Noticias del mercado

-

17:48

Oil prices climb as market participants eyed the International Energy Agency’s (IEA) World Energy Outlook

Oil prices rose as market participants eyed the International Energy Agency's (IEA) World Energy Outlook. The IEA said on Tuesday that oil prices will reach $80 a barrel by 2020.

The IEA expects investment in oil to drop more than 20% in 2015, and is expected to decline in 2016.

IEA Executive Director Fatih Birol said in an interview with CNBC on Tuesday that the oil production in Iraq, Brazil, Canada and Russia will slow down.

Market participants are awaiting the release of U.S. crude oil inventories data. The American Petroleum Institute (API) is scheduled to release its U.S. oil inventories data later in the day, and U.S. oil inventories data from the U.S. Energy Information Administration is expected on Thursday.

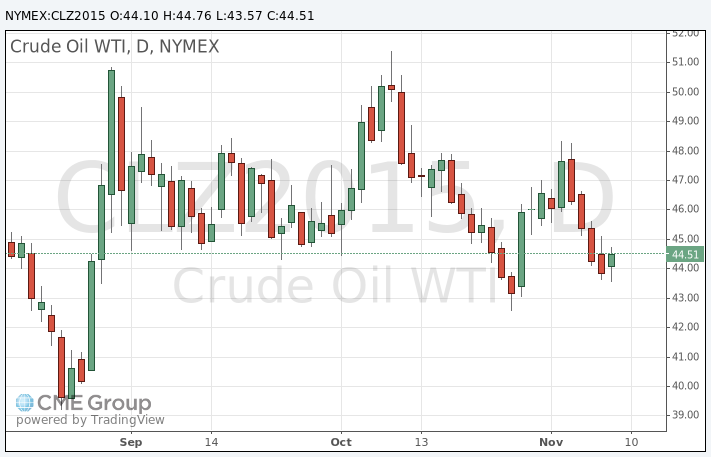

WTI crude oil for December delivery rose to $44.76 a barrel on the New York Mercantile Exchange.

Brent crude oil for December increased to $47.38 a barrel on ICE Futures Europe.

-

17:26

Gold price falls toward 3-month low

Gold price fell on speculation that the Fed will start raising its interest rates in December. Friday's labour market data from the U.S. added to this speculation. The U.S. economy added 271,000 jobs in October, exceeding expectations for a rise of 180,000 jobs, after a gain of 137,000 jobs in September. It was the largest increase since December 2014. The U.S. unemployment rate declined to 5.0% in October from 5.1% in September. It was the lowest level since April 2008.

Market participants are awaiting the release of the U.S. retail sales and producer price index data on Friday.

December futures for gold on the COMEX today declined to 1084.00 dollars per ounce.

-

13:51

International Energy Agency (IEA): oil prices will reach $80 a barrel by 2020

The International Energy Agency (IEA) released its World Energy Outlook on Tuesday. The agency said that oil prices will reach $80 a barrel by 2020.

The IEA expects investment in oil to drop more than 20% in 2015, and is expected to decline in 2016.

IEA Executive Director Fatih Birol said in an interview with CNBC on Tuesday that the oil production in Iraq, Brazil, Canada and Russia will slow down.

-

12:58

OPEC Secretary-General Abdullah al-Badri: the oil market will be balanced in 2016

OPEC Secretary-General Abdullah al-Badri said on Tuesday that the oil market will be balanced in 2016.

"The expectation is that the market will return to more balance in 2016. We see global oil demand maintaining its recent healthy growth. We see less non-OPEC supply. And we see an increase in the demand for OPEC crude," he said.

Next OPEC meeting is scheduled to be on December 04.

-

10:50

Chinese consumer price index rises at annual rate of 1.3% in October

The Chinese National Bureau of Statistics released its consumer and producer price inflation data for China on Tuesday. The Chinese consumer price index (CPI) rose at annual rate of 1.3% in October, missing expectations for a 1.5% increase, after a 1.6% gain in September.

Food prices rose at an annual rate of 1.9% in October, while non-food prices increased 0.9%.

On a monthly basis, consumer price inflation decreased 0.3% in October, after a 0.1% rise in September.

The Chinese producer price index (PPI) dropped 5.9% in October, missing expectations for a 5.8% fall, after a 5.9% decline in September.

-

10:27

Oman's Oil Minister Mohammed Bin Hamad Al Rumhy: OPEC’s oil production levels are “irresponsible”

Oman's Oil Minister Mohammed Bin Hamad Al Rumhy said on Monday that OPEC's oil production levels are "irresponsible".

"This is a commodity that if you have one million barrels a day extra in the market, you just destroy the market. We are hurting, we are feeling the pain and we're taking it like a God-driven crisis. Sorry I don't buy this, I think we've created it ourselves," he said.

Oman isn't a member of OPEC.

-

07:59

Oil prices slightly climbed but remained under pressure

West Texas Intermediate futures for December delivery climbed to $44.13 (+0.59%), while Brent crude advanced to $47.32 (+0.28%) after yesterday's declines, but concerns over ample supplies and weak global economic growth continue weighing on prices.

The latest data have shown that China's inflation slowed down to 1.3% y/y in October from 1.6% y/y in September, while the Organization for Economic Co-operation and Development cut its global economic growth forecasts to 2.9% from 3% and to 3.3% from 3.6% for 2015 and 2016 respectively.

In an interview published in The National executive director of the International Energy Agency Fatih Birol expressed his concerns over declines in investment in the oil sector. He said that "this year oil investment declined by about 20% compared to previous years" and "it is expected to decline by the same amount next year."

Birol also noted a substantial change in China's demand growth outlook. "Energy demand growth and economic growth had been rising in parallel but we expect to see a divorce in those trajectories, mainly because of efficiency improvements in the energy sector and the changing nature of the Chinese economy," he said.

-

07:13

Gold near three-month low

Gold is currently near a three-month low at $1,091.20 (+0.28%) amid an imminent Fed's rate hike.

A stronger-than-expected U.S. jobs report, which was released on Friday, added to the speculation that the Federal Open Market Committee could conduct the first rate hike in nearly a decade in December. Higher rates would harm demand for the non-interest-bearing precious metal.

"We may see occasional spurts of buying, but gold remains on a downtrend," an analyst at Huatai Great Wall Futures Co. said.

-

00:35

Commodities. Daily history for Nov 9’2015:

(raw materials / closing price /% change)

Oil 44.11 +0.55%

Gold 1,091.40 +0.30%

-