Noticias del mercado

-

21:00

Dow -1.58% 17,219.31 -276.53 Nasdaq -1.10% 4,947.75 -54.80 S&P -1.20% 2017.32 -24.57

-

18:28

WSE: Session Results

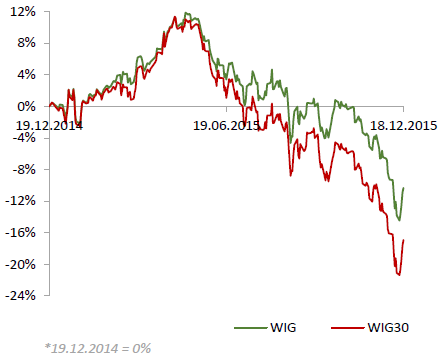

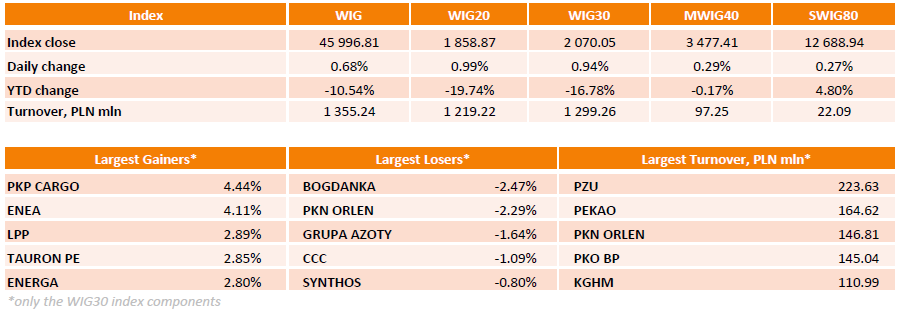

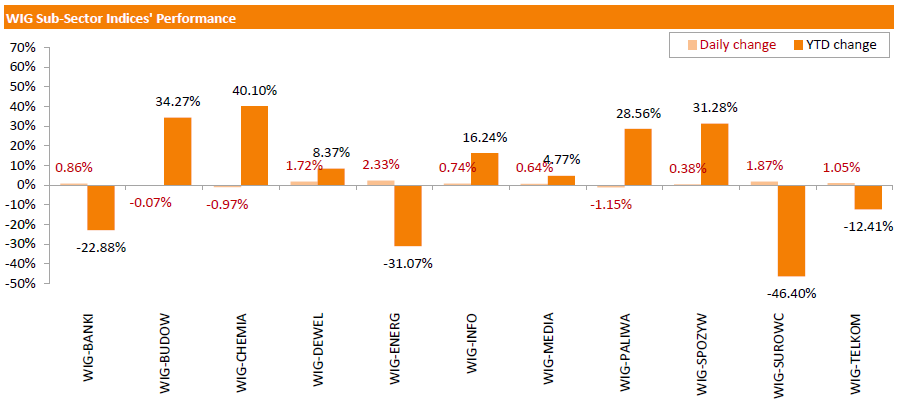

Polish equity market closed higher on Friday. The broad market measure, the WIG Index, surged by 0.68%. Sector performance in the WIG Index was mixed. Utilities stocks (+2.33%) recorded the biggest gain, while oil and gas sector names (-1.15%) lagged behind.

The large-cap stocks' measure, the WIG30 Index, rose by 0.94%. In the index basket, railway freight transport operator PKP CARGO (WSE: PKP) became the best-performing name, advancing 4.44%. All 4 utilities names, namely ENEA (WSE: ENA), TAURON PE (WSE: TPE), ENERGA (WSE: ENG) and PGE (WSE: PGE) also demonstrated strong performance, growing by 2.16%-4.11%, following Poland's energy minister's announcement that the mergers of the country's biggest gencos is unlikely in 2016. The other notable gainers were clothing retailer LPP (WSE: LPP) and bank ING BSK (WSE: ING), adding 2.89% and 2.68% respectively. On the other side of the ledger, thermal coal miner BOGDANKA (WSE: LWB) and oil refiner PKN ORLEN (WSE: PKN) were the poorest performers, losing 2.47% and 2.29% respectively.

-

18:00

European stocks close: stocks closed lower as commodity prices remained in focus

Stock indices closed lower as commodity prices remained in focus.

Meanwhile, the economic data from Eurozone was negative. The European Central Bank (ECB) released its current account on Friday. Eurozone's current account surplus fell to a seasonally adjusted €20.4 billion in October from €30.1 billion in September.

