Noticias del mercado

-

20:21

American focus: the US dollar fell

The US dollar fell against other major currencies, as trading volumes are likely to remain low for the Christmas holidays, but demand for the dollar rose to a recent decision of the Federal Reserve System.

The dollar showed an increase last week after the Federal Reserve raised interest rates by a quarter percentage point to 0.25% -0.5%, as many expected.

Commenting on the statement of the Fed, Janet Yellen head of the bank promised that the Fed will not rush to the tightening of monetary policy, and the future rate hikes will be gradual and will depend on economic indicators.

According to a National Activity Index Chicago Fed, economic activity in the US fell in November.

The index, which is weighted value of the 85 individual indicators, since data on production and sales and ending salaries and expenses in November fell to -0.30 from -0.17 in October. A reading above zero indicates that the national economy is growing at a rate of long-term trend, while values below zero indicate growth below average.

The moving average of the index in three months, which smooths volatility of the monthly index in November fell to -0.20 from -0.18 in October. In November 2014, the index was equal to 0.77, while the moving average stood at 0.42.

These figures are not terrible, but they are a warning to all those who believe that the pace of US economic growth in 2016 will be strong, but also point to the fact that at the end of 2015 the economy lost momentum for growth.

Little impact on the dynamics of the euro earlier had data for Germany. The Federal Statistics Office Destatis reported that the producer price index fell in November by 0.2% compared to October and 2.5% per annum. The index showed the biggest annual fall in nearly six years, helped by lower energy prices. Economists had forecast a drop of 0.2% compared to October and 2.5% per annum. Excluding energy prices, producer prices fell by 0.2% in monthly terms and 0.7% per annum.

Also today, the ECB's chief economist, Peter Pret said that the economic outlook had improved in terms of low interest rates and a sharp drop in oil prices. "The positive effects of structural reforms in a number of countries such as Spain and Ireland, should also be highlighted. These factors had a positive effect on the labor market and economic recovery. Fiscal policy will be more neutral, even slightly expansionary. In fact, these measures will promote the growth of the eurozone's GDP by 0.1% in 2016 and 2017 "- added Pret. "There have been attached huge financial effort, although debt levels are still too high. However, we must bear in mind that the real GDP in the euro area in the first quarter of 2016 just come back to the level of the beginning of 2008. This means that for the past eight years, the euro zone's GDP did not grow in real terms on average, while countries such as Germany recorded a moderate expansion. Other countries, however, experienced a serious recession, "- said the politician.

The British pound fell slightly against the dollar, updating the at least Friday. Experts point out that in recent years the pound is under pressure as markets no longer expect a rate hike of the Bank of England in 2016. Today, representatives of the Bank of England Martin Weale said that a pause in the growth of wages and a further decline in commodity prices have made the need for tighter monetary policy, "a little less urgent." Recall, according to the latest forecasts of the Central Bank, inflation will remain below 1 percent until the second half of next year. We also add the interest rate remains unchanged at the current record low of 0.50% since the beginning of 2009. During the interview, Will said that the growth of the pound against the euro has been a significant factor hampering the rate increase. He believes that the rate should be increased before the beginning of 2017, to keep inflation from rising above the target level of the Central Bank.

In addition, the survey results Confederation of British Industry (CBI) showed that retail sales in the country grew slightly less than expected in the run up to Christmas. According to the data, the balance of retail sales rose to 19 in December from a nine-month low of seven in November. Nevertheless, the latter value was slightly less than forecasts of experts at around 21. In addition, the index of expected sales next month fell to its lowest level since May 2012.

