Noticias del mercado

-

21:01

Dow +0.15% 17,509.41 +26.40 Nasdaq +0.14% 4,991.82 +7.20 S&P -0.02% 2,052.86 -0.33

-

18:05

European stocks close: stocks closed higher on a deal between Greece and its creditors and on the better-than-expected ZEW economic sentiment data from Germany

Stock indices closed higher on a deal between Greece and its creditors and on the better-than-expected ZEW economic sentiment data from Germany. The ZEW Center for European Economic Research released its economic sentiment index for Germany and the Eurozone on Tuesday. Germany's ZEW economic sentiment index climbed to 10.4 in November from 1.9 in October, exceeding expectations for a rise to 6.0.

"The outlook for the German economy is brightening again towards the end of the year. Economic pessimism appears not to have increased after the terror attacks in Paris. The currently high level of consumption in Germany, the recent decline in the external value of the euro, and the ongoing recovery in the United States are likely to bolster the robust development of the German economy," the ZEW President Clemens Fuest.

Eurozone's ZEW economic sentiment index decreased to 28.3 in November from 30.1 in October, missing expectations for an increase to 35.2.

Greek Finance Minister Euclid Tsakalotos said on Tuesday that the Greek government reached a deal with its creditors.

"We have reached agreement on everything, including the 48 additional measures," he said.

The Office for National Statistics (ONS) released the consumer price inflation data for the U.K. on Tuesday. The U.K. consumer price index remained unchanged at -0.1% in October, in line with expectations.

The decline was driven by lower food, alcohol and tobacco prices.

Consumer price inflation excluding food, energy, alcohol and tobacco prices climbed to 1.1% year-on-year in October from 1.0% in September. Analysts had expected the inflation to remain unchanged at 1.0%.

The consumer price inflation is below the Bank of England's 2% target.

The European Central Bank (ECB) Chief Economist Peter Praet said in an interview with Bloomberg published on Tuesday that downside risks may increase due to terror attacks in Paris.

He also said that inflation in the Eurozone remained low, adding that data was "a little bit less encouraging".

"I would say that the downside risks haven't decreased, probably rather, unfortunately, increased a little bit," Praet noted.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,268.76 +122.38 +1.99 %

DAX 10,971.04 +257.81 +2.41 %

CAC 40 4,937.31 +133.00 +2.77 %

-

18:00

European stocks closed: FTSE 100 6,268.76 +122.38 +1.99% CAC 40 4,937.31 +133.00 +2.77% DAX 10,971.04 +257.81 +2.41%