The trade surplus declined to €26.8 billion in October from €30.1 billion in September.

The surplus on services decreased to €4.4 billion in October from €4.5 billion in September.

The primary income surplus slid to €3.1 billion in October from €5.3 billion in September, while the secondary income deficit increased to €14.0 billion from €9.8 billion.

Eurozone's unadjusted current account surplus dropped to €25.9 billion in October from €33.8 billion in September. September's figure was revised up from a surplus of €33.1 billion.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,056.38 -46.16 -0.76 %

DAX 10,608.19 -129.93 -1.21 %

CAC 40 4,625.26 -52.28 -1.12 %

-

16:46

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes lower on Friday as a selloff in commodity markets showed no signs of easing.

Most of Dow stocks in negative area (27 of 30). Top looser - The Boeing Company (BA, -2.75%). Top gainer - Caterpillar Inc. (CAT, +1.03%).

Almost all S&P index sectors also in negative area. Top looser - Utilities (-1.2%). Top gainer - Basic Materials (+0,5%).

At the moment:

Dow 17177.00 -179.00 -1.03%

S&P 500 2008.75 -16.00 -0.79%

Nasdaq 100 4545.50 -24.00 -0.53%

Oil 36.44 +0.17 +0.47%

Gold 1067.60 +18.00 +1.71%

U.S. 10yr 2.22 -0.02

-

16:30

German public debt falls 0.8% in the third quarter

The German statistical office Destatis released its public debt data on Friday. German public debt fell 0.8% to € 2,027.7 billion in the third quarter from a year ago.

The debt of the Federation dropped by 1.2% to €1,267.5 billion on 30 September 2015, compared with the last year.

-

16:04

Italy’s current account surplus climbs to €6.13 billion in October

The Bank of Italy released its current account data on Friday. Italy's current account surplus climbed to €6.13 billion in October from €5.98 billion in October last year.

The goods trade surplus decreased to €5.88 billion in October from €5.89 billion in October last year. The services trade surplus rose to €285 million from €61 million.

The capital account surplus jumped to €1.04 billion in October from a deficit of €182 million last year.

-

15:56

U.S. preliminary services purchasing managers' index drops to 53.7 in December

Markit Economics released its preliminary services purchasing managers' index (PMI) for the U.S. on Friday. The U.S. preliminary services purchasing managers' index (PMI) dropped to 53.7 in December from 56.1 in November. It was the lowest level since December 2014.

Analysts had expected the index to fell to 56.0.

A reading above 50 indicates expansion in economic activity.

The drop was driven by a sharp slowdown in new business growth.

"A lack of inflationary pressures, slowing growth and a drop in business confidence to a five-year low are all disappointing news for an economy which has seen the first US interest rate hike for almost a decade," Markit Chief Economist Chris Williamson said.

He added that the data was consistent with an annual 1.8% growth in the fourth quarter.

-

15:34

U.S. Stocks open: Dow -0.58%, Nasdaq -0.41%, S&P -0.46%

-

15:26

Before the bell: S&P futures -0.21%, NASDAQ futures +0.06%

U.S. stock-index futures were flat.

Global Stocks:

Nikkei 18,986.8 -366.76 -1.90%

Hang Seng 21,755.56 -116.50 -0.53%

Shanghai Composite 3,579.49 -0.51 -0.01%

FTSE 6,077.42 -25.12 -0.41%

CAC 4,625.13 -52.41 -1.12%

DAX 10,620.5 -117.62 -1.10%

Crude oil $34.58 (-1.06%)

Gold $1057.10 (+0.71%)

-

15:00

Canadian consumer price inflation falls 0.1% in November

Statistics Canada released consumer price inflation data on Friday. Canadian consumer price inflation fell 0.1% in November, missing expectations for a 0.1% gain, after a 0.1% rise in October.

The monthly drop was mainly driven by declines in clothing and footwear, and recreation, education and reading prices.

Clothing and footwear fell 1.0% in November, while recreation, education and reading prices dropped 1.8%.

On a yearly basis, the consumer price index increased to 1.4% in November from 1.0% in October, missing expectations for a rise to 1.5%.

The consumer price index was partly driven by higher food and shelter prices. Food prices climbed 3.4% year-on-year in November, while transportation prices decreased 1.1%.

