Noticias del mercado

-

18:00

European stocks closed: FTSE 100 6,056.38 -46.16 -0.76% CAC 40 4,625.26 -52.28 -1.12% DAX 10,608.19 -129.93 -1.21%

-

16:30

German public debt falls 0.8% in the third quarter

The German statistical office Destatis released its public debt data on Friday. German public debt fell 0.8% to € 2,027.7 billion in the third quarter from a year ago.

The debt of the Federation dropped by 1.2% to €1,267.5 billion on 30 September 2015, compared with the last year.

-

16:04

Italy’s current account surplus climbs to €6.13 billion in October

The Bank of Italy released its current account data on Friday. Italy's current account surplus climbed to €6.13 billion in October from €5.98 billion in October last year.

The goods trade surplus decreased to €5.88 billion in October from €5.89 billion in October last year. The services trade surplus rose to €285 million from €61 million.

The capital account surplus jumped to €1.04 billion in October from a deficit of €182 million last year.

-

15:56

U.S. preliminary services purchasing managers' index drops to 53.7 in December

Markit Economics released its preliminary services purchasing managers' index (PMI) for the U.S. on Friday. The U.S. preliminary services purchasing managers' index (PMI) dropped to 53.7 in December from 56.1 in November. It was the lowest level since December 2014.

Analysts had expected the index to fell to 56.0.

A reading above 50 indicates expansion in economic activity.

The drop was driven by a sharp slowdown in new business growth.

"A lack of inflationary pressures, slowing growth and a drop in business confidence to a five-year low are all disappointing news for an economy which has seen the first US interest rate hike for almost a decade," Markit Chief Economist Chris Williamson said.

He added that the data was consistent with an annual 1.8% growth in the fourth quarter.

-

15:45

U.S.: Services PMI, December 53.7 (forecast 56)

-

15:00

Canadian consumer price inflation falls 0.1% in November

Statistics Canada released consumer price inflation data on Friday. Canadian consumer price inflation fell 0.1% in November, missing expectations for a 0.1% gain, after a 0.1% rise in October.

The monthly drop was mainly driven by declines in clothing and footwear, and recreation, education and reading prices.

Clothing and footwear fell 1.0% in November, while recreation, education and reading prices dropped 1.8%.

On a yearly basis, the consumer price index increased to 1.4% in November from 1.0% in October, missing expectations for a rise to 1.5%.

The consumer price index was partly driven by higher food and shelter prices. Food prices climbed 3.4% year-on-year in November, while transportation prices decreased 1.1%.

The index for recreation, education and reading climbed by 1.9% in November from the same month a year earlier, the shelter index gained 1.2%, while gasoline prices dropped 10.6%.

The Canadian core consumer price index, which excludes some volatile goods, dropped 0.3% in November, after a 0.3% gain in October.

On a yearly basis, core consumer price index in Canada declined to 2.0% in November from 2.1% in October, missing expectations for a gain to 2.3%.

The Bank of Canada's inflation target is 2.0%.

-

14:52

Option expiries for today's 10:00 ET NY cut

USD/JPY 120.00 (USD 1bln) 121.00 (1bln) 121.50 (1bln) 122.00 (1.8bln 122.50 (13bln)

EUR/USD 1.0700 (EUR 3.7bln) 1.0750 (1.8bln) 1.0800 (5.1bln) 1.0850-55 (1.3bln) 1.0900 (3.5bln) 1.0950 (1.3bln) 1.0975 (1bln) 1.1000(4.5bln)

GBP/USD 1.4900 (GBP 600m) 1.5000 (1.3bln) 1.5100 (602m) 1.5150 (642m)

AUD/USD 0.7000 (AUD 1.4bln) 0.7100 (814m) 0.7150 (451m) 0.7200 (500m) 0.7300 (569m)

NZD/USD 0.6500 (NZD 1.8bln) 0.6650 (1.2bln)

-

14:44

Canada’s wholesale sales decrease 0.6% in October

Statistics Canada released wholesale sales figures on Friday. Wholesale sales fell 0.6% in October, missing expectations for a 0.1% gain, after a 0.3% decline in September. September's figure was revised down from a 0.1% decrease.

The decline was driven by lower sales in the food, beverage and tobacco and the motor vehicle and parts subsectors.