-

17:48

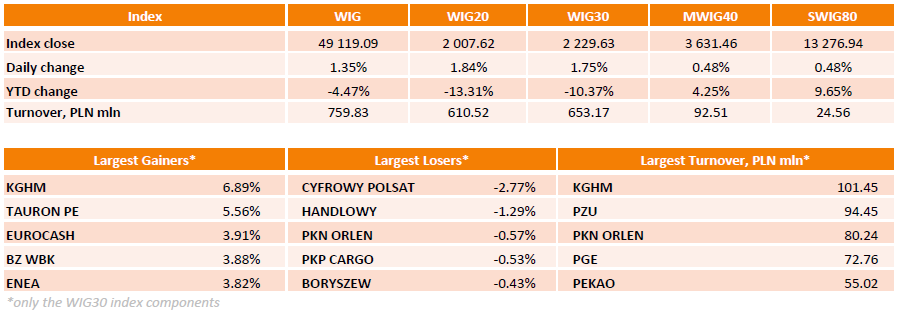

WSE: Session Results

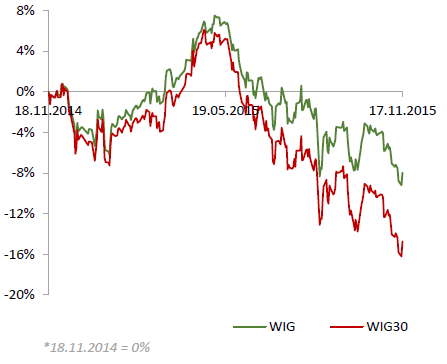

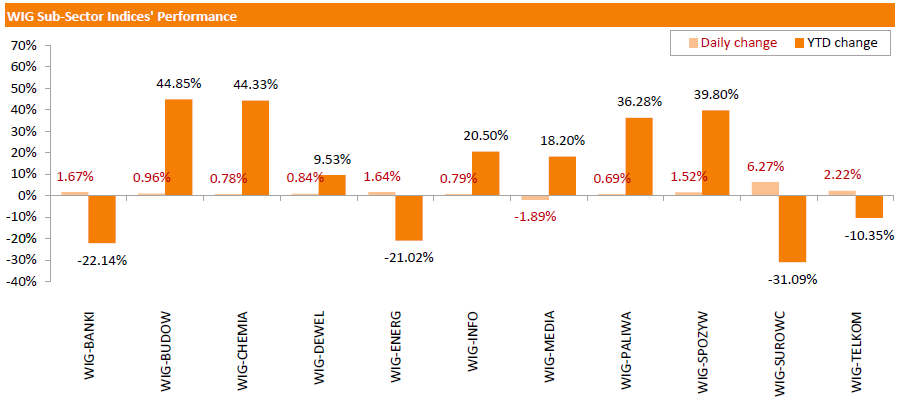

Polish equity market demonstrated solid growth on Tuesday. The broad market measure, the WIG Index, gained 1.35%. Media sector (-1.89%) was the sole laggard among the WIG's 11 industry groups. At the same time, the materials (+6.27%) and telecommunication sector (+2.22%) posed the best results.

The large-cap stocks' benchmark, the WIG30 Index, added 1.75%. Within the WIG30 Index components, KGHM (WSE: KGH) led advancers, climbing by 6.89% after seven consecutive sessions of losses. It was followed by TAURON PE (WSE: TPE), jumping by 5.56%. EUROCASH (WSE: EUR), BZ WBK (WSE: BZW), ENEA (WSE: ENA), MBANK (MBK) and PGNIG (WSE: PGN) also were among best-performers, boosting 3.55%-3.91%. On the other side of the ledger, CYFROWY POLSAT (WSE: CPS) and HANDLOWY (WSE: BHW) suffered the steepest declines, plunging by 2.77% and 1.29% respectively.

-

17:11

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock indexes rose on Tuesday as better-than-expected earnings from Wal-Mart (WMT) and Home Depot (HD) allayed fears of a retail slowdown after last week's sharp selloff in the sector.

Most of Dow stocks in positive area (18 of 30). Top looser - Caterpillar Inc. (CAT, -0.80%). Top gainer - Wal-Mart Stores Inc. (WMT +4.26%).

Almost all of S&P index sectors also in positive area. Top looser - Healthcare (+1,0%). Top looser - Conglomerates (-1.3%).

At the moment:

Dow 17529.00 +108.00 +0.62%

S&P 500 2059.50 +11.50 +0.56%

Nasdaq 100 4586.25 +26.50 +0.58%

Oil 41.20 -0.54 -1.29%

Gold 1074.40 -9.20 -0.85%

U.S. 10yr 2.31 +0.04

-

16:54

Reserve Bank of New Zealand’s: inflation expectations for the next 12 months rise to 1.51% in the three months to November

According to the Reserve Bank of New Zealand's survey published on Tuesday, New Zealand's inflation expectations for the next 12 months rose to 1.51% in the three months to November from 1.46% in the previous quarter.

Inflation expectations for the next 24 months slid to 1.85% from 1.94%.

-

16:30

European Central Bank Chief Economist Peter Praet: downside risks may increase due to terror attacks in Paris

The European Central Bank (ECB) Chief Economist Peter Praet said in an interview with Bloomberg published on Tuesday that downside risks may increase due to terror attacks in Paris.

He also said that inflation in the Eurozone remained low, adding that data was "a little bit less encouraging".

"I would say that the downside risks haven't decreased, probably rather, unfortunately, increased a little bit," Praet noted.

-

16:15

NAHB housing market index declines to 62 in November

The National Association of Home Builders (NAHB) released its housing market index for the U.S. on Tuesday. The NAHB housing market index fell to 62 in November from 65 in October, missing expectations for a decrease to 64. October's figure was revised up from 64.