The index for recreation, education and reading climbed by 1.9% in November from the same month a year earlier, the shelter index gained 1.2%, while gasoline prices dropped 10.6%.

The Canadian core consumer price index, which excludes some volatile goods, dropped 0.3% in November, after a 0.3% gain in October.

On a yearly basis, core consumer price index in Canada declined to 2.0% in November from 2.1% in October, missing expectations for a gain to 2.3%.

The Bank of Canada's inflation target is 2.0%.

-

14:59

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Barrick Gold Corporation, NYSE

ABX

7.08

2.02%

39.4K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

6.18

0.98%

54.6K

E. I. du Pont de Nemours and Co

DD

65.55

0.49%

7.2K

ALCOA INC.

AA

9.18

0.33%

2.1K

Twitter, Inc., NYSE

TWTR

23.38

0.30%

15.0K

Microsoft Corp

MSFT

55.80

0.18%

27.4K

General Motors Company, NYSE

GM

34.10

-0.03%

0.1K

Walt Disney Co

DIS

111.97

-0.04%

11.0K

Amazon.com Inc., NASDAQ

AMZN

669.48

-0.17%

15.2K

Nike

NKE

129.99

-0.18%

1K

Google Inc.

GOOG

747.00

-0.32%

5.3K

McDonald's Corp

MCD

117.11

-0.33%

1.0K

Facebook, Inc.

FB

105.87

-0.33%

47.1K

Pfizer Inc

PFE

32.21

-0.37%

17.0K

Intel Corp

INTC

34.77

-0.40%

3.0K

3M Co

MMM

148.24

-0.41%

0.8K

Visa

V

78.37

-0.41%

0.5K

Apple Inc.

AAPL

108.52

-0.42%

182.9K

AMERICAN INTERNATIONAL GROUP

AIG

59.88

-0.42%

27.7K

Verizon Communications Inc

VZ

45.90

-0.43%

6.8K

AT&T Inc

T

33.88

-0.44%

16.7K

Caterpillar Inc

CAT

64.60

-0.46%

1.4K

Ford Motor Co.

F

13.91

-0.50%

10.7K

General Electric Co

GE

30.39

-0.52%

24.4K

American Express Co

AXP

69.20

-0.53%

0.2K

International Business Machines Co...

IBM

136.00

-0.55%

1.6K

Procter & Gamble Co

PG

79.84

-0.56%

4.5K

Travelers Companies Inc

TRV

112.60

-0.59%

0.2K

JPMorgan Chase and Co

JPM

65.88

-0.60%

3.1K

Tesla Motors, Inc., NASDAQ

TSLA

231.91

-0.63%

1.5K

Yahoo! Inc., NASDAQ

YHOO

33.02

-0.63%

9.8K

Exxon Mobil Corp

XOM

77.46

-0.64%

5.4K

Cisco Systems Inc

CSCO

26.54

-0.67%

0.7K

Wal-Mart Stores Inc

WMT

58.57

-0.70%

1.7K

Citigroup Inc., NYSE

C

52.45

-0.74%

15.5K

Chevron Corp

CVX

89.80

-0.82%

5.9K

The Coca-Cola Co

KO

43.06

-0.99%

6.4K

FedEx Corporation, NYSE

FDX

150.00

-1.21%

13.2K

Boeing Co

BA

143.53

-1.39%

1.9K

Starbucks Corporation, NASDAQ

SBUX

58.67

-1.42%

2.6K

Yandex N.V., NASDAQ

YNDX

15.00

-2.41%

0.8K

-

14:45

Upgrades and downgrades before the market open

Upgrades:

DuPont (DD) upgraded to Buy at BofA/Merrill

Microsoft (MSFT) upgraded to Neutral from Sell at Goldman

Downgrades:

Boeing (BA) downgraded to Market Perform from Outperform at Wells Fargo

Other:

Merck (MRK) initiated with a Neutral at Atlantic Equities

Johnson & Johnson (JNJ) initiated with a Neutral at Atlantic Equities

-

14:44

Canada’s wholesale sales decrease 0.6% in October

Statistics Canada released wholesale sales figures on Friday. Wholesale sales fell 0.6% in October, missing expectations for a 0.1% gain, after a 0.3% decline in September. September's figure was revised down from a 0.1% decrease.

The decline was driven by lower sales in the food, beverage and tobacco and the motor vehicle and parts subsectors.

Sales in the food, beverage and tobacco subsector dropped 3.0% in October, while sales of motor vehicle and parts were down 2.1%.

