)

USD/CAD 1.3200 (USD 610m) 1.3300 (825m)

AUD/USD 0.7000 ( AUD 391m)

NZD/USD 0.6600 (NZD 915m)

-

14:34

OECD downgrades its global growth outlook

The Organization for Economic Cooperation and Development (OECD) released its growth forecast on Monday. The OECD downgraded its global growth outlook.

"The slowdown in global trade and the continuing weakness in investment are deeply concerning. Robust trade and investment and stronger global growth should go hand in hand," the OECD Secretary-General Angel Gurria.

The OECD expect the global economy to grow at 2.9% in 2015, down from the previous estimate of 3.0%, and at 3.3% in 2016, down from the previous estimate of 3.6%.

The global economy is expected to expand 3.6% in 2017.

The U.S. economy is expected to grow at 2.4% in 2015, 2.5% in 2016, down from the previous estimate of 2.6%, and 2.4% in 2017.

Japan's economy is expected to grow at 0.6% in 2015 and at 1.0% in 2016, down from its previous estimate of 1.2%, and 0.5% for 2017.

Eurozone's forecasts were downgraded to 1.5% in 2015 from the previous estimate of 1.6% and to 1.8% in 2016 from the previous estimate of 1.9%. Eurozone's economy is expected to expand 1.9%.

China is expected to expand at 6.8% in 2015, up from the previous estimate of 6.7%. Growth forecast for 2016 remained unchanged at 6.5%, while 2017 forecast was 6.2%.

-

14:22

Housing starts in Canada declines to a seasonally adjusted annualized rate of 198,065 units in October

The Canada Mortgage and Housing Corporation (CMHC) released housing starts data on Monday. Housing starts in Canada fell to a seasonally adjusted annualized rate of 198,065 units in October from a revised reading of 231,304 units in September.

Housing starts were driven by a rise in new condominium and rental starts.

"Rental starts across urban centres are poised to reach their highest level since 1992 due to low vacancy rates in recent years," the CMHC's Chief Economist Bob Dugan said.

-

14:14

Canada: Housing Starts, October 198.1 (forecast 200)

-

14:00

Foreign exchange market. European session: the euro traded higher against the U.S. dollar on the positive economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia ANZ Job Advertisements (MoM) October 3.8% Revised From 3.9% 0.4%

01:30 Japan Labor Cash Earnings, YoY September 0.4% Revised From 0.5% 0.6%

07:00 Germany Current Account September 13.3 Revised From 12.3 25.1

07:00 Germany Trade Balance September 15.3 Revised From 15.4 22.9

09:30 Eurozone Sentix Investor Confidence November 11.7 15.1

13:15 Canada Housing Starts October 230.7 200

The U.S. dollar traded mixed against the most major currencies in the absence of any U.S. major economic reports.

The greenback declined on profit taking after the Friday's significant rise on the U.S. labour market.

The euro traded higher against the U.S. dollar on the positive economic data from the Eurozone. Market research group Sentix released its investor confidence index for the Eurozone on Monday. The index climbed to 15.1 in November from 11.7 in October. It was the lowest level since February.

A reading above 0.0 indicates optimism, below indicates pessimism.

"Reason for rising economic expectations is gaining confidence in Asian markets," Sentix said in its statement.

Destatis released its trade data for Germany on Monday. Germany's seasonally adjusted trade surplus declined to €19.4 billion in September from 19.4 in August.

Exports rose 4.4% year-on-year in September, while imports climbed 3.9% year-on-year.

On a yearly basis, German exports increased at a seasonally and calendar-adjusted 2.6% in September, while imports rose by 3.6%.

Germany's current account surplus was at €25.1 billion in September, up from €13.3 billion in August. August's figure was revised up from €12.3 billion.