Sales in the food, beverage and tobacco subsector dropped 3.0% in October, while sales of motor vehicle and parts were down 2.1%.

Sales in the building material and supplies subsector declined 0.3% in October.

Inventories increased by 0.5% in October.

-

14:30

Canada: Bank of Canada Consumer Price Index Core, y/y, November 2% (forecast 2.3%)

-

14:30

Canada: Consumer price index, y/y, November 1.4% (forecast 1.5%)

-

14:30

Canada: Consumer Price Index m / m, November -0.1% (forecast 0.1%)

-

14:30

Canada: Wholesale Sales, m/m, October -0.6% (forecast 0.1%)

-

14:26

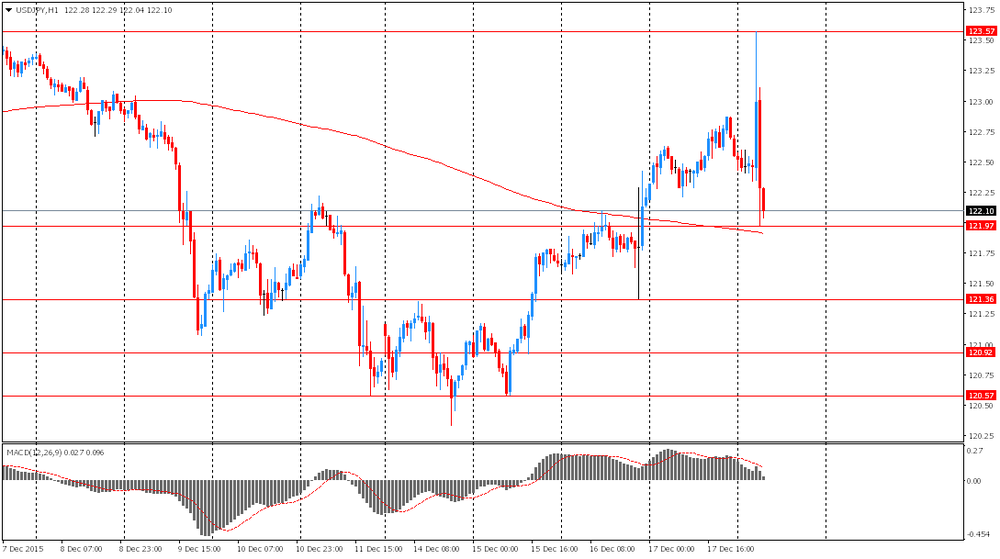

Bank of Japan Governor Haruhiko Kuroda: the central bank’s new stimulus measures were only an adjustment of quantitative easing

The Bank of Japan (BoJ) Governor Haruhiko Kuroda said in a press conference on Friday that the central bank's new stimulus measures were only an adjustment of quantitative easing. New stimulus measures will help to ease the BoJ's further if needed, he added.

"We've taken steps to supplement QQE [quantitative and qualitative easing] so that we can expand the program without hesitation if needed," Kuroda noted.

He pointed out that new stimulus measures do not address downside risks to the economy.

The BoJ governor also said that the Fed's interest rate hike was not a trigger for new stimulus measures.

