Noticias del mercado

-

21:00

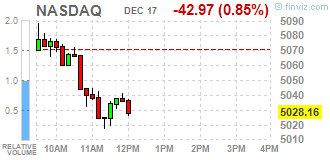

Dow -0.97% 17,576.55 -172.54 Nasdaq -0.83% 5,029.14 -41.99 S&P -1.00% 2052.44 -20.63

-

18:10

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes fell on Thursday, a day after the Federal Reserve raised interest rates for the first time in almost a decade. The central bank raised its benchmark rate by 25 basis points to 0.25%-0.50%, signaling confidence in the strength of the world's largest economy. Global stocks surged after Fed Chair Janet Yellen's assurance that further tightening would be gradual and heavily dependent on inflation, which remained firmly below the central bank's 2% target.

Most of Dow stocks in negative area (27 of 30). Top looser - Caterpillar Inc. (CAT, -2.23%). Top gainer - UnitedHealth Group Incorporated (UNH, +1.24%).

Almost all S&P index sectors also in negative area. Top looser - Basic Materials (-2.0%). Top gainer - Utilities (+0,0%).

At the moment:

Dow 17533.00 -121.00 -0.69%

S&P 500 2045.25 -18.50 -0.90%

Nasdaq 100 4628.00 -29.75 -0.64%

Oil 36.17 -0.58 -1.58%

Gold 1051.90 -24.90 -2.31%

U.S. 10yr 2.25 -0.04

-

18:08

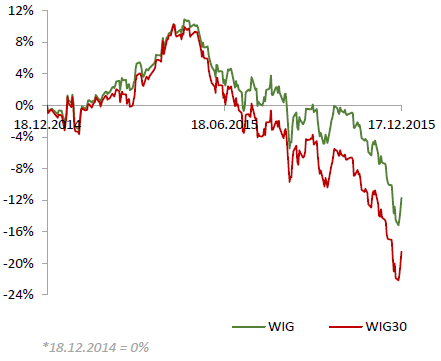

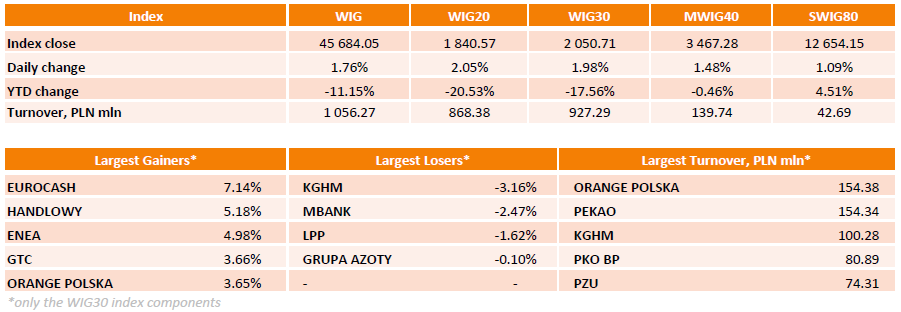

WSE: Session Results

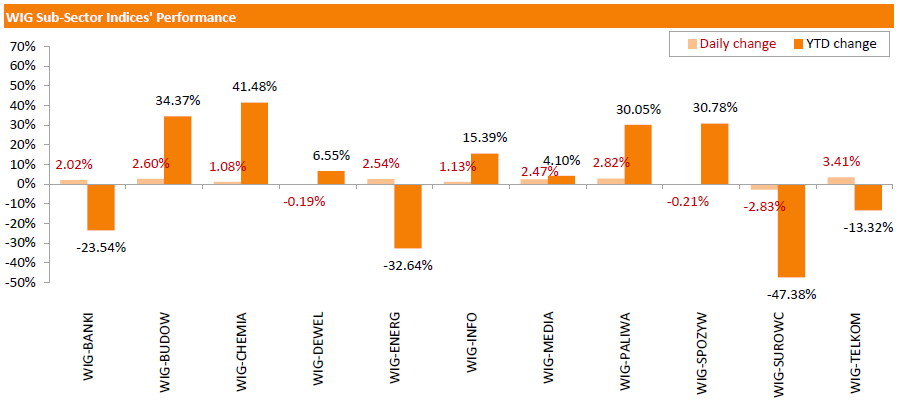

Polish equity market surged on Thursday. The broad market measure, the WIG Index, added 1.76%. Sector-wise, materials (-2.83%) fared the worst, while telecoms (+3.41%) outperformed.

