Noticias del mercado

-

22:45

New Zealand: PPI Output (QoQ) , Quarter III 1.3%

-

22:45

New Zealand: PPI Input (QoQ), Quarter III 1.6%

-

16:30

U.S.: Crude Oil Inventories, November 0.252 (forecast 1.9)

-

16:11

Richmond Fed President Jeffrey Lacker has not changed his view that the Fed should start raising its interest rates

Richmond Fed President Jeffrey Lacker said in an interview with CNBC on Wednesday that he has not changed his view that the Fed should start raising its interest rates.

He noted that terrorist attacks in Paris have only temporary impact on the economy.

"We've been through episodes like this before in which some disruption of a certain geopolitical or military nature affects things. For a time people can get cautious and pull back a little bit. These tend to be transitory," Richmond Fed president.

Lacker also said that consumer spending in the U.S. is strong, adding that the economy needs higher real interest rates".

"There's a chance, I think it's raising that we're going to get behind the curve", he noted.

-

16:01

Atlanta Fed President Dennis Lockhart would be ready to start raising interest raise soon

Atlanta Fed President Dennis Lockhart said on Wednesday that the Fed's targets are met and he would be ready to start raising interest raise soon.

"I am comfortable with moving off zero soon, conditioned on no marked deterioration in economic conditions. I believe it will soon be appropriate to begin a new policy phase," he said.

Lockhart added that he will analyse the incoming economic data.

-

15:23

Housing starts in the U.S. drops 11.0% in October

The U.S. Commerce Department released the housing market data on Wednesday. Housing starts in the U.S. dropped 11.0% to 1.060 million annualized rate in October from a 1,191 million pace in September, missing expectations for a decrease to 1.160 million.

September's figure was revised down from 1.206 million units.

The decrease was driven by declines in starts of single-family and multifamily homes.

Housing market benefits from the strengthening of the labour market.

Building permits in the U.S. climbed 4.1% to 1.150 million annualized rate in October from a 1.105 million pace in September, in line with expectations.

Starts of single-family homes decreased 2.4% in October. Building permits for single-family homes were up 2.4%.

Starts of multifamily buildings slid 25.1% in October. Permits for multi-family housing rose 6.8%.

-

14:50

Option expiries for today's 10:00 ET NY cut

USD/JPY 123.00 (USD 940m) 123.50 (288m)

EUR/USD 1.0650 (EUR 764m) 1.0735-50 (850m) 1.0800 (1.23bln)

AUD/USD 0.7000 (AUD 360m) 0.7200 (312m)

NZD/USD 0.6500 (NZD 200m)

EUR/JPY 132.25 (EUR 520m)

-

14:37

Bank of England Deputy Governor Ben Broadbent: the interest rate hike by the central bank depends on different factors

The Bank of England (BoE) Deputy Governor Ben Broadbent said in a speech on Wednesday that the interest rate hike by the central bank depends on different factors.

"The MPC's headline forecasts are based on the assumption that interest rates follow the path priced into financial markets. That may or may not be the same thing as the true outside expectation of future rates. At times, the yield curve can move around for other reasons as well," he said.

"The MPC's inflation forecast is a far from perfect indicator of interest rates. It involves lots of conditioning assumptions, not just forward interest rates, and any of these can change," Broadbent added.

The BoE deputy governor pointed out that markets should not focus too much on the timing of the interest rate hike.

"When it comes to the so-called "lift-off" date for interest rates, is that the yield curve is currently very flat. As a result, even relatively moderate changes in forward rates, prompted by unexceptional news about the economy, can result in big shifts in the date at which the yield curve first reaches some particular level," he said.

-

14:30

U.S.: Building Permits, October 1150 (forecast 1150)

-

14:30

U.S.: Housing Starts, October 1060 (forecast 1160)

-

14:15

Foreign exchange market. European session: the euro traded higher against the U.S. dollar despite the negative economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Wage Price Index, q/q Quarter III 0.6% 0.6% 0.6%

00:30 Australia Wage Price Index, y/y Quarter III 2.3% 2.3% 2.3%

10:00 Eurozone Construction Output, y/y September -1.4% Revised From -6.0% 1.8%

10:00 Switzerland Credit Suisse ZEW Survey (Expectations) November 18.3 0.0

12:00 U.S. MBA Mortgage Applications November -1.3% 6.2%

The U.S. dollar traded mixed against the most major currencies ahead the release of the U.S. housing market data from the U.S. Housing starts in the U.S. are expected to decline to 1.160 million units in October from 1.206 million units in September.