-

14:13

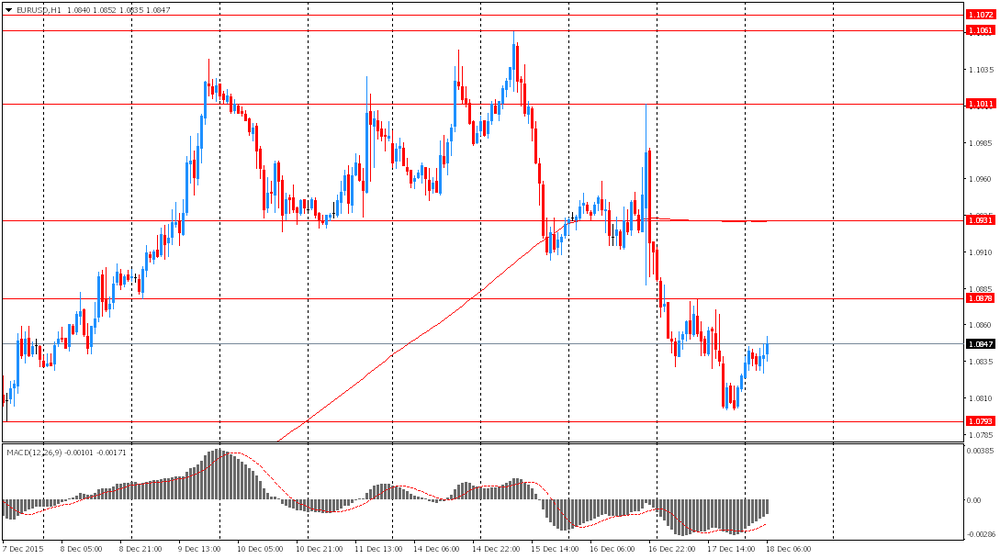

Foreign exchange market. European session: the euro traded mixed against the U.S. dollar after the release of the negative economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 New Zealand Westpac Consumer Sentiment Quarter IV 106

04:00 Japan BoJ Interest Rate Decision 0% 0%

04:00 Japan Bank of Japan Monetary Base Target 275 275

04:00 Japan BoJ Monetary Policy Statement

06:30 Japan BOJ Press Conference

09:00 Eurozone Current account, unadjusted, bln October 33.8 Revised From 33.1 25.9

The U.S. dollar traded higher against the most major currencies ahead of the release of the U.S. services PMI data. The preliminary U.S. services PMI is expected to fall to 56.0 in December from 56.1 in November.

The euro traded mixed against the U.S. dollar after the release of the negative economic data from the Eurozone. The European Central Bank (ECB) released its current account on Friday. Eurozone's current account surplus fell to a seasonally adjusted €20.4 billion in October from €30.1 billion in September.

The trade surplus declined to €26.8 billion in October from €30.1 billion in September.

The surplus on services decreased to €4.4 billion in October from €4.5 billion in September.

The primary income surplus slid to €3.1 billion in October from €5.3 billion in September, while the secondary income deficit increased to €14.0 billion from €9.8 billion.

Eurozone's unadjusted current account surplus dropped to €25.9 billion in October from €33.8 billion in September. September's figure was revised up from a surplus of €33.1 billion.

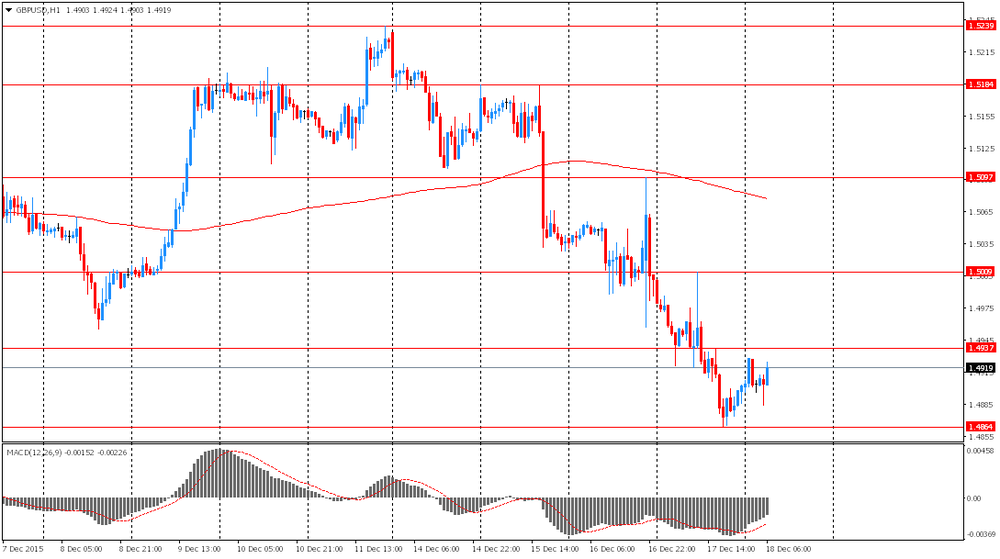

The British pound traded lower against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded lower against the U.S. dollar ahead of the release of the Canadian economic data. The consumer price index in Canada is expected to climb 1.5% year-on-year in November from 1.0% in October.

The core consumer price index in Canada is expected to rise to 2.3% year-on-year in November from 2.1% in October.

