Noticias del mercado

-

21:00

DJIA 17740.50 205.18 1.17%, NASDAQ 4787.86 70.19 1.49%, S&P 500 2070.26 23.65 1.16%

-

18:00

European stocks closed: FTSE 6151.40 12.90 0.21%, DAX Closed, CAC 40 4312.28 -7.71 -0.18%

-

17:44

WSE: Session Results

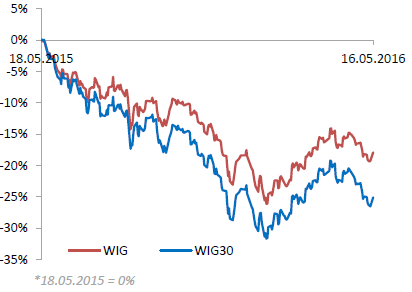

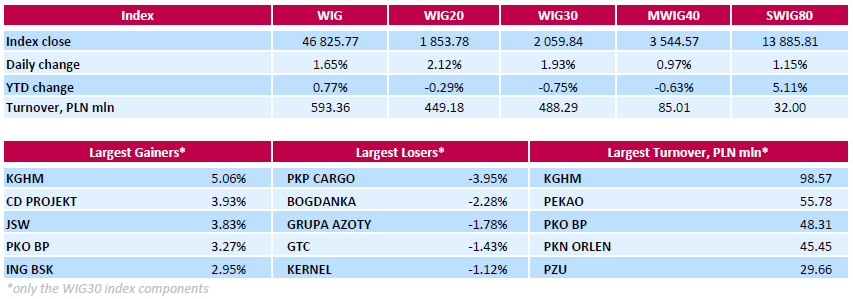

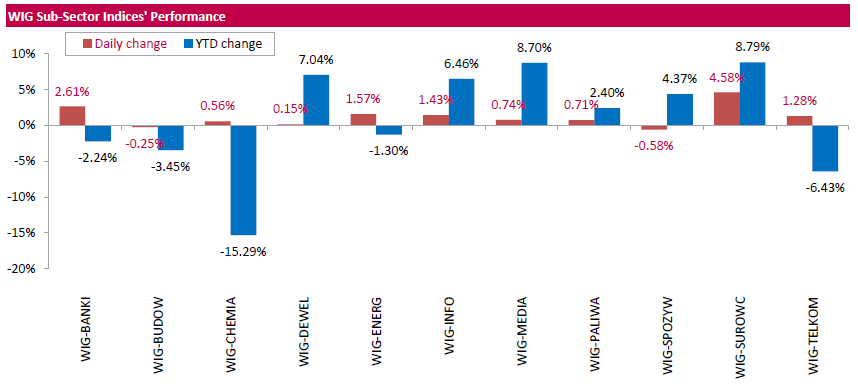

Polish equity market closed higher on Monday. The broad market measure, the WIG Index, surged by 1.65%. Except for food sector (-0.58%) and construction (-0.25%), every sector in the WIG Index rose, with materials (+4.58%) outperforming.

The large-cap stocks' measure, the WIG30 Index, rose by 1.93%. There were only five decliners among the index components. Railway freight transport operator PKP CARGO (WSE: PKP) was the worst-performing name, tumbling by 3.95% after the company reported Q1 net loss of PLN 66 mln, deeper than the expected loss of PLN 44 mln. Other laggards were thermal coal miner BOGDANKA (WSE: LWB), chemical producer GRUPA AZOTY (WSE: ATT), property developer GTC (WSE: GTC) and agricultural producer KERNEL (WSE: KER), losing between 1.12% and 2.28%. At the same time, copper producer KGHM (WSE: KGH) became the strongest advancer with a 5.06% gain. On Friday, the company reported its net profit reached PLN 161 mln in Q1, above the analysts' forecasts of PLN 101 mln. KGHM also stated it was delaying the next phase of expansion at its key overseas mine in Chile as stubbornly low metals prices more than halved its net profit in Q1. Oher major outperformers were videogame developer CD PROJEKT (WSE: CDR), coking coal producer JSW (WSE: JSW) and banking name PKO BP (WSE: PKO), climbing by 3.93%, 3.83% and 3.27% respectively.

-

17:22

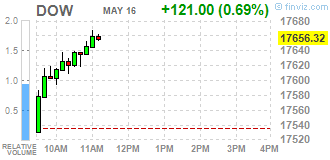

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes higher on Monday, following a bruising week, helped by Apple and a surge in oil prices. Apple (AAPL) shares rose more 3% after Warren Buffett's Berkshire Hathaway reported a stake worth about $1 billion in the iPhone maker. Oil jumped near 3% to its highest since November 2015 on growing Nigerian output disruptions and after Goldman Sachs said the market had ended almost two years of oversupply and flipped to a deficit.

Most of Dow stocks in positive area (25 of 30). Top looser - The Walt Disney Company (DIS, -0,71). Top gainer - Apple Inc. (AAPL, +3,34%).