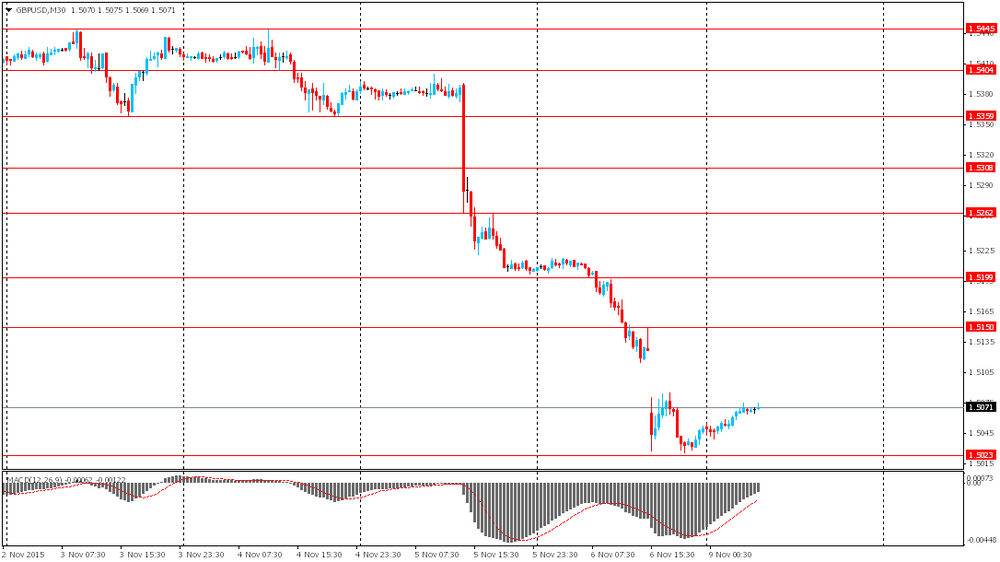

The British pound traded higher against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded higher against the U.S. dollar ahead the Canadian housing starts data. Housing starts in Canada are expected to drop 200,000 in October from 230,700 in September.

