Noticias del mercado

-

21:00

Dow +1.04% 17,671.85 +182.35 Nasdaq +1.38% 5,054.68 +68.66 S&P +1.17% 2074.43 +23.99

-

18:27

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes higher on Wednesday ahead of the release of the minutes of the Federal Reserve's October meeting, but investors remained cautious due to heightened security concerns after last week's attacks in Paris.

Most of Dow stocks in positive area (25 of 30). Top looser - The Home Depot, Inc. (HD, -0.42%). Top gainer - Apple Inc. (AAPL +2.80%).

Almost all of S&P index sectors also in positive area. Top looser - Healthcare (+1,0%). Top looser - Utilities (-0.2%).

At the moment:

Dow 17582.00 +126.00 +0.72%

S&P 500 2062.00 +13.00 +0.63%

Nasdaq 100 4610.75 +41.25 +0.90%

Oil 41.39 -0.32 -0.77%

Gold 1067.00 -1.60 -0.15%

U.S. 10yr 2.28 +0.01

-

18:00

European stocks close: stocks closed mixed on concerns over new terrorist attacks

Stock indices closed mixed on concerns over new terrorist attacks. 129 people died in Paris on Friday.

The European Central Bank (ECB) executive board member Yves Mersch said on Wednesday that there is no indication that terror attacks in Paris will have a negative impact on the economy.

"We have no indication of any economic pessimism as a result of the Paris attacks, let alone weaker hard data. Doom-and-gloom talk is not warranted at this stage," he said.

Meanwhile, the economic data from the Eurozone was negative. The Eurostat released its construction production data for the Eurozone on Wednesday. Construction production in the Eurozone decreased 0.4% in September, after a 0.5% rise in August.

Civil engineering output gained 0.3% in September, while production in the building sector was down 0.6%.

On a yearly basis, construction output increased 1.8% in September, after a 1.8% decline in August. August's figure was revised up from a 6.0% drop.

Civil engineering output rose 2.4% year-on-year in September, while production in the building sector climbed 1.6% year-on-year.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,278.97 +10.21 +0.16 %

DAX 10,959.95 -11.09 -0.10 %

CAC 40 4,906.72 -30.59 -0.62 %

-

18:00

European stocks closed: FTSE 100 6,278.97 +10.21 +0.16% CAC 40 4,906.72 -30.59 -0.62% DAX 10,959.95 -11.09 -0.10%

