Noticias del mercado

-

17:47

Oil prices slide on the U.S. crude oil inventories data

Oil prices dropped on the U.S. crude oil inventories data. The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Thursday. U.S. crude inventories increased by 4.22 million barrels to 487.03 million in the week to November 06. It was the seventh consecutive increase.

Analysts had expected U.S. crude oil inventories to rise by 1.7 million barrels.

Gasoline inventories decreased by 2.1 million barrels, according to the EIA.

Crude stocks at the Cushing, Oklahoma, climbed by 2.24 million barrels.

U.S. crude oil imports increased by 434,000 barrels per day.

Refineries in the U.S. were running at 89.5% of capacity, up from 88.7% the previous week.

The Organization of the Petroleum Exporting Countries (OPEC) released its monthly report on Thursday. OPEC said that oil output in October totalled 31.38 million barrels per day (bpd), down 256,000 bpd from September. It was the first fall since March.

WTI crude oil for December delivery dropped to $41.69 a barrel on the New York Mercantile Exchange.

Brent crude oil for December fell to $45.12 a barrel on ICE Futures Europe.

-

17:44

U.S. crude inventories climb by 4.22 million barrels to 487.03 million in the week to November 06

The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Thursday. U.S. crude inventories increased by 4.22 million barrels to 487.03 million in the week to November 06. It was the seventh consecutive increase.

Analysts had expected U.S. crude oil inventories to rise by 1.7 million barrels.

Gasoline inventories decreased by 2.1 million barrels, according to the EIA.

Crude stocks at the Cushing, Oklahoma, climbed by 2.24 million barrels.

U.S. crude oil imports increased by 434,000 barrels per day.

Refineries in the U.S. were running at 89.5% of capacity, up from 88.7% the previous week.

-

17:33

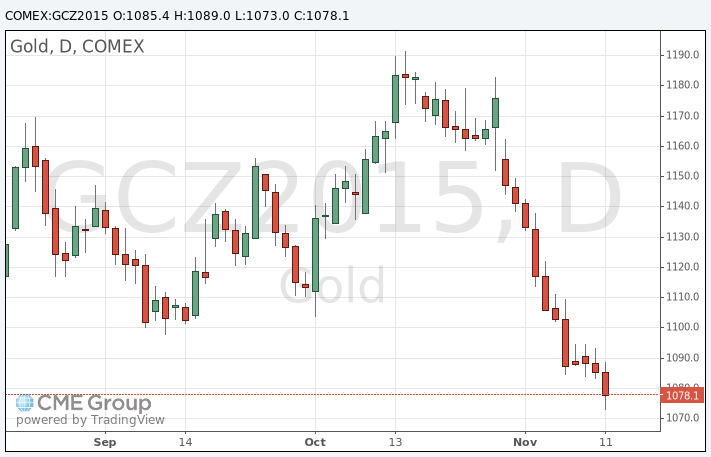

Gold price declines as market participants eye speeches by Fed officials

Gold price declined as market participants eyed speeches by Fed officials. St. Louis Fed President James Bullard said in a speech on Thursday that the Fed should start raising its interest rate as the Fed's targets are reached.

"During 2015, I have been an advocate of beginning to normalize the policy rate in the U.S. My arguments have focused on the idea that the U.S. economy is quite close to normal today based on an unemployment rate of 5 percent, which is essentially at the Committee's estimate of the long‐run rate, and inflation net of the 2014 oil price shock only slightly below the Committee's target," he said.

"My current policy views have not changed," Bullard added.

Chicago Fed President Charles Evans said in a speech on Thursday that he wants to be confident that inflation begins to pick up toward the Fed's target before to start raising interest rates.

"Before raising rates, I would like to have more confidence than I do today that inflation is indeed beginning to head higher. Given the current low level of core inflation, some evidence of true upward momentum in actual inflation is critical to this assessment," he said.

"I believe that it could well be the middle of next year before the headwinds from lower energy prices and the stronger dollar dissipate enough so that we begin to see some sustained upward movement in core inflation," Evans added.

December futures for gold on the COMEX today fell to 1073.00 dollars per ounce.

-

15:55

OPEC’s oil output declines in October

The Organization of the Petroleum Exporting Countries (OPEC) released its monthly report on Thursday. OPEC said that oil output in October totalled 31.38 million barrels per day (bpd), down 256,000 bpd from September. It was the first fall since March.

"The recent decline in oil prices has encouraged additional oil demand. It has also provided a challenging market environment for some higher-cost crude oil production, which has already shown a slowdown," OPEC said.

OPEC expects that non-OPEC members will cut their output by about 130,000 bpd next year, after a rise by 720,000 bpd this year.

OPEC's oil demand forecasts remained unchanged. OPEC expects that demand for its oil will rise by 1.2 million bpd in 2016 to average 30.8 million bpd.

-

14:39

Initial jobless claims remain unchanged at 276,000 in the week ending November 01

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending November 01 in the U.S. remained unchanged at 276,000.

Analysts had expected the initial jobless claims to decrease to 270,000.

Jobless claims remained below 300,000 the 36th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims increased by 5,000 to 2,174,000 in the week ended October 31.

-

14:27

Global demand for gold climbs 6% in the third quarter

The World Gold Council (WGC) released its report on Thursday. Global demand for gold increased 8% in the third quarter, after a 12% drop in the second quarter. The increase was mainly driven by higher demand for bars, coins and jewellery.

Demand for gold totalled 1,120.9 tons in the third quarter, up 8% from the same period in 2014.

Global demand for jewellery climbed by 6% in the third quarter to 631.9 tons, up from 594.1 tons a year ago. Jewellery makes up about 60% of global gold consumption.

According to the World Gold Council, annual gold demand is expected to be between 4,200 tons and 4,300 tons.

Demand in China in 2015 is expected to be 900-1,000 tons, while demand in India is expected to be 850-950 tons.

-

07:49

Oil prices rebounded but remained under pressure amid global oversupply

West Texas Intermediate futures for December delivery climbed to $43.19 (+0.61%), while Brent crude rebounded to $46.07 (+0.57%) after yesterday's declines, but fundamental remained unfavorable. Analysts say that crude oversupply might continue next year. Market participants are waiting for the U.S. Energy Information Administration to report on U.S. crude stockpiles later today. Earlier this week the American Petroleum Institute said U.S. stockpiles likely rose by 6.3 million barrels in the week ending November 6.

The Organization of the Petroleum Exporting Countries (OPEC) will hold a policy meeting next month.

-

07:47

Gold near three-month low

Gold is currently at $1,087.50 (+0.24%) near a three-month low amid an imminent Fed's rate hike.

Physical demand picked up. According to the World Gold Council, total bar and coin demand advanced by 33% during the third quarter to 295.7 tonnes, led by a 70% year-on-year growth in Chinese investment. Jewelry demand rose by 6% to 631.9 tonnes (the highest level for Q3 since 2008).

Meanwhile global gold supply rose 1% on an annualized basis to 1,100.1 tonnes. Mine supply rose 3% to 847.8 tonnes, while recycled gold fell 6% to 252.3 tonnes.

-