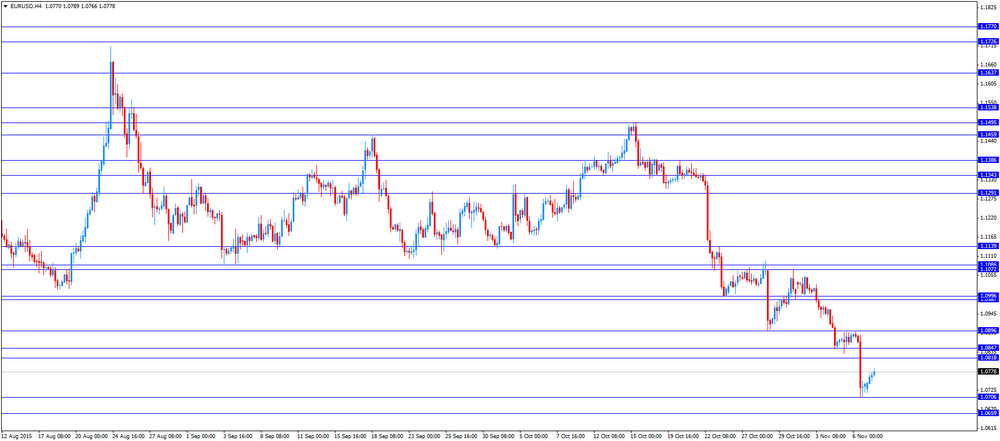

EUR/USD: the currency pair rose to $1.0789

GBP/USD: the currency pair was up to $1.5114

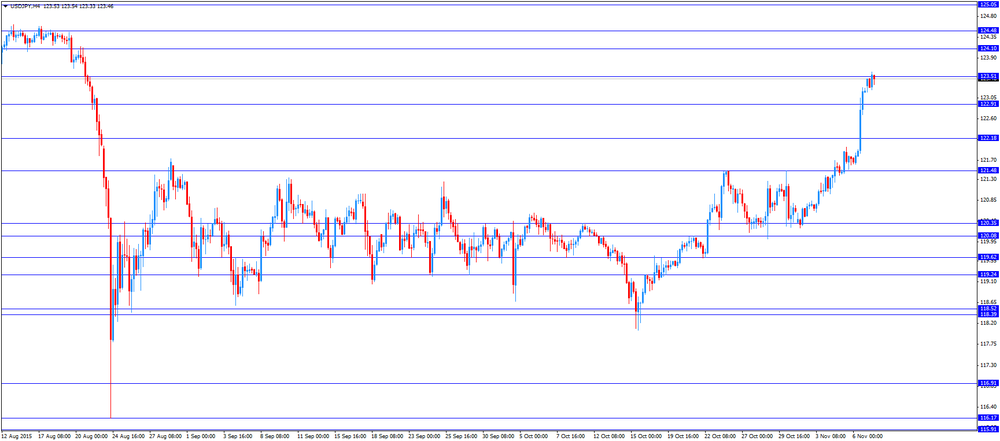

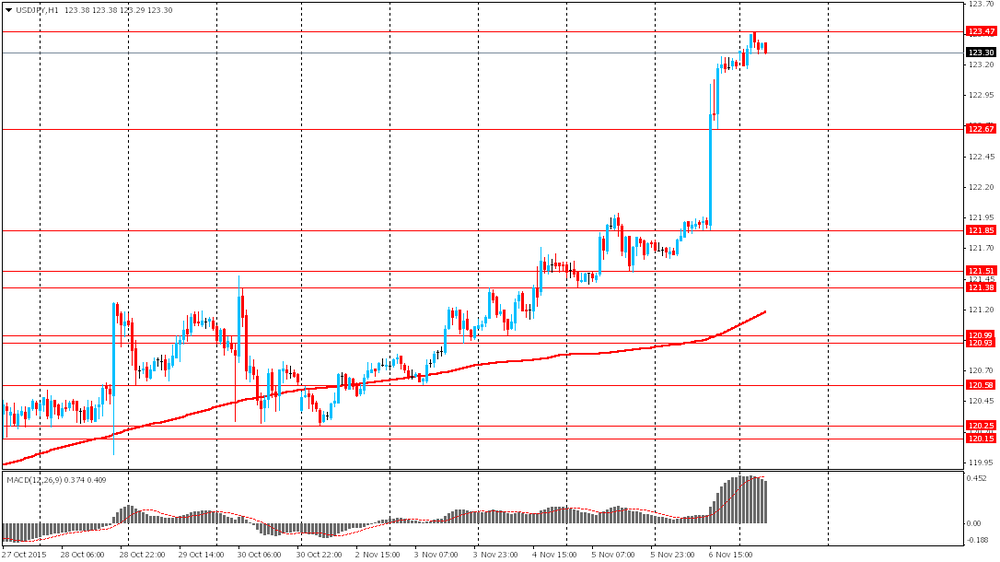

USD/JPY: the currency pair increased to Y123.60

The most important news that are expected (GMT0):

13:15 Canada Housing Starts October 230.7 200

15:00 U.S. Labor Market Conditions Index October 0

23:50 Japan Current Account, bln September 1653 2235.2

-

13:45

Orders

EUR/USD

Offers 1.0780-85 1.0800 1.0820 1.0845-50 1.0885 1.0900 1.0925-30 1.0960 1.0980 1.1000

Bids 1.0745-50 1.0725-30 1.0700 1.0685 1.0665 1.0650 1.0630 1.0600

GBP/USD

Offers 1.5085 1.5100 1.5120 1.5140 1.5175-80 1.5200 1.5220 1.5245-50

Bids 1.5060 1.5045 1.5025-30 1.5000 1.4985 1.4965 1.4950 1.4930 1.4900

EUR/GBP

Offers0.7150 0.7170 0.7185 0.7200 0.7225-30 0.7250 0.7275 0.7300

Bids 0.7130-35 0.7100 0.7085 0.7050 0.7030-35 0.7020 0.7000

EUR/JPY

Offers 133.00 133.20 133.50-60 133.75-80 134.00 134.30 134.50

Bids 132.60 132.25-30 132.00 131.80 131.50 131.30 131.00

USD/JPY

Offers 123.50 123.75-80 124.00 124.30 124.50 124.75 125.00

Bids 123.20-25 123.00 122.80 122.50 122.25 122.00 121.80 121.50-60

AUD/USD

Offers 0.7075-80 0.7100 0.7125-30 0.7150 0.7180-85 0.7200 0.7220 0.7250

Bids 0.7035-40 0.7020 0.7000 0.6985 0.6965 0.6950 0.6930 0.6900

-

13:09

Greek industrial production declines 1.8% in September

The Hellenic Statistical Authority released its preliminary industrial production data for Greece on Monday. Greek industrial production fell 1.8% in September.