-

17:52

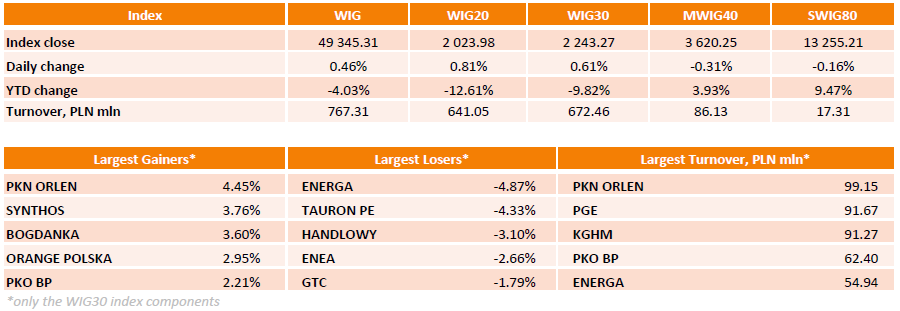

WSE: Session Results

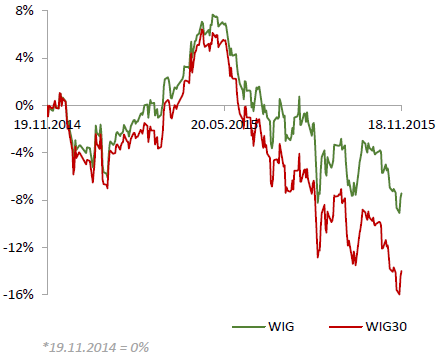

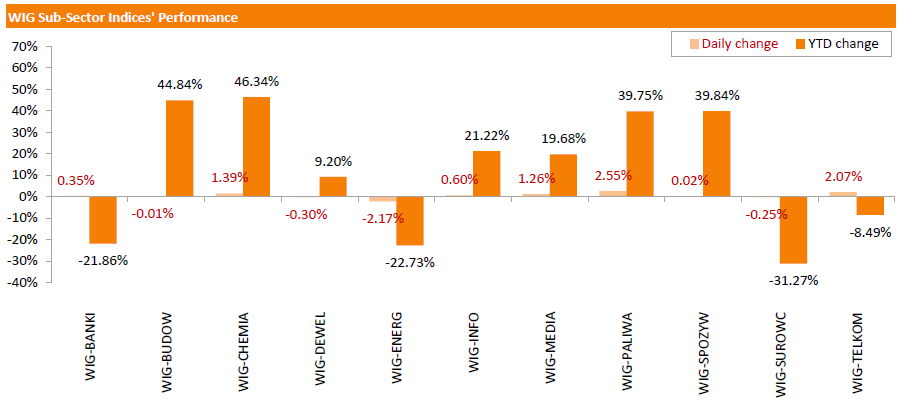

Polish equity market closed higher on Wednesday. The market broad measure, the WIG Index, added 0.46%. Sector-wise, oil and gas sector stocks (+2.55%) were the growth leaders in the WIG, while utilities names (-2.17%) were the poorest performers.

The large-cap stocks' benchmark, the WIG30 Index, rose by 0.61%. Within the index components, PKN ORLEN (WSE: PKN) generated the biggest advance, up 4.45%. Other noticeable gainers were SYNTHOS (WSE: SNS), BOGDANKA (WSE: LWB) and ORANGE POLSKA (WSE: OPL), climbing 2.95%-3.76%. On the other side of the ledger, ENERGA (WSE: ENG) led the decliners with a 4.87% drop, followed by TAURON PE (WSE: TPE) and HANDLOWY (WSE: BHW), sliding 4.33% and 3.10% respectively.

-

16:11

Richmond Fed President Jeffrey Lacker has not changed his view that the Fed should start raising its interest rates

Richmond Fed President Jeffrey Lacker said in an interview with CNBC on Wednesday that he has not changed his view that the Fed should start raising its interest rates.

He noted that terrorist attacks in Paris have only temporary impact on the economy.

"We've been through episodes like this before in which some disruption of a certain geopolitical or military nature affects things. For a time people can get cautious and pull back a little bit. These tend to be transitory," Richmond Fed president.

Lacker also said that consumer spending in the U.S. is strong, adding that the economy needs higher real interest rates".

"There's a chance, I think it's raising that we're going to get behind the curve", he noted.

-

16:01

Atlanta Fed President Dennis Lockhart would be ready to start raising interest raise soon

Atlanta Fed President Dennis Lockhart said on Wednesday that the Fed's targets are met and he would be ready to start raising interest raise soon.

"I am comfortable with moving off zero soon, conditioned on no marked deterioration in economic conditions. I believe it will soon be appropriate to begin a new policy phase," he said.

Lockhart added that he will analyse the incoming economic data.

-

15:35

U.S. Stocks open: Dow +0.39%, Nasdaq +0.34%, S&P +0.38%

-

15:26

Before the bell: S&P futures +0.26%, NASDAQ futures +0.32%

U.S. equity-index futures climbed.

Global Stocks:

Nikkei 19,649.18 +18.55 +0.09%

Hang Seng 22,188.26 -75.99 -0.34%

Shanghai Composite 3,569.79 -35.01 -0.97%

FTSE 6,263.52 -5.24 -0.08%

CAC 4,903.06 -34.25 -0.69%

DAX 10,943.46 -27.58 -0.25%

Crude oil $40.93 (+0.64%)

Gold $1067.00 (-0.15%)

-

15:23

Housing starts in the U.S. drops 11.0% in October

The U.S. Commerce Department released the housing market data on Wednesday. Housing starts in the U.S. dropped 11.0% to 1.060 million annualized rate in October from a 1,191 million pace in September, missing expectations for a decrease to 1.160 million.

