Noticias del mercado

-

18:00

European stocks closed: FTSE 100 6,329.93 +50.96 +0.81% CAC 40 4,915.1 +8.38 +0.17% DAX 11,085.44 +125.49 +1.14%

-

17:18

The People's Bank of China cuts Standing Lending Facility (SLF) interest rates

The People's Bank of China (PBoC) lowered its seven-day Standing Lending Facility (SLF) interest rate for local financial institutions to 3.25% from 5.5%. The overnight SLF rate for some local financial institutions was cut to 2.75% from 4.5%.

The central bank hopes with this decision to stimulate the country's economy.

The interest rate cut would be effective from November 20.

-

17:06

Preliminary real GDP in the OECD area climbs 0.4% in the third quarter

The Organization for Economic Cooperation and Development (OECD) released its preliminary real gross domestic product (GDP) growth figures on Thursday. Real GDP of 34 OECD member countries rose 0.4% in the third quarter, after a 0.6% gain in the second quarter.

Real GDP of the United States was down to 0.4% from 1.0%, real GDP of Germany fell to 0.3% from 0.4%, while Britain's economy decreased to 0.5% from 0.7%.

GDP of China remained unchanged at 1.8% in the third quarter.

GDP of France increased to 0.3% from 0.0%, Italy's economy decreased to 0.2% from 0.3%, while Japan's GDP contracted by 0.2%.

Eurozone's economy expanded at 0.4% in the third quarter, after a 0.4% rise in the second quarter.

On a yearly basis, GDP of 34 OECD member countries was up 2.0% in the third quarter, after a 2.2% gain in the previous quarter.

-

16:51

Cleveland Fed President Loretta Mester hints that an interest rate hike by the Fed is possible soon

Cleveland Fed President Loretta Mester hinted in an interview with CNBC on Thursday that an interest rate hike by the Fed is possible soon.

"Things are on track," she said.

Mester noted that the U.S. labour market is near or reached full employment, while inflation is moving toward the 2% target.

Cleveland Fed president pointed out that terrorist attacks are unlikely to have a negative impact on the outlook of the U.S. economy.

-

16:40

Spain’s trade deficit narrows to €2.57 billion in September

Spain's Economy Ministry released its trade data on Thursday. The trade deficit narrowed to €2.57 billion in September from €2.37 billion in September a year ago.

Exports rose at an annual rate of 1.1% in September, while imports rose 1.8%.

In the January to September period, the trade deficit totalled €18.64 billion, down 1.1% from the same period of 2014.

Exports increased 4.4% in the January to September period, while imports gained 3.9%.

-

16:36

U.S. leading economic index climbs 0.6% in October

The Conference Board released its leading economic index (LEI) for the U.S. on Thursday. The leading economic index climb 0.6% in October, exceeding expectations a 0.5% gain, after a 0.1% fall in September. September's figure was revised up from a 0.2% decrease.

The coincident economic index rose 0.2% in October, after a 0.1% gain in September.

"The U.S. LEI rose sharply in October, with the yield spread, stock prices, and building permits driving the increase. Despite lacklustre third quarter growth, the economic outlook now appears to be improving. While the U.S. LEI's six-month growth rate has moderated, the U.S. economy remains on track for continued expansion heading into 2016," director of business cycles and growth research at The Conference Board, Ataman Ozyildirim, said.

-

16:29

New Zealand’s producer price inflation climbs in the third quarter

Statistics New Zealand released its output and input producer price index (PPI) data on the late Wednesday evening. New Zealand's input PPI rose 1.6% in the third quarter, after a 0.3% drop in the second quarter.

Output PPI climbed 1.3% in the third quarter, after a 0.2% fall in the second quarter.

Producer prices were driven by higher meat and farm-gate milk prices.

"Prices were up 10 percent for sheep, beef, and grain farmers. This meant meat product manufacturers had an 8.0 percent rise in their input prices. The prices they received rose 5.5 percent, due to higher meat export prices on the back of a weaker New Zealand dollar," Statistics New Zealand's prices manager Chris Pike said.

-

16:19

Japan's trade deficit turns into a surplus of ¥115.5 billion in October

The Ministry of Finance released its trade data for Japan on the late Wednesday evening. Japan's trade deficit turned into a surplus of ¥115.5 billion in October from a deficit of ¥114.5 billion in September.

Analysts had expected a deficit of ¥292 billion.

Exports rose 7.6% year-on-year in October, while imports dropped 13.4%.

