Noticias del mercado

-

22:08

The main US stock indices grew moderately on the basis of Friday's session

The main US stock indexes registered a moderate increase, which was promoted by the rise in price of shares in the consumer sector and conglomerate sector.

The focus was also on the United States. As shown by preliminary research results submitted by Thomson-Reuters and the Michigan Institute, a gauge of sentiment among US consumers fell in January despite the average predictions of experts. According to the data, in January the consumer sentiment index fell to 94.4 compared with the final reading for December 95.9. It was expected that the index will rise to the level of 97 points.

Quotes of oil moderately fell on Friday, as the rebound in oil production in the US outweighed the continued decline in crude oil reserves in the country.

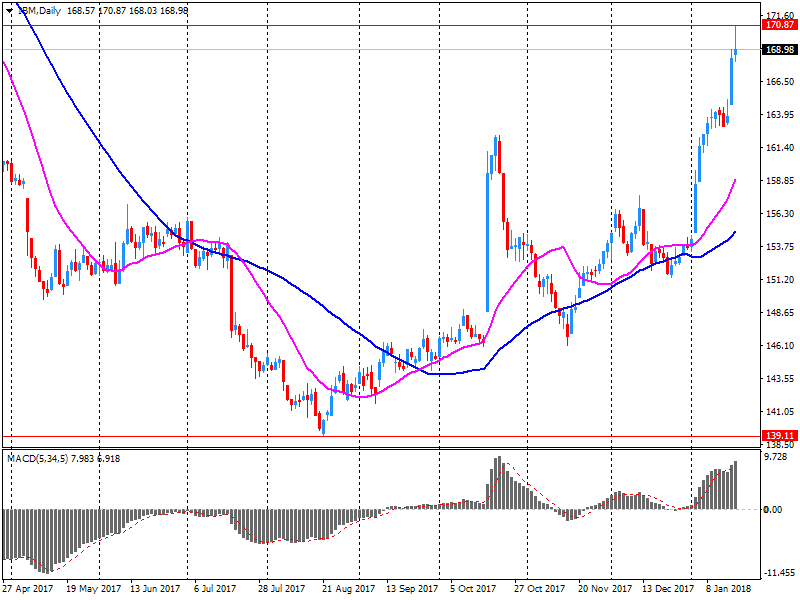

The components of the DOW index finished the auction mixed (15 in positive territory, 15 in negative territory). Leader of the growth were shares of NIKE, Inc. (NKE, + 4.73%). Outsider were shares of International Business Machines Corporation (IBM, -4.09%).

Most sectors of the S & P recorded a rise. The conglomerate sector grew most (+ 0.9%). The utilities sector showed the greatest decrease (-0.2%).

At closing:

Dow + 0.21% 26,071.72 +53.91

Nasdaq + 0.55% 7.336.38 +40.33

S & P + 0.44% 2,810.30 +12.27

-

21:00

DJIA +0.05% 26,030.44 +12.63 Nasdaq +0.49% 7,331.79 +35.74 S&P +0.32% 2,807.08 +9.05

-

18:00

European stocks closed: FTSE 100 +29.83 7730.79 +0.39% DAX +153.02 13434.45 +1.15% CAC 40 +31.68 5526.51 +0.58%

-

15:33

U.S. Stocks open: Dow +0.05% Nasdaq +0.32%, S&P +0.24%

-

15:25

Before the bell: S&P futures +0.04%, NASDAQ futures +0.25%

U.S. stock-index futures rose slightly on Thursday, as investors looked eager to buy yesterday's dip, despite risks of a U.S. government shutdown.

Global Stocks:

Nikkei 23,808.06 +44.69 +0.19%

Hang Seng 32,254.89 +132.95 +0.41%

Shanghai 3,489.11 +14.35 +0.41%

S&P/ASX 6,005.80 -8.80 -0.15%

FTSE 7,709.25 +8.29 +0.11%

CAC 5,513.83 +19.00 +0.35%

DAX 13,406.71 +125.28 +0.94%

Crude $63.04 (-1.42%)

Gold $1,334.90 (+0.58%)

-

14:53

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

53.02

0.02(0.04%)

2716

ALTRIA GROUP INC.