On a yearly basis, industrial production in Greece increased at an adjusted rate of 2.8% in September, after a 4.1% rise in August. August's figure was revised down from a 4.5% gain.

Production in the manufacturing sector rose at an annual rate of 2.6% in September, output in the mining and quarrying sector slid 4.4%, while electricity production jumped by 6.3%.

-

12:55

Building permits in Canada drops 6.7% in September

Statistics Canada released housing market data on Friday. Building permits in Canada fell 6.7% in September, missing expectations for a 1.3% rise, after a 3.6% drop in August. August's figure was revised up from a 3.7% decrease.

The decline was mainly driven by lower construction intentions for residential buildings and commercial structures in Ontario.

Building permits for non-residential construction gained 1.6% in September, while permits in the residential sector slid 11.6%.

-

12:44

Canada’s unemployment rate falls to 7.0%in October

Statistics Canada released the labour market data on Friday. Canada's unemployment rate fell to 7.0% in October from 7.1% in September. Analysts had expected the unemployment rate to remain unchanged at 7.1%.

The increase was driven by higher labour participation. The labour participation rate increased slightly to 66.0% in October from 65.9% in September.

The number of employed people climbed by 44,400 jobs in October, beating expectations for a rise of 10,000 jobs, after a 12,100 increase in September.

The increase was driven by a rise in full-time work. Full-time employment was up by 14,587 in October, while part-time employment increased by 3,436 jobs.

The Bank of Canada monitors closely the labour participation rate.

-

12:23

Bank of France expects the country’s economy to expand at 0.4% in the fourth quarter

The Bank of France released its gross domestic product (GDP) forecasts for France on Monday. French economy is expected to expand at 0.4% in the fourth quarter.

The economy is expected to grow 0.2% in the third quarter.

The manufacturing business confidence index increased to 99 in October 98 in September, driven by rises in the automobile and chemical sectors. Services companies expect an increase in activity in November.

The services business sentiment index rose to 98 in October from 97 in September. Services companies expect a rise in activity in November.

The construction business sentiment index was up to 96 in October from 95 in September.

-

12:10

NIESR’s gross domestic product rises by 0.6% in three months to October

The National Institute of Economic and Social Research (NIESR) released its estimate of gross domestic product (GDP) for the U.K. on Friday. The GDP estimate rose by 0.6% in three months to October, in line with forecasts, after a 0.5% growth in three months to September.

"This implies that reasonable economic growth has continued into the fourth quarter of 2015," the NIESR said.

-

12:05

China's trade surplus climbs to $61.64 billion in October

The Chinese Customs Office released its trade data on Sunday. China's trade surplus rose to $61.64 billion in October from $60.34 billion in September.

Exports fell at an annual rate of 6.9% in October, while imports slid at an annual rate of 18.8%, the twelfth consecutive decline.

-

11:54

St. Louis Fed President James Bullard: the risk of the slowdown in China and other concerns over the global economy, which led to the delay of the Fed’s interest rate hike in September, almost dissipated

St. Louis Fed President James Bullard said on Friday that the risk of the slowdown in China and other concerns over the global economy, which led to the delay of the Fed's interest rate hike in September, almost dissipated.

"The probability of a hard landing in China is no higher today than it was earlier this year," he noted.

Regarding the U.S. economy, Bullard said that U.S. labour markets have largely normalized, and it is likely that the inflation will return to 2% target when oil prices will stabilise.

-

11:46

Sentix investor confidence index for the Eurozone is up to 15.1 in November

Market research group Sentix released its investor confidence index for the Eurozone on Monday. The index climbed to 15.1 in November from 11.7 in October. It was the lowest level since February.

A reading above 0.0 indicates optimism, below indicates pessimism.

"Reason for rising economic expectations is gaining confidence in Asian markets," Sentix said in its statement.

The current conditions index rose to 16.0 in November from 13.0 in October.

The expectations index jumped to 14.3 in November from 10.5 in October from 12.3 in September.

German investor confidence index increased to 20.1 from 17.8.