Exports to Asia declined by 3.6% year-on-year, exports to the United States increased by 6.3%, exports to China fell by 3.6%, while exports to the European Union were up 5.6%.

Imports from Asia decreased 4.7% year-on-year, imports from the United States jumped 1.0%, while imports from China slid 5.2%.

-

16:00

U.S.: Leading Indicators , October 0.6% (forecast 0.5%)

-

15:18

ECB Monetary Policy Meeting Account: current measures may not be sufficient to reach the inflation target

The European Central Bank's (ECB) its minutes of October meeting on Thursday. According to the minutes, the central bank will review its stimulus measures at the December monetary policy meeting, and is ready to add further stimulus measures if needed.

"The Governing Council was willing and able to act, if warranted, by using all available tools within its mandate, including by adjusting the size, composition and duration of the APP [asset purchase programme]," the minutes said.

The central bank said that current measures may not be sufficient to reach the inflation target.

"The impact of external factors and heightened uncertainty raised the possibility that the ECB's measures, despite their magnitude, might not be gaining sufficient traction in the present environment to achieve their ultimate objective in terms of inflation rates, also in view of low price pressures globally," the ECB said.

The central bank also said that it will likely miss its inflation target.

"The anticipated timing of inflation normalising towards 2% was likely to be pushed back again, as had already been the case in previous staff projections," the ECB noted.

-

14:58

Philadelphia Federal Reserve Bank’s manufacturing index is up to 1.9 in November

The Philadelphia Federal Reserve Bank released its manufacturing index on Thursday. The index increased to 1.9 in November from-4.5 in October, exceeding expectations for a rise to -1.0.

A reading above zero indicates expansion, while a reading below zero indicates contraction.

"Manufacturing conditions in the region showed slight improvement this month, according to firms responding to the November Manufacturing Business Outlook Survey. The indicator for general activity was slightly positive this month, following two months in negative territory," the Philadelphia Federal Reserve Bank said in its survey.

The shipments index was up to -2.5 in November from -6.1 in October.

The new orders index increased to -3.7 in November from 10.6 in October.

The prices paid index slid to -4.9 in November from -0.1 in October, while the prices received index decreased to -0.4 from 1.3.

The number of employees index climbed to 2.6 in November from -1.7 in October.

According to the report, the future general activity index was up to 43.4 in November from 36.7 in October.

-

14:46

Initial jobless claims decline to 271,000 in the week ending November 14

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending November 14 in the U.S. fell to 271,000 from 276,000 in the previous week, in line with expectations.

Jobless claims remained below 300,000 the 37th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims decreased by 2,000 to 2,175,000 in the week ended November 07.

-

14:45

Option expiries for today's 10:00 ET NY cut

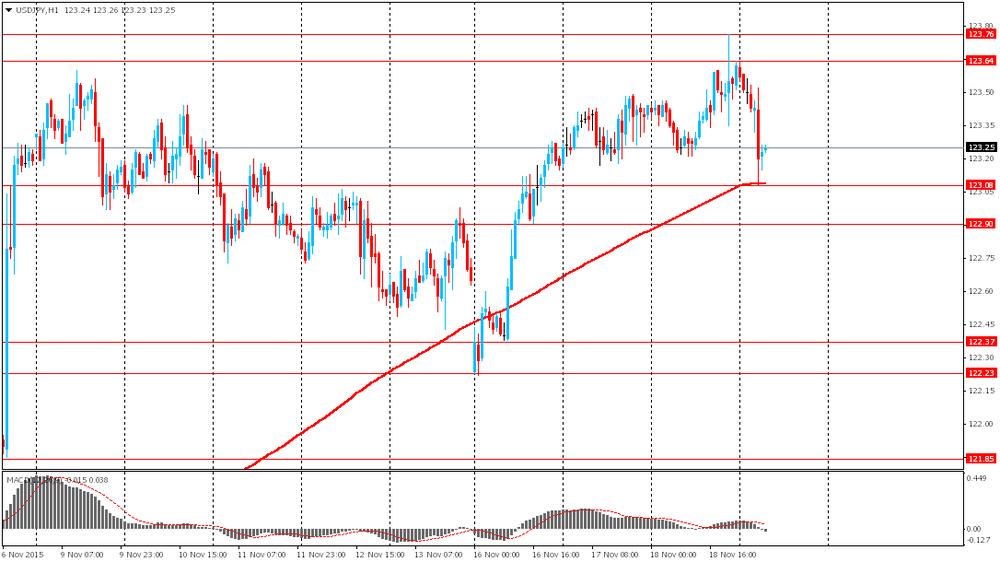

USD/JPY 122.50 (USD 1.65bln) 122.75 (636m) 123.00 (612m) 124.00-05 (1bln)