A level above 50.0 is considered positive, below indicates a negative outlook.

The fall was driven by a decline in two of three components of the index. The buyer traffic sub-index increased to 48 in November, the current sales conditions sub-index fell to 67 from 70, while the sub-index measuring sales expectations in the next six months dropped to 70 from 75.

"Even with this month's drop, builder confidence has remained in the 60s for six straight months - a sign that the single-family housing market is making long-term headway. However, our members continue to voice concerns about the availability of lots and labour," the NAHB Chairman Tom Woods said.

"A firming economy, continued job creation and affordable mortgage rates should keep housing on an upward trajectory as we approach 2016," the NAHB Chief Economist David Crowe said.

-

16:08

U.S. industrial production declines 0.2% in October

The Federal Reserve released its industrial production report on Tuesday. The U.S. industrial production fell 0.2% in October, missing expectations for a 0.1% rise, after a 0.2% decline in September.

The drop was mainly driven by a fall in the mining output and utilities. Mining output plunged by 1.5% in October, while utilities production slid 2.5%.

Manufacturing output was up 0.4% in October, after a 0.1% fall in September.

Capacity utilisation rate decreased to 77.5% in October from 77.7% in September, in line with expectations. September's figure was revised up from 77.5%.

-

15:36

U.S. Stocks open: Dow +0.13%, Nasdaq +0.08%, S&P +0.04%

-

15:29

Before the bell: S&P futures +0.34%, NASDAQ futures +0.31%

U.S. equity-index futures climbed.

Global Stocks:

Nikkei 19,630.63 +236.94 +1.22%

Hang Seng 22,264.25 +253.43 +1.15%

Shanghai Composite 3,605.5 -1.46 -0.04%

FTSE 6,260.6 +114.22 +1.86%

CAC 4,917.85 +113.54 +2.36%

DAX 10,918.51 +205.28 +1.92%

Crude oil $41.50 (-0.57%)

Gold $1078.30 (-0.49%)

-

15:01

U.S. consumer price inflation rises 0.2% in October

The U.S. Labor Department released consumer price inflation data on Tuesday. The U.S. consumer price inflation rise 0.2% in October, in line with expectations, after a 0.2% fall in September.

The increase was partly driven by higher shelter and medical care costs. Shelter costs climbed 0.3% in October, while medical care costs rose 0.8%.

Gasoline prices were up 0.4% in October.

Food prices increased 0.1% in October.

On a yearly basis, the U.S. consumer price index increased to 0.2% in October from 0.0% in September, beating expectations for a rise to 0.1%.

The U.S. consumer price inflation excluding food and energy gained 0.2% in October, in line with expectations, after a 0.2% increase in September.

On a yearly basis, the U.S. consumer price index excluding food and energy remained unchanged at 1.9% in October, in line with expectations.

The inflation remains low due to a weak wage growth and a stronger U.S. dollar.

The consumer price index is not preferred Fed's inflation measure.

-

15:00

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Home Depot Inc

HD

124.36

2.91%

96.7K

General Electric Co

GE

31.09

2.40%

4.8M

Wal-Mart Stores Inc

WMT

59.18

2.26%

210.6K

Yandex N.V., NASDAQ

YNDX

15.60

1.73%

14.7K

HONEYWELL INTERNATIONAL INC.

HON

104.00

1.60%

0.1K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

8.98

1.35%

15.8K

Twitter, Inc., NYSE

TWTR

25.60

0.75%

9.0K

ALTRIA GROUP INC.

MO

57.19

0.74%

1.1K

International Business Machines Co...

IBM

134.67

0.72%

1.6K

ALCOA INC.

AA

8.34

0.60%

30.3K

Apple Inc.

AAPL

114.84

0.58%

109.0K

JPMorgan Chase and Co

JPM

66.89

0.57%

1.9K

Intel Corp

INTC

32.27

0.53%

0.5K

Starbucks Corporation, NASDAQ

SBUX

61.00

0.53%

2.1K

Amazon.com Inc., NASDAQ

AMZN

650.95

0.48%

12.9K

Facebook, Inc.