September's figure was revised down from 1.206 million units.

The decrease was driven by declines in starts of single-family and multifamily homes.

Housing market benefits from the strengthening of the labour market.

Building permits in the U.S. climbed 4.1% to 1.150 million annualized rate in October from a 1.105 million pace in September, in line with expectations.

Starts of single-family homes decreased 2.4% in October. Building permits for single-family homes were up 2.4%.

Starts of multifamily buildings slid 25.1% in October. Permits for multi-family housing rose 6.8%.

-

14:57

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

8.57

2.15%

37.8K

Apple Inc.

AAPL

115.38

1.49%

374.2K

ALCOA INC.

AA

8.32

0.60%

58.5K

Johnson & Johnson

JNJ

102.00

0.49%

2.0K

Tesla Motors, Inc., NASDAQ

TSLA

215.00

0.47%

0.5K

Facebook, Inc.

FB

105.61

0.46%

55.3K

JPMorgan Chase and Co

JPM

66.43

0.45%

0.1K

Wal-Mart Stores Inc

WMT

60.18

0.43%

13.9K

Yahoo! Inc., NASDAQ

YHOO

33.00

0.43%

0.4K

Pfizer Inc

PFE

33.00

0.40%

4.7K

Cisco Systems Inc

CSCO

26.91

0.37%

0.8K

Nike

NKE

123.01

0.35%

0.1K

Amazon.com Inc., NASDAQ

AMZN

645.35

0.32%

3.6K

Google Inc.

GOOG

727.55

0.31%

5.6K

Barrick Gold Corporation, NYSE

ABX

7.01

0.29%

32.3K

Chevron Corp

CVX

91.25

0.24%

14.6K

E. I. du Pont de Nemours and Co

DD

67.23

0.24%

1.1K

Citigroup Inc., NYSE

C

53.60

0.21%

1.2K

Intel Corp

INTC

32.70

0.18%

2.7K

American Express Co

AXP

71.21

0.14%

0.2K

Goldman Sachs

GS

190.63

0.03%

0.2K

Verizon Communications Inc

VZ

45.09

0.02%

2.2K

Starbucks Corporation, NASDAQ

SBUX

60.55

0.00%

0.5K

Ford Motor Co.

F

14.14

-0.07%

2.6K

Exxon Mobil Corp

XOM

79.90

-0.08%

25.0K

Microsoft Corp

MSFT

52.92

-0.09%

16.8K

Twitter, Inc., NYSE

TWTR

25.20

-0.12%

10.1K

Home Depot Inc

HD

126.00

-0.14%

2.0K

AT&T Inc

T

33.20

-0.18%

2.8K

Yandex N.V., NASDAQ

YNDX

16.23

-0.25%

15.9K

General Motors Company, NYSE

GM

35.10

-0.31%

1.5K

General Electric Co

GE

30.21

-0.36%

22.7K

International Paper Company

IP

39.50

-0.93%

0.1K

-

14:52

Upgrades and downgrades before the market open

Upgrades:

Yandex (YNDX) upgraded to Overweight from Equal-Weight at Morgan Stanley

Downgrades:

Exxon Mobil (XOM) downgraded to Underperform from Mkt Perform at Raymond James

Other:

Apple (AAPL) added to Conviction Buy List at Goldman

Hewlett Packard Enterprise (HPE) initiated with a Market Perform at Raymond James

Home Depot (HD) target raised to $142 from $136 at Argus

-

14:37

Bank of England Deputy Governor Ben Broadbent: the interest rate hike by the central bank depends on different factors

The Bank of England (BoE) Deputy Governor Ben Broadbent said in a speech on Wednesday that the interest rate hike by the central bank depends on different factors.

"The MPC's headline forecasts are based on the assumption that interest rates follow the path priced into financial markets. That may or may not be the same thing as the true outside expectation of future rates. At times, the yield curve can move around for other reasons as well," he said.