EUR/USD 1.0650 (USD 643m) 1.0700 (797m)

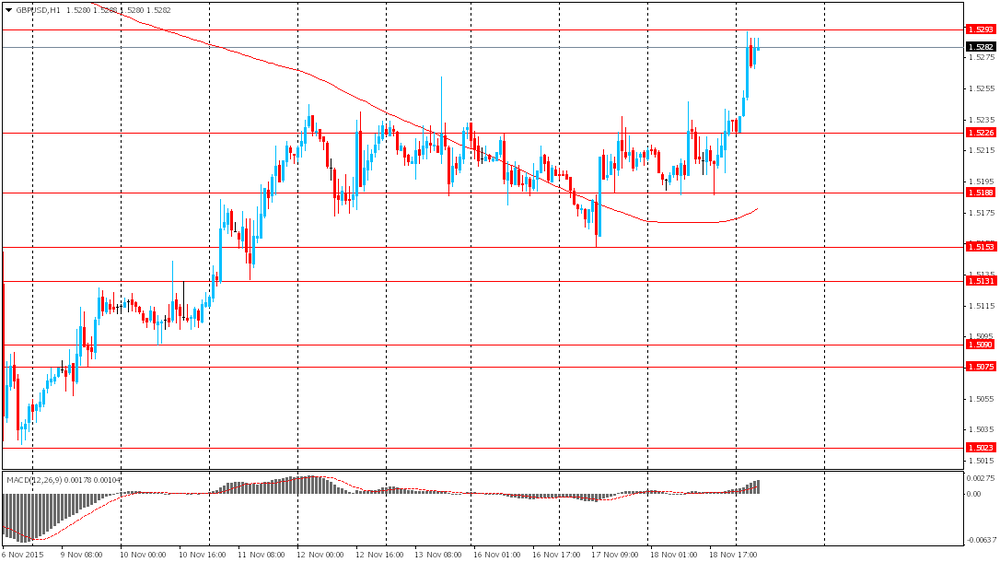

GBP/USD 1.5100 (GBP 460m) 1.5250 (306m)

USD/CAD 1.3250-65 (USD 620m)

AUD/USD 0.7100 (AUD 763m) 0.7150 (667m) 0.7200 (431m) 0.7270 (737m)

EUR/GBP 0.7055 (EUR 225m)

-

14:40

Canada’s wholesale sales decrease 0.1% in September

Statistics Canada released wholesale sales figures on Thursday. Wholesale sales fell 0.1% in September, missing expectations for a 0.3% gain, after a 0.1% decline in August.

The decline was driven by lower sales in the motor vehicle and parts and the building material and supplies subsectors.

Sales of automobiles and parts were down 3.0% in September.

Sales in the building material and supplies subsector declined 2.1% in September, while sales in the food, beverage and tobacco subsector increased 1.6%.

Inventories fell by 0.4% in September.

-

14:30

U.S.: Initial Jobless Claims, November 271 (forecast 271)

-

14:30

Canada: Wholesale Sales, m/m, September -0.1% (forecast 0.3%)

-

14:30

U.S.: Continuing Jobless Claims, November 2175 (forecast 2170)

-

14:26

CBI industrial order books balance rises to -11% in November

The Confederation of British Industry (CBI) released its industrial order books balance on Thursday. The CBI industrial order books balance rose to -11% in November to -18% in October.

Decline in export demand weighed on new orders.

"Poor export performance is weighing on the UK economy, as manufacturers are held back by a strong pound and a weakening global growth outlook," the CBI director of economics Rain Newton-Smith said.