All S&P sectors also in positive area. Top gainer - Basic Materials (+2,3%).

At the moment:

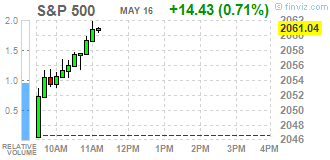

Dow 17608.00 +113.00 +0.65%

S&P 500 2057.00 +13.50 +0.66%

Nasdaq 100 4358.00 +34.00 +0.79%

Oil 47.57 +1.36 +2.94%

Gold 1276.50 +3.80 +0.30%

U.S. 10yr 1.75 +0.04

-

15:48

WSE: After start on Wall Street

In the afternoon, we met the weaker reading from the US - NY Empire State index. This index starts a series of regional data on the economic situation in the industry. Its May reading was not quite successful, as clearly go down from nearly 10 to -9. It might seem that a weaker dollar should support the economic situation in industry, and as we may see is not so easy. Same regional data are not so relevant, however after Friday break (related to better reporting of sales) a return to the negative trend on the front of macroeconomic data would be detrimental to the stock market bulls.

U.S. Stocks open: Dow +0.15%, Nasdaq +0.27%, S&P +0.18%

The market in the United States opens with a cosmetic upward. The market on Wall Street on one side weakens, but on the other maintains consolidation. However, the chance of the pit out grows, which would pose quite negative consequences also for the Warsaw Stock Exchange.

-

15:35

U.S. Stocks open: Dow +0.15%, Nasdaq +0.27%, S&P +0.18%

-

15:27

Before the bell: S&P futures +0.05%, NASDAQ futures +0.13%

U.S. stock-index futures were little changed.

Global Stocks:

Nikkei 16,466.4 +54.19 +0.33%

Hang Seng 19,883.95 +164.66 +0.84%

Shanghai Composite 2,850.93 +23.83 +0.84%

FTSE 6,111.62 -26.88 -0.44%

CAC 4,283.61 -36.38 -0.84%

DAX Closed

Crude $47.30 (+2.36%)

Gold $1287.90 (+1.19%)

-

14:54

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

9.26

0.06(0.6522%)

38045

Amazon.com Inc., NASDAQ

AMZN

712

2.08(0.293%)

24354

Apple Inc.

AAPL

92

1.48(1.635%)

1331192

AT&T Inc

T

38.86

-0.29(-0.7407%)

21268

Barrick Gold Corporation, NYSE

ABX

18.85

0.44(2.39%)

152918

Boeing Co

BA

131

-1.12(-0.8477%)

1018

Caterpillar Inc

CAT

70.12

0.05(0.0714%)

1600

Chevron Corp

CVX

101.5

0.76(0.7544%)

5049

Cisco Systems Inc

CSCO

26.55

0.02(0.0754%)

2881

Citigroup Inc., NYSE

C

43.09

-0.02(-0.0464%)

21981

E. I. du Pont de Nemours and Co

DD

63.17

0.26(0.4133%)

400

Exxon Mobil Corp

XOM

89.1

0.44(0.4963%)

4124

Facebook, Inc.

FB

119.96

0.15(0.1252%)

94099

Ford Motor Co.

F

13.25

0.03(0.2269%)

50113

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.7

0.29(2.7858%)

455524

General Electric Co

GE

29.57

-0.07(-0.2362%)

12407

General Motors Company, NYSE

GM

30.57

0.05(0.1638%)

5432

Goldman Sachs

GS

155.11

-0.23(-0.1481%)

970

Home Depot Inc

HD

133.61

0.48(0.3606%)

6812

Intel Corp

INTC

29.92

0.01(0.0334%)

801

International Business Machines Co...

IBM

147.7

-0.02(-0.0135%)

3388

McDonald's Corp

MCD

129.25

0.42(0.326%)

1360

Microsoft Corp

MSFT

51.04

-0.04(-0.0783%)

3431

Nike

NKE

57.51

0.20(0.349%)

500

Pfizer Inc

PFE

33

-0.19(-0.5725%)

7433

Procter & Gamble Co

PG

80.4

-0.83(-1.0218%)

4948

Starbucks Corporation, NASDAQ

SBUX

55.94

0.12(0.215%)

2770

Tesla Motors, Inc., NASDAQ

TSLA

208.5

0.89(0.4287%)

13493

The Coca-Cola Co

KO

45.25

-0.10(-0.2205%)

348

Twitter, Inc., NYSE

TWTR

14.21

0.11(0.7801%)

11867

UnitedHealth Group Inc

UNH

129

0.00(0.00%)

320

Verizon Communications Inc

VZ

50.95

0.01(0.0196%)

1725

Visa

V

76.9

0.07(0.0911%)

4383

Wal-Mart Stores Inc

WMT

64.7

-0.24(-0.3696%)