FB

104.54

0.48%

174.9K

Cisco Systems Inc

CSCO

26.91

0.45%

2.1K

Visa

V

79.25

0.44%

1.9K

Ford Motor Co.

F

14.10

0.43%

8.4K

General Motors Company, NYSE

GM

35.31

0.40%

0.6K

Citigroup Inc., NYSE

C

53.88

0.35%

14.8K

Google Inc.

GOOG

731.50

0.35%

1.7K

American Express Co

AXP

71.90

0.33%

0.1K

AT&T Inc

T

33.15

0.33%

4.9K

Walt Disney Co

DIS

116.30

0.33%

3.1K

Tesla Motors, Inc., NASDAQ

TSLA

215.00

0.32%

4.5K

Hewlett-Packard Co.

HPQ

13.39

0.30%

0.6K

Verizon Communications Inc

VZ

45.17

0.29%

1.5K

Microsoft Corp

MSFT

53.55

0.27%

28.0K

Pfizer Inc

PFE

33.25

0.27%

2.0K

McDonald's Corp

MCD

111.35

0.26%

0.9K

Procter & Gamble Co

PG

75.49

0.25%

0.5K

Boeing Co

BA

144.75

0.23%

1.5K

Yahoo! Inc., NASDAQ

YHOO

33.01

0.20%

7.2K

3M Co

MMM

158.50

0.18%

0.7K

UnitedHealth Group Inc

UNH

113.85

0.03%

0.2K

Caterpillar Inc

CAT

70.36

-0.04%

0.1K

Exxon Mobil Corp

XOM

80.77

-0.16%

2.5K

Chevron Corp

CVX

91.09

-0.39%

2.2K

Nike

NKE

122.90

-0.45%

18.2K

Barrick Gold Corporation, NYSE

ABX

7.56

-0.92%

6.5K

-

14:53

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Merck (MRK) target lowered to $65 from $70 at Argus

-

14:41

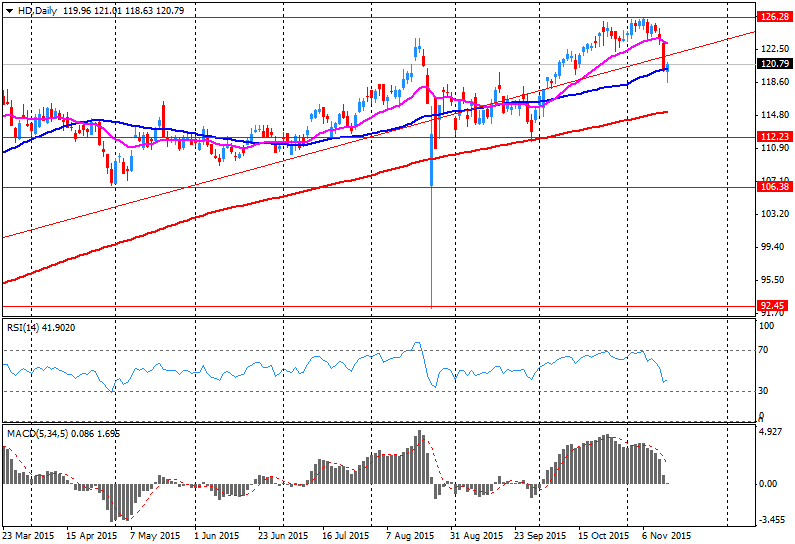

Company News: Home Depot (HD) Q3 Profit Beats Expectations

Home Depot reported Q3 earnings of $1.36 per share (versus $1.15 in the corresponding period of previous year), beating analysts' consensus of $1.32.

The company's revenues amounted to $21.819 bln (+6.4% y/y), slightly beating consensus estimate of $21.772 bln.

Home Depot revised upwards its EPS FY16 guidance to $5.36 from $5.31-5.36. The analysts' consensus forecast for the company's EPS FY16 stands at $5.31.

HD rose to $120.84 (+2.99%) in pre-market trading.