-

14:17

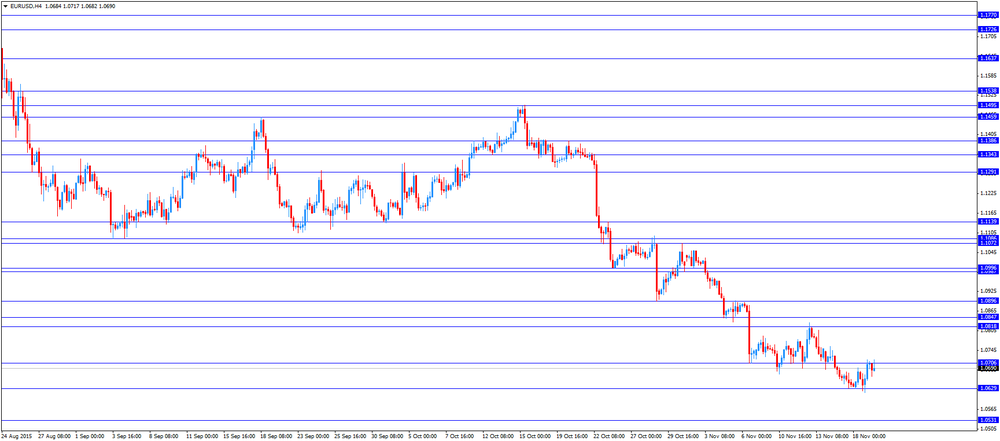

Foreign exchange market. European session: the euro slightly fell against the U.S. dollar after the release of the European Central Bank’s (ECB) minutes

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

04:00 Japan BoJ Interest Rate Decision 0% 0% 0%

04:00 Japan Bank of Japan Monetary Base Target 275 275

04:00 Japan BoJ Monetary Policy Statement

04:30 Japan All Industry Activity Index, m/m September -0.2% 0.2% -0.2%

06:30 Japan BOJ Press Conference

07:00 Switzerland Trade Balance October 3.25 Revised From 3.05 3.4 4.16

08:00 Eurozone ECB's Jens Weidmann Speaks

09:00 Eurozone Current account, unadjusted, bln September 14.6 Revised From 18.7 33.1

09:30 United Kingdom Retail Sales (MoM) October 1.7% Revised From 1.9% -0.5% -0.6%

09:30 United Kingdom Retail Sales (YoY) October 6.2% Revised From 6.5% 4.2% 3.8%

12:30 Eurozone ECB Monetary Policy Meeting Accounts

The U.S. dollar traded mixed against the most major currencies ahead the release of the U.S. economic data. The number of initial jobless claims in the U.S. is expected to decrease by 5,000 to 271,000 last week.

The Philadelphia Federal Reserve Bank' manufacturing index is expected to increase to -1.0 in November from -4.5 in October.

The U.S. leading economic index is expected to climb 0.5% in October, after a 0.2% decrease in September.

Yesterday's minutes of the Fed's latest monetary policy meeting minutes weighed on the greenback. The minutes showed that an interest rate hike in December is possible, but it will depend on the incoming data.

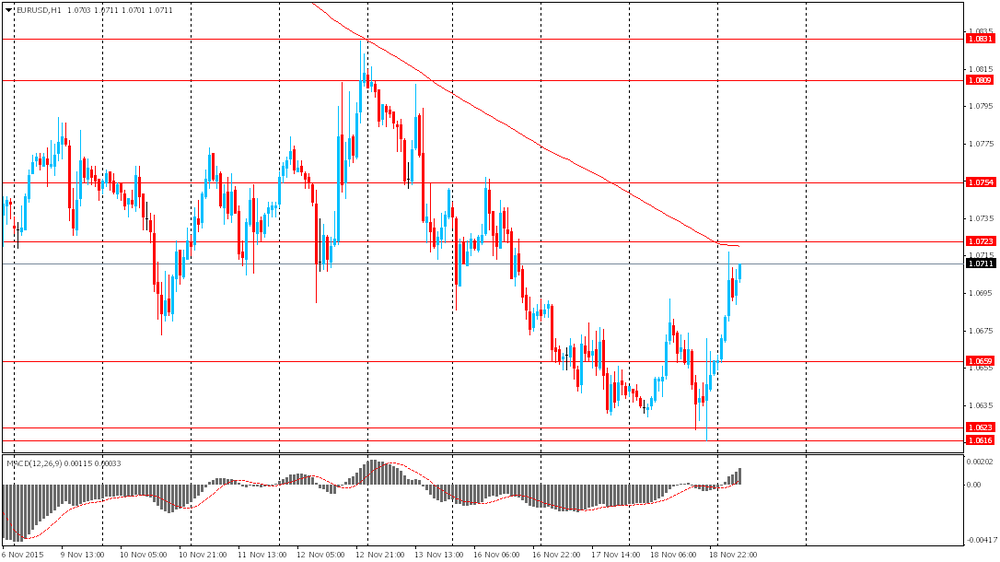

The euro slightly fell against the U.S. dollar after the release of the European Central Bank's (ECB) minutes. The central bank said that current measures may not be sufficient to reach the inflation target. The ECB noted that it will review its stimulus measures at its monetary policy meeting in December.