The number of building permits is expected to increase to 1.150 million units in October from 1.105 million units in September.

The Fed will release its latest monetary policy minutes at 19:00 GMT.

The euro traded higher against the U.S. dollar despite the negative economic data from the Eurozone. The Eurostat released its construction production data for the Eurozone on Wednesday. Construction production in the Eurozone decreased 0.4% in September, after a 0.5% rise in August.

Civil engineering output gained 0.3% in September, while production in the building sector was down 0.6%.

On a yearly basis, construction output increased 1.8% in September, after a 1.8% decline in August. August's figure was revised up from a 6.0% drop.

Civil engineering output rose 2.4% year-on-year in September, while production in the building sector climbed 1.6% year-on-year.

The European Central Bank (ECB) executive board member Yves Mersch said on Wednesday that there is no indication that terror attacks in Paris will have a negative impact on the economy.

"We have no indication of any economic pessimism as a result of the Paris attacks, let alone weaker hard data. Doom-and-gloom talk is not warranted at this stage," he said.

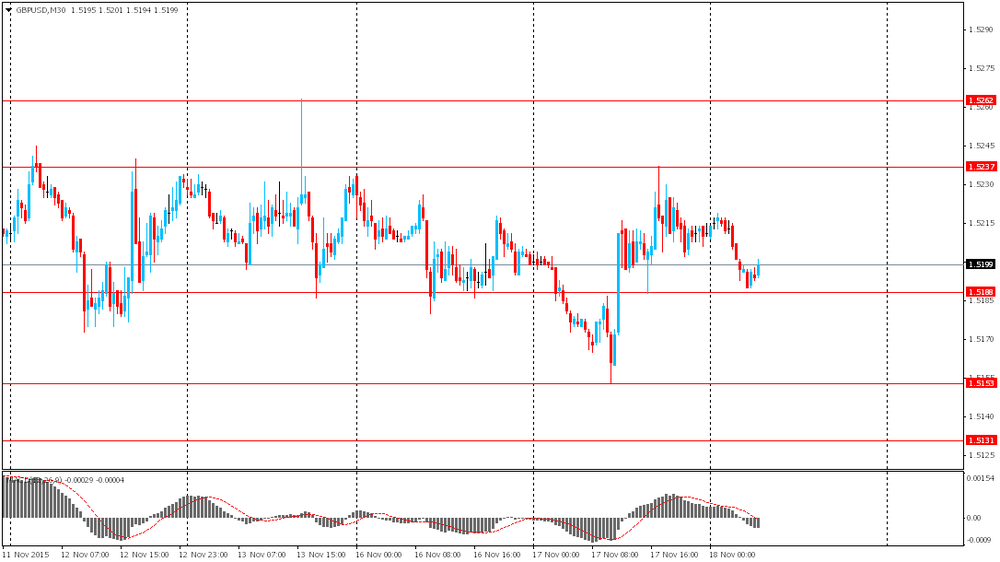

The British pound traded higher against the U.S. dollar in the absence of any major economic reports from the U.K.

The Swiss franc traded mixed against the U.S. dollar. A survey by the ZEW Institute and Credit Suisse Group showed on Wednesday that Switzerland's economic sentiment index dropped to 0.0 in November from 18.3 points in October.

"The financial analysts surveyed expect to see neither an improvement nor a deterioration in Swiss economic activity over the next six months," the ZEW said.

The current conditions fell to -12.2 in November from -5.3 points in October.