-

11:37

European Central Bank Governing Council member Ardo Hansson: there is no need for further stimulus measures

The European Central Bank (ECB) Governing Council member Ardo Hansson said in an interview with Bloomberg on Friday that there is no need for further stimulus measures.

"I would see even less reason to make changes now," he said.

-

11:35

European Central Bank Executive Board member Peter Praet: the central bank will run its asset-buying programme until the Eurozone reaches sustained adjustment in the path of inflation

The European Central Bank (ECB) Executive Board member Peter Praet said on Friday that the central bank will run its asset-buying programme until the Eurozone reaches sustained adjustment in the path of inflation.

The ECB President Mario Draghi said that the ECB will review the volume of its asset-buying programme at its December monetary policy meeting.

-

10:08

Option expiries for today's 10:00 ET NY cut

USD/JPY 122.00 (USD 305m)

EUR/USD 1.0800 (EUR 909m)

GBP/USD 1.5400 (GBP 478m)

USD/CHF 0.9925 (USD 525m)

USD/CAD 1.3200 (USD 610m) 1.3300 (825m)

AUD/USD 0.7000 ( AUD 391m)

NZD/USD 0.6600 (NZD 915m)

-

09:26

Germany’s manufacturing turnover declines by 1.1% in September

Destatis released its manufacturing turnover data for Germany on Monday. Manufacturing turnover declined on seasonally adjusted and on adjusted for working days basis by 1.1% in September, after a 1.0% fall in August. August's figure was revised down up a 1.3% decrease.

Meanwhile, domestic turnover decreased by 1.2% in September, while the business with foreign customers dropped 1.1%.

Sales to euro area countries rose 1.6% in September, while sales to other countries were down 2.9%.

On a yearly basis, manufacturing turnover in Germany was up on seasonally adjusted and on adjusted for working days basis by 0.7% in September.

-

09:15

Germany's seasonally adjusted trade surplus declines to €19.4 billion in September

Destatis released its trade data for Germany on Monday. Germany's seasonally adjusted trade surplus declined to €19.4 billion in September from 19.4 in August.

Exports rose 4.4% year-on-year in September, while imports climbed 3.9% year-on-year.

On a yearly basis, German exports increased at a seasonally and calendar-adjusted 2.6% in September, while imports rose by 3.6%.

Germany's current account surplus was at €25.1 billion in September, up from €13.3 billion in August. August's figure was revised up from €12.3 billion.

-

09:05

Chicago Federal Reserve Bank President Charles Evans: the Fed should delay the interest rate hike despite the strong U.S. labour market data

Chicago Federal Reserve Bank President Charles Evans said in an interview with CNBC on Friday that the Fed should delay the interest rate hike despite the strong U.S. labour market data until the inflation in the U.S. will be on the track to achieve the Fed's 2% target.

He noted that the strong U.S. labour market data in October was "very good news".

"We've indicated that conditions look like they could be ripe of an increase," Evans said.

-

08:55

U.S. unemployment rate falls to 5.0% in October, 271,000 jobs are added

The U.S. Labor Department released the labour market data on Friday. The U.S. economy added 271,000 jobs in October, exceeding expectations for a rise of 180,000 jobs, after a gain of 137,000 jobs in September. It was the largest increase since December 2014.

September's figure was revised down from a rise of 142,000 jobs.

The increase was mainly driven by a rise in the services sector. The services sector added 241,000 jobs in October, while the manufacturing sector added no jobs.

The strong U.S. dollar weighed on the manufacturing sector.

Professional and business services sector added 78,000 jobs in October.

The U.S. unemployment rate declined to 5.0% in October from 5.1% in September. It was the lowest level since April 2008.

Analysts had expected the unemployment rate to remain unchanged at 5.1%.

Average hourly earnings climbed 0.4% in October, beating forecasts of a 0.2% gain, after a flat reading in September.

The labour-force participation rate remained unchanged at 62.4% in October. It was the lowest level since October 1977.

These figures indicate that the interest rate by the Fed in December is likely if November's labour market data will be strong enough and there will be no surprises.

