Noticias del mercado

-

22:12

U.S. stocks closed

U.S. stocks fluctuated as China's signal that it may add to stimulus boosted metals prices from copper to gold. Brent crude slipped to an 11-year low on signs the global glut will persist, while Treasuries advanced.

The Standard & Poor's 500 Index pared gains to 0.1 percent, after earlier rallying as much as 0.9 percent. The U.S. benchmark recovered from a 3.3 percent rout over two days after the Federal Reserve raised interest rates. Ten-year Treasury notes erased losses for December, while the dollar slipped. Brent futures in London fell to the weakest intraday level since July 2004, with drilling in the U.S. increasing. Emerging-market equities headed for the fourth gain in five days.

The rout in crude prices has pushed oil to the lowest levels since before financial crisis, threatening to keep inflation from rising to levels targeted by central banks in Europe and America. Equities have tumbled since the Fed's tightening on concern that U.S. growth could slow without zero-percent interest rates. China's government said monetary policy must be more "flexible" and fiscal policy more "forceful" to combat slowing growth in the world's second-largest economy.

Brent crude futures were 1.9 percent lower at $36.19 a barrel, after a 2.8 percent decline last week. It fell as low as $36.04 on Monday, the lowest since July 2004. West Texas Intermediate crude in New York was little changed at $34.74 a barrel.

Gas, which has been battered by widespread warmth in the eastern half of the country, headed for the biggest one-day gain in seven weeks as forecasts showed mild weather fading in the U.S. Midwest. Gas futures for January delivery rose 7.9 percent, to $1.907 per million British thermal units on the New York Mercantile Exchange.

-

21:00

DJIA 17172.95 44.40 0.26%, NASDAQ 4942.67 19.59 0.40%, S&P 500 2011.72 6.17 0.31%

-

18:00

European stocks closed: FTSE 6034.84 -17.58 -0.29%, DAX 10497.77 -110.42 -1.04%, CAC 40 4565.17 -60.09 -1.30%