5384

Walt Disney Co

DIS

100.55

0.03(0.0298%)

1527

Yahoo! Inc., NASDAQ

YHOO

37

0.52(1.4254%)

89287

Yandex N.V., NASDAQ

YNDX

19.52

0.00(0.00%)

2050

-

14:50

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Bank of America (BAC) downgraded to Mkt Perform from Outperform at Keefe Bruyette

Other:

Microsoft (MSFT) initiated with a Hold at Canaccord Genuity

Freeport-McMoRan (FCX) target raised to $15 from $10 at Cowen

-

13:09

WSE: Mid session comment

Characteristics of today's trading on the Warsaw Stock Exchange are quite different from those of the environment. The German market is closed, which reduces the activity on other floors of Euroland. London is not too active today, but nevertheless looks better than Paris. In Warsaw, the WIG20 maintains levels close to session highs. If the result of the session are sustained till the end of the session, this could signify a change of market's attitude and direction, albeit on a less than impressive turnover.

In the mid-session, the WIG 20 index reached the level of 1,950 points (+1,93%) with turnover of PLN 190 mln.

-

09:11

WSE: After opening

Warsaw futures market (WSE: FW20M16) began from increase by 0.88% to 1,838 points. So we opened up with a gap above the main volatility of the last three sessions and in the vicinity of the next psychological level of 1,850 points.

WIG20 index opened at 1829.37 points (+0.77%)*

WIG 46463.09 0.87%

WIG30 2042.66 1.08%

mWIG40 3515.79 0.15%

*/ - change to previous close

Due to Moody's, we have a good chance to create today trade on their own, in complete isolation from the environment. Due to closed markets (Pentecost) in Germany, Switzerland, Hungary and Norway we may say that will saves us a bit of the skin. In "normal" conditions it will mean for our parquet likely solid apathy. With Moody's we have a chance to avoid the stagnation today.

-

08:24

WSE: Before opening

On Saturday early morning we met a long-awaited decision by Moody's rating on the Polish debt. In the context of the same expectations veer between the credit rating declines we may speak about a positive surprise, as the same rating remained unchanged. It has been reduced only his perspective, to negative.

Such a turn of events the morning is positively reflected in the domestic currency, which abruptly strengthened to most currencies of approx. 0.7%.

The positive impact should also be seen on the stock exchange, which should be supported in the defense area level of 1,800 points. As a rule, the impact of the rating on the stock exchange should be less than what is observed in the case of currency or bonds.

Another factor affecting the Warsaw Stock Exchange is the external situation. This is heterogeneous. Friday's session on Wall Street was poor and characterized by a decline of nearly 0.9%. As shown the last Thursday, it does not necessarily mean clearly a difficult session in Europe, although the start probably will not belong to particularly successful ones. As a support can be a neutral behavior of Asian parquets despite weaker economic data from China indicated during the weekend. The beginning of the Asian session was even positive, but the end of it runs in bad moods.

-

06:12

Global Stocks

European stocks finished higher on Friday as a better-than-expected report on U.S. retail sales lifted sentiment, easing fears that the world's largest economy isn't heading for a slowdown. The weekly advance comes even as investors world-wide this week have been wrestling with a crop of lackluster corporate earnings, including a run of poor results from U.S. retailers.

U.S stocks tumbled Friday, notching another weekly loss for the three main benchmarks. Shares dropped as a strong report on U.S. retail sales failed to assuage investor worries about the troubled sector. Meanwhile, a drop in crude-oil futures weighed on energy shares and deflated investors' appetite for risky assets.

Buoyant Japanese stocks led Asian stocks to modest gains on Monday, helping to offset some of the gloom from soft Chinese data, while the dollar firmed against the euro and yen after receiving a boost from upbeat U.S. indicators. It held the gains despite a denial by Japan's top government spokesman on Monday that Prime Minister Shinzo Abe has decided to delay the tax hike.

Based on MarketWatch materials

-

04:09

Nikkei 225 16,583.04 +170.83 +1.04 %, Hang Seng 19,954.73 +235.44 +1.19 %, Shanghai Composite 2,821.69 -5.42 -0.19 %

-

01:06

Stocks. Daily history for Sep Apr May 13’2016:

(index / closing price / change items /% change)

Nikkei 225 16,412.21 -234.13 -1.41 %

Hang Seng 19,719.29 -196.17 -0.99 %

S&P/ASX 200 5,328.99 -30.31 -0.57 %

Shanghai Composite 2,827.37 -8.49 -0.30 %

FTSE 100 6,138.5 +34.31 +0.56 %

CAC 40 4,319.99 +26.72 +0.62 %

Xetra DAX 9,952.9 +90.78 +0.92 %

S&P 500 2,046.61 -17.50 -0.85 %

NASDAQ Composite 4,717.68 -19.66 -0.41 %

Dow Jones 17,535.32 -185.18 -1.05 %

-