Sales in the building material and supplies subsector declined 0.3% in October.

Inventories increased by 0.5% in October.

-

14:26

Bank of Japan Governor Haruhiko Kuroda: the central bank’s new stimulus measures were only an adjustment of quantitative easing

The Bank of Japan (BoJ) Governor Haruhiko Kuroda said in a press conference on Friday that the central bank's new stimulus measures were only an adjustment of quantitative easing. New stimulus measures will help to ease the BoJ's further if needed, he added.

"We've taken steps to supplement QQE [quantitative and qualitative easing] so that we can expand the program without hesitation if needed," Kuroda noted.

He pointed out that new stimulus measures do not address downside risks to the economy.

The BoJ governor also said that the Fed's interest rate hike was not a trigger for new stimulus measures.

-

12:00

European stock markets mid session: stocks traded lower on a decline in commodity prices

Stock indices traded lower on a decline in commodity prices.

Meanwhile, the economic data from Eurozone was negative. The European Central Bank (ECB) released its current account on Friday. Eurozone's current account surplus fell to a seasonally adjusted €20.4 billion in October from €30.1 billion in September.

The trade surplus declined to €26.8 billion in October from €30.1 billion in September.

The surplus on services decreased to €4.4 billion in October from €4.5 billion in September.

The primary income surplus slid to €3.1 billion in October from €5.3 billion in September, while the secondary income deficit increased to €14.0 billion from €9.8 billion.

Eurozone's unadjusted current account surplus dropped to €25.9 billion in October from €33.8 billion in September. September's figure was revised up from a surplus of €33.1 billion.

Current figures:

Name Price Change Change %

FTSE 100 6,076.32 -26.22 -0.43%

DAX 10,691.15 -46.97 -0.44%

CAC 40 4,648.98 -28.56 -0.61%

-

11:41

French manufacturing confidence index rises to 103 in December

The French statistical office Insee released its manufacturing confidence index for France on Friday. The French manufacturing confidence index increased to 103 in December from 102 in November.

Past change in production activity was down to 2 in December from 11 in November.

Personal production expectations index climbed to 10 in December from 3 in November, while general production outlook index dropped to 0 from 9.

-

11:36

French producer prices increase 0.1% in November

French statistical office INSEE released its producer price index (PPI) data on Friday. French producer prices increased 0.1% in November, after a 0.2% rise in October.

The increase was driven a rise in prices for mining and quarrying products, energy and water, which were up 1.1% in November.

On a yearly basis, French PPI fell 2.4% in November, after a 2.5% drop in October.

The annual drop was driven by a decline in prices for coke and refined petroleum products, which slid 27.8 year-on-year in November.

Import prices were up 0.2% in November, after a 0.4% fall in October.

-

11:25

Eurozone’s current account surplus drops to a seasonally adjusted €20.4 billion in October

The European Central Bank (ECB) released its current account on Friday. Eurozone's current account surplus fell to a seasonally adjusted €20.4 billion in October from €30.1 billion in September.

The trade surplus declined to €26.8 billion in October from €30.1 billion in September.

The surplus on services decreased to €4.4 billion in October from €4.5 billion in September.

The primary income surplus slid to €3.1 billion in October from €5.3 billion in September, while the secondary income deficit increased to €14.0 billion from €9.8 billion.

Eurozone's unadjusted current account surplus dropped to €25.9 billion in October from €33.8 billion in September. September's figure was revised up from a surplus of €33.1 billion.

-

11:03

Bank of Japan keeps its interest rate unchanged in December but adds new stimulus measures

The Bank of Japan (BoJ) released its interest rate decision on Friday. The BoJ kept its monetary policy unchanged (interest rate: 0.00-0.10%, monetary base target: 275 trillion yen). The central bank said that it will expand its monetary base at an annual pace of 80 trillion yen, adding that the average maturity of the Japanese government bonds was increased to seven to 12 years from seven to 10 years.

The BoJ also said that it will annually purchase ¥300 billion of ETFs (exchange-traded funds) issued by companies that are making investment in physical and human capital. This decision was not expected by analysts.

Only 6 of 9 board members backed new measures, while three board members voted against new measures.

-

10:50

Chinese banks sell a net 276.2 billion yuan in foreign exchange to clients in November

According to China's State Administration of Foreign Exchange (SAFE), Chinese banks sold a net 276.2 billion yuan in foreign exchange to clients in November, up from a net sale of 190.9 billion yuan in October.