-

17:59

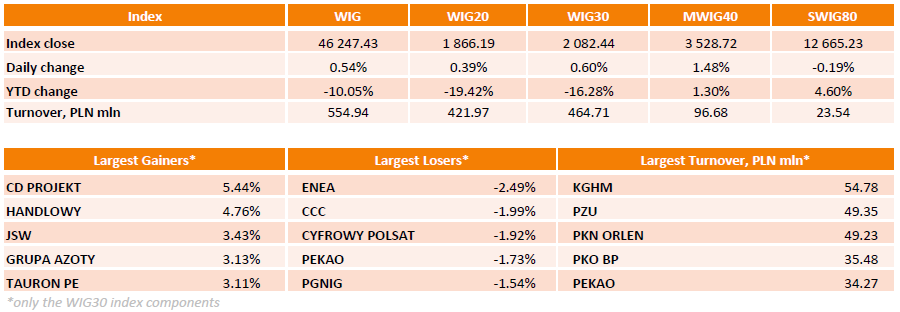

WSE: Session Results

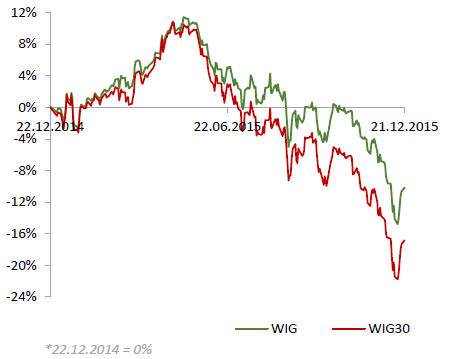

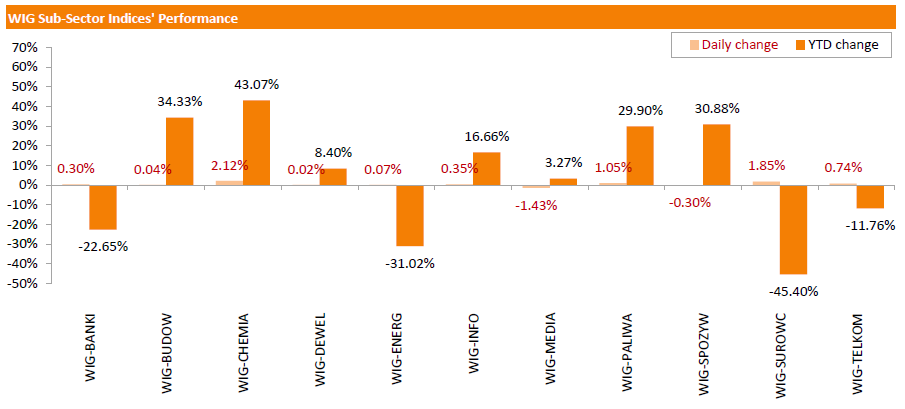

Polish equity market surged on Monday. The broad market measure, the WIG Index, added 0.54%. Except for media (-1.43%) and food sector (-0.30%), every sector in the WIG Index gained, with chemicals (+2.12%) outperforming.

The large-cap stocks' measure, the WIG30 Index, advanced by 0.6%. Videogame developer CD PROJEKT (WSE: CDR) closed its first day as WIG30 Index component with a 5.44% boost. CDR replaced the shares of auto components producer BORYSZEW (WSE: BRS). Other major gainers included bank HANDLOWY (WSE: BHW), coal miner JSW (WSE: JSW), chemical producer GRUPA AZOTY (WSE: ATT) and genco TAURON PE (WSE: TPE), advancing between 3.11% and 4.76%. On the other side of the ledger, genco ENEA (WSE: ENA) was the weakest name, retreating by 2.49% after two consecutive sessions of gains. Retailer CCC (WSE: CCC) and media group CYFROWY POLSAT (WSE: CPS) posted declines of 1.99% and 1.92% respectively.

-

17:34

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes started the Christmas holiday week on a positive note, led by tech and financials, but energy stocks lagged as Brent crude hit an 11 year low. Trading volumes are expected to be relatively light this week, with U.S. stock markets operating a shortened session on Thursday and closing on Friday for Christmas.

Oil prices have been sliding under continued pressure from global oversupply and tepid demand.

Most of Dow stocks in positive area (24 of 30). Top looser - The Walt Disney Company (DIS, -1,33%). Top gainer - JPMorgan Chase & Co. (JPM, +1.18%).

All S&P index sectors in positive area. Top looser - Conglomerates (+0,7%).

At the moment:

Dow 17087.00 +70.00 +0.41%

S&P 500 2004.00 +12.00 +0.60%

Nasdaq 100 4530.50 +26.00 +0.58%

Oil 35.57 -0.49 -1.36%

Gold 1078.30 +13.30 +1.25%

U.S. 10yr 2.19 -0.01

-

15:34

U.S. Stocks open: Dow +0.79%, Nasdaq +0.84%, S&P +0.80%

-

15:23

Before the bell: S&P futures +0.84%, NASDAQ futures +0.83%

U.S. stock-index futures were rose.

Global Stocks:

Nikkei 18,916.02 -70.78 -0.37%

Hang Seng 21,791.68 +36.12 +0.17%

Shanghai Composite 3,642.63 +63.67 +1.78%

FTSE 6,108.01 +55.59 +0.92%

CAC 4,644.48 +19.22 +0.42%

DAX 10,696.51 +88.32 +0.83%

Crude oil $34.57 (-0.46%)

Gold $1073.70 (+0.82%)

-

15:01

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Barrick Gold Corporation, NYSE

ABX

7.40

2.35%

1.4K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

6.31

1.61%

24.9K

Hewlett-Packard Co.

HPQ

11.68

1.48%

0.1K

Walt Disney Co

DIS

109.25

1.42%

73.5K

ALCOA INC.

AA

9.33

1.08%

15.0K

Apple Inc.

AAPL

107.16

1.07%

246.7K

Microsoft Corp

MSFT

54.70

1.05%

87.1K

Goldman Sachs

GS

177.30

1.03%

0.1K

Citigroup Inc., NYSE

C

51.72

1.00%

10.7K

Intel Corp

INTC

34.20

0.99%

8.6K

Starbucks Corporation, NASDAQ

SBUX

59.20

0.99%

1.0K

Nike

NKE

129.68

0.90%

0.5K

Visa

V

77.00

0.89%

2.1K

Chevron Corp

CVX

90.60

0.88%

1.1K

Yahoo! Inc., NASDAQ

YHOO

33.24

0.88%

3.3K

ALTRIA GROUP INC.