Wholesales sales in Canada are expected to rise 0.1% in October, after a 0.1% decline in September.

EUR/USD: the currency pair declined to $1.0804

GBP/USD: the currency pair fell to $1.4895

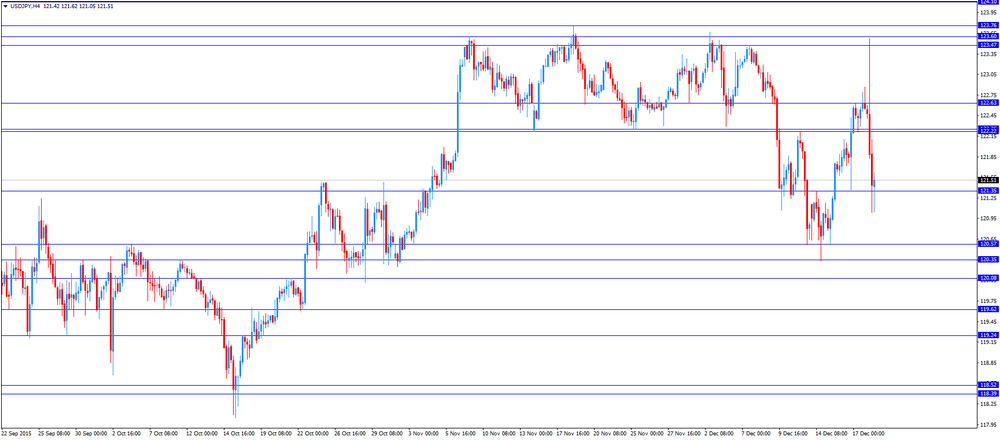

USD/JPY: the currency pair decreased to Y121.04

The most important news that are expected (GMT0):

13:30 Canada Wholesale Sales, m/m October -0.1% 0.1%

13:30 Canada Consumer Price Index m / m November 0.1% 0.1%

13:30 Canada Consumer price index, y/y November 1.0% 1.5%

13:30 Canada Bank of Canada Consumer Price Index Core, y/y November 2.1% 2.3%

14:45 U.S. Services PMI (Preliminary) December 56.1 56

18:00 U.S. FOMC Member Laсker Speaks

-

13:50

Orders

EUR/USD

Offers 1.0880 1.0900 1.0930 1.0960 1.0985 1.1000 1.1025-30 1.1050 1.1065 1.1080-85 1.1100

Bids 1.0830 1.0800 1.0780-85 1.0750 1.0730 1.0700 1.0685 1.0670 1.0650

GBP/USD

Offers 1.4950-55 1.4980-85 1.5000 1.5030 1.5050 1.5075-80 1.5100 1.5120 1.5150

Bids 1.4920-25 1.4900 1.4885 1.4865 1.4850 1.4830 1.4800 1.4785 1.4765 1.4750

EUR/GBP

Offers 0.7280-85 0.7300 0.7320 0.7350 0.7375 0.7400 0.7420 0.7450

Bids 0.7250 0.7225-30 0.7200 0.7180 0.7165 0.7150

EUR/JPY

Offers 132.30 132.50 132.80 133.00 133.20 133.50 133.85 134.00

Bids 131.75-80 131.50 131.00 130.80 130.50 130.30 130.00

USD/JPY

Offers 121.85 122.00 122.20 122.50 122.65 122.80 123.00 123.20 123.50

Bids 121.50 121.30 121.00 120.85 120.60-65 120.50 120.30 120.00

AUD/USD

Offers 0.7150 0.7180 0.7200 0.7220 0.7255-60 0.7280 0.7300 0.7320-25 0.7345-50

Bids 0.7120-25 0.7100 0.7085 0.7065 0.7050 0.7020 0.7000

-

11:41

French manufacturing confidence index rises to 103 in December

The French statistical office Insee released its manufacturing confidence index for France on Friday. The French manufacturing confidence index increased to 103 in December from 102 in November.

Past change in production activity was down to 2 in December from 11 in November.

Personal production expectations index climbed to 10 in December from 3 in November, while general production outlook index dropped to 0 from 9.

-

11:36

French producer prices increase 0.1% in November

French statistical office INSEE released its producer price index (PPI) data on Friday. French producer prices increased 0.1% in November, after a 0.2% rise in October.