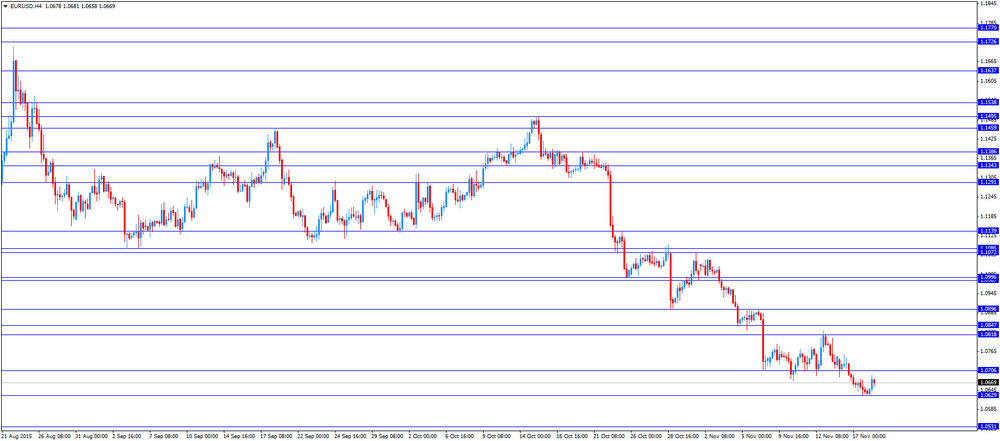

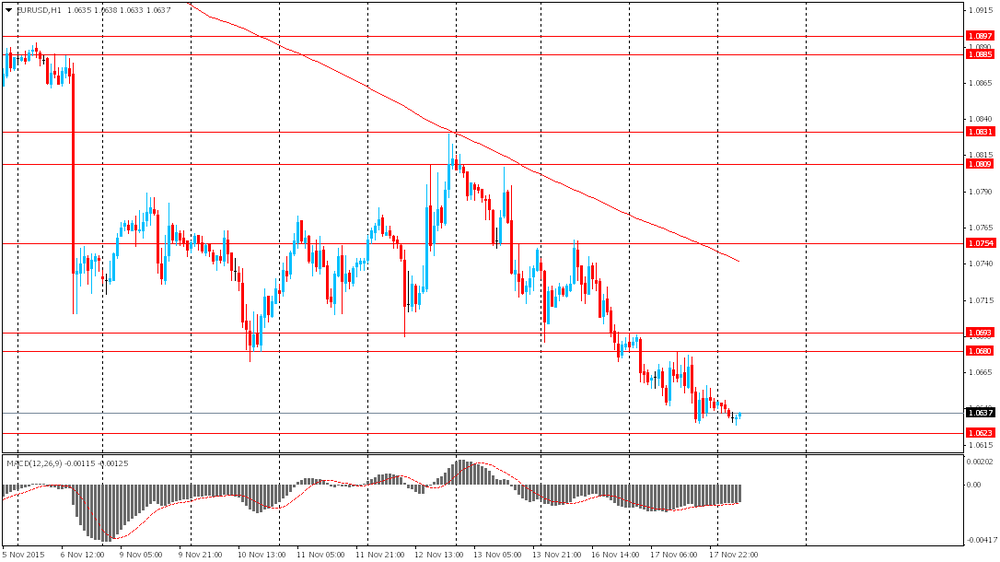

EUR/USD: the currency pair increased to $1.0692

GBP/USD: the currency pair rose to $1.5247

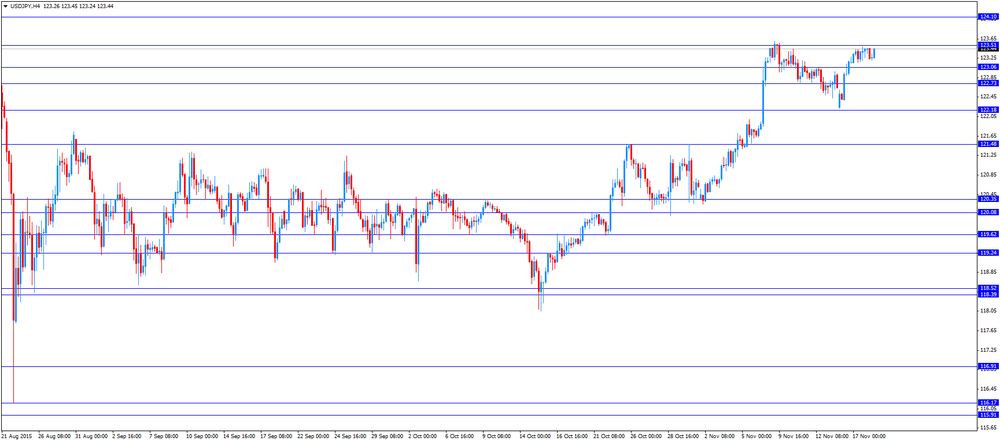

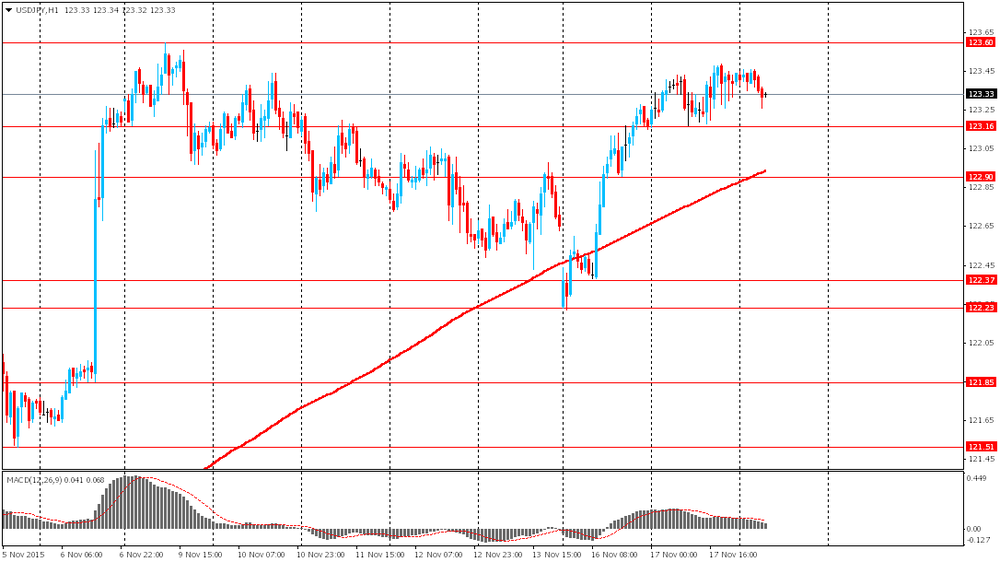

USD/JPY: the currency pair climbed to Y123.45

The most important news that are expected (GMT0):

13:30 U.S. Housing Starts October 1206 1160

13:30 U.S. Building Permits October 1105 1150

15:30 U.S. Crude Oil Inventories November 4.224 1.9

19:00 U.S. FOMC meeting minutes

21:45 New Zealand PPI Input (QoQ) Quarter III -0.3%

21:45 New Zealand PPI Output (QoQ) Quarter III -0.2%

23:50 Japan Trade Balance Total, bln October -114.5 -292

-

14:00

Orders

EUR/USD

Offers 1.0680 1.0700 1.0725 1.0745 1.0760 1.0780-85 1.0800

Bids 1.0630-35 1.0620 1.0600 1.0580 1.0550 1.0525-30 1.0500

GBP/USD

Offers 1.5220-25 1.5235 1.5250 1.5265 1.5280 1.5300 1.5325 1.5350

Bids 1.5185 1.5150 1.5125-30 1.5100 1.5080-85 1.5060 1.5030 1.5000

EUR/GBP

Offers 0.7025 0.7035 0.7050 0.7075-80 0.7100 0.7125-30 0.7150 0.7185 0.7200

Bids 0.7000 0.6985 0.6965 0.6950 0.6930 0.6900 0.6885 0.6865 0.6850

EUR/JPY

Offers 131.85 132.00 132.40 132.60 132.75-80 133.00

Bids 131.50 131.20 131.00 130.80 130.50 130.25-30 130.00

USD/JPY

Offers 123.50 123.75-80 124.00 124.30 124.50 124.75 125.00

Bids 123.00 122.80-85 122.50 122.25 122.00 121.80 121.50-60

AUD/USD

Offers 0.7120 0.7140-50 0.7180-85 0.7200 0.7220 0.7250

Bids 0.7085 0.7065 0.7050 0.7035 0.7020 0.7000 0.6985 0.6950

-

13:16

U.S.: MBA Mortgage Applications, November 6.2%

-

11:41

European Central Bank executive board member Yves Mersch: there is no indication that terror attacks in Paris will have a negative impact on the economy

The European Central Bank (ECB) executive board member Yves Mersch said on Wednesday that there is no indication that terror attacks in Paris will have a negative impact on the economy.

"We have no indication of any economic pessimism as a result of the Paris attacks, let alone weaker hard data. Doom-and-gloom talk is not warranted at this stage," he said.

-

11:27

Construction production in the Eurozone declines 0.4% in September

The Eurostat released its construction production data for the Eurozone on Wednesday. Construction production in the Eurozone decreased 0.4% in September, after a 0.5% rise in August.