"The MPC's inflation forecast is a far from perfect indicator of interest rates. It involves lots of conditioning assumptions, not just forward interest rates, and any of these can change," Broadbent added.

The BoE deputy governor pointed out that markets should not focus too much on the timing of the interest rate hike.

"When it comes to the so-called "lift-off" date for interest rates, is that the yield curve is currently very flat. As a result, even relatively moderate changes in forward rates, prompted by unexceptional news about the economy, can result in big shifts in the date at which the yield curve first reaches some particular level," he said.

-

12:02

European stock markets mid session: stocks traded lower on concerns over new terrorist attacks

Stock indices traded lower on concerns over new terrorist attacks. 129 people died in Paris on Friday.

The European Central Bank (ECB) executive board member Yves Mersch said on Wednesday that there is no indication that terror attacks in Paris will have a negative impact on the economy.

"We have no indication of any economic pessimism as a result of the Paris attacks, let alone weaker hard data. Doom-and-gloom talk is not warranted at this stage," he said.

Meanwhile, the economic data from the Eurozone was negative. The Eurostat released its construction production data for the Eurozone on Wednesday. Construction production in the Eurozone decreased 0.4% in September, after a 0.5% rise in August.

Civil engineering output gained 0.3% in September, while production in the building sector was down 0.6%.

On a yearly basis, construction output increased 1.8% in September, after a 1.8% decline in August. August's figure was revised up from a 6.0% drop.

Civil engineering output rose 2.4% year-on-year in September, while production in the building sector climbed 1.6% year-on-year.

Current figures:

Name Price Change Change %

FTSE 100 6,246.35 -22.41 -0.36 %

DAX 10,904.34 -66.70 -0.61 %

CAC 40 4,893.16 -44.15 -0.89 %

-

11:41

European Central Bank executive board member Yves Mersch: there is no indication that terror attacks in Paris will have a negative impact on the economy

The European Central Bank (ECB) executive board member Yves Mersch said on Wednesday that there is no indication that terror attacks in Paris will have a negative impact on the economy.

"We have no indication of any economic pessimism as a result of the Paris attacks, let alone weaker hard data. Doom-and-gloom talk is not warranted at this stage," he said.

-

11:27

Construction production in the Eurozone declines 0.4% in September

The Eurostat released its construction production data for the Eurozone on Wednesday. Construction production in the Eurozone decreased 0.4% in September, after a 0.5% rise in August.

Civil engineering output gained 0.3% in September, while production in the building sector was down 0.6%.

On a yearly basis, construction output increased 1.8% in September, after a 1.8% decline in August. August's figure was revised up from a 6.0% drop.

Civil engineering output rose 2.4% year-on-year in September, while production in the building sector climbed 1.6% year-on-year.

-

11:17

ZEW Institute and Credit Suisse Group’s survey: Switzerland's economic sentiment index drops to 0.0 in November

A survey by the ZEW Institute and Credit Suisse Group showed on Wednesday that Switzerland's economic sentiment index dropped to 0.0 in November from 18.3 points in October.

"The financial analysts surveyed expect to see neither an improvement nor a deterioration in Swiss economic activity over the next six months," the ZEW said.

The current conditions fell to -12.2 in November from -5.3 points in October.

-

11:05

Nomura Research Institute survey: fewer Japanese think that the country’s economy will worsen

According to a survey by Nomura Research Institute (NRI), fewer Japanese think that the country's economy will worsen. More Japanese expect the economy to improve over the next year.

"In 2012, there was very strong pessimism. Now, it's not like people really want to spend money, but there is less pessimism," NRI consultant Motoko Matsushita said.

-

10:51

BofA Merrill Lynch Fund Manager Survey: 81% of investors expect the Fed to start raising its interest rates this year

According to the BofA Merrill Lynch Fund Manager Survey, 81% of investors expect the Fed to start raising its interest rates this year, up from 43% in October. 201 investors were surveyed.