-

14:37

UK house price inflation rises 0.8% in September

The Office for National Statistics (ONS) released its house inflation data for the U.K. on Tuesday. The U.K. house price index rose at a seasonally adjusted rate of 0.8% in September, slower than a 0.9% in August.

On a yearly basis, the U.K. house price index increased at a seasonally adjusted rate of 6.1% in September, after a 5.5% in August. It was the highest rise since March.

The higher house price inflation was mainly driven by an increase in prices in the East and the South East.

The average mix-adjusted house price was £286,000 in September, up from £285,000 in August.

-

14:06

Company News: Wal-Mart (WMT) Q3 Results Meet Expectations

Wal-Mart reported Q3 earnings of $0.99 per share (versus $1.15 in Q3 FY 2014), slightly beating analysts' consensus of $0.98.

The company's revenues amounted to $116.598 bln (-1.3% y/y), slightly missing consensus estimate of $117.371 bln.

Wal-Mart confirmed its forecasts for Q4 EPS of $1.40-1.55 (versus consensus of $1.42), but narrowed forecasts for FY16 EPS to $4.50-4.65 from $4.40-4.70 (versus consensus of $4.51).

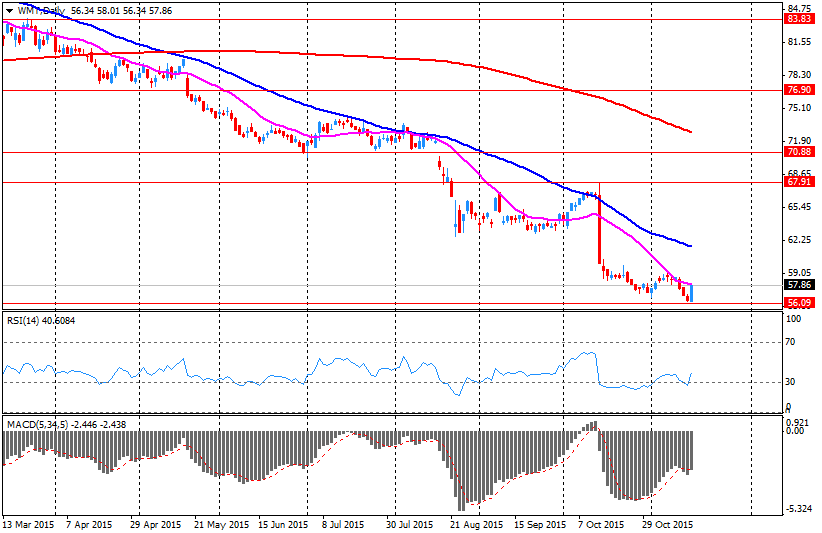

WMT rose to $57.87 (+2.57%) in pre-market trading.

-

12:00

European stock markets mid session: stocks traded higher on a deal between Greece and its creditors and on the better-than-expected ZEW economic sentiment data from Germany

Stock indices traded higher on a deal between Greece and its creditors and on the better-than-expected ZEW economic sentiment data from Germany. The ZEW Center for European Economic Research released its economic sentiment index for Germany and the Eurozone on Tuesday. Germany's ZEW economic sentiment index climbed to 10.4 in November from 1.9 in October, exceeding expectations for a rise to 6.0.

"The outlook for the German economy is brightening again towards the end of the year. Economic pessimism appears not to have increased after the terror attacks in Paris. The currently high level of consumption in Germany, the recent decline in the external value of the euro, and the ongoing recovery in the United States are likely to bolster the robust development of the German economy," the ZEW President Clemens Fuest.

Eurozone's ZEW economic sentiment index decreased to 28.3 in November from 30.1 in October, missing expectations for an increase to 35.2.

Greek Finance Minister Euclid Tsakalotos said on Tuesday that the Greek government reached a deal with its creditors.

"We have reached agreement on everything, including the 48 additional measures," he said.

The Office for National Statistics (ONS) released the consumer price inflation data for the U.K. on Tuesday. The U.K. consumer price index remained unchanged at -0.1% in October, in line with expectations.

The decline was driven by lower food, alcohol and tobacco prices.