Civil engineering output gained 0.3% in September, while production in the building sector was down 0.6%.

On a yearly basis, construction output increased 1.8% in September, after a 1.8% decline in August. August's figure was revised up from a 6.0% drop.

Civil engineering output rose 2.4% year-on-year in September, while production in the building sector climbed 1.6% year-on-year.

-

11:20

Option expiries for today's 10:00 ET NY cut

USD/JPY 123.00 (USD 940m) 123.50 (288m)

EUR/USD 1.0650 (EUR 764m) 1.0735-50 (850m) 1.0800 (1.23bln)

AUD/USD 0.7000 (AUD 360m) 0.7200 (312m)

NZD/USD 0.6500 (NZD 200m)

EUR/JPY 132.25 (EUR 520m)

-

11:17

ZEW Institute and Credit Suisse Group’s survey: Switzerland's economic sentiment index drops to 0.0 in November

A survey by the ZEW Institute and Credit Suisse Group showed on Wednesday that Switzerland's economic sentiment index dropped to 0.0 in November from 18.3 points in October.

"The financial analysts surveyed expect to see neither an improvement nor a deterioration in Swiss economic activity over the next six months," the ZEW said.

The current conditions fell to -12.2 in November from -5.3 points in October.

-

11:16

Eurozone: Construction Output, y/y, September 1.8%

-

11:05

Nomura Research Institute survey: fewer Japanese think that the country’s economy will worsen

According to a survey by Nomura Research Institute (NRI), fewer Japanese think that the country's economy will worsen. More Japanese expect the economy to improve over the next year.

"In 2012, there was very strong pessimism. Now, it's not like people really want to spend money, but there is less pessimism," NRI consultant Motoko Matsushita said.

-

11:00

Switzerland: Credit Suisse ZEW Survey (Expectations), November 0.0

-

10:51

BofA Merrill Lynch Fund Manager Survey: 81% of investors expect the Fed to start raising its interest rates this year

According to the BofA Merrill Lynch Fund Manager Survey, 81% of investors expect the Fed to start raising its interest rates this year, up from 43% in October. 201 investors were surveyed.

The increase was driven by October's better-than-expected U.S. labour market data.

4% of investors expect a weaker economy in China over the next 12 months, down from 22% in October.

-

10:38

Federal Reserve Chairwoman Janet Yellen: Congress should reject a reform bill on the Fed’s transparency

Federal Reserve Chairwoman Janet Yellen on Tuesday wrote a letter to House Speaker Paul Ryan and House Democratic leader Nancy Pelosi, saying that Congress should reject a reform bill on the Fed's transparency.

"The bill would severely impair the Federal Reserve's ability to carry out its congressional mandate and would be a grave mistake, detrimental to the economy and the American people," she wrote.

Yellen pointed out that the bill would lead to "poor economic outcomes".

-

10:21

Australian leading economic index falls 0.1% in September

The Conference Board (CB) released its leading economic index for Australia on late Tuesday evening. The leading economic index decreased 0.1% in September, after a 0.4% drop in August.

The decrease was driven by a drop in building approvals and share prices.

The coincident index was up 0.2% in September, after a 0.4% gain in August.

The rise was driven by an increase in household gross disposable income, retail trade and industrial production.

-

10:10

French Prime Minister Manuel Valls: the government will likely miss the EU budget deficit target

French Prime Minister Manuel Valls said on Tuesday that the government will likely miss the EU budget deficit target of 3% of gross domestic product (GDP) due to higher security spending.

"France's [deficit] commitments will be inevitably overshot. Europe must understand," he said.

Earlier, France promised to reduce its budget deficit to 3.3% of GDP in 2016 from 3.8% of GDP in 2015, and to 2.7% in 2017.