The European Central Bank (ECB) Executive Board member Peter Praet said in a speech on Thursday that the uncertainty about the economy increased.

He noted that the economy in the Eurozone improved, adding that downside risks increased, while tail risks receded.

Meanwhile, the economic data from the Eurozone was positive. The European Central Bank (ECB) released its current account on Thursday. Eurozone's current account surplus rose to a seasonally adjusted €29.4 billion in September from €18.7 billion in August. August's figure was revised up from a surplus of €17.7 billion.

The British pound traded lower against the U.S. dollar after the release of the weaker-than-expected retail sales data from the U.K. The Office for National Statistics released its retail sales data for the U.K. on Thursday. Retail sales in the U.K. fell 0.6% in October, missing expectations for a 0.5% decline, after a 1.7% rise in September. September's figure was revised down from a 1.9% increase.

The decline was driven by lower food stores, department stores and clothing sales.

Food sales declined 1.3% in October, non-food sales fell 0.3%, and clothing and footwear sales slid 1.8%, while household goods sales dropped 0.8%.

Sales of auto fuel climbed 1.7% in October.

On a yearly basis, retail sales in the U.K. climbed 3.8% in October, missing forecasts of 4.2% increase, after a 6.2% rise in September. September's figure was revised down from a 6.5% gain.

The Confederation of British Industry (CBI) released its industrial order books balance on Thursday. The CBI industrial order books balance rose to -11% in November to -18% in October.

The Canadian dollar traded mixed against the U.S. dollar ahead of the release of the wholesale sales data from Canada. Wholesales sales in Canada are expected to rise 0.3% in September, after a 0.1% decline in August.

The Swiss franc traded mixed against the U.S. dollar. The Swiss Federal Customs Administration released its trade data on Thursday. The Swiss trade surplus rose to CHF4.16 billion in October from CHF3.25 billion in the previous month. September's figure was revised up from a surplus of CHF3.05 billion.

Exports climbed 5.1% in October, while imports rose 3.5%.

Exports dropped 1.5% year-on-year in October, while imports were down 5.3% year-on-year.

EUR/USD: the currency pair increased to $1.0717

GBP/USD: the currency pair fell to $1.5236

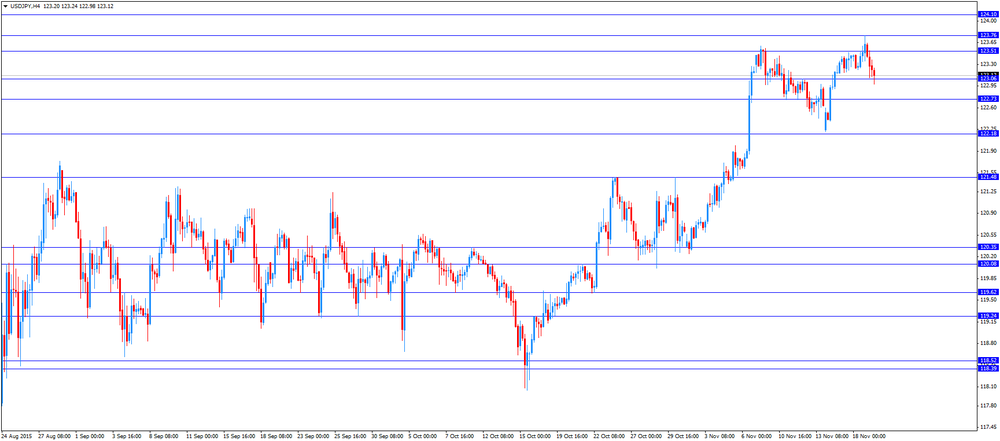

USD/JPY: the currency pair declined to Y122.98

The most important news that are expected (GMT0):