The SAFE noted that Chinese banks sold a net 2.6799 yuan trillion in foreign exchange to clients in the first 11 months of 2015.

-

10:37

The ANZ business confidence index for New Zealand rises to 23.0% in December

ANZ Bank released its latest business sentiment survey for New Zealand on Friday. The ANZ business confidence index for New Zealand rose to 23.0% in December from 14.6% in November. The index means that 23% of respondents expected the country's economy to improve over the coming year.

"New Zealand remains the two-bit player at the international roulette table. Volatility across equities, commodities, the NZD and international economies is here to stay. Where China and the export price toboggan settle remains uncertain. We're cautious," the ANZ Chief Economist Cameron Bagrie said.

-

10:22

Bloomberg Consumer Comfort Index: consumers’ expectations for U.S. economy rise to 43.5 in December

According to data from the Bloomberg Consumer Comfort Index, consumers' expectations for U.S. economy increased to 43.5 in December from 42.5 in November. The increase was driven by a more favourable assessment of the U.S. economy.

Weekly consumers' expectations for U.S. economy increased to 40.9 in in the week ended December 13 from 40.1 the prior week. The increase was driven by a more favourable assessment of the personal finances and buying climate.

The measure of views of the economy declined.

The buying climate climbed to 37.2 from 35.3.

The personal finances index increased to 54.9 from 53.4.

-

10:10

Britain’s Prime Minister David Cameron: there is a progress in talks with European Union leaders regarding Britain’s membership in the EU

Britain's Prime Minister David Cameron said on Thursday that there is a progress in talks with European Union leaders regarding Britain's membership in the European Union (EU).

"Nothing is certain in life, nor in Brussels, but what I would say is there is a pathway to a deal in February," he said after the EU summit in Brussels.

European Council President Donald Tusk said after the EU summit that he was more optimistic that a deal between Britain and EU will be reached in February to keep Britain in the EU.

-

06:51

Global Stocks: U.S. stock indices declined amid low oil prices

U.S. stock indices fell on Thursday weighed by declines in oil prices.

The Dow Jones Industrial Average fell 253.25 points, or 1.4%, to 17,495.84. The S&P 500 lost 31.18 points, or 1.5%, to 2,041.89 (nine out of its 10 sectors fell; utilities edged up 0.1%). The Nasdaq Composite dropped 68.58 points, or 1.4% to 5,002.55.

In the previous session all three indices posted significant gains after the Federal Reserve raised its interest rate by 25 basis points to a range of 0.25%-0.50% expressing confidence in the U.S. economy. However later investors turned their attention to persistent concerns over global oil supply glut.

The U.S. Department of Labor reported that the number of initial jobless claims declined by 11,000 to 271,000 in the week ending December 12. Economists had expected 275,000 claims. These data point to stability in the labor market.

Meanwhile Philadelphia Fed Manufacturing Survey showed that the index of business activity fell to -5.9 points in December from 1.9 in November. Economists had expected the index to decline to 1.5.

This morning in Asia Hong Kong Hang Seng declined 0.12%, or 26.48, to 21,845.58. China Shanghai Composite Index climbed 0.12%, or 4.42, to 3.584.42. The Nikkei fell by 1.38%, or 267.31, to 19,086.25.

Asian indices traded mixed.

Japanese stocks rose after the Bank of Japan announced an additional program to purchase ETFs at annual pace of 300 billion yen ($2.45 billion). However later stocks declines as new measures were considered modest. Declines in U.S. equities weighed on stocks as well.

-

03:04

Nikkei 225 19,263.2 -90.36 -0.47%, Hang Seng 21,751.19 -120.87 -0.55%, Shanghai Composite 3,576.34 -3.65 -0.10%

-

00:35

Stocks. Daily history for Sep Dec 17’2015:

(index / closing price / change items /% change)

Nikkei 225 19,353.56 +303.65 +1.59 %

Hang Seng 21,872.06 +170.85 +0.79 %

Shanghai Composite 3,580.55 +64.37 +1.83 %

FTSE 100 6,102.54 +41.35 +0.68 %

CAC 40 4,677.54 +52.87 +1.14 %

Xetra DAX 10,738.12 +268.86 +2.57 %

S&P 500 2,041.89 -31.18 -1.50 %

NASDAQ Composite 5,002.55 -68.58 -1.35 %

Dow Jones 17,495.84 -253.25 -1.43 %

-