The increase was driven a rise in prices for mining and quarrying products, energy and water, which were up 1.1% in November.

On a yearly basis, French PPI fell 2.4% in November, after a 2.5% drop in October.

The annual drop was driven by a decline in prices for coke and refined petroleum products, which slid 27.8 year-on-year in November.

Import prices were up 0.2% in November, after a 0.4% fall in October.

-

11:25

Eurozone’s current account surplus drops to a seasonally adjusted €20.4 billion in October

The European Central Bank (ECB) released its current account on Friday. Eurozone's current account surplus fell to a seasonally adjusted €20.4 billion in October from €30.1 billion in September.

The trade surplus declined to €26.8 billion in October from €30.1 billion in September.

The surplus on services decreased to €4.4 billion in October from €4.5 billion in September.

The primary income surplus slid to €3.1 billion in October from €5.3 billion in September, while the secondary income deficit increased to €14.0 billion from €9.8 billion.

Eurozone's unadjusted current account surplus dropped to €25.9 billion in October from €33.8 billion in September. September's figure was revised up from a surplus of €33.1 billion.

-

11:03

Bank of Japan keeps its interest rate unchanged in December but adds new stimulus measures

The Bank of Japan (BoJ) released its interest rate decision on Friday. The BoJ kept its monetary policy unchanged (interest rate: 0.00-0.10%, monetary base target: 275 trillion yen). The central bank said that it will expand its monetary base at an annual pace of 80 trillion yen, adding that the average maturity of the Japanese government bonds was increased to seven to 12 years from seven to 10 years.

The BoJ also said that it will annually purchase ¥300 billion of ETFs (exchange-traded funds) issued by companies that are making investment in physical and human capital. This decision was not expected by analysts.

Only 6 of 9 board members backed new measures, while three board members voted against new measures.

-

10:50

Chinese banks sell a net 276.2 billion yuan in foreign exchange to clients in November

According to China's State Administration of Foreign Exchange (SAFE), Chinese banks sold a net 276.2 billion yuan in foreign exchange to clients in November, up from a net sale of 190.9 billion yuan in October.

The SAFE noted that Chinese banks sold a net 2.6799 yuan trillion in foreign exchange to clients in the first 11 months of 2015.

-

10:37

The ANZ business confidence index for New Zealand rises to 23.0% in December

ANZ Bank released its latest business sentiment survey for New Zealand on Friday. The ANZ business confidence index for New Zealand rose to 23.0% in December from 14.6% in November. The index means that 23% of respondents expected the country's economy to improve over the coming year.

"New Zealand remains the two-bit player at the international roulette table. Volatility across equities, commodities, the NZD and international economies is here to stay. Where China and the export price toboggan settle remains uncertain. We're cautious," the ANZ Chief Economist Cameron Bagrie said.

-

10:22

Bloomberg Consumer Comfort Index: consumers’ expectations for U.S. economy rise to 43.5 in December

According to data from the Bloomberg Consumer Comfort Index, consumers' expectations for U.S. economy increased to 43.5 in December from 42.5 in November. The increase was driven by a more favourable assessment of the U.S. economy.

Weekly consumers' expectations for U.S. economy increased to 40.9 in in the week ended December 13 from 40.1 the prior week. The increase was driven by a more favourable assessment of the personal finances and buying climate.

The measure of views of the economy declined.

The buying climate climbed to 37.2 from 35.3.

The personal finances index increased to 54.9 from 53.4.

-

10:10

Britain’s Prime Minister David Cameron: there is a progress in talks with European Union leaders regarding Britain’s membership in the EU

Britain's Prime Minister David Cameron said on Thursday that there is a progress in talks with European Union leaders regarding Britain's membership in the European Union (EU).

"Nothing is certain in life, nor in Brussels, but what I would say is there is a pathway to a deal in February," he said after the EU summit in Brussels.

European Council President Donald Tusk said after the EU summit that he was more optimistic that a deal between Britain and EU will be reached in February to keep Britain in the EU.