The large-cap stocks' measure, the WIG30 Index, advanced by 1.98%. There were only four decliners among the index components. Copper producer KGHM (WSE: KGH) was the worst-performing name, falling by 3.16%. Other laggards were banking name MBANK (WSE: MBK), clothing retailer LPP (WSE: LPP) and chemical producer GRUPA AZOTY (WSE: ATT), losing 2.47%, 1.62% and 0.1% respectively. On the other side of the ledger, FMCG wholesaler EUROCASH (WSE: EUR) became the strongest advancer, jumping 7.14%. It was followed by banking name HANDLOWY (WSE: BHW) and genco ENEA (WSE: ENA), climbing by 5.18% and 4.98% respectively.

-

18:00

European stocks close: stocks closed higher on the Fed's interest rate hike

Stock indices closed higher on the Fed's interest rate hike. The Fed on Wednesday raised its interest rate to the range 0.25% - 0.50% from 0.00% - 0.25% as widely expected by analysts. All Federal Open Market Committee (FOMC) members voted for the interest rate hike. The Fed repeated that further interest rate hikes will be gradual.

Meanwhile, the economic data from Eurozone was negative. German Ifo Institute released its business confidence figures for Germany on Thursday. German business confidence index declines to 108.7 in December from 109.0 in November. Analysts had expected the index to remain unchanged at 109.0.

"The economic situation could hardly be better in the run-up to Christmas," Ifo President Hans-Werner Sinn said.

The European Central Bank (ECB) released its economic bulletin on Thursday. The central bank noted that the economic recovery in the Eurozone is expected to continue, supported by domestic demand.

The Office for National Statistics released its retail sales data for the U.K. on Thursday. Retail sales in the U.K. climbed 1.7% in November, exceeding expectations for a 0.5% rise, after a 0.5% decline in October. October's figure was revised up from a 0.6% decrease.

The increase was driven by retailers' promotions at the end of the month.

Food sales were up 0.8% in November, sales at department stores rose 4.3%, while household goods sales climbed 4.1%.

On a yearly basis, retail sales in the U.K. jumped 5.0% in November, beating forecasts of 3.0% increase, after a 4.2% rise in October. October's figure was revised up from a 3.8% gain.

The Confederation of British Industry (CBI) released its industrial order books balance on Thursday. The CBI industrial order books balance rose to -7 in December from -11% in November.

The index increased in December as export orders improved.

"Manufacturers are still having a tough time of it with output slipping and exports remaining a weak spot in spite of an improvement at the end of the year. But there is a pick-up in orders from previous months which could be a sign of light at the end of the tunnel," the CBI director of economics Rain Newton-Smith said.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,102.54 +41.35 +0.68%

DAX 10,738.12 +268.86 +2.57%

CAC 40 4,677.54 +52.87 +1.14%

-

17:10

The European Central Bank’s economic bulletin: the economic recovery in the Eurozone is expected to continue, supported by domestic demand

The European Central Bank (ECB) released its economic bulletin on Thursday. The central bank noted that the economic recovery in the Eurozone is expected to continue, supported by domestic demand.

"Looking ahead, the economic recovery is expected to proceed, although risks remain on the downside. Domestic demand should be further supported by the ECB's monetary policy measures and their favourable impact on financial conditions, as well as by the earlier progress made with fiscal consolidation and structural reforms," the ECB said.

"The risks to the euro area growth outlook remain on the downside and relate in particular to the heightened uncertainties regarding developments in the global economy as well as to broader geopolitical risks. These risks have the potential to weigh on global growth and foreign demand for euro area exports and on confidence more widely," the central bank added.