13:30 Canada Wholesale Sales, m/m September -0.1% 0.3%

13:30 U.S. Initial Jobless Claims November 276 271

15:00 U.S. Leading Indicators October -0.2% 0.5%

15:00 U.S. Philadelphia Fed Manufacturing Survey November -4.5 -1

17:30 U.S. FOMC Member Dennis Lockhart Speaks

21:45 U.S. FED Vice Chairman Stanley Fischer Speaks

-

13:59

Orders

EUR/USD

Offers 1.0700 1.0720-25 1.0745 1.0760 1.0780-85 1.0800 1.0830 1.0850

Bids 1.0665 1.0650 1.0630-35 1.0620 1.0600 1.0580 1.0550 1.0525-30 1.0500

GBP/USD

Offers 1.5285 1.5300-10 1.5325 1.5350 1.5380 1.5400

Bids 1.5250-60 1.5220-25 1.5200 1.5185 1.5150 1.5125-30 1.5100

EUR/GBP

Offers 0.7000 0.7010 0.7025 0.7035 0.7050 0.7075-80 0.7100 0.7125-30 0.7150

Bids 0.6980-85 0.6965 0.6950 0.6930 0.6900 0.6885 0.6865 0.6850

EUR/JPY

Offers 131.85 132.00 132.40 132.60 132.75-80 133.00

Bids 131.20 131.00 130.80 130.50 130.25-30 130.00

USD/JPY

Offers 123.35 123.50 123.65.70 123.85 124.00 124.30 124.50 124.75 125.00

Bids 123.00 122.80-85 122.50 122.25 122.00 121.80 121.50-60

AUD/USD

Offers 0.7180-85 0.7200 0.7220 0.7250 0.7275-80 0.7300

Bids 0.7150 0.7120-25 0.7100 0.7085 0.7065 0.7050

-

12:08

European Central Bank Executive Board member Peter Praet: the uncertainty about the economy increased

The European Central Bank (ECB) Executive Board member Peter Praet said in a speech on Thursday that the uncertainty about the economy increased.

He noted that the economy in the Eurozone improved.

"The incoming data points to an overall picture of normalisation in the euro area economy. Domestic demand is gradually strengthening," Praet said.

But he added that downside risks increased, while tail risks receded.

-

11:53

Bank of Japan Governor Haruhiko Kuroda plays down the weak GDP data

The Bank of Japan (BoJ) Governor Haruhiko Kuroda played down the weak GDP data at a press conference on Thursday, saying the Japanese economy shrank in the third quarter due to a reduction in inventories.

He added that he expects business capital expenditure to improve.

Kuroda noted that underlying long-term inflation was picking up.

The BoJ government pointed out that terrorist attacks in Paris will have only limited impact on the economy.

-

11:41

Option expiries for today's 10:00 ET NY cut

USD/JPY 122.50 (USD 1.65bln) 122.75 (636m) 123.00 (612m) 124.00-05 (1bln)

EUR/USD 1.0650 (USD 643m) 1.0700 (797m)

GBP/USD 1.5100 (GBP 460m) 1.5250 (306m)

USD/CAD 1.3250-65 (USD 620m)

AUD/USD 0.7100 (AUD 763m) 0.7150 (667m) 0.7200 (431m) 0.7270 (737m)

EUR/GBP 0.7055 (EUR 225m)

-

11:26

Swiss trade surplus rises to CHF4.16 billion in October

The Swiss Federal Customs Administration released its trade data on Thursday. The Swiss trade surplus rose to CHF4.16 billion in October from CHF3.25 billion in the previous month. September's figure was revised up from a surplus of CHF3.05 billion.

Exports climbed 5.1% in October, while imports rose 3.5%.

Exports dropped 1.5% year-on-year in October, while imports were down 5.3% year-on-year.

-

11:14

UK retail sales drop 0.6% in October

The Office for National Statistics released its retail sales data for the U.K. on Thursday. Retail sales in the U.K. fell 0.6% in October, missing expectations for a 0.5% decline, after a 1.7% rise in September. September's figure was revised down from a 1.9% increase.

The decline was driven by lower food stores, department stores and clothing sales.

Food sales declined 1.3% in October, non-food sales fell 0.3%, and clothing and footwear sales slid 1.8%, while household goods sales dropped 0.8%.

Sales of auto fuel climbed 1.7% in October.

On a yearly basis, retail sales in the U.K. climbed 3.8% in October, missing forecasts of 4.2% increase, after a 6.2% rise in September. September's figure was revised down from a 6.5% gain.

-

11:05

Eurozone’s current account surplus rises to a seasonally adjusted €29.4 billion in September

The European Central Bank (ECB) released its current account on Thursday. Eurozone's current account surplus rose to a seasonally adjusted €29.4 billion in September from €18.7 billion in August. August's figure was revised up from a surplus of €17.7 billion.

The trade surplus climbed to €29.8 billion in September from €22.1 billion in August.

The surplus on services remained unchanged at €4.5 billion in September.

The secondary income deficit decreased to €9.8 billion in September from €11.6 billion in August, while the primary income surplus increased to €4.8 billion from €3.8 billion.

Eurozone's unadjusted current account surplus jumped to €33.1 billion in September from €14.6 billion in August. August's figure was revised down from a surplus of €18.7 billion.