-

10:05

Option expiries for today's 10:00 ET NY cut

USD/JPY 120.00 (USD 1bln) 121.00 (1bln) 121.50 (1bln) 122.00 (1.8bln 122.50 (13bln)

EUR/USD 1.0700 (EUR 3.7bln) 1.0750 (1.8bln) 1.0800 (5.1bln) 1.0850-55 (1.3bln) 1.0900 (3.5bln) 1.0950 (1.3bln) 1.0975 (1bln) 1.1000(4.5bln)

GBP/USD 1.4900 (GBP 600m) 1.5000 (1.3bln) 1.5100 (602m) 1.5150 (642m)

AUD/USD 0.7000 (AUD 1.4bln) 0.7100 (814m) 0.7150 (451m) 0.7200 (500m) 0.7300 (569m)

NZD/USD 0.6500 (NZD 1.8bln) 0.6650 (1.2bln)

-

10:00

Eurozone: Current account, unadjusted, bln , October 25.9

-

08:33

Options levels on friday, December 18, 2015:

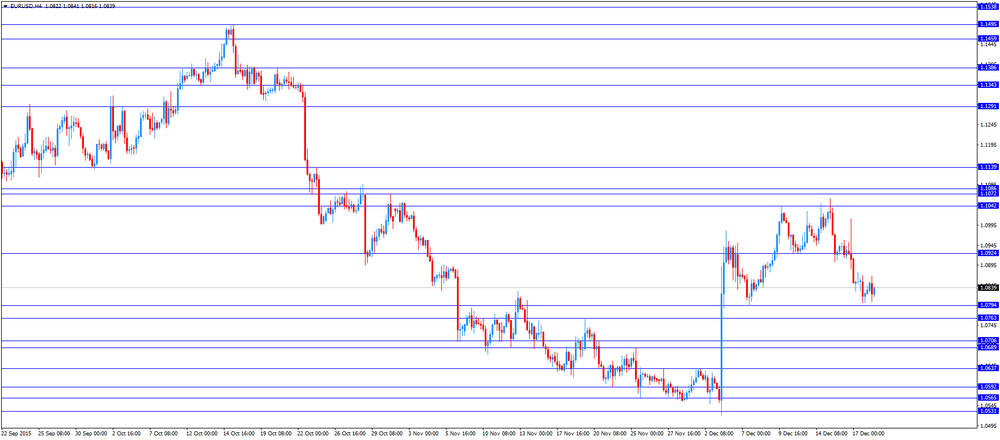

EUR / USD

Resistance levels (open interest**, contracts)

$1.1076 (3222)

$1.1036 (4395)

$1.0968 (4838)

Price at time of writing this review: $1.0854

Support levels (open interest**, contracts):

$1.0794 (1855)

$1.0762 (2515)

$1.0714 (5958)

Comments:

- Overall open interest on the CALL options with the expiration date January, 8 is 54387 contracts, with the maximum number of contracts with strike price $1,1100 (6852);

- Overall open interest on the PUT options with the expiration date January, 8 is 72346 contracts, with the maximum number of contracts with strike price $1,0450 (8108);

- The ratio of PUT/CALL was 1.33 versus 1.28 from the previous trading day according to data from December, 17

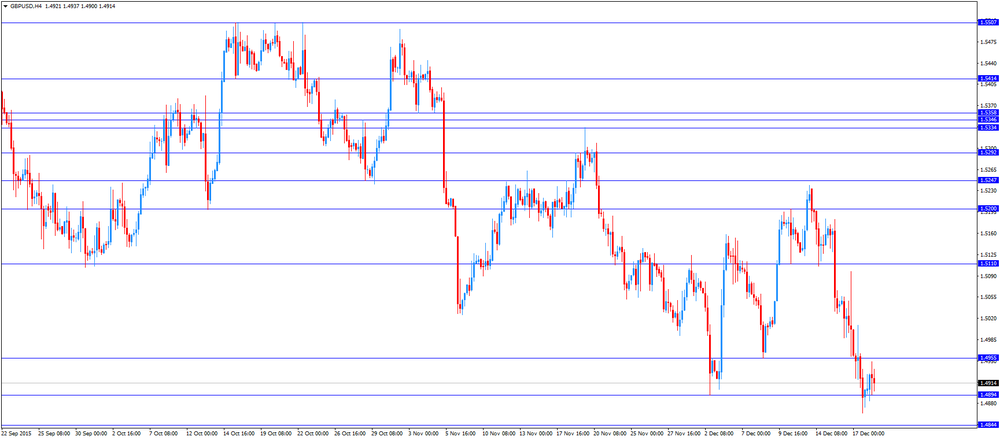

GBP/USD

Resistance levels (open interest**, contracts)