MO

70.63

0.60(0.86%)

9858

Amazon.com Inc., NASDAQ

AMZN

1,298.00

4.68(0.36%)

22324

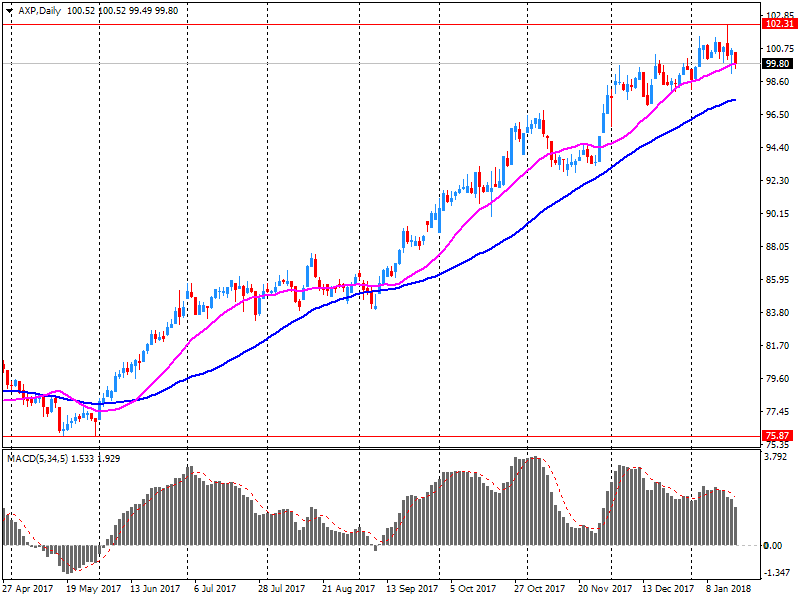

American Express Co

AXP

97

-2.86(-2.86%)

95157

Apple Inc.

AAPL

178.99

-0.27(-0.15%)

127089

AT&T Inc

T

37

-0.15(-0.40%)

3307

Barrick Gold Corporation, NYSE

ABX

14.46

0.18(1.26%)

25167

Boeing Co

BA

340.51

0.35(0.10%)

30833

Caterpillar Inc

CAT

169.1

1.05(0.62%)

15662

Chevron Corp

CVX

131.46

-0.13(-0.10%)

15597

Cisco Systems Inc

CSCO

41.34

0.04(0.10%)

800

Citigroup Inc., NYSE

C

77.41

0.02(0.03%)

12675

Facebook, Inc.

FB

180.28

0.48(0.27%)

122797

FedEx Corporation, NYSE

FDX

272.5

0.32(0.12%)

836

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

19.33

-0.07(-0.36%)

6886

General Electric Co

GE

16.78

0.01(0.06%)

703440

General Motors Company, NYSE

GM

43.61

-0.25(-0.57%)

650

Goldman Sachs

GS

251.22

0.25(0.10%)

15486

Google Inc.

GOOG

1,134.00

4.21(0.37%)

2090

Home Depot Inc

HD

199.4

1.07(0.54%)

3159

HONEYWELL INTERNATIONAL INC.

HON

158.05

0.27(0.17%)

236

Intel Corp

INTC

44.52

0.04(0.09%)

18183

International Business Machines Co...

IBM

164

-5.12(-3.03%)

412534

Johnson & Johnson

JNJ

147.37

0.45(0.31%)

511

JPMorgan Chase and Co

JPM

113.43

0.17(0.15%)

19203

McDonald's Corp

MCD

174.75

0.18(0.10%)

1119

Merck & Co Inc

MRK

61.15

0.02(0.03%)

1905

Microsoft Corp

MSFT

90.31

0.21(0.23%)

22777

Nike

NKE

64.9

0.79(1.23%)

22863

Pfizer Inc

PFE

37.01

0.02(0.05%)

13457

Procter & Gamble Co

PG

90.36

0.18(0.20%)

100

Starbucks Corporation, NASDAQ

SBUX

61.4

0.31(0.51%)

2642

Tesla Motors, Inc., NASDAQ

TSLA

345.49

0.92(0.27%)

26716

The Coca-Cola Co

KO

46.73

-0.15(-0.32%)

4715

Twitter, Inc., NYSE

TWTR

24.18

0.14(0.58%)

23490

UnitedHealth Group Inc

UNH

244.5

1.34(0.55%)

4105

Verizon Communications Inc

VZ

51.65

0.10(0.19%)