-

10:52

Bank of Japan keeps its monetary policy unchanged in November

The Bank of Japan (BoJ) released its interest rate decision on Thursday. The BoJ kept its monetary policy unchanged (interest rate: 0.00-0.10%, monetary base target: 275 trillion yen). The central bank will expand its monetary base at an annual pace of 80 trillion yen. This decision was expected by analysts.

The BoJ board members voted 8-1 to keep monetary policy unchanged.

The BoJ noted that the country's economy continued to recover moderately, "although exports and production are affected by the slowdown in emerging economies".

The central bank said that the annual inflation in Japan was flat, but inflation expectations seems to be rising.

The BoJ expect the inflation to be about 0% "for the time being", due to low energy prices.

-

10:40

The People’s Bank of China limits the capital outflow

The People's Bank of China (PBoC) limited the capital outflow. According people with direct knowledge of the matter, China's central bank suspended offshore yuan clearing banks' and related offshore participant banks' trading in bond repos and account finance.

There were no comments by the PBoC.

-

10:30

United Kingdom: Retail Sales (MoM), October -0.6% (forecast -0.5%)

-

10:30

United Kingdom: Retail Sales (YoY) , October 3.8% (forecast 4.2%)

-

10:21

Fed’s October monetary policy meeting minutes: an interest rate hike in December is possible

The Fed released its October monetary policy meeting minutes on Wednesday. The minutes showed that an interest rate hike in December is possible.

"Some participants thought that the conditions for beginning the policy normalization process had already been met. Most participants anticipated that, based on their assessment of the current economic situation and their outlook for economic activity, the labour market, and inflation, these conditions could well be met by the time of the next meeting," the minutes said.

Members noted that there should be no "unanticipated shocks", which could "adversely affect the economic outlook and that incoming data support the expectation that labour market conditions will continue to improve and that inflation will return to the Committee's 2 percent objective over the medium term".

Most members said that the downside risks to the outlook arising from economic and financial developments abroad diminished.

FOMC members voted 9-1in September to keep interest rates unchanged. Only Richmond Fed President Jeffrey Lacker voted to raise interest rate by 0.25%.

-

10:16

Eurozone: Current account, unadjusted, bln , September 29.4

-

10:10

Federal Reserve Bank of Dallas President Robert Steven Kaplan: the Fed’s monetary policy should remain accommodative for some time

New Federal Reserve Bank of Dallas President Robert Steven Kaplan, a former vice chairman of Goldman Sachs Group Inc. and professor at Harvard Business School, said that the Fed's monetary policy should remain accommodative for some time.

"In my view, the FOMC-in the previous two meetings-has been prudent in waiting for more data before taking policy action," he said.

"Accommodative policy does not necessarily mean a zero fed funds rate. There are various costs to maintaining a zero fed funds rate for too long-particularly in terms of potential distortions in investment and business decisions. These distortions can create imbalances in investments, inventory and hiring decisions that may later need to be (painfully) unwound when policy normalizes," Kaplan added.

-

08:29

Options levels on thursday, November 19, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.0861 (4803)

$1.0797 (1975)

$1.0746 (947)

Price at time of writing this review: $1.0686

Support levels (open interest**, contracts):

$1.0639 (5088)

$1.0589 (5365)

$1.0553 (7531)

Comments:

- Overall open interest on the CALL options with the expiration date December, 4 is 91023 contracts, with the maximum number of contracts with strike price $1,1100 (5732);

- Overall open interest on the PUT options with the expiration date December, 4 is 115183 contracts, with the maximum number of contracts with strike price $1,0500 (8511);

- The ratio of PUT/CALL was 1.27 versus 1.28 from the previous trading day according to data from November, 18

GBP/USD

Resistance levels (open interest**, contracts)

$1.5501 (1002)

$1.5403 (1793)

$1.5305 (2705)

Price at time of writing this review: $1.5275

Support levels (open interest**, contracts):

$1.5193 (2217)

$1.5096 (2754)

$1.4998 (2899)

Comments:

- Overall open interest on the CALL options with the expiration date December, 4 is 28430 contracts, with the maximum number of contracts with strike price $1,5600 (3583);

- Overall open interest on the PUT options with the expiration date December, 4 is 32584 contracts, with the maximum number of contracts with strike price $1,5050 (5015);

- The ratio of PUT/CALL was 1.15 versus 1.14 from the previous trading day according to data from November, 18