-

16:47

U.S. leading economic index climbs 0.4% in November

The Conference Board released its leading economic index (LEI) for the U.S. on Thursday. The leading economic index climb 0.4% in November, after a 0.6% rise in October.

The coincident economic index rose 0.1% in November, after a 0.2% gain in October.

"The U.S. LEI registered another increase in November, with building permits, the interest rate spread, and stock prices driving the improvement. Although the six-month growth rate of the LEI has moderated, the economic outlook for the final quarter of the year and into the new year remains positive," director of business cycles and growth research at The Conference Board, Ataman Ozyildirim, said.

-

16:39

Construction production in the Eurozone rises 0.5% in October

The Eurostat released its construction production data for the Eurozone on Thursday. Construction production in the Eurozone rose 0.5% in October, after a 0.7% drop in September. September's figure was revised down from a 0.4% fall.

Civil engineering output gained 1.5% in October, while production in the building sector was up 0.3%.

On a yearly basis, construction output increased 1.1% in October, after a 0.1% increase in September.

Civil engineering output rose 1.1% year-on-year in October, while production in the building sector climbed 1.0% year-on-year.

-

16:17

Hourly labour costs in the Eurozone climb 1.1% in the third quarter

Eurostat released its labour costs data for the Eurozone on Thursday. Hourly labour costs in the Eurozone rose at an annual rate of 1.1% in the third quarter, after a 1.6% gain in the previous quarter.

Wages and salaries per hour climbed 1.4% year-on-year in the third quarter, while non-wage costs gained 0.1%.

In the third quarter of 2015, hourly labour costs increased 1.3% year-on-year in industry, 0.8% in construction, 1.2% in services, while 0.8% in the mainly non-business economy.

-

16:12

Italy’ trade surplus rises to €4.81 billion in October

The Italian statistical office Istat released its trade data for Italy on Thursday. Italy' trade surplus widened to €4.81 billion in October from €2.19 billion in September.

Exports fell 1.4% year-on-year in October, while imports were flat.

The seasonally-adjusted trade surplus with the EU was €1.02 billion in October, while the trade surplus with non-EU countries was €2.38 billion.

-

15:52

Greek unemployment rate falls to 24.0% in the third quarter

The Hellenic Statistical Authority released its labour market data for Greece on Thursday. The Greek unemployment rate declined to 24.0% in the third quarter from 24.6% in the previous quarter.

The number of unemployed people fell by 1.7% in the third quarter.

The youth unemployment rate was down to 48.8% in the third quarter from 49.5% in the second quarter.

-

15:34

U.S. Stocks open: Dow +0.17%, Nasdaq +0.29%, S&P +0.08%

-

15:29

Before the bell: S&P futures +0.21%, NASDAQ futures +0.43%

U.S. stock-index futures rose.

Global Stocks:

Nikkei 19,353.56 +303.65 +1.59%

Hang Seng 21,872.06 +170.85 +0.79%

Shanghai Composite 3,580.55 +64.37 +1.83%

FTSE 6,140.42 +79.23 +1.31%

CAC 4,730.85 +106.18 +2.30%

DAX 10,803.62 +334.36 +3.19%

Crude oil $35.25 (-0.76%)

Gold $1059.10 (-1.64%)

-

15:02

U.S. current account deficit widens to $124.1 billion in the third quarter, the largest deficit since 2008

The U.S. Commerce Department released its current account data on Thursday. The U.S. current account deficit widened to $124.1 billion in the third quarter from $111.1 billion in the second quarter, missing expectations for a deficit of $118.0 billion. It was the largest deficit since the fourth quarter of 2008.

The second quarter's figure was revised down from a deficit of $109.7 billion.

The trade deficit increased due to a drop in the surplus on primary income and a rise in the deficit on secondary income.

Exports of goods fell to $379.9 billion in the third quarter from $384.7 billion in the second quarter, while goods imports declined to $569.9 billion from $573.9 billion.

The surplus on primary income decreased to $46.1 billion in the third quarter from $52.8 billion in the first quarter.