9104

Visa

V

123.19

0.08(0.07%)

6177

Wal-Mart Stores Inc

WMT

104.48

0.18(0.17%)

2061

Walt Disney Co

DIS

110.73

0.31(0.28%)

2555

Yandex N.V., NASDAQ

YNDX

37.16

-0.35(-0.93%)

4900

-

14:44

Analyst coverage resumption before the market open

Twitter (TWTR) resumed with a Hold at Stifel; target $21

-

14:44

Rating reiterations before the market open

Exxon Mobil (XOM) reiterated with an Outperform at Cowen; target $100

-

14:43

Target price changes before the market open

Home Depot (HD) target raised to $220 from $190 at Telsey Advisory Group

Apple (AAPL) target raised to $175 from $160 at Mizuho

Starbucks (SBUX) target raised to $70 from $66 at Telsey Advisory Group

IBM (IBM) target raised to $160 from $150 at Deutsche Bank

IBM (IBM) target raised to $170 from $160 at UBS

-

14:42

Upgrades before the market open

NIKE (NKE) upgraded to Outperform from Neutral at Wedbush

Altria (MO) upgraded to Buy from Hold at Jefferies

-

14:08

Company News: IBM (IBM) quarterly results beat analysts’ estimates

IBM (IBM) reported Q4 FY 2017 earnings of $5.18 per share (versus $5.01 in Q4 FY 2016), beating analysts' consensus estimate of $5.17.

The company's quarterly revenues amounted to $22.543 bln (+3.6% y/y), beating analysts' consensus estimate of $22.028 bln.

The company also said it expects to report 2018 operating EPS of 'at least $13.80' (flat y/y) versus analysts' consensus estimate of $13.92.

IBM fell to $163.48 (-3.33%) in pre-market trading.

-

13:57

Company News: American Express (AXP) quarterly results beat analysts’ expectations

American Express (AXP) reported Q4 FY 2017 earnings of $1.58 per share (versus $0.91 in Q4 FY 2016), beating analysts' consensus estimate of $1.54.

The company's quarterly revenues amounted to $8.839 bln (+10.2% y/y), beating analysts' consensus estimate of $8.730 bln.

The company also issued guidance for FY2018, projecting EPS of $6.90-7.30 versus analysts' consensus estimate of $7.29.

AXP also announced plans to suspend its share buyback program for the first half of 2018 "in order to rebuild our capital".

AXP fell to $97.75 (-2.11%) in pre-market trading.

-

09:35

Major stock exchanges in Europe trading mixed: FTSE 7696.48 -4.48 -0.06%, DAX 13318.82 +37.39 + 0.28%, CAC 5494.31 -0.52 -0.01%

-

07:36

Global Stocks

U.K. stocks dropped for a fourth straight session on Thursday, with pressure on London's blue-chips benchmark coming from continued strength in the pound and a decline in shares of Primark chain operator Associated British Foods following a trading update.

U.S. stock benchmarks finished lower Thursday, pressured by worries over the possibility of a partial government shutdown, as investors sorted through a fresh batch of quarterly earnings results. The Dow, however, managed to retain a foothold above 26,000 while the S&P 500 tied the longest stretch in history without a 5% pullback at 394 sessions.

Asia-Pacific stocks turned broadly higher by midday after a slow start to Friday's trading, as investors largely ignored ongoing U.S. budget negotiations. "Equities are the name of the game in Asia at the moment and it's going to continue," said Stephen Innes, head of trading in Asia at Oanda, in the wake of strong January gains in the region.

-

00:34

Stocks. Daily history for Jan 18’2018:

(index / closing price / change items /% change)

Nikkei -104.97 23763.37 -0.44%

TOPIX -13.96 1876.86 -0.74%

Hang Seng +138.53 32121.94 +0.43%

CSI 300 +23.30 4271.42 +0.55%

Euro Stoxx 50 +8.13 3620.91 +0.23%

FTSE 100 -24.47 7700.96 -0.32%

DAX +97.47 13281.43 +0.74%

CAC 40 +0.84 5494.83 +0.02%

DJIA -97.84 26017.81 -0.37%

S&P 500 -4.53 2798.03 -0.16%

NASDAQ -2.23 7296.05 -0.03%

S&P/TSX -42.24 16284.46 -0.26%

-