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:02

Foreign exchange market. Asian session: the yen rose

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

04:00 Japan BoJ Interest Rate Decision 0% 0% 0%

04:00 Japan Bank of Japan Monetary Base Target 275 275

04:00 Japan BoJ Monetary Policy Statement

04:30 Japan All Industry Activity Index, m/m September -0.2% 0.2% -0.2%

06:30 Japan BOJ Press Conference

07:00 Switzerland Trade Balance October 3.05 3.4 4.16

The U.S. dollar stepped down from a seven-month high against other major currencies amid profit taking. Earlier the greenback rose significantly against the euro and the yen after the minutes of the Fed's meeting showed some policy makers were concerned that a signal of a probability of higher rates in December would be exaggerated. However most policy makers believe that the U.S. economy will improve by December meeting and will be able to withstand a rate hike.

The yen rose against the greenback on positive data. For the first time in six months Japanese trade balance has recovered from a deficit in October. Exports exceeded imports by ¥111.5 billion. Japanese exports declined by 2.1% in October despite a weaker yen. However imports fell by 13.4%. Exports to China fell by 3.6% marking the third month of declines in a row. The Bank of Japan's decision to leave its monetary policy unchanged also supported the yen.

EUR/USD: the pair rose to $1.0715 in Asian trade

USD/JPY: the pair fell to Y123.10

GBP/USD: the pair rose to $1.5295

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:00 Eurozone ECB's Jens Weidmann Speaks

09:00 Eurozone Current account, unadjusted, bln September 13.7

09:30 United Kingdom Retail Sales (MoM) October 1.9% -0.5%

09:30 United Kingdom Retail Sales (YoY) October 6.5% 4.2%

12:30 Eurozone ECB Monetary Policy Meeting Accounts

13:30 Canada Wholesale Sales, m/m September -0.1% 0.3%

13:30 U.S. Continuing Jobless Claims November 2174 2170

13:30 U.S. Initial Jobless Claims November 276 271

15:00 U.S. Leading Indicators October -0.2% 0.5%

15:00 U.S. Philadelphia Fed Manufacturing Survey November -4.5 -1

17:30 U.S. FOMC Member Dennis Lockhart Speaks

21:45 U.S. FED Vice Chairman Stanley Fischer Speaks

-

08:00

Switzerland: Trade Balance, October 4.16 (forecast 3.4)

-

05:31

Japan: All Industry Activity Index, m/m, September -0.2% (forecast 0.2%)

-

04:24

Japan: BoJ Interest Rate Decision, 0% (forecast 0%)

-

04:24

Japan: Bank of Japan Monetary Base Target, 275

-

01:01

Currencies. Daily history for Nov 18’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0659 +0,17%

GBP/USD $1,5234 +0,15%

USD/CHF Chf1,0197 +0,50%

USD/JPY Y123,62 +0,15%

EUR/JPY Y131,76 +0,31%

GBP/JPY Y188,35 +0,31%

AUD/USD $0,7109 -0,01%

NZD/USD $0,6470 +0,02%

USD/CAD C$1,3301 -0,13%

-

00:51

Japan: Trade Balance Total, bln, October 111.5 (forecast -292)

-

00:05

Schedule for today, Thursday, Nov 19’2015:

(time / country / index / period / previous value / forecast)

04:00 Japan BoJ Interest Rate Decision 0% 0%

04:00 Japan Bank of Japan Monetary Base Target 275

04:00 Japan BoJ Monetary Policy Statement

04:30 Japan All Industry Activity Index, m/m September -0.2% 0.2%

06:30 Japan BOJ Press Conference

07:00 Switzerland Trade Balance October 3.05 3.4

08:00 Eurozone ECB's Jens Weidmann Speaks

09:00 Eurozone Current account, unadjusted, bln September 13.7

09:30 United Kingdom Retail Sales (MoM) October 1.9% -0.5%

09:30 United Kingdom Retail Sales (YoY) October 6.5% 4.2%

12:30 Eurozone ECB Monetary Policy Meeting Accounts

13:30 Canada Wholesale Sales, m/m September -0.1% 0.3%

13:30 U.S. Continuing Jobless Claims November 2174 2170

13:30 U.S. Initial Jobless Claims November 276 271

15:00 U.S. Leading Indicators October -0.2% 0.5%

15:00 U.S. Philadelphia Fed Manufacturing Survey November -4.5 -1

17:30 U.S. FOMC Member Dennis Lockhart Speaks

21:45 U.S. FED Vice Chairman Stanley Fischer Speaks

-