The deficit on secondary income rose to $36.6 billion in the third quarter from $30.8 billion in the first quarter.

-

14:54

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

FedEx Corporation, NYSE

FDX

157.45

5.79%

1.1K

3M Co

MMM

151.79

1.23%

0.1K

Yandex N.V., NASDAQ

YNDX

15.33

0.92%

1.1K

Apple Inc.

AAPL

112.25

0.82%

113.1K

Boeing Co

BA

149.25

0.77%

0.9K

Goldman Sachs

GS

187.50

0.69%

0.5K

AMERICAN INTERNATIONAL GROUP

AIG

61.30

0.61%

0.1K

Nike

NKE

131.70

0.59%

3.4K

Visa

V

80.30

0.55%

1.5K

Ford Motor Co.

F

14.43

0.49%

0.4K

General Electric Co

GE

30.88

0.42%

117.2K

Microsoft Corp

MSFT

56.36

0.41%

7.4K

Twitter, Inc., NYSE

TWTR

24.40

0.41%

10.8K

Facebook, Inc.

FB

107.22

0.40%

88.4K

McDonald's Corp

MCD

118.30

0.39%

1.6K

Google Inc.

GOOG

761.00

0.38%

2.4K

JPMorgan Chase and Co

JPM

67.78

0.37%

14.9K

Citigroup Inc., NYSE

C

54.10

0.37%

15.9K

Home Depot Inc

HD

133.35

0.34%

0.4K

Amazon.com Inc., NASDAQ

AMZN

678.10

0.34%

23.3K

Cisco Systems Inc

CSCO

27.30

0.24%

0.1K

Yahoo! Inc., NASDAQ

YHOO

33.85

0.21%

2.2K

Walt Disney Co

DIS

114.00

0.18%

5.3K

Pfizer Inc

PFE

32.63

0.15%

0.5K

Intel Corp

INTC

35.35

0.14%

0.3K

General Motors Company, NYSE

GM

35.19

0.14%

1.1K

Chevron Corp

CVX

93.55

0.12%

0.3K

The Coca-Cola Co

KO

43.89

0.11%

1.8K

Verizon Communications Inc

VZ

46.56

0.11%

3.7K

American Express Co

AXP

70.75

0.06%

0.4K

Johnson & Johnson

JNJ

105.27

0.02%

1K

International Business Machines Co...

IBM

139.31

0.01%

0.2K

AT&T Inc

T

34.40

0.00%

6.1K

Exxon Mobil Corp

XOM

79.15

0.00%

4.4K

Wal-Mart Stores Inc

WMT

60.30

0.00%

0.2K

Starbucks Corporation, NASDAQ

SBUX

60.35

0.00%

0.3K

Tesla Motors, Inc., NASDAQ

TSLA

234.00

-0.22%

5.3K

Hewlett-Packard Co.

HPQ

12.22

-0.33%

0.4K

ALTRIA GROUP INC.

MO

58.75

-0.34%

1.8K

ALCOA INC.

AA

9.20

-0.43%

23.6K

Caterpillar Inc

CAT

67.30

-0.62%

2.7K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

6.61

-1.20%

34.1K

Barrick Gold Corporation, NYSE

ABX

7.44

-2.75%

20.1K

-

14:48

Philadelphia Federal Reserve Bank’s manufacturing index drops to -5.9 in December

The Philadelphia Federal Reserve Bank released its manufacturing index on Thursday. The index dropped to -5.9 in December from 1.9 in November, missing expectations for a decline to 1.5.

A reading above zero indicates expansion, while a reading below zero indicates contraction.

"Manufacturing conditions in the region weakened this month, according to firms responding to the December Manufacturing Business Outlook Survey. The indicator for general activity, which was slightly positive last month, fell into negative territory," the Philadelphia Federal Reserve Bank said in its survey.

The shipments index was up to 3.7 in December from -2.5 in November.

The new orders index decreased to -9.5 in December from -3.7 in November.