Consumer price inflation excluding food, energy, alcohol and tobacco prices climbed to 1.1% year-on-year in October from 1.0% in September. Analysts had expected the inflation to remain unchanged at 1.0%.

The consumer price inflation is below the Bank of England's 2% target.

Current figures:

Name Price Change Change %

FTSE 100 6,257.18 +110.80 +1.80 %

DAX 10,903.57 +190.34 +1.78 %

CAC 40 4,904.48 +100.17 +2.09 %

-

11:39

Greek Finance Minister Euclid Tsakalotos: the Greek government reached a deal with its creditors

Greek Finance Minister Euclid Tsakalotos said on Tuesday that the Greek government reached a deal with its creditors.

"We have reached agreement on everything, including the 48 additional measures," he said.

The deal will unblock a €12 billion euro tranche of aid.

The Greek and EU parliaments are expected to approve the deal later on Tuesday.

-

11:31

Italy’ trade surplus rises to €2.19 billion in September

The Italian statistical office Istat released its trade data for Italy on Tuesday. Italy' trade surplus rose to €2.19 billion in September from €1.85 billion in August.

Exports increased 1.4% year-on-year in September, while imports climbed 0.7%.

The trade surplus with the EU was €760 million in September, while the trade surplus with non-EU countries was €1.43 billion.

-

11:15

Germany's ZEW economic sentiment index rises to 10.4 in November

The ZEW Center for European Economic Research released its economic sentiment index for Germany and the Eurozone on Tuesday. Germany's ZEW economic sentiment index climbed to 10.4 in November from 1.9 in October, exceeding expectations for a rise to 6.0.

The assessment of the current situation in Germany fell by 0.8 points to 54.4 points.

"The outlook for the German economy is brightening again towards the end of the year. Economic pessimism appears not to have increased after the terror attacks in Paris. The currently high level of consumption in Germany, the recent decline in the external value of the euro, and the ongoing recovery in the United States are likely to bolster the robust development of the German economy," the ZEW President Clemens Fuest.

Eurozone's ZEW economic sentiment index decreased to 28.3 in November from 30.1 in October, missing expectations for an increase to 35.2.

The assessment of the current situation in the Eurozone rose by 1.2 points to -10.0 points.

-

11:07

UK consumer price inflation remains unchanged at -0.1% year-on-year in October

The Office for National Statistics (ONS) released the consumer price inflation data for the U.K. on Tuesday. The U.K. consumer price index remained unchanged at -0.1% in October, in line with expectations.

The decline was driven by lower food, alcohol and tobacco prices.

"This is now the ninth month running that CPI has been at or very closer to zero. CPI remained steady at -0.1 percent in October, with stronger clothing price growth being offset by food and alcohol and tobacco, as well as a smaller impact from rising tuition fees," ONS statistician Richard Campbell said.

On a monthly basis, U.K. consumer prices rose 0.1% in October, in line with expectations, after a 0.1% fall in September.

Consumer price inflation excluding food, energy, alcohol and tobacco prices climbed to 1.1% year-on-year in October from 1.0% in September. Analysts had expected the inflation to remain unchanged at 1.0%.

The Retail Prices Index dropped to 0.7% year-on-year in October from 0.8% in September, missing expectations for an increase to 0.9%.

The consumer price inflation is below the Bank of England's 2% target.

-

10:49

November’s Reserve Bank of Australia monetary policy meeting: the outlook for the Asian region, particularly China, is one of the key uncertainties in forecasting global growth

The Reserve Bank of Australia (RBA) released its minutes from November monetary policy meeting on Tuesday. The RBA said that the accommodative monetary policy was appropriate, adding that low interest rates supported growth in household consumption and dwelling investment.

The Australian economy continued to expand moderately, the RBA said.

According to the minutes, "the Australian dollar was adjusting to the significant declines in key commodity prices and boosting demand for domestic production".

Members also said that there is "spare capacity, including the relatively high unemployment rate, low wage growth and the lower-than-expected inflation outcome in the September quarter".

The minutes said that the outlook for the Asian region, particularly China, is one of the key uncertainties in forecasting global growth.