The increase was driven by October's better-than-expected U.S. labour market data.

4% of investors expect a weaker economy in China over the next 12 months, down from 22% in October.

-

10:38

Federal Reserve Chairwoman Janet Yellen: Congress should reject a reform bill on the Fed’s transparency

Federal Reserve Chairwoman Janet Yellen on Tuesday wrote a letter to House Speaker Paul Ryan and House Democratic leader Nancy Pelosi, saying that Congress should reject a reform bill on the Fed's transparency.

"The bill would severely impair the Federal Reserve's ability to carry out its congressional mandate and would be a grave mistake, detrimental to the economy and the American people," she wrote.

Yellen pointed out that the bill would lead to "poor economic outcomes".

-

10:21

Australian leading economic index falls 0.1% in September

The Conference Board (CB) released its leading economic index for Australia on late Tuesday evening. The leading economic index decreased 0.1% in September, after a 0.4% drop in August.

The decrease was driven by a drop in building approvals and share prices.

The coincident index was up 0.2% in September, after a 0.4% gain in August.

The rise was driven by an increase in household gross disposable income, retail trade and industrial production.

-

10:10

French Prime Minister Manuel Valls: the government will likely miss the EU budget deficit target

French Prime Minister Manuel Valls said on Tuesday that the government will likely miss the EU budget deficit target of 3% of gross domestic product (GDP) due to higher security spending.

"France's [deficit] commitments will be inevitably overshot. Europe must understand," he said.

Earlier, France promised to reduce its budget deficit to 3.3% of GDP in 2016 from 3.8% of GDP in 2015, and to 2.7% in 2017.

-

07:17

Global Stocks: U.S. stock indices little changed

U.S. stock indices ended Tuesday's session mixed with minor changes. Several companies reported strong earnings contributing to indices' gains. However declines in energy stocks put pressure on markets.

The Dow Jones Industrial Average climbed 6.49 points, or less than 0.1%, to 17,489.50. The S&P 500 declined 2.75 points, or 0.1%, to 2,050.44 (its energy sector fell 1.2%). The Nasdaq Composite edged up 1.4 points, or less than 0.1%, to 4,986.01.

U.S. consumer prices rose in October, though data also signaled that the core inflation remained at historically low levels. The consumer price index rose by 0.2% on a seasonally adjusted basis after two months of declines. Prices excluding food and energy rose by 0.2% just like in September.

The index of housing construction confidence declined this month, but remained close to a 10-year high suggesting that the industry keeps momentum despite issues in the global economy. The Housing Market Index calculated by the National Association of Home Builders slid 3 points to 62 in November. A reading above 50 suggests that most builders are optimistic about conditions in the single-family homes market.

This morning in Asia Hong Kong Hang Seng fell 0.19%, or 42.27, to 22,221.98. China Shanghai Composite Index lost 0.26%, or 9.55, to 3.595.24. The Nikkei 225 gained 0.27%, or 53.59, to 19,684.22.

Asian indices traded mixed following U.S. indices. Japanese stocks rose as the yen weakened ahead of BOJ meeting.

-

03:34

Nikkei 225 19,785.73 +155.10 +0.79 %, Hang Seng 22,262.87 -1.38 -0.01 %, Shanghai Composite 3,587.97 -16.83 -0.47 %

-

01:01

Stocks. Daily history for Sep Nov 17’2015:

(index / closing price / change items /% change)

Nikkei 225 19,630.63 +236.94 +1.22 %

Hang Seng 22,264.25 +253.43 +1.15 %

Shanghai Composite 3,605.5 -1.46 -0.04 %

FTSE 100 6,268.76 +122.38 +1.99 %

CAC 40 4,937.31 +133.00 +2.77 %

Xetra DAX 10,971.04 +257.81 +2.41 %

S&P 500 2,050.44 -2.75 -0.13 %

NASDAQ Composite 4,986.02 +1.40 +0.03 %

Dow Jones 17,489.5 +6.49 +0.04 %

-