The prices paid index slid to -9.8 in December from -4.9 in November, while the prices received index declined to -8.7 from -0.4.

The number of employees index climbed to 4.1 in December from 2.6 in November.

According to the report, the future general activity index slid to 23.0 in December from 43.4 in November.

-

14:47

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Apple (AAPL) target lowered to $140 from $150 at RBC Capital Mkts

NIKE (NKE) target raised to $150 from $145 at Jefferies

Visa (V) initiated with a Buy at Sterne Agee CRT -

14:38

Initial jobless claims decline to 271,000 in the week ending December 12

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending December 12 in the U.S. declined by 11,000 to 271,000 from 282,000 in the previous week. Analysts had expected jobless claims to fall to 275,000.

Jobless claims remained below 300,000 the 41st straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims fell by 7,000 to 2,238,000 in the week ended December 05.

-

14:32

New Zealand's economy expanded at 0.9% in the third quarter

Statistics New Zealand released its GDP data on late Wednesday evening. New Zealand's GDP rose 0.9% in the third quarter, exceeding expectations for a 0.8% increase, after a 0.3% gain in the second quarter. The second quarter's figure was revised down from a 0.4% rise.

On a yearly basis, New Zealand's GDP climbed by 2.3% in the third quarter, in line with expectations, after a 2.4% rise in the second quarter.

The increase was driven by a rise in the service and manufacturing industries.

The services sector rose 0.9% in the third quarter, while the manufacturing sector climbed 2.8%.

-

14:18

CBI industrial order books balance rises to -7 in December

The Confederation of British Industry (CBI) released its industrial order books balance on Thursday. The CBI industrial order books balance rose to -7 in December from -11% in November.

The index increased in December as export orders improved.

"Manufacturers are still having a tough time of it with output slipping and exports remaining a weak spot in spite of an improvement at the end of the year. But there is a pick-up in orders from previous months which could be a sign of light at the end of the tunnel," the CBI director of economics Rain Newton-Smith said.

-

14:11

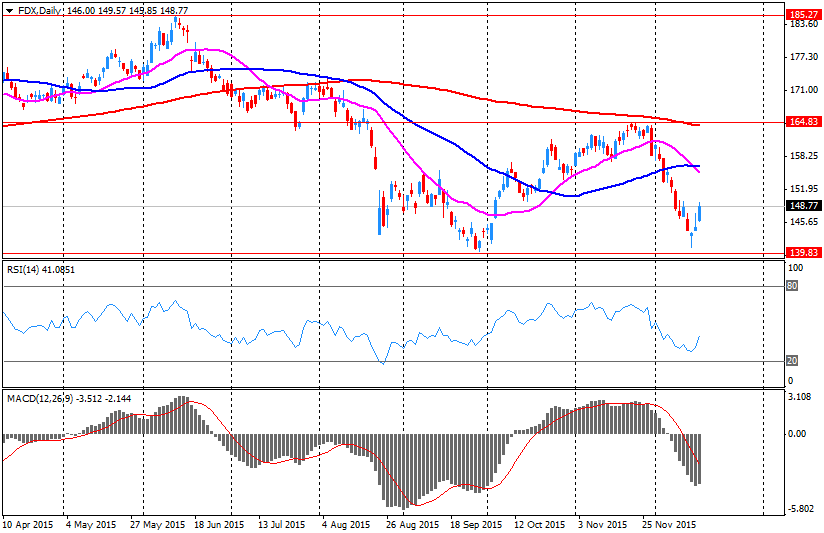

Company News: FedEx (FDX) Quarterly Results Beat Expectations

FedEx reported Q2 earnings of $2.58 per share (versus $2.14 in Q2 FY 2015), beating analysts' consensus of $2.50.

The company's revenues amounted to $12.5 bln (+5% y/y), beating consensus estimate of $12.421 bln.

FedEx confirmed its FY 2016 EPS guidance of $10.40-10.90 versus analysts' consensus estimate of $10.55.

FDX rose to $148.83 (+2.86%) yesterday.