-

16:00

Eurozone: Consumer Confidence, December -5.7 (forecast -5.85)

-

14:49

Option expiries for today's 10:00 ET NY cut

USD/JPY: 120.35 (USD 600m) 122.50 (360m) 122.70-85 (685m)

EUR/USD: 1.0750 (EUR 380m) 1.0785 (343m) 1.0810 (559m) 1.0900 (761m)

GBP/USD: 1.5050 (GBP 279m)

USD/CAD:1.3600 (USD 1.1bln)

AUD/USD: 0.7195 (AUD 750m) 0.7270 (307m)

NZD/USD: 0.6600 (NZD 300m) 0.6850 (297m)

-

14:09

Orders

EUR/USD

Offers 1.0885 1.0900 1.0930 1.0960 1.0985 1.1000 1.1025-30 1.1050

Bids 1.0845-50 1.0830 1.0800 1.0780-85 1.0750 1.0730 1.0700 1.0685 1.0670 1.0650

GBP/USD

Offers 1.4925-30 1.4950-55 1.4980-85 1.5000 1.5030 1.5050 1.5075-80 1.5100

Bids 1.4900 1.4885 1.4865 1.4850 1.4830 1.4800 1.4785 1.4765 1.4750

EUR/GBP

Offers 0.7300 0.7320 0.7350 0.7375 0.7400 0.7420 0.7450

Bids 0.7275-80 0.7250 0.7225-30 0.7200 0.7180 0.7165 0.7150

EUR/JPY

Offers 132.10 132.25 132.50 132.80 133.00 133.20 133.50 133.85 134.00

Bids 131.75-80 131.50 131.00 130.80 130.50 130.30 130.00

USD/JPY

Offers 121.50-55 121.80 122.00 122.20 122.50 122.65 122.80 123.00

Bids 121.20-25 121.00 120.85 120.60-65 120.50 120.30 120.00

AUD/USD

Offers 0.7200 0.7220 0.7255-60 0.7280 0.7300 0.7320-25 0.7345-50

Bids 0.7150 0.7120-25 0.7100 0.7085 0.7065 0.7050 0.7020 0.7000

-

12:00

United Kingdom: CBI retail sales volume balance, December 19 (forecast 21)

-

09:22

Option expiries for today's 10:00 ET NY cut

USD/JPY: 120.35 (USD 600m) 122.50 (360m) 122.70-85 (685m)

EUR/USD: 1.0750 (EUR 380m) 1.0785 (343m) 1.0810 (559m) 1.0900 (761m)

GBP/USD: 1.5050 (GBP 279m)

USD/CAD:1.3600 (USD 1.1bln)

AUD/USD: 0.7195 (AUD 750m) 0.7270 (307m)

NZD/USD: 0.6600 (NZD 300m) 0.6850 (297m)

-

08:10

Foreign exchange market. Asian session: the dollar little changed

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

04:30 Japan All Industry Activity Index, m/m October -0.2% 1.0%

05:00 Japan BoJ monthly economic report

07:00 Germany Producer Price Index (MoM) November -0.4% -0.2% -0.2%

07:00 Germany Producer Price Index (YoY) November -2.3% -2.5% -2.5%

The U.S. dollar traded range-bound against major currencies ahead of Christmas at the end of the current working week. Trading is not expected to be dynamic. At the same time many traders have already closed their positions ahead of the end of the year, which increases market volatility. On Thursday, December 24, markets in Germany and Italy will be closed. On December 25 markets in other European countries as well as in Canada, the U.S., Australia and New Zealand will be on holiday.

The pound also traded range-bound. Market participants are waiting for data on U.K. budged deficit. The report is expected to show that the deficit rose to £11.7 billion ($17.4 billion) in November. This would suggest that Osborne will face difficulties fulfilling his pledge to balance the budget by 2020.

The New Zealand dollar climbed on positive data. Visitor arrivals rose by 11.1% in November. Meanwhile Westpac consumer sentiment rose to 110.7 in the fourth quarter from 106 reported previously (the best quarterly increase in two years).