$1.5201 (1168)

$1.5103 (2623)

$1.5005 (527)

Price at time of writing this review: $1.4935

Support levels (open interest**, contracts):

$1.4890 (2225)

$1.4794 (1520)

$1.4696 (1049)

Comments:

- Overall open interest on the CALL options with the expiration date January, 8 is 18640 contracts, with the maximum number of contracts with strike price $1,5100 (2623);

- Overall open interest on the PUT options with the expiration date January, 8 is 18595 contracts, with the maximum number of contracts with strike price $1,5100 (3086);

- The ratio of PUT/CALL was 1.00 versus 1.00 from the previous trading day according to data from December, 17

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:57

Foreign exchange market. Asian session: the yen advanced

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:00 New Zealand Westpac Consumer Sentiment Quarter IV 106

04:00 Japan BoJ Interest Rate Decision 0% 0%

04:00 Japan Bank of Japan Monetary Base Target 275 275

04:00 Japan BoJ Monetary Policy Statement

06:30 Japan BOJ Press Conference

The yen climbed after Bank of Japan unexpectedly announced an additional program to purchase ETFs at annual pace of 300 billion yen ($2.45 billion) and extended the current program of bond purchases. Policymakers voted 6 to 3 to extend the program.

The Australian dollar edged up on positive data from China, its major trading partner. MNI China business sentiment rose to 52.7 in December from 49.9 in November. Other data showed that prices of new houses in China rose by 0.9% pointing to modest growth. This gain was driven by sharp increases in Beijing and Shanghai (+7.7% y/y and 13.1% y/y respectively).

The New Zealand dollar climbed on business confidence data from ANZ. The corresponding index continued rising in December and reached 23 points compared to 14.6 in the previous month. The latest reading is the highest in eight months.

EUR/USD: the pair rose to $1.0855 in Asian trade

USD/JPY: the pair fell to Y121.95

GBP/USD: the pair traded within $1.4885-25

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

09:00 Eurozone Current account, unadjusted, bln October 33.1

13:30 Canada Wholesale Sales, m/m October -0.1% 0.1%

13:30 Canada Consumer Price Index m / m November 0.1% 0.1%

13:30 Canada Consumer price index, y/y November 1.0% 1.5%

13:30 Canada Bank of Canada Consumer Price Index Core, y/y November 2.1% 2.3%

14:45 U.S. Services PMI (Preliminary) December 56.1 56

18:00 U.S. FOMC Member Laсker Speaks

-

05:08

Japan: Bank of Japan Monetary Base Target, 275

-

04:59

Japan: BoJ Interest Rate Decision, 0%

-

00:33

Currencies. Daily history for Dec 17’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0825 -0,79%

GBP/USD $1,4901 -0,68%

USD/CHF Chf0,9961 +0,64%

USD/JPY Y122,54 +0,29%

EUR/JPY Y132,67 -0,50%

GBP/JPY Y182,59 -0,40%

AUD/USD $0,7125 -1,47%

NZD/USD $0,6700 -1,45%

USD/CAD C$1,3935 +1,13%

-

00:01

Schedule for today, Friday, 18’2015:

(time / country / index / period / previous value / forecast)

00:00 New Zealand Westpac Consumer Sentiment Quarter IV 106

04:00 Japan BoJ Interest Rate Decision 0%

04:00 Japan Bank of Japan Monetary Base Target 275

04:00 Japan BoJ Monetary Policy Statement

06:30 Japan BOJ Press Conference

09:00 Eurozone Current account, unadjusted, bln October 33.1

13:30 Canada Wholesale Sales, m/m October -0.1% 0.1%

13:30 Canada Consumer Price Index m / m November 0.1% 0.1%

13:30 Canada Consumer price index, y/y November 1.0% 1.5%

13:30 Canada Bank of Canada Consumer Price Index Core, y/y November 2.1% 2.3%

14:45 U.S. Services PMI (Preliminary) December 56.1 56

18:00 U.S. FOMC Member Laсker Speaks

-