-

08:00

Germany: Current Account , September 35.1

-

08:00

Germany: Trade Balance, September 19.4

-

07:48

Foreign exchange market. Asian session: the euro rose slightly

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia ANZ Job Advertisements (MoM) October 3.8% Revised From 3.9% 0.4%

01:30 Japan Labor Cash Earnings, YoY September 0.4% Revised From 0.5% 0.6%

The euro slightly rebounded after Friday's fall, which was caused by U.S. employment data. It's worth to remind that the U.S. economy exceeded expectations for 180,000 jobs and generated 271,000 jobs outside the farming sector in October, the biggest monthly gain this year, while the unemployment rate fell to 5% from 5.1%. Hourly wages rose 9 cents or 2.5% y/y at the fastest year-over-year pace since 2009.

The yen declined despite favorable data on Japanese wages. Labor Cash Earnings rose by 0.6% in September compared to a 0.4% rise in September 2014. Higher earnings stimulate consumption making earnings an inflation factor.

The New Zealand dollar rose despite Fonterra chief executive officer Theo Spierings' words that the company may lose its market share in China. Dairy products are key exports for New Zealand, that's why concerns over Fonterra may weigh on the NZD.

EUR/USD: the pair rose to $1.0770 in Asian trade

USD/JPY: the pair traded within Y123.15-45

GBP/USD: the pair rose to $1.5075

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:00 Germany Current Account September 12.3

07:00 Germany Trade Balance September 15.3

09:30 Eurozone Sentix Investor Confidence November 11.7

13:15 Canada Housing Starts October 230.7 200

15:00 U.S. Labor Market Conditions Index October 0

23:50 Japan Current Account, bln September 1653 2235.2

-

07:05

Options levels on monday, November 9, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.0978 (2435)

$1.0917 (1677)

$1.0868 (378)

Price at time of writing this review: $1.0766

Support levels (open interest**, contracts):

$1.0700 (5555)

$1.0672 (4898)

$1.0633 (5953)

Comments:

- Overall open interest on the CALL options with the expiration date December, 4 is 78440 contracts, with the maximum number of contracts with strike price $1,1200 (5413);

- Overall open interest on the PUT options with the expiration date December, 4 is 114161 contracts, with the maximum number of contracts with strike price $1,0700 (8176);

- The ratio of PUT/CALL was 1.46 versus 0.93 from the previous trading day according to data from November, 6

GBP/USD

Resistance levels (open interest**, contracts)

$1.5303 (1502)

$1.5206 (860)

$1.5109 (500)

Price at time of writing this review: $1.5076

Support levels (open interest**, contracts):

$1.4989 (2307)

$1.4893 (1311)

$1.4796 (1170)

Comments:

- Overall open interest on the CALL options with the expiration date December, 4 is 22845 contracts, with the maximum number of contracts with strike price $1,5600 (3634);

- Overall open interest on the PUT options with the expiration date December, 4 is 24919 contracts, with the maximum number of contracts with strike price $1,5000 (2307);

- The ratio of PUT/CALL was 1.09 versus 0.98 from the previous trading day according to data from November, 6

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

02:31

Japan: Labor Cash Earnings, YoY, September 0.6%

-

01:30

Australia: ANZ Job Advertisements (MoM), October 0.4%

-

00:43

Currencies. Daily history for Nov 6’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0743 -1,30%

GBP/USD $1,5050 -1,04%

USD/CHF Chf1,0057 +1,06%

USD/JPY Y123,19 +1,18%

EUR/JPY Y132,35 -0,11%

GBP/JPY Y185,4 +0,16%

AUD/USD $0,7046 -1,35%

NZD/USD $0,6522 -1,35%

USD/CAD C$1,3293 +0,94%

-

00:01

Schedule for today, Monday, Nov 9’2015:

(time / country / index / period / previous value / forecast)

00:30 Australia ANZ Job Advertisements (MoM) October 3.9%

01:30 Japan Labor Cash Earnings, YoY September 0.5%

07:00 Germany Current Account September 12.3

07:00 Germany Trade Balance September 15.3

09:30 Eurozone Sentix Investor Confidence November 11.7

13:15 Canada Housing Starts October 230.7 200

15:00 U.S. Labor Market Conditions Index October 0

23:50 Japan Current Account, bln September 1653 2235.2

-