MO

57.61

0.84%

9.7K

Boeing Co

BA

140.70

0.80%

0.3K

JPMorgan Chase and Co

JPM

64.90

0.78%

1.0K

E. I. du Pont de Nemours and Co

DD

63.88

0.76%

2.3K

Facebook, Inc.

FB

104.81

0.74%

45.0K

AT&T Inc

T

33.80

0.60%

6.7K

Amazon.com Inc., NASDAQ

AMZN

667.80

0.55%

4.0K

Home Depot Inc

HD

131.00

0.54%

0.5K

Johnson & Johnson

JNJ

102.50

0.54%

0.5K

Exxon Mobil Corp

XOM

77.69

0.53%

0.9K

Pfizer Inc

PFE

32.16

0.53%

45.6K

Ford Motor Co.

F

13.87

0.51%

1.0K

Tesla Motors, Inc., NASDAQ

TSLA

231.62

0.50%

3.2K

Twitter, Inc., NYSE

TWTR

23.10

0.48%

6.8K

The Coca-Cola Co

KO

42.70

0.47%

22.3K

Google Inc.

GOOG

742.52

0.43%

1.1K

Procter & Gamble Co

PG

78.45

0.41%

1.0K

General Electric Co

GE

30.40

0.40%

0.2K

Cisco Systems Inc

CSCO

26.37

0.38%

2.3K

Verizon Communications Inc

VZ

45.72

0.35%

0.4K

Caterpillar Inc

CAT

65.32

0.32%

31.7K

International Business Machines Co...

IBM

135.31

0.30%

0.5K

Wal-Mart Stores Inc

WMT

59.02

0.29%

0.3K

American Express Co

AXP

67.94

0.10%

0.1K

Deere & Company, NYSE

DE

75.03

0.08%

0.1K

Yandex N.V., NASDAQ

YNDX

15.30

-0.13%

0.5K

-

14:46

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Alphabet (GOOG) target raised to $850 from $820 at Pacific Crest

-

07:30

Global Stocks: U.S. stock indices fell amid declines in oil prices

U.S. stock indices fell on Friday weighed by declines in oil prices.

The Dow Jones Industrial Average fell 367.39 points, or 2.1%, to 17,128.45 (-0.8% over the week). The S&P 500 dropped 36.37 points, or 1.8%, to 2,005.52 (-0.3% over the week; financials led declines with a 2.5% fall). The Nasdaq Composite lost 79.47 points, or 1.6% to 4,923.08 (-0.2% over the week).

Earlier in the week Fed's decision to raise interest rates spurred a rally in stocks. Normally higher rates steepen the spread between ten-year and 2-year yields, but this effect is not seen yet this time. That's why investors focused on concerns over bank's exposure to energy companies.

This morning in Asia Hong Kong Hang Seng climbed 0.40%, or 86.09, to 21,841.65. China Shanghai Composite Index advanced 1.98%, or 70.42, to 3.649.88. The Nikkei fell by 0.41%, or 78.19, to 18,908.61.

Asian indices outside Japan rose.

Japanese stocks fell reacting to declines in Wall Street on Friday.

The People's Bank of China strengthened the daily fix for the yuan by 0.09% to 6.4753 per dollar avoiding an unprecedented 11th weakening in a row.

-

03:05

Nikkei 225 18,717.49 -269.31 -1.4 %, Hang Seng 21,775.39 +19.83 +0.1 %, Shanghai Composite 3,568.34 -10.63 -0.3 %

-

01:03

Stocks. Daily history for Sep Dec 18’2015:

(index / closing price / change items /% change)

Nikkei 225 18,986.8 -366.76 -1.90 %

Hang Seng 21,755.56 -116.50 -0.53 %

Shanghai Composite 3,579.49 -0.51 -0.01 %

FTSE 100 6,052.42 -50.12 -0.82%

CAC 40 4,625.26 -52.28 -1.12%

Xetra DAX 10,608.19 -129.93 -1.21%

S&P 500 2,005.55 -36.34 -1.78%

NASDAQ Composite 4,923.08 -79.47 -1.59%

Dow Jones 17,128.55 -367.29 -2.10%

-