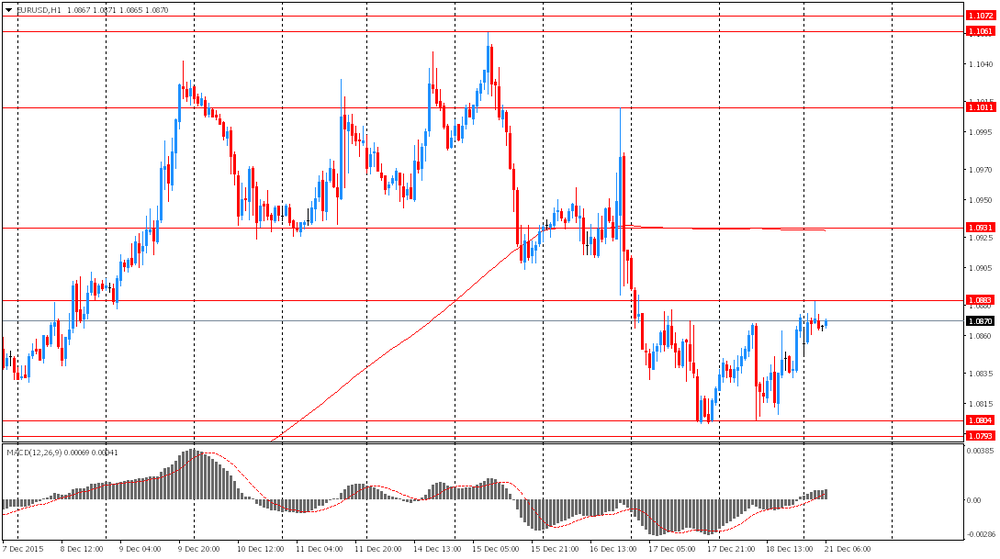

EUR/USD: the pair fluctuated within $1.0855-85 in Asian trade

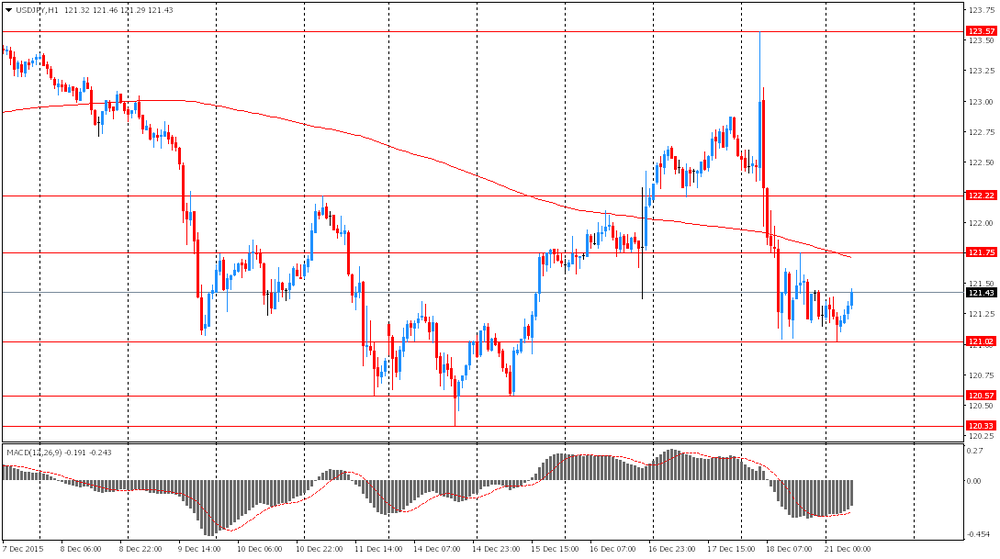

USD/JPY: the pair traded within Y121.00-50

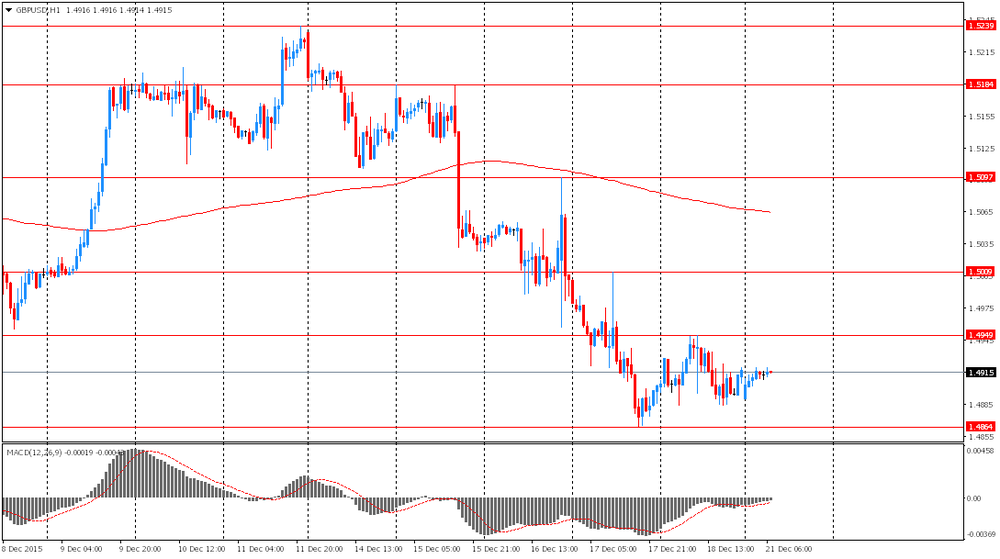

GBP/USD: the pair traded within $1.4885-20

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

11:00 United Kingdom CBI retail sales volume balance December 7 21

11:00 Germany Bundesbank Monthly Report

15:00 Eurozone Consumer Confidence (Preliminary) December -5.9 -5.85

-

08:00

Germany: Producer Price Index (MoM), November -0.2% (forecast -0.2%)

-

08:00

Germany: Producer Price Index (YoY), November -2.5% (forecast -2.5%)

-

07:05

Options levels on monday, December 21, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1076 (3222)

$1.1036 (4395)

$1.0968 (4838)

Price at time of writing this review: $1.0873

Support levels (open interest**, contracts):

$1.0794 (1855)

$1.0762 (2515)

$1.0714 (5958)

Comments:

- Overall open interest on the CALL options with the expiration date January, 8 is 54387 contracts, with the maximum number of contracts with strike price $1,1100 (6852);

- Overall open interest on the PUT options with the expiration date January, 8 is 72346 contracts, with the maximum number of contracts with strike price $1,0450 (8108);

- The ratio of PUT/CALL was 1.33 versus 1.28 from the previous trading day according to data from December, 17

GBP/USD

Resistance levels (open interest**, contracts)

$1.5201 (1168)

$1.5103 (2623)

$1.5005 (527)