-

12:00

European stock markets mid session: stocks traded higher on the Fed’s interest rate hike

Stock indices traded higher on the Fed's interest rate hike. The Fed on Wednesday raised its interest rate to the range 0.25% - 0.50% from 0.00% - 0.25% as widely expected by analysts. All Federal Open Market Committee (FOMC) members voted for the interest rate hike. The Fed repeated that further interest rate hikes will be gradual.

Meanwhile, the economic data from Eurozone was negative. German Ifo Institute released its business confidence figures for Germany on Thursday. German business confidence index declines to 108.7 in December from 109.0 in November. Analysts had expected the index to remain unchanged at 109.0.

"The economic situation could hardly be better in the run-up to Christmas," Ifo President Hans-Werner Sinn said.

The Ifo current conditions index decreased to 112.8 from 113.4. Analysts had expected the index to remain unchanged at 113.4.

The Ifo expectations index remained unchanged at 104.7, missing expectations for a rise to 105.0.

The Office for National Statistics released its retail sales data for the U.K. on Thursday. Retail sales in the U.K. climbed 1.7% in November, exceeding expectations for a 0.5% rise, after a 0.5% decline in October. October's figure was revised up from a 0.6% decrease.

The increase was driven by retailers' promotions at the end of the month.

Food sales were up 0.8% in November, sales at department stores rose 4.3%, while household goods sales climbed 4.1%.

On a yearly basis, retail sales in the U.K. jumped 5.0% in November, beating forecasts of 3.0% increase, after a 4.2% rise in October. October's figure was revised up from a 3.8% gain.

Current figures:

Name Price Change Change %

FTSE 100 6,147.93 +86.74 +1.43 %

DAX 10,779 +309.74 +2.96 %

CAC 40 4,739.07 +114.40 +2.47 %

-

11:44

The KOF Swiss Economic Institute lowers its growth forecasts for Switzerland

The KOF Swiss Economic Institute released its growth forecasts for Switzerland on Thursday. The Swiss economy is expected to expand 0.7% in 2015, down from the previous estimate of 0.9%, 1.1% in 2016, down from the previous estimate of 1.4%, and 2.0% in 2017.

The KOF noted that the economy will be driven by exports.

"The impact of the suspension of the minimum exchange rate at the beginning of the year was, and remains, significant for the Swiss economy although, all in all, it was less substantial than initially expected," the KOF said in its statement.

The KOF forecasted that consumer prices in Switzerland would be at -0.5% year-on-year in 2016. The Swiss inflation is not expected to increase to 0.2% year-year before 2017.

-

11:33

State Secretariat for Economics (SECO) cut its 2015 growth forecast for Switzerland

The State Secretariat for Economics (SECO) released its growth forecasts for Switzerland on Thursday. The Swiss economy is expected to expand 0.8% in 2015, down from the previous estimate of 0.9%, 1.5% in 2016, unchanged from the previous estimate, and 1.9% in 2017.

"The marked slowdown in growth is mainly attributable to the appreciation of the Swiss franc from mid-January. The weaker expansion of global trade and the slowing dynamic of the domestic economy also had a dampening effect," SECO said in its statement.

SECO forecasted that consumer prices in Switzerland would be at -1.1% year-on-year in 2015, unchanged from the previous estimate. The Swiss inflation is expected to be -0.1% next year, down from its September forecast of a 0.1% increase, and 0.2% in 2017.

The unemployment rate is expected to be 3.3% in 2015 and 3.6% in 2016, unchanged from the previous forecasts.

-

11:20

UK retail sales climb 1.7% in November

The Office for National Statistics released its retail sales data for the U.K. on Thursday. Retail sales in the U.K. climbed 1.7% in November, exceeding expectations for a 0.5% rise, after a 0.5% decline in October. October's figure was revised up from a 0.6% decrease.

The increase was driven by retailers' promotions at the end of the month.

Food sales were up 0.8% in November, sales at department stores rose 4.3%, while household goods sales climbed 4.1%.