-

08:30

Options levels on wednesday, November 18, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.0865 (4689)

$1.0802 (1755)

$1.0753 (949)

Price at time of writing this review: $1.0645

Support levels (open interest**, contracts):

$1.0587 (5488)

$1.0550 (7565)

$1.0499 (6513)

Comments:

- Overall open interest on the CALL options with the expiration date December, 4 is 90245 contracts, with the maximum number of contracts with strike price $1,1200 (5515);

- Overall open interest on the PUT options with the expiration date December, 4 is 115221 contracts, with the maximum number of contracts with strike price $1,0500 (8469);

- The ratio of PUT/CALL was 1.28 versus 1.29 from the previous trading day according to data from November, 17

GBP/USD

Resistance levels (open interest**, contracts)

$1.5501 (1002)

$1.5402 (1846)

$1.5305 (2652)

Price at time of writing this review: $1.5193

Support levels (open interest**, contracts):

$1.5095 (2736)

$1.4998 (2870)

$1.4899 (2343)

Comments:

- Overall open interest on the CALL options with the expiration date December, 4 is 28629 contracts, with the maximum number of contracts with strike price $1,5600 (3583);

- Overall open interest on the PUT options with the expiration date December, 4 is 32627 contracts, with the maximum number of contracts with strike price $1,5050 (5030);

- The ratio of PUT/CALL was 1.14 versus 1.13 from the previous trading day according to data from November, 17

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:45

Foreign exchange market. Asian session: the pound declined

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia Wage Price Index, q/q Quarter III 0.6% 0.6% 0.6%

00:30 Australia Wage Price Index, y/y Quarter III 2.3% 2.3% 2.3%

Today investors are focused on the release of minutes of Fed's latest meeting. Market participants want to assess probability of a rate hike in December. A survey by Bloomberg suggests a 66% chance of a rate hike when the FOMC meets next month. At the end of October the probability stood at 50%.

The pound declined against the U.S. dollar ahead of a speech by U.K. Energy Secretary Amber Rudd, who is expected to unveil a new energy strategy for the country.

The New Zealand dollar edged down at the beginning of the session amid declines in dairy prices. Prices have fallen for the third time in a row at a global dairy auction. This means the Reserve Bank of New Zealand may cut its benchmark interest rate next month. Nevertheless the NZD rebounded later in the session.

EUR/USD: the pair fluctuated within $1.0630-50 in Asian trade

USD/JPY: the pair fell to Y123.25

GBP/USD: the pair fell to $1.5190

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

10:00 Eurozone Construction Output, y/y September -6.0%

10:00 Switzerland Credit Suisse ZEW Survey (Expectations) November 18.3

12:00 U.S. MBA Mortgage Applications November -1.3%

13:30 U.S. Housing Starts October 1206 1160

13:30 U.S. Building Permits October 1105 1150

15:30 U.S. Crude Oil Inventories November 4.224 1.9

19:00 U.S. FOMC meeting minutes

21:45 New Zealand PPI Input (QoQ) Quarter III -0.3%

21:45 New Zealand PPI Output (QoQ) Quarter III -0.2%

23:50 Japan Trade Balance Total, bln October -114.5 -292

-

01:30

Australia: Wage Price Index, q/q, Quarter III 0.6% (forecast 0.6%)

-

01:30

Australia: Wage Price Index, y/y, Quarter III 2.3% (forecast 2.3%)

-

01:00

Currencies. Daily history for Nov 17’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0641 -0,41%

GBP/USD $1,5211 +0,08%

USD/CHF Chf1,0146 +0,50%

USD/JPY Y123,44 +0,22%

EUR/JPY Y131,35 -0,20%

GBP/JPY Y187,76 +0,30%

AUD/USD $0,7110 +0,23%

NZD/USD $0,6469 -0,34%

USD/CAD C$1,3318 -0,08%

-

00:30

Australia: Leading Index, October 0.1%

-

00:15

Schedule for today, Wednesday, Nov 18’2015:

(time / country / index / period / previous value / forecast)

0:30 Australia Wage Price Index, q/q Quarter III 0.6% 0.6%

00:30 Australia Wage Price Index, y/y Quarter III 2.3% 2.3%

10:00 Eurozone Construction Output, y/y September -6.0%

10:00 Switzerland Credit Suisse ZEW Survey (Expectations) November 18.3

12:00 U.S. MBA Mortgage Applications November -1.3%

13:30 U.S. Housing Starts October 1206 1160

13:30 U.S. Building Permits October 1105 1150

15:30 U.S. Crude Oil Inventories November 4.224 1.6

19:00 U.S. FOMC meeting minutes

21:45 New Zealand PPI Input (QoQ) Quarter III -0.3%

21:45 New Zealand PPI Output (QoQ) Quarter III -0.2%

23:50 Japan Trade Balance Total, bln October -114.5 -292

-

00:00

Australia: Conference Board Australia Leading Index, September -0.1%

-