Price at time of writing this review: $1.4918

Support levels (open interest**, contracts):

$1.4794 (1520)

$1.4696 (1049)

$1.4598 (561)

Comments:

- Overall open interest on the CALL options with the expiration date January, 8 is 18640 contracts, with the maximum number of contracts with strike price $1,5100 (2623);

- Overall open interest on the PUT options with the expiration date January, 8 is 18595 contracts, with the maximum number of contracts with strike price $1,5100 (3086);

- The ratio of PUT/CALL was 1.00 versus 1.00 from the previous trading day according to data from December, 17

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

05:32

Japan: All Industry Activity Index, m/m, October 1.0%

-

01:02

Currencies. Daily history for Dec 18’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0872 +0,43%

GBP/USD $1,4917 +0,11%

USD/CHF Chf0,9914 -0,47%

USD/JPY Y121,24 -1,07%

EUR/JPY Y131,82 -0,64%

GBP/JPY Y180,85 -0,96%

AUD/USD $0,7179 +0,75%

NZD/USD $0,6736 +0,53%

USD/CAD C$1,3942 +0,05%

-

00:00

Schedule for today, Monday, 21’2015:

(time / country / index / period / previous value / forecast)

04:30 Japan All Industry Activity Index, m/m October -0.2%

05:00 Japan BoJ monthly economic report

07:00 Germany Producer Price Index (MoM) November -0.4% -0.2%

07:00 Germany Producer Price Index (YoY) November -2.3% -2.5%

11:00 United Kingdom CBI retail sales volume balance December 7 21

11:00 Germany Bundesbank Monthly Report

15:00 Eurozone Consumer Confidence (Preliminary) December -5.9 -5.85

-