The RBA kept unchanged its interest rate at 2.00% in November.

-

10:37

Reserve Bank of Australia Assistant Governor Christopher Kent: a slower rise in the Chinese industrial production led to a drop in commodity prices over the course of this year

The Reserve Bank of Australia Assistant Governor Christopher Kent said on late Monday evening that a slower rise in the Chinese industrial production led to a drop in commodity prices over the course of this year. He added that the industrial sector in China and Asia will have impact on commodity prices.

"Conditions in the industrial sector in China, and Asia more broadly, will have an important influence on the path of commodity prices over the near term. Beyond that, the changing nature of China's development implies that the potential for commodity prices to rise from here is somewhat limited," Kent said.

He pointed out that "the shift in demand towards services and agricultural products within China and the Asian region" is new opportunity for Australian exporters.

-

10:21

Japan’s ruling party member Kozo Yamamoto: the Bank of Japan (BoJ) will likely not add further stimulus measures this year

Japan's ruling party member Kozo Yamamoto said on Monday that the Bank of Japan (BoJ) will likely not add further stimulus measures this year as a weaker yen could hurt low-income households.

"If the U.S. Federal Reserve raises interest rates this year that could accelerate yen declines. That would hurt households," he said. Yamamoto noted that the BoJ will likely analyse effects on the yen from the possible Fed's interest rate hike.

-

10:11

PayNet's Canadian small business lending index climbs to 142.0 in September

According to data from PayNet released on Monday, Canadian small business lending index climbed to 142.0 in September from 131.8 in August. On a yearly basis, the index rose 14% in September.

"We are seeing that the small businesses are becoming an engine of growth for the Canadian economy at a time when the big companies, some of them in the energy sector, are contracting," PayNet's president Bill Phelan said. He added that small businesses "are a good leading economic indicator".

The index of Canadian medium-sized businesses declined to 213.6 in September from 220.7 in August. On a yearly basis, the index fell 12% in September.

-

06:50

Global Stocks: U.S. stock indices rebounded

U.S. stock indices recovered from losses triggered by Paris attacks and closed higher on Monday. Travel-related stocks remained under pressure; however experts say that the influence of events in Paris will not last long.

The Dow Jones Industrial Average rose 237.77 points, or 1.4%, to 17,483.24. The S&P 500 gained 30.15 points, or 1.5%, to 2,053.19 (all of its 10 sectors rose). The Nasdaq Composite climbed 56.73 points, or 1.2%, to 4,984.62.

NY Fed Empire State manufacturing index slightly improved in November, but missed forecasts. The index rose to -10.74 this month from -11.36 in October, while economists had expected a reading of -6.25 points.

Market participants are waiting for FOMC meeting minutes, which will be released on Wednesday. Earlier Fed Vice Chairman Stanley Fischer said that December might be the right time for a liftoff in the benchmark interest rate.

This morning in Asia Hong Kong Hang Seng surged 2.07%, or 456.39, to 22,467.21. China Shanghai Composite Index rose 1.36%, or 49.00, to 3.655.96. The Nikkei 225 gained 1.61%, or 312.89, to 19,706.58.

Asian indices rose following gains in U.S. equities. Japanese stocks were also supported by a weaker yen, which is favorable for exporters.

-

03:06

Nikkei 225 19,653.41 +259.72 +1.34 %, Hang Seng 22,354.56 +343.74 +1.56 %, Shanghai Composite 3,631.36 +24.40 +0.68 %

-

00:36

Stocks. Daily history for Sep Nov 16’2015:

(index / closing price / change items /% change)

Nikkei 225 19,393.69 -203.22 -1.04 %

Hang Seng 22,010.82 -385.32 -1.72 %

Shanghai Composite 3,606.96 +26.12 +0.73 %

FTSE 100 6,146.38 +28.10 +0.46 %

CAC 40 4,804.31 -3.64 -0.08 %

Xetra DAX 10,713.23 +4.83 +0.05 %

S&P 500 2,053.19 +30.15 +1.49 %

NASDAQ Composite 4,984.62 +56.73 +1.15 %

Dow Jones 17,483.01 +237.77 +1.38 %

-