On a yearly basis, retail sales in the U.K. jumped 5.0% in November, beating forecasts of 3.0% increase, after a 4.2% rise in October. October's figure was revised up from a 3.8% gain.

-

10:51

German Ifo business confidence index declines to 108.7 in December

German Ifo Institute released its business confidence figures for Germany on Thursday. German business confidence index declines to 108.7 in December from 109.0 in November. Analysts had expected the index to remain unchanged at 109.0.

"The economic situation could hardly be better in the run-up to Christmas," Ifo President Hans-Werner Sinn said.

The Ifo current conditions index decreased to 112.8 from 113.4. Analysts had expected the index to remain unchanged at 113.4.

The Ifo expectations index remained unchanged at 104.7, missing expectations for a rise to 105.0.

-

10:41

The Fed raises its interest rate to the range 0.25% - 0.50% in December

The Fed released its interest rate decision on Wednesday. It raised its interest rate to the range 0.25% - 0.50% from 0.00% - 0.25% as widely expected by analysts. All Federal Open Market Committee (FOMC) members voted for the interest rate hike, despite the observed differences earlier.

The Fed repeated that further interest rate hikes will be gradual.

"The actual path of the federal funds rate will depend on the economic outlook as informed by incoming data," the Fed said in its statement.

Interest rate forecasts were downgraded. The Fed expects its fed-funds rate to be 1.375% by the end of 2016, 2.375% by the end of 2017, down from its previous estimate of 2.625%, and 3.25% by the end of 2018, down from its previous estimate of 3.375%.

The Fed noted that risks to the outlook for both economic activity and the labour market are balanced, adding that low inflation was driven by declines in energy and import prices which are temporary.

The Fed Chairwoman Janet Yellen said in a press conference on Wednesday that the Fed is confident regarding the strength of the U.S. economy.

"The Fed's decision today reflects our confidence in the U.S. economy. We believe we have seen substantial improvement in labour market conditions and while things may be uneven across regions of the country, and different industrial sectors, we see an economy that is on a path of sustainable improvement," she said.

-

10:36

Japan's trade surplus turns into a deficit of ¥379.7 billion in November

The Ministry of Finance released its trade data for Japan on the late Wednesday evening. Japan's trade surplus turned into a deficit of ¥379.7 billion in November from a surplus of ¥111.5 billion in October.

Analysts had expected a deficit of ¥446.2 billion.

Exports fell 3.3% year-on-year in November, while imports dropped 10.2%.

Exports to Asia declined by 8.7% year-on-year in November, exports to the United States increased by 2.0%, while exports to China fell by 8.1%.

-

10:23

Canadian Prime Minister Justin Trudeau: an interest rate by the Fed was a good news for Canadian exporters

Canadian Prime Minister Justin Trudeau said on Wednesday that an interest rate by the Fed was a good news for Canadian exporters.

"There will be opportunities for our exporters to benefit from it," he said.

But he pointed out that a weaker Canadian dollar will bring challenges to Canadian producers and to the Canadian economy in general.

-

10:09

U.S. President Barack Obama signs a short-term spending measure

U.S. President Barack Obama on Wednesday signed a short-term spending measure which will keep the U.S. government fully operational until Congress will reach a final budget deal.

The House and Senate are expected to vote on Thursday on a budget for fiscal 2016. The budget contains $1.1 trillion spending plan.

-

01:04

Stocks. Daily history for Sep Dec 16’2015:

(index / closing price / change items /% change)

S&P/ASX 200 5,028.45 +118.89 +2.42%

TOPIX 1,540.72 +38.17 +2.54%

SHANGHAI COMP 3,517.05 +6.70 +0.19%

HANG SENG 21,701.21 +426.84 +2.01%

FTSE 100 6,061.19 +43.40 +0.7 %

CAC 40 4,624.67 +10.27 +0.2 %

Xetra DAX 10,469.26 +18.88 +0.2 %

S&P 500 2,073.07 +29.66 +1.5 %

NASDAQ Composite 5,071.13 +75.78 +1.5 %

Dow Jones 17,749.09 +224.18 +1.3 %

-